Swap Definitions Rules Finalized by the SEC and the CFTC Under Dodd-Frank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

International Harmonization of Reporting for Financial Securities

International Harmonization of Reporting for Financial Securities Authors Dr. Jiri Strouhal Dr. Carmen Bonaci Editor Prof. Nikos Mastorakis Published by WSEAS Press ISBN: 9781-61804-008-4 www.wseas.org International Harmonization of Reporting for Financial Securities Published by WSEAS Press www.wseas.org Copyright © 2011, by WSEAS Press All the copyright of the present book belongs to the World Scientific and Engineering Academy and Society Press. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the Editor of World Scientific and Engineering Academy and Society Press. All papers of the present volume were peer reviewed by two independent reviewers. Acceptance was granted when both reviewers' recommendations were positive. See also: http://www.worldses.org/review/index.html ISBN: 9781-61804-008-4 World Scientific and Engineering Academy and Society Preface Dear readers, This publication is devoted to problems of financial reporting for financial instruments. This branch is among academicians and practitioners widely discussed topic. It is mainly caused due to current developments in financial engineering, while accounting standard setters still lag. Moreover measurement based on fair value approach – popular phenomenon of last decades – brings to accounting entities considerable problems. The text is clearly divided into four chapters. The introductory part is devoted to the theoretical background for the measurement and reporting of financial securities and derivative contracts. The second chapter focuses on reporting of equity and debt securities. There are outlined the theoretical bases for the measurement, and accounting treatment for selected portfolios of financial securities. -

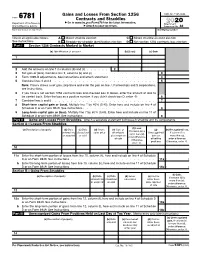

Form 6781 Contracts and Straddles ▶ Go to for the Latest Information

Gains and Losses From Section 1256 OMB No. 1545-0644 Form 6781 Contracts and Straddles ▶ Go to www.irs.gov/Form6781 for the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service ▶ Attach to your tax return. Sequence No. 82 Name(s) shown on tax return Identifying number Check all applicable boxes. A Mixed straddle election C Mixed straddle account election See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election Part I Section 1256 Contracts Marked to Market (a) Identification of account (b) (Loss) (c) Gain 1 2 Add the amounts on line 1 in columns (b) and (c) . 2 ( ) 3 Net gain or (loss). Combine line 2, columns (b) and (c) . 3 4 Form 1099-B adjustments. See instructions and attach statement . 4 5 Combine lines 3 and 4 . 5 Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions. 6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . 6 7 Combine lines 5 and 6 . 7 8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of Schedule D or on Form 8949. See instructions . 8 9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of Schedule D or on Form 8949. -

The Economics of Financial Derivative Instruments

MPRA Munich Personal RePEc Archive The Economics of Financial Derivative Instruments GODWIN C NWAOBI QUANTITATIVE ECONOMIC RESEARCH BUREAU, NIGERIA 5. July 2008 Online at http://mpra.ub.uni-muenchen.de/9463/ MPRA Paper No. 9463, posted 7. July 2008 02:31 UTC THE ECONOMICS OF FINANCIAL DERIVATIVE INSTRUMENTS GODWIN CHUKWUDUM NWAOBI PROFESSOR OF ECONOMICS / RESEARCH DIRECTOR [email protected] +234 8035925021 www.quanterb.org QUANTITATIVE ECONOMIC RESEARCH BUEREAU P O BOX 7173 ABA, ABIA STATE, NIGERIAN 1 ABSTRACT The phenomenal growth of derivative markets across the globe indicates their impact on the global financial scene. As the securitie s markets continue to evolve, market participants, investors and regulators are looking at different way in which the risk management and hedging needs of investors may be effectively met through the derivative instruments. However, it is equally recognized that derivative markets present market participates and regulatory (control) issues, which must be adequately addressed if derivative markets are to gain and maintain investor confidence. And yet, more and more companies are using (ordering forced to use) futures and derivatives to stay competitive in a fast- changing word characterized by both unprecedented opportunities and unprecedented risks. Thus, the thrust of this paper is to provide a detailed study of the manner in which the market works and how the knowledge can be used to make profits and avoid losses a competitive economy setting. KEY WORDS: DERIVATIVES, FUTURES, OPTIONS, COMMODITIES, OTC, ASSETS, STOCKS, INDEXES, SWAPS, INSTRUMENTS, FOREIGN EXCHANGE, FOREX, HEDGING, SPOTMARKETS, ARBITRAGE, RISK, EXCHANGES, BROKERS, STORAGE, ECONOMIES, FINANCIAL, PRICES JEL NO: F31, G24, G10, G13 , M40 2 1.0 INTRODUCTION A derivative security is a security or contract designed in such a way that its price is derived from the price of an underlying asset. -

Statement of Additional Information Vivaldi Multi-Strategy Fund

Statement of Additional Information February 1, 2019 Vivaldi Multi-Strategy Fund Class A Shares (Ticker Symbol: OMOAX) Class I Shares (Ticker Symbol: OMOIX) a series of Investment Managers Series Trust II This Statement of Additional Information (“SAI”) is not a prospectus, and it should be read in conjunction with the Prospectus dated February 1, 2019, as may be amended from time to time, of the Vivaldi Multi-Strategy Fund (the “Fund”), a series of Investment Managers Series Trust II (the “Trust”). Vivaldi Asset Management, LLC (the “Advisor”) is the investment advisor to the Fund. RiverNorth Capital Management, LLC and Angel Oak Capital Advisors, LLC (the “Sub-Advisors”) are the Fund’s sub-advisors. A copy of the Fund’s Prospectus may be obtained on the Fund’s website at www.vivaldifunds.com, or by contacting the Fund at the address or telephone number specified below. The Fund’s Annual Report to shareholders for the fiscal year ended September 30, 2018, is incorporated by reference herein. A copy of the Fund’s Annual Report can be obtained by contacting the Fund at the address or telephone number specified below. Vivaldi Multi-Strategy Fund P.O. Box 2175 Milwaukee, Wisconsin 53201 1-877-779-1999 TABLE OF CONTENTS THE TRUST AND THE FUND .................................................................................................................. B-2 INVESTMENT STRATEGIES, POLICIES AND RISKS ........................................................................... B-2 MANAGEMENT OF THE FUND............................................................................................................ -

OTC Derivatives Statistics at End-December 2014

Statistical release OTC derivatives statistics at end-December 2014 Monetary and Economic Department April 2015 Queries concerning this release may be directed to [email protected]. This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2015. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. 1. OTC derivatives statistics at end-December 2014 Highlights from the latest BIS semiannual survey of over-the-counter (OTC) derivatives markets: OTC derivatives markets contracted in the second half of 2014. The notional amount of outstanding contracts fell by 9% between end-June 2014 and end-December 2014, from $692 trillion to $630 trillion. Exchange rate movements exaggerated the contraction of positions denominated in currencies other than the US dollar. Yet, even after adjusting for exchange rate movements, notional amounts were still down by about 3%. The gross market value of outstanding derivatives contracts – which provide a more meaningful measure of amounts at risk than notional amounts – rose sharply in the second half of 2014. Market values increased from $17 trillion to $21 trillion between end-June 2014 and end-December 2014, to their highest level since 2012. The increase was likely driven by pronounced moves in long-term interest rates and exchange rates during the period. Central clearing, a key element in global regulators’ agenda for reforming OTC derivatives markets to reduce systemic risks, made further inroads. In credit default swap markets, the share of outstanding contracts cleared through central counterparties rose from 27% to 29% in the second half of 2014. -

The Influence of Credit Derivatives on Corporate Debt Restructuring

KEY POINTS Feature In recent times, distressed corporate borrowers have become better informed about and advised on how credit derivatives might impact a planned debt restructuring and also how the structure and timing of such a restructuring can affect the value and utility of credit derivatives entered into by their creditors. This information has allowed distressed corporate borrowers to be more strategic in the planning of the restructuring of their debt. Regulators in the UK and the US are now focussed on the potential for the integrity of the global market for credit derivatives to be undermined by strategic co-operative behaviour between distressed corporate borrowers and stakeholders who have bought or sold credit protection. Amendments made to the standard terms of credit derivative contracts in response to this regulatory attention goes some way to clarifying the intended operation of these highly complex instruments, but careful analysis of such terms will continue to be necessary for distressed corporate borrowers looking to have the greatest influence on their creditors’ behaviour during a workout. Author Jeremy Green The influence of credit derivatives on corporate debt restructuring In this article Jeremy Green considers some of the novel issues arising from the presence It is little surprise that the FCA is interested of credit derivatives in corporate debt restructuring for distressed companies, buyers and in credit derivatives – after all, credit derivatives sellers of protection, their respective advisers and regulators -

SWAPS: Definition and Types

RS: IF-V-4 SWAPS SWAPS: Definition and Types Definition A swap is a contract between two parties to deliver one sum of money against another sum of money at periodic intervals. • Obviously, the sums exchanged should be different: – Different amounts (say, one fixed & the other variable) – Different currencies (say, USD vs EUR) • The two payments are the legs or sides of the swap. - Usually, one leg is fixed and one leg is floating (a market price). • The swap terms specify the duration and frequency of payments. 1 RS: IF-V-4 Example: Two parties (A & B) enter into a swap agreement. The agreement lasts for 3 years. The payments will be made semi-annually. Every six months, A and B will exchange payments. Leg 1: Fixed A B Leg 2: Variable • Swaps can be used to change the profile of cash flows. If a swap is combined with an underlying position, one of the (or both) parties can change the profile of their cash flows (and risk exposure). For example, A can change its cash flows from variable to fixed. Fixed A B Variable Payment Variable • Types Popular swaps: - Interest Rate Swap (one leg floats with market interest rates) - Currency Swap (one leg in one currency, other leg in another) - Equity Swap (one leg floats with market equity returns) - Commodity Swap (one leg floats with market commodity prices) - CDS (one leg is paid if credit event occurs) Most common swap: fixed-for-floating interest rate swap. - Payments are based on hypothetical quantities called notionals. - The fixed rate is called the swap coupon. -

User's Guide to the 2002 ISDA Equity Derivatives Definitions

______________________________________________________ User’s Guide to the 2002 ISDA Equity Derivatives Definitions ______________________________________________________ 2003 EDITION ISDA® INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. Copyright © 2003 by INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. 360 Madison Avenue, 16th Floor New York, N.Y. 10017 TABLE OF CONTENTS INTRODUCTION...........................................................................................................................1 A NOTE ON COPYRIGHT.............................................................................................................1 A. OVERVIEW OF THE 2002 DEFINITIONS.........................................................2 B. ARCHITECTURE OF DOCUMENTATION........................................................3 1. Use of 2002 Definitions with other ISDA Definitional Booklets...............................3 2. Confirmations..............................................................................................................3 C. DISCUSSION OF THE 2002 DEFINITIONS.......................................................4 1. ARTICLE 1 – CERTAIN GENERAL DEFINITIONS..............................................4 Section 1.1. Transaction........................................................................................4 Section 1.2. Option Transaction............................................................................4 Section 1.3. Forward Transaction.........................................................................4 -

CHAPTER 10 Equity Derivatives

CHAPTER 10 Equity Derivatives A. Derivatives: An Introduction A derivative security is simply a financial instrument whose value is derived from that of another security, financial index or rate. A large number of different types of derivative securities have become very important for management of a variety of different types of equity-related - risks. Pricing of relevant derivative securities can provide useful information regarding characteristics of the equities from which they derive their values. Thus, derivative security pricing models, particularly the option pricing methodology, can very useful for the pricing of stocks and understanding their risks. A few observers of financial markets have argued that derivative securities play no important productive role in our economy. It has been argued that derivative securities merely provide gambling opportunities to speculators, enabling them transfer wealth among themselves without contributing to the economy. However, it can also be argued that derivative securities play a very important role in improving the efficiency of capital markets. Clearly, active and efficient capital markets are essential to the output and growth of our economy. Business firms require capital resources to produce goods and services and to maintain jobs for our labor force. Firms obtain this capital from investors, who, either directly or through financial institutions, purchase the securities that firms sell. Poorly functioning capital markets inhibit production capabilities of business, and result in economic decline. However, risk and uncertainty are unavoidable characteristics of a capitalist economy. Businesses and the capital markets in which investors entrust their savings are profoundly affected by risk. Because investors and businesses tend to shy away from risk, the proper functioning of capital markets is impaired by uncertainty and volatility. -

Order Granting Approval of a Proposed Rule Change to List and Trade, Under Nasdaq Rule 5705, the Shares of the Horizons Russell 2000 Covered Call ETF

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-83046; File No. SR-NASDAQ-2018-012) April 13, 2018 Self-Regulatory Organizations; The Nasdaq Stock Market LLC; Order Granting Approval of a Proposed Rule Change to List and Trade, Under Nasdaq Rule 5705, the Shares of the Horizons Russell 2000 Covered Call ETF I. Introduction On February 9, 2018, The Nasdaq Stock Market LLC (“Nasdaq” or “Exchange”) filed with the Securities and Exchange Commission (“Commission”), pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (“Act”)1 and Rule 19b-4 thereunder,2 a proposed rule change to list and trade shares (“Shares”) of the Horizons Russell 2000 Covered Call ETF (“Fund”). The proposed rule change was published for comment in the Federal Register on February 28, 2018.3 The Commission received no comments on the proposal. This order approves the proposed rule change. II. Description of the Proposed Rule Change The Exchange proposes to list and trade Shares of the Fund under Rule 5705, which governs the listing and trading of Index Fund Shares on the Exchange. The Shares will be offered by the Fund, which will be a passively managed exchange-traded fund (“ETF”) that seeks to track the performance of the CBOE Russell 2000 30-Delta BuyWrite V2 Index 1 15 U.S.C. 78s(b)(1). 2 17 CFR 240.19b-4. 3 See Securities Exchange Act Release No. 82761 (Feb. 22, 2018), 83 FR 8719 (“Notice”). (“Benchmark Index”).4 The Fund is a series of the Horizons ETF Trust I (“Trust”).5 Horizons ETF Management (US), LLC will serve as the investment adviser (“Adviser”) to the Fund.6 Foreside Fund Services, LLC will serve as the principal underwriter and distributor of the Fund’s Shares. -

Equity-Derivatives-Disclosure-Annex

International Swaps and Derivatives Association, Inc. Disclosure Annex for Equity Derivative Transactions This Annex supplements and should be read in conjunction with the General Disclosure Statement. NOTHING IN THIS ANNEX AMENDS OR SUPERSEDES THE EXPRESS TERMS OF ANY TRANSACTION BETWEEN YOU AND US OR ANY RELATED GOVERNING DOCUMENTATION. Accordingly, descriptions in this Annex of the operation of Equity Transactions (as defined below) and the consequences of various events are in all cases subject to the actual terms of an Equity Transaction executed between you and us and its governing documentation (whether or not such qualification is expressly stated). We refer to Transactions in which the Underliers are corporate equity securities or baskets or indexes of equity securities as “Equity Transactions”. The terms of an Equity Transaction may incorporate standard definitions, master confirmations, transaction matrices and other market standard terms, which may in turn be amended or customized pursuant to the terms of the Equity Transaction and its governing documentation. Before entering into an Equity Transaction, you should obtain and review carefully any such materials incorporated by reference as their content could materially affect your rights and obligations under the Equity Transaction, its value and its appropriateness for your particular objectives. Valuation of Underliers Trading of equity securities typically takes place on securities exchanges, dealer quotation systems, electronic communications networks, and other trading facilities and execution venues, the regulation of which may differ from jurisdiction to jurisdiction. Futures and option contracts related to equity securities and indexes may trade on futures exchanges, securities exchanges or other derivatives exchanges, depending on the type of contract. -

Tax Section Report

Tax Report #928 J. 1 V^ VV JLWA .1V VJUCtL^ AJCtJ. .T-k^^^^iailAJll Hill One Elk Street, Albany, Nef*\\iw Warii onre 1izzu 90m/ • • jlo/4oJ-ozU ^IQ/A^I "sonfU i p M ™_^ • •INI JL ^3 «~»w^W TAX SECTION MEMBERS-AT-LARGE OF EXECUTIVE COMMITTEE: Kennerh H. Heitner Glen A. Kohl Dale L. Pomkvar Leslie S Samuels Eugene I Vogei 1998-1999 Executive Committee Thomas A. Humphreys Emily S McMahon Yafon Z. Reich Robert T. Smith David E Watls Charles 1. Kingson Cha'les M. Morgan. Ill David M. Rievman Ann F.Thomas Mary Kale Wold STEVEN C.TODRYS Chair Simpson Thacher & Bartletl 425 Lexington Avenue New York. NY 100 17 212/455-3750 HAROLD R. HANDLER First Vice-Chair May 22, 1998 212/455-3110 ROBERT H. SCARBOROUGH Second Vice-Chair 212/906-2317 ROBERT A. JACOBS Secretary 212/530-5664 COMMITTEE CHAIRS: Bankruptcy and Losses Linda Zan Swartz The Honorable Donald C. Lubick David R Sicular Basis and Cost Recovery Elliot Pisem Assistant Secretary (Tax Policy) Joel Scharfslein CLE and Pro Bono Department of the Treasury James A Locke Victor Zonana Compliance, Practice & Procedure 1500 Pennsylvania Avenue, N.W. Robert S. Fink Arnold Y. KapiloH Washington, D.C. 20220 Consolidated Returns Ann-Elizabeth Purintun Jodi J.Schwartz Corporations The Honorable Charles O. Rossotti Andrew N. Berg Dana Trier Employee Benefits Commissioner Robert C. Fleder Barbara Nims Internal Revenue Service Estates and Trusts Sherwin Kamin Carlyn S. McCaffrey 1111 Constitution Avenue, N.W. Financial Instruments Samuel J. Dimon Washington, D.C. 20224 DavidS. Miller Financial Intermediaries Bruce Kayle Andrew Solomon Foreign Activities of U.S.