Charities Act 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Charities Bill

Research and Information Service Bill Paper 11th August 2021 RaISe Charities Bill NIAR 185-21 This Bill Paper has been prepared to inform consideration of the Charities Bill. It provides background to the Bill’s introduction and content, including comparison with current law in Great Britain and the Republic of Ireland, and highlights potential issues for consideration. Paper 55/21 11th August 2021 Research and Information Service briefings are compiled for the benefit of MLAs and their support staff. Authors are available to discuss the contents of these papers with Members and their staff, but cannot advise members of the general public. We do, however, welcome written evidence that relates to our papers and this should be sent to the Research and Information Service, Northern Ireland Assembly, Room 139, Parliament Buildings, Belfast BT4 3XX or e-mailed to [email protected] NIAR 185-21 Bill Paper Key Points On 21st June 2021, the Charities Bill was introduced to the Assembly. The Bill would amend the Charities (Northern Ireland) Act 2008 to make Charity Commission staff decisions lawful; establish a Commission ability to delegate to staff in future; and enable regulations creating a charity registration threshold. This paper aims to support the Assembly’s consideration of the Bill. Background The Charities Act (Northern Ireland) 2008 (‘the 2008 Act’) deals broadly with charity regulation. It was intended to update Northern Ireland charity law, at a time when similar updates were ongoing in England & Wales, Scotland and the Republic of Ireland (‘RoI’). The 2008 Act was subsequently amended by the Charities Act (Northern Ireland) 2013 (‘the 2013 Act’), to correct technical issues with the public benefit test. -

![Cities and Local Government Devolution Bill [HL]; Psychoactive Substances Bill [HL]; Charities (Protection and Social Investment) Bill [HL]](https://docslib.b-cdn.net/cover/7276/cities-and-local-government-devolution-bill-hl-psychoactive-substances-bill-hl-charities-protection-and-social-investment-bill-hl-1297276.webp)

Cities and Local Government Devolution Bill [HL]; Psychoactive Substances Bill [HL]; Charities (Protection and Social Investment) Bill [HL]

HOUSE OF LORDS Select Committee on the Constitution 2nd Report of Session 2015‒16 Cities and Local Government Devolution Bill [HL]; Psychoactive Substances Bill [HL]; Charities (Protection and Social Investment) Bill [HL] Ordered to be printed 18 June 2015 and published 22 June 2015 Published by the Authority of the House of Lords HL Paper 9 Select Committee on the Constitution The Constitution Committee is appointed by the House of Lords in each session “to examine the constitutional implications of all public bills coming before the House; and to keep under review the operation of the constitution.” Membership The Members of the Constitution Committee are: Lord Brennan Lord Judge Lord Maclennan of Rogart Lord Cullen of Whitekirk Lord Lang of Monkton (Chairman) Lord Morgan Baroness Dean of Thornton-le-Fylde Lord Lester of Herne Hill Lord Norton of Louth Lord Hunt of Wirral Lord MacGregor of Pulham Market Baroness Taylor of Bolton Declarations of interests The following relevant interest was declared by Lord Hunt of Wirral: Partner in commercial law firm DAC Beachcroft LLP A full list of Members’ interests can be found in the Register of Lords’ Interests: http://www.parliament.uk/mps-lords-and-offices/standards-and-interests/register-of-lords-interests Publications All publications of the committee are available at: http://www.parliament.uk/hlconstitution Parliament Live Live coverage of debates and public sessions of the committee’s meetings are available at: http://www.parliamentlive.tv Further information Further information about the House of Lords and its committees, including guidance to witnesses, details of current inquiries and forthcoming meetings is available at: http://www.parliament.uk/business/lords Committee staff The current staff of the committee are Antony Willott (Clerk), Dr Stuart Hallifax (Policy Analyst) and Hadia Garwell and Victoria Rifaat (Committee Assistants). -

Charities Act 2006

Charities Act 2006 CHAPTER 50 Explanatory Notes have been produced to assist in the understanding of this Act and are available separately £26·00 Charities Act 2006 CHAPTER 50 CONTENTS PART 1 MEANING OF "CHARITY" AND "CHARITABLE PURPOSE" 1 Meaning of “charity” 2 Meaning of “charitable purpose” 3 The “public benefit” test 4 Guidance as to operation of public benefit requirement 5 Special provisions about recreational charities, sports clubs etc. PART 2 REGULATION OF CHARITIES CHAPTER 1 THE CHARITY COMMISSION Establishment of Charity Commission 6 The Charity Commission Commission’s objectives, general functions etc. 7 The Commission’s objectives, general functions and duties CHAPTER 2 THE CHARITY TRIBUNAL 8 The Charity Tribunal ii Charities Act 2006 (c. 50) CHAPTER 3 REGISTRATION OF CHARITIES General 9 Registration of charities 10 Interim changes in threshold for registration of small charities Exempt charities: registration and regulation 11 Changes in exempt charities 12 Increased regulation of exempt charities under 1993 Act 13 General duty of principal regulator in relation to exempt charity 14 Commission to consult principal regulator before exercising powers in relation to exempt charity CHAPTER 4 APPLICATION OF PROPERTY CY-PRÈS Cy-près occasions 15 Application cy-près by reference to current circumstances 16 Application cy-près of gifts by donors unknown or disclaiming 17 Application cy-près of gifts made in response to certain solicitations Schemes 18 Cy-près schemes CHAPTER 5 ASSISTANCE AND SUPERVISION OF CHARITIES BY COURT AND COMMISSION Suspension or removal of trustees etc. from membership 19 Power to suspend or remove trustees etc. from membership of charity Directions by Commission 20 Power to give specific directions for protection of charity 21 Power to direct application of charity property Publicity relating to schemes 22 Relaxation of publicity requirements relating to schemes etc. -

Consultation on Extending the Charity Commission's Powers to Tackle Abuse in Charities

CONSULTATION ON EXTENDING THE CHARITY COMMISSION’S POWERS TO TACKLE ABUSE IN CHARITIES 4 December 2013 CONTENTS Part I - About this consultation Topic of this consultation Scope of this consultation Geographical scope Audience Body responsible for the consultation Duration How to respond, or make an enquiry After the consultation Part II - Background Role of the Charity Commission Serious cases requiring the Commission‟s involvement Existing powers of the Charity Commission Criticism of the Charity Commission regarding charity regulation and weaknesses of the Charity Commission‟s existing powers Part III - Proposals Proposed Changes Case studies demonstrating difficulties with the existing powers Part IV – Impact The impact of these proposed changes on charities, trustees, the Charity Commission and the Charity Tribunal 2 Part I - About this consultation Topic of this consultation 1. This consultation is about strengthening the Charity Commission‟s powers to act where there is abuse of a charity and/or non-compliance with charity law, in particular where there is misconduct or mismanagement or risk to charity property, and considering whether the criteria for disqualification from acting as a charity trustee should be extended. The aim is to ensure more effective regulation of charities by tackling malpractice and to support public trust and confidence in charities, the regulator and the regulation of the charity sector. 2. We want to seek views on several changes proposed by the Charity Commission. The proposals would close loopholes in and extend the Charity Commission‟s existing powers to investigate and remedy non-compliance in relation to charities in England and Wales, including the provisions that disqualify someone from acting as a charity trustee. -

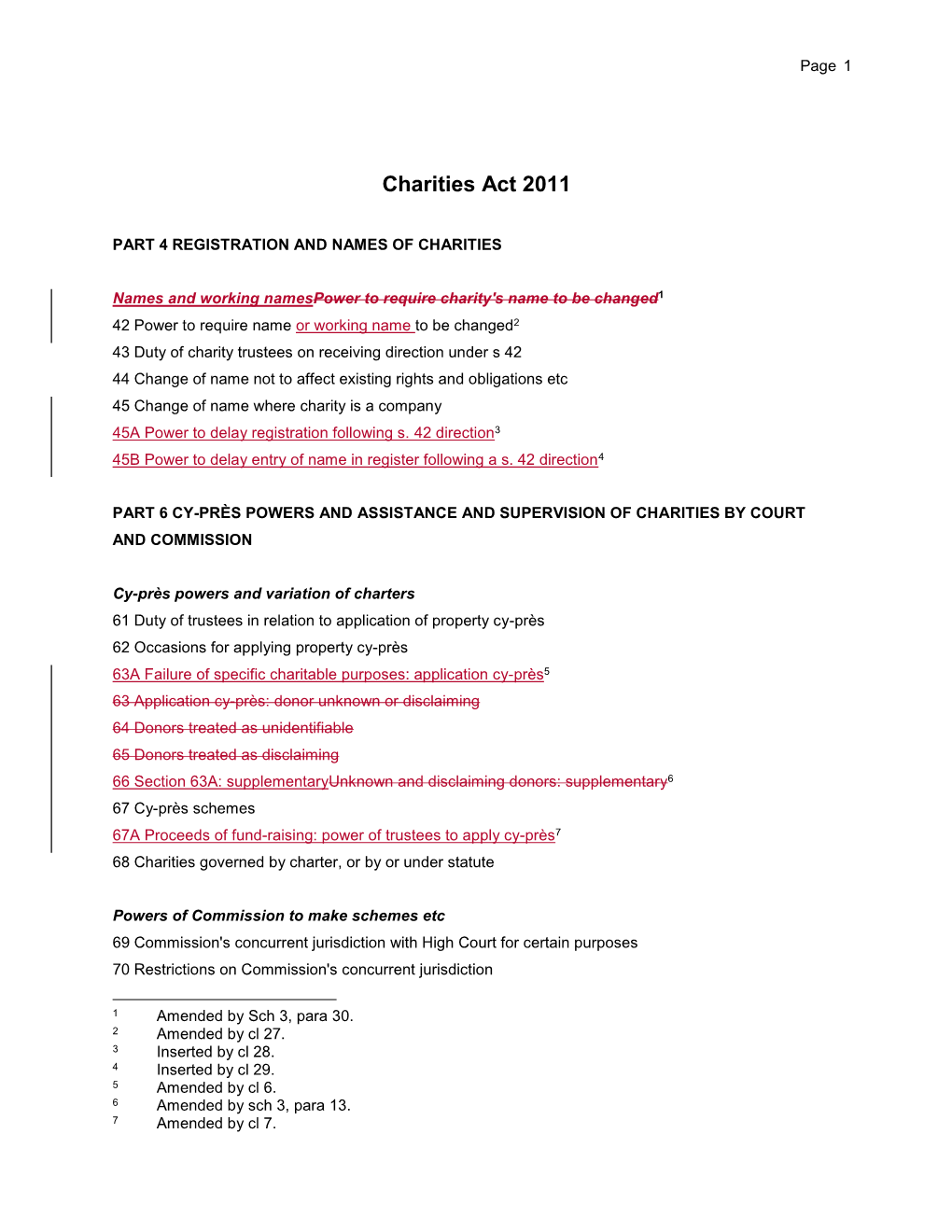

Charities Act 2011

Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Charities Act 2011. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) Charities Act 2011 2011 CHAPTER 25 An Act to consolidate the Charities Act 1993 and other enactments which relate to charities. [14th December 2011] BE IT ENACTED by the Queen's most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:— PART 1 MEANING OF “CHARITY” AND “CHARITABLE PURPOSE” CHAPTER 1 GENERAL Charity 1 Meaning of “charity” (1) For the purposes of the law of England and Wales, “charity” means an institution which— (a) is established for charitable purposes only, and (b) falls to be subject to the control of the High Court in the exercise of its jurisdiction with respect to charities. (2) The definition of “charity” in subsection (1) does not apply for the purposes of an enactment if a different definition of that term applies for those purposes by virtue of that or any other enactment. 2 Charities Act 2011 (c. 25) Part 1 – Meaning of “charity” and “charitable purpose” CHAPTER 1 – General Document Generated: 2013-03-13 Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Charities Act 2011. Any changes that have already been made by the team appear in the content and are referenced with annotations. -

Family Provision and Bequests to Charity in Wills

QUT Digital Repository: http://eprints.qut.edu.au/ Hannah, Frances M. and McGregor-Lowndes, Myles (2008) From testamentary freedom to testamentary duty: Finding the balance. © Copyright 2008 Queensland University of Technology From testamentary freedom to testamentary duty: Finding the balance Working Paper No. CPNS 42 Frances Hannah and Professor Myles McGregor-Lowndes The Australian Centre for Philanthropy and Nonprofit Studies Queensland University of Technology Brisbane, Australia October 2008 This research is funded by the E F and S L Gluyas Trust and the Edward Corbould Charitable Trust under the management of Perpetual Trustees Company Ltd GPO Box 2434 BRISBANE QLD 4001 Phone: 07 3138 1020 Fax: 07 3138 9131 Email: [email protected] http://cpns.bus.qut.edu.au CRICOS code: 00213J The Australian Centre for Philanthropy and Nonprofit Studies (CPNS) is a specialist research and teaching unit at the Queensland University of Technology in Brisbane, Australia It seeks to promote the understanding of philanthropy and nonprofit issues by drawing upon academics from many disciplines and working closely with nonprofit practitioners, intermediaries and government departments. The mission of the CPNS is “to bring to the community the benefits of teaching, research, technology and service relevant to philanthropic and nonprofit communities”. Its theme is ‘For the Common Good’. The Australian Centre for Philanthropy and Nonprofit Studies reproduces and distributes these working papers from authors who are affiliated with the Centre or who present -

Charities (Protection and Social Investment) Act 2016 Chapter 4

EXPLANATORY NOTES Charities (Protection and Social Investment) Act 2016 Chapter 4 £6.00 CHARITIES (PROTECTION AND SOCIAL INVESTMENT) ACT EXPLANATORY NOTES What these notes do These Explanatory Notes relate to the Charities (Protection and Social Investment) Act 2016 (c. 4) which received Royal Assent on 16 March 2016. • These Explanatory Notes have been prepared by the Cabinet Office in order to assist the reader in understanding the Act. They do not form part of the Act and have not been endorsed by Parliament. • These Explanatory Notes explain what each part of the Act will mean in practice; provide background information on the development of policy; and provide additional information on how the Act will affect existing legislation in this area. • These Explanatory Notes might best be read alongside the Act. They are not, and are not intended to be, a comprehensive description of the Act. 2016 c. 4-EN Table of Contents Subject Page of these Notes Overview of the Act 4 Policy background 4 Protection of Charities 4 Social Investment 6 Fund-raising 7 Legal background 8 Territorial extent and application 10 Scotland 10 Wales 10 Northern Ireland 10 Commentary on provisions of Act 11 Section 1: Official warnings by the Commission 11 Example (1): unauthorised payments 11 Example (2): governance problems 11 Example (3): where a statutory inquiry would be disproportionate 12 Section 2: Investigations and power to suspend 12 Section 3: Range of conduct to be considered when exercising powers 12 Section 4: Power to remove charity trustees following -

Charities Act 1993 (Repealed)

Status: Point in time view as at 01/07/2010. This version of this Act contains provisions that are prospective. Changes to legislation: There are currently no known outstanding effects for the Charities Act 1993 (repealed). (See end of Document for details) Charities Act 1993 1993 CHAPTER 10 An Act to consolidate the Charitable Trustees Incorporation Act 1872 and, except for certain spent or transitional provisions, the Charities Act 1960 and Part I of the Charities Act 1992. [27th May 1993] Be it enacted by the Queen’s most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:— Modifications etc. (not altering text) C1 Act extended (1.10.1998) by 1992 c. 13, s. 22A(1)(2) (as added (1.10.1998) by 1998 c. 30, s. 41(2)) (with s. 42(8)); S.I. 1998/2215, art. 2 C2 Act modified (8.8.1998) by 1998 c. 31, s. 11, Sch. 1 para. 10 (with ss. 138(9), 144(6)); S.I. 1998/2048, art. 2 C3 Act excluded (1.9.1999) by 1998 c. 31, s. 23(3); S.I. 1999/2323, art. 2(1), Sch. 1 C4 Act amended (1.9.1999) by 1998 c. 31, s. 23(1)(2); S.I. 1999/2323, art. 2(1), Sch. 1 Act: power to modify conferred (2.4.2002) by 2000 c. 39, s. 7(2); S.I. 2001/766, art. 2(1)(a) (subject to transitional provisions in art. -

Memorandum of Understanding Between the Charity Commission and the Welsh Ministers in Their Role As Principal Regulator of Exempt Educational Charities in Wales

Memorandum of understanding between the Charity Commission and the Welsh Ministers in their role as Principal Regulator of exempt educational charities in Wales April 2015 Digital ISBN 978 1 4734 3328 1 © Crown Copyright 2015 WG25053 Contents Page Section 1 What this memorandum of understanding is for 3 Section 2 Our roles 3-5 Section 3 Working together 6 A - Regulating charities and points of contact 6 B - Collecting information and monitoring 6-7 C - Public information 7-8 D - Sharing information 8-9 E - Use of statutory powers 9-11 F - Policy development and liaison 11 G - Staff development and training 11-12 H- Responding to complaints 12 I - General 12 Appendix A Concordat with The Welsh Assembly Government 13-15 (published in February 2002) Appendix B The Commission’s powers 16-17 Appendix C Welsh Government Intervention powers 18-19 Appendix D Key principles of an effective charity regulation 20 framework Appendix E Designated Points of Contact 21 Principal Regulator Memorandum of Understanding – WG / Charity Commission 2 of 21 Section 1 What this memorandum of understanding is for 1. This memorandum of understanding (MoU) is supplemental to the Concordat agreed between the Charity Commission for England and Wales (the Commission) and the Welsh Ministers, a copy of which is attached at Appendix A. 2. This MoU sets out how the Commission and the Welsh Ministers propose to work together, both in co-ordinating our regulatory operations and formulating the regulatory policy framework within which we work, in the specific context of the Welsh Ministers role as principal regulator of the following exempt charities1 in Wales: (a) The governing bodies of foundation, foundation special and voluntary schools and foundation bodies (b) Further Education Corporations (c) The governing body of St David’s Catholic College2 (d) Any other charity that is exempt by virtue of being a connected institution of one of these charities in accordance with paragraph 28 of Schedule 3 to the Charities Act 2011 (“the Charities Act”) 3. -

Religion in Scots Law: Report of an Audit at the University of Glasgow

1 RELIGION IN SCOTS LAW: THE REPORT OF AN AUDIT AT THE UNIVERSITY OF GLASGOW Sponsored by Humanist Society Scotland Written by Callum G Brown, Thomas Green and Jane Mair Published by Humanist Society Scotland Edinburgh 2016 2 This Report has been written by Callum G Brown, Thomas Green and Jane Mair. Commissioned by Humanist Society Scotland, it is published in the public domain for general consultation and reference. It may be freely copied, distributed and quoted on condition that its authorship and sponsoring organisation are acknowledged, that the DOI is cited, and that citation uses the format given below. In the case of any queries, these should be directed to either Callum Brown on [email protected] or Jane Mair on [email protected]. Format for citation: Callum G Brown, Thomas Green and Jane Mair, Religion in Scots Law: The Report of an Audit at the University of Glasgow: Sponsored by Humanist Society Scotland (Edinburgh, HSS, 2016) 3 CONTENTS Humanist Society Scotland: Chief Executive’s Preface 11 About Humanist Society Scotland 12 Author’s Preface 13 About the authors 15 PART I: The context 16 Chapter 1: Introduction 17 1.1 Where might we find religion in law? 17 1.2 The Scottish background: the historical origins of religion in 19 Scots law 1.3 The impact of secularisation 22 1.4 What this project has done 24 1.5 The structure of this report 25 PART II: Three case studies 28 Chapter 2: The Church of Scotland 29 2.1 How do we identify an Established Church in Scotland? 30 2.1.1 The nature of establishment 30 2.1.2 -

Exempt Charities the Charity Commission the Charity Commission Is the Independent Regulator of Charities in England and Wales

STARTING UP Exempt Charities The Charity Commission The Charity Commission is the independent regulator of charities in England and Wales. Its aim is to provide the best possible regulation of charities in England and Wales in order to increase charities’ effectiveness and public confidence and trust. Most charities must register with the Commission, although some special types of charity do not have to register. There are over 160,000 registered charities in England and Wales. In Scotland the framework is different, and the Commission does not regulate Scottish charities. The Commission provides a wide range of advice and guidance to charities and their trustees, and can often help with problems. Registered charities with an annual income over £10,000 must provide annual information to the Commission. The Commission has wide powers to intervene in the affairs of a charity where things have gone wrong. Published by the Charity Commission Contents A. Introduction 2 B. Regulating exempt charities 4 C. Exempt charities and the law 6 D. Help and advice for exempt charities 9 Annex 1: Exempt charities and their principal regulators 12 Annex 2: Contact details for principal regulators 16 Annex 3 - Other useful guidance for exempt charities 18 1 A. Introduction A1. What is this guidance about? This guidance explains what exempt charities are. It also explains what parts of charity law they must follow, how they are regulated and how the Charity Commission can help them. It only applies to charities based in England and Wales. You may find this guidance helpful if you are involved in running an exempt charity, or if you have concerns or questions about an exempt charity. -

Introduction

1 Introduction It has been an interesting decade for charity law. A major piece of legislative reform was introduced in 2004 and then lambasted in 2013 as ‘ critically fl awed ’ and ‘ an administrative and fi nancial disaster ’ by the Public Administration Select Committee. 1 A newly formed Charity Commission (the Commission) came into existence in 2008 and was then castigated as ‘ not fi t for purpose ’ in 2014 by the Chair of the Public Accounts Committee. 2 Guidance on the public benefi t requirement was published by the Commission in 2008 and then completely replaced in 2013 after the Upper Tribunal (Tax and Chancery) (the Tribunal) subjected it to criticism and called it ‘ wrong ’ in places. 3 The Tribunal, for its part, had the opportunity to bring clarity and order to the disarray which had marked the early part of the new millennium, but instead delivered a judg- ment which has been widely criticised for its unfathomability and lack of a sound legal base. 4 And, although not normally a high profi le subject, charity law aroused strong public opinion and found itself in the headlines: ‘ Private schools are vic- tims of ‘ medieval ’ attack ’ , 5 ‘ Private schools win £ 100m charity tax relief case ’ 6 and ‘ Churches battle “ anti-Christian ” charity chiefs ’, 7 to name but a few. The reform in question was the new statutory defi nition of charity in the Chari- ties Act 2006 (the 2006 Act), which required a charitable institution ’ s purposes to be ‘ for the public benefi t ’ . 8 Whilst not a new requirement in itself, its statutory 1 The role of the Charity Commission and ‘ public benefi t ’ : Post-legislative Scrutiny of the Charities Act 2006 , Third Report of Session 2013 – 14 (TSO, June 2013) paras 92 and 86 respectively.