Academic Calendar, Payment Periods, & Disbursements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Law School Calendar Academic Year 2021 - 2022 August

LAW SCHOOL CALENDAR ACADEMIC YEAR 2021 - 2022 AUGUST 19 - 20 Thursday and Friday First-Year Orientation 23 Monday Classes Begin 1 31 Tuesday Last day to drop a class without a grade of “W” and to change from credit to audit SEPTEMBER 6 Monday Labor Day – No Classes OCTOBER 12 Tuesday Last day to drop a class with a grade of “W” NOVEMBER 24 - 28 Wednesday – Sunday Thanksgiving Holiday – No Classes DECEMBER 2 Thursday Last Day of Classes 3 Friday Study Day 6 Monday Examinations Begin 16 Thursday Examinations End JANUARY 17 Monday Birthday of Martin Luther King, Jr. 18 Tuesday Classes Begin 26 Wednesday Last day to drop a class without a grade of “W” and to change from credit to audit MARCH 1 Tuesday Last day to drop a class with a grade of “W” 13 – 20 Sunday – Sunday Spring Break – No Classes APRIL 15 - 17 Friday – Sunday Easter Holiday – No Classes 28 Thursday Last Day of Classes – No Classes beginning after 4:45 pm 29 Friday Study Day MAY 2 Monday Exams Begin 12 Thursday Examinations End 21 Saturday Law School Hooding Ceremony 22 Sunday Graduation Approved 2/15/2021 SELECTED RELIGIOUS OBSERVANCES ACADEMIC YEAR 2021-2022 ALL JEWISH HOLIDAYS BEGIN AT SUNDOWN THE DAY BEFORE THE DATE LISTED JULY 12 Rath Yatra – Hindu 18 Tisha B’Av – Jewish 20 Eid al Adha – Islamic 31 Feast of St. Ignatius – Catholic AUGUST 15 Assumption of the Blessed Virgin Mary – Catholic 18 Ashura – Islamic SEPTEMBER 7-8 Rosh Hashanah – Jewish 16 Yom Kippur – Jewish 21-27 Sukkot – Jewish OCTOBER 15 Dussehra – Hindu NOVEMBER 1 All Saints’ Day – Catholic 4 Diwali (Deepavalia) -

20210521 2021-2022 Academic Year Calendar

Phillips Brooks School 2021–2022 Calendar • July 2021 – June 2022 Mon., Jan. 3 • All-employee professional day (no school, office open) July 2021 August 2021 September 2021 Summer@PBS Learn more at phillipsbrooks.org/summer Tue., Jan. 4 • School resumes after winter vacation Su M Tu W Th F Sa Su M Tu W Th F Sa Su M Tu W Th F Sa Enrichment Camps and Online Learning Fri., Jan. 14 • Progress Reports distributed to parents 1 2 3 1 2 3 4 5 6 7 1 2 3 4 Week 1: June 21–25 Week 4: July 19–23 Mon., Jan. 17 • Martin Luther King Jr. Day holiday (office closed) 4 5 6 7 8 9 10 8 9 10 11 12 13 14 5 6 7 8 9 10 11 Week 2: June 28 – July 2 Week 5: July 26–30 Fri., Feb. 18 • PS–5 regular dismissal time for February vacation Week 3: July 12–16 Week 6: Aug. 2–6 11 12 13 14 15 16 17 15 16 17 18 19 20 21 12 13 14 15 16 17 18 Mon., Feb. 21 • Presidents Day holiday (office closed) Day Camp 18 19 20 21 22 23 24 22 23 24 25 26 27 28 19 20 21 22 23 24 25 Tue., Feb. 22 – Fri., Feb. 25 • February vacation (office open) Session 1 (3 weeks): 25 26 27 28 29 30 31 29 30 31 26 27 28 29 30 Mon., Feb. 28 • School resumes after February vacation June 14–18 • June 21–25 • June 28 – July 2 Fri., Mar. -

Academic-Calendar-2019-2020.Pdf

Academic Year Calendar 2019 – 2020 FALL SEMESTER 2019 Monday August 26 Official beginning of Academic Year Faculty return for professional week Monday September 2 College closed for Labor Day holiday Tuesday September 3 Fall semester classes begin Saturday-Sunday September 7-8 Fall semester weekend classes begin Wednesday November 27 No classes for students Non-instructional duty day for faculty Thursday-Sunday November 28-December 1 College closed for Thanksgiving holiday Monday-Sunday December 16–22 Final exams week Sunday December 22 Official end of fall semester Monday-Wednesday December 23–January 1 Winter break; College closed WINTER SESSION 2020 Monday December 23 Online only classes begin Monday January 6 Campus based and short session online classes begin Monday January 20 College closed for Dr. Martin Luther King, Jr. holiday Friday January 24 Winter session classes end SPRING SEMESTER 2020 Monday December 23 Official beginning of spring semester Monday January 20 College closed for Dr. Martin Luther King, Jr. holiday Tuesday January 21 Faculty return for professional days Monday January 27 Spring semester classes begin Saturday-Sunday February 1-2 Spring semester weekend classes begin Monday-Sunday March 16-22 Spring recess for students and faculty Friday March 20 Spring break; College closed Monday-Sunday May 11-17 Final exams week Monday-Friday May 18-22 Non-instructional duty days for faculty Friday May 22 Commencement Official end of spring semester/Academic Year SUMMER SESSION 2020 Monday May 25 Official beginning of summer sessions Monday May 25 College closed for Memorial Day holiday Tuesday May 26 Summer session I classes begin Monday June 15 Midsummer session classes begin Friday July 3 College closed for Independence Day holiday Monday July 6 Summer session II classes begin Friday August 21 Official end of summer sessions. -

Academic Calendar 2020-2021.Indd

Roycemore 2020-2021 Academic Year Calendar (Subject to change) Tuesday, August 18 New Parent Orientation & Dinner Wednesday, August 19 Faculty Returns Friday, August 21 Roycemore Family Association Back-to-School Griffin Gathering Monday, August 24 Orientation for New Students, International Student, 5th Grade Students, and 9th Grade Students Tuesday, August 25 SCHOOL OPENS - Regular Class Schedule Begins Thursday, September 3 Miniature School Night for Parents Thursday, September 7 NO SCHOOL – Labor Day (no EDP) Monday, September 28 NO SCHOOL – Yom Kippur (EDP available) Monday, October 12 NO SCHOOL – Faculty Professional Day (no EDP) Sunday, October 25 Fall Admissions Open House Friday, October 30 Carnival Friday, November 6 NO SCHOOL – Parent-Teacher Conferences (no EDP) Tuesday, November 24 Grandparents & Special Friends Day November 25 - November 27 NO SCHOOL – Thanksgiving Break December 15-18 Semester Exams (9th-12th Grade) December 21 - January 1 NO SCHOOL – Winter Break Monday, January 4 School Resumes, Upper School January Short Term Begins January 4 - January 22 January Short Term (9th - 12th Grade) Monday, January 18 NO SCHOOL – Martin Luther King Jr. Day Observed January 19-22 P3 / Experience Week (5th-8th Grade) Friday, February 12 NO SCHOOL – Faculty Professional Day Monday, February 15 NO SCHOOL – Presidents’ Day Friday, February 26 NO SCHOOL for LS/MS – Parent-Teacher Conferences (no EDP) Friday, March 12 PALIO – School dismissed at 11:30am (EDP available) Wednesday, March 17 Junior Palio - 8:45-10:00am March 22 - April -

2020-2021 Academic Year Grid ALL 11X17

Fall 2020 Spring 2021 Summer 2021* EVENTS / DEADLINES Session 1 Session 1 Session 2 Session 3 Session 4 Session 5 Session 6 Winter Mini Session 2 Session 3 Session 4 Session 5 Session 6 Summer Mini Session 1 Session 2 Session 3 Session 4 Regular Regular First Day of Classes September 28, October 19, November 2, December 21, February 22, *Please also see notes below August 24, 2020 August 24, 2020 August 24, 2020 January 19, 2021 January 19, 2021 January 19, 2021 March 22, 2021 April 5, 2021 May 17, 2021 June 7, 2021 June 7, 2021 June 7, 2021 July 12, 2021 2020 2020 2020 2020 2021 regarding college-specific dates and Monday Monday Monday Tuesday Tuesday Tuesday Monday Monday Monday Monday Monday Monday Monday Monday Monday Monday Monday Monday summer sessions meeting days. Labor Day Holiday (Fall); September 7, 2020 January 18, 2021 May 31, 2021 Martin Luther King Holiday (Spring); Monday Monday Monday Memorial Day (Summer) **Extended** September 30, October 21, November 4, December 22, February 24, Last Day to Add a Class September 1, August 26, 2020 August 26, 2020 January 26, 2021 January 21, 2021 January 21, 2021 March 24, 2021 April 7, 2021 May 18, 2021 June 8, 2021 June 8, 2021 June 8, 2021 July 13, 2021 2020 2020 2020 2020 2021 or be enrolled from the Wait List 2020 Wednesday Wednesday Tuesday Thursday Thursday Wednesday Wednesday Tuesday Tuesday Tuesday Tuesday Tuesday Wednesday Wednesday Wednesday Tuesday Wednesday Tuesday ORD - Official Reporting Day Last day to drop a course or withdraw without receiving a grade Last day to -

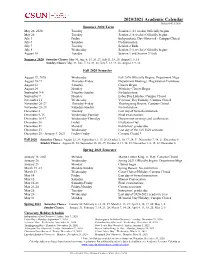

2020/2021 Academic Calendar

2020/2021 Academic Calendar Updated 4/15/2020 Summer 2020 Term May 26, 2020 Tuesday Session 1 (12 weeks) Officially begins May 26 Tuesday Session 2 (6 weeks) Officially begins July 3 Friday Independence Day Observed - Campus Closed July 4 Saturday No Instruction July 7 Tuesday Session 2 Ends July 8 Wednesday Session 3 (6 weeks) Officially begins August 18 Tuesday Session 1 and Session 3 Ends Summer 2020 Saturday Classes: May 30; June 6, 13, 20, 27; July 11, 18, 25; August 1, 8, 15 Sunday Classes: May 31; June 7, 14, 21, 28; July 5, 12, 19, 26; August 2, 9, 16 Fall 2020 Semester August 19, 2020 Wednesday Fall 2020 Officially Begins; Department Mtgs August 20-21 Thursday-Friday Department Meetings / Registration Continues August 22 Saturday Classes Begin August 24 Monday Weekday Classes Begin September 5-6 Saturday-Sunday No Instruction September 7 Monday Labor Day Holiday; Campus Closed November 11 Wednesday Veterans’ Day Holiday; Campus Closed November 26-27 Thursday-Friday Thanksgiving Recess; Campus Closed November 28-29 Saturday -Sunday No Instruction December 8 Tuesday Last day of formal instruction December 9-15 Wednesday-Tuesday Final examinations December 16-17 Wednesday-Thursday Department meetings and conferences December 18 Friday Evaluation Day December 21 Monday Instructors' grades due December 23 Wednesday Last day of the Fall 2020 semester December 25 - January 1, 2021 Friday-Friday Campus Closed * Fall 2020 Saturday Classes: August 22, 29; September 12, 19, 26; October 3, 10, 17, 24, 31; November 7, 14, 21; December 5 Sunday Classes: August 23, 30; September 13, 20, 27; October 4, 11, 18, 25; November 1, 8, 15, 22; December 6 Spring 2021 Semester January 18, 2021 Monday Martin Luther King, Jr. -

2020-21 IVC Academic Calendar

LAST ACADEMIC YEAR IImperialmperial VValleyalley CCollegeollege JULY 2020 S M T W R F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Academic Calendar 26 27 28 29 30 31 July 2 - Independence Day (Campus Closed) 2020-2021 July 30 - Summer Session Classes End 2020 FALL SEMESTER AUGUST 2020 SEPTEMBER 2020 OCTOBER 2020 NOVEMBER 2020 DECEMBER 2020 S M T W R F S S M T W R F S S M T W R F S S M T W R F S S M T W R F S 1 1 2 3 4 5 1 2 3 1 2 3 4 5 6 7 1 2 3 4 5 2 3 4 5 6 7 8 6 7 8 9 10 11 12 4 5 6 7 8 9 10 8 9 10 11 12 13 14 6 7 8 9 10 11 12 9 10 11 12 13 14 15 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 13 14 15 16 17 18 19 16 17 18 19 20 21 22 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 20 21 22 23 24 25 26 23 24 25 26 27 28 29 27 28 29 30 25 26 27 28 29 30 31 29 30 27 28 29 30 31 30 31 Aug 3-6, 10-13 - No Classes (Campus Open) Sep 7 - Labor Day (Campus Closed) Nov 11 - Veterans Day (Campus Closed) Dec 12 - Fall Semester Classes End Aug 14 -Convocation (Mandatory/All Campus) Nov 23-24 - No Classes (Campus Open) Dec 14-18 - No Classes (Campus Open) Aug 17 - Fall Semester Classes Begin Nov 25-28 - Thanksgiving (Campus Closed) Dec 21-31 - Winter Recess (Campus Closed) 2021 WINTER INTERSESSION 2021 SPRING SEMESTER JANUARY 2021 FEBRUARY 2021 MARCH 2021 APRIL 2021 MAY 2021 S M T W R F S S M T W R F S S M T W R F S S M T W R F S S M T W R F S 1 2 1 2 3 4 5 6 1 2 3 4 5 6 1 2 3 1 3 4 5 6 7 8 9 7 8 9 10 11 12 13 7 8 9 10 11 12 13 4 5 6 7 8 9 10 2 3 4 5 6 7 8 10 11 12 13 14 15 16 14 15 16 17 18 19 20 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 17 18 19 20 21 22 23 21 22 23 24 25 26 27 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 24 25 26 27 28 29 30 28 28 29 30 31 25 26 27 28 29 30 23 24 25 26 27 28 29 31 30 31 Jan 1 - New Year's Day (Campus Closed) Feb 4 - Winter Session Classes End April 5-10 - Spring Recess (Campus Closed) May 31 - Memorial Day (Campus Closed) Jan 4 - Winter Session Classes Begin Feb 5, 8-11 - No Classes (Campus Open) Jan 18 - MLK Jr. -

Academic Year Calendar 2021-22

Concord Academy 2021-22 Academic Calendar August 27 New student registration January 28 New student orientation 9 Houses open at 4:00p.m.; boarding students 29 Boarding student orientation return by 8:00 p.m. 30 Returning student registration 10 Second semester classes begin Athletic preseason begins 17 Martin Luther King, Jr Day; school in 31 Convocation; First semester classes begin session February September 1 Lunar New Year; school in session 3 Class Day 21 Presidents’ Day; no classes; houses open 6 Labor Day; school in session 7-8 Rosh Hashanah; school in session March 16 Yom Kippur; no classes; houses 2 Ash Wednesday; school in session open 4 Second semester break begins at noon; 20-27 Sukkot; school in session students depart between 12:00 p.m. and 4:00 p.m.; houses close and school is closed October 21 Second semester break ends; Houses open at 7-9 Family Weekend 4:00 p.m.; boarding students return by 8:00 9-12 Fall break; no classes; houses open p.m. 11 Indigenous Peoples' Day; offices open 22 Second semester classes resume 13 First semester classes resume 25 Senior Transition Seminar (mandatory) 23 Chandler Bowl 25-26 Junior Leadership Retreat (mandatory) 30 Admission Open House April November 2 Ramadan (ends May 1); school in session 4 Diwali; school in session 4, 6, 8 Admission Revisit Days 11 Veterans Day; school in session 15 Passover; school in session 19 Thanksgiving Break begins at 15 Good Friday; school in session 6 p.m. or after last commitment 18 Patriots’ Day; no classes; houses open 20 Boarding students depart by -

Bowdoin College 219Th Academic Year

Bowdoin College 219th Academic Year Fall 2020 August 29, Saturday First Year and Transfer Student arrival day August 29-Sept. 1, Sat.-Tues. Orientation August 30, Sunday College housing ready for occupancy for upperclass students, noon September 1, Tuesday Opening of the College—Convocation, 3:30 pm September 2, Wednesday Fall semester classes begin, 8:30 pm September 13-19, Sun-Sat. Explore Bowdoin I September 24-26, Thurs.-Sat. Alumni Council, Alumni Fund Directors and BRAVO National Advisory Board meetings October 2-4, Fri.-Sun. Homecoming Weekend October 9, Friday Fall vacation begins after last class October 14, Wednesday Fall vacation ends, 8:30 am October 15-17, Thurs.-Sat. Meetings of the Board of Trustees October 18-24, Sun.-Sat. Explore Bowdoin II October 23, Friday Sarah and James Bowdoin Day October 23-25, Fri.-Sun. Family Weekend November 3, Tuesday Election Day November 21, Saturday College housing closes, 5 pm November 25, Wednesday Thanksgiving vacation begins, 8:30 am November 30, Monday Thanksgiving vacation ends, 8:30 am December 11, Friday Last day of classes December 12-15, Sat.-Tues. Reading period December 16-21, Wed.-Mon. Fall semester examinations Dec. 24-Jan. 11, Thurs.-Mon. College holidays, most offices closed Spring 2021 (as of 01/21/21) February 4-6, Thurs.-Sat. Meetings of the Board of Trustees February 5-6, Fri.-Sat. Move-in timeslots available 9:00 am -6:00 pm each day (tentative) February 8, Monday Spring semester classes begin, 8:30 am March 19, Friday Spring vacation begins after last class March 24, Wednesday Spring vacation ends, 8:30 am March 25-27, Thurs.-Sat. -

HIGHER EDUCATION in ESTONIA HIGHER EDUCATION in ESTONIA ARCHIMEDES FOUNDATION Estonian Academic Recognition Information Centre

HIGHER EDUCATION IN ESTONIA HIGHER EDUCATION IN ESTONIA ARCHIMEDES FOUNDATION Estonian Academic Recognition Information Centre HIGHER EDUCATION IN ESTONIA Fourth Edition TALLINN 2010 Compiled and edited by: Gunnar Vaht Liia Tüür Ülla Kulasalu With the support of the Lifelong Learning Programme/NARIC action of the European Union Cover design and layout: AS Ajakirjade Kirjastus ISBN 978-9949-9062-6-0 HIGHER EDUCATION IN ESTONIA PREFACE The current publication is the fourth edition of Higher Education in Es- tonia. The first edition was compiled in collaboration with the Estonian Ministry of Education in 1998, the second and the third (revised) edition appeared in 2001 and 2004 respectively. This edition has been considerably revised and updated to reflect the many changes that have taken place in the course of higher education reforms in general, and in the systems of higher education cycles and qualifications in particular, including the changes in the quality assess- ment procedures. The publication is an information tool for all those concerned with higher education in its international context. It contains information about the Estonian higher education system and the higher education institutions, meant primarily for use by credential evaluation and recognition bodies, such as recognition information centres, higher education institutions and employers. This information is necessary for a better understanding of Estonian qualifications and for their fair recognition in foreign countries. Taking into account the fact that credential evaluators and competent recogni- tion authorities in other countries will come across qualifications of the former systems, this book describes not only the current higher educa- tion system and the corresponding qualifications, but also the qualifica- tions of the former systems beginning with the Soviet period. -

Ces Academic Calendar 2020/2021

CES ACADEMIC CALENDAR ACADEMIC YEAR AND DURATION OF PROGRAMMES 2020/2021 A. Scheduled Academic Year The academic year is defined as running from 1 October until the following 30 September. This is the academic year which is used to determine the length of most bureaucratic procedures such as bank loans and insurance. B. Semesters In Poland, the academic year is divided into two semesters. In 2020/2021, they will be: 1st semester: 2 October 2020 – 28 January 2021 regular classes for all programmes at JU 2 October – 11 December 2020 classes for SA Programme at CES 14 December – 18 December 2020 exams for SA programme* 29 January – 10 February 2021 regular exams 18 – 24 February 2021 regular re-sit exams** 2nd semester: 25 February 2021 – 30 June 2021 regular classes for all programmes at JU 25 February 2021 – 15 June 2021 classes for SA Programme at CES 16 – 29 June 2021 regular exams (for SA programme as well) 1 – 15 September 2021 regular re-sit exams** *Please note that due to the difference in academic calendars between sending university and JU, study abroad students may either finish their 1st semester abroad in mid-December or stay till mid-January to finish MA-level and other JU courses. CES courses dedicated to SA Students finish December 11, with exams following shortly after, however MA-level and other JU courses last until the end of January, with exams in late January and early February. Please notify CES staff of your preference, so that they may advise on courses as well as visas in due time. -

2022 Academic Year 2021 Spring Semester 22.02.2021

Bachelor degree programs (BSc) Master degree programs (MSc) Schedule for the 2021 - 2023 Academic Year From To 2021/2022 Fall Semester 20.09.2021 05.02.2022 Orientation week for new students 13.09.2021 17.09.2021 Semester weeks - 2021/2022 Fall Semester 20.09.2021 23.12.2021 Student orientation, 17:30 - 18:00 pm, Webex: (Link to follow), Bachelor's thesis (cohorts 2018 part-time and 2019 full-time students only) 04.10.2021 Student orientation, 18.:00 - 18:30 pm, Aula (SW E11), Bachelor's thesis (cohorts 2018 part-time and 2019 full-time students only) 06.10.2021 Student orientation, 12:00 - 12:30 pm, Webex: (Link to follow), Bachelor's thesis (cohorts 2018 part-time and 2019 full-time students only) 07.10.2021 Student orientation, 17:00 - 18:00 pm , SW 101: selection of specialization (cohorts BSc BA 2020 part-time students only) 27.09.2021 Student orientation, 17:00 - 18:00 pm , Online Webex: selection of specialization (cohorts BSc Business Information Technology 2020 part-time students only) 27.09.2021 Selection of specialization (cohorts BSc Business Administration 2020 part-time students only) - (11.10.2021 - 15.10.2021 interruption Selection of discipline) 04.10.2021 (11:00 Uhr) 28.10.2021 (16:00 Uhr) Selection of specialization (cohorts BSc Business Information Technology 2020 part-time students only) - (11.10.2021 - 15.10.2021 interruption Selection of discipline) 04.10.2021 (11:00 Uhr) 22.10.2021 (16:00 Uhr) Release of examination schedule and provisional seating plan for end-of-module exams 2021/2022 Fall Semester 23.11.2021