The Electronic Communication Networks and the Internet: a New Concept of Business in the Capital Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

INET to Join NASDAQ's Supermontage New York, NY— Instinet ECN And

INET to join NASDAQ's SuperMontage New York, NY— Instinet ECN and Island ECN, soon to be combined into one electronic marketplace branded INET, today announced plans to participate in NASDAQ's SuperMontage. INET will begin displaying orders on SuperMontage in January following the consolidation of the Island ECN and Instinet ECN. "We are committed to exposing our customers' orders to as much liquidity as possible and improving the marketplace for all investors," said Alex Goor, executive vice president, head of Alternative Trading Systems, Instinet Corporation. "As a result of NASDAQ's recent proposed rule changes, we expect that participation in SuperMontage will benefit our subscribers." "With Instinet's participation, SuperMontage offers a deeper pool of liquidity for NASDAQ market participants and ultimately, enhanced opportunity for best execution," said Chris Concannon, executive vice president of The NASDAQ Stock Market. "SuperMontage was designed to provide a highly transparent, highly liquid venue where multiple parties -- and competing market models -- can come together to yield the best outcome for investors." Separately, NASDAQ announced that it intends to use Instinet SmartRouter technology to provide its members with access to enhanced routing services. Instinet SmartRouter integrates liquidity pools including all major ECNs through its order routing algorithm. "NASDAQ is pleased to announce that it intends to partner with INET to make available Instinet's enhanced order-routing technology to NASDAQ's SuperMontage participants," Concannon added. Instinet ECN and Island ECN, soon to be combined into one electronic marketplace branded INET, will comprise one of the largest liquidity pools in U.S. over-the-counter securities. -

Filing for SEC Rule

Rule 606 Quarterly Report Instinet, LLC 309 West 49th Street New York, NY 10019 Disclosure of Order Routing Information – SEC Rule 606 for Quarter Ending on June 28 2019 In accordance with Securities and Exchange Commission (“SEC”) requirements, Instinet, LLC (“Instinet” or the “Firm”), is publishing statistical information about its routing of certain customers’ orders in NMS Securities and Listed Options. SEC rules require all registered broker- dealers that route orders in certain equity and option securities to make publicly available quarterly reports that present a general overview of a firm’s non-directed order routing practices. Non-directed orders are orders that the customer has not instructed to route to a particular venue for execution. For these non-directed orders, the Firm has selected the execution venue on behalf of its customers. Please note that consistent with the SEC’s requirements, these statistics capture only a portion of Instinet's order flow. This report is intended to provide an overview of Instinet’s order routing practices, and does not create a reliable basis on which to assess whether Instinet or any other trading venue, to which we route orders, has satisfied its duty of best execution. Decisions concerning whether to open an account or direct orders to the Firm should not be established on the information presented in this report alone, but on a broader evaluation of the full range of services and products Instinet provides. This report is divided into four sections: 1. Securities listed on the New York Stock Exchange, LLC and reported as Network A eligible securities; 2. -

Electronic Call Market Trading Nicholas Economides and Robert A

VOLUME 21 NUMBER 3 SPRING 1995 Electronic Call Market Trading Nicholas Economides and Robert A. Schwartz Hidden Limit Orders on the NYSE Thomas H.Mclnish and Robert A. Wood Benchmark Orthogonality Properties David E. Tierney and Jgery K Bailey - Equity Style ClassXcations Jon A. Christophmon "'Equity Style Classi6ications": Comment Charles A. Trzn'nka Corporate Governance: There's Danger in New Orthodoxies Bevis Longstreth Industry and Country EfZ'ects in International Stock Returns StmL. Heston and K. Ceert Routuenhont Currency Risk in International Portfolios: How Satisfying is Optimal Hedging? Grant W Gardner and Thieny Wuilloud Fundamental Analysis, Stock Prices, and the Demise of Miniscribe Corporation Philip D. Drake and John W Peavy, LLI Market Timing Can Work in the Real World Glen A. Lmm,Jt., and Gregory D. Wozniak "Market Timing Can Work in the Real World": Comment Joe Brocato and ER. Chandy Testing PSR Filters with the Stochastic Dominance Approach Tung Liang Liao and Peter Shyan-Rong Chou Diverfication Benefits for Investors in Real Estate Susan Hudson- Wonand Bernard L. Elbaum A PUBLICATION OF INSTITUTIONAL INVESTOR, INC. Electronic Call Market Trading Let competition increase @n'ency. Nicholas Economides and Robert A. Schwartz ince Toronto became the first stock exchange to computerize its execution system in 1977, electronic trading has been instituted in Tokyo S(1 982), Paris (1986), Australia (1990), Germany (1991). Israel (1991), Mexico (1993). Switzerland (1995), and elsewhere around the globe. Quite likely, by the year 2000, floor trading will be totally eliminat- ed in Europe, predominantly in favor of electronic con- tinuous markets. Some of the new electronic systems are call mar- kets, however, including the Tel Aviv StockExchange, the Paris Bourse (for thinner issues), and the Bolsa Mexicana's intermediate market. -

New Approach to the Regulation of Trading Across Securities Markets, A

NEW YORK UNIVERSITY LAW REVIEW VoLuME 71 DECEMBER 1996 - NUM-BER 6 A NEW APPROACH TO THE REGULATION OF TRADING ACROSS SECURITIES MARKETS YAKOV AMImHU* HAIM IVIENDELSON** In this Article, ProfessorsAmihud and Mendelson propose that a securities issuer should have the exclusive right to determine in which markets its securities will be traded, in contrast to the current regulatoryscheme under which markets may uni- laterally enable trading in securities without issuer consent Professors Amihud and Mendelson demonstrate that the tradingregime of a security affects its liquidity, and consequently its value, and that multinmarket tradingby some securitiesholders may produce negative externalities that harm securities holders collectively. Under the current scheme; some markets compete for orderflow from individuals by low- eringstandards, thereby creatingthe need for regulatoryoversight. A rule requiring issuer consent would protect the liquidity interests of issuers and of securitieshold- ers as a group. ProfessorsAmihud and Mendelson addresstie treatment of deriva- tive securities under their scheme, proposing a fair use test that would balance the issuer's liquidity interest against the public's right to use price information freely. The authors suggest that under their proposed rule, markets will compete to attract securities issuers by implementing and enforcing value-maximizing trading rules, thereby providing a market-based solution to market regulation. * Professor and Yamaichi Faculty Fellow, Stern School of Business, New York Univer- sity. B.S.S., 1969, Hebrew University, M.B.A., 1973, New York University, Ph.D., 1975. New York University. ** The James Irvin Miller Professor, Stanford Business School, Stanford University. B.Sc., 1972, Hebrew University, M.Sc., 1977, Tel Aviv University; Ph.D., 1979, Tel Aviv University. -

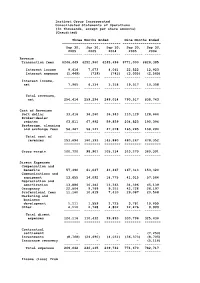

Instinet Group Incorporated Consolidated Statements of Operations (In Thousands, Except Per Share Amounts) (Unaudited)

Instinet Group Incorporated Consolidated Statements of Operations (In thousands, except per share amounts) (Unaudited) Three Months Ended Nine Months Ended ----------------------------- ------------------- Sep 30, Jun 30, Sep 30, Sep 30, Sep 30, 2005 2005 2004 2005 2004 --------- --------- -------- --------- -------- Revenue Transaction fees $246,449 $252,960 $245,696 $771,000 $828,385 Interest income 9,414 7,073 4,061 22,522 12,923 Interest expense (1,449) (739) (743) (3,005) (2,565) -------- -------- -------- -------- -------- Interest income, net 7,965 6,334 3,318 19,517 10,358 -------- -------- -------- -------- -------- Total revenues, net 254,414 259,294 249,014 790,517 838,743 -------- -------- -------- -------- -------- Cost of Revenues Soft dollar 33,416 36,260 36,943 110,129 128,664 Broker-dealer rebates 63,811 67,992 59,859 204,823 190,394 Brokerage, clearing and exchange fees 56,467 56,141 47,078 165,295 159,294 -------- -------- -------- -------- -------- Total cost of revenues 153,694 160,393 143,880 480,247 478,352 -------- -------- -------- -------- -------- Gross margin 100,720 98,901 105,134 310,270 360,391 -------- -------- -------- -------- -------- Direct Expenses Compensation and benefits 57,390 61,047 43,467 167,313 153,320 Communications and equipment 13,655 14,092 18,775 41,015 57,564 Depreciation and amortization 13,886 10,382 13,363 34,396 45,139 Occupancy 22,804 9,769 9,351 42,728 28,197 Professional fees 11,160 10,815 7,410 29,087 20,568 Marketing and business development 1,111 1,559 2,725 3,781 10,655 Other -

Instinet Group Incorporated Second Quarter 2005 Earnings ______Conference Call Transcript July 22, 2005

Instinet Group Incorporated Second Quarter 2005 Earnings _____________________________________________________ Conference Call Transcript July 22, 2005 CORPORATE PARTICIPANTS Lisa Kampf Instinet Group - Investor Relations Ed Nicoll Instinet Group - CEO John F. Fay Instinet Group – Co-President and CFO CONFERENCE CALL PARTICIPANTS Alex Kremm Lehman Brothers - Analyst Daniel Goldberg Bear Stearns – Analyst Charlotte Chamberlain Jeffries & Company – Analyst ___________________________________________________________________________________________________________ Instinet Group Incorporated. 2Q05 Earnings Call 1 Operator: Good morning ladies and gentlemen. This is the operator. Today’s conference is scheduled to begin momentarily. Until that time, your lines will again be placed on music hold. Thank you for your patience. Good morning. My name is Cynthia and I will be your conference facilitator. At this time I would like to welcome everyone to the Instinet Group, Incorporated Second Quarter 2005 Earnings conference call. All lines have been placed on mute to prevent any background noise. After the speaker’s remarks there will be a question and answer period. If you would like to ask a question during this time, simply press star then the number 1 on your telephone keypad. If you would like to withdraw your question, press star then the number 2. I would now like to turn the conference over to Lisa Kampf, Investor Relations Officer. Ma’am, you may begin your conference. Lisa Kampf: Good morning and welcome to the Instinet Group conference call to discuss results for the second quarter of 2005. During this conference call we may make statements that are forward looking in nature. Our actual results may be materially different from the results anticipated in those statements. -

Market Mechanics: a Guide to U.S

BRCM CDWC CEFT CEPH CHIR CHKP CHTR CIEN CMCSK CMVT CNXT COST CPWR CSCO CTAS CTXS CYTC DELL Market Mechanics: A Guide to U.S. Stock Markets release 1.2 Although the inner workings of the stock market are fas- cinating, few introductory texts have the space to describe them in detail. Furthermore, the U.S. stock markets have been chang- ing so rapidly in recent years that many books have not yet caught up with the changes. This quick note provides an up-to- date view of how the U.S. stock markets work today. This note will teach you about: • The functions of a stock market; • Stock markets in the United States, including Nasdaq JAMES J. ANGEL, Ph.D. and the NYSE; Associate Professor of Finance • The difference between limit and market orders; McDonough School of Business • How stock trades take place; and Georgetown University • Lots of other interesting tidbits about the stock market that you wanted to know, but were afraid to ask. Market Mechanics: A Guide to U.S. Stock Markets DISH EBAY ERICY ERTS ESRX FISV FLEX GENZ GILD GMST HGSI ICOS IDPH IDTI IMCL IMNX INTC INTU ITWO What a Stock Market Does most productive opportunities are. These signals channel The stock market provides a mechanism where people capital to the areas that investors think are most produc- who want to own shares of stock can buy them from peo- tive. Finally, the financial markets provide important risk- ple who already own those shares. This mechanism not management tools by letting investors diversify their only matches buyer and seller, but it also provides a way investments and transfer risk from those less able to toler- for the buyer and seller to agree mutually on the price. -

Wall Street's New Alchemist Buyout Specialist Glenn Hutchins Is Behind Discount Brokerage and Electronic Exchange Deals That Could Reshape Stock Trading

Close Window AUGUST 8, 2005 FINANCE Wall Street's New Alchemist Buyout specialist Glenn Hutchins is behind discount brokerage and electronic exchange deals that could reshape stock trading Directors of Sungard Data Systems Inc. sat around a conference table on Mar. 22 at a midtown Manhattan law firm and listened to some bad news. A consortium of seven private-equity firms had been pursuing a buyout of SunGard, which processes transactions for Wall Street firms, for four months. Now five of them were balking at the price. The lead firm, Silver Lake Partners, had agreed to the amount but needed more time to convince co-investors. But James L. Mann, SunGard's 70-year-old chairman and a former bomber pilot, is not one to haggle. Mann and the board delivered an ultimatum: accept the price within 48 hours, or the deal is off. The same day, Silver Lake co-founder and managing director Glenn H. Hutchins began working the phone. Compared with the other consortium members, which included Kohlberg Kravis Roberts & Co. and the Blackstone Group, the $5.8 billion Silver Lake was small fry. Still, Hutchins could draw on 20 years of relationships in private equity. By the deadline, only two original consortium members, Thomas H. Lee Co. and the Carlyle Group, had dropped out and Silver Lake had helped persuade Goldman Sachs Group Inc. (GS ) and Providence Equity Partners Inc. to replace them. "It's a tribute to the credibility that Glenn has in the sector that people wanted to be partners with him," says Jane Wheeler, senior managing director at New York investment bank Evercore Partners Inc. -

The Classification and Regulation of Automated Trading Systems

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Industrial Organization and Regulation of the Securities Industry Volume Author/Editor: Andrew W. Lo, editor Volume Publisher: University of Chicago Press Volume ISBN: 0-226-48847-0 Volume URL: http://www.nber.org/books/lo__96-1 Conference Date: January 19-22, 1994 Publication Date: January 1996 Chapter Title: An Exchange Is a Many-Splendored Thing: The Classification and Regulation of Automated Trading Systems Chapter Author: Ian Domowitz Chapter URL: http://www.nber.org/chapters/c8103 Chapter pages in book: (p. 93 - 124) 4 An Exchange Is a Many- Splendored Thing: The Classification and Regulation of Automated Trading Systems Ian Domowitz 4.1 Introduction In 1969, a company called Instinet established a computer-based trading facility as an alternative to the exchange markets. The Securities and Exchange Commission (SEC) responded by proposing rule 15~2-10,a filing requirement for automated trading and information systems.' The proposed rule was the first direct regulatory action aimed specifically at automated trading markets. Since then, the growth in automated trade execution systems on a worldwide basis has been explosive. In the United States alone, there are roughly twenty such mechanisms, including completely automated exchanges, exchange facil- ities with automated trade execution components, and proprietary systems not currently regulated as exchanges.* Growth in regulatory initiatives and analysis with respect to this new form of financial market structure quickly followed. These efforts can be classified in four general ways. There are the obvious hardware and software concerns that are generic in the oversight of any computerized system. -

Instinet's Trading Floor Features Yahoo! Financevision Live

Instinet's Trading Floor Features Yahoo! FinanceVision Live Instinet Research Analysts to Provide Live Pre- and Post-Market Analysis Twice Daily on Yahoo! FinanceVision NEW YORK, February 1, 2001 -- Instinet Corporation, a wholly-owned subsidiary of Reuters Group PLC (Nasdaq: RTRSY) and the eFinancial Marketplace offering equities trading, research, fixed income trading, and clearing and settlement services, today extended its relationship with Yahoo! Inc. (Nasdaq: YHOO), a global Internet communications, commerce and media company. Instinet Research analysts will provide live market analysis, twice daily, from the Instinet trading floor to Yahoo!® FinanceVision (http://financevision.yahoo.com). Yahoo! FinanceVision will broadcast from Instinet's trading floor at regularly scheduled time slots, once before 9:30 a.m. (EST) and once after 4:00 p.m. (EST). Instinet Research analysts will provide Yahoo! viewers with pre- and post- market analysis. To date, this information has not been widely available to the public from Instinet or any other broker. Presently, on the Instinet trading floor, CNBC and CNN hold daily broadcasts, with their respective reporters commenting on market conditions and movements pre-, post- and during market hours. In September 2000, Instinet signed an agreement with Yahoo! to provide Instinet top of book and last sale trade data on Yahoo! Finance, the Web's No. 1 finance site. Commenting on today's deal, John Oddie, CEO, Global Equities, Instinet Corporation said, "Instinet's expanded relationship with Yahoo! demonstrates our continued efforts to provide investors with unique and valuable market data that was previously available to institutional investors only, via various distribution points. Our skilled analysts have access to information that enables them to highlight specific stock trends and analyze market direction. -

Discussion Papers

Consulting Assistance on Economic Reform II Discussion Papers The objectives of the Consulting Assistance on Economic Reform (CAER II) project are to contribute to broad-based and sustainable economic growth and to improve the policy reform content of USAID assistance activities that aim to strengthen markets in recipient countries. Services are provided by the Harvard Institute for International Development (HIID) and its subcontractors. It is funded by the U.S. Agency for International Development, Bureau for Global Programs, Field Support and Research, Center for Economic Growth and Agricultural Development, Office of Emerging Markets through Contracts PCE-C-00-95-00015-00 and PCE-Q-00-95-00016-00. Integration of Stock Exchanges in Europe, Asia, Canada and the U.S. Philip Wellons CAER II Discussion Paper No. 14 April 1998 The views and interpretations in these papers are those of the authors and should not be attributed to the Agency for International Development, the Harvard Institute for International Development, or CAER II subcontractors. For information contact: CAER II Project Office Harvard Institute for International Development 14 Story Street Cambridge, MA 02138 USA Tel: (617) 495-9776; Fax: (617) 495-0527 Email: [email protected] INTEGRATION OF STOCK EXCHANGES IN REGIONS IN EUROPE, ASIA, CANADA, AND THE U.S. Philip A. Wellons Program on International Financial Systems Harvard Law School April 1997 Not for publication. Please do not duplicate without author's permission. TABLE OF CONTENTS I. INTRODUCTION......................................................................................................................1 -

Destinations of Choice Mapping the New Equity Trading Landscape Opening up the Market

Market Commentary & Insights Destinations of Choice Mapping the New Equity Trading Landscape Opening Up the Market MiFID II is transforming the European equity For a buy-side firm, the trading options are trading landscape, resulting in unprecedented not limited to traditional multilateral venues choice for participants. To remain competitive, such as dark pools operating within central buy-side firms looking to optimise order limit order books (“CLOBs”). Indeed, bilateral performance and meet more stringent best protocols such as SIs and requests-for-quote execution requirements need to be aware (“RFQs”), as well as the increasing use of of the growing range of options now at their conditional trading via Indications of Interest disposal. (“IOIs”), are at the forefront of this new, more open marketplace. The choices start with selecting the optimal type of venue: should your order be routed to Broker dealers also have a choice to make, a Regulated Market (“RM”) or a multilateral as they cannot run an MTF and an SI within trading facility (“MTF”)—regulated the same legal entity. trading venues required to provide non- discriminatory access—or, directly to a AROUND THE BLOCK Systematic Internaliser (“SI”)? RMs and MTFs are able to cross buyers and sellers and may The diversification in trading choices responds benefit from pre-trade transparency waivers. to a clear (though not necessarily loud) SIs, on the other hand, must trade on risk investor need. Buy-side firms, especially the but benefit from being able to price improve larger ones, have an ongoing requirement to relative to their published quotes as well as efficiently and quietly manage trillions of euros keep their quotes private when they deal above in assets.