Day Month Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report: the Social and Economic Impact of Rural Wind Farms

The Senate Community Affairs References Committee The Social and Economic Impact of Rural Wind Farms June 2011 © Commonwealth of Australia 2011 ISBN 978-1-74229-462-9 Printed by the Senate Printing Unit, Parliament House, Canberra. MEMBERSHIP OF THE COMMITTEE 43rd Parliament Members Senator Rachel Siewert, Chair Western Australia, AG Senator Claire Moore, Deputy Chair Queensland, ALP Senator Judith Adams Western Australia, LP Senator Sue Boyce Queensland, LP Senator Carol Brown Tasmania, ALP Senator the Hon Helen Coonan New South Wales, LP Participating members Senator Steve Fielding Victoria, FFP Secretariat Dr Ian Holland, Committee Secretary Ms Toni Matulick, Committee Secretary Dr Timothy Kendall, Principal Research Officer Mr Terence Brown, Principal Research Officer Ms Sophie Dunstone, Senior Research Officer Ms Janice Webster, Senior Research Officer Ms Tegan Gaha, Administrative Officer Ms Christina Schwarz, Administrative Officer Mr Dylan Harrington, Administrative Officer PO Box 6100 Parliament House Canberra ACT 2600 Ph: 02 6277 3515 Fax: 02 6277 5829 E-mail: [email protected] Internet: http://www.aph.gov.au/Senate/committee/clac_ctte/index.htm iii TABLE OF CONTENTS MEMBERSHIP OF THE COMMITTEE ...................................................................... iii ABBREVIATIONS .......................................................................................................... vii RECOMMENDATIONS ................................................................................................. ix CHAPTER -

Annual Report 2017/18 Overview Agency Performance Significant Issues Disclosures and Legal Compliance Appendices

OVERVIEW AGENCY PERFORMANCE SIGNIFICANT ISSUES DISCLOSURES AND LEGAL COMPLIANCE APPENDICES ANNUAL REPORT 2017/18 OVERVIEW AGENCY PERFORMANCE SIGNIFICANT ISSUES DISCLOSURES AND LEGAL COMPLIANCE APPENDICES Statement of compliance Hon. Ben Wyatt MLA Treasurer 11th Floor, Dumas House Havelock Street West Perth WA 6005 Dear Treasurer ECONOMIC REGULATION AUTHORITY 2017/18 ANNUAL REPORT In accordance with section 61 of the Financial Management Act 2006, I hereby submit for your information and presentation to Parliament, the annual report of the Economic Regulation Authority for the financial year ended 30 June 2018. The annual report has been prepared in accordance with the provisions of the Financial Management Act 2006, the Public Sector Management Act 1994 and the Treasurer’s Instructions. Yours sincerely, Nicola Cusworth Chair 2 / Economic Regulation Authority Annual Report 2017/18 OVERVIEW AGENCY PERFORMANCE SIGNIFICANT ISSUES DISCLOSURES AND LEGAL COMPLIANCE APPENDICES Contact details Accessing the annual report Office address The 2017/18 annual report and previous reports are Level 4, Albert Facey House available on the ERA’s website: www.erawa.com.au. 469 Wellington Street To make the annual report as accessible as possible, Perth WA 6000 we have provided it in the following formats: Office hours 9:00am to 5:00pm • An interactive PDF version, which has links to other Monday to Friday (except public holidays) sections of the annual report. Postal address • A version with separate chapters to reduce file size PO Box 8469 and download times. Perth WA 6849 • A text version, which is suitable for use with screen Telephone 08 6557 7900 reader software applications. Fax 08 6557 7999 Email [email protected] This report can also be made available in alternative formats upon request. -

Clean Energy Fact Sheet We All Want Affordable, Reliable and Clean Energy So We Can Enjoy a Good Quality of Life

Clean Energy fact sheet We all want affordable, reliable and clean energy so we can enjoy a good quality of life. This fact sheet sets out how we’re leading a transition from fossil fuels to cleaner forms of energy. Background Minimising or, where we can, avoiding financial EnergyAustralia is one of the country’s biggest hardship is part of the challenge as we transition generators of power from fossil fuels. Each to cleaner generation. We need to do this while preserving the reliability of supply. +800 MW year we produce around 20 million tonnes Rights to of greenhouse gases, mostly carbon dioxide Our approach involves supporting the renewable energy or CO₂, from burning coal and gas to supply development of clean energy while helping our electricity to our 2.4 million accounts across customers manage their own consumption so eastern Australia. they use less energy. Because when they do For around a century, coal-fired power plants that, they generate fewer emissions and they ~$3B have provided Australians with reliable and save money. Long term affordable power and supported jobs and renewable Supporting renewable energy agreements economic development. The world is changing with fossil fuel generation being replaced by Right now, EnergyAustralia has the rights to lower emissions technologies. more than 800 MW worth of renewable energy, combining solar and wind farm power purchase The way we generate, deliver and use energy agreements, and we half-own the Cathedral 7.5% has to change. As a big emitter of carbon, it’s Rocks wind farm. Of large-scale up to us to lead the transition to cleaner energy wind and solar in a way that maintains that same reliable and project in the NEM affordable access to energy for everyone. -

ROAM Consulting Report on Security of Supply and Tranmission Impacts Of

ROAM Consulting Pty Ltd A.B.N. 54 091 533 621 Report (EMC00017) to Impact of the LRET on the costs of FCAS, NCAS and Transmission augmentation 13 September 2011 Report to: Impact of the LRET on the costs of FCAS, NCAS and Transmission augmentation EMC00017 13 September 2011 VERSION HISTORY Version History Revision Date Issued Prepared By Approved By Revision Type Jenny Riesz Joel Gilmore Sam Shiao 0.9 2011-07-04 Ian Rose Preliminary Draft David Yeowart Richard Bean Matthew Holmes Jenny Riesz 1 2011-07-07 Ian Rose Complete Matthew Holmes 1.1 2011-07-07 Jenny Riesz Ian Rose Minor text edits Minor text edits - Appendix B 1.2 2011-09-01 Jenny Riesz - and explanation of Badgingarra Minor text edits – further 1.3 2011-09-13 Jenny Riesz - explanation of Badgingarra ROAM Consulting Pty Ltd VERSION HISTORY www.roamconsulting.com.au Report to: Impact of the LRET on the costs of FCAS, NCAS and Transmission augmentation EMC00017 13 September 2011 EXECUTIVE SUMMARY At the request of the Ministerial Council on Energy, the Australian Energy Market Commission (AEMC) is conducting an assessment of the impact of the Large-scale Renewable Energy Target (LRET) on security of energy supply, the price of electricity and emissions levels from the energy sector. The AEMC appointed consultants to develop a long-term generation expansion plan for meeting the LRET. Consequently, the ‘core’ scenarios for the portfolio and geographic distribution of technologies have been determined. ROAM Consulting was subsequently appointed to utilise these scenarios to forecast the cost of Frequency Control Ancillary Services (FCAS), Network Support and Control Ancillary Services (NSCAS) and transmission augmentation associated with the LRET for the National Electricity Market (NEM) and the South West Interconnected System (SWIS). -

BUILDING STRONGER COMMUNITIES Wind's Growing

BUILDING STRONGER COMMUNITIES Wind’s Growing Role in Regional Australia 1 This report has been compiled from research and interviews in respect of select wind farm projects in Australia. Opinions expressed are those of the author. Estimates where given are based on evidence available procured through research and interviews.To the best of our knowledge, the information contained herein is accurate and reliable as of the date PHOTO (COVER): of publication; however, we do not assume any liability whatsoever for Pouring a concrete turbine the accuracy and completeness of the above information. footing. © Sapphire Wind Farm. This report does not purport to give nor contain any advice, including PHOTO (ABOVE): Local farmers discuss wind legal or fnancial advice and is not a substitute for advice, and no person farm projects in NSW Southern may rely on this report without the express consent of the author. Tablelands. © AWA. 2 BUILDING STRONGER COMMUNITIES Wind’s Growing Role in Regional Australia CONTENTS Executive Summary 2 Wind Delivers New Benefits for Regional Australia 4 Sharing Community Benefits 6 Community Enhancement Funds 8 Addressing Community Needs Through Community Enhancement Funds 11 Additional Benefts Beyond Community Enhancement Funds 15 Community Initiated Wind Farms 16 Community Co-ownership and Co-investment Models 19 Payments to Host Landholders 20 Payments to Neighbours 23 Doing Business 24 Local Jobs and Investment 25 Contributions to Councils 26 Appendix A – Community Enhancement Funds 29 Appendix B – Methodology 31 References -

Renewable Energy Resources of New South Wales

Renewable energy resources of New South Wales Wind Ballina REFERENCE Moree Wind power generator capacity (megawatts) Grafton 100 < 1000 10 < 100 Bourke 1 < 10 less than 1 Cos Harbour Armidale Wind speed (metres per second) 10.2 Tamworth 6.3 Cobar Nyngan Port Macquarie 2.4 Topographic Broken Hill Dubbo City, town Highway State border Newcastle Key transmission lines (kilovolts) Orange Forbes 66 132 370 people directly employed (2014–15) 220 & 330 Sydney 500 * Mildura 1725 Hay Wollongong GWh generated (2015) Wagga Goulburn Wagga 7 major* wind farms Major project – over 30 MW. Gullen Range Wind Farm A.C.T. Capacity: 172 MW Batemans Bay 327 0 200 km Capital Wind Farm wind turbines Albury Capacity: 140 MW 650 MW maximum capacity Bega Boco Rock Wind Farm Eden Capacity: 114 MW NT QLD This map shows modelled onshore and offshore mean annual wind WA speed data, and the location and capacity of operating wind farms. SA The modelled wind speed data has a spatial resolution of 1 km and is presented at 100 m above the ground. This height is representative of ACT hub heights used for modern wind turbines. Hub height refers to the VIC height of a wind turbine, excluding the length of the turbine blades. TAS www.resourcesandenergy.nsw.gov.au Taralga Wind Farm (107 MW), all of which have been Wind Onshore and offshore wind provided by Garrad Hassan Pacific Pty Ltd Glossary (DNV GL) https://www.dnvgl.com/energy Wind energy commissioned since late 2009. Infographics and figure data sources In 2015, wind energy provided 2.5% of total electricity capacity the amount of energy generated for any length Economic Capacity and generation data compiled by NSW Division of What is wind energy? generated in NSW (including ACT). -

Minutes Template

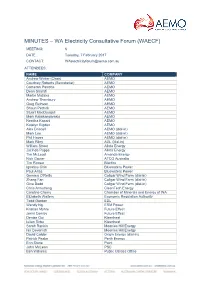

MINUTES – WA Electricity Consultative Forum (WAECF) MEETING: 6 DATE: Tuesday, 7 February 2017 CONTACT: [email protected] ATTENDEES: NAME COMPANY Andrew Winter (Chair) AEMO Courtney Roberts (Secretariat) AEMO Cameron Parrotte AEMO Dean Sharafi AEMO Martin Maticka AEMO Andrew Thornbury AEMO Greg Ruthven AEMO Shaun Pethick AEMO Stuart MacDougall AEMO Mark Katsikandarakis AEMO Neetika Kapani AEMO Katelyn Rigden AEMO Alex Driscoll AEMO (dial-in) Mark Lee AEMO (dial-in) Phil Hayes AEMO (dial-in) Mark Riley AGL (dial-in) William Street Alinta Energy Jacinda Papps Alinta Energy Tim McLeod Amanda Energy Nick Govier ATCO Australia Tim Rosser Blairfox Ignatius Chin Bluewaters Power Paul Arias Bluewaters Power Gemma O’Reilly Collgar Wind Farm (dial-in) Zhang Fan Collgar Wind Farm (dial-in) Gina Dodd Collgar Wind Farm (dial-in) Chris Armstrong CleanTech Energy Caroline Cherry Chamber of Minerals and Energy of WA Elizabeth Walters Economic Regulation Authority Todd Gordon EDL Wendy Ng ERM Power Kristian Myhre Future Effect Jenni Conroy Future Effect Denise Ooi Kleenheat Iulian Sirbu Kleenheat Sarah Rankin Moonies Hill Energy Ian Devenish Moonies Hill Energy David Calder Origin Energy (dial-in) Patrick Peake Perth Energy Erin Stone Point John McLean PSC Ben Williams Public Utilities Office Bobby Ditric Public Utilities Office Jenny Laidlaw Public Utilities Office Mike Reid Public Utilities Office Ray Challen Public Utilities Office Simon Middleton Public Utilities Office Andrew Woodroffe Skyfarming Adam Stephen Summit Southern Cross Power Ben Hammer Synergy Neil Duffy Transalta Peter Huxtable Water Corporation Dean Frost Western Power Doug Thomson Western Power Margaret Pyrchla Western Power Shane Duryea Western Power 1. Welcome Andrew Winter (Australian Energy Market Operator (AEMO)) opened the meeting at 1:00pm and welcomed attendees to the sixth AEMO WA Electricity Consultative Forum (WAECF). -

Australia's Climate Policy 2020

Australia’s climate policy A de facto net zero target | August 2020 Norton Rose Fulbright is at the forefront of regulatory and market developments, providing advisory services on business risk and opportunities in relation to emissions regulation, carbon markets, offsets projects, clean energy, climate finance, sustainable development or resource scarcity. We bring a global perspective to the international patchwork of emerging policy and regulation, as well as trends in climate risk and climate change litigation. When you need help transitioning to a zero-carbon economy, we’re there. Australia’s climate policy The emerging patchwork | July 2020 Contents Introduction 04 State and Territory snapshot 05 Australian Capital Territory 06 New South Wales 08 Northern Territory 12 Queensland 16 South Australia 18 Tasmania 21 Victoria 23 Western Australia 26 Global Resources 29 Contacts 30 03 Australia’s climate policy The emerging patchwork | July 2020 Introduction This year, Australia experienced horrific bushfires, described In March 2020, the Climate Change Authority released a as the most “evident and deeply traumatic experience of the report making 35 recommendations, directed primarily to huge impacts of climate change” by Christiana Figueres, the the Federal Government, to assist with creating the policy Former Executive Secretary of The United Nations Framework settings necessary to meet our commitments under the Paris Convention On Climate Change.1 Also this year, the 2015 Agreement. Our update on that report can be found here Paris Agreement, which Ms Figueres helped to deliver, invites update. governments to set and communicate their long-term 2050 goals, and shorter term targets up to 2030 to decarbonise their As the business and financial community would attest to, economies. -

Peak Demand Forecasts

2014 Electricity Statement of Opportunities (ESOO) Stakeholder Workshop Neetika Kapani A/Manager, System Capacity 1 July 2015 1 Agenda Background Purpose Key Findings o Peak Demand Forecasts o Energy Forecasts Interesting Analysis o Capacity Credits by Market Participant o Individual Reserve Capacity Requirement (IRCR) o Solar PV o Battery Questions 2 2014 and 2015 ESOO deferrals Minister for Energy directed IMO on 29 April 2014 to defer certain aspects of the 2014 Reserve Capacity Cycle, by a year. 13 March 2015 to defer certain aspects of the 2015 Reserve Capacity Cycle, by a year. On 17 June 2015, the IMO published 2014 ESOO and sets the Reserve Capacity Target for the 2016-17 Capacity Year Reserve Capacity Information Pack 3 RCM Process http://www.imowa.com.au/home/electricity/reserve-capacity 4 Purpose of the 2014 ESOO Provides market data and information of interest to current and potential WEM participants and stakeholders Sets the Reserve Capacity Target (RCT) for the 2016-17 Capacity Year o RCT for 2016-17 is 4,557 MW o Based on the 10 per cent probability of exceedance (PoE) forecast plus a reserve margin 5 Key Findings • Unusual Early Peak 5 January 2015 15:30- 16:00 TI Demand of 3744 MW • SWIS demand growth flattening • IRCR mechanism continues to be effective • Customer behaviour changing rapidly • Healthy mix and diversity of generation capacity and DSM continues • No new generation or Demand Side Management (DSM) capacity will be required for the 2015 to 2025 forecast period 6 Forecasting presents Challenges -

Herbert Smith Freehills Advises Banco Santander SA on Sale of the Taralga Wind Farm

3/21/2016 Herbert Smith Freehills Herbert Smith Freehills advises Banco Santander SA on sale of the Taralga Wind Farm INDUSTRIES PRACTICE AREAS INSIGHTS PEOPLE LOCATIONS NEWS CAREERS Home › News › Herbert Smith Freehills advises Banco Santander SA on sale of the Taralga Wind Farm Herbert Smith Freehills advises Banco Santander SA on sale of the Taralga Wind Farm Australia, Brisbane, Melbourne, Perth, Sydney | 15 March 2016 Herbert Smith Freehills has advised Inversiones Capital Global SA (ICG), a wholly owned subsidiary of Banco Santander SA, on its agreement to sell the 106.8MW Taralga Wind Farm to State Power Investment Corporation of China (SPIC). SPIC was also the recent purchaser of the Pacific Hydro business, on which Herbert Smith Freehills acted for the vendor, IFM Investors. The sale of the Taralga Wind Farm follows a competitive trade sale process and caps ICG’s involvement in the Taralga project from its initial development. Herbert Smith Freehills has been involved in all stages of the project, including its construction, offtake arrangements and project financing. The Herbert Smith Freehills team was led by partners David Ryan and Gerard Pike with significant assistance from senior associate Jon Evans and associates Michael D’Agostino and Arnica Mullins. David Ryan commented: ‘We are very pleased to help ICG complete its involvement with the Taralga project and exit in accordance with its stated business model. The Taralga project demonstrates the full service capabilities of Herbert Smith Freehills in the renewable energy sector, covering project development & construction, project financing and structuring & selldown. It has been a real pleasure working with the ICG team during development of the Taralga project and the course of this transaction.” ICG was also advised by ANZ Corporate Advisory and IGWT Advisory. -

Complaints from Noise of Wind Turbines – Australian and New Zealand Experience

Proceedings of ACOUSTICS 2006 20-22 November 2006, Christchurch, New Zealand Complaints from noise of wind turbines – Australian and New Zealand experience Colin Tickell Hatch, Sydney, NSW, Australia ABSTRACT Wind farms are a growing form of energy supply in Australia and New Zealand. Wind farm development in Australia has grown significantly since 1999. From 2003 to 2005, there were several proposals submitted for approval with numbers of turbines ranging from 30 to over 100. Noise impacts from wind farms remains a contentious issue for the community and statutory authorities in the planning stage, but there is no nationally agreed approach to assessment. A recent Swedish study identified a dose-response relationship for noise from wind farms that was significantly higher than that obtained for general industrial noise. This paper attempts to compare the incidence of complaints in Austra- lia and New Zealand, about noise from wind farms and complaints about noise in general. Data on complaints or ob- jections from planning and approval stages is compared with those from the operating phases of wind farms. Under- standing of any dose response to wind farm noise is likely to be a key factor in their future approval conditions, siting and operation. INTRODUCTION Some wind farms in Australia have similar distances to resi- dences. Australia currently has 738 MW of installed wind turbine power and 5818 MW proposed (AUSWEA 2006). Figure 1 The prevalence of complaints against operating wind farms in shows the locations of existing Australian wind farms (AGO, Australia and New Zealand has not been considered in detail 2006). The rate of development of wind energy is controlled and this paper was intended to be an attempt to obtain some to some extent by responses to government policy such as statistics and report on them. -

Clean Energy Australia 2015

CLEAN ENERGY AUSTRALIA REPORT 2015 AUSTRALIA CLEAN ENERGY CLEAN ENERGY AUSTRALIA REPORT 2015 Front cover image: Nyngan Solar Farm, New South Wales. Image courtesy AGL. This page: Taralga Wind Farm, New South Wales TABLE OF CONTENTS 02 Introduction 04 Executive summary 05 About us 06 2015 Snapshot 08 Industry outlook 2016–2020 10 State initiatives 14 Employment 16 Investment 18 Electricity prices 20 Demand for electricity 22 Energy storage 24 Summary of clean energy generation 28 Bioenergy 30 Geothermal 32 Hydro 34 Marine 36 Solar: household and commercial systems up to 100 kW 42 Solar: medium-scale systems between 100 kW and 1 MW 44 Solar: large-scale systems larger than 1 MW 48 Solar water heating 50 Wind power 56 Appendices INTRODUCTION While 2015 was a challenging year for the renewable energy sector, continued reductions in the cost of renewable energy and battery storage, combined with some policy Kane Thornton Chief Executive, stability, meant the year ended with Clean Energy Council much optimism. Image: Boco Rock Wind Farm, New South Wales As the costs of renewable energy The national Renewable Energy competitive market, and a broader and battery storage continue to Target is now locked in until 2020 and range of increasingly attractive options plunge, the long-term outlook for our confidence is gradually returning to the to help consumers save money on their industry remains extremely positive. sector. But with only four years until power bills. The International Renewable Energy most large-scale projects need to be The buzz around storage and smart Agency released analysis at the delivered under the scheme, there is no technology is building to a crescendo.