The Microbanking Bulletin No. 18

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shared Interest's Guarantee Fund for South Africa

42 Community Development INVESTMENT REVIEW Unlocking Local Capital for Development: Shared Interest’s Guarantee Fund for South Africa Donna Katzin, Shared Interest Robert Rosenbloom, Strategic Philanthropy Advisors, LLC Introduction s the world grapples with growing income disparities that leave more than three billion of the planet’s people in poverty, and as the current recession shrinks the pool of public and private resources available to remedy the situation, inves- tors and policymakers across the globe are seeking high-impact, cost-effective Astrategies and tools to reduce the cavernous income and wealth gap and create bridges out of poverty.1 South Africa is a stark case in point. In 1994, when the country replaced apartheid with majority rule and elected Nelson Mandela president, South Africa was one of the most unequal nations on earth, with the preponderance of the country’s wealth concentrated in the hands of 9 percent of the population.2 Eighty-four percent of that wealth was deposited in the country’s four major banks, which by and large did not extend credit or most other banking services to blacks, who made up 80 percent of the population.3 That year, after the country transferred political power, but left economic power concen- trated in the same minority hands, Shared Interest was launched to provide U.S. inves- tors with a catalytic vehicle to help reverse apartheid’s legacy of institutionalized race-based inequality. In creating a model that would respond to South Africa’s particular conditions and needs, Shared Interest established a guarantee fund that moved highly capitalized South African banks to lend to community development financial institutions (CDFIs), coopera- tives, and emerging enterprises that, in turn, have supplied credit, affordable homes, and jobs to more than one million low-income black (including mixed race) South Africans. -

BANKING for IMPACT a Historical Review of Our Partner Financial Institutions, Their Business Models and Key Developments

WHITE PAPER NOVEMBER 2018 BANKING FOR IMPACT A historical review of our partner financial institutions, their business models and key developments This publication follows of a series of white papers produced by Symbiotics intended to share market intelligence on different topics related to microfinance, financial inclusion and impact investing. Building on our track record of partnering with financial institutions in emerging and frontier markets, we have prepared this paper in order to trace the evolution of the financial inclusion sector. The paper thus offers a broad understanding of the specificities and differences that exist between financial institutions of different regions, types and size. This paper was written by Ramkumar Narayanan. A special thanks to Roland Dominicé, Brendan Mackinnon and Marina Parashkevova Holmegaard for their valuable contributions, as well as to Patrick d’Huart, Duncan Frayne, Vincent Lehner, Yvan Renaud, Jérôme Savelli and Sebastian Sombra for their review and market expertise insights. The publication was proofread by Danielle Carpenter and designed by James Atkins Design Ltd and Pierre Weber. Legal Disclaimer This paper contains general information only. Symbiotics is not by means of this paper rendering professional advice or services. The content of this paper is meant for research purposes, with an aim to broaden and deepen the understanding of financial inclusion in emerging and frontier markets. This paper refers to specific figures, outcomes and performances. Such references are made for research purposes only and are not intended as a solicitation or recommendation to buy or sell any specific investment product or services. Similarly, the information and opinions expressed in the text have been obtained from sources believed to be reliable and in good faith, reflecting the view of the authors on the state of the industry or on the firm’s practice, but no representation or warranty, expressed or implied, is made as to its accuracy or completeness. -

Knowledge Exchange and Data Networking And

- ACCELERATING FINANCE FOR BUSINESSES - KNOWLEDGE EXCHANGE AND DATA NETWORKING AND CONVENING ADVOCACY AND POLICY CHANGE The SME Finance Forum has over 100 members from 42 countries Members by % % % % Organization 52 26 11 11 Financial Fintech Development Associations Type Institutions companies finance institutions NORTH EUROPE EAST ASIA AMERICA AND PACIFIC 20 % 16 % 26 % Advisory Board Issac Awundo, Group Managing Director, Commercial Bank of Africa Thomas DeLuca, CEO and Founder, AMP Credit Technologies Aysen Kulakoglu, Head of Department, Undersecretariat of Members the Turkish Treasury by Region Dawei Liu, Senior Vice President, CreditEase Jay Singer, Senior Vice President, Global SME Products, Mastercard 9 % Peer Stein, Advisor, Financial 15 % SOUTH Institutions Group, International ASIA 4 % Finance Corporation AFRICA 10 % LATIN AMERICA Devrim Tavil, International Head AND CARIBBEAN of SME Banking, BNP Paribas MIDDLE EAST AND CENTRAL ASIA List of all member organizations • ACCIS • CreditEase • Inter-American Investment • OPIC • ADFIAP • CRIF Corporation • Oxigen • Afriland First Bank • DCB Comemrcial Bank • International Factors Group • Palestine Investment Bank • Akiba Commercial Bank • DHGate • International Finance Corporation • PERC • AMP Credit Technologies • Diamond Bank • Intesa Sanpaolo • PRASAC • Ant Financial • Dianrong • Janalakshmi Financial Services • Qianhai Credit Bureau • Asian Credit Fund • DigiVation • Kabbage • Rakuten • Asifma • Ecobank • Kafalah SME Loan Guarantee • RBL Bank • Association of Banks in Malaysia -

IFC Financing to Micro, Small, and Medium Enterprises in Sub-Saharan Africa Key Highlights

IFC Financing to Micro, Small, and Medium Enterprises in Sub-Saharan Africa Key Highlights IFC is working to develop solutions to close the micro, small, and $342 million for trade finance. In fiscal year 2011 alone, IFC MSME medium enterprise (MSME1) financing gap, collaborating with commitments in the region were $1,095 million. In addition, IFC’s 69 financial institutions across 23 countries in Sub-Saharan Africa. microfinance institution (MFI) clients had 157,000 loans outstanding to micro-enterprises in Sub-Saharan Africa by end of 2010, totaling As of June 2011, IFC committed a total of $1.8 billion to $128.3 million. Similarly, IFC’s SME financial institution (SME FI) MSME finance in Sub-Saharan Africa, $1.48 billion for long term clients had 34,000 loans outstanding to SMEs by end of 2010, finance (including $220 million for funds supporting MSMEs), and totaling $4.2 billion in this region. MSME Financial Intermediary Portfolio, June 2011 IFC’s Committed Portfolio in MSME Financial Institutions IFC’s Regional Committed Portfolio in MSME in Sub-Saharan Africa2 Financial Institutions 1,400 2% 1,200 13% Europe & Central Asia 1,000 East Asia & the Caribbeans 6% 34% s n 800 Latin America & the Caribbeans o illi Middle East & North Africa 600 M 11% South Asia 400 Sub-Saharan Africa 200 19% 15% WORLD 0 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 MSME Loans by IFC Clients, December 2010 MSME Loans by Microfinance Institutions MSME Loans by SME Financial Institutions IFC was able to survey or extrapolate outreach data from IFC was able to survey or extrapolate outreach data from 23 SME FI 17 microfinance clients in 12 countries, 53 percent of these clients clients in 12 countries, 35 percent of these clients received advisory received advisory services from IFC. -

Best Practices in Collections Strategies

Number 26 November 2008 Best Practices in Collections Strategies Past-due or non-collectible loans are part and parcel of the financial sector. As past-due rates surpass expected limits, though, this piece of the credit cycle can become a true problem. While often seen as a final step in the lending cycle, collections 1 actually plays a much more integral role in the overall process. In recent years microfinance institutions (MFIs) have sought to develop new and more effective strategies for collections. This increased attention to collections is in part due to an industry-wide emphasis on credit promotion and analysis as well as to the changing and increasingly competitive environments in which MFIs are operating. Drawing from the experiences of collections programs throughout Latin America 2 and through the implementation of initial collections activities in India that are mainly focusing on Individual lending methodology, this InSight explores “best practices” and considerations that an MFI should take into account when attempting to successfully implement collections activities. I. The Role of Collections Collections is an integral part of the credit Collections is an important service cycle. that helps to both maintain clients and free up money for lending again. It is a strategic process that is key to generating good habits and a payment culture among clients. It can also be seen as a business activity whose primary objective is to generate returns for the institution, converting losses into income. MFIs should view collections as an essential piece of the credit cycle, not just the final step. During the collections process, institutions receive feedback on policies and activities within each sub- process of the lending cycle: promotion, evaluation, approval, and disbursement. -

CALIMAG INDUCTED ANEW in This Issue

JUNE 2015 AN OFFICIAL PUBLICATION OF PHILIPPINE MEDICAL ASSOCIATION VOLUME XXV NO. 1 CALIMAG INDUCTED ANEW In this issue: From the President's Desk p2-3 Editorial p4 As I See It p5 Dates to Remember p6 The Vice President's Corner p7 Maria Minerva P. Calimag, M.D. was emotionally; that they all love their fellow Money Matters: The inducted as 2015-2016 Philippine Medical physicians because that was what they have National Treasurer's Association President by Hon. Commissioner sworn to do when they took the Oath of Report p8-9 Florentino C. Doble, MD, PRC Chairman, during Hippocrates; that they should love the th Know your Governor the closing ceremonies of the 108 PMA Philippine Medical Association because it was p12-19 Annual Convention at the Marriott Grand built upon the age-old ideals of its founders as Ballroom in Pasay City. Dr. Calimag was an association of all physicians that would look Feature p20-21 reelected PMA President during the March 15, after each other‟s welfare. She urged the The MCP-KLP p22 2015 National Elections. members to thwart any attempt by any sector to disembowel the profession, to divide the MERS-CoV p23 In her speech, Dr. Calimag said that physicians, and disintegrate the PMA in the doctors have been under constant external exchange for personal gains or political CME Commission p24 threats but a united front and a solid ambitions. foundation would be their shield against all of Specialty & Affiliate these threats. She also stated that the Dr. Calimag asked all physician-leaders Societies p26-27 physicians are revered and looked up to by present during the closing ceremonies to society because eminence, empathy, erudition stand up, recite and live up to heart the and expertise have been the values attributed Declaration of Commitment to the Ethos of the to them. -

0113 Titlepage

APRACA FinPower Programme A Review of Rural Finance Innovations in Asia: New Approaches, Best Practices and Lessons Ramon C. Yedra With Special Sponsorship of the International Fund for Agricultural Development (IFAD) APRACA FinPower Publication 2007/4 A Review of Rural Finance Innovations in Asia: New Approaches, Best Practices and Lessons Ramon C. Yedra With Special Sponsorship of the International Fund for Agricultural Development (IFAD) i Published by: Asia-Pacific Rural and Agricultural Credit Association (APRACA) Printing by: Erawan Printing Press Distribution: For copies write to: The Secretary General Asia-Pacific Rural and Agricultural Credit Association (APRACA) 39 Maliwan Mansion, Phra Atit Road Bangkok 10200, Thailand Tel: (66-2) 280-0195, 697-4360 Fax: (66-2) 280-1524 E-mail: [email protected] Website: www.apraca.org Editing: Benedicto S. Bayaua Layout credit: Sofia Champanand E-Copies: E-copies in PDF file can also be downloaded from APRACA’s website. This review is published by APRACA under the auspices of the IFAD-supported APRACA FinPower Program. The review was commissioned through APRACA CENTRAB, the training and research arm of APRACA. The data gathered were based on primary and secondary data, interviews and information with key informants in selected APRACA represented countries. Opinions expressed by the author do not necessarily represent the official views of APRACA nor of IFAD. This review is published during the incumbency of Mr. Thiraphong Tangthirasunan (APRACA Chairman), Dr. Do Tat Ngoc (APRACA Vice-Chairman), Mr. Benedicto S. Bayaua (Secretary General). ii MESSAGE from the APRACA CHAIRMAN and VICE-CHAIRMAN reetings! This review of rural financial innovations and best practices is a testimony of APRACA’s G strong commitment to pursue the promotion of efficient and effective rural financial systems and broadened access to rural financial services in order to help reduce rural poverty among countries in Asia and the Pacific. -

Bootstrapdreams.Pdf (1.428Mb)

CONTENTS Preface IX Abbreviations Xlll INTRODUCTION 1 Chapter 1 THE INTERNATIONAL ROOTS OF MICROENTERPRISE DEVELOPMENT 19 Chapter 2 THE EMERGENCE OF U.S. MICROENTERPRISE DEVELOPMENT 44 Chapter 3 CHARACTERISTICS OF U.S. MICROENTERPRISE PROGRAMS 78 (Julie Cowgill, coauthor) Chapter 4 FORMING A MICROENTERPRISE PROGRAM: CASE STUDY PART' 120 (Julie Cowgill, coauthor) Chapter 5 MATURATION OF A MICROENTERPRISE PROGRAM: CASE STUDY PART" 159 Chapter 6 CONCLUSION: MICROENTERPRISE DEVELOPMENT CONTEXT, 201 CONTRADICTION, AND PRACTICE Notes 219 References 225 Index 245 0.. CHAPTER 1 THE INTERNATIONAL ROOTS OF MICROENTERPRISE DEVELOPMENT Conventional banking institutions do not make loans to the poor, especially to rural women. The bankers I met laughed at me. -YUNus (1997) After the bank's eighteen years in business, one could estimate that conservatively half a million families were able to throw off a life of destitution and begin living with a modicum of honor and dignity as a result of intervention from the Grameen Bank. -COUNTS (1996) [T]he development community is riding the microcredit band-wagon given that it is consistent with the dominant paradigm of self-help, decentralization. and given that structural adjustment programs have forced the poor into self-employment. -McMICHAEL (2000) A major source of the excitement surrounding microenterprise develop- ment has been the Grameen Bank in Bangladesh (Ryan 1997; Brill 1999). The statement by Mohammed Yunus, the bank's founder, describes his struggle to offer microcredit in the 1970s. The second statement captures the popular acclaim surrounding the bank and the hopes for future mi- croenterprise development. Many U.S. MDPs were modeled after famous southern programs such as the Grameen (Wahid 1993a; Counts 1996). -

Accelerating Financial Inclusion in South-East Asia with Digital Finance Asian Development Bank Table of Contents

ACCELERATING FINANCIAL INCLUSION IN SOUTH-EAST ASIA WITH DIGITAL FINANCE ASIAN DEVELOPMENT BANK TABLE OF CONTENTS PREFACE 3 EXECUTIVE SUMMARY 4 1 INTRODUCTION 7 2 CURRENT SITUATION AND OPPORTUNITY 9 3 FRAMEWORK TO IDENTIFY BARRIERS TO FINANCIAL INCLUSION 11 4 IMPACT OF DIGITAL FINANCE 18 5 QUANTIFYING THE IMPACT OF DIGITAL IN FINANCIAL INCLUSION 41 6 SEGMENT-SPECIFIC INSIGHTS 43 7 COUNTRY-SPECIFIC INSIGHTS 50 8 CONCLUDING REMARKS 65 9 APPENDIX 67 2 PREFACE Supporting financial sector development has been a strategic priority for ADB over the past several decades because of the critical role the financial sector plays in facilitating economic growth. ADB’s long-term strategic framework, “Strategy 2020,” emphasizes financial inclusion as an essential part of financial sector development: Without access to formal financial services, the unserved and underserved segments of society will be excluded from growth and its benefits.1 Digital finance presents a potentially transformational opportunity to advance financial inclusion. ADB engaged Oliver Wyman and MicroSave to conduct the following study on the role digital finance can play in accelerating financial inclusion, focusing on four Southeast Asian markets – Indonesia, the Philippines, Cambodia, and Myanmar. This study – informed by more than 80 stakeholder interviews across the four markets, extensive secondary research, and economic analysis – is an endeavour to better understand and quantify the nature of this impact. Oliver Wyman is a global leader in management consulting with a specialization in financial services. As a recognized thought leader in financial inclusion and digital finance, Oliver Wyman has a strong body of client work covering a broad range of financial institutions, regulators, and multilateral agencies. -

A Tool to Measure Poverty

IN THIS ISSUE: A SPECIAL FEATURE PAGE 3 B NEWS FROM AROUND THE WORLD PAGE 4 C SPOTLIGHT ON OUR SUPPORTERS PAGE 5 D VOICES FROM THE FIELD PAGE 6 FALL-WINTER // 2013-14 Income and Health and Housing and Happy Employment Environment Infrastructure Families 69 18 20 PERCENT PERCENT PERCENT A TOOL TO MEASURE POVERTY IN PARAGUAY IS ALSO HELPING Reported to be below Reported having access Reported having no the poverty threshold to drinking water in access to electricity TO ELIMINATE IT their homes BY JORDAN CORIZA Education and Organization and Interiority and Culture Participation Motivation 29 56 39 PERCENT PERCENT PERCENT Reported being unable Reported having some Reported having complete to read or write Spanish or full capacity to solve autonomy and ability to problems and conflicts make decisions Scorecard for Curuguaty, a town in eastern Paraguay, where Fundación Paraguaya is working with indigenous groups, rural residents and local business leaders to assess and eliminate poverty uruguaty is a Paraguayan town in the eastern department of Canindeyú. income, strengthen existing jobs and create new ones. The idea worked. But If you’ve heard of it – which you almost certainly haven’t – it’s probably like similar programs in Latin America, Fundación Paraguaya dedicated its early C because its population, which is poor and mostly rural, has been surveyed years to achieving financial self-sufficiency. Doing so required the adoption of and plotted on a map using Fundación Paraguaya’s color-coded ‘Poverty Stoplight,’ what some refer to as a minimalist strategy: focusing solely on providing access an innovative poverty measurement tool that has helped nearly 18,000 families to credit rather than the integrated strategy of urban and rural development overcome economic poverty since the program began in 2010. -

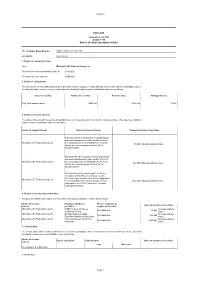

Form 603 Notice of Initial Substantial Holder

Form603 Form 603 Corporations Act 2001 Section 671B Notice of initial substantial holder To: Company Name/Scheme: Apollo Tourism & Leisure Ltd ACN/ARSN: 614 714 742 1. Details of substantial holder Name Mitsubishi UFJ Financial Group, Inc. The holder became a substantial holder on: 28/04/2021 The holder became aware on: 30/04/2021 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of securities Person's votes Voting power (%) Fully Paid ordinary shares 9,403,663 9,403,663 5.05% 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities Relevant interest in securities that Morgan Stanley has a relevant interest in under section 608(3) of Mitsubishi UFJ Financial Group, Inc. the Corporations Act as Mitsubishi UFJ Financial 70,000 Fully paid ordinary shares Group, Inc. has voting power of over 20% in Morgan Stanley. Relevant interest in securities that Morgan Stanley has a relevant interest in under section 608(3) of Mitsubishi UFJ Financial Group, Inc. the Corporations Act as Mitsubishi UFJ Financial 812,969 Fully paid ordinary shares Group, Inc. -

Apr02 UR Social Exclusion

TIONAL BA A NK RN E F T O N R I WORLD BANK R E T C N O E N M S P T O R L U E CT EV ION AND D August 2002 No.7 A regular series of notes highlighting recent lessons emerging from the operational and analytical program of the World Bank‘s Latin America and Caribbean Region BRINGING MICROFINANCE SERVICES TO THE POOR: CREDIAMIGO IN BRAZIL Susana M. Sánchez, Sophie Sirtaine, and Rita Valente Among policymakers and economists, there is a widely- micro and small enterprises. These products typically held perception that microenterprises1 face severe financ- carry very high interest rates and require collateral. ing shortages that limit their growth opportunities. Re- Banking networks also leave many areas, particularly solving the problems of access to finance as well as the poor and remote regions in the Northeast and North of high cost of financing has become the main objective of Brazil, underserved. About 57 percent of all munici- many government programs. palities in these regions have no access to a bank branch, compared to a national average of around 30 With a view to increasing access to credit for percent. Although in many other Latin American coun- microenterprises in the Northeast Region of Brazil, the tries, microfinance institutions have been able to par- World Bank has supported Banco do Nordeste’s tially fill the gap left by larger institutions, in Brazil, CrediAmigo microfinance program since 1997. This note only a small fraction of the potential demand for describes how Banco do Nordeste initiated CrediAmigo microfinance appears to be satisfied by the current as part of its restructuring strategy and how the program supply.