Q1 2013 Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Peugeot 3008 My Peugeot 5008

MY PEUGEOT 3008 MY PEUGEOT 5008 HANDBOOK Access to the Handbook MOBILE APPLICATION ONLINE Install the (content available Visit the website and select the Scan MyPeugeot App PEUGEOT offline). ‘MyPeugeot’ section to view or download the handbook or go to the following address: http://public.servicebox.peugeot.com/APddb/ Scan this QR Code for direct access. Then select: – the vehicle, Select: – the issue period corresponding to the vehicle’s initial – the language, registration date. – the vehicle and body style, – the issue period of the handbook corresponding to the vehicle’s initial registration date. This symbol indicates the latest information available. Welcome Key Safety warning Thank you for choosing a Peugeot 3008 or a Peugeot 5008. This document presents the key information and recommendations required Additional information for you to be able to explore your vehicle in complete safety. We strongly recommend familiarising yourself with this document and the Warranty and Maintenance Record. Environmental protection feature Your vehicle will be fitted with only some of the equipment described in this document, depending on its trim level, version and the specification for the Left-hand drive vehicle country in which it was sold. The descriptions and illustrations are for guidance only. Automobiles PEUGEOT reserves the right to modify the technical specifications, Right-hand drive vehicle equipment and accessories without having to update this guide. If ownership of your vehicle is transferred, please ensure this Handbook is Location -

Catalogooilfilterskyfil.Pdf

oil filter SKO-2-2017 SKO-2-2018 OF. 9018 OF. 8806 CHEV. ASTRA 2.2 LTS. 4 LTS. 02/04 CHEV. ASTRA 1.8 LTS. 4 CIL. 00/01 MALIBU 2.2 LTS. 4 CIL. 04/08 CHEVROLET SKO-2-2020 SKO-2-2021 OF. 2518 OF. 10246 CHEV. SPARK 1.2 LTS. 4 CIL. 11/15 CHEV. ASTRA 1.8 LTS. 4 CIL. 07/08 CRUZE 1.8 LTS. 4 CIL. 11/15 SKA-L-2005 SKO-L-2006 OF. 3675 OF. 2933 CHEV. SIERRA V6 CHEV. ASTRA 2.4 LTS. 4 CIL. 04 SKO-L-2007 SKA-L-2008 OF. 3506 OF. 3387 CHEV. COLORADO 2.9 LTS. 4 CIL. 08/12 CHEV. CHEVY 1.6 LTS. 4 CIL. 01/12 CHEYENNE 5.3 LTS. 8V 03/07 CAVALIER 2.2 LTS. 4 CIL. 95/05 1 oil filter CHEVROLET SKO-L-2009 SKO-L-2010 OF. 05 CHEV. CAPTIVA SPORT 2.4 LTS. 4 CIL. 11/15 CHEV. SUBURBAN 7.4 LTS. 8V 92/95 ZAFIRA 2.2 LTS. 4 CIL. 02/07 SILVERADO 3500 HEAVY DUTY 5.7 LTS. 8V 03/05 CHRYSLER SKO-D-2033 SKO-D-2037 OF. 16 OF. 10060 CHRYS. GRAND VOYAGER 3.3 LTS. 6V 99/02 CHRYS. NITRO 4.0 LTS. 6V 09/11 RAM SRT-10 P-UP 8.3 LTS. 10V 04/06 JOURNEY 3.5 LTS. 6V 09/10 SKO-D-2038 SKO-D-2039 OF. 11665 OF. 3614 CHRYS. DURANGO 3.6 LTS. 6V 11/16 CHRYS. NEON 2.4 LTS. 4 CIL. 04/06 GRAND CARAVAN 3.6 LTS. -

FP-Mag Février 2009

Mars 2009 n°15 Spécial Salon de Genève 2009 Peugeot 3008 Découverte Sport Musée Programme 2009 L’exposition «Interdite» Sommaire Éditorial «Le Crossover by Peugeot». Après avoir découvert le 3008 en statique, Actualités les premiers avis donnés à la sortie des Les chiffres.....................................p 3 photos officielles changent pour beaucoup de personnes. En effet, une fois assis à son Evènement bord, une seule envie surgie : rouler avec ! Salon de Genève.............................p 4 Dans ce numéro nous vous faisons partager cette découverte, et dans le prochain nu- Sport méro vous retrouverez un essai de ce 3008, Programme Endurance 2009...........p7 ainsi que de la 308 CC. C’est une nou- Actualités.......................................p11 veauté, dorénavant presque tous les mois, l’équipe de la rédaction réalisera un essai Essai sur route pour vous. Peugeot 3008.................................p12 Bonne lecture. Reportage Exposition Interdite.......................p14 Guillaume OLLIER, rédacteur en chef. Tribune libre Les dessins des lecteurs...............p16 Le groupe Actualités.......................................p17 Dico Glossaire mécanique.....................p18 2 Forum Peugeot Mag’ n° 15 / Mars 2009 La crise mondiale qui touche le monde automobile depuis le début du second se- mestre 2008 n’a pas épargné le groupe PSA. Bien que le début d’année 2008 sem- blait être en hausse, les 6 derniers mois de l’année ont semble-t-il eu raison du bilan du groupe qui enregistre un déficit de 343 millions d’euros pour un chiffre d’affaire de 54,3 milliards d’euros (-7,4%). Depuis le début de l’année, le marché Français est toujours en net recul avec un repli de 12,9% (-8,6% à nombre de jours ouvrables comparables) par rapport à Jan- vier, Février 2008. -

Hertz Vehicle Fleet

Hertz 2016 Vehicle Fleet Vehicles shown in size order with Manual Transmission vehicles first followed by Automatic transmission vehicles. Scroll down. Special Note: The determining factor on choosing the right vehicle size for you will be the amount of luggage you will be bringing. Rule of thumb: luggage size defined: 29” (Large) - 22” (Small), so consider that when comparing the vehicles luggage capacity to the number of persons in your party. MANUAL TRANSMISSION VEHICLES Category A - Mini Size Car - Example: Ford Ka Touring passenger capacity - 2 persons Category B - Economy Size Car - Example: Ford Fiesta Touring passenger capacity - 2 persons Category C - Compact Size Car - Example: VW Golf Touring passenger capacity - 3 persons - possibly 4 persons Category D - Intermediate Size Car - Example: VW Jetta Touring passenger capacity - 4 persons Category Q - Intermediate Size - SUV - Example: Nissan Qashqai Touring passenger capacity - 4 persons Category J - Standard Size - Example: VW Passat Touring passenger capacity - 4 persons Category W - Premium Size - Example: Audi A4 Touring passenger capacity - 4 persons Possibly 5 persons Category P - Intermediate Size - Minivan - Example: Opel Safira Touring passenger capacity - 5 persons - Category S - Full Size - Minivan - Example: Ford Galaxy Touring passenger capacity - 5 persons - Possibly 6 persons Category M - Premium Size - Minivan - Example: VW Caravelle Touring passenger capacity - 6 persons - Possibly 7 persons AUTOMATIC TRANSMISSION VEHICLES Special Note: The determining factor on choosing the right vehicle size for you will be the amount of luggage you will be bringing. Rule of thumb: luggage size defined: 29” (Large) - 22” (Small), so consider that when comparing the vehicles luggage capacity to the number of persons in your party. -

Peugeot 3008 Guía De Utilización

GUÍA DE UTILIZACIÓN PEUGEOT 3008 La guía de utilización en línea Elija una de las siguientes formas para consultar su guía de utilización Escanee este código para acceder directamente a su guía de en línea. utilización. Acceda a su guía de utilización a través de la web de Peugeot, apartado "MyPeugeot". Este espacio personal le ofrece consejos e información útil para el mantenimiento de su vehículo. Consultando la guía de utilización en línea podrá acceder a la Si el apartado "MyPeugeot" no está disponible en el portal última información disponible, que identificará fácilmente gracias al Peugeot del país, consulte su guía de utilización en la siguiente marcapáginas con el siguiente pictograma: dirección: http://public.servicebox.peugeot.com/ddb/ Seleccione: el idioma; el vehículo, la silueta; la fecha de edición de su guía de utilización correspondiente a la fecha de matriculación del vehículo. Bienvenido Esta guía presenta todos los equipamientos disponibles en el conjunto Le agradecemos que haya elegido un 3008. de la gama. El vehículo va equipado solo con parte de los equipamientos descritos Esta guía de utilización ha sido concebida para que en este documento, en función del nivel de acabado, la versión y las usted disfrute plenamente de su vehículo en todas las características específicas del país de comercialización. situaciones. Las descripciones e imágenes no tienen valor contractual. Automóviles PEUGEOT se reserva el derecho a modificar las características técnicas, equipos y accesorios sin obligación de actualizar la presente guía. Este documento forma parte integrante del vehículo. No olvide entregárselo al nuevo propietario en caso de venderlo. Leyenda advertencias de seguridad información complementaria contribución a la protección de la naturaleza Índice Vista general . -

Fleet Trends in the European Industrial Industry 2018-2020

Industrial industry benchmark Fleet trends in the European industrial industry 2018-2020 LeasePlan International Consultancy Services • June 2021 2 Industrial industry benchmark 2018-2020 Contents Introduction 3 Most driven car segments, 2018-2020 4 Most driven car models, 2018-2020 5 Powertrain trends, 2018-2020 6 Share of powertrains per country, 2018-2020 7 CO2 averages per country, 2018-2020 9 Conclusion 10 Appendix A: overview of car segments 11 3 Industrial industry benchmark 2018-2020 Introduction In this industrial industry benchmark report, we highlight the most important fleet trends in Europe by comparing the passenger car registrations between 2018 and 2020. We applied the following definition of the industrial industry: Companies producing or maintaining physical material or products for the B2B sector. This analysis of fleet trends is based on LeasePlan passenger car data from over 200 international companies. For the scope and to make sure the data is representative, we’ve only included countries where at least 200 passenger cars were renewed within the industry each year (2018, 2019 and 2020). If you would like to know how sustainable this industry is compared to other industries please check out our 2021 Fleet Sustainability Ranking by Industry. 4 Industrial industry benchmark 2018-2020 * Most driven car segments, 2018-2020 • The C1 segment has remained the most popular car segment, although its share has decreased from 26% in 2018 to 22% in 2020. • The SUV trend continues with a significant increase in its share in 2018 2019 2020 the top 10 (from 17% in 2018 to 27% in 2020). 1 C1 26% C1 22% C1 22% • The regular volume segments (B1, C1 and D1) have lost share in the top 10 from 49% in 2018 to 38% in 2020. -

New PEUGEOT PARTNER Mastering the Impossible

PRESS PACK 26th June 2018 New PEUGEOT PARTNER Mastering the impossible Why not combine practicality with pleasure, feel that delight every time you drive, why not optimise your time, guarantee your safety and feel sure that your vehicle is rugged enough to withstand any test … this is exactly what new PEUGEOT PARTNER provides to all professional clients in the LCV segment. New PEUGEOT PARTNER, which includes the PEUGEOT i-Cockpit® as standard, an unprecedented move in this vehicle segment, offers a new driving experience and a setting that is conducive to productivity. PEUGEOT is revolutionising the LCV segment with a relevant, dynamic and generous market offering, the perfect balance between convenience and drivability - the Brand's hallmark. With its dynamic design, New PEUGEOT PARTNER is not only practical and elegant - it features an unparalleled range of driving aids that, to date, have only been seen on the latest saloon vehicle generations. Two major original innovations are featured for the first time: Overload Alert and Surround Rear Vision, which provides blind angle camera vision. New PEUGEOT PARTNER offers a stimulating, stress-free mobile office; the dimensions are perfectly in line with the market segment, it is exceedingly comfortable and the payload area is even more practical and versatile than ever. No matter what your profession, you will find the right configuration to enable you to work effectively: just look at the Grip version, which meets a need for ruggedness in all circumstance or the Asphalt version for those of you who do not count the time spent behind the wheel. New PEUGEOT PARTNER is at the heart of the entrepreneur mentality; it boosts your capacity to deliver results and makes it possible to go far beyond what might have previously seemed impossible. -

Peugeot 2008 Suv | Specification Sheet

PEUGEOT 2008 SUV | SPECIFICATION SHEET ACTIVE 1.6 HDi ALLURE 1.6 HDi ACTIVE 1.2 PureTech ALLURE 1.2 PureTech GT LINE 1.2 PureTech MODEL Manual Manual Manual Auto Auto 1 2 3 4 5 ENGINE Power (kW @ r/min) 68 @ 4000 68 @ 4000 81 @ 5500 81 @ 5500 81 @ 5500 Torque (Nm @ r/min) 230 @ 1750 230 @ 1750 205 @ 1500 205 @ 1500 205 @ 1500 Cubic Capacity 1560 1560 1199 1199 1199 Cylinders 4 4 3 3 3 Transmission Manual Manual Manual Auto Auto Gears 5-speed manual 5-speed manual 5-speed manual 6-speed auto 6-speed auto Fuel tank capacity (liters) 50 50 50 50 50 Fuel Type Diesel Diesel Unleaded Unleaded Unleaded PERFORMANCE Consumption Urban 4.7 4.7 6.6 6.6 6.6 Consumption Rural 3.6 3.6 4.4 4.4 4.4 Consumption Combined 4.0 4.0 5.2 5.2 5.2 CO2 Emissions (g C02/Km) 103 103 121 121 121 0 to 100 km/h in (s) 11.5 11.5 10.3 10.3 10.3 Top Speed 181 181 188 188 188 DIMENSIONS Boot Space (litres) min / max (with seats folded down) 410 / 1400 410 / 1400 410 / 1400 410 / 1400 410 / 1400 Length (mm) 4159 4159 4159 4159 4159 Height (mm) 1,556 1,556 1,556 1,556 1,556 Width with mirrors (mm) 2,004 2,004 2,004 2,004 2,004 Ground Clearance (mm) 165 165 165 165 165 Wheelbase (mm) 2,538 2,538 2,538 2,538 2,538 WHEELS & TYRES Alloy wheels 16'' 17'' 16'' 17'' 17'' Spare Wheel S S S S S Tyre Pressure Sensor S S S S S EXTERIOR FEATURES Colour Coded Mirrors S S S S - Perla Black Mirrors - - - - S Colour Coded Door Handles S S S S S Electric and Heated Mirrors S S S S S Electric Folding Mirrors S S S S S Roof Bars S S S S S LIGHTING Two-tone Black and Chrome Headlights S S S S -

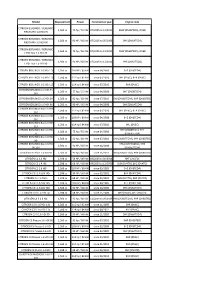

Model Displacement Power Construction Year Engine Code

Model Displacement Power Construction year Engine code CITROËN BERLINGO / BERLINGO 1,560 cc 75 hp / 55 kW 07/2005 to 12/2011 9HW (DV6BTED4), DV6B FIRST MPV 1.6 HDI 75 CITROËN BERLINGO / BERLINGO 1,560 cc 90 HP / 66 kW 07/2005 to 05/2008 9HX (DV6ATED4) FIRST MPV 1.6 HDI 90 CITROËN BERLINGO / BERLINGO 1,560 cc 75 hp / 55 kW 07/2005 to 12/2011 9HW (DV6BTED4), DV6B FIRST Box 1.6 HDI 75 CITROËN BERLINGO / BERLINGO 1,560 cc 90 HP / 66 kW 07/2005 to 12/2011 9HX (DV6ATED4) FIRST Box 1.6 HDI 90 CITROËN BERLINGO 1.6 HDi 110 1,560 cc 109 HP / 80 kW since 04/2008 9HZ (DV6TED4) CITROËN BERLINGO 1.6 HDi 110 1,560 cc 112 hp / 82 kW since 07/2010 9HL (DV6C), 9HR (DV6C) CITROËN BERLINGO 1.6 HDi 115 1,560 cc 114 hp / 84 kW since 07/2010 9HR (DV6C) CITROËN BERLINGO 1.6 HDi 75 1,560 cc 75 hp / 55 kW since 04/2008 9HT (DV6BTED4) 16V CITROËN BERLINGO 1.6 HDi 90 1,560 cc 92 hp / 68 kW since 07/2010 9HJ (DV6DTEDM), 9HP (DV6DTED) CITROËN BERLINGO 1.6 HDi 90 1,560 cc 90 HP / 66 kW since 04/2008 9HX (DV6ATED4) CITROËN BERLINGO Box 1.6 HDi 1,560 cc 112 hp / 82 kW since 07/2010 9HL (DV6C), 9HR (DV6C) 110 CITROËN BERLINGO Box 1.6 HDi 1,560 cc 109 HP / 80 kW since 04/2008 9HZ (DV6TED4) 110 CITROËN BERLINGO Box 1.6 HDi 1,560 cc 114 hp / 84 kW since 07/2010 9HL (DV6C) 115 CITROËN BERLINGO Box 1.6 HDi 9HT (DV6BTED4), 9HT 1,560 cc 75 hp / 55 kW since 04/2008 75 (DV6BUTED4) CITROËN BERLINGO Box 1.6 HDi 1,560 cc 92 hp / 68 kW since 07/2010 9HJ (DV6DTEDM), 9HP (DV6DTED) 90 CITROËN BERLINGO Box 1.6 HDi 9HS (DV6TED4BU), 9HX 1,560 cc 90 HP / 66 kW since 04/2008 90 16V (DV6AUTED4) -

PEUGEOT 108 Top Range : Equipment

PEUGEOT 108 top range : equipment PEUGEOT Car Range Pricing Guide Pricing Valid from 1st November 2019 A PEUGEOT For EVERY Occasion Hatchbacks Page 4 Page 9 Page 17 108 208 Compact, chic and full of character. If you're looking for a 308 fun way to get around town, the 108 will be right up your Behind its neat and compact appearance, this car is The PEUGEOT 308 is a real show-stopper, with a street. bursting with energy and ambition – just like you. stunning design, superior technology and ultra-efficient engines. SUVs Page 13 Page 23 Page 28 2008 SUV 3008 SUV 5008 SUV A strong visual signature ensures the 2008 SUV The PEUGEOT 3008 SUV unveils its strength and Enter a new dimension with PEUGEOT 5008 SUV,offering commands road presence and offers a distinctive air of character. Featuring a sleek design,this distinct SUV cutting edge technology and the flexibility offered by adventure. combines robustness with elegance. seven individual seats Fastback Estate Page 39 Page 40 Page 17 All-new 508 All-new 508 SW 308 SW Discover the all-new PEUGEOT 508: the radical Fastback Discover the all-new Peugeot 508 SW: the premium estate The 308 SW, is the ultimate family car. with a bold look , offering advanced technology for an car with uncompromising design, combining the comfort Feel good behind the wheel, its attention to detail and outstanding driving experience. of a tourer. cavernous 660 litre boot set it apart from its rivals. MPVs Cabrio Page 4 Page 33 Page 44 108 TOP! All-new Rifter This 5-door cabrio, comes with a retractable electric fabric Traveller Featuring great levels of comfort, outstanding modularity roof and wind deflector so that you can enjoy that Distinctive design, expert PEUGEOT handling, elegance and intelligent storage solutions, all-new Rifter is the “outdoor” experience throughout the year. -

301 Catalogue DOI

THE NEW PEUGEOT 301 Dealer stamp Creation : Extrême Muse – Production : Altavia Paris – Edition : Gutenberg Networks - Automobiles Peugeot RC Paris B 552 503 - Printed in UE - Ref : CAT_301_02_2017_EN February 2017 www.peugeot.com Peugeot has always adhered to the French tradition of high-quality, all the senses. Ergonomics, materials, connectivity...we have tended 04 Exterior design 15 Modularity innovative manufacturing. Now more than ever, Peugeot is to every detail to provide you with a more intuitive driving experience. 08 Interior design 16 Road benefits channelling all its energy into designing vehicles with a classy design 12 Connectivity 20 Safety that give a sensory experience beyond driving by heightening 13 Technologies 22 Engines 14 Comfort 24 Customisation A NEW CITY OPENS UP TO YOU. LIVE THE DIFFERENCE. AN INCREDIBLE IMPRESSION. The new PEUGEOT 301 embraces all the trademark signature of the PEUGEOT style. Here, elegance is on tap with the chrome package, a flattering complement to the modern, The redesigned front affirms its character with a vertical grille, imposing front bumper light lines of the new PEUGEOT 301. A symbol of brand excellence, the new PEUGEOT 301 and prominent hood. New light alloy wheels and the lion carved into the grille guarantee boasts a winning light combination driven by the LED daytime lights* in front and claw-like that you are in the right place and ready to make the road your own. streaks in the back. 6 * Equipment available depending on country 7 INSIDE, EVERYTHING IS EXPRESSED. THE FUTURE MEETS THE PRESENT. A DESIGN FOR THE FUTURE. The future unfolds in front of you with the dashboard of the new PEUGEOT 301. -

Sébastien Loeb På Väg Till Toppen I Peugeot 208 T16 Pikes Peak!

Sébastien Loeb på väg till toppen i Peugeot 208 T16 Pikes Peak! Den niofaldiga rallyvärldsmästaren Sébastien Loeb ställs nu inför sin nästa stora utmaning, när han i samarbete med Peugeot Sport deltar i Pikes Peak International Hill Climb den 30 juni, i en specialdesignad Peugeot 208 T16. Det legendariska loppet i Pikes Peak i Colorado är världens högst belägna lopp och det är första gången det franska teamet återvänder till detta klassiska lopp sedan de historiska segrarna 1988 och 1989. Ari Vatanens seger i en 405 T16 1989 har senare hyllats i den prisbelönta filmen ”Climb Dance”, där han visar prov på sin dödsföraktande stil på vägen uppför berget. Pikes Peak: ett legendariskt lopp Pikes Peak International Race är det näst äldsta amerikanska motorloppet och startade redan 1916. Idag deltar mer än 150 förare i loppet som även kallas ”Race to the Clouds”. Starten går på 2 865 meter höjd och under den 20 km långa sträckan är det inte mindre än 156 hisnande kurvor som ska klaras av innan vinnaren når toppen på 4 301 meter. Under åren har sträckan gradvis asfalterats och 2012 genomfördes det första loppet helt på asfalt. Det ledde till ett nytt världsrekord genom Rhys Millen (Hyundai Genesis Coupé) på tiden 9’46’’164, det vill säga dubbelt så snabbt som när loppet gick av stapeln 1916! Loppet består av 20 klasser och innefattar förutom bilar även motorcyklar och tyngre lastbilar. Sébastien Loebs 208 T16 Pikes Peak deltar i kategorin ”Unlimited”. Alla detaljer om bilen har inte avslöjats ännu, men bilderna på bilen offentliggörs nu på webben.