Community Redevelopment Tax Increment Financing Projects Tax Year 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

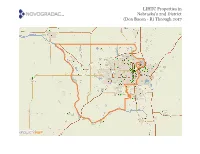

Nebraska's 2Nd District (Don Bacon - R) Through 2017 LIHTC Properties in Nebraska's 2Nd District Through 2017

LIHTC Properties in Nebraska's 2nd District (Don Bacon - R) Through 2017 LIHTC Properties in Nebraska's 2nd District Through 2017 Annual Low Rent or Tax- HUD Multi-Family Nonprofit Allocation Total Project Name Address City State Zip Code Allocated Year PIS Construction Type Income Income Credit % Exempt Financing/ Sponsor Year Units Amount Units Ceiling Bond Rental Assistance Not 1511 APTS 1511 VINTON ST Omaha NE 68108 No 1989 $11,703 1990 Acquisition and Rehab6 6 No Indicated GEORGEANNA COURT 2612 DEWEY Not Omaha NE 68105 No 1988 $32,608 1988 Acquisition and Rehab36 18 No APTS AVE Indicated 70 % present GREENVIEW 1806 N 17TH ST Omaha NE 68110 1995 $321,625 1996 Not Indicated 36 36 value 1840 FLORENCE Not GRACE PLAZA APTS Omaha NE 68110 Yes 1991 $184,125 1992 New Construction 24 24 No BLVD Indicated LIVESTOCK EXCHANGE 70 % present 4920 S 30TH ST Omaha NE 68107 No 2003 $850,000 2004 Acquisition and Rehab 102 102 No BUILDING value KOUNTZE PARK 4510 N 34TH 70 % present Omaha NE 68111 Yes 2001 $205,421 2002 New Construction 16 16 No CROWN III AVE value 12835 Not MILLARD MANOR Omaha NE 68137 2009 $579,380 2010 Not Indicated 51 51 DEAUVILLE DR Indicated LIVESTOCK EXCHANGE 70 % present 4930 S 30TH ST Omaha NE 68107 No 2010 $579,417 2012 New Construction 32 32 60% AMGI No No CAMPUS BUILDINGS value SCATTERED 30 % present PINE TREE OMAHA NE 68114-0000 No 2016 $684,727 2016 Acquisition and Rehab 198 198 60% AMGI No ADDRESSES value Not BOYD STREET APTS 6518 BOYD ST Omaha NE 68104 No 1989 $52,524 1989 Acquisition and Rehab 26 26 No Indicated Not -

Neil Bush's Massive Usa Pedophile Network

NEIL BUSH'S MASSIVE USA PEDOPHILE NETWORK Neil Mallon Bush 4 South West Oak Drive Unit 1 Houston, TX 77056-2063 Phone numbers: 713-552-0882 713-850-1288 The brother of George W. Bush, Neil is another evil Satanist running the biggest pedophile network in the USA currently. He MUST be stopped, he MUST be punished, since he (and lots of other high-level Satanists) operates his crime empire with impunity and always has had immunity from prosecution by the FBI and the rest of the FEDS. Many, many other little kids will suffer INTOLERABLE, EXCRUCIATING sexual agony and torture that their little bodies are not ready for, and will be scared and traumatized for the rest of their lives because of sick perverted fun these monsters enjoy by inflicting on these innocent little children, some of which are even used in secret Satanic sacrifices, and are brutally murdered, all for the sickening pleasure of these evil perverts. All of the Senate, and just about all of the Congress, and Federal Attorneys, and high-ranking military officers are involved in this Illuminati death cult. If you just sit there doing nothing, nothing will be stopped. Check out what happens at your local Masonic Temple or Scottish Rite Temple between tomorrow (Halloween) and November 1st. Every sheriff department and every police department has an imbedded agent who's job it is to get arrested and charged Satanists, and Freemasons off the hook, having their charges dropped quickly once they find out these criminals are a Satanist or a Mason. People Neil may know Ned Bush Pierce G Bush Elizabeth D Andrews Ashley Bush REPUBLICAN PARTY PEDOPHILES LIST * Republican mayor Thomas Adams of Illinois charged with 11 counts of disseminating child pornography and two counts of possession of child pornography. -

Nebraska's 2Nd District (Don Bacon - R) Through 2018 LIHTC Properties in Nebraska's 2Nd District Through 2018

LIHTC Properties in Nebraska's 2nd District (Don Bacon - R) Through 2018 LIHTC Properties in Nebraska's 2nd District Through 2018 Annual Low Rent or HUD Multi-Family Nonprofit Allocation Total Tax-Exempt Project Name Address City State Zip Code Allocated Year PIS Construction Type Income Income Credit % Financing/ Sponsor Year Units Bond Amount Units Ceiling Rental Assistance 2215 FOWLER Not HAUSCHILD HOUSES OMAHA NE 68110 No 1987 $5,702 1987 Acquisition and Rehab 8 8 No AVE Indicated 15605 N FOURTH Not BEN APTS BENNINGTON NE 68007 No 1987 $34,252 1987 New Construction 24 24 No ST Indicated Not PRAGUE HOTEL 1402 S 13TH ST OMAHA NE 68108 No 1987 $20,108 1987 Acquisition and Rehab 11 11 No Indicated Not KT COMPANY XVI 2207 JONES ST OMAHA NE 68102 No 1987 $23,268 1987 Acquisition and Rehab 36 36 No Indicated GEORGEANNA COURT 2612 DEWEY Not OMAHA NE 68105 No 1988 $32,608 1988 Acquisition and Rehab 36 18 No APTS AVE Indicated Not ROSELAND THEATRE 4932 S 24TH ST OMAHA NE 68107 No 1988 $35,437 1988 Acquisition and Rehab 17 17 No Indicated Not RIDGEWOOD HEIGHTS 3102 S 68TH PLZ OMAHA NE 68106 No 1988 $292,514 1988 New Construction 116 116 No Indicated Not MASON APTS 1010 S 24TH ST OMAHA NE 68108 No 1988 $91,863 1988 Acquisition and Rehab 32 32 No Indicated Not KT COMPANY XV 3031 BURT ST OMAHA NE 68131 No 1988 $17,250 1988 Acquisition and Rehab 19 19 No Indicated Not K-T COMPANY XV 3021 BURT ST OMAHA NE 68131 No 1988 $17,213 1988 Acquisition and Rehab 19 19 No Indicated Not KT COMPANY XV 3011 BURT ST OMAHA NE 68131 No 1988 $20,223 1988 Acquisition -

North Omaha History Timeline by Adam Fletcher Sasse

North Omaha History Timeline A Supplement to the North Omaha History Volumes 1, 2 & 3 including People, Organizations, Places, Businesses and Events from the pre-1800s to Present. © 2017 Adam Fletcher Sasse North Omaha History northomahahistory.com CommonAction Publishing Olympia, Washington North Omaha History Timeline: A Supplement to the North Omaha History Volumes 1, 2 & 3 including People, Organizations, Places, Businesses and Events from the pre-1800s to present. © 2017 Adam Fletcher Sasse CommonAction Publishing PO Box 6185 Olympia, WA 98507-6185 USA commonaction.org (360) 489-9680 To request permission to reproduce information from this publication, please visit adamfletcher.net All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior written permission of the author, or a license permitting restricted copying issued in the United States by the author. The material presented in this publication is provided for information purposes only. This book is sold with the understanding that no one involved in this publication is attempting herein to provide professional advice. First Printing Printed in the United States Interior design by Adam Fletcher Sasse. This is for all my friends, allies, supporters and advocates who are building, nurturing, growing and sustaining the movement for historical preservation and development in North Omaha today. North Omaha History Timeline Introduction and Acknowledgments This work is intended as a supplement to the North Omaha History: Volumes 1, 2 and 3 that I completed in December 2016. These three books contain almost 900-pages of content covering more than 200 years history of the part of Omaha north of Dodge Street and east of 72nd Street. -

Selected Writings of Elia Peattie, a Journalist in the Gilded

1 2 3 4 Impertinences 5 6 7 8 9 10 11 12 [First Page] 13 [-1], (1) 14 15 16 Lines: 0 to 19 17 ——— 18 * 451.24823pt PgVar 19 ——— 20 Normal Page 21 * PgEnds: PageBreak 22 23 24 [-1], (1) 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Kim—UofNPress/Pagei//Impertinencies / Elia Peattie 1 2 3 4 5 6 7 8 9 10 11 12 13 [-2], (2) 14 15 16 Lines: 19 to 21 17 ——— 18 0.0pt PgVar 19 ——— 20 Normal Page 21 PgEnds: TEX 22 23 24 [-2], (2) 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Kim—UofNPress/Pageii//Impertinencies / Elia Peattie 1 2 3 4 Impertinences 5 6 7 8 9 Selected Writings of Elia Peattie, 10 11 a Journalist in the Gilded Age 12 13 Edited and with a biography by [-3], (3) 14 15 Susanne George Bloomfield 16 Lines: 21 to 55 17 ——— 18 10.60019pt PgVar 19 ——— 20 Normal Page 21 * PgEnds: PageBreak 22 23 24 [-3], (3) 25 26 27 28 29 30 31 32 33 34 35 36 37 38 University of Nebraska Press 39 Lincoln and London 40 Kim—UofNPress/Pageiii/ /Impertinencies / Elia Peattie 1 Publication of this book was supported by the 2 University of Nebraska at Kearney. © 2005 by the 3 Board of Regents of the University of 4 Nebraska. 5 All rights reserved. Manufactured in the United 6 States of America. 7 Set in Adobe Minion by Kim Essman. -

Archives Record

ARCHIVES RECORD RG014 Nebraska. Nebraska State Historical Society & film Records: 1878-current Cubic ft.: 165.5 Approx. # of Items: 350 boxes and oversize HISTORICAL NOTE The Nebraska State Historical Society is the oldest state institutions organized as the Nebraska Historical and Library Association in 1867. On September 25, 1878 this association was reorganized as the Nebraska State Historical Society. The University of Nebraska provided space to house the records and property of the Society, and the first annual meetings were held at the University. In 1883 the Nebraska State Historical Society was designated a state institution and the legislature made an appropriation to carry on Society activities. Because of this appropriation, the Society was able to begin publishing the first volume of Transactions and Reports. The Society is governed by a twelve- member executive board elected by members and three who are gubernatorial appointees. It is assisted by the Nebraska State Historical Society Foundation which solicits and accepts gifts of real or personal property for the use and benefit of the Nebraska State Historical Society and gives financial support to many of its programs. The first Secretary of the Nebraska State Historical Society was Dr. Samuel Aughey of the University of Nebraska, who served until 1885 when Professor George E. Howard assumed this position. Howard remained Secretary and Superintendent of the Society until 1891 when he was succeeded by Howard W. Caldwell, also of the University of Nebraska. A staff of permanent employees was retained during Caldwell's administration and the Society began more active work in the collection and preservation of materials relating to Nebraska's history.