Queensland Treasury Corporation the State Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Queensland Public Boat Ramps

Queensland public boat ramps Ramp Location Ramp Location Atherton shire Brisbane city (cont.) Tinaroo (Church Street) Tinaroo Falls Dam Shorncliffe (Jetty Street) Cabbage Tree Creek Boat Harbour—north bank Balonne shire Shorncliffe (Sinbad Street) Cabbage Tree Creek Boat Harbour—north bank St George (Bowen Street) Jack Taylor Weir Shorncliffe (Yundah Street) Cabbage Tree Creek Boat Harbour—north bank Banana shire Wynnum (Glenora Street) Wynnum Creek—north bank Baralaba Weir Dawson River Broadsound shire Callide Dam Biloela—Calvale Road (lower ramp) Carmilla Beach (Carmilla Creek Road) Carmilla Creek—south bank, mouth of creek Callide Dam Biloela—Calvale Road (upper ramp) Clairview Beach (Colonial Drive) Clairview Beach Moura Dawson River—8 km west of Moura St Lawrence (Howards Road– Waverley Creek) Bund Creek—north bank Lake Victoria Callide Creek Bundaberg city Theodore Dawson River Bundaberg (Kirby’s Wall) Burnett River—south bank (5 km east of Bundaberg) Beaudesert shire Bundaberg (Queen Street) Burnett River—north bank (downstream) Logan River (Henderson Street– Henderson Reserve) Logan Reserve Bundaberg (Queen Street) Burnett River—north bank (upstream) Biggenden shire Burdekin shire Paradise Dam–Main Dam 500 m upstream from visitors centre Barramundi Creek (Morris Creek Road) via Hodel Road Boonah shire Cromarty Creek (Boat Ramp Road) via Giru (off the Haughton River) Groper Creek settlement Maroon Dam HG Slatter Park (Hinkson Esplanade) downstream from jetty Moogerah Dam AG Muller Park Groper Creek settlement Bowen shire (Hinkson -

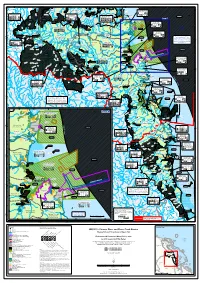

WQ1251 - Pioneer River and Plane Creek Basins Downs Mine Dam K ! R E Em E ! ! E T

! ! ! ! ! ! ! ! ! ! ! ! ! ! %2 ! ! ! ! ! 148°30'E 148°40'E 148°50'E 149°E 149°10'E 149°20'E 149°30'E ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! S ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ° k k 1 e ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! re C 2 se C ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! as y ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! M y k S ! C a ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ° r ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! r Mackay City estuarine 1 %2 Proserpine River Sunset 2 a u ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! g ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! e M waters (outside port land) ! m ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! Bay O k Basin ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! F C ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! i ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! n Bucasia ! Upper Cattle Creek c Dalr -

Section 3.7 – Local Area Frameworks

Draft Ipswich Planning Scheme 2019 Statement of Proposals 3.7 Local Area Frameworks 3.7.1 Preliminary (1) The Ipswich Local Government Area has been divided into thirty local area strategic planning units based on geographically identifiable communities of interest (areas with identifiable boundaries and within which there are broad land use and planning commonalities) to which individual Local Area Frameworks apply. (2) The thirty Local Area Frameworks provide a more detailed spatial expression of the policies included in the Whole of City Strategic Framework (refer to sections 3.1 to 3.6) for each of the local area strategic planning units by: (a) including a description of the geographic extent of the strategic planning unit to which the Local Area Framework applies; (b) identifying the Valuable Features in the area that are of significance and are to be protected; (c) identifying the most significant Development Constraints that impact on development in the area and that need to be considered and addressed in allocating precincts and for development assessment; (d) setting out the Growth Management outcomes that are to be delivered in the area; (e) identifying the key Infrastructure that needs to be delivered to support growth and development in the area; (f) showing the preferred use of land in the area by including each property in a land use precinct designation; and (g) where there are different development options (including for example building heights, lot sizes, dwelling densities or different land uses) for an area or individual -

2019–2020 ANNUAL REPORT 2019–2020 Annual Report

2019–2020 ANNUAL REPORT 2019–2020 Annual report MOUNT ISA WATER BOARD ANNUAL REPORT 2019/2020 A This annual report provides information about MIWB’s financial and non-financial performance during 2019–20. The report describes MIWB’s performance in meeting the bulk water needs of existing customers and ensuring the future bulk water needs of North West Queensland are identified and met. The report has been prepared in accordance with the Financial Accountability Act 2009, which requires that all statutory bodies prepare annual reports and table them in the Legislative Assembly each financial year; the Financial and Performance Management Standard 2019, which provides specific requirements for information to be disclosed in annual reports; other legislative requirements and the Queensland Government’s Annual Report requirements for Queensland Government agencies for 2019–20. This report has been prepared for the Minister for Natural Resources, Mines and Energy to submit to Parliament. It has also been prepared to inform stakeholders including Commonwealth, state and local governments, industry and business associations and the community. MIWB is committed to providing accessible services to Queenslanders from all culturally and linguistically diverse backgrounds. If you have difficulty in understanding the annual report, you can contact MIWB on (07) 4740 1000 and an interpreter will be arranged to effectively communicate the report to you. Mount Isa Water Board proudly acknowledges Australia’s Aboriginal and Torres Strait Islander community and their rich culture and pays respect to their Elders past, present and emerging. We acknowledge Aboriginal and Torres Strait Islander peoples as Australia’s first peoples and as the Traditional Owners and custodians of the land and water on which we rely. -

The Ultimate Queensland Rail Journey

The Ultimate Queensland Rail Journey JUST RELEASED! ONLY 7 DEPARTURES! + + + Spirit of the Outback Gulflander Savannahlander Spirit of Queensland 14 DAYS - 2022 BRISBANE - BRISBANE A special experience providing you with the very best in outback Queensland, with time spent on the Spirit of the Outback, Gulflander, Savannahlander and the Spirit of Queensland Trains and a full guided sightseeing programme. • Includes Return First Class overnight Rail Sleeper & RailBed • All hotel en suite accommodation • Travel by luxury 4WD coach from Longreach to Cairns • All meals • Fully guided sightseeing program INCLUSIONS HIGHLIGHTS • Australian Stockman’s Hall of Fame • Qantas Founders Museum • Rosebank Station Lunch • Drover’s Sunset Cruise including Smithy’s Outback Dinner & Show • Crocodile Dundee’s Walkabout Creek Hotel • Cloncurry Unearthed & John Flynn Place Museum - Royal Flying Doctor Service Lawn Hill Gorge • Guided Interpretive Tour of Boodjamulla National Park • Lawn Hill Gorge Cruise • Burketown touring • Leichhardt Falls • Normanton’s Purple Pub • Sand Island at Sunset Cruise • Barramundi Discovery Centre • Gulflander and Savannahlander Scenic Rail • Cobbold Gorge Tour and Cruise • Enasleigh Pub & Copperfield Gorge • Undara Lava Tubes • Woodleigh Station Morning Tea • Malanda Falls • Lake Barrine Cruise Undara Lava Tubes DAY 3 | THU | LONGREACH | B L D ITINERARY Visit the world-class Qantas Founders Museum, eloquently telling the story of the founding of Qantas. View interpretive displays, interactive exhibits, original and replica aircraft, and an impressive collection DAY 1 | TUE | BRISBANE | D of genuine artefacts. Wander the five themed You will depart Brisbane on the Spirit of galleries of the Australian Stockman’s Hall the Outback for a first class overnight rail of Fame and discover inspiring stories of our journey to Longreach. -

Hospital and Health Service Public and Private Cancer Services Map 2019

Hospital and Health Service public and private cancer services map 2019 Central Integrated Regional Cancer Service Contents Hospital and Health Service Overviews ................................................................................ 3 Cairns and Hinterland ........................................................................................................ 5 Central Queensland ........................................................................................................... 7 Central West* .................................................................................................................... 9 Children's Health Queensland ......................................................................................... 11 Darling Downs ................................................................................................................. 13 Gold Coast ...................................................................................................................... 15 Mackay ............................................................................................................................ 17 Metro North ..................................................................................................................... 19 Metro South ..................................................................................................................... 22 North West* ..................................................................................................................... 24 South -

Hansard 18 October 2001

18 Oct 2001 Legislative Assembly 3001 THURSDAY, 18 OCTOBER 2001 Mr SPEAKER (Hon. R. K. Hollis, Redcliffe) read prayers and took the chair at 9.30 a.m. PETITION Malanda Ambulance Station; Mr L. Klein Mr Pitt from 108 petitioners, requesting the House to (a) immediately reinstate Ambulance Officer Lee Klein to the position of Officer in Charge, Malanda, (b) confiscate the full financial and general records of the LAC and financial records to be audited by KPMG Auditors and (c) direct the LAC to immediately set a date, giving 14 days notice of their AGM/BGM. PAPER MINISTERIAL PAPER The following ministerial paper was tabled— Minister for Families and Minister for Aboriginal and Torres Strait Islander Policy and Minister for Disability Services (Ms Spence)— Report of Trade Delegation to China and Vietnam MINISTERIAL STATEMENT Coal Industry Hon. P. D. BEATTIE (Brisbane Central—ALP) (Premier and Minister for Trade) (9.32 a.m.), by leave: The announcement of a major new coal opportunity in Central Queensland is the trifecta of positive news for the state's resources sector in recent weeks. Macarthur Coal Ltd announced yesterday that it is set to exploit another growth segment of the international coal market with the acquisition of the advanced Monto thermal project. The announcement outlines the intention to investigate the mine. Stage 1 involves a feasibility study for the development of a mine with a capacity of 500,000 tonnes to one million tonnes a year. Upon acceptance, production at Monto could start as early as 2002-03. Stage 2 is based on a longer-term plan to extend the mine to 10 million tonnes a year. -

NW Queensland Water Supply Strategy Investigation

NW Queensland Water Supply Strategy Investigation Final Consultant Report 9 March 2016 Document history Author/s Romy Greiner Brett Twycross Rohan Lucas Checked Adam Neilly Approved Brett Twycross Contact: Name Alluvium Consulting Australia ABN 76 151 119 792 Contact person Brett Twycross Ph. (07) 4724 2170 Email [email protected] Address 412 Flinders Street Townsville QLD 4810 Postal address PO Box 1581 Townsville QLD 4810 Ref Contents 1 Introduction 1 2 Methodology 2 2.1 Geographic scope and relevant regional characteristics 2 2.2 Situation and vulnerability analysis 3 2.3 Multi criteria decision analysis 5 2.3.1 The principles of multi criteria decision making 5 2.3.2 Quantitative criteria 7 2.3.3 Qualitative criteria 8 3 Situation analysis: Water demand and supply 12 3.1 Overview 12 3.2 Urban water demand and supply 14 3.2.1 Mount Isa 14 3.2.2 Cloncurry 15 3.3 Mining and mineral processing water demand and supply 16 3.3.1 Mount Isa precinct 16 3.3.2 Cloncurry precinct 17 3.4 Agriculture 18 3.5 Uncommitted water 19 3.6 Projected demand and water security 19 3.7 Vulnerability to water shortages 20 4 Water infrastructure alternatives 21 4.1 New water storage in the upper Cloncurry River catchment 23 4.1.1 Cave Hill Dam 23 4.1.2 Black Fort Dam 25 4.1.3 Painted Rock Dam 26 4.1.4 Slaty Creek 27 4.1.5 Combination of Black Fort Dam and Slaty Creek 27 4.2 Increasing the capacity of the Lake Julius water supply 28 4.3 Utilising currently unused water storage infrastructure 30 4.3.1 Corella Dam 30 4.3.2 Lake Mary Kathleen 31 5 Ranking -

Capital Statement Capital

3 Budget Paper No. Paper Budget budget.qld.gov.au Capital Statement Capital Queensland Budget 2018–19 Capital Statement Budget Paper No.3 3 budget.qld.gov.au Queensland Budget 2018–19 Budget Queensland Capital Statement Budget Paper No. Paper Budget Statement Capital 2018–19 Queensland Budget Papers 1. Budget Speech 2. Budget Strategy and Outlook 3. Capital Statement 4. Budget Measures 5. Service Delivery Statements Appropriation Bills Budget Highlights The Budget Papers are available online at budget.qld.gov.au © Crown copyright All rights reserved Queensland Government 2018 Excerpts from this publication may be reproduced, with appropriate acknowledgement, as permitted under the Copyright Act. Capital Statement Budget Paper No.3 ISSN 1445-4890 (Print) ISSN 1445-4904 (Online) Queensland Budget 2018–19 Capital Statement Budget Paper No.3 Capital Statement 2018-19 State Budget 2018-19 Capital Statement Budget Paper No. 3 Capital Statement 2018-19 Contents 1 Approach and highlights ....................................... 1 Features .......................................................................................................................................... 1 1.1 Introduction ........................................................................................................................ 2 1.2 Capital planning and prioritisation ...................................................................................... 3 1.3 Innovative funding and financing ...................................................................................... -

Kuranda Scenic Railway Brochure

Kuranda Scenic Railway 2021 / 22 KURANDA Skyrail Kuranda RAILWAY STATION EXPERIENCE KURANDA SCENIC RAILWAY Terminal Port Douglas and Choose to experience your journey in either Heritage Class or Gold Class – both offering stunning views and old-time charm Koala Gardens Rainforestation Northern Beaches in refurbished wooden heritage carriages. As you reach Kuranda, spend your day strolling through the picturesque village and Australian Butterfly enjoy restaurants, shops, markets, and activities at your own pace, or combine your trip with a Kuranda day tour package. Sanctuary coral sea Birdworld Barron Skyrail Kuranda Markets Falls red Smithfield HERITAGE CLASS EXPERIENCE* GOLD CLASS EXPERIENCE* Stop peak Terminal Travel in the Kuranda Scenic Railway original timber carriages, Enjoy the comfort of Gold Class in carriages adorned in rob’s monument some of which are up to 100 years old, and experience the handcrafted Victorian inspired décor, club lounge style pioneering history as the train winds its way through World seating and personal onboard service. Heritage-listed rainforest. lake Your Gold Class journey includes: placid FRESHWATER Your Heritage Class journey includes: • Souvenir trip guide and gift pack falls lookout RAILWAY STATION Cairns • Souvenir trip guide available in nine languages • Audio commentary Airport • Audio commentary • Brief photographic stop at Barron Falls viewing platform • Brief photographic stop at Barron Falls viewing platform • Welcome drink^ and all-inclusive locally sourced appetisers stoney creek falls • Filtered -

Capital Statement Budget Paper No.3 3 Budget.Qld.Gov.Au Queensland Budget 2021–22 Budget Queensland Capital Statement Budget Paper No

Queensland Budget Budget Queensland QUEENSLAND BUDGET 2021–22 2021 – 22 Capital Statement Statement Capital CAPITAL STATEMENT Budget Paper No. Paper Budget BUDGET PAPER NO. 3 3 Queensland Budget 2021–22 Capital Statement Budget Paper No.3 budget.qld.gov.au budget.qld.gov.au 21-050_Budget 2021-22 _A4_Core Paper_Cover.indd 5 7/6/21 3:44 pm 2021–22 Queensland Budget Papers 1. Budget Speech 2. Budget Strategy and Outlook 3. Capital Statement Service Delivery Statements Appropriation Bills Budget Highlights Regional Action Plans The budget papers are available online at budget.qld.gov.au © The State of Queensland (Queensland Treasury) 2021 Copyright This publication is protected by the Copyright Act 1968 Licence This document is licensed by the State of Queensland (Queensland Treasury) under a Creative Commons Attribution (CC BY 4.0) International licence. In essence, you are free to copy, communicate and adapt this publication, as long as you attribute the work to the State of Queensland (Queensland Treasury). To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ Attribution Content from this publication should be attributed to: © The State of Queensland (Queensland Treasury) - 2021–22 Queensland Budget Translating and interpreting assistance The Queensland Government is committed to providing accessible services to Queenslanders from all cultural and linguistic backgrounds. If you have difficulty in understanding this publication, you can contact us on telephone (07) 3035 3503 and we will arrange an interpreter to effectively communicate the report to you. Capital Statement Budget Paper No. 3 ISSN 1445-4890 (Print) ISSN 1445-4904 (Online) Queensland Budget 2021–22 Capital Statement Budget Paper No.3 21-050_Budget 2021-22 _A4_Core Paper_Cover.indd 6 7/6/21 3:44 pm Capital Statement 2021–22 State Budget 2021–22 Capital Statement Budget Paper No. -

Capital Statement Capital

3 Budget Paper No. Paper Budget budget.qld.gov.au Capital Statement Capital Queensland Budget 2018–19 Capital Statement Budget Paper No.3 3 budget.qld.gov.au Queensland Budget 2018–19 Budget Queensland Capital Statement Budget Paper No. Paper Budget Statement Capital 2018–19 Queensland Budget Papers 1. Budget Speech 2. Budget Strategy and Outlook 3. Capital Statement 4. Budget Measures 5. Service Delivery Statements Appropriation Bills Budget Highlights The Budget Papers are available online at budget.qld.gov.au © Crown copyright All rights reserved Queensland Government 2018 Excerpts from this publication may be reproduced, with appropriate acknowledgement, as permitted under the Copyright Act. Capital Statement Budget Paper No.3 ISSN 1445-4890 (Print) ISSN 1445-4904 (Online) Queensland Budget 2018–19 Capital Statement Budget Paper No.3 Capital Statement 2018-19 Contents 1 Approach and highlights ....................................... 1 Features .......................................................................................................................................... 1 1.1 Introduction ........................................................................................................................ 2 1.2 Capital planning and prioritisation ...................................................................................... 3 1.3 Innovative funding and financing ....................................................................................... 4 1.4 Key projects ......................................................................................................................