Banking Ombudsman Scheme 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Defender (Ombudsman) – Equinet

7/30/2019 Public Defender (Ombudsman) – Equinet Equality Bodies Equinet Equality in Europe Equality Blog Have you been treated unfairly? PUBLIC DEFENDER (OMBUDSMAN) Overview: Public Defender (Ombudsman) of Georgia is mandated by the Constitution and Full name in English Organic Law of Georgia to oversee the observance of human rights and fundamental Public Defender freedoms on the territory of Georgia, identify the cases of infringement of human (Ombudsman) of Georgia rights and assist individuals in redressing of violations of their rights. It is an Full name in the national independent constitutional body, which acts to promote human rights and protect language(s): individuals from maladministration of State administrative organs. საქართველოს სახალხო დამცველის ოფისი Postal address Brief history 150 Aghmashenebeli Ave. Tbilisi 0112, Georgia Oce of Public Defender has a broad mandate to promote and protect human rights, and that Website it exercises this mandate in practice. In addition to its existing mandate, the PD has been http://www.ombudsman.ge/ mandated with responsibilities for as National Preventive Mechanism under OPCAT, and as monitoring mechanism under the Convention on the Rights of Persons with Disabilities. General email address [email protected] Since 2014 Oce of Public Defender is designated as an Equality Body under the Law of Georgia on Elimination of All Forms of Discrimination. Helpline 1481 PDO submits to the Parliament of Georgia annual reports, which includes general assessment of human rights situation in the country, a summary of ndings and recommendations on how Telephone number to address problems identied. PDO also prepares special reports concerning human rights +995 598 08 30 06 issues in various elds and presents main ndings and recommendations to the public and Other social media relevant state institutions. -

Monitoring Forced Return Operations

MONITORING FORCED RETURN OPERATIONS 0 The Ombudsman as a human rights monitor in forced return operations Contents ▌Introduction ................................................................................................... 2 ▌ The operations .............................................................................................. 4 ▌ What monitoring is about ............................................................................ 4 ▌ The mandate................................................................................................ 6 ▌ The monitors …………………………………………………………………..... 7 ▌ Before the operation ……………………………………………………….… 9 - Preparing for monitoring missions - Pre-return phase ▌ During the operation…………………………………………………...……..12 - Pre-departure phase - In-transit phase - Hand-over phase ▌ After the operation .................................................................................... 15 - Monitoring reports - Following-up on the reports’ findings and recommendations - Complaint mechanism, assessment of monitors’ work and possible disciplinary proceedings - Publicising conclusions and recommendations ▌ Frontex pool of monitors .......................................................................... 18 ▌ COVID-19 and forced returns monitoring............................................... 19 ▌ Concluding remarks ................................................................................... 21 ▌ Annex – Questionnaire sent ..................................................................... 22 1 -

Summary Report of Actions Taken by the Catalan Ombudsman Regarding the Day of October 1, 2017

SUMMARY REPORT OF ACTIONS TAKEN BY THE CATALAN OMBUDSMAN REGARDING THE DAY OF OCTOBER 1, 2017 NOVEMBER 2017 SUMMARY REPORT OF ACTIONS TAKEN BY THE CATALAN OMBUDSMAN REGARDING THE DAY OF OCTOBER 1, 2017 NOVEMBER 2017 Síndic de Greuges de Catalunya 1st edition: November 2017 Summary report of actions taken by the Catalan Ombudsman regarding the day of october 1, 2017. November 2017 Layout: Síndic de Greuges Original design: America Sanchez Cover picture: © Pixabay INDEX INTRODUCTION . 5 1. EVENTS PRIOR TO OCTOBER 1ST . 7 1.1. Freedom of assembly and expression . .7 1.2. Lack of proportionality in actions of the Prosecutor’s Office . 7 1.3. Arrests of elected officials and various searches . 10 1.4. Intervention of the Autonomous Catalan Government . .11 1.5. Constitutional Court fines levied against members of the Electoral Commission of Catalonia . .12 2. THE DAY OF OCTOBER 1ST . 13 3. COMPLAINTS AND QUERIES RECEIVED IN THIS PERIOD . 15 4. EVENTS FOLLOWING OCTOBER 1ST . 17 4.1. Proposal for dialog and investigation . 17 4.2. Order for pretrial imprisonment of Catalan National Assembly and Òmnium Cultural presidents . 18 4.3. Application of Article 155 . 18 4.4. Criminal indictment of the dismissed government and Presiding Board of Parliament . 19 SUMMARY REPORT OF ACTIONS TAKEN BY THE CATALAN OMBUDSMAN REGARDING OCTOBER 1, 2017 5 INTRODUCTION take a number of positions, always with the purpose of protecting respect for human rights and fundamental freedoms and In the month of April, 2017, the Catalan making repeated appeals for a start to Ombudsman filed in the Parliament of political dialog to resolve the conflict. -

The Reserve Bank of India Has Set up a Third Office of the Banking

The Reserve Bank of India has set up a third office of the Banking Ombudsman(BO)and Ombudsman for Digital transactions(ODT) at Reserve Bank of India ,New Delhi (New Delhi –III) The territorial jurisdiction and e-mail ids of BO and ODT are as under : SN BO/ODT Territorial Jurisdiction Email ID North,North-west,West,south West,New Delhi and South districts [email protected] (for BO) 1 New Delhi I of Delhi [email protected](for ODT) Haryana(except Panchkula,Yamuna Nagarand AmbalaDistricts)and Ghaziabad and Gautam Budh Nagar [email protected] (for BO) 2 New Delhi II districts of Uttar Pradesh [email protected](for ODT) North-East, Central,Shahdara,East [email protected] (for BO) 3 New Delhi III and South-East districts of Delhi [email protected](for ODT) Banking Ombudsman: New Delhi I Smt.Anupam Sonal C/o Reserve Bank of India Sansad Marg, New Delhi- 110001 Telephone: +91-11-23725445/23710882 Fax: +91-11-23725218 Email: [email protected] New Delhi II Shri R.S.Amar C/o Reserve Bank of India Sansad Marg, New Delhi- 110001 Telephone: +91-11-23724856 Fax: +91-11-23725218-19 Email: [email protected] New Delhi III Shri V.G.Sekar C/o Reserve Bank of India Sansad Marg, New Delhi- 110001 Telephone: +91-11-23715393 Fax: +91-11-23765234 Email - [email protected] (Mumbai I –Districts of Mumbai, Mumbai Suburban and Thane) Smt.Ranjana Sahajwala C/o Reserve Bank of India 4th Floor, RBI Byculla Office Building Opp.Mumbai Central Ralway Station Byculla,Mumbai -400 008 STD Code: 022 Tel.No.23022028 Fax: 23022024 Email: [email protected] (Mumbai II – Goa and Maharashtra (except the districts of Mumbai ,Mumbai Suburban and Thane) Shri P.K.Jena C/o Reserve Bank of India 4th Floor, RBI Byculla Office Building Opp.Mumbai Central Ralway Station Byculla,Mumbai -400 008 STD Code: 022 Tel.No.23001280 Fax: 23022024 Email: [email protected] Reserve Bank of India has launched a software application “Complaint Management System (CMS)” to facilitate RBI’s grievance redressal processes. -

Address and Area of Operation of Banking Ombudsman Centre Contact Details of the Office of Banking Ombudsman Area of Operati

Address and Area of Operation of Banking Ombudsman Centre Contact details of the Office of Area of Operation Banking Ombudsman Shri P.K.Brahma Ahmedabad C/o Reserve Bank of India Gujarat, Union Territories of Dadra and La Gajjar Chambers, Nagar Haveli, Daman and Diu Ashram Road, Ahmedabad-380 009 Tel.No.079- 26582357, 079-26586718 Fax No.079-26583325 email: [email protected] Shri. K.R.Ananda Bangalore C/o Reserve Bank of India Karnataka 10/3/8, Nrupathunga Road Bangalore-560 001 Tel.No.080-22210771, 080-22275629 Fax No.080-22244047 email: [email protected] Shri B.P.Kanungo Bhopal C/o Reserve Bank of India Madhya Pradesh and Chattisgarh Hoshangabad Road, Post Box No.32, Bhopal-462 011 Tel.No.0755-2573772, 0755-2573776 Fax No.0755-2573779 email: [email protected] Shri P.K.Jena Bhubaneswar C/o Reserve Bank of India Orissa Pt. Jawaharlal Nehru Marg Bhubaneswar-751 001 Tel.No.0674-2396207, 0674-2396008 Fax No.0674-2393906 email: [email protected] Smt. Balbir Kaur Chandigarh C/o Reserve Bank of India Himachal Pradesh, Punjab and Union New Office Building Territory of Chandigarh Sector-17, Central Vista Chandigarh-160 017 Tel.No.0172-2721109, 0172-2721011 Fax No.0172-2721880 email: [email protected] Shri S.Gopalakrishnan Chennai C/o Reserve Bank of India, Tamil Nadu, Union Territories of Fort Glacis, Pondicherry and Andaman and Nicobar Chennai 600 001 Islands Tel No.044-25399170, 044-25395964 Fax No.044-25395488 email: [email protected] Shri P.K.Datta Guwahati C/o Reserve Bank of India Assam, Arunachal Pradesh, Manipur, Station Road, Meghalaya, Mizoram, Nagaland and Pan Bazar Tripura Guwahati-781 001 Tel.No.0361-2542556, 0361-2540445 Fax No.0361-2540445 email: [email protected] Dr. -

Czech Republic

CZECH REPUBLIC Part II: Non-discrimination 1. Sharing Examples of Good Practice on the National Level In April 2013, Ministry of Labour and Social Affairs started a new feature on its website where examples of good practice concerning different areas of life of elderly persons (non-discrimination, health care, employment, education etc.) will be collected and published. http://www.mpsv.cz/cs/15163 2. Measures for Protection of Rights of Elderly Persons in the Czech Republic National Action Plan Promoting Positive Ageing for 2013-2017 In 2013, the Czech Republic adopted the new national strategic policy document called ”National Action Plan promoting positive ageing for 2013-2017“, which explicitly underlines „protection of human rights of elderly persons“ inter alia as a key principle of this plan. Therefore in the part of the Plan”Human Rights of Elderly Persons“, various tools are set up to implement two main strategic goals: 1) to ensure that the public is better informed about the needs of the elderly persons and is more responsive to them; 2) to provide the protection of elderly persons against all forms of discrimination, abuse or neglect. Among the measures to reach the second goal are: to support all forms of help (psychological, legal, social etc.) to elderly persons (as well as victims of discrimination or abuse) and to develop educational materials and trainings for professional staff (also in institutional care) on how to prevent and recognise abuse of elderly persons. 3. Activities of the Government Council for Elderly Persons and Population Ageing http://www.mpsv.cz/en/4538 The Government Council for Elderly Persons and Population Ageing (hereinafter „the Council“) was established on March 22, 2006 by Government resolution No. -

Armenian Ombudsman

OFFICE OF THE HUMAN RIGHTS DEFENDER OF THE REPUBLIC OF ARMENIA PUBLIC RELATIONS UNIT The Human Rights Defender’s observations on the recent events taking place in the country Fulfilling its constitution mission to guarantee and safeguard human rights the Human Rights Defender contributes to the effective functioning of the country's entire system on human rights protection. The latter assumes that democratic developments, taking place in the country, are one of the fundamental issues under the Defender’s consideration. The Human Rights Defender fulfils the named mission by virtue of his constitutional status and guided by the fundamental principles of impartiality and political neutrality. Recent developments in the country are under due consideration of the Defender. The study of the latter situation in the country emphasizes the necessity to publicly express the Human Rights Defender's position on them, which are: 1. During the democratic developments in the country in April-May of the current year, citizens of Armenia, exercising their free will, had an opportunity to make fundamental changes that directly concerns each of us. 2. Relying on the high level of trust among citizens, the outcomes of these democratic developments should be served for putting the public power system on a solid institutional grounds. Being a fundamental guarantee of country’s strength, trust of citizens is the basis of power. Everyone’s mission is to make mutual efforts to strengthen and preserve the atmosphere of trust. 3. Nevertheless, it is necessary to guarantee that state power is exercised in conformity with the Constitution and the laws based on the separation and balance of the legislative, executive and judicial powers. -

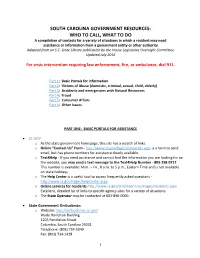

South Carolina Government Resources: Who to Call

SOUTH CAROLINA GOVERNMENT RESOURCES: WHO TO CALL, WHAT TO DO A compilation of contacts for a variety of situations in which a resident may need assistance or information from a government entity or other authority Adapted from an S.C. State Library publication by the House Legislative Oversight Committee Updated July 2018 For crisis intervention requiring law enforcement, fire, or ambulance, dial 911. Part 1: Basic Portals for information Part 2: Victims of Abuse (domestic, criminal, sexual, child, elderly) Part 3: Accidents and emergencies with Natural Resources Part 4: Fraud Part 5: Consumer Affairs Part 6: Other Issues PART ONE: BASIC PORTALS FOR ASSISTANCE SC.GOV o As the state government homepage, this site has a wealth of links. o Online “Contact Us” Form - http://www.sc.gov/Pages/contactUs.aspx is a form to send email, but has phone numbers for assistance clearly available. o Text4Help - If you need assistance and cannot find the information you are looking for on the website, you may send a text message to the Text4Help Number - 803-258-0717. This number is available: Mon. – Fri., 8 a.m. to 5 p.m., Eastern Time and is not available on state holidays. o The Help Center is a useful tool to access frequently asked questions - http://www.sc.gov/Pages/helpCenter.aspx. o Online services for residents http://www.sc.gov/OnlineServices/Pages/Residents.aspx Excellent, detailed list of links to specific agency sites for a variety of situations. o The State Operator may be contacted at 803-896-0000. State Government Ombudsman o Website: http://ombudsman.sc.gov/ Wade Hampton Building 1205 Pendleton Street Columbia, South Carolina 29201 Telephone: (803) 734-5049 Fax: (803) 734-1428 1 South Carolina State Library o Website: http://www.statelibrary.sc.gov o Phone Number: 803-734-8026 South Carolina State Legislators o Website: http://www.scstatehouse.gov/index.php Charities and Non-Profits in S.C. -

Annual Report 2018

REPUBLIC OF ALBANIA ANNUAL REPORT On the activity of the Ombudsman’s Institution January 1st – December 31st Year 2018 Tirana, on May 2019 CONTENT The welcome speech of the Ombudsman CHAPTER 1 The legal and institutional framework CHAPTER 2 Cooperation 2.1 Cooperation with public administration institutions and the level of implementation of the Ombudsman’s recommendations 2.2 International cooperation 2.3 Cooperation within the framework of projects CHAPTER 3 The follow-up and implementation of Parliament’s resolution for the evaluation of the activity of the Ombudsman’s Institution for the year 2017. CHAPTER 4 Assessment of the situation for the observance of human rights by the public administration 4.1 The rights of people deprived of their liberty 4.2 The observance of human rights by the State Police bodies 4.3 The prevention of violence and torture 4.4 The observance of Human Rights by the Prosecution 4.5 The execution of civil and administrative judicial decisions 4.6 Free legal aid 4.7 The observance of property rights 4.8 The right to health care 4.9 The right to education 4.10 Environment and human rights 4.11 The right to housing 4.12 Economic aid 4.13 The right to social security 4.14 The rights of people with disabilities 4.15 Children's rights CHAPTER 5 Other institutional engagements 5.1 Special report on the issues related to the implementation of the construction project of the road segment "Tirana’s Eastern Ring Road", in the area of Shkoza. 5.2 The right to peaceful rallies 5.3 The Protest against the National Road Tax 5.4. -

Greek Ombudsman – Equal Treatment

EQUAL TREATMENT SPECIAL REPORT 2017 SPECIAL REPORT 2017 REPORT SPECIAL • EQUAL TREATMENT TREATMENT EQUAL THE GREEK OMBUDSMAN INDEPENDENT AUTHORITY INDEPENDENT AUTHORITY INDEPENDENT OMBUDSMAN THE GREEK NATIONAL PRINTING HOUSE THE GREEK OMBUDSMAN INDEPENDENT AUTHORITY EQUAL TREATMENT SPECIAL REPORT 2017 (article 25 paragraph 8 Law 3896/2010 and article 19 paragraph 6 Law 4443/2016) EQUAL TREATMENT SPECIAL REPORT 2017 (article 25 paragraph 8 Law 3896/2010 and article 19 paragraph 6 Law 4443/2016) THE GREEK OMBUDSMAN INDEPENDENT AUTHORITY In memory of Vassilis Karydis Editor in Chief Kalliopi Lykovardi Central Editorial Board Anastasia Matana Dimitra Mytilineou Editors Christina Angeli Konstantinos Bartzeliotis Ilektra Demirou Amalia Leventi Anastasia Matana Dimitra Mytilineou Andriani Papadopoulou Eleni Stampouli Evangelos Tsakirakis Dimitris Veremis Maria Voutsinou Statistical Data Processing Dimitra Mytilineou Ilias Vouropoulos English Translation Irene Spanaki English Language Editing Andriani Papadopoulou Copy Editing Vaso Bachourou Cover Page – Art Direction SYNTHESI Graphic Arts & Printing Company The Equal Treatment Special Report 2017 was printed by the National Printing House, in 2018, and issued in 700 Greek and 300 English copies. The full version of the Report is available on the website of the Greek Ombudsman. www.synigoros.gr The Greek Ombudsman 17, Halkokondyli Str., Athens, GR-104 32 Tel. No: (+30) 213 1306 600 www.synigoros.gr ISSN: 2623-4327 TABLE OF CONTENTS PREFACE ......................................................................................................................................................7 -

REPUBLIC of ALBANIA OMBUDSMAN Special Section

REPUBLIC OF ALBANIA OMBUDSMAN Special section Address: Bulevardi "Zhan D'Ark" Nr.2 Tel/Fax +355 4 2380 300/315 Tirana, Albania E-mail: [email protected] www.avokatipopullit.gov Protocol no. K2/A35-2 Tirana, 14 April 2016 Doc. No. 201600595/2 Subject matter: Recommendation for the initiation of investigations against citizens Admir Goduni and Servet Daliu for the commitment of the criminal offense of "Conducting arbitrary actions" carried out with accomplices, as provided for by Articles 250 and 25 of the Criminal Code. To: Chief Prosecutor of the Prosecution Office of District Court, Mr. Petrit FUSHA Tirana Dear Mr. Fusha, On 26 March 2016, in the afternoon, a protest was organized at the Tirana Artificial Lake Park by the leaders of the Democratic Party, its supporters and members of civil society, who were against the construction of a playground in this park by the Municipality of Tirana. In the evening of this date, the Ombudsperson Office was informed by some civil society activists who had been protesting in this place permanently that one of their members was beaten by an employee of the Municipality of Tirana. On the basis of this complaint, the Ombudsman ordered two staff members to go to the place and make the appropriate verifications. The staff members of the Ombudsman Office went to the site and met with representatives of civil society. They claimed that the police officers of Tirana Municipality had broken their tent, which they had erected near the site the playground was being built, and in which they kept some of their belongings and stayed in it 11 days without interruption. -

Federal Complaint-Handling, Ombudsman, and Advocacy Offices

Federal Complaint-Handling, Ombudsman, and Advocacy Offices Wendy R. Ginsberg Analyst in Government Organization and Management Frederick M. Kaiser Specialist in American National Government August 4, 2009 Congressional Research Service 7-5700 www.crs.gov RL34606 CRS Report for Congress Prepared for Members and Committees of Congress Federal Complaint-Handling, Ombudsman, and Advocacy Offices Summary Federal complaint-handling, ombudsman, and advocacy offices have different forms, capacities, and designations. This report, which reviews the state of research in this field and the heritage of such offices, examines and compares them, along with recent legislative developments and past proposals to establish a government-wide ombudsman. In so doing, the report identifies the basic characteristics of these offices, recognizing differences among them with regard to their powers, duties, jurisdictions, locations, and resources, as well as control over them. This study covers only ombudsman-like offices at the federal level that deal with the public, sometimes known as “external ombudsmen.” It does not cover “internal ombudsmen,” that is, offices created to handle complaints from employees and resolve disputes between them and management; ombudsman- like offices in the private sector; or similar entities at other levels of government in the United States or abroad, except to note differences among them. Legislative interest, albeit sporadic, in establishing a government-wide ombudsman or standardizing individual offices across-the-board dates to the early 1960s. These efforts extended in the 1970s to proposals to establish an independent office of consumer representation or consumer affairs, a plan that President Jimmy Carter later endorsed. Another initiative emerged in 1993, when President William Clinton—through an executive order “Setting Customer Service Standards”—directed executive departments and agencies to make information, service, and complaint-systems easily accessible and provide means to address such complaints.