ASSET MANAGEMENT PLAN 2019-2029 Contents 1 EXECUTIVE SUMMARY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Moutere Gravels

LAND USE ON THE MOUTERE GRAVELS, I\TELSON, AND THE DilPORTANOE OF PHYSIC.AL AND EOONMIC FACTORS IN DEVJt~LOPHTG THE F'T:?ESE:NT PATTERN. THESIS FOR THE DEGREE OF MASTER OF ARTS ( Honours ) GEOGRAPHY UNIVERSITY OF NEW ZEALAND 1953 H. B. BOURNE-WEBB.- - TABLE OF CONTENTS. CRAFTER 1. INTRODUCTION. Page i. Terminology. Location. Maps. General Description. CH.AFTER 11. HISTORY OF LAND USE. Page 1. Natural Vegetation 1840. Land use in 1860. Land use in 1905. Land use in 1915. Land use in 1930. CHA.PrER 111. PRESENT DAY LAND USE. Page 17. Intensively farmed areas. Forestry in the region. Reversion in the region. CHA.PrER l V. A NOTE ON TEE GEOLOGY OF THE REGION Page 48. Geological History. Composition of the gravels. Structure and surface forms. Slope. Effect on land use. CHA.mm v. CLIMATE OF THE REGION. Page 55. Effect on land use. CRAFTER Vl. SOILS ON Tlffi: MGm'ERE GRAVELS. Page 59. Soil.tYJDes. Effect on land use. CHAPrER Vll. ECONOMIC FACTORS WrIICH HAVE INFLUENCED TEE LAND USE PATTERN. Page 66. ILLUSTRATIONS AND MAPS. ~- After page. l. Location. ii. 2. Natu.ral Vegetation. i2. 3. Land use in 1905. 6. Land use regions and generalized land use. 5. Terraces and sub-regions at Motupiko. 27a. 6. Slope Map. Folder at back. 7. Rainfall Distribution. 55. 8. Soils. 59. PLATES. Page. 1. Lower Moutere 20. 2. Tapawera. 29. 3. View of Orcharding Arf;;a. 34a. 4. Contoured Orchard. 37. 5. Reversion and Orchards. 38a. 6. Golden Downs State Forest. 39a. 7. Japanese Larch. 40a. B. -

Full Article

Southern Bird No. 47 September 2011 • ISSN 1175-1916 The Magazine of the Ornithological Society of New Zealand NEW ZEALANd’s LARGEST RECORDED SEABIRD WRECK CELEBRITY PENGUIN THE MISSING RARITIES Southern Bird No. 47 June 2011 • ISSN 1175-1916 QUOTATION RARE AUSTRALIAN VISITOR Why do you sit, so dreamily, dreamily, TO Kingfisher over the stream STEWART ISLAND'S Silent your beak, and silent the water. What is your dream?.. HORSESHOE BAY The Kingfisher by Eileen Duggan 1894-1972 The power lines of Sydney and Perth are quite a contrast to the windswept, rain lashed climate of Stewart Island for the Black- Faced Cuckoo Shrike, so spotting one on the island recently was a surprise for Brent Beaven, the Department of Conservation's CONTENTS Biodiversity Manager on Stewart Island/Rakiura. Brent spotted the rare Australian vagrant on 26th May 2011 at the Dancing President's Report 3 Star Foundation's Ecological Preserve at Horseshoe Bay. Writer and photographer, Fraser Crichton, who was working as a Treasurer's Report 5 conservation volunteer with the Foundation at the time, captured New Zealand's Largest Recorded Seabird Wreck 10 this image of the bird on a power line just outside the predator proof fence of the preserve. Bird News 13 Philip Rhodes Southland's Regional Recorder said, "Yes quite a The Missing Rarities 15 rare bird to see, and yes definitely a juvenile Black-faced Cuckoo shrike. There was another of these spotted on Stewart Island in Regional Roundup 16 about 2001." The immature Black-Faced Cuckoo Shrike (Coracina novaehollandiae) has an eye stripe rather than the full black mask of the mature bird. -

Y9 HANDBOOK Nelson College for Girls Te Kura Tamawahine O Whakatu MAP of NELSON COLLEGE for GIRLS

Y9 HANDBOOK Nelson College for Girls Te Kura Tamawahine o Whakatu MAP OF NELSON COLLEGE FOR GIRLS FOR COLLEGE NELSON OF MAP 5 2 6 P4 7 Musi Nelson College for Girls Te Kura Tamawahine o Whakatu A WARM WELCOME TO NELSON COLLEGE FOR GIRLS November 2017 Dear Parents, Caregivers, Whānau of 2018 Year 9 Students Tēnā koē We are delighted to welcome your daughter to Nelson College for Girls as a Year 9 student in 2018. We hope that the information in this booklet will begin to answer some of the questions your daughter may have about our school. It covers various aspects of life at Nelson College for Girls, which should help your daughter to make a smooth transition into secondary school. The first stage of the orientation process for next year is happening today. The next step will be the interviews that are planned for later this month. You will have received information about this earlier in the week, along with the booking process. The first day for Year 9 in 2018 is Wednesday 31 January 2018 at 12 noon. The girls will gather at the main gates for a Mihi Whakatau (official welcome) and then proceed to the College Hall. We would encourage you to take part in the Mihi Whakatau with your daughter if you are able to. Your daughter will spend most of the first day with her mentor class, getting to know the students in her class and in particular her Mentor Teacher. We look forward to having your daughter as a part of our school and to working closely with you to ensure the best educational opportunities for her. -

Car Company Nelson U7 2018

Car Company Nelson U7 2018 Draw dated 3/5/18 Game times are posted on the Monday prior on our website http://www.tasmanrugby.co.nz/draws-results/juniorage-grade Date Home Away Venue Week 1 5/5/2018 Tapawera: U7 V Murchison: U7 Tapawera 5/5/2018 Rangers: U7 V Riwaka: Aqua Taxi U7 Black Upper Moutere 5/5/2018 Wanderers: U7 Gold V Waimea Old Boys: U7 Griffins Lord Rutherford Park 5/5/2018 Wanderers: U7 Stripes V Riwaka: Aqua Taxi U7 White Lord Rutherford Park 5/5/2018 Wanderers: U7 Blue V Waimea Old Boys: U7 Mako Lord Rutherford Park 5/5/2018 Nelson: U7 Blue V Nelson: U7 White Neale Park 5/5/2018 Waimea Old Boys: U7 Red V Huia: U7 Jubilee Park 5/5/2018 Waimea Old Boys: U7 White V Stoke: U7 White Jubilee Park 5/5/2018 Marist: U7 V Stoke: U7 Red Tahunanui Week 2 12/5/2018 Wanderers: U7 Stripes V Murchison: U7 Lord Rutherford Park 12/5/2018 Wanderers: U7 Gold V Riwaka: Aqua Taxi U7 Black Lord Rutherford Park 12/5/2018 Wanderers: U7 Blue V Riwaka: Aqua Taxi U7 White Lord Rutherford Park 12/5/2018 Stoke: U7 Red V Waimea Old Boys: U7 Red Greenmeadows 12/5/2018 Rangers: U7 V Tapawera: U7 Upper Moutere 12/5/2018 Huia: U7 V Waimea Old Boys: U7 Griffins Sports Park Motueka 12/5/2018 Nelson: U7 White V Waimea Old Boys: U7 White Neale Park 12/5/2018 Nelson: U7 Blue V Marist: U7 Neale Park 12/5/2018 Stoke: U7 White V Waimea Old Boys: U7 Mako Greenmeadows Week 3 19/5/2018 Tapawera: U7 V Wanderers: U7 Stripes Tapawera 19/5/2018 Murchison: U7 V Wanderers: U7 Blue Murchison 19/5/2018 Waimea Old Boys: U7 Griffins V Stoke: U7 Red Jubilee Park 19/5/2018 Waimea -

New Zealand 16 Marlborough Nelson Chapter

©Lonely Planet Publications Pty Ltd Marlborough & Nelson Why Go? Marlborough Region ....400 For many travellers, Marlborough and Nelson will be their Picton ........................... 400 introduction to what South Islanders refer to as the ‘Main- Marlborough Sounds ...404 land’. Having left windy Wellington, and made a white- Queen Charlotte Track ...407 knuckled crossing of Cook Strait, folk are often surprised to fi nd the sun shining and the temperature up to 10 degrees Kenepuru & Pelorus Sounds.............409 warmer. Good pals, these two neighbouring regions have much Blenheim ........................411 in common beyond an amenable climate: both boast re- Kaikoura ........................ 416 nowned coastal holiday spots, particularly the Marlborough Nelson ...........................423 Sounds and Abel Tasman National Park. There are two other Nelson Lakes national parks (Kahurangi and Nelson Lakes) and more National Park ................430 mountain ranges than you can poke a stick at. Motueka ........................432 And so it follows that these two regions have an abun- Motueka to Abel dance of luscious produce: summer cherries for a starter, Tasman ..........................435 but most famously the grapes that work their way into the Golden Bay ....................440 wineglasses of the world’s fi nest restaurants. Keep your pen- Kahurangi National knife and picnic set at the ready. Park ...............................444 When to Go? Best Places to Eat The forecast is good: Marlborough and Nelson soak up some » Green Dolphin (p 422 ) of New Zealand’s sunniest weather. January and February are the warmest months, with daytime temperatures aver- » Wither Hills (p 414 ) aging 22°C; July is the coldest, averaging 12°C. It’s wetter » Hopgood’s (p 428 ) and more windswept the closer you get to Farewell Spit and » Sans Souci Inn (p 442 ) the West Coast. -

Inland Moutere Valleys Plant Lists

INLAND MOUTERE VALLEYS ECOSYSTEM NATIVE PLANT RESTORATION LIST Valleys draining the inland Moutere hill country of the Wai-iti, Dove, Redwood, Locality: Eves and upper Moutere catchments. Topography: Flat to gently sloping terraces, fans and flood-plains. Free-draining alluvial sandy, silty or gravelly loams of low to medium fertility. Soils and Geology: Derived from Moutere Gravels. Stoniness is variable. Moderately drought-prone. High sunshine hours; frosts moderate to heavy; mild annual temperatures, warm Climate: summers; rainfall 890-1150mm. Coastal influence: None, except for very small area Waimea River mouth. Mixed podocarp-beech-broadleaf forests. Wetlands in channels and Original Vegetation: depressions of flood-plains, and backs of terraces below toe-slopes. No areas of native vegetation remain except for several small copses of forest Human Modification: and treeland. Hydrology is altered in places by drainage and channelisation. Base water table has been lowered in places. [Refer to the Ecosystem Restoration map showing the colour-coded area covered by this list.] KEY TYPE OF FOOD PROVIDED FOR PLANTING RATIO PLANT PREFERENCES BIRDS AND LIZARDS Early Stage plants are able to Wet, Moist, Dry, Sun, Shade, Frost establish in open sites and can act as F = Fruit/seeds a nursery for later stage plants by 1 = prefers or tolerates providing initial cover. ½ = prefers or tolerates some N = Nectar Later Stage plants need cover to 0 = intolerant of establish. B = Buds/foliage Plant in habitat type: 2 = plant commonly I = Insects 1 = -

Feasibility of Restoring Tasman Bay Mussel Beds

Feasibility of restoring Tasman Bay mussel beds Prepared for Nelson City Council May 2012 29 June 2012 11.52 a.m. Authors/Contributors : Sean Handley Stephen Brown For any information regarding this report please contact: Sean Handley Marine Ecologist Nelson Marine Ecology and Aquaculture +64-3-548 1715 [email protected] National Institute of Water & Atmospheric Research Ltd 217 Akersten Street, Port Nelson PO Box 893 Nelson 7040 New Zealand Phone +64-3-548 1715 Fax +64-3-548 1716 NIWA Client Report No: NEL2012-013 Report date: May 2012 NIWA Project: ELF12243 © All rights reserved. This publication may not be reproduced or copied in any form without the permission of the copyright owner(s). Such permission is only to be given in accordance with the terms of the client’s contract with NIWA. This copyright extends to all forms of copying and any storage of material in any kind of information retrieval system. Whilst NIWA has used all reasonable endeavours to ensure that the information contained in this document is accurate, NIWA does not give any express or implied warranty as to the completeness of the information contained herein, or that it will be suitable for any purpose(s) other than those specifically contemplated during the Project or agreed by NIWA and the Client. 29 June 2012 11.52 a.m. Contents Executive summary .............................................................................................................. 5 1 Introduction ................................................................................................................ -

Asset Management Plan 2019–2029 SUMMARY DOCUMENT

Asset Management Plan 2019–2029 SUMMARY DOCUMENT Planning and investing in the network we need for the future Every year Network Tasman reviews DEMAND FORECAST the capital development, renewals, Demand in the industrial sector and maintenance sections of its Asset continued to increase throughout 2018 Management plan. The annual review and is expected to continue for the considers: next few years. This is driven by supply z Recent network performance (safety requirements for cold storage, shell fish and reliability) processing/extraction, rest homes, hop z An updated demand forecast processing, and dairy irrigation. z The current status of capital and There is also strong demand due to $120m network renewal projects land subdivision to support growth in This summary provides you with the residential housing developments. The Over the next 10 key information from our review and impact of electric vehicle charging is identifies the key steps Network Tasman likely to become a consideration later years, we plan to is taking to ensure our network is well in the timeframe covered by this plan. placed to support changes in electricity Work is underway to identify the LV invest $120 million usage and increased demand for networks in our system that will require electricity supply. investment to accommodate this. in our network. Network Tasman Asset Management Plan • 2019–2029 Summary Document Where do we fit in the electricity industry? Generation In New Zealand electricity is created in several ways, using water, wind, geo-thermal, gas and coal. Transmission High-voltage electricity is moved around the country using pylons and the national grid, which are owned and managed by Transpower. -

Waimea Inlet Restoration Information for Communities on Best Practice Approaches CONTENTS

Waimea Inlet restoration Information for communities on best practice approaches CONTENTS 1. Purpose 1 2. Context 1 2.1 Why restore Waimea Inlet’s native ecosystems? 1 2.2 Long-term benefits of restoration 3 2.3 Threats to Waimea Inlet 3 2.4 ‘Future proofing’ for climate change 4 3. Legal considerations 4 4. Ways to get involved 5 4.1 Join an existing project 5 4.2 Set up your own project 5 4.3 Other ways to contribute 6 5. Basic principles for restoration projects 6 5.1 Habitat restoration and amenity planting values 6 5.2 Ecosourcing 7 5.3 Ecositing 7 6. Project planning and design 8 6.1 Restoration plan and objectives 8 6.2 Health and safety 9 6.3 Baseline surveys of the area’s history, flora, fauna and threats 9 7. Implementation – doing the restoration work 12 7.1 The 5 stages of restoration planting 12 7.2 How to prepare your site 14 7.3 How to plant native species 17 7.4 Cost estimates for planting 19 7.5 Managing sedimentation 19 7.6 Restoring whitebait habitat 19 7.7 Timelines 20 7.8 Monitoring and follow-up 20 Appendix 1: Native ecosystems and vegetation sequences in Waimea Inlet’s estuaries and estuarine margin 21 Appendix 2: Valuable riparian sites in Waimea Inlet for native fish, macroinvertebrates and plants 29 Appendix 3: Tasman District Council list of Significant Natural Areas for native species in Waimea Inlet estuaries, margins and islets 32 Appendix 4: Evolutionary and cyclical nature of community restoration projects 35 Appendix 5: Methods of weed control 36 Appendix 6: Further resources 38 1. -

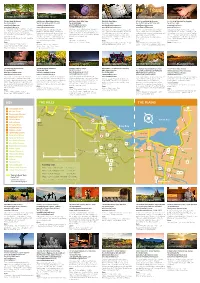

0172 Wine Nelson Guide 2016 FINAL Copy

1. FOSSIL RIDGE WINES 2. MILCREST ESTATE 3. GREENHOUGH VINEYARD 4. BRIGHTWATER VINEYARDS 5. KAIMIRA WINES 6. SEIFRIED ESTATE 72 Hart Road, Richmond 114 Haycock Road, Hope, Nelson 411 Paton Road, RD1, Hope 546 Main Road, Hope 97 Livingston Road, Brightwater Cnr. SH 60 & Redwood Rd, Appleby Tel: 03 544 9463 Tel: 03 544 9850 or 027 554 6622 Tel: 03 542 3868 Tel: 03 544 1066 Tel: 03 5423 491 or 021 2484 107 Tel: 03 544 1600 [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] www.fossilridge.co.nz www.milcrestestate.co.nz www.greenhough.co.nz www.brightwaterwine.co.nz www.KaimiraWines.com www.seifried.co.nz An intensively managed boutque vineyard Milcrest Estate is a boutque vineyard Welcome to our cellar door just fve minutes “You will feel at home at the spacious cellar Certfed organic vineyards and winery. A treasure amongst the vines. The perfect in the Richmond foothills. Established 1998, situated at the foothills of the Richmond from Richmond. Winemakers in Hope for door. There is an unpretentous, helpful and Visit our cellar door/local art gallery for way to spend an afernoon – relaxing in the currently featuring seven wine optons. Ranges producing award winning Aromatcs, twenty fve years. Taste our certfed organic enjoyable approach to wine tastng here. tastng and sales of your favourite wines plus vineyard garden or next to the open freplace Visitors invited for cellar door tastngs in an Chardonnay, Pinot Noir, Syrah, Dolceto Hope Vineyard wines – Chardonnay, Riesling, These seriously made wines show clarity, some more unusual varietes. -

Recent Studies of Historical Earthquake-Induced Landsliding, Ground Damage, and Mm Intensity

59 RECENT STUDIES OF HISTORICAL EARTHQUAKE-INDUCED LANDSLIDING, GROUND DAMAGE, AND MM INTENSITY IN NEW ZEALAND G. T. Hancox 1, N. D. Perrin 1 and G.D. Dellow 1 ABSTRACT A study of landsliding caused by 22 historical earthquakes in New Zealand was completed at the end of 1997. The main aims of that study were to: (a) study the nature and extent of landsliding and other ground damage (sand boils, subsidence and lateral spreading due to soil liquefaction) caused by historical earthquakes; (b) determine relationships between landslide distribution and earthquake magnitude, epicentre, isoseismals, faulting, geology and topography; and (c) establish improved environmental response criteria and ground classes for assigning MM intensities and seismic hazard assessments in New Zealand. Relationships developed from the study indicate that the minimum magnitude for earthquake-induced landsliding (EIL) in N.Z. is about M 5, with significant landsliding occurring at M 6 or greater. The minimum MM intensity for landsliding is MM6, while the most common intensities for significant landsliding are MM7-8. The intensity threshold for soil liquefaction in New Zealand was found to be MM7 for sand boils, and MMS for lateral spreading, although such effects may also occur at one intensity level lower in highly susceptible materials. The minimum magnitude for liquefaction phenomena in N.Z. is about M 6, compared to M 5 overseas where highly susceptible soils are probably more widespread. Revised environmental response criteria (landsliding, subsidence, liquefaction-induced sand boils and lateral spreading) have also been established for the New Zealand MM Intensity Scale, and provisional landslide susceptibility Ground Classes developed for assigning MM intensities in areas where there are few buildings. -

St James Conservation Area Brochure

St James Conservation Area NORTH CANTERBURY Track grades Easy tramping track Hanmer Springs Moderate day or multi-day tramping/ The alpine spa resort town of Hanmer Springs is hiking the main gateway to the St James Conservation Track generally well formed, may be steep Area. rough or muddy Suitable for people with moderate fitness For complete information on accommodation, and some backcountry/remote area bike hire, transport and other Hanmer Springs experience visitor services, visit the website Track has signs, poles or markers. www.visithanmersprings.co.nz Major stream and river crossings are or contact the Hanmer Springs i-SITE Visitor bridged Centre on 0800 442 663. Light tramping/hiking boots required Tramping track Challenging day or multi-day tramping/ hiking Contact us: Track is mostly unformed with steep, rough For gate combination details, concessions, or muddy sections hunting permits and other information contact: Suitable for people with good fitness. Moderate to high-level backcountry skills DOC – Rangiora Office and experience, including navigation and 32 River Road, RANGIORA survival skills required 03 313 0820 Track has markers, poles or rock cairns 8.00 am – 5.00 pm, Monday to Friday Expect unbridged stream and river [email protected] crossings Tramping/hiking boots required Route For information on bike hire, transport and other Challenging overnight tramping/hiking accommodation go to: www.visithurunui.co.nz Track unformed and natural, may be rough and very steep Suitable for people with above-average fitness. High-level backcountry skills and Map backgrounds: Geographx experience, including navigation and All photos, unless otherwise credited, are copyright DOC.