Marginable List Grading V2 (Jun2012)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Assessment of Environmental and Social Transparency of Food Related Companies Currently Listing in Hong Kong Stock Exchange

An assessment of Environmental and Social transparency of food related companies currently listing in Hong Kong Stock Exchange October 2017 Hong Kong 1 Executive Summary Oxfam Hong Kong seeks to better understand opportunities to engage with companies in Hong Kong. Oxfam Hong Kong commissioned CSR Asia to conduct a benchmarking exercise to assess the Environmental and Social transparency in the food, beverages, and agricultural products sectors in Hong Kong. The aims of this exercise were: To assess food companies’ Environment and Social transparency To summarise the Environment and Social transparency of selected companies. To assess what companies are doing to create more inclusive business models relating to both products and value chains, and to engage with issues associated with access to food products for poor people. To make recommendations on the business case for food companies to implement responsible business policies In total, 61 companies were benchmarked in this study. Data was compiled from publicly available information published in 2015 including corporate websites, annual reports and sustainability reports. Overall, the level of disclosure by the 61 companies is relatively low and indeed they were failed. Only 3 companies achieved over 30 points and 55 of the companies scoring below 20 points. This may seem disappointing at first but it should be recognized that the GRI indicators are very comprehensive and that most companies in Hong Kong are a long way from being able to report on them. Companies demonstrated weak performance in both categories in which the average score of social and environment are 12.5 and 8.7 respectively. -

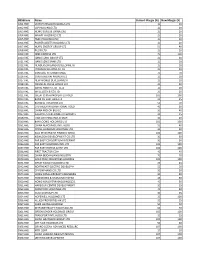

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON

Stock Code Stock Name Financing Ratio(%) 1 CK HUTCHISON HOLDINGS LTD 70 2 CLP HOLDINGS LTD 70 3 HONG KONG & CHINA GAS 70 4 WHARF HOLDINGS LTD 70 5 HSBC HOLDINGS PLC 70 6 POWER ASSETS HOLDINGS LTD 70 7 HONG KONG FINANCE INVESTMENT 0 8 PCCW LTD 60 9 NINE EXPRESS LTD 0 10 HANG LUNG GROUP LTD 60 11 HANG SENG BANK LTD 70 12 HENDERSON LAND DEVELOPMENT 70 14 HYSAN DEVELOPMENT CO 50 15 VANTAGE INTERNATIONAL 0 16 SUN HUNG KAI PROPERTIES 70 17 NEW WORLD DEVELOPMENT 70 18 ORIENTAL PRESS GROUP LTD 0 19 SWIRE PACIFIC LTD - CL A 70 20 WHEELOCK & CO LTD 70 21 GREAT CHINA PROPERTIES HOLDI 0 22 MEXAN LTD 0 23 BANK OF EAST ASIA LTD 60 24 BURWILL HOLDINGS LTD 0 25 CHEVALIER INTERNATIONAL HOLD 0 26 CHINA MOTOR BUS CO 0 27 GALAXY ENTERTAINMENT GROUP L 70 28 TIAN AN CHINA INVESTMENT 0 29 DYNAMIC HOLDINGS LTD. 0 30 BAN LOONG HOLDINGS LTD 0 31 CHINA AEROSPACE INTL HLDG 0 32 CROSS-HARBOUR HOLDINGS LTD 0 33 ASIA INVESTMENT FINANCE GROU 0 34 KOWLOON DEVELOPMENT CO LTD 30 35 FAR EAST CONSORTIUM INTERNAT 10 36 FAR EAST HOLDINGS INTL LTD 0 37 FAR EAST HOTELS & ENT LTD 0 38 FIRST TRACTOR CO-H 0 39 CHINA BEIDAHUANG INDUSTRY 0 40 GOLD PEAK INDUSTRIES HOLDING 0 41 GREAT EAGLE HOLDINGS LTD 50 42 NORTHEAST ELECTRIC DEVELOP-H 0 43 CP POKPHAND CO LTD 0 45 HONGKONG & SHANGHAI HOTELS 50 46 COMPUTER & TECHNOLOGIES HLDG 0 47 HOP HING GROUP HOLDINGS LTD 0 48 CHINA AUTOMOTIVE INTERIOR 0 50 HONG KONG FERRY(HOLDINGS)CO. -

CUNY 9-30-14 Holdings W $ Amounts.Xlsx

City University of New York (CUNY) Portfolio Holdings by Manager as of September 30, 2014 Manager A Total Size of Holding Region/Country/Security ($000) North America - Dev. United States Yum Brands Inc 120.2 Europe - Dev. Luxembourg Tenaris Sa 246.3 Portugal Jeronimo Martins 97.1 United Kingdom Bhp Billiton Plc 118.0 Sabmiller Plc 208.3 Standard Chart Plc 217.2 Asia/Pacific - Dev. Hong Kong Aia Group Ltd 276.7 China Mobile Ltd 355.1 Hang Lung Group 127.5 Hang Lung Prop 113.7 Swire Pacific 217.1 Swire Pacific 39.5 Swire Properties L 44.7 Europe - Emg. Hungary Danubius Hotel 0.0 Gedeon Richter Plc 115.2 Legend: EGR* = Earnings Growth Rate, "---" = Not Available Sources: MSCI Inc. and FactSet Fundamentals City University of New York (CUNY) Portfolio Holdings by Manager as of September 30, 2014 Manager A Total Size of Holding Region/Country/Security ($000) Poland Bk Pekao 197.4 Russia Lukoil Oil Company 280.9 Magnit Pjsc 178.6 Turkey Akbank 172.7 Bim Birlesik Magaz 151.5 T Garanti Bankasi 168.1 South/Latin America - Emg. Brazil Bco Bradesco Sa 8.7 Bradesco Banco 291.1 Cia Souza Cruz 99.8 Lojas Renner Sa 115.9 Multiplan Empreend 97.3 Petrobras-Petroleo Brasilier 193.3 Petrobras-Petroleo Brasilier 23.6 Ultrapar Participa 219.5 Vale Sa 244.7 Vale Sa 37.1 Chile Banco Santander-Chile 132.6 Mexico Consorcio Ara Sab 1.6 Fomento Economico Mexicano 302.2 Gpo Fin Banorte 249.9 Grupo Aeroportuario Sureste 125.7 Organizaci Soriana 52.1 Legend: EGR* = Earnings Growth Rate, "---" = Not Available Sources: MSCI Inc. -

2010 IR Global Rankings: Invitation for Investors and Analysts Vote for Companies Página 1 De 4

2010 IR Global Rankings: Invitation for Investors and Analysts Vote for Companies Página 1 de 4 Send a release Member sign in Become a member For journalists Global sites Products & Services Knowledge Center Browse News Releases See more news releases in: Advertising , Publishing & Information Services , Banking & Financial Services , Awards 2010 IR Global Rankings: Invitation for Investors and Analysts Vote for Companies with the Best IR Program and for the Best IR Officer NEW YORK, Nov. 16 /PRNewswire/ -- MZ Consult NY ( www.mz-ir.com ), a leading global investor relations and financial communications firm, invites all market participants to vote on the Investors' Choice award (POP+) through December 16, 2009. You can register your vote via the website www.irglobalrankings.com . The 2010 IRGR, supported by KPMG, Arnold & Porter, The Bank of New York Mellon, Corporate Asia Network, Bloomberg, NEVIR and Sodali, is a unique and independent external review of any company's communication process with the capital markets. For the 2010 edition, the Investors' Choice awards are for the categories of Best IR Program and Best IR Officer. This is the only award defined by direct vote. The Investors' Choice ranking complements the IR Global Ranking's technical evaluations and constitutes clear and direct feedback from the capital markets on the quality and effectiveness of investor relations efforts. More than 490 companies from over 39 countries have already registered for the 2010 IR Global Rankings, among them (in alphabetical order): A8 Digital Music Holdings (HKSE: 0800); Abbott ( ABT); ABNote (BMF&BOVESPA: ABNB3); Acer Inc. (TWSE: 2353); Acucar Guarani (BMF&BOVESPA: ACGU3); Adecco (SIX: ADEN); adidas (FSE: ADS); Aditya Birla Nuvo (NSE: ABIRLANUVO); Advanced Semiconductor Engineering ( ASX); Advantech Co. -

Wires Voting Period 14Dec2009

Last days to vote for companies in the 2010 IR Global Rankings Don´t miss the opportunity to vote for the best IR Program and IR Officer NEW YORK, December 14, 2009 /PRNewswire/ -- MZ Consult NY (www.mz-ir.com), a leading global investor relations and financial communications firm, announces that the voting period for the Investors’ Choice award (POP+) has entered its final days – deadline is this Wednesday, December 16, 2009. All market participants can register your vote via the website www.irglobalrankings.com. The 2010 IRGR, supported by KPMG, Arnold & Porter, The Bank of New York Mellon, Corporate Asia Network, Bloomberg, NEVIR and Sodali is a unique and independent external review of any company's communication process with the capital markets. For the 2010 edition, the Investors’ Choice awards consist of Best IR Program and Best IR Officer . This is the only award determined by direct vote. The Investors’ Choice ranking complements the IR Global Ranking’s technical evaluations and constitutes clear and direct feedback from the capital markets on the quality and effectiveness of investor relations efforts. More than 490 companies from over 39 countries are participating, among them (in alphabetical order): A8 Digital Music Holdings (HKSE: 0800); Abbott (NYSE: ABT); ABNote (BMF&BOVESPA: ABNB3); Acer Inc. (TWSE: 2353); Açúcar Guarani (BMF&BOVESPA: ACGU3); Adecco (SIX: ADEN); adidas (FSE: ADS); Aditya Birla Nuvo (NSE: ABIRLANUVO); Advanced Semiconductor Engineering (NYSE: ASX); Advantech Co. (TWSE: 2395); AECOM (NYSE: ACM); Aegon (EURONEXT: AGN.AS); AES Eletropaulo (BMF&BOVESPA: ELPL6); AES Gener (SCL: GENER); AES Tietê (BMF&BOVESPA: GETI4); Air France-KLM (EURONEXT: AFLYY); Air Products (NYSE: APD); Airmedia Group Inc (NASDAQ: AMCN); Akamai Technologies (NASDAQ: AKAM); AkzoNobel (EURONEXT: AKZA); Alibaba.com Limited (HKSE: 1688); ALL – América Latina Logística (BMF&BOVESPA: ALLL1); Alpha Networks Inc. -

Download the 2010 IRGR Magazine, with the Winners and Best Practices, Please Go To

IR Global Rankings 2011 Best Ranked Companies in North America NEW YORK, Feb. 7, 2011 /PRNewswire/ - IR Global Rankings ("IRGR"), the most comprehensive technical ranking system for investor relations websites, corporate governance practices and financial disclosure procedures, jointly with its coordination group and supporting entities, Arnold & Porter, MZ, KPMG and Sodali, announced today at The IR Summit, an IR conference produced in association with Institutional Investor, the 2011 Best Ranked Companies in North America, as follows: Best Ranked IR Websites in North America: Life Technologies,PotashCorp,Intel, Cameco and Microsoft. Best Ranked Online Annual Report in North America: Nexen. Best Ranked Financial Disclosure Procedures in North America: URS Corporation, Fedex Corp., Ryder System, Cameco and BMO Financial Group. Best Ranked Corporate Governance Practices in North America: Nexen. We congratulate all the investor relations teams of the best ranked companies for their achievements and efforts. The Top 30 global results, as well as the industry results, will be available on our website http://www.irglobalrankings.com/ in December 2011. To learn more about the 2011 IRGR or download the 2010 IRGR magazine, with the winners and best practices, please go to: http://www.irglobalrankings.com/. More than 60 North American companies have registered for the 2011 IR Global Rankings, among them (in alphabetical order):AAAAmerican (LUX: AAA); Advent Software (NASDAQ: ADVS); Agnico-Eagle Mines (TSX, NYSE: AEM); Akamai Technologies (Nasdaq: AKAM); Alternet Systems (OTCBB: ALYI); Applied Materials, Inc. (NASDAQ: AMAT); Assurant (New York Stock Exchange: AIZ); AT&T (NYSE: T); AXA Equitable (CAC: CS FP); BAXTER (NYSE: BAX); Beckman Coulter, Inc. -

Updated April 2009

® ™ LexisNexis SmartIndexing Technology New Company Terms Updated April 2009 A-B........................................................................................................................1 C ...........................................................................................................................2 D-E........................................................................................................................4 F-G........................................................................................................................4 H-I.........................................................................................................................4 J-K ........................................................................................................................5 L-M........................................................................................................................5 N-O .......................................................................................................................6 P-Q-R....................................................................................................................7 S ...........................................................................................................................8 T-U........................................................................................................................9 V-W.......................................................................................................................9 -

Copy of Default Margin List

IRESSCode Name Current Margin (%) New Margin (%) 0001.HKE CK HUTCHISON HOLDINGS LTD 10 10 0002.HKE CLP HOLDINGS LTD 10 10 0003.HKE HONG KONG & CHINA GAS 20 20 0004.HKE WHARF HOLDINGS LTD 20 20 0005.HKE HSBC HOLDINGS PLC 10 10 0006.HKE POWER ASSETS HOLDINGS LTD 10 10 0007.HKE HOIFU ENERGY GROUP LTD 50 40 0008.HKE PCCW LTD 20 20 0009.HKE NINE EXPRESS LTD 70 100 0010.HKE HANG LUNG GROUP LTD 20 20 0011.HKE HANG SENG BANK LTD 10 10 0012.HKE HENDERSON LAND DEVELOPMENT 10 10 0014.HKE HYSAN DEVELOPMENT CO 20 20 0015.HKE VANTAGE INTERNATIONAL 70 70 0016.HKE SUN HUNG KAI PROPERTIES 10 10 0017.HKE NEW WORLD DEVELOPMENT 10 10 0018.HKE ORIENTAL PRESS GROUP LTD 40 30 0019.HKE SWIRE PACIFIC LTD - CL A 10 10 0020.HKE WHEELOCK & CO LTD 20 20 0021.HKE GREAT CHINA PROPERTIES HOLDI 100 100 0023.HKE BANK OF EAST ASIA LTD 20 25 0024.HKE BURWILL HOLDINGS LTD 50 50 0025.HKE CHEVALIER INTERNATIONAL HOLD 40 30 0026.HKE CHINA MOTOR BUS CO 30 40 0027.HKE GALAXY ENTERTAINMENT GROUP L 20 15 0028.HKE TIAN AN CHINA INVESTMENT 30 20 0030.HKE BAN LOONG HOLDINGS LTD 100 100 0031.HKE CHINA AEROSPACE INTL HLDG 50 40 0032.HKE CROSS-HARBOUR HOLDINGS LTD 30 30 0033.HKE ASIA INVESTMENT FINANCE GROU 100 100 0034.HKE KOWLOON DEVELOPMENT CO LTD 30 30 0035.HKE FAR EAST CONSORTIUM INTERNAT 30 30 0036.HKE FAR EAST HOLDINGS INTL LTD 100 100 0037.HKE FAR EAST HOTELS & ENT LTD 100 100 0038.HKE FIRST TRACTOR CO-H 40 40 0039.HKE CHINA BEIDAHUANG INDUSTRY 70 70 0040.HKE GOLD PEAK INDUSTRIES HOLDING 100 100 0041.HKE GREAT EAGLE HOLDINGS LTD 25 25 0042.HKE NORTHEAST ELECTRIC DEVELOP-H 50 50 0043.HKE CP POKPHAND CO LTD 30 30 0044.HKE HONG KONG AIRCRAFT ENGINEERG 30 30 0045.HKE HONGKONG & SHANGHAI HOTELS 25 30 0050.HKE HONG KONG FERRY(HOLDINGS)CO. -

An Assessment of the Environmental and Social Transparency of Food Companies Currently Listed in the Hong Kong Stock Exchange

An assessment of the environmental and social transparency of food companies currently listed in the Hong Kong Stock Exchange Oct 2017 1. Foreword Oxfam, as an international poverty alleviation organisation, has been working to realise the United Nations Sustainable Development Goals (SDGs), particularly SDG 1 and 10: to end poverty, and tackle inequality and injustice. Oxfam believes that a just society should move towards a human economy. In other words, profit should not be the only goal; instead, the needs of people should be a priority in economic development. To build a just society, the basic needs of the underprivileged should be taken into account. Among the UN’s 17 SDGs1, Oxfam believes that by ending poverty (SDG 1), achieving gender equality (SDG 5), ensuring decent work and economic growth (SDG 8), and reducing inequality (SDG 10), the disparity between the rich and poor would be lessened, and our society would be better off and be more equal. To ensure people living in poverty can benefit from economic development, Oxfam has been promoting the integration of ‘Environmental, Social, and Governance’ (ESG) into corporate policies and business operations since 2004. Oxfam conducted three pioneering studies in 2008, 2009 and 2016 to study the corporate social responsibility (CSR) performance of the Hang Seng Index (HSI) constituents by looking at the implementation of their CSR initiatives. Oxfam hopes to influence companies to adopt international standards to formulate or improve their CSR policies ‒ especially in terms of committing to or reporting on areas such as the labour and supply chain, human rights, equal employment opportunities and the environment ‒ and set pro-poor policies. -

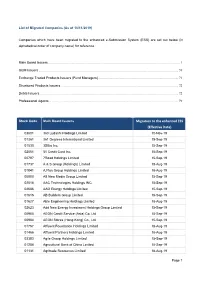

ESS Migration

List of Migrated Companies (As of 10/11/2019) Companies which have been migrated to the enhanced e-Submission System (ESS) are set out below (in alphabetical order of company name) for reference. Main Board Issuers ............................................................................................................................................................ 1 GEM Issuers ..................................................................................................................................................................... 59 Exchange Traded Products Issuers (Fund Managers) ............................................................................................... 71 Structured Products Issuers ........................................................................................................................................... 72 Debts Issuers .................................................................................................................................................................... 72 Professional Agents ......................................................................................................................................................... 79 Stock Code Main Board Issuers Migration to the enhanced ESS (Effective Date) 03601 360 Ludashi Holdings Limited 10-Nov-19 01361 361 Degrees International Limited 15-Sep-19 01530 3SBio Inc. 15-Sep-19 02051 51 Credit Card Inc. 15-Sep-19 00797 7Road Holdings Limited 15-Sep-19 01737 A & S Group (Holdings) Limited 18-Aug-19 01841 A.Plus -

Wires Voting Period 16Dec2009

LAST DAY to vote for the Best IR Program and Best IR Officer The IRGR Investors’ Choice Rankings voting period ends TODAY!! NEW YORK, December 16, 2009 /PRNewswire/ -- MZ Consult NY (www.mz-ir.com), a leading global investor relations and financial communications firm, announces that the voting period for the Investors’ Choice award (POP+) has entered its final day. Last opportunity for all market participants to register their vote via the website: www.irglobalrankings.com. The 2010 IRGR, supported by KPMG, Arnold & Porter, The Bank of New York Mellon, Corporate Asia Network, Bloomberg, NEVIR and Sodali is a unique and independent external review of any company's communication process with the capital markets. For the 2010 edition, the Investors’ Choice awards consist of Best IR Program and Best IR Officer . This is the only award determined by direct vote. The Investors’ Choice ranking complements the IR Global Ranking’s technical evaluations and constitutes clear and direct feedback from the capital markets on the quality and effectiveness of investor relations efforts. More than 490 companies from over 39 countries are participating, among them (in alphabetical order): A8 Digital Music Holdings (HKSE: 0800); Abbott (NYSE: ABT); ABNote (BMF&BOVESPA: ABNB3); Acer Inc. (TWSE: 2353); Açúcar Guarani (BMF&BOVESPA: ACGU3); Adecco (SIX: ADEN); adidas (FSE: ADS); Aditya Birla Nuvo (NSE: ABIRLANUVO); Advanced Semiconductor Engineering (NYSE: ASX); Advantech Co. (TWSE: 2395); AECOM (NYSE: ACM); Aegon (EURONEXT: AGN.AS); AES Eletropaulo (BMF&BOVESPA: ELPL6); AES Gener (SCL: GENER); AES Tietê (BMF&BOVESPA: GETI4); Air France-KLM (EURONEXT: AFLYY); Air Products (NYSE: APD); Airmedia Group Inc (NASDAQ: AMCN); Akamai Technologies (NASDAQ: AKAM); AkzoNobel (EURONEXT: AKZA); Alibaba.com Limited (HKSE: 1688); ALL – América Latina Logística (BMF&BOVESPA: ALLL1); Alpha Networks Inc.