Sustainable Investment in China 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Harvest Global Investments Limited

IMPORTANT: If you are in any doubt about the contents of this Prospectus, you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser for independent financial advice. HARVEST FUNDS (HONG KONG) ETF (a Hong Kong umbrella unit trust authorised under Section 104 of the Securities and Futures Ordinance (Cap. 571) of Hong Kong) Harvest MSCI China A Index ETF (RMB Counter Stock Code: 83118 HKD Counter Stock Code: 03118) Harvest MSCI China A 50 Index ETF (RMB Counter Stock Code: 83136 HKD Counter Stock Code: 03136) Harvest CSI Smallcap 500 Index ETF (RMB Counter Stock Code: 83150 HKD Counter Stock Code: 03150) PROSPECTUS Manager Harvest Global Investments Limited Investment Adviser Harvest Fund Management Co., Ltd. Listing Agent for the Harvest CSI Smallcap 500 Index ETF Altus Capital Limited 16 November 2018 Hong Kong Exchanges and Clearing Limited (“HKEx”), The Stock Exchange of Hong Kong Limited (the “SEHK”), Hong Kong Securities Clearing Company Limited (“HKSCC”) and the Hong Kong Securities and Futures Commission (the “SFC”) take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. The Trust and the Sub-Funds have each been authorised as collective investment schemes by the SFC. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. -

Expert Affidavit

Case 4:13-cr-00147-SMR-CFB Document 224-2 Filed 03/13/15 Page 1 of 17 DECLARATION OF TONG YAO I, Tong YAO, declare as follows: 1. I am older than (18) years of age. Except as indicated herein, I have persona! knowledge of the facts and circumstances of the matters set forth in this Declaration. If called as a witness, I could and would testi~’ competently to the matters set forth herein. 2. 1am a native of Changzhou, Jiangsu Province, China. I lived in China until I came to the United States in 1994 for graduate school. I have remained in the United States for 21 years. I teach and publish primarily in English, but I remain fluent in Mandarin. 3. I currently hold the title of Associate Professor of Finance at the Tippie College of Business at the University of Iowa. My field of specialization is financial markets, with a sub-specialization in Asian financial markets. I have studied and published multiple papers about Asian stock markets, and the Chinese stock market in particular. A current copy of my curriculum vitae is attached to this Declaration as Exhibit A. 4. I was asked to determine whether a publicly traded Chinese corporation, DBN, was owned or controlled by the Chinese government, or any entity controlled by the Chinese government, at any time from 2011 through 2014. 5. DBN is a private Chinese corporation, registered at the Industrial and Commercial Administration Authority as “Company Limited by Shares (Listed, Invested or Controlled by Natural Persons),” with its principal place of business in Beijing. -

UBS Shifting Asia – Smart Cities

25 September 2019 Chief Investment Office GWM Investment Research Sustainable investment in Asia Shifting Asia Wind powered turbines in the Pacific Ocean Gettyimages Editorial Dear reader, Few would have forecast a few years ago that China would to follow suit. Many have also backed regulators to enhance emerge as the world’s second largest green bond issuer in corporate stewardship and governance code frameworks 2018, just two percentage points behind the US; or that and enforced ESG disclosure reporting. The HKMA, which Abenomics would transform Japan into the world’s fastest- regulates the Hong Kong financial system and manages an growing sustainable investing (SI) market with a similar as- HKD 4 trillion Exchange Fund, is a case in point; it has been sets under management (AUM) penetration to what the US uniquely positioned to put into practice what it has promul- had in 2014; or that in 2019 Asia would have more stock gated via new green finance and ESG regulation. Others, like exchanges with mandatory environmental, social and gov- Singapore’s Temasek, have adopted ESG into investment ernance (ESG) reporting than any region in the world. decisions strongly motivated by climate change risk. Attitudes toward sustainable investment in Asia have Asian asset owners have embraced SI because of the rising changed radically in just a few years. And while it has acceptance that SI does not compromise financial returns become evident that governments must lead in Asia to or performance. For long-term investors, including pension produce meaningful change to sustainability challenges, funds and insurance companies, SI can lower downside risk there has also been indirect pressure from the wider public from “stranded assets” created by climate change and on governments and corporations, particularly on issues re- transition risk. -

Investor Members and Signatories to CDP 2019

Investor Members and Signatories to CDP 2019 MEMBERS MEMBERS MEMBERS ACTIAM Catholic Super Hang Seng Bank CCLA Investment Management Aegon Harvest Fund Management Ltd Allianz Global Investors ClearBridge Investments Hermes Fund Managers Allianz Group Danske Bank A/S HSBC Global Asset Management Aviva Investors EdenTree Investment HSBC Holdings plc Management AXA Group Edmond de Rothschild Asset Invesco Ltd Management AXA Investment Managers Energy Income Partners, LLC Investec Asset Management Baillie Gifford & Co. Environment Agency Pension Itaú Asset Management Fund Bank of America Ethos Foundation Janus Henderson Investors BBVA Etica SGR Jupiter Asset Management Bluebay Asset Management LLP Eurizon Capital SGR S.p.A. Kames Capital BNP Paribas Asset Management Evenlode Investments KEVA Boston Common Asset Legal and General Management, LLC Fidelity International British Columbia Investment Legg Mason, Inc. Management Corporation (BCI) Fondaction CSN Caisse des Dépôts Franklin Templeton London Pensions Fund Authority California Public Employees' M&G Investments Retirement System (CalPERS) FUNDAÇÃO ITAUBANCO California State Teachers' Generation Investment Martin Currie Retirement System (CalSTRS) Management Calvert Investment Management, Mongeral Aegon Seguros e GMO LLC Inc Previdência S.A. Canada Pension Plan Investment Goldman Sachs Asset MS&AD Insurance Group Board (CPPIB) Management Holdings, Inc. Capricorn Investment Group Group La Française National Australia Bank 2 MEMBERS MEMBERS MEMBERS PREVI Caixa de Previdência dos Neuberger -

Participating Companies & Organizations As of September 19

Participating Companies & Organizations As of September 19, 2019 ADNOC George W. Bush Institute OYO Hotels and Homes African Development Bank GMO Asset Management Paramount Pictures Akbank Government Pension Investment Patagonia Allianz Global Investors Fund (GPIF) Japan PensionDanmark Alphabet and Google Greentech Capital Advisors Perella Weinberg Partners Anheuser-Busch InBev Guggenheim Partners Planet Labs AP7 Gulf International Bank (UK) Ltd. Propper Daley Apollo Global Management Harvest Fund Management Qatar Investment Authority Arm Hellman & Friedman Qatar Stock Exchange Atlassian HSBC Revolution AustralianSuper Hudson Institute Royal DSM Avenue Capital India Today Group Royal Dutch Shell Aviva Investors Indonesia Investment Sesame Workshop AXA Group Ingersoll Rand Sinovation Ventures Bain Capital Inspired Capital Snap Inc. Bank of America International Monetary Fund Softbank Bank of England Investec Group Spring Labs Bank of Canada Islamic Development Bank Group SRMG BGD Holdings, LLC JPMorgan Chase State Street Corp. BlackRock, Inc. K5 Global Suez Blackstone Group Kering Sygnia Group Bloomberg LP Kissinger Associates Temasek International Bloomberg Philanthropies Kohlberg Kravis Roberts & Co. Teneo BNP Paribas Kuwait Investment Authority Tesco Boudica Macquarie Group The Carlyle Group Brazilian Agribusiness Association Mahindra Group The Goldman Sachs Group, Inc. Business Roundtable Marathon Asset The New York Times Canaccord Mars, Incorporated The Paulson Institute Capital Market Authority Mastercard The Saudi Stock Exchange Carlsberg Group/Carlsberg Matarin Capital (Tadawul) Foundation Merck The Walt Disney Company CBS Metlife The World Bank Group China General Chamber of MidOcean TIAA Commerce (CGCC) Moelis & Company Tigress Financial Partners Cisneros Moody’s Tudor Investment Corp Citigroup MSNBC U.S. Department of State CNN National Geographic Partners Uber ConsenSys National Stock Exchange of Unitel SA Angola Cowen, Inc. -

Industry Overview

THIS WEB PROOF INFORMATION PACK IS IN DRAFT FORM. The information contained herein is incomplete and subject to change and it must be read in conjunction with the section headed “Warning” on the cover of this Web Proof Information Pack. INDUSTRY OVERVIEW FROST & SULLIVAN REPORT We commissioned Frost & Sullivan, an independent global market research and consulting company based in the United States which was founded in 1961, to conduct an analysis of, and to report on, the sportswear market in the PRC as well as some brief sportswear market information on Europe and United States at an aggregate fixed fee of RMB228,000. The Frost & Sullivan report we commissioned includes information on the PRC sportswear market such as sales value, market share and ranking of brand sportswear companies, total sportswear consumption, consumption per capita and other economic data, which have been quoted in this document. Frost & Sullivan’s independent research was undertaken through both primary and secondary research obtained from various sources. Primary research involves interviewing leading industry participants including sportswear brand companies and sportswear retailers. Secondary research involves reviewing company reports, independent research reports and data based on Frost & Sullivan’s own research database. Projected total sportswear consumption and total sales value in the PRC were obtained from historical data analysis plotted against macroeconomic data as well as specific related industry drivers such as level of brand awareness, product -

30 April 2010 Page 1 of 15 SATURDAY 24 APRIL 2010 Show of Hands Methods and Subject Matter

Radio 4 Listings for 24 – 30 April 2010 Page 1 of 15 SATURDAY 24 APRIL 2010 Show of Hands methods and subject matter. SAT 00:00 Midnight News (b00s0zxc) Helen Mark visits the landscapes that have inspired award In the glamorous setting of the flamboyant Goan film festival, The latest national and international news from BBC Radio 4. winning folk group Show of Hands who have won many awards we'll discover how huge Gurinder is there, and talk to Indian Followed by Weather. for their music depicting rural life in Dorset and the West cinemagoers, directors, actors, and movie buffs about the larger Country. Helen meets singer/songwriter Steve Knightley in his than life director, her films, and how, whilst they're clad in their home town of Topsham on the Exe Estuary in Devon. He talks designer labels in a country that's a new world power, they see SAT 00:30 Book of the Week (b00rzrsx) about his love of the area and explains why he chooses to sing the British Asian community as endearingly old fashioned. Michael Chabon - Manhood for Amateurs about the countryside and its people in a way that's earned him the reputation for being 'the gravelly voiced spokesman of the Producer: Lucy Greenwell. Episode 5 rural poor'. The group's song Country Life encapsulates many of the harsher realities of contemporary rural England. Helen A Just Radio production first broadcast on BBC Radio 4 in Jason Butler Harner continues to read from Pulitzer prize- meets some of the characters who feature in those songs that 2010. -

Annual Report 2018

PRINCIPLES FOR RESPONSIBLE INVESTMENT Annual Report 2018 An investor initiative in partnership with UNEP Finance Initiative and UN Global Compact THIS ANNUAL REPORT SETS OUT HOW OUR WORK OVER THE PAST YEAR CONTRIBUTES TO THE GOALS OF OUR 10-YEAR BLUEPRINT FOR RESPONSIBLE INVESTMENT 2 ANNUAL REPORT | 2018 3 FOREWORD Chair, Martin Skancke One of our longstanding commitments has been to bring the PRI closer to our signatories through more regional support. Last year, we hired a first-ever head of China to meet the growing interest in responsible investment that we see not only in that country but also in other countries across the region, most notably in Malaysia, Singapore and South Korea. Not content to stand still In Europe, we’ve added a head of Benelux and a head of Nordic, CEE and CIS. A MEANINGFUL COMMITMENT Accountability is another priority in the Blueprint. Following considerable consultation and discussion, the PRI is implementing minimum requirements for signatories. We will work closely with those who are not meeting the requirements in order to help them improve their performance. Failure to meet these requirements by 2020 would result in delisting. But, in order to further move responsible investment forward, it is equally important to recognise leadership. We will highlight and share good practices being carried out by our signatories. At this year’s PRI in Person in San Francisco, we will be announcing the establishment of leadership As we look back over the past year, delivering on the awards, the first of which will be awarded at PRI in Person ambitious agenda outlined in our Blueprint for responsible 2019 in Paris. -

The Top 400 Asset Managers

THE TOP 400 ASSET MANAGERS 23 The top 400 asset managers Asset managers in our listing are ranked by global assets under management and by the country of the main headquarters and/or main European domicile. Assets managed by these groups total €56.3trn. Company Country Total 2016 Total 2015 Company Country Total 2016 Total 2015 31/12/15 (€m) 31/12/14 (€m) 31/12/15 (€m) 31/12/14 (€m) 1 BlackRock US/UK 4,398,439 3,844,383 62 SEI US/UK 239,800 208,000 2 Vanguard Asset Management US/UK 3,091,979 2,577,380 63 Dodge & Cox US 238,761 222,779 3 State Street Global Advisors US/UK 2,066,479 2,023,149 64 Pioneer Investments Italy 223,614 201,030 4 Fidelity Investments US 1,830,330 1,595,380 65 Neuberger Berman US/UK 221,263 206,637 5 BNY Mellon Investment Management US/UK 1,492,895 1,407,163 66 DekaBank Germany 217,555 202,238 6 J.P. Morgan Asset Management US/UK 1,361,178 1,266,805 67 BNY Mellon Cash Inv. Strategies* US 205,990 197,718 7 PIMCO US/Germany 1,321,158 1,162,583 68 Babson Capital Management US 205,068 175,900 8 Capital Group US 1,272,080 1,167,231 69 Loomis Sayles & Company* US 204,200 185,800 9 Prudential Financial US 1,089,737 968,628 70 Voya Investment Management US 191,901 - 10 Legal & General Investment Mngt.† UK 1,012,389 893,900 71 Nordea Asset Management Denmark 188,978 173,873 11 Goldman Sachs Asset Management Int. -

Qualified Domestic Institutional Investors(Qdiis) with Investment Quotas Granted by the SAFE

Qualified Domestic Institutional Investors(QDIIs) with Investment Quotas Granted by the SAFE By September30, 2019 Unit: 100 million USD No. Name of QDII Latest Approval Date Investment Quota 1 Bank of China, Ltd. 2018.06.28 8.00 Industrial and Commercial Bank of 2 2018.05.30 8.00 China Limited 3 Bank of East Asia (China), Ltd. 2014.12.28 2.00 4 Bank of Communications Co., Ltd. 2006.07.27 5.00 5 China Construction Bank Corporation 2014.12.28 5.00 6 HSBC Bank (China) Company, Ltd. 2015.03.26 34.00 7 China Merchants Bank Co., Ltd. 2014.12.28 2.00 8 China Citic Bank 2006.09.18 1.00 9 Hang Seng Bank (China) Company, Ltd. 2006.09.27 0.30 10 Citibank (China) Co., Ltd. 2006.09.27 34.00 11 Industrial Bank 2014.12.28 1.00 12 Standard Chartered Bank (China), Ltd. 2015.01.30 20.00 13 Minsheng Bank 2006.11.08 1.00 14 China Everbright Bank 2014.12.28 1.00 15 Bank of Beijing 2006.12.11 0.50 Bank of China (Hong Kong), Ltd. 16 2007.01.11 0.30 Branches in Mainland 17 Credit Suisse Shanghai Branch 2007.01.30 0.30 18 Agricultural Bank of China 2014.12.28 2.00 19 Nanyang Commercial Bank (China) Co., 2015.02.13 1.80 20 DeutscheLtd. Bank (China) Co., Ltd. 2007.08.17 0.30 21 Shanghai Pudong Development Bank 2007.08.31 0.30 22 Bank of Shanghai 2008.01.24 0.30 23 DBS Bank (China), Ltd. -

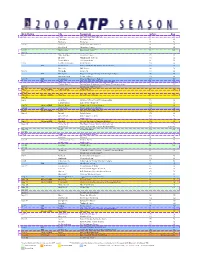

ATP World Tour 2009 Calendar Final

Week Starting City Tournament Surface Draw Jan 5 Doha Qatar ExxonMobil Open H 32 Chennai Chennai Open H 32 Brisbane Brisbane H 32 Jan 12 Sydney Medibank International H 28 Auckland Heineken Open H 28 Jan 19 Melbourne Australian Open*Open H 128 Jan 26 Feb 2 Viña del Mar Movistar Open CL 32 Zagreb PBZ Zagreb Indoors IH 32 South Africa Johannesburgg H 32 Feb 9 Costa do Sauipep Brasil Openp CL 32 500 Rotterdam ABN AMRO World Tennis Tournament IH 32 San Jose SAP Openp IH 32 Feb 16 Marseille Openp 13 IH 32 500 Memphisp Regionsgggpp Morgan Keegan Championships IH 32 Buenos Aires Copa Telmex CL 32 Feb 23 500 Acapulco Abierto Mexicano Telcel CL 32 500 Dubai Barclays Dubai Tennis Championships H 32 Delray Beach Delray Beach International Tennis Championships H 32 Mar 2 Davis Cup First Round* Mar 9 Masters 1000 Indian Wells Indian Wells H 96 Mar 16 Mar 23 Masters 1000 Miami Sony Ericsson Open H 96 Mar 30 Apr 6 Houston US Men’s Clay Court Championship CL 32 Casablanca Grand Prix Hassan II CL 32 Apr 13 Masters 1000 Monte-Carlo Monte-Carlo Rolex Masters CL 56 Apr 20 500 Barcelona Open Sabadell Atlantico CL 56 Apr 27 Masters 1000 Rome Internazionali BNL d’Italia CL 56 MMay 4 EEstoril t il EEstoril t il OpenO CL 32 AftAmersfoort DthDutch OpenO TennisT i CL 32 MunichMih BMW OpenO CL 32 MayM 11 MastersM t 1000 MadridMdid MutuaMt MadrileñaMdilñ MMasters t MdidMadrid CL 56 MMay 18 PöPörtschach t h h ThThe HHypo GroupG TennisT i InternationalI t ti l CL 32 DüDüsseldorf ld f ARAG ATP WorldW ld TeamT ChChampionship i hi CL 8 tteams MMay 25 PiParis RlRoland d -

Our Thoughts on the Mainland-Hong Kong Mutual Recognition of Funds

Insights From Morningstar's Manager Research Analysts July 2015 Talking Points Our Thoughts on the Mainland-Hong Kong Mutual Recognition of Funds Morningstar Analysts The China Securities Regulatory Commission (CSRC) and Hong number of onshore asset management firms that could Kong’s Securities and Futures Commission (SFC) launched the participate in the MRF (Figure 1). Mainland-Hong Kong Mutual Recognition of Funds, or MRF, on July 1, 2015. Prior to this initiative, international investors could Out of the estimated 844 eligible funds, about 46% (388) are only invest in China’s onshore market through Qualified Foreign equity funds, 16% (133) are aggressive-allocation funds, and Institutional Investor (QFII) or Renminbi Qualified Foreign 10% (85) are aggressive bond funds (Figure 2), as categorized Institutional Investor (RQFII) schemes, while onshore Chinese by Morningstar. Additionally, 18 of the qualified funds are QDII fund investors could only gain access to global markets through funds and 30 are exchange-traded fund (ETF) feeder funds. Over Qualified Domestic Institutional Investor (QDII) funds. Through half of the 388 qualified equity funds have a large-growth- the MRF initiative, global investors will be able to invest in oriented investment style according to the Morningstar Equity eligible onshore Chinese funds via Hong Kong and, similarly, Style Box, followed by preferences for mid-growth and large- onshore Chinese investors will be able to gain access to eligible blend styles (Figure 3). Hong Kong-domiciled funds. With a net quota of RMB 300 billion (about USD 48 billion) each way, this regime is an Breakdown of the 103 Qualified Hong Kong-domiciled important step towards the progressive opening of China’s Funds capital market.