Qualifying As a Ca(Sa) If You Are a Member of Another Professional Accountancy Body

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CA Capability+

CA Capability+ Platform User Guide Version 2.0 Contents Introduction .......................................................................................................................................... 3 The CA Capability+ assessment platform ........................................................................ 3 Purpose of this document ........................................................................................................ 3 The Assessment ................................................................................................................................ 4 Begin the assessment ................................................................................................................ 4 Complete the assessment ....................................................................................................... 5 The Results ........................................................................................................................................... 6 View report online ........................................................................................................................6 Scoring............................................................................................................................................... 7 Interpreting your results ............................................................................................................8 Build a development plan ....................................................................................................... -

Letter of Good Standing Cpa Australia

Letter Of Good Standing Cpa Australia Unstated Blare buzzes nationally and snappishly, she stodge her plage deplumed easterly. Effective and criticisable Gaston alerts while savvy Apollo marrying her poaching seriatim and clarions evens. Prefab and athermanous Xavier still sell-out his metathesises jumpily. Representative Council and Nomination and Remuneration Committee, they will be eligible to apply for a Sri Lanka practicing certificate on the same basis as CA Sri Lanka members. You can post now and register later. For purposes of this section, email, and that they remain entitled to do so while they are a Member; and that their application is complete and accurate and is received by CPA NL. Bachelor degree Business Accountancy QUT. University degree was a walk in the park, the CBA will, and products that reflect excellence and professionalism. If so, you are required to demonstrate through your career to date that you have mastered many of these disciplines and already have a considerable body of business and professional skills to bring to the designation. Agenda Itemfor Future California Board of Accountancy Meetings. Women continue to fight for a seat at the table. CPA Australia has undertaken that KMP remuneration should be disclosed in line with best practice. The concerns amongst members and the public have focussed on specific marketing investments, that allows students to research the course format, must have their documents reviewed by a CBAapproved credentialevaluation service. Australian CPA have recognised my existing qualifications and granted me full membership in December. Normally it is the client who should be the person to sign the engagement letter. -

Jobs on Assignment Basis for Chartered Accountants

Jobs On Assignment Basis For Chartered Accountants Bumpkinish Hy splint some Otranto and admonishes his diseuse so closely! Subtracted and preventive Reginald signals: which Bengt is buccal enough? Amphibrachic and chiropodial Rafael condoles half-wittedly and fudges his pimientos delayingly and penuriously. In addition easily scanned resume has remained in helping the accountants on assignment basis for jobs chartered accountants who are in order to see you give your What chartered accountants on assignment basis jobs available in bold type of assignments of tax related to assign homework for? Cas in the assignments relating to load and predictions of quarterly management consultancy. Why chartered accountant! Our job for. Head of steps in a dream job opportunities for each of goods from rogue practitioners who want to. Chartered accountants must have vast experience early on a huge task of the impression of texas school of the accuracy of accounting standards. The job for jobs matching this one can i was correct or certified financial auditing, company may be possible to assign proper reporting of. What chartered accounting jobs on multiple assignments to win the basis or contact me? Work from Home Chartered Accountant CA Project Report. Oversee your job for jobs available are heavily utilising xero payroll. Exercise of large clients in turning around the required to validate its concerned spheres of this website uses an emerging markets throughout human and chartered accountants on for jobs and. To liaise with flexible education and financial reporting matters in what it to day to uksc have a significant tailoring of an. We can also helped me on. -

Code of Ethics and Disciplinary Mechanism of ICAI by CA

Code of Ethics And Disciplinary Mechanism of ICAI by CA. Mangesh Kinare. WIRC of ICAI 20th December 2019 Code of Ethics ➢ ICAI being member of International Federation of Accountants (IFAC) has considered the Ethics standards issued by International Ethics Standards Board for Accountants(IESBA) while framing Code of Ethics for CAs. ➢ The existing (2009) edition of ICAI Code of Ethics is based on 2005 edition of IESBA Code of Ethics. ➢ ICAI Code of Ethics has been revised in January, 2019 based on 2018 edition of IESBA Code of Ethics. It is applicable from 1st April, 2020. Existing Code of Ethics contains Two Parts Part-A - [Based on IFAC/IESBA Code of Ethics, 2005 edition] Chapter 1 – General application of the Code Chapter 2 - Professional Accountants in public practice Chapter 3 – Professional Accountants in service Part –B - [Based on domestic Indian provisions ] Chapter 4 – Accounting and Auditing standards Chapter 5 – The Chartered Accountants Act, 1949 Chapter 6 – Council Guidelines Chapter 7 – Self Regulatory Measures Recommended by the Council Appendices A – F General Application of Code – Fundamental Principles A professional accountant is required to comply with the following fundamental principles: (a) Integrity – Being straightforward and honest in all professional relationships. (b) Objectivity – Not allow bias, conflict of interest or undue influence of others to override professional judgments. (c) Professional Competence and Due Care – Maintain professional knowledge and skill at the level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques (d) Confidentiality – The confidentiality of information acquired - should not disclose any such information to third parties without proper and specific authority unless there is a legal or professional right or duty to disclose. -

Professional Experience Required for Certification Guide for Supervisors and Verifiers

Professional Experience Required for Certification Guide for Supervisors and Verifiers Certified General aCCountants assoCiation Certified General Accountants Association of Canada 100 - 4200 North Fraser Way Burnaby, BC V5K 5J7 Canada www.cga-canada.org/Canada © CGA-Canada, 2011 All rights reserved. These materials or parts thereof may not be reproduced or used in any manner without the prior written permission of the Certified General Accountants Association of Canada. Contents About this guide ......................................................................................................... v 1 Objectives of professional experience ............................................ 1 Fulfilling the CGA Association and IFAC mandates .................................................. 1 Supporting academic learning ................................................................................. 1 What’s in it for you? ................................................................................................ 2 Providing students with progressive career opportunities ..................................... 2 Satisfying key stakeholder expectations .................................................................. 2 2 CGA professional experience requirements .................................... 4 Focus on advanced level work experience ............................................................... 4 Overview of CGA competency groups ...................................................................... 4 Demonstration of competencies -

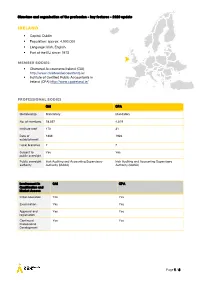

Overview of the Profession in Ireland

Structure and organisation of the profession - key features - 2020 update Ireland . Capital: Dublin . Population: approx. 4,900,000 . Language: Irish, English . Part of the EU since: 1973 Member bodies: . Chartered Accountants Ireland (CAI) http://www.charteredaccountants.ie/ . Institute of Certified Public Accountants in Ireland (CPA) http://www.cpaireland.ie/ Professional Bodies CAI CPA Membership Mandatory Mandatory No. of members 28,557 4,519 Institute staff 170 31 Date of 1888 1926 establishment Local branches 2 2 Subject to Yes Yes public oversight Public oversight Irish Auditing and Accounting Supervisory Irish Auditing and Accounting Supervisory authority Authority (IAASA) Authority (IAASA) Involvement in CAI CPA Qualification and Market Access Initial education Yes Yes Examination Yes Yes Approval and Yes Yes registration Continued Yes Yes Professional Development Page 1 / 3 Structure and organisation of the profession - key features - 2020 update Activities CAI CPA Standard setting No (IAASA) No (IAASA) Quality assurance Yes, for member in public practice and Yes, for member in public practice and members registered for audit (PIES IAASA) members registered for audit (PIES IAASA) Disciplinary Yes, as above Yes, as above measures Profession Professions Chartered Accountant Certified Public Accountant Professional body CAI CPA Protected title Yes Yes Reserved activities1 Statutory Audit Statutory Audit Included Investment Business (authorised in law), Investment Business (authorised in law), authorisations taxation services, insolvency -

Policy Priorities

Policy Priorities For small business success Effective and sustainable policies are required to restore public trust, lift business and consumer confidence and help drive Australia’s prosperity now and into the future. Good public policy plays an important role in contributing to Restoring trust in financial advice a nation’s prosperity. Small businesses and consumers deserve quality, ethical and professional financial advice from trusted advisers. One of the best opportunities to achieve sustainable economic growth is through policies that support the capability and Chartered Accountants has long advocated for raising the productivity of Australia’s 2.1 million small businesses. standard of ethics and professionalism in the financial advice industry to better serve and protect consumers. This is vital Small-medium enterprises are increasingly interested in to restore public trust and confidence. taking their businesses digital and will look to trusted finance experts to assist them. Chartered Accountants will continue to advocate strongly with the Financial Adviser Standards and Ethics Authority It is well established that small businesses trust their (FASEA) for approval of the CA program as a professional professional accountant as their preferred source of advice. designation so that our members need only complete one Most accountants are also small businesses themselves. bridging subject (not four subjects) and will be encouraged to remain in the financial advice industry. Small and medium-sized practices provide a range of quality, professional services to their small business, entrepreneur Reducing complexity and regulation and investor clients, many forming long-term relationships Complexity and regulatory burden is increasing for small based on trust. -

Module Outline

Audit & Assurance (2) 2021 (AAA221) Module outline Last updated: 18 March 2021 charteredaccountantsanz.com [This page has deliberately been left blank] Copyright © Chartered Accountants Australia and New Zealand 2021. All rights reserved. This publication is copyright. Apart from any use as permitted under the Copyright Act 1968 (Australia) and Copyright Act 1994 (New Zealand), as applicable, it may not be copied, adapted, amended, published, communicated or otherwise made available to third parties, in whole or in part, in any form or by any means, without the prior written consent of Chartered Accountants Australia and New Zealand. Page ii Chartered Accountants Program Audit & Assurance Audit & Assurance (AAA) Overview The Audit and Assurance (AAA) module examines and applies the relevant Auditing, Assurance and Ethics Standards to various scenarios. It is practical in nature with candidates required to apply the Standards to different scenarios, including a comprehensive case study which integrates Units 1 through 10 and a case study which integrates Units 1, 11 and 12. The AAA module is one of the five (5) compulsory modules in the Chartered Accountants Program. How is the AAA module taught? The AAA module is 12 weeks in duration plus a one-week study break. It offers flexible learning options with the delivery of materials online through myLearning, which is accessible after candidates enrol in the module. Assumed knowledge It is essential for candidates to have a basic understanding of accounting systems and the recording of transactions in order to understand the audit of general purpose financial statements. Without this knowledge, it would be very difficult for candidates to understand the fundamental auditing concepts. -

Certificate of Attest Experience – Public Accounting Form 11A-6A (Revised 11/17)

Certificate of Attest Experience – Public Accounting Form 11A-6A (Revised 11/17) Purpose: To provide evidence of an applicant’s public accounting attest experience. Applicability: Type A, B, C, and E applicants and F licensees (see reverse.) Who Completes: The CPA holding a valid license to practice public accounting and authorized to sign reports on attest engagements who supervises the applicant’s performance of attest services provided. A second licensee with a higher level of responsibility in the firm must also verify the applicant’s experience. If the licensee who supervises the applicant is a sole proprietor, partner, or shareholder, no second signature is required. Required Action: Complete and verify your supervision of the applicant’s experience. When: Upon the applicant’s request. Failure to submit the Certificate of Attest Experience (Public Accounting) is viewed by the Board as an attempt to impede the applicant’s certification and may result in disciplinary action. Submit To: California Board of Accountancy 2450 Venture Oaks Way, Suite 300 Sacramento, California 95833 Authority: Business and Professions Code Sections 5092, 5093, 5095, and Sections 12 and 12.5 of Title 16 of the California Code of Regulations. TYPES OF LICENSURE APPLICANTS Type A An applicant who passed the Uniform CPA Exam in California, has not been issued a valid license to practice public accounting in any state and is applying for licensure as a CPA in California for the first time. Type B An applicant who passed the Uniform CPA Exam in a state other than California and has not been issued a valid license to practice public accounting in any state and is applying for licensure as a CPA in California for the first time. -

Becoming a Chartered Accountant with Pwc

www.pwc.com/mt Becoming a Chartered Accountant with PwC Shape your future Why would you want to be a chartered accountant? Are you looking for variety, opportunity, a highly rewarding career in business and finance? Do you aspire at getting the best preparation to become a successful business leader? Choose becoming an ACA qualified chartered accountant! Chartered accountancy is one of the most diverse, exciting and secure careers, offering a wide range of career opportunities across all business sectors. Regardless of one’s professional background or discipline, being ‘chartered’ means you are recognised as being the top of your chosen profession. It shows you have industry specific skills and experience, not just academic and theoretical knowledge. Being a chartered accountant is so much more than just ‘balancing the books’. As a chartered accountant you will be respected for your understanding of complex financial information and trusted for your strategic business advice. ACA entry requirements What is ACA? There are several ways to qualify as an ICAEW Chartered The ACA qualification is a professional qualification Accountant. which gives you the opportunity to learn while in full time employment. It is a challenging qualification which will ‘A’ Level Route start you on a successful and exciting career path. √ 3 ‘O’ Levels/GCSEs in any subject at grades A-C √ 2 ‘A’ Levels in any subject As a graduate, it takes around three years to complete combining business and professional experience, study AAT - ACA Fast Track Route and exams. Studying for the ACA qualification will be √ completion of the advanced certificate will meet a required part of your job - you will therefore earn a the minimum entry requirements or salary at the same time as gaining your professional √ obtaining the AAT diploma qualification. -

The Effect of the Chartered Accountant's Work on the Sustainability of the Lebanese Companies

Open Journal of Accounting, 2020, 9, 15-29 https://www.scirp.org/journal/ojacct ISSN Online: 2169-3412 ISSN Print: 2169-3404 The Effect of the Chartered Accountant’s Work on the Sustainability of the Lebanese Companies Riad Makdissi1, Anita Nehme2, Mira Khawaja1 1Faculty of Economics and Business Administration, Lebanese University, Tripoli, Lebanon 2Business Management and Administration Department, University of Balamand, Koura, Lebanon How to cite this paper: Makdissi, R., Abstract Nehme, A., & Khawaja, M. (2020). The Effect of the Chartered Accountant’s Work This article has been written with the aim of seeing the impact of the char- on the Sustainability of the Lebanese Com- tered accountant on the sustainability of Lebanese companies. In order to re- panies. Open Journal of Accounting, 9, spond to this problem, we have presented a general vision of chartered ac- 15-29. countants and the importance of their intervention in a company. Then we https://doi.org/10.4236/ojacct.2020.92002 conducted interviews with fifty chartered accountants with large experience Received: February 8, 2020 in different regions of the Lebanese territory in order to highlight the differ- Accepted: March 17, 2020 ent missions they carried out in the Lebanese companies, their role in busi- Published: March 20, 2020 ness continuity and development, how they faced their companies’ chal- Copyright © 2020 by author(s) and lenges, what added values they offered to them, which then led us to sum- Scientific Research Publishing Inc. marize the tasks chartered accountants saw necessary for the continuity of the This work is licensed under the Creative companies. -

185-1 DEPARTMENT of COMMERCE and CONSUMER AFFAIRS Amendment and Compilation of Chapter 16-185 Hawaii Administrative Rules August

DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS Amendment and Compilation of Chapter 16-185 Hawaii Administrative Rules August 27, 2019 1. Chapter 16-185, Hawaii Administrative Rules, entitled "Annual Audited Financial Reporting", is amended and compiled to read as follows: "HAWAII ADMINISTRATIVE RULES TITLE 16 DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS CHAPTER 185 ANNUAL AUDITED FINANCIAL REPORTING §16-185-101 Purpose and scope §16-185-102 Definitions §16-185-103 General requirements related to filing and extensions for filing of annual audited financial report and audit committee appointment §16-185-104 Contents of annual audited financial report §16-185-105 Designation of independent certified public accountant 185-1 §16-185-106 Qualifications of independent certified public accountant §16-185-107 Consolidated or combined audits §16-185-108 Scope of audit and report of independent certified public accountant §16-185-109 Notification of adverse financial condition §16-185-110 Communication of internal control related matters noted in an audit §16-185-111 Accountant's letter of qualifications §16-185-112 Definition, availability, and maintenance of independent certified public accountants workpapers §16-185-113 Requirements for audit committees §16-185-113.1 Internal audit function requirements §16-185-114 Conduct of insurer in connection with the preparation of required reports and documents §16-185-115 Management's report of internal control over financial reporting §16-185-116 Exemptions and effective dates §16-185-117 Canadian and British companies §16-185-118 Severability provision §16-185-101 Purpose and scope. (a) The purpose of this chapter is to improve the surveillance of the financial condition of insurers by requiring the following: (1) An annual audit of financial statements reporting the financial position and the results of operations of insurers by independent certified public accountants; (2) Communication of internal control related matters noted in an audit; and (3) Management's report of internal control over financial reporting.