AL MAHA ENG AR-2020.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Al Maha Petroleum Products Marketing Company SAOG

≥jƒ`````°ùàd É¡````ŸG á`````cô```°T Al Maha Petroleum Products ´ ´ Ω ¢T á«£ØædG äÉéàæŸG Marketing Company SAOG 2018 …ƒæ°ùdG ôjô≤àdG ᣠFilling Oƒ``````````bh218 Stations 218 COVER.indd 1 3/13/19 3:21 PM His Majesty Sultan Qaboos Bin Said Al Maha AR Eng 2018 MZ.indd 3 3/13/19 12:47 PM ANNUAL REPORT 2018 4 218 FILLING STATIONS Al Maha AR Eng 2018 MZ.indd 4 3/13/19 12:47 PM ANNUAL REPORT 2018 CONTENTS Board of Directors 1 Management Team 2 Board of Directors’ Report 3 - 5 Auditor’s Report on Corporate Governance Report 6 Corporate Governance Report 7- 16 Management Discussions and Analysis 17 - 20 Auditor’s Report on the Financial Statements 21- 24 Financial Statements 25 - 59 218 FILLING STATIONS 5 Al Maha AR Eng 2018 MZ.indd 5 3/13/19 12:47 PM ANNUAL REPORT 2018 BOARD OF DIRECTORS Dr. Juma Ali Juma Al-Juma His Highness Sheikh Zayed Chairman Bin Sultan Bin Khalifa Al Nahyan Deputy Chairman Gamal Aly Aly Al-Gamal Brigadier General Director Saif Salim Saif Al-Harthi Director Saleh Nasser Juma Al-Araimi Sultan Khalifa Saleh Al-Tai Director Director Mohammed Ali Said Al-Qassabi Director 1 218 FILLING STATIONS Al Maha AR Eng 2018 MZ.indd 1 3/13/19 12:47 PM ANNUAL REPORT 2018 MANAGEMENT TEAM Eng. Mohammed Fareed Hussain Al Darwish Chief Executive Officer Ahmed Bakhit Al Shanfari General Manager - Sales, Marketing & Business Development Hamdi Mohamed El Sayed General Manager - Finance Abdulhaleem Ali Issa Al Sabbagh General Manager - Corporate Services Hafidh Awadh Al Hadeed Senior Manager - Aviation Business Osama Mirghani A.Rahim Senior Manager - Internal Audit 218 FILLING STATIONS 2 Al Maha AR Eng 2018 MZ.indd 2 3/13/19 12:47 PM ANNUAL REPORT 2018 BOARD OF DIRECTORS’ REPORT Dear Shareholders, On behalf of the Board of Directors, I am pleased to present the 15 th Annual Report of your Company, together with the Audited Financial Statements for the year ended 31 December 2018. -

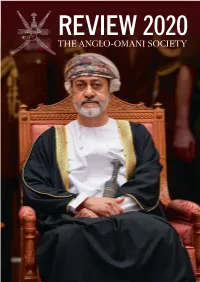

THE ANGLO-OMANI SOCIETY REVIEW 2020 Project Associates’ Business Is to Build, Manage and Protect Our Clients’ Reputations

REVIEW 2020 THE ANGLO-OMANI SOCIETY THE ANGLO-OMANI SOCIETY REVIEW 2020 Project Associates’ business is to build, manage and protect our clients’ reputations. Founded over 20 years ago, we advise corporations, individuals and governments on complex communication issues - issues which are usually at the nexus of the political, business, and media worlds. Our reach, and our experience, is global. We often work on complex issues where traditional models have failed. Whether advising corporates, individuals, or governments, our goal is to achieve maximum targeted impact for our clients. In the midst of a media or political crisis, or when seeking to build a profile to better dominate a new market or subject-area, our role is to devise communication strategies that meet these goals. We leverage our experience in politics, diplomacy and media to provide our clients with insightful counsel, delivering effective results. We are purposefully discerning about the projects we work on, and only pursue those where we can have a real impact. Through our global footprint, with offices in Europe’s major capitals, and in the United States, we are here to help you target the opinions which need to be better informed, and design strategies so as to bring about powerful change. Corporate Practice Private Client Practice Government & Political Project Associates’ Corporate Practice Project Associates’ Private Client Project Associates’ Government helps companies build and enhance Practice provides profile building & Political Practice provides strategic their reputations, in order to ensure and issues and crisis management advisory and public diplomacy their continued licence to operate. for individuals and families. -

Annual Report 2011 اﻟﺘﻘﺮﻳﺮ اﻟﺴﻨﻮي 2011م

ُ ﺷﺮﻛﺔ اﻟﻨﻔﻂ اﻟﻌ ﻟﻠﺘﺴﻮﻳﻖ اﻟﺴﻨﻮي ش.م.ع.ع اﻟﺘﻘﺮﻳﺮ ﻤﺎﻧﻴﺔ -اﺘﺮﺮ ﻟﻨي 2011 م Annual Report 2011 اﻟﺘﻘﺮﻳﺮ اﻟﺴﻨﻮي 2011م ôîa πµH ÊɪYo ôîa πµH ÊɪYo Proudly Omani Proudly Omani Oman Oil Marketing Company S.A.O.G - Annual Report 2011 PROUDLY OMANI The Sultanate has always proudly showcased its rich culture and heritage and we at Oman Oil Marketing Company (omanoil) have harnessed the very definition of “being Omani” by integrating the inherent values that are shared by an endearing nation not only into our corporate culture, but into everyday business practices. Under the visionary leadership of His Majesty Sultan Qaboos bin Said, Oman has enjoyed a proven track record of strong and steady growth. In parallel, omanoil has cemented its frontrunner position in a vibrant energy sector, fueling the country’s economy with innovative products and customer services that complement the company’s worth in quality omanoil registered tremendous developments across its various retail businesses, accelerated by deep and detailed knowledge of smart and efficient operational practices. As a fully- pledged Omani company, the benefit of an intimate understanding of local market sensibilities, coupled with best international practice results in trust, confidence and loyalty among stakeholders. New tailored services offered in 2011 showed our substantial efforts centered on augmenting customer experiences, and we will continue this development in 2012. Financial growth was only a part of our celebrated achievements; most rewarding was the company’s corporate stewardship programs that empowered the nation’s socio- economic advancement. omanoil set critical benchmarks throughout the year and remains steadfast to raise the bar of excellence in the industry. -

Hire / Rental & Leasing CA R PO Box : 2436 Ruwi Code 112 Ruwi Oman 0

OMAN COMPANIES CONTACT DETAILS 4 X 4 RENT A CAR Car - Hire / Rental & Leasing CA R P.O. Box : 2436 Ruwi Code 112 Ruwi Oman 0096824798437 0096824798243 AAA (ALPHA GRAPHICS) Advertising - Outdoor Media ADVERTISING P.O. Box : 291 Mina Al Fahal Code 116 - Al Fursan St Waljia Oman 0096824830828 0096824832921 graphics@omantel .net.om AADIL HAMED ISMAIL TRADING Stationers STATIONERS P.O. Box : 2840 Ruwi Co de 112 - Mutrah Souq, Behind OTC Mutrah Oman 0096824712767 / 24711615 0096824711 012 A.A.K & PARTNERS LLC Batteries - Manufacturers BATTERY P.O. Box : 1650 Jibro o Code 114 - Behind Oman Express Rest Ruwi Ruwi Oman 0096824834470 / 24831672 00 96824835186 [email protected] AARAM TRADING & CONT CO Aluminium Fabricator s ALUMINIUM P.O. Box : 1886 Salalah Code 211 - Nr Bosch Showroom Sanaya Oman 009 6823212137 / 23211366 0096823212138 AA GROUP OF COMPANIES Import and Export Comp any & Agents IMPORT AND EXPORT COMPANY & AGENTS P.O. Box : 654 Muscat Code 113 A zaiba Industrial Area Azaiba Oman 0096824590075 0096824590012 / 24593105 ABBAS H ARDWARE & TRADING STORE Sanitaryware Sales & Supply SANITARYWARE SALES & SUPPLY P.O. Box : 2879 Ruwi Code 112 - Honda Road Oman 0096824832761 / 24837417 0096824 830562 ABDULLAH ALI AI KASHRY & PARTNERS CO.LLC Bricks & Blocks BRICKS & BLOCKS P.O.Box : 668 Mutrah Code 114 - Room 403, 4th Floor, OC Centre. Ruwi Ruwi Oman 0 096824701065 / 24701093 0096824701140 [email protected] ABDULLAH AHMED TEX TILES Textile Merchants TEXTILE MERCHANTS P.O. Box : 2923 Ruwi Code 112 - High S treet, Ruwi Oman 0096824798936 0096824834917 ABDULLAH AQEEL TRADING & CONT EST F ood & Consumables Importers & Wholesalers FOOD P.O. Box : 17 Nizwa Code 611 Nizw a Oman 0096825410227 0096825431737 ABDULLAH AHMED HASSAN TRADING Jewellers JEWEL LERS P.O. -

Al Maha Petroleum Products Marketing Co

Al Maha Petroleum Products Marketing Co. (MHAS.MSM) Country: Oman Current Market Price (OMR) 18.345 Exchange: Muscat Securities Market YTD Stock Performance (%) 57.7 Outstanding Shares (In million) 6.90 Sector: Oil and Gas/ Distribution and Marketing Market Cap (OMR Million) 126.58 Annualized EPS (1Q Local Ticker: MHAS 1.273 P/E 14.41 2008) (OMR) Reuters Code: MHAS.MSM BVPS (1Q 2008) (OMR) 3.25 P/B 5.64 Investment Opinion: OVERWEIGHT Adj. DPS (OMR) 0.35 Dividend Yield (%) 1.9 Last traded Price: OMR 18.345 (as on July 08, 2008) 52-week High (OMR) 19.200 52-week Low (OMR) 8.174 Fair Value: OMR 22.925 Source: Muscat Securities Market, Zawya.com Products & Services: Ownership and operation of fuel filling stations, distribution of marine and aviation fuel, lubricants, and other petroleum products. Share Price Movement Al Maha vs. MSM Index Al Maha Petroleum Products Marketing Co. (Al Maha) is the second largest oil distribution and marketing company in Oman, with has a market share of 30%. The country’s stimulating macro economic environment together with accelerating industrialization, infrastructure development and tourism activities provides abundant opportunities for Al Maha. In 1Q 2008, the company’s top and bottom- line soared 43.2% and 78.2% to OMR 51.76 million and OMR 2.20 million, respectively. In line with the robust results, on March 30, 2008, the company distributed 40% cash dividend and 15% stock dividend for the year 2007. On the other hand, rising cost of sales along with intensifying competitive heat is a cause for concern. -

ANNUAL REPORT 2019 33 Notes to the Financial

ANNUAL REPORT 2019 His Majesty Sultan Haitham Bin Tariq His Majesty Sultan Qaboos Bin Said Bin Taimour (Late) ANNUAL REPORT 2019 C-STORE - NEW LOOK Registered Office: Al Maha Petroleum Products Marketing Company SAOG P.O. Box : 57, P.C. : 116, Operator No.: (968) 24610200 Fax No. : (968) 24610380 Mina Al Fahal, Sultanate of Oman CR No. 1613707 Location : Building No.: 245 Block No. : 250 Street : Al Maaredh, Street No.: 61 Area : Ghala Website : www.almaha.com.om 4 ANNUAL REPORT 2019 CONTENTS Sl. No. Page No. 1) Board of Directors 2 2) Executive Managment Team 3 3) Chairman’s Report 4-6 4) Auditor’s Report on Corporate Governance Report 7 5) Corporate Governance Report 8-16 C-STORE - NEW LOOK 6) Management Discussion and Analysis 17-21 7) Auditor’s Report on the Financial Statements 22-25 8) Financial Statements 26-56 1 ANNUAL REPORT 2019 BOARD OF DIRECTORS Dr. Juma Ali Juma Al-Juma His Highness Sheikh Zayed Chairman Bin Sultan Bin Khalifa Al Nahyan Deputy Chairman Saleh Nasser Juma Al-Araimi Saif Salim Saif Al-Harthi Director Director Faisal Ali Saleh Al Ahmed Al Ali Sultan Khalifa Saleh Al-Tai Director Director Mohammed Ali Said Al-Qassabi Director 2 PART 4/4 CEO image ANNUAL REPORT 2019 EXECUTIVE MANAGMENT TEAM Eng. Hamed Salim Hamed Al Maghdri Chief Executive Officer Ahmed Bakhit Al Shanfari Hafedh Awadh Al Hadeed Head - Marketing Division Head - Sales Division Hiriyanna Narayanaswamy Salah Abdullah Al Shamsi Chief Financial Officer Head – Strategic Planning & Risk Management Division Abdulhaleem Ali Issa Al Sabbagh Hamood Salah Hamood -

U Capital Yearly MSM Report

05 January 2020 U Capital Yearly MSM Report Market 2019 Review & 2020 Outlook 4400 a)Budget announcement (b) Companies' initial financial (a) Geo-political tensions (b) a) Presence of GCC investors (b) results for FY18 Rennaisance Services sold its Market picking up from 15yr lows subsidiary (Topaz) affecting Services (d) Positive reaction to 9M19 4300 a) Dividend announcements (b) US Fed holds sector performance negatively corporate financial results rates stable between 2.25%-2.5% (c) Positive (c) Regional markets' Government announcements on PPP initiatives upgrades/inclusions to/in world leading indices and hence outflow 4200 from Oman towards those markets a) 1Q19 Earnings (d) Corporates' 1H19 financial Announcements (b) S&P cut results rating for Oman 4100 4000 (a) Regional institutional selling pressure (b) TRA announced OMR 3900 75mn telecom license renewal fee for 15years 3800 (a) Ex-dividend prices impacting the price index (b) Impact of suspension Moody's downgrade of of tax on dividends for (a) Selling pressure 3700 Oman's rating (c) CBO foreigners and announcement on revising from foreigners (b) subsequently foreign Absence of catalysts Banking Law inflows 3600 Jul-19 Jan-19 Jun-19 Oct-19 Feb-19 Apr-19 Sep-19 Dec-19 Aug-19 Nov-19 Mar-19 May-19 Source: Media, U Capital The year 2019 was a challenging year for the local stock market. MSM 30 Price Index closed down, however, MSM total return index was up as as it takes into account dividend reinvestment while the earlier one does not. There were a number of good news during the year on the macro-economic front, however, in spite of positive announcements by the Government, the regulator and the companies, the local market witnessed a fall during the year as per the price index while it was higher if we calculate on the MSM total return index. -

Oil Marketing Sector - Oman

Oil Marketing Sector - Oman Defensive bet in volatile times… Gulf Baader Capital Markets Research Oil Marketing Sector Oil Marketing Sector in Oman – Defensive bet in volatile times . Oman Oil Marketing remains our favorite pick . Al Maha Petro provides strong case of valuation . Shell Oman to provide consistent dividend yield August 14, 2010 Oil Marketing Sector in Oman - Rationale to Initiate coverage… During the prevailing volatile epoch in equity markets, the long term investors remain baffled to pump in new funds in the listed equities space. It is noteworthy that capital protection has become paramount among investors rather than looking for capital enhancement during these turbulent times. The investing strategy has tilted in favour of long term investment and expects to play prudent approach as the thumb rule moving forward. Towards this initiative, GBCM research has identified Oman’s Oil Marketing Sector as a defensive bet and also provides much needed solace throughout the market instability period. As compared to other sectors, Oil marketing segment remains as a stable Industry with the presence of low beta stocks. The sector also provides strong entry barriers on back of higher capital requirements, government policy and prevailing economies of scale. We also believe that the presence of favorable Demographics in Oman along with strong Fiscal Spending to aid stable and steady economic growth in the coming years. The continuing emphasis on employment generation among local population (Refer FY2010 Oman Budget) could lead to improved demand, healthy domestic savings and consumption mix. The continuance of Government spending on infrastructure development mainly into Airports, Seaports, Roads and other infrastructure to augment consistent revenue growth for the local companies.