SBM Core Values

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wings Unfold ABBREVIATIONS

SBM HOLDINGS LTD Wings Unfold ABBREVIATIONS REFERENCE Also referred as: SBM Holdings Ltd including its subsidiaries SBM Group or The Group SBMH or The Holding Company or The Bank Investment Holding SBM Holdings Ltd Company SBM (Bank) Holdings Ltd including its subsidiaries SBM Bank Group SBM Bank (Mauritius) Ltd SBM Bank (Mauritius) Ltd or The Bank SBM (NBFC) Holdings Ltd including its subsidiaries SBM Non-Bank Group SBM (NFC) Holdings Ltd SBM Non-Financial Investment Holding Company Bank of Mauritius BOM Financial Services Commission FSC Reserve Bank of India RBI Wholly Owned Subsidiary WOS Special Purpose Vehicle SPV Basel Committee on Banking Supervision BCBS African Currency Unit AfCU Stock Exchange of Mauritius SEM Capital Adequacy Ratio CAR Caution regarding forward-looking statements Within this report, SBM Holdings Ltd (SBMH) has made various forward-looking statements with respect to its financial position, business strategy and objectives of management. Such forward-looking statements are identified by the use of words such as ‘expects’, ‘estimates’, ‘anticipates’, ‘believes’, ‘intends’, ‘plans’, ‘forecasts’, ‘projects’ or words or phrases of a similar nature. By their nature, forward-looking statements require SBMH to make assumptions and are subject to inherent risks and uncertainties. There is a significant risk that predictions and other forward-looking statements may not prove to be accurate. Readers of this report are thus cautioned not to place undue reliance on forward-looking statements as a number of factors could cause -

1 Executive Summary Mauritius Is an Upper Middle-Income Island Nation

Executive Summary Mauritius is an upper middle-income island nation of 1.2 million people and one of the most competitive, stable, and successful economies in Africa, with a Gross Domestic Product (GDP) of USD 11.9 billion and per capita GDP of over USD 9,000. Mauritius’ small land area of only 2,040 square kilometers understates its importance to the Indian Ocean region as it controls an Exclusive Economic Zone of more than 2 million square kilometers, one of the largest in the world. Emerging from the British colonial period in 1968 with a monoculture economy based on sugar production, Mauritius has since successfully diversified its economy into manufacturing and services, with a vibrant export sector focused on textiles, apparel, and jewelry as well as a growing, modern, and well-regulated offshore financial sector. Recently, the government of Mauritius has focused its attention on opportunities in three areas: serving as a platform for investment into Africa, moving the country towards renewable sources of energy, and developing economic activity related to the country’s vast oceanic resources. Mauritius actively seeks investment and seeks to service investment in the region, having signed more than forty Double Taxation Avoidance Agreements and maintaining a legal and regulatory framework that keeps Mauritius highly-ranked on “ease of doing business” and good governance indices. 1. Openness To, and Restrictions Upon, Foreign Investment Attitude Toward FDI Mauritius actively seeks and prides itself on being open to foreign investment. According to the World Bank report “Investing Across Borders,” Mauritius has one of the world’s most open economies to foreign ownership and is one of the highest recipients of FDI per capita. -

State Bank of Mauritius (Sbm) Holdings Limited Analysis: Is Investors Cash Safe with Sbm?

STATE BANK OF MAURITIUS (SBM) HOLDINGS LIMITED ANALYSIS: IS INVESTORS CASH SAFE WITH SBM? January 2018 i List of Abbreviations: BOM – Bank of Mauritius CBK – Central bank of Kenya EOI – Expression of Interest KDIC – Kenya Deposit Insurance Corporation Kes – Kenya Shillings NAV – Net Assets Value SEMTRI - Stock Exchange of Mauritius Total Return Index SEM – Stock Exchange of Mauritius SBM – State bank of Mauritius ROE – Return on Equity USD – United States Dollar ii Table of Contents Executive Summary ........................................................ 1 Bank Overview.............................................................. 2 Ownership and Governance .............................................. 2 Corporate Governance .................................................... 3 SBM Stock Performance ................................................... 5 SBMH Acquisition of Fidelity Commercial Bank (Kenya) ............. 5 SBM Financial Performance ............................................... 6 SBM Holding Comparison with some selected Kenyan Banks ........ 9 SBM’s Binding Offer on Chase Bank ................................... 10 Chase Bank Acquisition Terms ......................................... 10 Fusion’s View on the terms of this deal .............................. 11 Fusion’s View on SBM Bank acquiring Chase Bank .................. 12 iii Executive Summary SBM Holdings ‘SBM’ was founded in 1973 by the Government of Mauritius and was listed in the Stock Exchange of Mauritius ‘SEM’ in 1995. The Bank is engaged in banking, non-banking -

Automated Clearing House Participants Bank / Branches Report

Automated Clearing House Participants Bank / Branches Report 21/06/2017 Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name 091 Eastleigh 092 KCB CPC 094 Head Office 095 Wote 096 Head Office Finance 100 Moi Avenue Nairobi 101 Kipande House 102 Treasury Sq Mombasa 103 Nakuru 104 Kicc 105 Kisumu 106 Kericho 107 Tom Mboya 108 Thika 109 Eldoret 110 Kakamega 111 Kilindini Mombasa 112 Nyeri 113 Industrial Area Nairobi 114 River Road 115 Muranga 116 Embu 117 Kangema 119 Kiambu 120 Karatina 121 Siaya 122 Nyahururu 123 Meru 124 Mumias 125 Nanyuki 127 Moyale 129 Kikuyu 130 Tala 131 Kajiado 133 KCB Custody services 134 Matuu 135 Kitui 136 Mvita 137 Jogoo Rd Nairobi 139 Card Centre Page 1 of 42 Bank / Branches Report 21/06/2017 140 Marsabit 141 Sarit Centre 142 Loitokitok 143 Nandi Hills 144 Lodwar 145 Un Gigiri 146 Hola 147 Ruiru 148 Mwingi 149 Kitale 150 Mandera 151 Kapenguria 152 Kabarnet 153 Wajir 154 Maralal 155 Limuru 157 Ukunda 158 Iten 159 Gilgil 161 Ongata Rongai 162 Kitengela 163 Eldama Ravine 164 Kibwezi 166 Kapsabet 167 University Way 168 KCB Eldoret West 169 Garissa 173 Lamu 174 Kilifi 175 Milimani 176 Nyamira 177 Mukuruweini 180 Village Market 181 Bomet 183 Mbale 184 Narok 185 Othaya 186 Voi 188 Webuye 189 Sotik 190 Naivasha 191 Kisii 192 Migori 193 Githunguri Page 2 of 42 Bank / Branches Report 21/06/2017 194 Machakos 195 Kerugoya 196 Chuka 197 Bungoma 198 Wundanyi 199 Malindi 201 Capital Hill 202 Karen 203 Lokichogio 204 Gateway Msa Road 205 Buruburu 206 Chogoria 207 Kangare 208 Kianyaga 209 Nkubu 210 -

Bank Supervision Annual Report 2019 1 Table of Contents

CENTRAL BANK OF KENYA BANK SUPERVISION ANNUAL REPORT 2019 1 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE IX FOREWORD BY DIRECTOR, BANK SUPERVISION X EXECUTIVE SUMMARY XII CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 7 1.7 Microfinance Banks Market Share Analysis 9 1.8 Distribution of Foreign Exchange Bureaus 11 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 13 2.2 Banking Sector Charter 13 2.3 Demonetization 13 2.4 Legal and Regulatory Framework 13 2.5 Consolidations, Mergers and Acquisitions, New Entrants 13 2.6 Medium, Small and Micro-Enterprises (MSME) Support 14 2.7 Developments in Information and Communication Technology 14 2.8 Mobile Phone Financial Services 22 2.9 New Products 23 2.10 Operations of Representative Offices of Authorized Foreign Financial Institutions 23 2.11 Surveys 2019 24 2.12 Innovative MSME Products by Banks 27 2.13 Employment Trend in the Banking Sector 27 2.14 Future Outlook 28 CENTRAL BANK OF KENYA 2 BANK SUPERVISION ANNUAL REPORT 2019 TABLE OF CONTENTS CHAPTER THREE MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE 3.1 Global Economic Conditions 30 3.2 Regional Economy 31 3.3 Domestic Economy 31 3.4 Inflation 33 3.5 Exchange Rates 33 3.6 Interest -

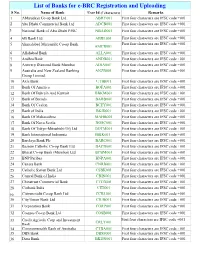

List of Bank Names

List of Banks for e-BRC Registration and Uploading S No. Name of Bank User Id (7 characters) Remarks 1 Abhyudaya Co-op Bank Ltd ABHY001 First four characters are IFSC code +001 2 Abu Dhabi Commercial Bank Ltd ADCB001 First four characters are IFSC code +001 3 National Bank of Abu Dhabi PJSC NBAD001 First four characters are IFSC code +001 4 AB Bank Ltd. ABBL001 First four characters are IFSC code +001 5 Ahmedabad Mercantile Co-op Bank First four characters are IFSC code +001 AMCB001 6 Allahabad Bank ALLA001 First four characters are IFSC code +001 7 Andhra Bank ANDB001 First four characters are IFSC code +001 8 Antwerp Diamond Bank Mumbai ADIA001 First four characters are IFSC code +001 9 Australia and New Zealand Banking ANZB001 First four characters are IFSC code +001 Group Limited 10 Axis Bank UTIB001 First four characters are IFSC code +001 11 Bank Of America BOFA001 First four characters are IFSC code +001 12 Bank Of Bahrain And Kuwait BBKM001 First four characters are IFSC code +001 13 Bank of Baroda BARB001 First four characters are IFSC code +001 14 Bank Of Ceylon BCEY001 First four characters are IFSC code +001 15 Bank of India BKID001 First four characters are IFSC code +001 16 Bank Of Maharashtra MAHB001 First four characters are IFSC code +001 Bank Of Nova Scotia NOSC001 First four characters are IFSC code +001 17 18 Bank Of Tokyo-Mitsubishi Ufj Ltd BOTM001 First four characters are IFSC code +001 19 Bank Internasional Indonesia IBBK001 First four characters are IFSC code +001 20 Barclays Bank Plc BARC001 First four characters -

Effect of Mobile Banking on Cost Efficiency Of

EFFECT OF MOBILE BANKING ON COST EFFICIENCY OF COMMERCIAL BANKS IN KENYA WILLY WACHIRA MUTHII A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF SCIENCE IN FINANCE, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI OCTOBER, 2019 DECLARATION I, the undersigned, declare that this is my original work and has not been presented to any institution or university other than the University of Nairobi for examination. Signed: _____________________Date: __________________________ WILLY WACHIRA MUTHII D63/64566/2013 This research project has been submitted for examination with my approval as the University Supervisor. Signed: _____________________Date: __________________________ DR. CYRUS IRAYA Department of Finance and Accounting School of Business, University of Nairobi ii ACKNOWLEDGEMENTS Quoting the words of Shannon L Adler, "When you invite people to share in your miracle, you create future allies during rough weather". This quote is a true reflection of my journey writing this research project because without the individuals involved, this journey would have been impossible. A sincere thank you goes to my supervisor Dr. Cyrus Iraya for his patience, support and guidance. For believing in my project and offering his insight and expertise in this field. For not hesitating to share his thoughts and views enabling me to be where I am today. A special thank you to Mr. Murage for his guidance and support throughout this process. Finally I would like to thank my colleagues and friends who were there to offer me support and listen to me and my views while writing this research project. They encouraged me to never give up and for that I will forever be grateful. -

List of Bank Names

List of Banks for e-BRC Registration and Uploading S No. Name of Bank User Id (7 characters) Remarks 1 Abhyudaya Co-op Bank Ltd ABHY001 First four characters are IFSC code +001 2 Abu Dhabi Commercial Bank Ltd ADCB001 First four characters are IFSC code +001 3 National Bank of Abu Dhabi PJSC NBAD001 First four characters are IFSC code +001 4 AB Bank Ltd. ABBL001 First four characters are IFSC code +001 5 Ahmedabad Mercantile Co-op Bank First four characters are IFSC code +001 AMCB001 6 Allahabad Bank ALLA001 First four characters are IFSC code +001 7 Andhra Bank ANDB001 First four characters are IFSC code +001 8 Antwerp Diamond Bank Mumbai ADIA001 First four characters are IFSC code +001 9 Australia and New Zealand Banking ANZB001 First four characters are IFSC code +001 Group Limited 10 Axis Bank UTIB001 First four characters are IFSC code +001 11 Bank Of America BOFA001 First four characters are IFSC code +001 12 Bank Of Bahrain And Kuwait BBKM001 First four characters are IFSC code +001 13 Bank of Baroda BARB001 First four characters are IFSC code +001 14 Bank Of Ceylon BCEY001 First four characters are IFSC code +001 15 Bank of India BKID001 First four characters are IFSC code +001 16 Bank Of Maharashtra MAHB001 First four characters are IFSC code +001 17 Bank Of Nova Scotia NOSC001 First four characters are IFSC code +001 18 Bank Of Tokyo-Mitsubishi Ufj Ltd BOTM001 First four characters are IFSC code +001 19 Bank Internasional Indonesia IBBK001 First four characters are IFSC code +001 20 Barclays Bank Plc BARC001 First four characters -

March Current Affairs

1 March Current Affairs 1. Name the 2021 United Nations World Water 5) Manikarnika: The Queen of Jhansi Development Report, that reported on the Answer- 2) Marakkar: Arabikadalinte Simham decreasing per capita water capacity in the world’s reservoirs? 4. Which organisation recorded India’s 1st successful demonstration of free-space Quantum 1) Leaving no one behind Communication over a distance of 300m? 2) Valuing Water 1) DRDO s 3) Nature for Water 2) IISC, Bangalore 4) Water and Climate Change 3) ISRO 5) Wastewater 4) IIT-Madras e Answer- 2) Valuing Water 5) IIT-Delhi According to the 2021 edition of the United Nations Answer- 3) ISRO World Water Development Report (UN WWDR 2021) For the 1st time in India, Indian Space Research titled ‘Valuing Water’, Each person on the planet s Organisation (ISRO) successfully demonstrated may have to live on less Water as the per capita reservoir free-space Quantum Communication over a distance of capacity is decreasing. 300 Metres. The free-space QKD (Quantum Key • The World population is set to increase to 9 Billion s Distribution) was demonstrated at Space Applications by 2040, but the projected reservoir volume is Centre (SAC), Ahmedabad, Gujarat. It is a major stabilising around 7, 000 billion cubic metre. milestone achievement for unconditionally secured • This report was published by the United Nations satellite dataa communication using quantum Educational, Scientific, and Cultural Organization technologies.l (UNESCO) on behalf of UN-Water. 5. When is the World Tuberculosis Day annually 2. In March 2021, SEBI amended the valuation rule of observed by the World Health Organisation (WHO)? Perpetual Bonds. -

Key Financial Indicators

Key financial indicators ---------------------------Restateda----------------------------- 2006 2005 2004 2003 2002 Earnings per Share (Cents) 406 366 346 284 262 Net Income before Tax (Rs M) 1,524 1,489 1,360 1,176 1,022 Net Income available to Shareholders (Rs M) 1,319 1,191 1,127 1,018 952 Economic Value Added (Rs M) 392 304 338 286 247 Capital to Risk Weighted Assets (%)b 20.77 21.78 17.79 18.16 20.55 Return on Average Risk Weighted Assets (%)c 4.22 4.01 4.11 4.23 4.46 Return on Average Assets (%)d 2.61 2.64 2.90 2.93 2.94 Return on Average Shareholders’ Funds (%)d 15.62 15.45 19.29 19.65 20.31 Return on Average Tier 1 Capital (%)d 22.36 22.41 24.13 20.29 21.34 Risk Adjusted Return on Capital (RAROC) (%)e 41.38 39.37 39.87 N/A N/A Cost to Income (%)f 41.11 38.91 40.15 39.17 38.24 Cost to Income excluding depreciation (%)f 30.94 28.55 31.55 28.88 27.01 Electronic to Total Transactions (%) 83.00 82.00 80.00 76.00 72.00 a Restated wherever applicable for comparative purposes. b Capital adequacy is computed as per regulatory requirement, based on credit as well as operational risks of the Group in line with Basel II Accord. c Average Risk Weighted Assets are calculated using year end balances. d Averages are based on daily balances as from 2003. 2002 average is based on monthly balances. -

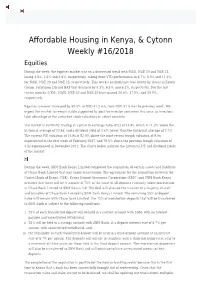

Cytonn Report a Product of Cytonn Technologies

Affordable Housing in Kenya, & Cytonn Weekly #16/2018 Equities During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 losing 4.5%, 2.5% and 3.6%, respectively, taking their YTD performance to 6.7%, 0.0% and 11.4%, for NASI, NSE 20 and NSE 25, respectively. This week’s performance was driven by losses in Equity Group, Safaricom Ltd and BAT that declined by 8.1%, 6.5%, and 6.3%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 36.6%, 17.8%, and 34.9%, respectively. Equities turnover increased by 30.8% to USD 41.2 mn, from USD 31.5 mn the previous week. We expect the market to remain stable supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations in select counters. The market is currently trading at a price to earnings ratio (P/E) of 14.9x, which is 11.2% above the historical average of 13.4x, and a dividend yield of 3.6%, lower than the historical average of 3.7%. The current P/E valuation of 14.9x is 52.0% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 79.5% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market. During the week, SBM Bank Kenya Limited completed the acquisition of certain assets and liabilities of Chase Bank Limited that was under receivership. -

Current Affairs August-2018 National News

CURRENT AFFAIRS AUGUST-2018 Visit us @ Sehpaathi.in NATIONAL NEWS To showcase Buddhist Heritage in India and boost tourism to the Buddhist sites, the International Buddhist Conclave was inaugurated by President Ram Nath Kovind in New Delhi. theme: - 'Buddha Path – The Living Heritage'. The Centre unveiled The Draft International Air Connectivity (IAC) scheme, for extending the affordable air travel programme UDAN to international circuits. The Food Safety and Standards Authority of India (FSSAI) constituted B Sesikeran Committee to Review Food Labelling Standards AIBD India has been elected as the President of the Asia-Pacific Institute for Broadcasting Development (AIBD) for two years. To create awareness about Intellectual Property Rights (IPRs), Commerce and Industry Minister Suresh Prabhu launched logo and tagline for Geographical Indications (GI) GI tag: Invaluable Treasures of Incredible India Government Approves 122 New Research Projects Under ‘IMPRINT-2’ Scheme to advance research in energy, security and healthcare domains in the high education institutions. Committee Formed to Address Issues of Stressed Thermal Power Projects headed by Cabinet Secretary, Pradeep Kumar Sinha. 2nd Conference of Young Superintendent of Police held in New Delhi, Theme: “Predictive Policing and Contemporary Challenges for Indian Police Forces”. Union Government Provides Rs 66,000 crore green funds to increase the country’s forest cover. For monitoring the rejuvenation project of Ganga, National Green Tribunal constituted a committee headed by former Allahabad High Court judge. Under the Impacting Research Innovation and Technology ‘IMPRINT-2’ scheme, Government has approved 122 new research projects of 112 crore rupees. 1 CURRENT AFFAIRS AUGUST-2018 Visit us @ Sehpaathi.in NITI Aayog Identified 117 Districts as Aspirational Districts for ashtriya Uchchatar Shiksha Abhiyan (RUSA) Scheme.