Sodexo (7-27-2020 to 2-28-2021)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SC17/TG08: Task Group on Completion/Workover Risers (17G)

SC17/TG08: Task Group on Completion/Workover Risers (17G) December 11, 2015 Chair Brian Skeels FMC Technologies Ph: 281 591-4333 Manufacturer 5875 N. Sam Houston Pkwy W. Fax: 281 405-4643 Houston, Texas 77086 [email protected] Co-Chairs Tony Muff FMC Technologies Ph: 47 3328-8865 Manufacturer Box 1012 Fax: 47 3228-6750 N-3601, Kongsberg [email protected] Norway Ray Stawaisz Chevron Corporation Ph: 832 854-3225 Operator-User 1500 Louisiana Street Fax: 832 854-3210 Room 12-092B [email protected] Houston, Texas 77002 Member Joe Scranton AlTiSS Technologies Ph: 832 288-5972 Contractor 3838 N. Sam Houston Pkwy, 430 Fax: 281 265-2818 Houston,Texas 77583 [email protected] Gary Rytlewski Retired - Schlumberger Ph: 832 573-6738 Consultant 4757 Oakmont Court League City, Texas 77573 [email protected] Brian Saucier Ph:713 817-6051 Consultant 95 Robindale Circle Fax: Conroe, Texas 77384 [email protected] Jim Miller Chevron Corporation Ph: 832 854-4811 Operator-User 1600 Smith Street, Fax: 832 854-3210 Room 33094A [email protected] Houston, Texas 77002 Richard Cummings Chevron Corporation Ph: 713 754-3196 Operator-User 1600 Smith Street, Fax: 832 854-3210 Room 33094C [email protected] Houston, Texas 77002 Paul Deacon Expro Group Ph: 44 1224-225-856 Contractor Lion House Fax: 44 1224-225-868 Dyce Avenue [email protected] Aberdeen, Scotland AB21 0LQ United Kingdom Jamie Walker Expro Group Ph: 44 1224-225-788 Contractor Lion House Fax: 44 1224-225-868 Dyce Avenue [email protected] Aberdeen, Scotland AB21 0LQ United Kingdom Finn Kirkemo Statoil Ph: 47-9012-7901 Operator-User Martinshaugen 30, Fax: 3408, Tranby [email protected] Norway Send updates to [email protected] 1 SC17/TG08: Task Group on Completion/Workover Risers (17G) December 11, 2015 Member Lorents Reinås Statoil Ph: 47-9115-3047 Operator-User Forus Øst, H2 Fax: 4035, Stavanger [email protected] Norway Tore Geir Wernø Statoil Ph: 47 9522-5568 Operator-User Forus Øst, H2 Fax: 4035, Stavanger [email protected] Norway Mirick Cox ExxonMobil Production Co. -

United States Department of the Interior Minerals Management Service

CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 1 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 10th OCS Oil and Gas Lease Sale 00087 DEC/QUAL : 09-OCT-1962 Term Date : 09-OCT-1962 Regns : G 11th OCS Oil and Gas Lease Sale Zone 3 00100 DEC/QUAL : 28-APR-1964 Term Date : 28-APR-1964 Regns : G 12th OCS Oil and Gas Sale Zone 2 00118 DEC/QUAL : 01-JAN-1947 Term Date : 14-OCT-1968 Regns : G 1400 CORP. 00622 DEC/QUAL : 10-DEC-1980 Term Date : 22-APR-1982 Regns : P 145 OG HOLDINGS, LLC 03267 4514 Cole Ave. DEC/QUAL : 07-NOV-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 2 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 157 OG Holdings, LLC 03271 4514 Cole Avenue DEC/QUAL : 21-DEC-2012 Suite 600 Term Date : Dallas, TX 75205 Regns : PAYG 1982 Drilling Program 00830 Box 6629 DEC/QUAL : 14-NOV-1983 San Antonio, TX 78209 Term Date : 19-JUL-1988 Regns : P 1986 STEA Limited Partnership I 01145 1221 Lamar, Suite 1600 DEC/QUAL : 19-JUN-1987 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-I STEA Limited Partnership 01253 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G 1987-VI STEA Limited Partnership 01252 1221 Lamar, Suite 1600 DEC/QUAL : 24-MAR-1988 Houston, TX 77010 Term Date : 19-SEP-1997 Regns : G * * * * * * UNCLASSIFIED * * * * * * CODETAIL UNITED STATES DEPARTMENT OF THE INTERIOR COMPANY MINERALS MANAGEMENT SERVICE 01-OCT-2021 PACIFIC OCS REGION PAGE: 3 Company Details Orders : COMPANY Companies: ALL Bonds : ALL 1988-I TEAI Limited Partnership 01470 c/o Torch Energy Assoc. -

Houston's Office Market Weakens Over the Quarter and Braces Itself Moving

Research & Forecast Report HOUSTON | OFFICE Q1 2020 Houston’s office market weakens over the quarter and braces itself moving forward amid $20 oil Lisa Bridges Director of Market Research | Houston Commentary by Patrick Duffy MCR Market Indicators Annual Quarterly Quarterly Colliers generally uses this space to discuss the trends we see Relative to prior period Change Change Forecast* in market data and in conversations we have with our clients, prospects and friendly competitors. We take that data and attempt VACANCY to project activity going forward. The bulk of the first quarter was, NET ABSORPTION for all practical purposes, pre-COVID. Net “move-in” data, as well as new leases signed, were likely unimpacted for Q1 based on the DELIVERIES virus or only marginally impacted. Our industry has a lead time of UNDER CONSTRUCTION at least 4-6 months before a lease is signed or space made ready for occupancy. The real impact of this COVID crisis will not present *Projected in the data until later in Q2. Inertia will carry us for a few more weeks. The world is focused on the COVID driven economic slowdown. Houston has two issues to watch – COVID and a collapse in oil prices. The oil issue is driven by Saudi Arabia and Russia failing to reach an agreement on production and by the severe decline of oil and gas demand driven by the COVID shutdown. Oil has been Summary Statistics Houston Office Market Q1 2019 Q4 2019 Q1 2020 in the low 20’s since the collision of these two events. The Energy Information Administration is projecting that supply will continue to Vacancy Rate 19.4% 19.8% 20.0% outpace demand for the balance of this year by approximately 10MM barrels per day. -

Houston's Office Market Closes out 2018 with Positive Net Absorption

Research & Forecast Report HOUSTON | OFFICE Q4 2018 Houston’s office market closes out 2018 with positive net absorption Lisa Bridges Director of Market Research | Houston Houston’s office market continues to take baby steps towards filling vacant space emptied during the energy downturn. In Q4 2018, the market posted positive absorption of 1.9 million SF, a substantial Market Indicators Annual Quarterly Quarterly increase from the negative 0.4 million SF of absorption recorded Relative to prior period Change Change Forecast* one year ago. Leasing activity remained steady over the quarter at VACANCY 3.5M SF pushing the year-end total to 14M SF. Houston’s overall vacancy rate fell slightly from 20.6% to 20.0% over the quarter, NET ABSORPTION but it is still well above Houston’s 5-year average vacancy rate of NEW CONSTRUCTION 16.4%. UNDER CONSTRUCTION Construction activity decreased in Q4 2018 from 3.2M SF to 2.5M SF as several new buildings were delivered. HP’s and ABS’s new *Projected CityPlace buildings in The Woodlands submarket delivered during Q4 2018. Houston’s job growth increased by 3.7% over the year, according to recent data released by the US Bureau of Labor Statistics. The Houston MSA created 114,400 jobs (not seasonally adjusted) between November 2017 and November 2018, growing faster than Summary Statistics the U.S. during the same time period. Employment sectors with the Houston Office Market Q4 2017 Q3 2018 Q4 2018 most substantial growth include support activities for mining which Vacancy Rate 19.9% 20.6% 20.0% grew by 11.7% over the year, construction increased by 10.8% and durable goods manufacturing was up by 9.0% over the year. -

Houston's Office Market Recovery Hits a Speed Bump in Q2

Research & Forecast Report HOUSTON | OFFICE Q2 2019 Houston’s office market recovery hits a speed bump in Q2 Lisa Bridges Director of Market Research | Houston Over the last two quarters, Houston’s office market has shown signs of a slow recovery from the energy downturn, but it hit a Market Indicators Annual Quarterly Quarterly speed bump in Q2. During the quarter, the market posted negative Relative to prior period Change Change Forecast* net absorption of 842,200 SF, a substantial reversal from the positive absorption of 492,000 SF recorded in Q1. The newest VACANCY trend of vacating older spaces for modern/creative, efficient interior NET ABSORPTION designs has tenants effectively leasing less space without reducing NEW INVENTORY head count. Unless the tenant is in an expansion mode, this trend will lead to a reduction in the amount of office space leased. UNDER CONSTRUCTION Leasing activity has trended down in the first half of 2019. The majority of the leasing activity is a result of horizontal movement *Projected (existing tenants in the market relocating). Houston’s overall vacancy rate rose from 19.1% to 19.8% over the quarter and is still well above Houston’s pre-downturn average vacancy rate in 2014 of 11.6%. An additional constraint to recovery is a very tight labor market, not just in Houston, but nationally. Companies wanting to increase head count and expand are finding it difficult to fill the available job openings. Given these conditions, Colliers estimates, in Summary Statistics the most optimistic scenario, it will take six to seven years of steady Houston Office Market Q2 2018 Q1 2019 Q2 2019 absorption to reach a pre-recession vacancy rate. -

Here Is the Call-In Information for Our Call at 4Pm, Toll-Free: 866-906-0040 Toll/International : 857-288- 2640 2

SrerE oF Tsxes Dnvrr Dnwnunsr Rrcr Pannv Joa Srneus Lrcutnu¡Nt GovsRNon Govnn¡¡on Spp¡xsn oF THE Housn P.o. Box 12068 P.O.Box 12428 P.O. Box 2910 Ausrrx, Tex¡s 7871 1-2068 AusrN, Texrs 7 87 17-2428 AustrN, Tpx.+s 7 87 68-29 lO (572) 463-0007 6t2) 463-2000 1512) 463-3000 June 5, 2013 Mr. Charles Johnson Assistant Secretary Chevron U.S.A. Inc. 1400 Smith Street, Suite 06016 Houston, Texas 77002 Dear Mr. Johnson: The State of Texas is honored that Chevron U.S.A. Inc. is considering making investments and creating jobs in our state. We are confident that you will find Texas to be an ideal location, and we are working with community leaders in Houston to promote your success' During the 78th Legislative Session, the Texas Enterprise Fund was created as a tool to bring jobs to Texas. Allocations from the Texas Enterprise Fund support the creation of quality jobs and leverage private investment for activities that will strenglhen the economic future of the state, We welcome your investment in our state and are prepared to allocate $12,000,000 to Chevron U'S.A. Inc., contingent upon execution of a formal Economic Development Agreement to be negotiated. This offer by the State of Texas may be rescinded iÎ a finalized Economic Development Agreement is not executed by all applicable parties within six months of the date of this letter. The State of Texas is pleased to provide this incentive for economið development purposes. We look forward to working with you to help this project achieve its objectives, Sincerely, lcH Rick Peny David Dewhurst Joe Straus Governor Lieutenant Governor Speaker of the House cc: Mr. -

Aiche's Program Committee

AIChE's Program Committee AIChE's Program Committee - Executive Board ............................................................................................ 2 Group 1: Engineering Sciences and Fundamentals ...................................................................................... 5 Group 2: Separations Division Program Chairs ............................................................................................. 9 Group 3: Particle Technology Forum ......................................................................................................... 17 Group 4: Education ..................................................................................................................................... 19 Group 5: Management Division ................................................................................................................. 22 Group 6: North American Mixing Forum ................................................................................................... 23 Group 7: Transport and Energy Processes ................................................................................................. 24 Group 8: Materials Engineering and Sciences Division .............................................................................. 27 Group 9: Environmental Division ............................................................................................................... 29 Group 10: Computing and Systems Technology Division ......................................................................... -

Houston's Office Market Vacancy Rate Continues to Struggle Amid $50

Research & Forecast Report HOUSTON | OFFICE Q3 2017 Houston’s office market vacancy rate continues to struggle amid $50 crude prices Lisa Bridges Director of Market Research | Houston Houston’s office market continues to struggle as U.S. crude prices waiver around $50 per barrel. According to the U.S. Energy Market Indicators Annual Quarterly Quarterly Information Administration (EIA), they are expected to stay in Relative to prior period Change Change Forecast* this range through 2018. With no indication that prices will rise substantially over the next few years, vacant office space placed VACANCY on the market by firms in the energy industry will take longer NET ABSORPTION to absorb. Recent news articles indicate that some of the large energy giants reported profits in the second quarter. However, NEW CONSTRUCTION profits were largely driven by lean budgets and staff reductions. UNDER CONSTRUCTION Fortunately, most of the proposed projects that were in the *Projected construction pipeline when the oil slump hit were put on hold. Companies such as Bank of America, American Bureau of Shipping and HP, have signed leases in proposed buildings that have either recently begun construction or will begin in the very near future. Once these projects deliver, those companies will vacate their existing space, leaving more than 1.0 million square feet for Summary Statistics Houston Office Market Q3 2016 Q2 2017 Q3 2017 landlords to backfill. Vacancy Rate 16.9% 18.8% 19.1% During the third quarter of 2017, Houston faced one of the worst Net Absorption natural disasters in history. Hurricane Harvey, a Category 4 -0.4 -0.7 -0.7 hurricane, slammed the Texas coast and dumped over 50 inches of (Million Square Feet) New Construction rain in parts of Houston. -

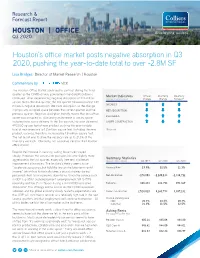

Houston's Office Market Posts Negative Absorption in Q3 2020, Pushing The

Research & Forecast Report HOUSTON | OFFICE Q3 2020 Houston’s office market posts negative absorption in Q3 2020, pushing the year-to-date total to over -2.8M SF Lisa Bridges Director of Market Research | Houston Commentary by Patrick Duffy MCR The Houston Office Market continued to contract during the third quarter as the COVID-driven, government-mandated lockdowns Market Indicators Annual Quarterly Quarterly continued. After experiencing negative absorption of 1.14 million Relative to prior period Change Change Forecast* square feet in the 2nd quarter, the 3rd quarter followed posting 1.33 million in negative absorption. We track absorption as the change VACANCY in physically occupied space between the current quarter and the NET ABSORPTION previous quarter. Negative absorption literally means that less office DELIVERIES space was occupied vs. discussing an increase in vacant space, including new space delivery. In the 3rd quarter, Houston delivered UNDER CONSTRUCTION 490,000 square feet of new product, pushing the year-to-date total of new inventory to 1.2 million square feet. Including the new *Projected product, vacancy, therefore, increased by 1.8 million square feet. The net result was to drive the vacancy rate up to 21.3% of the inventory we track. Obviously, not a positive trend for the Houston office market. Despite the increase in vacancy, asking lease rates stayed steady. However, the concession packages became slightly more Summary Statistics aggressive in the last quarter, especially free rent and tenant Houston Office Market Q3 2019 Q2 2020 Q3 2020 improvement allowances. The landlord’s theory seems to be “accelerate occupancy, but hold the line on the long-term rental Vacancy Rate 19.9% 20.5% 21.3% income,” which has historically been a sound strategy during perceived short-term economic downturns. -

Additional Sublease Space in Q1 Pushes Total Available Square Feet Back Above 9.0M SF

Research & Forecast Report HOUSTON | OFFICE Q1 2018 Additional sublease space in Q1 pushes total available square feet back above 9.0M SF Lisa Bridges Director of Market Research | Houston After six straight quarters of negative net absorption, Houston’s office market posted positive net absorption in Q4 2017, a little Market Indicators Annual Quarterly Quarterly glimmer of hope that Houston’s office market was finally starting to Relative to prior period Change Change Forecast* look up. The optimism was short-lived as several large companies vacated space during Q1 2018 due to layoffs and mergers, causing VACANCY negative absorption. One of the companies, Technip, which NET ABSORPTION announced its merger with FMC Technologies in 2017 had over 3,000 layoffs nationwide during Q1 and the company vacated over NEW CONSTRUCTION 375,000 SF of class A space in the Katy Freeway submarket. UNDER CONSTRUCTION Developers remain disciplined, only beginning new construction *Projected with a lead tenant in place. Currently, there are only four such projects under construction including Capital Tower in the Central Business District and three projects in North Houston within the CityPlace development. Most of the office buildings that were damaged by Hurricane Summary Statistics Harvey in 2017 have been rehabbed and are back on-line and Houston Office Market Q1 2017 Q4 2017 Q1 2018 landlords are making contingency plans for future unforeseen Vacancy Rate 18.5% 19.1% 20.1% events. Net Absorption -0.7 0.3 -1.5 According to the U.S. Bureau of Labor Statistics, the Houston MSA (Million Square Feet) created 67,100 jobs (not seasonally adjusted) between February New Construction 1.8 0.5 0.2 2017 and February 2018, an annual growth rate of 2.2%, which is (Million Square Feet) above the national average job growth rate of 1.6%. -

Houston's Office Market Posts Positive Absorption in Q2 2018

Research & Forecast Report HOUSTON | OFFICE Q2 2018 Houston’s office market posts positive absorption in Q2 2018 Lisa Bridges Director of Market Research | Houston Houston’s office market made progress in the second quarter, posting positive absorption of 84,750 SF. This is a substantial increase from the negative 1.4 million SF of absorption recorded Market Indicators Annual Quarterly Quarterly in the first quarter. Talos Energy relocated into 101,072 square Relative to prior period Change Change Forecast* feet in 3 Allen Center building in June and Cigna Corp. moved 600 VACANCY employees into 91,190 square feet of space in the Brookhollow Central One building located at 2800 North Loop West in May. NET ABSORPTION These were the largest relocations during the second quarter of NEW CONSTRUCTION 2018. UNDER CONSTRUCTION Even though the recent data released by the US Bureau of Labor Statistics shows the Houston MSA created 79,200 jobs (not *Projected seasonally adjusted) between May 2017 and May 2018, an annual growth rate of 2.6% which is above the national average job growth rate of 1.6%, indicating that Houston’s economy is humming along, many large firms have recently begun downsizing their office space or relocating to smaller footprints. This is proven to be true in the latest report that Occidental Petroleum will vacate close to 800,000 SF of its’ Greenway Plaza submarket space and place it Summary Statistics Houston Office Market Q2 2017 Q1 2018 Q2 2018 on the sublease market for occupancy in 2020. The company plans to move to a new West Houston building planned on the site of the Vacancy Rate 18.8% 22.0% 21.7% former ConocoPhillips West campus, according to a recent article in the Houston Business Journal. -

1 in the United States Bankruptcy Court for The

Case 17-36709 Document 309 Filed in TXSB on 01/26/18 Page 1 of 104 IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION _____________________________________________ ) In re: ) Chapter 11 ) COBALT INTERNATIONAL ENERGY, INC., et al.,1 ) Case No. 17-36709 (MI) ) Debtors. ) Jointly Administered ) CERTIFICATE OF SERVICE I, Andrew Henchen, depose and say that I am employed by Kurtzman Carson Consultants LLC (“KCC”), the proposed claims and noticing agent for the Debtors in the above-captioned cases. On January 23, 2018, at my direction and under my supervision, employees of KCC caused the following document to be served via Electronic Mail upon the service list attached hereto as Exhibit A; via Overnight mail to the parties on the service list attached hereto as Exhibit B for subsequent distribution to beneficial holders of the securities listed on the attached hereto as Exhibit C; via First Class Mail to the parties on the service list attached hereto as Exhibit D, and to the registered holders of Common Stock on the service list attached hereto as Exhibit E, provided by Continental Stock Transfer and Trust Company, as transfer agent; via First Class Mail upon the service lists attached hereto as Exhibit F and Exhibit G; and, on January 25, 2018, via First Class Mail upon the service list attached hereto as Exhibit H: Notice of (A) Disclosure Statement Hearing and (B) Deadline for Filing Objections to Approval of the Disclosure Statement and Disclosure Statement Motion [Docket No. 276] Dated: January 26, 2018 /s/ Andrew Henchen___ Andrew Henchen KCC 2335 Alaska Ave El Segundo, CA 90245 Tel 310.776.7333 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are: Cobalt International Energy, Inc.