QUADRA and FNX Announce Merger of Equals to Create New Leading Intermediate Copper Producer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mine Plus CANADA’S TOP 40 COMPANIES Are Performing Well

c a n a d a ’ s f i r s t m i n i n g publication CANADIANCANADIAN MMwww.canadianminingjournal.cominingining JJournalournalAugust 2011 INSIDEJOB An in-depth look at building the Copper Mountain Mine Plus CANADA’S TOP 40 COMPANIES are performing well CANADIANCANADIANMining Journal Departments CONTENTS 5 Editorial Calling miners “sissies” (as one ‘consul- COVER STORY 13 tant’ did) because of peer pressure to act “macho” when it comes to safety is Canada’s TOP 40 not only ludicrous according to Editor Russ Noble but it’s also something that 13 mining companies wouldn’te b tolerated in Canada’s mines thankso t self-governing of the rules by CMJ’s annual “TOP 40” survey other miners. takes a look at Canada’s best mining companies and what areas of mining 6 Mining Matters are most profitable. Canadian Mining Journal’s popular “Mining Matters” pages take a quick lookt a some of the names and events BC Copper Mine 18 that are making headlines across 18 Copper Mountain Mining’s Canada and around the world. new project starts producing in 8 Competitive Edge record time. CMJ’s Foreign Correspondent Jaquelina Jimena talks about “The new CSR frontier” and how importantt i is to introduce the topic of Corporate Social Responsibility CANADIANS WORKING OUTSIDE CANADA into the universities of the world. In Alaska 22 10 In My Mine(d) 22 Fire River Gold revives Nixon This month’s Guest Column has been writteny b Yusra Siddiquee, a Partner Fork gold project in remote site. at Norton Rose OR LLP, and entitled “Key Changes to Canada’s Foreign Work Program.” In Mexico 26 34 Products 26 Minfinders Corp. -

4. Composition of the KGHM Polska Miedź S.A. Group – Subsidiaries 2

Annual consolidated financial statements Accounting policies and other explanatory information 4. Composition of the KGHM Polska Miedź S.A. Group – subsidiaries Effect of changes in the structure of the KGHM Polska Miedź S.A. Group during the reporting period Purchase of KGHM INTERNATIONAL LTD. (formerly Quadra FNX Mining Ltd.) On 5 March 2012, the KGHM Polska Miedź S.A. Group purchased from the former shareholders of Quadra FNX Mining Ltd. with its registered head office in Vancouver (“Quadra FNX”) 100% of the shares of Quadra FNX. The consideration transferred comprises: the purchase of ordinary shares for the amount of PLN 9 363 million, the purchase of warrants for the amount of PLN 39 million, the realisation of purchased warrants in the amount of PLN 305 million. The shares were purchased in execution of the agreement dated 6 December 2011 signed by the Parent Entity of the KGHM Polska Miedź S.A. Group and Quadra FNX under a Plan of Arrangement recommended by the Board of Directors of Quadra FNX (“Agreement”). The shares purchased represent 100% of the share capital of Quadra FNX and 100% of the votes at the General Meeting of this company. 5 March 2012 was assumed as the date of obtaining control. Until the moment of obtaining control by the KGHM Polska Miedź S.A. Group, the Quadra FNX shares were listed on the TSX Venture Exchange in Toronto. The operations of Quadra FNX (name changed to KGHM INTERNATIONAL LTD. from 12 March 2012) are focused on mine production of metals (including copper, nickel, gold, platinum, palladium) in the following mines: Robinson and Carlota in the USA, Franke in Chile, and McCreedy West, Levack (with the Morrison deposit) and Podolsky in Canada. -

Newsletter #4 (April 2012)

NEWSLETTER | # 4 | April 2012 IMSA Project gains momentum PAGE 4 Premiere at the World Mining Congress PAGE 5 7 Golden Rules online PAGE 12 Photo "Beginners" courtesy of EU-OSHA/Miran Beškovnik. See page 15 for story. NEWSLETTER | # 4 | April 2012 | NEWSLETTER Version 3 Theodor Bülhoff John McEndoo Bui Hong Linh Helmut Ehnes Presid ent Vice-President Vice-President Secretary General We are proudly presenting the fourth edition of the We hope you will find the latest information help- ISSA Mining Newsletter. Thank you for your highly ful and, as always, appreciate your feedback and encouraging feedback on the previous issues! input for the next issue! Feature ISSA Mining and MoLISA Vietnam to continue successful cooperation on OSH Prior to the launch of Vietnam’s National Safety Week, 120 inter- national leaders and OSH experts met at the conference “Promot- ing Decent Work: Occupational Safety and Health, Prevention and Labour Inspection – Chal- lenges and Solutions” in Đồng Nai, Vietnam, 15-18 March, 2012. Jointly organized by ISSA Mining, the Ministry of Labour, Invalids and Social Affairs, the Inter- national Labour Organization, the International Association of Labour Inspection, and ASEAN- OSHNET, the conference served as an excellent platform for in- formation exchange on OSH and labour inspection strategies. To continue the successful coopera- tion, Vice Minister Bui Hong Linh on behalf of MoLISA and ISSA Mining President Theodor Bülhoff signed a cooperation agreement for the period 2012 to 2015, preceding a Memorandum of Understanding -

Vale Finds Gold in Marathon

Issue #15 July 2011 Vale finds gold in Marathon West Mines team dedicates win to colleagues ine rescuers from Vale West Mines celebrated winning the M61st annual Ontario Mine Rescue Competition in Marathon in June, but the festivities were muted by the deaths of two miners a few days earlier at the company’s Stobie Mine in Sudbury. Briefi ng Offi cer Jacques Joduin, in accepting Vale West Mines rescue team poses during a break in action at the 2011 Ontario the trophy for the team at the closing banquet, Mine Rescue Competition at Barrick-Hemlo’s Williams Mine, near Marathon. dedicated the achievement to miners Jason Chenier and Jordan Fram, killed in a run of muck. The fatalities, a poignant reminder of the importance of mine rescue, were commemorated The 2011 Winners with a minute of silence during the awards presentation as most participants and audience OVERALL WINNERS members wore black ribbons. 1st - Vale West Mines The Vale team of Captain Brian Small, 2nd - Barrick-Hemlo Vice-captain Paul Frising, Eric Gagne, Neil Thompson, Lorne Beleskey, Ron O’Bumsawin, FIREFIGHTING TEAM AWARD Jodie Dumochel, and Joduin, also won the Team Vale West Mines Firefi ghting Award. Barrick-Hemlo technician Denis Bilodeau won FIRST AID TEAM AWARD the Technician Award. Xstrata Copper, Kidd Mine Though the provincial competition has SPECIAL EQUIPMENT AWARD occasionally been held in underground venues in Xstrata Nickel recent years, this marks the fi rst time the entire competition has been held underground at an TECHNICIAN AWARD operating mine, Williams Mine. The effort was 1st - Denis Bilodeau, Barrick-Hemlo undertaken at the request of and with the full support of Barrick-Hemlo offi cials, as well as the 2nd - Derrick Parsons, Vale East Mines support of the Marathon community. -

Corporate Social Responsibility Report

CSR REPORT 2012 * CORPORATE SOCIAL RESPONSIBILITY REPORT KGHM POLSKA MIEDŹ S.A. ul. Marii Skłodowskiej-Curie 48, 59-301 Lubin, Poland tel. +48 76 74 78 200, fax +48 76 74 78 500 www.kghm.pl * THE MOST ATTRACTIVE EMPLOYER IN POLAND RESPONSIBLE EMPLOYER *KGHM Polska Miedź S.A. is the winner of the Most Attractive Employer title in third edition of the Randstadt Award survey held in Poland. The high employment* standards maintained in Poland will be implemented in all KGHM Group companies worldwide. KGHM Polska Miedź S.A. Contents Introduction 4 For schools and universities 63 Letter of the President (1.1) 4 Broad Benefits Package 65 Letter of the Minister of Economy 5 Safety of employees – safe mines 66 Our Report 6 Safe mines 67 1. About KGHM – Challenges and Opportunities Education is the key (LA8) 71 of a Local Entrepreneur on Global Markets 9 KGHM Polska Miedź S.A. valued and recognised 71 Significance of Copper for Sustainable 4. Good Neighbour and Trustworthy Investor 77 Development 10 KGHM Polska Miedź S.A.is an integral part Copper Production in Poland and Worldwide 11 of the Lower Silesia local community 78 KGHM Polska Miedź S.A. Market Position 13 Dialogue on Mining Concessions 80 Company’s Business Strategy 18 Partnership with Local Authorities 82 Establishment of KGHM INTERNATIONAL LTD. 20 KGHM Polska Miedź S.A. Listens to the Needs KGHM Polska Miedź S.A. – Leader of the People in the Copper Basin (4.17) 84 of Corporate Social Responsibility 26 Towards More Robust Buildings 88 KGHM Stakeholders 28 Polish Copper Foundation Collaboration on Knowledge and Experience for the People and the Region 90 Sharing and Setting New Standards 28 Healthcare 96 (2.10) Awards received by KGHM Polska Miedź S.A. -

KGHM INTERNATIONAL LTD. (Formerly “Quadra FNX Mining Ltd.”) Condensed Interim Consolidated Financial Statements March 31, 2012 (Expressed in Millions of U.S

KGHM INTERNATIONAL LTD. (Formerly “Quadra FNX Mining Ltd.”) Condensed Interim Consolidated Financial Statements March 31, 2012 (Expressed in millions of U.S. dollars, except where indicated) (Unaudited) KGHM International Ltd. (Formerly “Quadra FNX Mining Ltd.”) CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (US Dollars in Millions) (Unaudited) March 31, December 31, Notes 2012 2011 ASSETS Current Cash and cash equivalents 898.2 1,005.5 Receivables 7 207.1 199.5 Inventory 6 218.3 198.7 Derivative assets 15 - 0.1 Notes receivable 21 111.2 - Other current assets 8 71.8 69.3 Total Current Assets 1,506.6 1,473.1 Mineral properties, plant and equipment 9 1,134.0 1,141.7 Investment in Sierra Gorda JV 5 521.1 521.1 Subordinated loan receivable from Sierra Gorda JV 5 75.1 - Goodwill 180.6 180.6 Environmental trust and bond 82.6 82.4 Other non-current assets 8 40.9 31.7 Deferred income tax assets 99.4 93.6 Total Non-Current Assets 2,133.7 2,051.1 Total Assets 3,640.3 3,524.2 LIABILITIES AND SHAREHOLDERS’ EQUITY Current Accounts payable and accrued liabilities 10 142.3 125.0 Provisions 11 12.8 7.0 Derivative liabilities 15 9.2 13.6 Current portion of deferred revenue 12 17.3 17.9 Other current liabilities - 0.2 Current corporate tax liabilities 8.1 20.7 Total Current Liabilities 189.7 184.4 Senior Notes 13 488.5 488.2 Deferred revenue 12 167.9 169.9 Site closure and reclamation provision 14 87.7 88.6 Derivative liabilities 15 50.3 64.9 Deferred income tax liabilities 225.6 236.9 Total Non-Current Liabilities 1,020.0 1,048.5 Total Liabilities 1,209.7 1,232.9 Shareholders’ Equity Share capital 16(a) 1,847.6 1,706.3 Contributed surplus - 35.9 Accumulated other comprehensive loss (14.0) (15.2) Retained earnings 597.0 564.3 Total Shareholders’ Equity 2,430.6 2,291.3 Total Liabilities and Shareholders’ Equity 3,640.3 3,524.2 Commitments (Note 23), Contingencies (Note 24) The accompanying notes are an integral part of these condensed interim consolidated financial statements. -

MANAGEMENT DISCUSSION and ANALYSIS for the YEAR and FOURTH QUARTER ENDED DECEMBER 31, 2011 (Expressed in Millions of U.S

MANAGEMENT DISCUSSION AND ANALYSIS FOR THE YEAR AND FOURTH QUARTER ENDED DECEMBER 31, 2011 (Expressed in millions of U.S. dollars, except where indicated) Three months ended December 31 Year ended December 31 2011 2010 Change 2011 2010 Change FINANCIAL HIGHLIGHTS Revenues 286 332 -14% 1,179 958 23% Income from mining operations 46 114 -60% 146 302 -52% Adjusted EBITDA (1) 64 154 -58% 330 378 -13% Adjusted EBITDA per share (basic) 0.33 0.82 -59% 1.72 2.44 -29% (Loss) earnings for the period (108) (32) 242% 267 80 235% (Loss ) earnings per share (basic) (0.56) (0.17) 238% 1.39 0.26 436% Cash 1,006 319 215% 1,006 319 215% Working capital 1,289 760 70% 1,289 760 70% (1) See “Non-IFRS Financial Measures” HIGHLIGHTS: 2011 Annual Total revenues increased 23% to $1,179 million in the year compared to $958 million in 2010. After adjustments to leach pad inventories at Carlota and Franke totalling $87 million, earnings from mining operations was $146 million. Earnings increased 235% to $267 million compared to $80 million in 2010. Adjusted EBITDA decreased 13% to $330 million from $378 million in 2010. Total production for the year was 218 million pounds of copper and 103 ounces of total precious metals (TPMs). Cash costs were $2.18 per pound of copper. The Company formed a 55%/45% joint venture (“JV”) with Sumitomo Metal Mining Co., Ltd. and Sumitomo Corporation (collectively "Sumitomo") to develop the Sierra Gorda project in Chile with the Company retaining the 55%. -

Consolidated Annual Report SRR 2020 Mining

POLISH FINANCIAL SUPERVISION AUTHORITY Consolidated annual report SRR 2020 (in accordance with § 60 sec. 2 of the Decree regarding current and periodic information) for issuers of securities involved in production, construction, trade or services activities for the financial year 2020 comprising the period from 1 January 2020 to 31 December 2020 containing the consolidated financial statements according to International Accounting Standards approved in the EU in PLN. publication date: 24 March 2021 KGHM Polska Miedź Spółka Akcyjna (name of the issuer) KGHM Polska Miedź S.A. Mining (name of the issuer in brief) (issuer branch title per the Warsaw Stock Exchange) 59 – 301 LUBIN (postal code) (city) M. Skłodowskiej – Curie 48 (street) (number) (+48) 76 7478 200 (+48) 76 7478 500 (telephone) (fax) [email protected] www.kghm.com (e-mail) (www) 6920000013 390021764 (NIP) (REGON) G30CO71KTT9JDYJESN22 23302 (LEI) (KRS) PricewaterhouseCoopers Polska Spółka z ograniczoną odpowiedzialnością Audyt Sp.k. (auditing company) SELECTED FINANCIAL DATA in PLN mn in EUR mn 2020 2019 2020 2019 I. Revenues from contracts with customers 23 632 22 723 5 282 5 282 II. Profit on sales 3 161 2 455 706 571 III. Profit before income tax 2 756 2 122 616 493 IV. Profit for the period 1 797 1 421 401 330 Profit for the period attributable to shareholders V. 1 800 1 421 402 330 of the Parent Entity Profit for the period attributable to VI. ( 3) - ( 1) - non-controlling interest VII. Other comprehensive income ( 918) ( 444) ( 205) ( 103) VIII. Total comprehensive income 879 977 196 227 Total comprehensive income attributable to IX. -

You Can't Always Get What You Want Global Mining Deals 2010

www.pwc.com You Can’t Always Get What You Want Global mining deals 2010 March 2011 Contents 03 Highlights 05 Key Observations 2010 22 2010 Top 20 Global Mining Deals 24 2011 M&A Outlook 32 The Rise of Frontier Markets – Five Risks 34 Contact us 2 Mining Deals 2010 Highlights It’s likely that Mick Jagger and Keith Richards had other things on their minds while crafting “You Can’t Always Get What You Want”, the Rolling Stones’ 1969 classic, but we can’t think of a more fi tting theme for mining M&A in 2010 and, more importantly, for the decades ahead. The bottom line is that, with the world’s population estimated to reach 8.3 billion by 2030 amid fears of a fl eeting supply of resources, there may not be enough to go around. Someone, somewhere, may be disappointed. With this in mind, Mining Deals 2010 revisits Mining M&A in 2010. Our report sets out the winners, losers and those waiting in the wings. 2010 Retrospective 1. Number of transactions at all time high. Aggregate Australia were busy buying foreign assets. In somewhat of a dollar values post impressive annual gains, but “mega “hollowing in”, Canadian owned entities completed 236 deals” remain elusive. acquisitions of foreign targets worth $8 billion while Australian owned entities completed 109 acquisitions of foreign targets The numbers are in—2010 results prove that the fi rst decade of worth $9.7 billion. the millennium belongs to the mining sector! We tracked 2,693 global mining M&A deals worth $113 billion in 2010, bringing 4. -

The Mineral Industry of Canada in 2010

2010 Minerals Yearbook CANADA U.S. Department of the Interior July 2012 U.S. Geological Survey THE MINERAL INDUSTRY OF CANADA By Philip M. Mobbs Canada is a nation rich in mineral resources. In 2010, disclosure for mineral projects. National Instrument 51–101 sets Canada’s mineral industry continued its recovery from the the standards for disclosure for oil and gas activities. global financial crisis of 2008–9. As one of the major mining Saskatchewan enacted a diamond royalty system in 2010. The countries in the world, Canada leads the world in the production scheme includes a 1% royalty on the value of mine production, of potash (by volume). The country was estimated to rank which begins 5 years after initial production; a stepped royalty second in the production of uranium and was among the top five rate (up to 10%) on profits after capital investment is fully countries in the production of aluminum, cobalt ore, gem-quality recovered; a 100% depreciation rate of capital costs; and a diamond, refined indium, nickel ore, platinum-group metals processing allowance (Government of Saskatchewan, 2010). (PGM) ore, and sulfur (Apodaca, 2011; Bray, 2011; Jasinski, A significant number of international mineral exploration 2011; Kuck, 2011; Loferski, 2011; Olson, 2011; Tolcin, 2011; companies were based in Canada. Canadian companies owned World Nuclear Association, 2011). mining assets that were valued at about $106 billion in 123 countries. In 2010, the proposed Corporate Accountability of Minerals in the National Economy Mining, Oil and Gas Corporations in Developing Countries Act (Bill C-300) was defeated in the House of Commons. -

MANAGEMENT DISCUSSION and ANALYSIS for the SECOND QUARTER ENDED JUNE 30, 2011 (Expressed in Millions of U.S

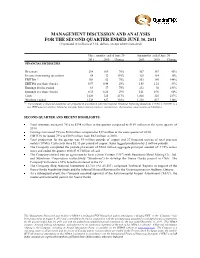

MANAGEMENT DISCUSSION AND ANALYSIS FOR THE SECOND QUARTER ENDED JUNE 30, 2011 (Expressed in millions of U.S. dollars, except where indicated) Three months ended June 30 Six months ended June 30 2011 2010 Change 2011 2010 Change FINANCIAL HIGHLIGHTS Revenues 298 169 76% 567 367 55% Income from mining operations 64 32 101% 125 114 10% EBITDA (1) 109 62 76% 353 145 144% EBITDA per share (basic) 0.57 0.44 29% 1.85 1.21 53% Earnings for the period 64 37 75% 232 92 153% Earnings per share (basic) 0.33 0.26 29% 1.21 0.76 60% Cash 1,028 325 217% 1,028 325 217% Working capital 1,338 637 110% 1,338 637 110% ( 1) The Company‟s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). EBITDA is a non-IFRS measure which is defined as earnings before interest expenses, income taxes, depreciation, amortization and depletion. SECOND QUARTER AND RECENT HIGHLIGHTS: Total revenues increased 76% to $298 million in the quarter compared to $169 million in the same quarter of 2010. Earnings increased 75% to $64 million compared to $37 million in the same quarter of 2010. EBITDA increased 79% to $109 million from $62 million in 2010. Total production for the quarter was 55 million pounds of copper and 27 thousand ounces of total precious metals (TPMs). Cash costs were $2.33 per pound of copper. Sales lagged production by 2 million pounds. The Company completed the private placement of $500 million aggregate principal amount of 7.75% senior notes and ended the quarter with $1.03 billion of cash. -

North American Nickel Inc. Defines Shallow Targets on Its Post Creek Property, North Range, Sudbury Basin, Ontario

NORTH AMERICAN NICKEL INC. 301 – 260 W. Esplanade North Vancouver, B.C. V7M 3G7 Tel: (604) 986-2020 Toll Free: 1-866-816-0118 North American Nickel Inc. defines shallow targets on its Post Creek Property, North Range, Sudbury Basin, Ontario Vancouver, B.C. – June 9, 2011, North American Nickel Inc. (TSXV: “NAN”; OTCbb: “WSCRF”; CUSIP: 65704T 108). Introduction The Post Creek property is North American Nickel’s flagship property in Sudbury, Ontario and consists of 35 contiguous unpatented mining claims and one isolated claim for a total area of 688 hectares. It is located along the extension of the Whistle Offset Dyke Structure, a major geological control for Ni-Cu- PGM mineralization in this area of the Sudbury Basin. The claims begin less than 2 km from the producing copper-nickel-platinum group metals Podolsky mine owned by Quadra FNX Mining. The Whistle Offset Structure also hosts the Podolsky North copper-precious metal deposit and is closely associated with Vale’s past-producing Whistle copper-nickel-PGM mine (5.7 million tons grading 0.33% Cu, 0.95% Ni and 3.77 g/t (0.11 ounces per ton) total platinum metals “TPM”). North American Nickel has also optioned the Halcyon claim block which lies adjacent to the north east of Post Creek and is also on trend with the projection of the Whistle Offset Structure. Determining shallow targets for drilling North American Nickel has conducted geophysical and geological surveys on the property since its acquisition in late 2009. The results were compiled and interpreted to form the basis of a qualifying NI 43- 101 report written by Dr.