Nihonbashi-Bakurocho 1-Chome Development Project)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020109-4N-5D-Tokyo-Tour.Pdf

Special Japan Holiday Offer!!!! ******* Limited Availability******* KNI Tour Code -2020109 Sky Hop Bus Pass - Hop on Hop off Tokyo Sightseeing Bus (JAPAN 4Nights/5Days) TOUR HIGHLIGHTS Starting from USD 595 Per Person Tour Cost Per Person : Minimum : 2 PAX , Twin/Double Sharing basis 2 Star USD 595 3 Star USD 730 4 Star USD 840 5 Star USD 1105 PACKAGE INCLUSIONS: - Hotel: Please refer hotel page ESG : English Speaking Guide during sightseeing on SIC basis tour only MEALS : Breakfast only basis TRANSPORTATION : A/C Coach ENTRANCE TKT : All Inclusive as per itinerary Exclusions: Gratuities Any meals other than mentioned in itinerary Camera charges, water bottle or any expense of personal nature Tipping - NA for SIC basis Tour ITINERARY Day 1: Arrival Transfer by Private Vehicle (From Kansai Airport) Overnight at hotel ( Osaka Hotel) Day 02: 1-Day Sky Hop Bus Pass - Hop on Hop off Tokyo Sightseeing Bus " Go to the bus stop from which you wish to board the bus Customers may board the bus from any Sky Hop bus stop during normal bus operating hours. Show a printed copy of the reservation confirmation sheet to the bus driver when boarding. Simply showing the confirmation on a mobile device screen will not be accepted. The reservation confirmation sheet is valid for 1 day (24 hours). *Bus seats are unreserved. Note that buses may be full in some cases. Take any bus route for sightseeing around Tokyo This pass gives you access to 3 different routes: Asakusa-TOKYO Skytree® course, Odaiba course, and Roppongi-Odaiba course. 1. Asakusa-TOKYO Skytree® course bus stops: Marunouchi Mitsubishi Building Ueno Station (Sat., Sun., and public holidays only) TOKYO SKYTREE Station Asakusa Hanakawado (East approach to Senso-ji Temple) Ueno Matsuzakaya Akihabara Shin-Nihombashi Station (Mitsui Tower/Mitsukoshi) Arrives back at Marunouchi Mitsubishi Building *This route operates from 9:30 to 20:00. -

Paper Shops in Tokyo

Orihouse: Paper shops in Tokyo | hall | floor-plan | welcome | my room | your room | dark room | guest room | knotology | library | links | meeting room | o-list | bedroom | guestbook | terms | email | MEETINGROOM :: | Chile 2006 | Barcelona 2005 | Tokyo 2004 | Tokyo Shops | Kraków 2004 | Bonn 2003 | Cambridge 2002 | New York 2002 | Museum Rijswijk 2002 | Singapore 2002 | London 2001 | Aranjuez 2001 | Veldhoven 2001 | :: MEETINGROOM Paper shops in Tokyo, Japan collected during August 2004 GALLERY ORIGAMI HOUSE SAKURAHORIKIRI SHIMOJIMA 100 YEN SHOPS TOKYU HANDS KINOKUNYA TAKEO ORIGAMI KAIKAN ITO-YA KURASAWA TANAKA WASHI (order visited) GALLERY ORIGAMI HOUSE Website: http://www.origamihouse.jp Shop location: http://www.origamihouse.jp/about/map/map_e.html Metro Station: HAKUSAN, opposite exit A1 On the second floor, you can see it from the street. Address: Origami House #216, 1-33-8, Hakusan,Bumkyo-ku, Tokyo,113-0001, JAPAN TEL:03-5684-6040 FAX:03-5684-6040 Page 1 Orihouse: Paper shops in Tokyo Heart of Origami Tanteidan and JOAS. You can see masterpieces and buy books and paper. Maybe you even meet Yamaguchi Sensei or Satoshi Kamiya! Very little, but *ORIGAMI ONLY*. They can also help you out with other origami-resources in Tokyo. Het hart van Origami Tanteidan en JOAS. Je kan meesterwerken bekijken en boeken en papier kopen. En misschien ontmoet je wel Satoshi Kamiya of Yamaguchi Sensei! Heel klein, maar *ALLEEN ORIGAMI*. Ze kunnen je ook helpen met andere origami-bronnen in Tokyo. SAKURAHORIKIRI Website: http://www.sakurahorikiri.co.jp/ More info about location other shops: http://www.sakurahorikiri.co.jp/zenntennpo-map.html JR Station: ASAKUSABASHI Address: Tokyo, Taito-ku, Yanagibashi 1-26-1 TEL 03-3864-1773 Opening hours: AM9:30~PM5:30 There are 5 shops in Tokyo. -

Notice Regarding Acquisition of Trust Beneficiary Interest in Domestic Real Estate (Higashi-Nihombashi Green Building)

December 14, 2015 For Translation Purpose Only MCUBS MidCity Investment Corporation 2-7-3, Marunouchi, Chiyoda-ku, Tokyo Katsura Matsuo Executive Director (Securities Code: 3227) URL: http://www.midreit.jp/english/ MCUBS MidCity Inc. Katsura Matsuo President & CEO & Representative Director Naoki Suzuki Deputy President & Representative Director TEL. +81-3-5293-4150 E-mail:[email protected] Notice Regarding Acquisition of Trust Beneficiary Interest in Domestic Real Estate (Higashi-Nihombashi Green Building) MCUBS MidCity Investment Corporation (hereafter “MCUBS MidCity”) announces that, its asset management company, MCUBS MidCity Inc. (hereafter the “Asset Management Company”), decided today to acquire a property, as detailed below. 1. Overview of Acquisition Type of Specified Asset Trust beneficiary interest in real estate Property name Higashi-Nihombashi Green Building Location 2-8-3, Higashi-Nihombashi, Chuo-Ku, Tokyo Planned acquisition price ¥2,705 million (Excluding various acquisition expenses, property taxes, city planning taxes, consumption taxes, etc.) Appraisal value ¥2,900 million Contracted date December 14, 2015 Planned acquisition date December 21, 2015 Seller HN Green Japan Holding TMK Acquisition funding Cash on hand Hereafter, the above asset to be acquired is referred as “the Asset” and the asset in trust of the Asset as “the Property.” 2. Reason for Acquisition (1) Location As the Higashi-Nihombashi area where the Property stands has long developed around the textile industry, there are many apparel wholesale companies, making the area a mixture of small and medium-sized offices and apartments. Standing on a corner lot along Kiyosugi-dori, an arterial road, the Property enjoys both excellent visibility and natural lighting. -

Notice of Opening: Planetyze Hostel Accommodation Facility for Foreign Visitors to Japan

February 1, 2017 Sun Frontier Fudousan Co., Ltd. (Stock code: 8934) Listing: First Section, Tokyo Stock Exchange Notice of Opening: Planetyze Hostel Accommodation Facility for Foreign Visitors to Japan Please note that this document is a translation of the official announcement that was released in Tokyo. The translation is prepared and provided for the purpose of the readers’ convenience only. All readers are strongly recommended to refer to the original Japanese version of the news release for complete and accurate information. As part of our real estate revitalization, Planetyze Hostel, the accommodation facility for foreign visitors to Japan will open on February 13, 2017 in Higashi-nihonbashi, Chuo-ku, Tokyo. 1. Overview of the Hostel Planetyze Hostel is about 4 minutes’ walk from the Toei Asakusa Line Higashi-nihonbashi Station. From this hotel one can get on the train which goes to Haneda Airport and Narita Airport directly. The hotel used to be an office building which was purchased by our company. By utilizing the experience gained from real estate revitalization business, we transformed it into an accommodation facility for foreign visitors to Japan. With the motto of “warm-hearted hotel”, we are to provide a relaxing space to our customers by utilizing the concept of “omotenashi”, hospitality and friendly smile of our multinational staff. “A place where you could find your next destination during your stay” is our service concept. As we have formed an alliance with Travelience Inc., foreign guests will be able to use Japan Travel Guidebook ” Planetyze” on internet and attendant services provided by Licensed Guide Interpreters. -

H.I.S. Hotel Holdings Hotel Lineup

H.I.S. Hotel Holdings Hotel Lineup 20200622 H.I.S. Hotel Group Map Henn na Hotel Kanazawa Korinbo Henn na Hotel Komatsu Eki-mae Commitments Henn na Hotel Kyoto, Hachijoguchi Eki-mae Henn na Hotel Sendai Kokubuncho Scheduled to open in 2021 H.I.S. Hotel Holdings Co. Ltd. is a company that provides pleasure in Henn na Hotel Maihama Tokyo Bay Watermark Hotel Kyoto Henn na Hotel Tokyo Nishikasai traveling based on its hotel and convenience in business scenes. Henn na Hotel Tokyo Ginza Henn na Hotel Tokyo Akasaka In order to achieve it, we pursue connection, comfort, advancement, playfulness, and productivity, Henn na Hotel Tokyo Asakusabashi placing them as our five core values. Henn na Hotel Tokyo Asakusa Tawaramachi Henn na Hotel Tokyo Hamamatsucho Henn na Hotel Tokyo Haneda Combining our world’s best productivity and efficiency, Henn na Hotel Fukuoka Hakata we would like to offer pleasant experiences that add spice to your life at more reasonable prices. Henn na Hotel Laguna Ten Bosch Nagoya Scheduled to open in 2022 H.I.S. Hotel Group VISON (Taki-cho, Mie) Scheduled to open in summer 2021 Henn na Hotel Huis Ten Bosch Henn na Hotel Nara Henn na Hotel Watermark Hotel Henn na Hotel Osaka Shinsaibashi Henn na Hotel Osaka Namba (former Osaka Nishi-shinsaibashi) Miyakojima Watermark Hotel Nagasaki Huis Ten Bosch Henn na Hotel Kansai Airport Scheduled to open in 2022 Scheduled to open in 2022 Hotel making a commitment to continue changing Kagoshima Implementing advanced technologies and The Watermark Hotel has been loved by technology robots, the robot-served hotel people in the world as a world-class hotel 変なホテル provides not only a comfortable stay but also since 1996, when the business first started in excitement and fun. -

Comfort Urban Smart

COMFORIA RESIDENTIAL REIT, INC ~Investor Presentation~ COMFORT 8th Fiscal Period (ended July 2014) September 2014 URBAN SMART Table of Contents 1. 8th Fiscal Period Highlights 5. Appendix Financial Highlights - 4 – P&L: 8th Period -23- Portfolio Highlights - 5 - Balance Sheet: 8th Period -24- 2. 8th Fiscal Period Results 8th ~ 9th Period Performance Forecast -25- Financial Results for the 8th Fiscal Period - 7 - CRR Characteristics -26- Stable Occupancy Rate - 8 - “COMFORIA” Series -27- Fluctuations in Rent Rate - 9 - “COMFORIA” Series Representative Properties -28- External Growth-①: PO Effect & Acquisition Portfolio Policy -29- Capacity -10- # of Net migration and Household in Tokyo 23 Wards -30- External Growth-②: Post-offering Acquisitions -11- Demand & Price Stability of Tokyo 23 Ward Assets -31- Property Management Initiatives -12- Portfolio Map (as at 8th FP end) -32- Financial Strategy-①: Borrowings & Bond Issue -13- Portfolio List -33- Financial Strategy-②: Financial Indicators Appraisal Value -36- (as at 8th FP end) -14- Occupancy and Rent Rates -39- Expansion of Retail Investor Base -15- Overview of Portfolio (as at 8th FP end) -40- 3. Future Strategy Status of Interest-bearing Debt (as at 8th FP end) -42- External Growth Targets -17- Unitholders (as at 8th FP end) -43- Solid External Growth-①: Historical Performance -18- Historical Unit Price -44- rd Solid External Growth-②: Opportunities Agenda of the 3 Unitholders’ Meeting -45- & Pipeline -19- Governance -46- 4. Performance Forecast Overview -

Discover Tokyo C1-C4 E

Basic Information about Tokyo Population: 13 million …One million Average Temperature and Precipitation Travel Times to Tokyo Celsius (℃) Fahrenheit (˚F) Precipitation (mm) City Flight time DISCOVER Taipei 3 hr 30 min January 6.1 43 52.3 Singapore 7 hr February 6.5 43.7 56.1 Seoul 2 hr 30 min 9.4 48.9 117.5 March Asia Hong Kong 4 hr 30 min April 14.6 58.3 124.5 Beijing 4 hr TOKYO Bangkok 6 hr 30 min May 18.9 66 137.8 Kuala Lumpur 7 hr June 22.1 71.8 167.7 An Unforgettable School Trip Chicago 11 hr 30 min 25.8 78.4 153.5 July Los Angeles 10 hr August 27.4 81.3 168.2 North America New York 12 hr 30 min September 23.8 74.8 209.9 San Francisco 9 hr Vancouver 8 hr 30 min October 18.5 65.3 197.8 Amsterdam 12 hr November 13.3 55.9 92.5 Europe London 12 hr 30 min December 8.7 47.7 51.0 Paris 12 hr 30 min Note: Approximate time it takes from airport to airport General Health and Safety Drinking Water Emergency Numbers In Tokyo, it’s perfectly safe to drink tap Police: Dial 110 water. Bottled mineral water is also easily available from automatic vending Ambulance: Dial 119 machines, convenience stores, and other places around the city. 6F Nisshin Bldg., 346-6 Yamabuki-cho, Shinjuku-ku, Tokyo 162-0801, Japan Tel: +81-3-5579-2683 Fax: +81-3-5579-2685 www.gotokyo.org/en/index.html [email protected] All rights reserved. -

Keio Presso Inn Otemachi

KEIO PRESSO INN OTEMACHI TEL Check-in 3:00 p.m. 03-3241-0202 We may cancel your reservation, if you do not arrive at the indicated FAX 03-3241-0203 arrival time without any notice. URL www.presso-inn.com/otemachi/ Check-out 10:00 a.m. 4-4-1 Honkokucho, Nihombashi, Chuo-ku, Number of Guest Rooms 386 Tokyo 103-0021 Number Room Type Room Size Capacity of Rooms Single 363Rooms 12m2 1Person Double 11Rooms 18m2 1-2 Persons Twin 11Rooms 18m2 1-2 Persons (Example pictured above) Universal- Complimentary Breakfast 1Room 24m2 1-2 Persons Designed Twin 6:30a.m. 9:30a.m. Kanda Sta. JR Yamanote Line Kamakurabashi South Mizuho Shin-nihombashi Tozai Line Ueno Exit Sta. Chugoku Bank Ginza Line Exit2 Mitsukoshi-mae Sta. JR Chuo Line/ Muromachi Sobu Line Kanda 3 chome COREDO Muromachi Edo Dori MINI STOP Mitsukoshimae Hanzomon Line Bank of Japan, Otemachi Sta. Chiyoda Line Otemachi Sta. Mitsukoshi Marunouchi Line Head Office Shin- Nihombashi River jobanbashi Marunouchi Line Otemachi Kayabacho Jobanbashi Hanzomon Line Ginza Line ExitB1 Tokyo Hanzomon Mitsukoshi-mae Sta. Toei Asakusa Line Nihombashi Line Shutoko Circular LineNihombashi Sta. Chiyoda Line Kasumigaseki ExitA5 COREDO Nihombashi ExitB6 Tozai Line Roppongi Tozai Line Otemachi Sta. Eitai Dori Nihombashi Sta. Otemachi Sta. Sta. Nihombashi Hibiya Ginza Line Hibiya Line Toei Mita Line Marunouchi Gofukubashi Ginza Nihombashi Sotobori Dori Toei Mita Line Oazo Exit Takashimaya Tokaido Shinkansen Marunouchi Line JR Keiyo Line Tokyo Sta. Yaesu North Showa Dori Shinagawa Hamamatsucho Exit Chuo Dori Monorail Tokyo Marunouchi North Exit Daimaru Marunouchi Tokyo Yaesu Dori Building Sta. -

Tokyo Subway Ticket

17-100 October 11, 2017 Tokyo Metro will expand the number of locations where its “Tokyo Subway Ticket” special passenger tickets for foreign visitors to Japan can be purchased! Also available for purchase at certain Tokyo Metro commuter pass sales counters starting Monday, October 16, 2017 Starting Monday, October 16, 2017, Tokyo Metro Co., Ltd. (Head Office in: Taito Ward, Tokyo; President: Akiyoshi Yamamura; “Tokyo Metro” below) will make its “Tokyo Subway Tickets,” which allow foreign visitors to Japan to take unlimited rides on all nine Tokyo Metro lines and all four Toei Subway Lines for a total of thirteen lines, available for purchase at certain Tokyo Metro commuter pass sales counters in addition to preexisting sales locations. Until now, these special passenger tickets were only available for purchase at the likes of locally-based travel agencies overseas, airports, hotels and certain traveler information centers. Based on the results of a questionnaire administered to foreign visitors to Japan in which many of them cited their desire to purchase Tokyo Subway Tickets in stations, Tokyo Metro has elected to offer the tickets for purchase at certain commuter pass sales counters Going forward, Tokyo Metro will continue endeavoring to make its railway services more convenient to use for foreign visitors to Japan. For details, please see the below. 1. Commuter Pass Sales Counters Where Tokyo Subway Tickets Are Available for Purchase (15 Locations Across 14 Stations) Ueno Station, Nihombashi Station, Ikebukuro Station, Ginza Station, Shimbashi Station, Shinjuku Station, Ebisu Station, Iidabashi Station, Takadanobaba Station, Akasaka-mitsuke Station, Meiji-jingumae Station <Harajuku>, Shin-ochanomizu Station, Otemachi Station and Tokyo Station *At Ikebukuro Station, Tokyo Subway Tickets can be purchased at the commuter pass sales corners for both the Marunouchi Line and the Yurakucho Line. -

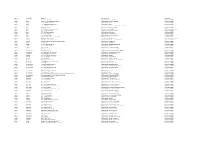

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho -

RESIDIA Minami-Shinagawa and 8 Other Properties>>

January 29, 2015 For Immediate Release Advance Residence Investment Corporation (Securities Code: 3269) 3-26 Kanda Nishiki-cho, Chiyoda-ku, Tokyo Kenji Kousaka, Executive Director Asset Management Company: AD Investment Management Co., Ltd. Kenji Kousaka, President Inquiries: Tomoyuki Kimura, Director, General Manager Corporate Management Department TEL. +81-3-3518-0480 Notice Concerning Acquisition of Investment Assets <<RESIDIA Minami-Shinagawa and 8 other properties>> AD Investment Management Co., Ltd, (ADIM) the asset management company to which Advance Residence Investment Corporation (ADR) entrusts the management of its assets announced its decision today to have ADR acquire assets (hereafter, the “Acquisition”) in Japan as detailed below as part of ADR`s growth strategy. 1. Details of the Acquisition ADIM decided on the following acquisitions pursuant to the target and policy of asset management as stipulated in its Articles of Incorporation of ADR, to increase the asset under management and build a portfolio that earns stable income through diversified investment in all regions and in all apartment unit types. Property No. Name of the to-be-acquired asset (Note 1) Type of asset(Note 2) Proposed acquisition price (Note 3) number Beneficiary interests in trust (1) P-103 RESIDIA Minami-Shinagawa (planned) ¥1,177 million (2) P-104 Chester Court Ochanomizu Beneficiary interests in trust ¥3,117 million RESIDIA Kanda-Iwamotocho II (3) P-105 Beneficiary interests in trust ¥1,280 million (Chester House Iwamotocho) RESIDIA Shinagawa (4) -

Notification Concerning Acquisition of Domestic Real Estate Properties and Domestic Real Estate Trust Beneficiary Interest

February 7, 2013 To All Concerned Parties Issuer of Real Estate Investment Trust Securities 1-1, Nihonbashi-Muromachi 2-chome, Chuo-ku, Tokyo 103-0022 Nippon Accommodations Fund Inc. Executive Director Yuji Yokoyama (Code number 3226) Investment Trust Management Company Mitsui Fudosan Accommodations Fund Management Co., Ltd. President and CEO Kosei Murakami Contact CFO and Director Satoshi Nohara (TEL. 03-3246-3677) Notification Concerning Acquisition of Domestic Real Estate Properties and Domestic Real Estate Trust Beneficiary Interest Nippon Accommodations Fund Inc. (“NAF“) hereby provides notice of its decision regarding its acquisition of real estate properties as well as real estate trust beneficiary interest in Japan as shown below. 1. Reason for acquisition Based on the provisions for investments and policies on asset management provided in Article of Incorporation, the decision to acquire the following properties was made to ensure the steady growth of the whole portfolio, and for the diversification and further enhancement of the investment portfolio in Tokyo's 23 wards, and the Tokyo area. 2. Overview of acquisitions Acquisition price Type of property to be Name of property to be acquired (Note 1) acquired (Thousands of yen) Property 1 Park Cube Nihonbashi Suitengu (Note 2) Trust beneficiary interest 2,711,000 Property 2 Park Cube Ginza East (Note 3) Trust beneficiary interest 2,269,000 Property 3 Park Cube Kayabacho (Note 4) Real estate (Note 6) 1,105,000 Property 4 Park Cube Honjo Azumabashi (Note 5) Real estate (Note 6) 1,252,000