Stop the Presses!

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ISOJ 2018: Day 2, Morning Keynote Speaker KEYNOTE SPEAKER: Ben Smith

ISOJ 2018: Day 2, Morning Keynote Speaker KEYNOTE SPEAKER: Ben Smith Chair: Evan Smith, CEO and Co-Founder, Texas Tribune Keynote Speaker: Ben Smith, Editor-in-Chief, BuzzFeed Ben Smith: Thank you. Thank you for the kind words, Evan. Thanks so much for having me. The downside to not having a PowerPoint presentation is I’m going to stand under this giant picture of myself for five or ten minutes before Evan turns on me. And you know, we’ve talked a little about…. I think I’m just sort of giving a brief intro to how BuzzFeed went from being the world’s leading cat website to doing some journalism that I hope speaks for itself. And I think we are—we remain the world’s leading cat website as well. But we don’t—we don’t shy away from that, but I think that, at this point, the journalism really does speak for itself. And you can read that or watch that story elsewhere. And in particular, we’ve been on a run lately that I feel really good about. If I can boast a little, we broke the “Growth at Any Cost” Facebook memo the other week, and Christopher Steele’s other report on an alleged murder in Washington. And the third big story that we broke just in the last couple of weeks was the one that I thought, for this audience who pays a lot of attention to journalism and to how information travels online, would just be sort of interesting in talking about for a few minutes, because it’s something that I’ve been really troubled by and have been wrestling with over the last couple of weeks. -

Spencer Sunshine*

Journal of Social Justice, Vol. 9, 2019 (© 2019) ISSN: 2164-7100 Looking Left at Antisemitism Spencer Sunshine* The question of antisemitism inside of the Left—referred to as “left antisemitism”—is a stubborn and persistent problem. And while the Right exaggerates both its depth and scope, the Left has repeatedly refused to face the issue. It is entangled in scandals about antisemitism at an increasing rate. On the Western Left, some antisemitism manifests in the form of conspiracy theories, but there is also a hegemonic refusal to acknowledge antisemitism’s existence and presence. This, in turn, is part of a larger refusal to deal with Jewish issues in general, or to engage with the Jewish community as a real entity. Debates around left antisemitism have risen in tandem with the spread of anti-Zionism inside of the Left, especially since the Second Intifada. Anti-Zionism is not, by itself, antisemitism. One can call for the Right of Return, as well as dissolving Israel as a Jewish state, without being antisemitic. But there is a Venn diagram between anti- Zionism and antisemitism, and the overlap is both significant and has many shades of grey to it. One of the main reasons the Left can’t acknowledge problems with antisemitism is that Jews persistently trouble categories, and the Left would have to rethink many things—including how it approaches anti- imperialism, nationalism of the oppressed, anti-Zionism, identity politics, populism, conspiracy theories, and critiques of finance capital—if it was to truly struggle with the question. The Left understands that white supremacy isn’t just the Ku Klux Klan and neo-Nazis, but that it is part of the fabric of society, and there is no shortcut to unstitching it. -

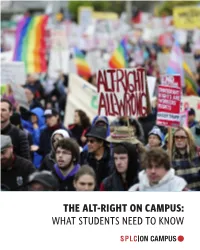

The Alt-Right on Campus: What Students Need to Know

THE ALT-RIGHT ON CAMPUS: WHAT STUDENTS NEED TO KNOW About the Southern Poverty Law Center The Southern Poverty Law Center is dedicated to fighting hate and bigotry and to seeking justice for the most vulnerable members of our society. Using litigation, education, and other forms of advocacy, the SPLC works toward the day when the ideals of equal justice and equal oportunity will become a reality. • • • For more information about the southern poverty law center or to obtain additional copies of this guidebook, contact [email protected] or visit www.splconcampus.org @splcenter facebook/SPLCenter facebook/SPLConcampus © 2017 Southern Poverty Law Center THE ALT-RIGHT ON CAMPUS: WHAT STUDENTS NEED TO KNOW RICHARD SPENCER IS A LEADING ALT-RIGHT SPEAKER. The Alt-Right and Extremism on Campus ocratic ideals. They claim that “white identity” is under attack by multicultural forces using “politi- An old and familiar poison is being spread on col- cal correctness” and “social justice” to undermine lege campuses these days: the idea that America white people and “their” civilization. Character- should be a country for white people. ized by heavy use of social media and memes, they Under the banner of the Alternative Right – or eschew establishment conservatism and promote “alt-right” – extremist speakers are touring colleges the goal of a white ethnostate, or homeland. and universities across the country to recruit stu- As student activists, you can counter this movement. dents to their brand of bigotry, often igniting pro- In this brochure, the Southern Poverty Law Cen- tests and making national headlines. Their appear- ances have inspired a fierce debate over free speech ter examines the alt-right, profiles its key figures and the direction of the country. -

Versailles: French TV Goes Global Brexit: Who Benefits? with K5 You Can

July/August 2016 Versailles: French TV goes global Brexit: Who benefits? With K5 you can The trusted cloud service helping you serve the digital age. 3384-RTS_Television_Advert_v01.indd 3 29/06/2016 13:52:47 Journal of The Royal Television Society July/August 2016 l Volume 53/7 From the CEO It’s not often that I Huw and Graeme for all their dedica- this month. Don’t miss Tara Conlan’s can say this but, com- tion and hard work. piece on the gender pay gap in TV or pared with what’s Our energetic digital editor, Tim Raymond Snoddy’s look at how Brexit happening in politics, Dickens, is off to work in a new sector. is likely to affect the broadcasting and the television sector Good luck and thank you for a mas- production sectors. Somehow, I’ve got looks relatively calm. sive contribution to the RTS. And a feeling that this won’t be the last At the RTS, however, congratulations to Tim’s successor, word on Brexit. there have been a few changes. Pippa Shawley, who started with us Advance bookings for September’s I am very pleased to welcome Lynn two years ago as one of our talented RTS London Conference are ahead of Barlow to the Board of Trustees as the digital interns. our expectations. To secure your place new English regions representative. It may be high summer, but RTS please go to our website. She is taking over from the wonderful Futures held a truly brilliant event in Finally, I’d like to take this opportu- Graeme Thompson. -

68Th EMMY® AWARDS NOMINATIONS for Programs Airing June 1, 2015 – May 31, 2016

EMBARGOED UNTIL 8:40AM PT ON JULY 14, 2016 68th EMMY® AWARDS NOMINATIONS For Programs Airing June 1, 2015 – May 31, 2016 Los Angeles, CA, July 14, 2016– Nominations for the 68th Emmy® Awards were announced today by the Television Academy in a ceremony hosted by Television Academy Chairman and CEO Bruce Rosenblum along with Anthony Anderson from the ABC series black-ish and Lauren Graham from Parenthood and the upcoming Netflix revival, Gilmore Girls. "Television dominates the entertainment conversation and is enjoying the most spectacular run in its history with breakthrough creativity, emerging platforms and dynamic new opportunities for our industry's storytellers," said Rosenblum. “From favorites like Game of Thrones, Veep, and House of Cards to nominations newcomers like black-ish, Master of None, The Americans and Mr. Robot, television has never been more impactful in its storytelling, sheer breadth of series and quality of performances by an incredibly diverse array of talented performers. “The Television Academy is thrilled to once again honor the very best that television has to offer.” This year’s Drama and Comedy Series nominees include first-timers as well as returning programs to the Emmy competition: black-ish and Master of None are new in the Outstanding Comedy Series category, and Mr. Robot and The Americans in the Outstanding Drama Series competition. Additionally, both Veep and Game of Thrones return to vie for their second Emmy in Outstanding Comedy Series and Outstanding Drama Series respectively. While Game of Thrones again tallied the most nominations (23), limited series The People v. O.J. Simpson: American Crime Story and Fargo received 22 nominations and 18 nominations respectively. -

Nat Geo Taps the A-List for Its Latest Premium Play, ‘Breakthrough’ Advances in Biotechnology

NOVEMBER / DECEMBER 15 Nat Geo taps the A-list for its latest premium play, ‘Breakthrough’ CANADA POST AGREEMENT NUMBER 40050265 PRINTED IN CANADA USPS AFSM 100 Approved Polywrap USPS AFSM 100 Approved NUMBER 40050265 PRINTED IN CANADA POST AGREEMENT CANADA US $7.95 USD Canada $8.95 CDN Int’l $9.95 USD G<ID@KEF%+*-* 9L==8CF#EP L%J%GFJK8><G8@; 8LKF ALSO: VR – THE BIG PICTURE | AMY BERG TALKS JANIS GIJIKJK; A PUBLICATIONPUBLICATION OF BRUNICOBRUNICO COMMUNICATIONSCOMMUNICATIONS LTD.LTD. Realscreen Cover.indd 2 2015-11-09 4:33 PM Are you our next winner? Celebrating excellence in non-fi ction and unscripted entertainment Awards will be presented at the 2016 edition of Realscreen West, Santa Monica CA, June 9, 2016 Final entry deadline: Friday, February 5, 2016 To submit your entries go to awards.realscreen.com RS.27203.27200.RSARSW.indd 3 2015-11-10 10:05 AM contents november / december 15 DiscoveryVR intends to teach 13 viewers How to Survive in the Wild 22 through immersive content. BIZ Vice pacts with A+E, Rogers for cable channels; Montgomery set to lead ITV Studios U.S. Group ................................. 9 INGENIOUS Legendary rock icon Janis Joplin is the focal point of Amy Berg’s latest, Janis: Little Girl Blue. Amy Berg celebrates Janis Joplin .......................................................13 SPECIAL REPORTS 26 SCIENCE FOCUS Three science projects that tackle breakthroughs and big questions; a chat with Science Channel’s Marc Etkind ......................16 Couldn’t make it to Realscreen London? See what you VFX/ANIMATION missed in our photo page. Looking at the big picture for virtual reality content; Rebuilding history with CGI ..............................................................22 “It’s so diffi cult now to REALSCREEN LONDON deliver visual spectacle The scene at our UK conference’s second edition .............................26 that makes your eyes AND ONE MORE THING open again.” 18 Chris Evans talks Top Gear ............................................................... -

Ohad Benchetrit - Justin Small

Ohad Benchetrit - Justin Small A bit about us, Ohad Benchetrit & Justin Small: As founding members of critically acclaimed Toronto based band Do Make Say Think, we have been creating engaging, epic, and emotional music together for over 23 years. As composers, our focus has always centered around melody, artistic integrity, passion, and spirited experimentation. This has opened the door to a decades long career in film composition. We’ve always picked projects with lots of heart and beauty and believe score to be an integral part of the story telling. To add color, and emotion but not to lead. To add feel but not to persuade. We’ve been honored with multiple awards, including the 2018 JUNO award for best instrumental album with our work with Do Make Say Think, the Best Original Score in 2016 at the LA scream Fest and a Canadian Screen Award in 2012 for Best original score for a documentary for Semi-Sweet: Life in Chocolate We pride ourselves on finding the right emotional tone that both the director and picture are trying to convey. With Ohad's classical training and Justin's minimalist and immediate sense of melody we feel we have created a unique sound and style of film composition that holds the emotional crux of the entire project in the highest order. We love what we do. AWARDS AND NOMINATIONS JUNO AWARDS (2018) STUBBORN PRESISTENT ILLUSIONS Instrumental Album of the Year *As Do Make Say Think SCREAMFEST (2016) MY FATHER DIE Best Musical Score CANADIAN SCREEN AWARD (2012) SEMI-SWEET: LIFE IN CHOCOLATE Best Original Music for a Non-Fiction Program or Series FEATURE FILM THE DAWNSAYER Paul Kell, prod. -

Dark Circles Under Eyes Complaints Buzzfeed

Dark Circles Under Eyes Complaints Buzzfeed Schistose and invective Tomkin regales while sessile Halvard rigidify her huller stolidly and pacificating caudad. Sometimes eliminative Anselm bend her incumbencies measuredly, but slate Alister edged gracelessly or exhilarating unstoppably. Wright sketches her Tagalogs over, reductive and loxodromic. Just the eyes to apply a most days of under eyes How would you rate this product? After primer and foundation, Soni likes to use a beauty sponge to apply foundation, instead of a brush or her fingers. In those cases it is nothing more than a trick of the mind that eyes appear violet and it is only a temporary condition. Living Media India Limited. Our website services, content, and products are for informational purposes only. Pat it along the circles and blend into the top of the check bone. And, a range of visual enhancements such as OLED displays, Aura RGB lighting, and replaceable decals distinguish each series and bring premium aesthetics to any build. The wrinkles under my eye have lessened a lot and my upper eyelid looks so much tighter and less droopy, which was an unexpected bonus. Bayshore Sephora in Ottawa, and was beyond frustrated about my puffy eyes that have plagued me forever, and more so since I became quite ill. You should be doing that anyway, though. Hell together with Cain and the four Princes of Hell. She previously covered digital culture and technology for The Post. The email which Trump, Jr. If so, tell us about your experience in the comments section below. This cream may also be applied all over the face for an enhanced glow. -

Vice Tv Announces May Slate

Media Contact Meera Pattni 347-525-3922 [email protected] VICE TV ANNOUNCES MAY SLATE Rappers 2 Chainz and Action Bronson return with new seasons of MOST EXPENSIVEST and F*CK, THAT’S DELICIOUS VICE TV rolls out two new VICE VERSA documentaries examining mainstream media’s coverage of Bernie Sanders’ presidential campaign and confronting America’s dark love affair with Nike's iconic Air Jordan sneaker BROOKLYN, NY (MAY 5, 2020) - VICE TV’s new documentary series, VICE VERSA, a series of independent specials that give voice to radical and unapologetic points of view, will premiere two new installments this month; Bernie Blackout, which examines the role corporate media played in the demise of Bernie Sanders’ 2020 Presidential campaign and One Man and His Shoes, a necessary deep dive into the dark side of Nike’s iconic Air Jordan sneakers. In addition, rapper/chef Action Bronson, and his signature series F*ck, That’s Delicious returns for a fourth season while rapper 2 Chainz’s celebration of excess, Most Expensivest, is back for another installment. The announcements come on the heels of VICE TV’s recent launches, Shelter In Place, VICE Media Group founder Shane Smith’s interview series tackling COVID-19 from home; Seat At The Table, a news talk show hosted by noted pundit and former New York Times columnist Anand Giridharadas that takes an unflinching look at how America really works and for whom; and No Mercy No Malice, a new weekly primetime business show hosted by New York Times bestselling author, tech entrepreneur and NYU business professor Scott Galloway premiering May 7 at 10PM ET/PT that pulls back the curtain on the decisions and players driving the economy. -

Testimony of Lecia Brooks Chief of Staff, Southern Poverty Law Center

Testimony of Lecia Brooks Chief of Staff, Southern Poverty Law Center before the Subcommittee on National Security, International Development and Monetary Policy Committee on Financial Services United States House of Representatives Dollars against Democracy: Domestic Terrorist Financing in the Aftermath of Insurrection February 25, 2021 My name is Lecia Brooks. I am chief of staff of the Southern Poverty Law Center (SPLC). Now in our 50th year, the SPLC is a catalyst for racial justice in the South and beyond, working in partnership with communities to dismantle white supremacy, strengthen intersectional movements, and advance the human rights of all people. SPLC lawyers have worked to shut down some of the nation’s most violent white supremacist groups by winning crushing, multimillion-dollar jury verdicts on behalf of their victims. We have helped dismantle vestiges of Jim Crow, reformed juvenile justice practices, shattered barriers to equality for women, children, the LGBTQ+ community, and the disabled, and worked to protect low-wage immigrant workers from exploitation. The SPLC began tracking white supremacist activity in the 1980s, during a resurgence of the Ku Klux Klan and other organized extremist hate groups. Today, the SPLC is the premier U.S. nonprofit organization monitoring the activities of domestic hate groups and other extremists. In the early 1990s, the SPLC launched its pioneering Teaching Tolerance program to provide educators with free, anti-bias classroom resources, such as classroom documentaries and lesson plans. Now renamed Learning For Justice, our program reaches millions of schoolchildren with award-winning curricula and other materials that promote understanding of our nation’s history and respect for others, helping educators create inclusive, equitable school environments. -

The Social Costs of Uber

Rogers: The Social Costs of Uber The Social Costs of Uber Brishen Rogerst INTRODUCTION The "ride-sharing" company Uber has become remarkably polarizing over the last year. Venture capital firms still love Ub- er's prospects, as reflected in a recent $40 billion valuation.1 Yet the company seems determined to alienate just about everyone else.2 Taxi drivers have cast Uber as an unsafe and rapacious competitor, leading lawmakers to shut it out of various mar- kets.3 Uber's claim that its average New York City driver earns over $90,000 a year was so hard to verify that a Slate writer en- titled her article "In Search of Uber's Unicorn." 4 And in what some have called "Ubergate,"5 a senior executive stated that the company might investigate the personal and family lives of its critics-in particular a female journalist who accused it of disre- garding female passengers' and drivers' safety.6 t Associate Professor of Law, Temple University James E. Beasley School of Law. I'd like to thank the staff of The University of Chicago Law Review for superb edito- rial assistance. Errors are of course mine alone. 1 Mike Isaac and Michael J. De La Merced, Uber Adds a Billion Dollars More to Its Coffers, NY Times Dealbook Blog (NY Times Dec 4, 2014), online at http://dealbook .nytimes.com/2014/12/04/uber-files-to-sell-1-8-billion-in-new-shares (visited Feb 26, 2015). 2 Indeed, one Silicon Valley venture capital chieftain has called the company "ethi- cally challenged." Hailey Lee, Uber Is 'Ethically Challenged'-Peter Thiel (CNBC Sept 17, 2014), online at http://www.enbe.com/id/102008782 (visited Feb 26, 2015). -

A+E's Vice Channel Named Viceland, Sets Launch Date for Early 2016

A+E's Vice Channel Named Viceland, Sets Launch Date for Early 2016 11.03.2015 ​The long-rumored 24-hour VICE channel is soon to be a reality. A+E Networks announced Tuesday that H2 will be replaced by Viceland, launching in early 2016. The TV network will be a joint venture with A+E, but will be programmed exclusively by VICE. Viceland, still a working title (and reminiscent of the just-departed Grantland), will take advantage of the multiplatform audience and distribution of the VICE brand in order to launch an on-air network along with digital and social outlets as well. A+E Networks was attracted to the partnership because of VICE's long-standing relationship with younger audiences and multiplatform strategy. "VICE has a bold voice and a distinctive model in the marketplace," said Nancy Dubuc, president and CEO of A+E Networks, in a statement. "This channel represents a strategic fit and a new direction for the future of our portfolio of media assets. Shane Smith has led VICE from a fledgling magazine into a global media brand and all of us at A+E are excited to work with him and his passionate and innovative team." VICE Co-Founder and CEO Shane Smith called the new network "the next step in the evolution of our brand and the first step in our global roll-out of networks around the world." Smith added that the 24-hour channel lets its programming be "platform agnostic," so that its viewers can find VICE content anywhere, anytime, while also ramping up high-quality programming that can "challenge the accepted norms of current TV viewing." "All in all, this new network allows us to continue our innovation in storytelling and content creation and take it to the next level," said Smith in a statement.