European Super Senior New Money Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Up to EUR 3,500,000.00 7% Fixed Rate Bonds Due 6 April 2026 ISIN

Up to EUR 3,500,000.00 7% Fixed Rate Bonds due 6 April 2026 ISIN IT0005440976 Terms and Conditions Executed by EPizza S.p.A. 4126-6190-7500.7 This Terms and Conditions are dated 6 April 2021. EPizza S.p.A., a company limited by shares incorporated in Italy as a società per azioni, whose registered office is at Piazza Castello n. 19, 20123 Milan, Italy, enrolled with the companies’ register of Milan-Monza-Brianza- Lodi under No. and fiscal code No. 08950850969, VAT No. 08950850969 (the “Issuer”). *** The issue of up to EUR 3,500,000.00 (three million and five hundred thousand /00) 7% (seven per cent.) fixed rate bonds due 6 April 2026 (the “Bonds”) was authorised by the Board of Directors of the Issuer, by exercising the powers conferred to it by the Articles (as defined below), through a resolution passed on 26 March 2021. The Bonds shall be issued and held subject to and with the benefit of the provisions of this Terms and Conditions. All such provisions shall be binding on the Issuer, the Bondholders (and their successors in title) and all Persons claiming through or under them and shall endure for the benefit of the Bondholders (and their successors in title). The Bondholders (and their successors in title) are deemed to have notice of all the provisions of this Terms and Conditions and the Articles. Copies of each of the Articles and this Terms and Conditions are available for inspection during normal business hours at the registered office for the time being of the Issuer being, as at the date of this Terms and Conditions, at Piazza Castello n. -

Margin Requirements Across Equity-Related Instruments: How Level Is the Playing Field?

Fortune pgs 31-50 1/6/04 8:21 PM Page 31 Margin Requirements Across Equity-Related Instruments: How Level Is the Playing Field? hen interest rates rose sharply in 1994, a number of derivatives- related failures occurred, prominent among them the bankrupt- cy of Orange County, California, which had invested heavily in W 1 structured notes called “inverse floaters.” These events led to vigorous public discussion about the links between derivative securities and finan- cial stability, as well as about the potential role of new regulation. In an effort to clarify the issues, the Federal Reserve Bank of Boston sponsored an educational forum in which the risks and risk management of deriva- tive securities were discussed by a range of interested parties: academics; lawmakers and regulators; experts from nonfinancial corporations, investment and commercial banks, and pension funds; and issuers of securities. The Bank published a summary of the presentations in Minehan and Simons (1995). In the keynote address, Harvard Business School Professor Jay Light noted that there are at least 11 ways that investors can participate in the returns on the Standard and Poor’s 500 composite index (see Box 1). Professor Light pointed out that these alternatives exist because they dif- Peter Fortune fer in a variety of important respects: Some carry higher transaction costs; others might have higher margin requirements; still others might differ in tax treatment or in regulatory restraints. The author is Senior Economist and The purpose of the present study is to assess one dimension of those Advisor to the Director of Research at differences—margin requirements. -

Margin Requirements and Equity Option Returns∗

Margin Requirements and Equity Option Returns∗ Steffen Hitzemann† Michael Hofmann‡ Marliese Uhrig-Homburg§ Christian Wagner¶ December 2017 Abstract In equity option markets, traders face margin requirements both for the options them- selves and for hedging-related positions in the underlying stock market. We show that these requirements carry a significant margin premium in the cross-section of equity option returns. The sign of the margin premium depends on demand pressure: If end-users are on the long side of the market, option returns decrease with margins, while they increase otherwise. Our results are statistically and economically significant and robust to different margin specifications and various control variables. We explain our findings by a model of funding-constrained derivatives dealers that require compensation for satisfying end-users’ option demand. Keywords: equity options, margins, funding liquidity, cross-section of option returns JEL Classification: G12, G13 ∗We thank Hameed Allaudeen, Mario Bellia, Jie Cao, Zhi Da, Matt Darst, Maxym Dedov, Bjørn Eraker, Andrea Frazzini, Ruslan Goyenko, Guanglian Hu, Hendrik Hülsbusch, Kris Jacobs, Stefan Kanne, Olaf Korn, Dmitriy Muravyev, Lasse Pedersen, Matthias Pelster, Oleg Rytchkov, Ivan Shaliastovich, as well as participants of the 2017 EFA Annual Meeting, the SFS Cavalcade North America 2017, the 2017 MFA Annual Meeting, the SGF Conference 2017, the Conference on the Econometrics of Financial Markets, the 2016 Annual Meeting of the German Finance Association, the Paris December 2016 Finance Meeting, and seminar participants at the Center for Financial Frictions at Copenhagen Business School, the CUHK Business School, the University of Gothenburg, and the University of Wisconsin-Madison for valuable discussions and helpful comments and suggestions. -

Evidence from SME Bond Markets

Temi di discussione (Working Papers) Asymmetric information in corporate lending: evidence from SME bond markets by Alessandra Iannamorelli, Stefano Nobili, Antonio Scalia and Luana Zaccaria September 2020 September Number 1292 Temi di discussione (Working Papers) Asymmetric information in corporate lending: evidence from SME bond markets by Alessandra Iannamorelli, Stefano Nobili, Antonio Scalia and Luana Zaccaria Number 1292 - September 2020 The papers published in the Temi di discussione series describe preliminary results and are made available to the public to encourage discussion and elicit comments. The views expressed in the articles are those of the authors and do not involve the responsibility of the Bank. Editorial Board: Federico Cingano, Marianna Riggi, Monica Andini, Audinga Baltrunaite, Marco Bottone, Davide Delle Monache, Sara Formai, Francesco Franceschi, Salvatore Lo Bello, Juho Taneli Makinen, Luca Metelli, Mario Pietrunti, Marco Savegnago. Editorial Assistants: Alessandra Giammarco, Roberto Marano. ISSN 1594-7939 (print) ISSN 2281-3950 (online) Printed by the Printing and Publishing Division of the Bank of Italy ASYMMETRIC INFORMATION IN CORPORATE LENDING: EVIDENCE FROM SME BOND MARKETS by Alessandra Iannamorelli†, Stefano Nobili†, Antonio Scalia† and Luana Zaccaria‡ Abstract Using a comprehensive dataset of Italian SMEs, we find that differences between private and public information on creditworthiness affect firms’ decisions to issue debt securities. Surprisingly, our evidence supports positive (rather than adverse) selection. Holding public information constant, firms with better private fundamentals are more likely to access bond markets. Additionally, credit conditions improve for issuers following the bond placement, compared with a matched sample of non-issuers. These results are consistent with a model where banks offer more flexibility than markets during financial distress and firms may use market lending to signal credit quality to outside stakeholders. -

Margin-Based Asset Pricing and Deviations from the Law of One Price∗

Margin-Based Asset Pricing and Deviations from the Law of One Price∗ Nicolae Gˆarleanu and Lasse Heje Pedersen† Current Version: September 2009 Abstract In a model with heterogeneous-risk-aversion agents facing margin constraints, we show how securities’ required returns are characterized both by their betas and their margins. Negative shocks to fundamentals make margin constraints bind, lowering risk-free rates and raising Sharpe ratios of risky securities, especially for high-margin securities. Such a funding liquidity crisis gives rise to “bases,” that is, price gaps between securities with identical cash-flows but different margins. In the time series, bases depend on the shadow cost of capital, which can be captured through the interest- rate spread between collateralized and uncollateralized loans, and, in the cross section, they depend on relative margins. We apply the model empirically to CDS-bond bases and other deviations from the Law of One Price, and to evaluate the Fed lending facilities. ∗We are grateful for helpful comments from Markus Brunnermeier, Xavier Gabaix, Andrei Shleifer, and Wei Xiong, as well as from seminar participants at the Bank of Canada, Columbia GSB, London School of Economics, MIT Sloan, McGill University, Northwestern University Kellog, UT Austin McCombs, UC Berkeley Haas, the Yale Financial Crisis Conference, and Yale SOM. †Gˆarleanu (corresponding author) is at Haas School of Business, University of California, Berkeley, NBER, and CEPR; e-mail: [email protected]. Pedersen is at New York University, NBER, and CEPR, 44 West Fourth Street, NY 10012-1126; e-mail: [email protected], http://www.stern.nyu.edu/∼lpederse/. -

Guide for Margin Finance

Guide for Margin Finance Guide for Margin Finance Contents Margin Finance What is margin finance? How does margin finance take place? Risks of margin finance Acknowledgement 1 / 6 Guide for Margin Finance Margin Finance Investors should request copies from their financial brokers and familiarize themselves with the following: The guide issued by the Jordan Securities Commission, Margin Finance Instructions, the list of securities allowed to be margin financed, and the margin finance agreement. Investors should also sign an acknowledgement that they have familiarized themselves with the above in order to protect their rights. This guide aims to familiarize investors with the concept of margin finance and the risks related to it. It should be read thoroughly. 2 / 6 Guide for Margin Finance What is margin finance? The term “Margin Finance” shall mean the financing by a Financial Broker of a part of the value of the securities in the margin finance account by guaranteeing the securities in that account. How does margin finance take place? Say you are an investor and you buy shares worth JD 5,000 with your own money, then the value of these shares rises to JD 7,500, your profit would be 50%. But if you finance your purchase of these shares through margin finance the shares, you would pay JD 2,500 of your own money and your broker would pay JD 2,500, so your profit would be 100%. In other words, your profit is greater when you margin finance. If, on the other hand, the value of the shares drops to JD 2,500 after you had bought them with your own money, your loss would be 50%; but if you had bought them from the margin finance account, your loss would be 100% plus any interest payments and fees. -

Pinnacle Notes Frequently Asked Questions 18

PINNACLE NOTES FREQUENTLY ASKED QUESTIONS 18 DECEMBER 20081 These Frequently Asked Questions have been prepared by Pinnacle Performance Limited for the distributors of the Pinnacle notes in Singapore in response to questions about the Pinnacle notes generally. Any questions from investors should be raised with the institution that sold them the Pinnacle notes in Singapore. Please read the important notice at the end of this document. 1. What are the Pinnacle notes? The Pinnacle notes are the Series 1, 2, 3, 5, 6, 7, 8, 9, 10, 11, 12, 15 and 16 notes issued by Pinnacle Performance Limited (the "Issuer"). Some of the Pinnacle notes are equity- linked notes and some are credit-linked notes. The Pinnacle equity-linked notes and the Pinnacle credit-linked notes are together referred to in this document as the "Pinnacle notes". 2. What are the Pinnacle equity-linked notes? The Pinnacle equity-linked notes (the "Pinnacle equity-linked notes") are the Series 8, 11, 12, 15 and 16 notes issued by the Issuer. An equity-linked note is, in general terms, a structured note where the return and/or interest on the note is determined by reference to, amongst other things, the performance of one or more shares or share indices. Investors in a Series of Pinnacle equity-linked notes should also refer to the Frequently Asked Questions in relation to Pinnacle equity-linked notes dated 14 November 2008 for further information. A copy of these Frequently Asked Questions is available on the website referred to in the important notice below. 3. What are the Pinnacle credit-linked notes? The Pinnacle credit-linked notes (the "Pinnacle credit-linked notes") are the Series 1, 2, 3, 5, 6, 7, 9 and 10 notes issued by the Issuer. -

EQUITY EQUITY DER- PARAMETERS METHODOLOGIES USED in MARGIN CALCULATIONS Manual

EQUITY EQUITY DER- PARAMETERS METHODOLOGIES USED IN MARGIN CALCULATIONS Manual APRIL 2021 V02.0 1 TABLE OF CONTENTS Executive summary ...................................................................................... 3 Methodologies for determining Margin Parameters used in Margin Calculations ...................................................................................................... 5 2.1 Main parameters...................................................................................... 6 2.2 Margin Interval calculation ...................................................................... 7 2.2.1 Defining Coverage Level......................................................................... 7 2.2.2 Determining the Margin Interval for Equity cash ........................................ 7 2.2.3 Determining the Margin Interval for Equity derivatives .............................. 10 2.3 Product Group Offset Factor .................................................................. 10 2.4 Futures Straddle Margin ........................................................................ 10 2.4.1 Straddle Interest Rate Methodology ........................................................ 11 2.4.2 Straddle Correlation Methodology ........................................................... 13 2.5 Minimum Initial Margin ......................................................................... 13 2.6 Margin Intervals and Additional Margin changes ................................... 14 2 EXECUTIVE SUMMARY 3 EXECUTIVE SUMMARY This -

International Harmonization of Reporting for Financial Securities

International Harmonization of Reporting for Financial Securities Authors Dr. Jiri Strouhal Dr. Carmen Bonaci Editor Prof. Nikos Mastorakis Published by WSEAS Press ISBN: 9781-61804-008-4 www.wseas.org International Harmonization of Reporting for Financial Securities Published by WSEAS Press www.wseas.org Copyright © 2011, by WSEAS Press All the copyright of the present book belongs to the World Scientific and Engineering Academy and Society Press. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the Editor of World Scientific and Engineering Academy and Society Press. All papers of the present volume were peer reviewed by two independent reviewers. Acceptance was granted when both reviewers' recommendations were positive. See also: http://www.worldses.org/review/index.html ISBN: 9781-61804-008-4 World Scientific and Engineering Academy and Society Preface Dear readers, This publication is devoted to problems of financial reporting for financial instruments. This branch is among academicians and practitioners widely discussed topic. It is mainly caused due to current developments in financial engineering, while accounting standard setters still lag. Moreover measurement based on fair value approach – popular phenomenon of last decades – brings to accounting entities considerable problems. The text is clearly divided into four chapters. The introductory part is devoted to the theoretical background for the measurement and reporting of financial securities and derivative contracts. The second chapter focuses on reporting of equity and debt securities. There are outlined the theoretical bases for the measurement, and accounting treatment for selected portfolios of financial securities. -

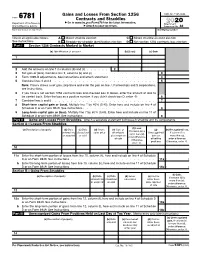

Form 6781 Contracts and Straddles ▶ Go to for the Latest Information

Gains and Losses From Section 1256 OMB No. 1545-0644 Form 6781 Contracts and Straddles ▶ Go to www.irs.gov/Form6781 for the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service ▶ Attach to your tax return. Sequence No. 82 Name(s) shown on tax return Identifying number Check all applicable boxes. A Mixed straddle election C Mixed straddle account election See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election Part I Section 1256 Contracts Marked to Market (a) Identification of account (b) (Loss) (c) Gain 1 2 Add the amounts on line 1 in columns (b) and (c) . 2 ( ) 3 Net gain or (loss). Combine line 2, columns (b) and (c) . 3 4 Form 1099-B adjustments. See instructions and attach statement . 4 5 Combine lines 3 and 4 . 5 Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions. 6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . 6 7 Combine lines 5 and 6 . 7 8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of Schedule D or on Form 8949. See instructions . 8 9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of Schedule D or on Form 8949. -

Margin-Based Asset Pricing and Deviations from the Law of One Price

Margin-based Asset Pricing and Deviations from the Law of One Price Nicolae Garleanuˆ University of California Lasse Heje Pedersen New York University In a model with heterogeneous-risk-aversion agents facing margin constraints, we show how securities’ required returns increase in both their betas and their margin require- ments. Negative shocks to fundamentals make margin constraints bind, lowering risk-free rates and raising Sharpe ratios of risky securities, especially for high-margin securities. Such a funding-liquidity crisis gives rise to “bases,” that is, price gaps between securities with identical cash-flows but different margins. In the time series, bases depend onthe shadow cost of capital, which can be captured through the interest-rate spread between collateralized and uncollateralized loans and, in the cross-section, they depend on rela- tive margins. We test the model empirically using the credit default swap–bond bases and other deviations from the Law of One Price, and use it to evaluate central banks’ lending facilities. (JEL G01, G12, G13, E44, E50) The paramount role of funding constraints becomes particularly salient dur- ing liquidity crises, with the one that started in 2007 being an excellent case in point. Banks unable to fund their operations closed down, and the fund- ing problems spread to other investors, such as hedge funds, that relied on bank funding. Therefore, traditional liquidity providers became forced sellers, interest-rate spreads increased dramatically, Treasury rates dropped sharply, and central -

The Economics of Financial Derivative Instruments

MPRA Munich Personal RePEc Archive The Economics of Financial Derivative Instruments GODWIN C NWAOBI QUANTITATIVE ECONOMIC RESEARCH BUREAU, NIGERIA 5. July 2008 Online at http://mpra.ub.uni-muenchen.de/9463/ MPRA Paper No. 9463, posted 7. July 2008 02:31 UTC THE ECONOMICS OF FINANCIAL DERIVATIVE INSTRUMENTS GODWIN CHUKWUDUM NWAOBI PROFESSOR OF ECONOMICS / RESEARCH DIRECTOR [email protected] +234 8035925021 www.quanterb.org QUANTITATIVE ECONOMIC RESEARCH BUEREAU P O BOX 7173 ABA, ABIA STATE, NIGERIAN 1 ABSTRACT The phenomenal growth of derivative markets across the globe indicates their impact on the global financial scene. As the securitie s markets continue to evolve, market participants, investors and regulators are looking at different way in which the risk management and hedging needs of investors may be effectively met through the derivative instruments. However, it is equally recognized that derivative markets present market participates and regulatory (control) issues, which must be adequately addressed if derivative markets are to gain and maintain investor confidence. And yet, more and more companies are using (ordering forced to use) futures and derivatives to stay competitive in a fast- changing word characterized by both unprecedented opportunities and unprecedented risks. Thus, the thrust of this paper is to provide a detailed study of the manner in which the market works and how the knowledge can be used to make profits and avoid losses a competitive economy setting. KEY WORDS: DERIVATIVES, FUTURES, OPTIONS, COMMODITIES, OTC, ASSETS, STOCKS, INDEXES, SWAPS, INSTRUMENTS, FOREIGN EXCHANGE, FOREX, HEDGING, SPOTMARKETS, ARBITRAGE, RISK, EXCHANGES, BROKERS, STORAGE, ECONOMIES, FINANCIAL, PRICES JEL NO: F31, G24, G10, G13 , M40 2 1.0 INTRODUCTION A derivative security is a security or contract designed in such a way that its price is derived from the price of an underlying asset.