Unlocking Broadband for All Appendix

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trends in the U.S. International Telecommunications Industry

TRENDS IN THE U.S. INTERNATIONAL TELECOMMUNICATIONS INDUSTRY Jim Lande Linda Blake Industry Analysis Division Common Carrier Bureau Federal Communications Commission June 1997 This report is available for reference in the Common Carrier Bureau's Public Reference Room, 2000 M Street, N.W., Room 575. Copies may be purchased by calling International Transcription Services, Inc. (ITS) at (202) 857-3800. The report can be downloaded [file name: ITLTRD97.ZIP] from the FCC- State Link internet site (http://www.fcc.gov/ccb/stats) on the World Wide Web. The report can also be downloaded from the FCC-State Link computer bulletin board system at (202) 418-0241. TRENDS IN THE U.S. INTERNATIONAL TELECOMMUNICATIONS INDUSTRY June 1997 Contents I. Service Growth, Facilities and Price Trends 1 A. Service Growth 1 B. International Facilities 21 C. Price Trends 26 II. Market Structure 37 A. Resale 37 B. Mergers and Acquisitions 41 C. Global Alliances and the WTO Agreement 43 D. Changes in Market Share 44 III. Accounting Rates and Settlement Payments 55 Appendix A: Notes on the Data 73 Appendix B: International Telephone Traffic with Canada 79 Appendix C: International Telephone Traffic with Mexico 80 Tables I. Service Growth, Facilities and Price Trends Table 1: International and Domestic Toll Service Revenues, 1950 to 1995 2 Table 2: International Revenue and Operating Statistics 6 Table 3: International Telephone Service Excluding Canada and Mexico 8 Table 4: International Telephone Service Traffic Data 10 Table 5: International Telex Service Traffic -

SAP S/4HANA Led Digital Transformation Globe Telecom Inc. Company Information

SAP® Innovation Awards 2020 Entry Pitch Deck SAP S/4HANA led Digital Transformation Globe Telecom Inc. Company Information Headquarters Manila, Philippines Industry Communications services, Remittance Web site https://www.globe.com.ph/ Globe Telecom, Inc., commonly shortened as Globe, is a major provider of telecommunications services in the Philippines. It operates one of the largest mobile, fixed line, and broadband networks in the country. Globe Telecom's mobile subscriber base reached 60.7 million as of end-December 2017 © 2019 SAP SE or an SAP affiliate company. All rights reserved. ǀ PUBLIC 2 SAP S/4HANA led Digital Transformation Globe Telecom Inc. Challenge Globe Telecom has been using SAP for all their business units globally spread across business functions of finance & accounting, procurement, and sales & distribution. Over a period of time, processes became fragmented and inefficient due to manual interventions, causing concerns over unavailability of required business insights, delay in decision making, user’s productivity and their experience. It realized the need of having next-gen ERP enabling best-in class business operations and workplace experience supporting ever changing business needs and future innovations Solution Globe Telecom partnered with TCS for consulting led SAP S/4HANA conversion. With TCS’ advisory services and industry best practices, Globe Telecom has been able to standardize, simplify, integrate, automate and optimize 50+ business processes across the business units. TCS leveraged proprietary transformation delivery methodology, tools and accelerators throughout the engagement ensuring faster time to market minimizing business disruptions. Outcome With SAP S/4HANA, Globe Telecom is able to improve system performance, speed up processing of financial transactions, faster & error free closing of books, cash flow reporting and management reporting. -

Affordability-Report-2020.Pdf

A global coalition working to make broadband affordable for all AFFORDABILITY REPORT 2020 www.a4ai.org ACKNOWLEDGEMENTS This report was written by and prepared under the direction of Teddy Woodhouse, with contributions from Ana María Rodríguez. It was edited by Lisa van Wyk. Additional comments and suggestions were provided by Carlos Iglesias, Sonia Jorge, Anju Mangal, and Eleanor Sarpong. The Affordability Drivers Index research and calculations were carried out by Siaka Lougue (African Institute for Mathematical Sciences) and Ana María Rodríguez, with support from Carlos Iglesias. A global team of 25 independent researchers assisted the Alliance in conducting the 72 comprehensive policy surveys that inform the report’s findings this year and provide the basis for the policy scores in the Affordability Drivers Index. We thank them for their contributions. The authors also wish to thank the interviewees from around the world and from various backgrounds who contributed their time and insights to help inform the analysis and recommendations of this report. Any errors remain the authors’ alone. Finally, we are grateful for the support of A4AI’s global sponsors — Sida and Google — and that of the Alliance’s entire membership. Suggested citation: Alliance for Affordable Internet (2020). The Affordability Report 2020. Web Foundation. This report is made available under a Creative Commons 4.0 International licence. For media or other inquiries: [email protected]. CONTENTS Welcome Letter from the Executive Director 4 Executive Summary -

Update on Equity Stake in Indus Towers

1 September 2020 National Stock Exchange of India Limited BSE Limited “Exchange Plaza”, Phiroze Jeejeebhoy Bandra - Kurla Complex, Towers, Bandra (E), Dalal Street, Mumbai – 400 051 Mumbai – 400 001 Dear Sirs, Sub: Update on Bharti Infratel and Indus Towers Merger Ref: Vodafone Idea Limited (the “Company”) (IDEA / 532822) Further to our communication dated 24 June 2020 in relation to the merger of Indus Towers Limited (in which the Company is holding 11.15% equity stake) with Bharti Infratel Limited (“Merger”), please find attached a press release titled “Update on Bharti Infratel and Indus Towers Merger”, being issued to media. The above is for your information and dissemination to the members. Thanking you, Yours truly, For Vodafone Idea Limited Pankaj Kapdeo Company Secretary Encl: As above Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group and Vodafone partnership Birla Centurion, 9th to 12th Floor, Century Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai – 400 030. T: +91 95940 04000F: +91 22 2482 0093 www.vodafoneidea.com Registered Office: Suman Tower, Plot no. 18, Sector 11, Gandhinagar – 382 011, Gujarat. T +91 79 6671 4000 F +91 79 2323 2251 CIN: L32100GJ1996PLC030976 Media Release – September 01, 2020 Update on Bharti Infratel and Indus Towers Merger Vodafone Idea Limited (“VIL”), Vodafone Group Plc (“Vodafone”), Bharti Airtel Limited (“Bharti Airtel”), Indus Towers Limited (“Indus”) and Bharti Infratel Limited (“Infratel”) (collectively referred as “Parties” and individually as “Party”) have agreed to proceed with completion of the merger of Indus and Infratel. VIL has undertaken to sell its 11.15% stake in Indus for cash. -

From Telkom to Hellkom1: a Critical Reflection on the Current Telecommunication Policy in South Africa from a Social Justice Perspective

ARTICLE IN PRESS + MODEL The International Information & Library Review (2008) xx,1e7 available at www.sciencedirect.com journal homepage: www.elsevier.com/locate/iilr To talk or not to talk? From Telkom to Hellkom1: A critical reflection on the current telecommunication policy in South Africa from a social justice perspective S.R. Ponelis a, J.J. Britz a,b,* a Department of Information Science, School of Information Technology, University of Pretoria, 0002 Pretoria, South Africa b School of Information Studies, University of Wisconsin-Milwaukee, 3210 N, Maryland Avenue, Milwaukee WI 53211, United States KEYWORDS Abstract With the development of new information and communication technologies, the Telecommunications; right to communicate assumes new dimensions, since it is almost impossible to fully participate Right to communicate; in the globalized world without access to modern information and communication technolo- South Africa; gies. South Africa held its first democratic elections in 1994 and has subsequently returned Telkom; to the international arena. Its citizens should rightly expect to be able to participate in all that Social justice this return offers, not only politically, but also economically and socially. Telecommunications are vital to making such participation possible. In recognition of this fact, the newly elected government developed policies and enacted legislation to ensure that the telecommunications sector, and specifically the sole fixed line service provider Telkom, provides South African citi- zens affordable access to the telecommunications infrastructure whilst providing acceptable levels of service. However, rather than meeting its obligation to the government and the people of South Africa, Telkom has misused its monopoly. The social injustice that this situa- tion creates is critically examined against the background of the right to communicate based on Rawls’ principles of social justice and Sen’s capability approach. -

National Broadband Strategy 2018-2023

The National Broadband Strategy 2018-2023 REPUBLIC OF KENYA NATIONAL BROADBAND STRATEGY 2018-2023 1 The National Broadband Strategy 2018-2023 ACKNOWLEDGEMENTS This strategy is a culmination of collaborative work that could not have been completed without the support of the government and the concerted efforts of the National Broadband Strategy (NBS) Steering Committee and stakeholders including Information and Communications Technology (ICT) infrastructure providers, service providers, the education sector, finance, complementary infrastructure sectors including Roads and Energy, special interest groups and the general public each of whom devoted their time, effort and expertise. It would not have been possible to develop the strategy without the invaluable input from the Cabinet Secretary Ministry of Information and Communication Technology (MoICT), Principal Secretaries in the Ministry, other Ministries, Departments and Agencies (MDAs), senior officials, the Communications Authority of Kenya (CA) and officials from other Government Ministries who took time to participate in extensive consultations that helped shape this Strategy. The Strategy echoes the country’s commitment to leverage on broadband as an enabler towards a globally competitive knowledge-based society and it is our hope that the same collaborative commitment and spirit that enriched the development of this Strategy will be carried forward for the successful implementation of the Strategy. 2 The National Broadband Strategy 2018-2023 TABLE OF CONTENTS ACKNOWLEDGEMENTS ........................................................................................................................................ -

UL-ISP Licences Final March 2015.Xlsx

Unified License of ISP Authorization S. No. Name of Licensee Cate Service Authorized person Registered Office Address Contact No. LanLine gory area 1 Mukand Infotel Pvt. Ltd. B Assam Rishi Gupta AC Dutta Lane , FA Road 0361-2450310 fax: no. Kumarpara, Guwahati- 781001, 03612464847 Asaam 2 Edge Telecommunications B Delhi Ajay Jain 1/9875, Gali No. 1, West Gorakh 011-45719242 Pvt. Ltd. Park, Shahdara, Delhi – 110032 3 Southern Online Bio B Andhra Satish kumar Nanubala A3, 3rd Floor, Office Block, Samrat 040-23241999 Technologies Ltd Pradesh Complex, Saifabad, Hyderabad-500 004 4 Blaze Net Limited B Gujarat and Sharad Varia 20, Paraskunj Society, Part I, Nr. 079-26405996/97,Fax- Mumbai Umiyavijay, Satellite Road, 07926405998 Ahmedabad-380015 Gujarat 5 Unified Voice Communication B + Tamilnadu K.Rajubharathan Old No. 14 (New No. 35), 4th Main 044-45585353 Pvt. Ltd. C (including Road, CIT Nagar, Nanthanam, Chennai)+ Chennai – 600035 Bangalore 6 Synchrist Network Services Pvt. B Mumbai Mr. Kiran Kumar Katara Shop No. 5, New Lake Palace Co- 022-61488888 Ltd , Director op-Hsg. Ltd., Plot No. 7-B, Opp Adishankaracharya Road, Powai, Mumbai – 400076 (MH) 7 Vala Infotech Pvt. Ltd. B Gujarat Mr. Bharat R Vala, Dhanlaxmi Building, Room No. 309, (02637) 243752. Fax M.D. 3rd Floor, Near Central Bank, (02637) 254191 Navsari – 396445 Gujarat 8 Arjun Telecom Pvt. C Chengalpatt Mr. N.Kannapaan, New No. 1, Old No. 4, 1st Floor, 044-43806716 Ltd(cancelled) u Managing Direcot, Kamakodi Nagar, Valasaravakkam, (Kancheepu Chennai – 600087 ram) 9 CNS Infotel Services Pvt. Ltd. B Jammu & Reyaz Ahmed Mir M.A. -

Investor Presentation

Investor Presentation September 30, 2008 Disclaimer This presentation has been prepared by SK Telecom Co., Ltd. (“the Company”). This presentation is being presented solely for your information and is subject to change without notice. No representation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, fairness or completeness of the information presented. The Company, its affiliates, advisers or representatives accept no liability whatsoever for any losses arising from any information contained in the presentation. This presentation does not constitute an offer or invitation to purchase or subscribe for any shares of the Company, and no part of this presentation shall form the basis of or be relied upon in connection with any contract or commitment. The contents of this presentation may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose. 1 TableTable ofof ContentsContents 1 Industry Overview 2 Financial Results 3 Growth Strategy 4 Investment Assets & Commitments to Shareholders 2 1 Industry Overview 2 Financial Results 3 Growth Strategy 4 Investment Assets & Commitments to Shareholders 3 OverviewOverview ofof KoreanKorean WirelessWireless MarketMarket Revenue growth driver is shifting to wireless data sector (000s, %) Subscriber Trend Wireless Market: Total & Data Revenue 93.2% (KRW Bn) 91.3% 92.7% 83.2% 89.8% 79.4% 20,107 75.9% 45,275 70.1% 44,266 44,983 18,825 43,498 40,197 17,884 38,342 16,578 36,586 33,592 16,006 14,581 14,682 5,705 9,056 12,344 166 2003 2004 2005 2006 2007 2008.1Q 2008. -

National Broadband Plan Executive Summary

A M E R I C A ’ S P LAN Ex ECUTIVE SUMMARY EXECUTIVE SUMMARY Broadband is the great infrastructure challenge of the early Broadband networks only create value to consumers and 21st century. businesses when they are used in conjunction with broadband- Like electricity a century ago, broadband is a foundation capable devices to deliver useful applications and content. To for economic growth, job creation, global competitiveness and fulfill Congress’s mandate, the plan seeks to ensure that the entire a better way of life. It is enabling entire new industries and broadband ecosystem—networks, devices, content and applica- unlocking vast new possibilities for existing ones. It is changing tions—is healthy. It makes recommendations to the FCC, the how we educate children, deliver health care, manage energy, Executive Branch, Congress and state and local governments. ensure public safety, engage government, and access, organize and disseminate knowledge. The Plan Fueled primarily by private sector investment and innova- Government can influence the broadband ecosystem in four ways: tion, the American broadband ecosystem has evolved rapidly. 1. Design policies to ensure robust competition and, as a The number of Americans who have broadband at home has result maximize consumer welfare, innovation and grown from eight million in 2000 to nearly 200 million last investment. year. Increasingly capable fixed and mobile networks allow 2. Ensure efficient allocation and management of assets Americans to access a growing number of valuable applications government controls or influences, such as spectrum, poles, through innovative devices. and rights-of-way, to encourage network upgrades and com- But broadband in America is not all it needs to be. -

AT&T Usadirect

AT&T USADirect® Travel Guide How USADirect® Works 02 Access Codes 03 Dialing Instructions 06 Language Assistance 08 Tips & Timesavers 09 Frequently Asked Questions 10 AT&T USADirect® Travel Guide How USADirect® Works AT&T USADirect® is ideal for frequent international travelers who want to save money on calls back to the U.S. while traveling abroad. Just sign up, and then use an AT&T USADirect access number to connect to the AT&T U.S. network. Once connected, you can call anywhere in the U.S. quickly, easily, and dependably. AT&T USADirect accepts the AT&T Corporate and Consumer Calling Cards, as well as AT&T PrePaid Phone Cards. You can also use your commercial credit cards from many countries, subject to availability. Payment terms are subject to your credit card agreement. If you're an AT&T long-distance customer, you have the option of billing calls to your AT&T residential long-distance account. To find out more or to sign up, call toll-free 1-800-731-8230 or 1-800-435-0812. 2 AT&T USADirect® Travel Guide Access Codes Albania 00-800-0010 Bulgaria 00-800-0010 Egypt Showing Countries American Samoa Cambodia 1-800-881-001 Cairo 2510-0200 Starting with 1-800-225-5288 Canada 1-800-CALL-ATT Outside Cairo 02-2510-0200 Al-Ho Cayman Islands Angola 808-000-011 1-800-225-5288 El Salvador 800-1785 Anguilla 1-800-225-5288 Estonia 800-12001 Legends: Antigua Fiji 004-890-1001 U.S. - United States MB - Miltary Bases #1 Chile Finland 0-800-11-0015 # - Pound Key Select Hotels 1-800-225-5288 Telmex 800-225-288 France SS - Service Suspended Argentina ENTEL 800-360-311 Hotels 1 0-800-99-1011 Telecom 0-800-555-4288 ENTEL {Spanish} 800-360-312 Hotels 2 0-800-99-1111 Note: Telefonica 0-800-222-1288 Telefonica 800-800-288 Hotels 3 0-800-99-1211 ^ indicates that you ALA {Spanish} 0-800-288-5288 Telmex 171-00-311 Hotels-Paris Only 0-800-99-0111 should wait for a second dial tone Telmex {Spanish} 171-00-312 France Telecom 0-800-99-0011 before dialing the next number. -

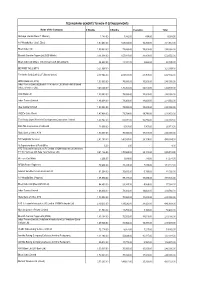

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

6. Market Distortions and Infrastructure Sharing

102959 world development report Public Disclosure Authorized BACKGROUND PAPER Digital Dividends The Economics and Policy Public Disclosure Authorized Implications of Infrastructure Sharing and Mutualisation in Africa Jose Marino Garcia Public Disclosure Authorized World Bank Group Tim Kelly World Bank Group Public Disclosure Authorized The economics and policy implications of infrastructure sharing and mutualisation in Africa Jose Marino Garcia [email protected] and Tim Kelly [email protected] November 2015 Table of contents Executive summary ......................................................................................................................................... 1 1. Introduction ............................................................................................................................................... 2 2. Demand trends, new technologies and the impact on infrastructure sharing ........................ 4 3. Internet supply markets and the Internet Ecosystem .................................................................... 8 4. Analysis of infrastructure sharing models ..................................................................................... 11 5. The role of infrastructure sharing to reduce market and regulatory failures in the provision of broadband internet ........................................................................................................ 30 6. Market distortions and infrastructure sharing ..............................................................................