COVID-19 Membership Update: February 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Congressional Record—Senate S7023

November 17, 2020 CONGRESSIONAL RECORD — SENATE S7023 Sinema Tillis Young The result was announced—yeas 52, Member of the Board of Governors of Sullivan Toomey Thune Wicker nays 44, as follows: the Federal Reserve System for the un- [Rollcall Vote No. 232 Ex.] expired term of fourteen years from NAYS—44 YEAS—52 February 1, 2010, shall be brought to a Baldwin Hassan Rosen close? Bennet Heinrich Sanders Barrasso Gardner Portman The yeas and nays are mandatory Blumenthal Hirono Schatz Blackburn Graham Risch Blunt Hawley under the rule. Booker Jones Schumer Roberts Boozman Hoeven Brown Kaine Shaheen Romney The clerk will call the roll. Braun Hyde-Smith Cantwell King Smith Rounds The bill clerk called the roll. Cardin Klobuchar Burr Inhofe Rubio Mr. THUNE. The following Senators Stabenow Capito Johnson Carper Leahy Tester Sasse are necessarily absent: the Senator Casey Markey Cassidy Kennedy Scott (SC) Udall Collins Lankford from Tennessee (Mr. ALEXANDER), the Coons Menendez Shelby Van Hollen Cornyn Lee Cortez Masto Merkley Sinema Senator from Iowa (Mr. GRASSLEY), and Warner Cotton Loeffler Duckworth Murphy Sullivan the Senator from Florida (Mr. SCOTT). Warren Cramer Manchin Durbin Murray Thune Further, if present and voting, the Feinstein Whitehouse Crapo McConnell Peters Tillis Gillibrand Reed Wyden Cruz McSally Senator from Tennessee (Mr. ALEX- Daines Moran Toomey ANDER) would have voted ‘‘nay,’’ the Wicker NOT VOTING—4 Enzi Murkowski Senator from Florida (Mr. SCOTT) Young Alexander Harris Ernst Paul would have voted ‘‘yea,’’ and the Sen- Grassley Scott (FL) Fischer Perdue ator from Iowa (Mr. GRASSLEY) would The PRESIDING OFFICER. The yeas NAYS—44 have voted ‘‘yea.’’ are 52, the nays are 44. -

Mcconnell Announces Senate Republican Committee Assignments for the 117Th Congress

For Immediate Release, Wednesday, February 3, 2021 Contacts: David Popp, Doug Andres Robert Steurer, Stephanie Penn McConnell Announces Senate Republican Committee Assignments for the 117th Congress Praises Senators Crapo and Tim Scott for their work on the Committee on Committees WASHINGTON, D.C. – Following the 50-50 power-sharing agreement finalized earlier today, Senate Republican Leader Mitch McConnell (R-KY) announced the Senate Republican Conference Committee Assignments for the 117th Congress. Leader McConnell once again selected Senator Mike Crapo (R-ID) to chair the Senate Republicans’ Committee on Committees, the panel responsible for committee assignments for the 117th Congress. This is the ninth consecutive Congress in which Senate leadership has asked Crapo to lead this important task among Senate Republicans. Senator Tim Scott (R-SC) assisted in the committee selection process as he did in the previous three Congresses. “I want to thank Mike and Tim for their work. They have both earned the trust of our colleagues in the Republican Conference by effectively leading these important negotiations in years past and this year was no different. Their trust and experience was especially important as we enter a power-sharing agreement with Democrats and prepare for equal representation on committees,” McConnell said. “I am very grateful for their work.” “I appreciate Leader McConnell’s continued trust in having me lead the important work of the Committee on Committees,” said Senator Crapo. “Americans elected an evenly-split Senate, and working together to achieve policy solutions will be critical in continuing to advance meaningful legislation impacting all Americans. Before the COVID-19 pandemic hit our nation, our economy was the strongest it has ever been. -

Sen. Catherine Cortez Masto Host

PBS’ “To the Contrary” Women Thought Leader: Sen. Catherine Cortez Masto Host: Bonnie Erbe 01/19/2018 Panelists: Del. Eleanor Holmes Norton, Erin Matson, Carrie Lukas, Rina Shah PLEASE CREDIT ANY QUOTES OR EXCERPTS FROM THIS PBS PROGRAM TO “PBS’ TO THE CONTRARY.” Sen. Catherine Cortez Masto: First of all, I would like to see more. I can tell you from experience being here and his just in general, more women would help us work towards better policy. And what I mean by that is, I think women bring a different perspective. Bonnie Erbe: Hello, I'm Bonnie Erbe. Welcome to “To The Contrary”. This week we continue our series of interviews with women thought leaders. Our guest is Nevada senator Catherine Cortez Masto, the first woman elected from Nevada to serve in the US Senate and the first Latina to serve in the US Senate. Cortez Masto is one of a record 22 women now serving in the US Senate. 17 of the women, including Cortez Masto, are Democrats, five are Republicans. in 2017. She replaced outgoing Senator Harry Reid, who had endorsed her. He also served as Senate Majority Leader. Joe Biden: So help you God. Congratulations, Senator. Bonnie Erbe: Senator Cortez Masto’s background includes being elected the 32nd Attorney General of Nevada, where she served eight years. She was also a civil attorney, a criminal prosecutor, and chief of staff or former Nevada Governor Bob Miller. Cortez Masto’s first speech before the full US Senate was not what she had originally planned. Sen. Catherine Cortez Masto: That speech was meant to demand that our country's leaders respect every American, American regardless of the color of their skin, or how they choose to worship. -

Monmouth University Poll NATIONAL: WHO LEADS in the VEEPSTAKES?

Please attribute this information to: Monmouth University Poll West Long Branch, NJ 07764 www.monmouth.edu/polling Follow on Twitter: @MonmouthPoll _____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ Released: Contact: Thursday, June 23, 2016 PATRICK MURRAY 732-979-6769 (cell); 732-263-5858 (office) [email protected] Follow on Twitter: @PollsterPatrick NATIONAL: WHO LEADS IN THE VEEPSTAKES? Sanders is top draw for undecideds; Palin a turnoff West Long Branch, NJ – With the presidential nominations in place, speculation about potential running-mates has ramped up considerably. The Monmouth University Poll tested 12 possible vice presidential picks – six from each party – and found that most would have no appreciable impact on voter support. Two names do stand out, however: Bernie Sanders, who could attract undecided voters to the Democratic column, and Sarah Palin, who could potentially hurt the GOP ticket. Scores of names have been mentioned as possible running mates for Hillary Clinton and Donald Trump. The Monmouth University Poll decided to test 12 of them – six Democrats and six Republicans – for their ability to attract voters to the parties’ respective tickets. On the Democratic side, only Sanders, Clinton’s primary opponent, registers any notable impact. Overall, 39% of voters nationwide say they would be more likely to vote for the Democratic ticket with the Vermont Senator as Clinton’s running mate compared to 20% who would be less likely to support this pairing. Among those voters who are currently undecided or are leaning toward supporting a third party candidate, fully 50% say they would be more likely to support Clinton if Sanders is her vice presidential nominee and just 16% say they would be less likely to vote for this ticket. -

August 1, 2019 the Honorable Joni Ernst United States Senate 730

FEDERAL COMMUNICATIONS COMMISSION WASHINGTON OFFICE OF THE CHAIRMAN August 1, 2019 The Honorable Joni Ernst United States Senate 730 Hart Senate Office Building Washington, DC 20510 Dear Senator Ernst: Thank you for your letter regarding broadband mapping. Closing the digital divide is my top priority. I have seen for myself in 45 states, including Iowa, and the territories of Puerto Rico and the Virgin Islands what affordable high-speed Internet access can do for a community—for its families, its schools, its hospitals, its farms, its businesses—as well as the impact of its absence. I agree that using updated and accurate broadband deployment data is critical to bridging the digital divide. We need to understand where broadband is available and where it is not to target our efforts and direct funding to areas that are most in needed. That is why the Commission began a top-to-bottom review of the form 477 process to ensure that broadband data was more accurate, granular, and ultimately useful to the Commission and the public. Afier a thorough review of the record and the painstaking work of our career staff, I circulated a Report and Order for consideration at the FCC’s August Open Meeting that would result in more granular and more accurate broadband maps through the creation of the Digital Opportunity Data Collection. That means requiring broadband providers to report where they actually offer service below the census block level and incorporating public feedback to ensure up to date and accurate broadband deployment maps. These updated maps would be used to focus funding to expand broadband through future initiatives such as the second phase of the proposed Rural Digital Opportunity fund. -

GUIDE to the 116Th CONGRESS

th GUIDE TO THE 116 CONGRESS - SECOND SESSION Table of Contents Click on the below links to jump directly to the page • Health Professionals in the 116th Congress……….1 • 2020 Congressional Calendar.……………………..……2 • 2020 OPM Federal Holidays………………………..……3 • U.S. Senate.……….…….…….…………………………..…...3 o Leadership…...……..…………………….………..4 o Committee Leadership….…..……….………..5 o Committee Rosters……….………………..……6 • U.S. House..……….…….…….…………………………...…...8 o Leadership…...……………………….……………..9 o Committee Leadership……………..….…….10 o Committee Rosters…………..…..……..…….11 • Freshman Member Biographies……….…………..…16 o Senate………………………………..…………..….16 o House……………………………..………..………..18 Prepared by Hart Health Strategies Inc. www.hhs.com, updated 7/17/20 Health Professionals Serving in the 116th Congress The number of healthcare professionals serving in Congress increased for the 116th Congress. Below is a list of Members of Congress and their area of health care. Member of Congress Profession UNITED STATES SENATE Sen. John Barrasso, MD (R-WY) Orthopaedic Surgeon Sen. John Boozman, OD (R-AR) Optometrist Sen. Bill Cassidy, MD (R-LA) Gastroenterologist/Heptalogist Sen. Rand Paul, MD (R-KY) Ophthalmologist HOUSE OF REPRESENTATIVES Rep. Ralph Abraham, MD (R-LA-05)† Family Physician/Veterinarian Rep. Brian Babin, DDS (R-TX-36) Dentist Rep. Karen Bass, PA, MSW (D-CA-37) Nurse/Physician Assistant Rep. Ami Bera, MD (D-CA-07) Internal Medicine Physician Rep. Larry Bucshon, MD (R-IN-08) Cardiothoracic Surgeon Rep. Michael Burgess, MD (R-TX-26) Obstetrician Rep. Buddy Carter, BSPharm (R-GA-01) Pharmacist Rep. Scott DesJarlais, MD (R-TN-04) General Medicine Rep. Neal Dunn, MD (R-FL-02) Urologist Rep. Drew Ferguson, IV, DMD, PC (R-GA-03) Dentist Rep. Paul Gosar, DDS (R-AZ-04) Dentist Rep. -

August 19, 2021 the Honorable Merrick Garland Attorney General

August 19, 2021 The Honorable Merrick Garland Attorney General Department of Justice 950 Pennsylvania Avenue, NW Washington, DC 20530-0001 Dear Attorney General Garland: We write to request an update on the status of Special Counsel John Durham’s inquiry into the Crossfire Hurricane Investigation. Two years ago, your predecessor appointed United States Attorney John Durham to conduct a review of the origins of the FBI’s investigation into Russian collusion in the 2016 United States presidential election. Mr. Durham was later elevated to special counsel in October 2020 so he could continue his work with greater investigatory authority and independence. The Special Counsel’s ongoing work is important to many Americans who were disturbed that government agents subverted lawful process to conduct inappropriate surveillance for political purposes. The truth pursued by this investigation is necessary to ensure transparency in our intelligence agencies and restore faith in our civil liberties. Thus, it is essential that the Special Counsel’s ongoing review should be allowed to continue unimpeded and without undue limitations. To that end, we ask that you provide an update on the status of Special Counsel Durham’s inquiry and that the investigation’s report be made available to the public upon completion. Thank you for your attention to this matter. Sincerely, Marsha Blackburn Mitch McConnell United States Senator United States Senator Pat Toomey Rick Scott United States Senator United States Senator Bill Hagerty Rand Paul United States Senator -

Committee Assignments for the 115Th Congress Senate Committee Assignments for the 115Th Congress

Committee Assignments for the 115th Congress Senate Committee Assignments for the 115th Congress AGRICULTURE, NUTRITION AND FORESTRY BANKING, HOUSING, AND URBAN AFFAIRS REPUBLICAN DEMOCRATIC REPUBLICAN DEMOCRATIC Pat Roberts, Kansas Debbie Stabenow, Michigan Mike Crapo, Idaho Sherrod Brown, Ohio Thad Cochran, Mississippi Patrick Leahy, Vermont Richard Shelby, Alabama Jack Reed, Rhode Island Mitch McConnell, Kentucky Sherrod Brown, Ohio Bob Corker, Tennessee Bob Menendez, New Jersey John Boozman, Arkansas Amy Klobuchar, Minnesota Pat Toomey, Pennsylvania Jon Tester, Montana John Hoeven, North Dakota Michael Bennet, Colorado Dean Heller, Nevada Mark Warner, Virginia Joni Ernst, Iowa Kirsten Gillibrand, New York Tim Scott, South Carolina Elizabeth Warren, Massachusetts Chuck Grassley, Iowa Joe Donnelly, Indiana Ben Sasse, Nebraska Heidi Heitkamp, North Dakota John Thune, South Dakota Heidi Heitkamp, North Dakota Tom Cotton, Arkansas Joe Donnelly, Indiana Steve Daines, Montana Bob Casey, Pennsylvania Mike Rounds, South Dakota Brian Schatz, Hawaii David Perdue, Georgia Chris Van Hollen, Maryland David Perdue, Georgia Chris Van Hollen, Maryland Luther Strange, Alabama Thom Tillis, North Carolina Catherine Cortez Masto, Nevada APPROPRIATIONS John Kennedy, Louisiana REPUBLICAN DEMOCRATIC BUDGET Thad Cochran, Mississippi Patrick Leahy, Vermont REPUBLICAN DEMOCRATIC Mitch McConnell, Patty Murray, Kentucky Washington Mike Enzi, Wyoming Bernie Sanders, Vermont Richard Shelby, Dianne Feinstein, Alabama California Chuck Grassley, Iowa Patty Murray, -

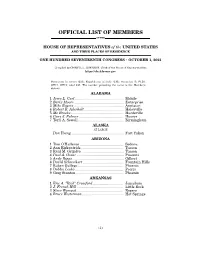

Official List of Members by State

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SEVENTEENTH CONGRESS • OCTOBER 1, 2021 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives https://clerk.house.gov Democrats in roman (220); Republicans in italic (212); vacancies (3) FL20, OH11, OH15; total 435. The number preceding the name is the Member's district. ALABAMA 1 Jerry L. Carl ................................................ Mobile 2 Barry Moore ................................................. Enterprise 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................. Phoenix 8 Debbie Lesko ............................................... -

June 11, 2021 Senator Bob Casey Senator Joni Ernst 393 Russell

June 11, 2021 Senator Bob Casey Senator Joni Ernst 393 Russell Senate Office Building 135 Hart Senate Office Building Washington, DC 20510 Washington, DC 20510 Representative Jim McGovern Representative Jaime Herrera Beutler 408 Cannon House Office Building 1107 Longworth House Office Building Washington, DC 20515 Washington, DC 20515 Dear Senators Casey and Ernst and Representatives McGovern and Herrera Beutler, On behalf of Patients & Providers for Medical Nutrition Equity, a coalition of more than 40 patient and provider organizations that represent individuals for whom specialized nutrition is medically necessary for treatment of their digestive or inherited metabolic disorder, we write to provide our strong endorsement of the Medical Nutrition Equity Act (S. 2013/H.R. 3783) as re-introduced in the 117th Congress. We applaud your leadership in recognizing the problems that patients with these chronic conditions face, and for introducing legislation that allows these patients and their physicians to pick the treatments that are medically appropriate for them. Thousands of children and adults in our country live with digestive or inherited metabolic disorders that inhibit their bodies from digesting or metabolizing the food they need to survive. When these conditions are left untreated, food can become toxic or the body can fail to absorb necessary nutrients. These individuals must turn to medically necessary nutrition, such as highly specialized formulas, both as a treatment for their condition and as sustenance. When diseases of the digestive system or inherited metabolic disorders are left unmanaged or untreated, the medical consequences are often significant, permanent, and costly. The implications of denied or delayed access to medical nutrition in pediatric populations are particularly profound — inadequate growth, abnormal development, cognitive impairment, and behavioral disorders. -

Women's Congressional Policy Institute 2020 Election Wrap-Up

Women’s Congressional Policy Institute 2020 Election Wrap-Up Perhaps it should come as no surprise that in the same year we celebrated the centennial anniversary of women securing the right to vote we also recognized the unprecedented number of women who ran for Congress. According to the Center for American Women and Politics, nearly 650 women ran for seats in the House of Representatives and Senate in 2020, with more than 300 of these candidates making it through the primaries and into the general election. With the race in the 22nd District of New York still subject to a recount of votes, 147 women were sworn- in to serve in the 117th Congress. This is the largest number of women elected to Congress in our nation’s history. This number includes 18 incumbent Senators who were not up for reelection this year, as well as the four Delegates to the House of Representatives reelected from American Samoa, the District of Columbia, Puerto Rico, and the Virgin Islands. The number of women in Congress will decrease if Rep. Marcia Fudge (D-OH) is confirmed as Secretary of Housing and Urban Development and Rep. Deb Haaland (D-NM) is confirmed as Secretary of the Interior. Senate In a historic first, Sen. Kamala Harris (D-CA) was elected Vice President of the United States, making her the first woman, first African American, and first South Asian person to serve as Vice President and, thus, President of the Senate. She resigned her Senate seat on January 20. Control of the Senate was hotly contested throughout the cycle and remained undecided until a pair of run-off elections in Georgia were held on January 5. -

Sen. Joni Ernst (R-IA)

Sen. Joni Ernst (R-IA) Official Photo Navy League Advocates in State 22 Previous Contacts 5 Grassroots Actions Since July 2020 0 Address Room 730, Hart Senate Office Building, Washington, DC 20510-1503 Next Election Term Before Politics 2026 2nd term Public Official, Public Official Education Education Columbus College (IA) M.P.A. 1995 Iowa State University B.S. 1992 Past Military Service Washington Office Phone Iowa Army National Guard, LTC, 2001-2015 (202) 224-3254 Bio Sen. Joni Ernst is the Senator in the US Congress who represents Iowa and received 51.7% of the vote in her last election. She is a member of the Agriculture, Small Business, Armed Services, and Environment committees.She works most frequently on Armed Forces and National Security (38 bills), Health (36 bills), Economics and Public Finance (25 bills), Government information and archives (22 bills), and Congressional oversight (20 bills). She has sponsored 105 bills in her last six year(s) in office, voting with her party 95.1% of the time, getting 14.29% of her bills out of committee, and 0.95% of her sponsored Sea Service Installations in State: Co-Sponsored Bills We Support S. 133: Merchant Mariners of World War II Powered by Quorum Sen. Joni Ernst (R-IA) Committees Senate Committee on Armed Services Senate Committee on Small Business and... Senate Committee on Environment and Public Works Senate Committee on Agriculture, Nutrition, and... Subcommittees Senate Subcommittee on Chemical Safety, Waste... Senate Subcommittee on Clean Air and Nuclear Safety Senate Subcommittee on Cybersecurity Senate Subcommittee on Emerging Threats and..