Chapter – Iii 3.1.1 Consumer Durable Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State Zone Commissionerate Name Division Name Range Name

Commissionerate State Zone Division Name Range Name Range Jurisdiction Name Gujarat Ahmedabad Ahmedabad South Rakhial Range I On the northern side the jurisdiction extends upto and inclusive of Ajaji-ni-Canal, Khodani Muvadi, Ringlu-ni-Muvadi and Badodara Village of Daskroi Taluka. It extends Undrel, Bhavda, Bakrol-Bujrang, Susserny, Ketrod, Vastral, Vadod of Daskroi Taluka and including the area to the south of Ahmedabad-Zalod Highway. On southern side it extends upto Gomtipur Jhulta Minars, Rasta Amraiwadi road from its intersection with Narol-Naroda Highway towards east. On the western side it extend upto Gomtipur road, Sukhramnagar road except Gomtipur area including textile mills viz. Ahmedabad New Cotton Mills, Mihir Textiles, Ashima Denims & Bharat Suryodaya(closed). Gujarat Ahmedabad Ahmedabad South Rakhial Range II On the northern side of this range extends upto the road from Udyognagar Post Office to Viratnagar (excluding Viratnagar) Narol-Naroda Highway (Soni ni Chawl) upto Mehta Petrol Pump at Rakhial Odhav Road. From Malaksaban Stadium and railway crossing Lal Bahadur Shashtri Marg upto Mehta Petrol Pump on Rakhial-Odhav. On the eastern side it extends from Mehta Petrol Pump to opposite of Sukhramnagar at Khandubhai Desai Marg. On Southern side it excludes upto Narol-Naroda Highway from its crossing by Odhav Road to Rajdeep Society. On the southern side it extends upto kulcha road from Rajdeep Society to Nagarvel Hanuman upto Gomtipur Road(excluding Gomtipur Village) from opposite side of Khandubhai Marg. Jurisdiction of this range including seven Mills viz. Anil Synthetics, New Rajpur Mills, Monogram Mills, Vivekananda Mill, Soma Textile Mills, Ajit Mills and Marsdan Spinning Mills. -

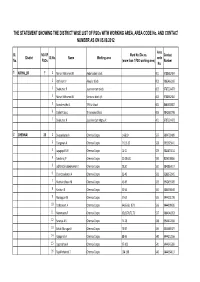

Dos-Fsos -District Wise List

THE STATEMENT SHOWING THE DISTRICT WISE LIST OF FSOs WITH WORKING AREA, AREA CODE No. AND CONTACT NUMBER AS ON 05.09.2012 Area Sl. NO.OF Ward No./Div.no. Contact District Sl.No. Name Working area code No. FSOs (more than 1 FSO working area) Number No. 1 ARIYALUR 7 1 Nainar Mohamed.M Andimadam block 001 9788682404 2 Rathinam.V Ariyalur block 002 9865463269 3 Sivakumar.P Jayankondam block 003 9787224473 4 Nainar Mohamed.M Sendurai block i/c 004 9788682404 5 Savadamuthu.S T.Palur block 005 8681920807 6 Stalin Prabu.L Thirumanur block 006 9842387798 7 Sivakumar.P Jayankondam Mpty i/c 401 9787224473 2 CHENNAI 25 1 Sivasankaran.A Chennai Corpn. 1-6&10 527 9894728409 2 Elangovan.A Chennai Corpn. 7-9,11-13 528 9952925641 3 Jayagopal.N.H Chennai Corpn. 14-21 529 9841453114 4 Sundarraj.P Chennai Corpn. 22-28 &31 530 8056198866 5 JebharajShobanaKumar.K Chennai Corpn. 29,30 531 9840867617 6 Chandrasekaran.A Chennai Corpn. 32-40 532 9283372045 7 Muthukrishnan.M Chennai Corpn. 41-49 533 9942495309 8 Kasthuri.K Chennai Corpn. 50-56 534 9865390140 9 Mariappan.M Chennai Corpn. 57-63 535 9444231720 10 Sathasivam.A Chennai Corpn. 64,66-68 &71 536 9444909695 11 Manimaran.P Chennai Corpn. 65,69,70,72,73 537 9884048353 12 Saranya.A.S Chennai Corpn. 74-78 538 9944422060 13 Sakthi Murugan.K Chennai Corpn. 79-87 539 9445489477 14 Rajapandi.A Chennai Corpn. 88-96 540 9444212556 15 Loganathan.K Chennai Corpn. 97-103 541 9444245359 16 RajaMohamed.T Chennai Corpn. -

Executive Summary Book Namakkal.Pmd

NAMAKKAL DISTRICT EXECUTIVE SUMMARY DISTRICT HUMAN DEVELOPMENT REPORT NAMAKKAL DISTRICT Introduction The district is divided into two Revenue Divisions: Namakkal and Thiruchengode, with five Taluks earlier namely Namakkal, Thiruchengode, Rasipuram, Paramathi and Kollihills. Sendamangalam has been announced as a new Taluk with 30 Revenue firkas. The district has five Municipalities, 15 Panchayat Unions (Blocks), 19 Town Panchayats and 322 Village Panchayats. The Northern portion of Namakkal is mountainous and the southern areas are plains. The chief rivers that run through the district are Cauvery, Aiyaru, Karipottan Aaru and Thirumanimutharu. The river Cauvery flows south and south west traversing across the border. It is one of the major water sources for over all socio economic progress of the district. Geography Namakkal District comes under the north western agro climatic zone of Tamil Nadu. It was bifurcated from Salem District and has been functioning as a separate district since 01-01-1997. 1 It is bounded by Salem in the north,Karur in the south,Trichy in the east and Erode in the west. The Geographical area of the district is 3363.35 square km. Geography of the district is vast and it possesses several hilly regions. The district is situated at an altitude of three hundred meters above the MSL (mean sea level). The Kumarapalayam channel runs for 10.7 km covering the land area of 1032.59 hectares. Thirumanimutharu River starts from Salem district up to Namakkal for the coverage of total area of 18,621 hectares by 105km long length of distance. It benefits the lands in Namakkal district by 34.44 per cent only. -

List of Food Safety Officers

LIST OF FOOD SAFETY OFFICER State S.No Name of Food Safety Area of Operation Address Contact No. Email address Officer /District ANDAMAN & 1. Smti. Sangeeta Naseem South Andaman District Food Safety Office, 09434274484 [email protected] NICOBAR District Directorate of Health Service, G. m ISLANDS B. Pant Road, Port Blair-744101 2. Smti. K. Sahaya Baby South Andaman -do- 09474213356 [email protected] District 3. Shri. A. Khalid South Andaman -do- 09474238383 [email protected] District 4. Shri. R. V. Murugaraj South Andaman -do- 09434266560 [email protected] District m 5. Shri. Tahseen Ali South Andaman -do- 09474288888 [email protected] District 6. Shri. Abdul Shahid South Andaman -do- 09434288608 [email protected] District 7. Smti. Kusum Rai South Andaman -do- 09434271940 [email protected] District 8. Smti. S. Nisha South Andaman -do- 09434269494 [email protected] District 9. Shri. S. S. Santhosh South Andaman -do- 09474272373 [email protected] District 10. Smti. N. Rekha South Andaman -do- 09434267055 [email protected] District 11. Shri. NagoorMeeran North & Middle District Food Safety Unit, 09434260017 [email protected] Andaman District Lucknow, Mayabunder-744204 12. Shri. Abdul Aziz North & Middle -do- 09434299786 [email protected] Andaman District 13. Shri. K. Kumar North & Middle -do- 09434296087 kkumarbudha68@gmail. Andaman District com 14. Smti. Sareena Nadeem Nicobar District District Food Safety Unit, Office 09434288913 [email protected] of the Deputy Commissioner , m Car Nicobar ANDHRA 1. G.Prabhakara Rao, Division-I, O/o The Gazetted Food 7659045567 [email protected] PRDESH Food Safety Officer Srikakulam District Inspector, Kalinga Road, 2. K.Kurmanayakulu, Division-II, Srikakulam District, 7659045567 [email protected] LIST OF FOOD SAFETY OFFICER State S.No Name of Food Safety Area of Operation Address Contact No. -

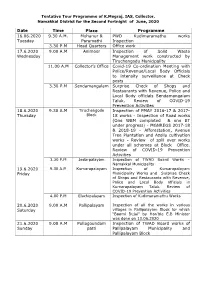

Date Time Place Programme 16.06.2020 Tuesday 9.30 A.M

Tentative Tour Programme of K.Megraj, IAS, Collector, Namakkal District for the Second Fortnight of June, 2020 Date Time Place Programme 16.06.2020 9.30 A.M. Mohanur & PWD Kudimaramathu works Tuesday Paramathi Inspection 3.30 P.M Head Quarters Office work 17.6.2020 9.00 A.M Animoor Inspection of Solid Waste Wednesday Management work constructed by Tiruchengodu Municipality 11.00 A.M Collector’s Office Covid-19 Co-ordination Meeting with Police/Revenue/Local Body Officials to intensity surveillance at Check posts 3.30 P.M Sendamangalam Surprise Check of Shops and Restaurants with Revenue, Police and Local Body officials Sendamangalam Taluk. Review of COVID-19 Prevention Activities 18.6.2020 9.30 A.M Tiruchengode Inspection of PMAY 2016-17 & 2017- Thursday Block 18 works - Inspection of Road works (One WBM completed & one BT under progress) - MGNREGS 2017-18 & 2018-19 – Afforestation, Avenue Tree Plantation and Azolla cultivation works - Review of spill over works under all schemes at Block Office. Review of COVID-19 Prevention Activities 3.30 P.M Jedarpalayam Inspection of TWAD Board Works – Namakkal Municipality 19.6.2020 9.30 A.M Kumarapalayam Inspection of Kumarapalayam Friday Municipality Works and Surprise Check of Shops and Restaurants with Revenue, Police and Local Body officials in Kumarapalayam Taluk. Review of COVID-19 Prevention Activities 4.00 P.M Elachipalayam Inspection of Kudimaramathu Works 20.6.2020 9.00 A.M Pallipalayam Inspection of all the works in various Saturday villages in Pallipalayam Block for which “Boomi Bujai” by Hon’ble E.B Minister was done on 13.06.2020 21.6.2020 9.00 A.M Pullagoundam Inspection of TWAD Board works of Sunday patti Pallipalayam Municipality and Pallipalayam Block 22.6.2020 9.00 A.M. -

District Census Handbook, Namakkal, Part-XII-A & B, Series-33

CENSUS OF INDIA 2001 SERIES-33 TAMIL NADU DISTRICT CENSUS HANDBOOK Part - A & B NAMAKKAL' DISTRICT VILLAGE & TOWN DIRECTORY -¢- VILLAGE AND TOWNWISE PRIMARY CENSUS,ABSTRACT Dr. C. Chandramouli of the Indian Administrative Service Director of Census Operations, Tamil Nadu LORD ANJ~NEYA A colossal idol ofAnjaneya about 18 feet high is the lial~¥k - ~f; -o~lossal statue-in Namakkal Town. AccoIding to legend, Sri Anjaneya who was, returning from Sri Lanka with the Sanjivi hills, brought with him Sri.Narasimha from the'Kiantaki River. As he was thirsty, he alighted on the banks ofthe Kamalalayam to drink: water_ He placed Sri.Narasimha on the banks of the tank before quenching his thirst. WhenAnjaney~ tried to remove him, he could not do so. Sri.Narasimha settled down at N amakkal with Sri .Mahalakshmi, who was doing penance there. To commemorate this incident the statue of Anjaneya has been installed here. He is facing east with folded hands worshipping Sri.Lakshmi Narasimha. (iIii) Contents .t:'ages Foreword Xl Preface Xlll Aclmowledgements xv Map of Namakkal District XYll District Highlights - 2001 XIX Important Statistics of the District, 2001 XXI Ranking of Taluks in the District xxiii Summary Statements Statement 1 Name of the headquarters of DistrictfTaluk, their rural-urban XXVi status and distance from District headquarters; 2001 Statement 2 Name of the headquarters of District/CD block, their XXVI rural-urban status and distance from District headquarters, 2001 Statement 3 PopUlation of the District at each census from 1901 to 2001 XXVll Statement 4 Area, number of villages/towns and population in District XXV11l and Taluk, 2001 Statement 5 CD block wise number of villages and rural population, 2001 xxx Statement 6 Population of urban agglomerations (including constituent units! XXX! towns),200l . -

ADDRESSES of the OFFICES of TAMILNADU POLLUTION CONTROL BOARD Head Office 76, Mount Salai, Guindy, Chennai-600 032 Phone: 044 22

ADDRESSES OF THE OFFICES OF TAMILNADU POLLUTION CONTROL BOARD Head office 76, Mount Salai, Guindy, Chennai-600 032 Phone: 044 2235 3134 to 2235 3136 Fax: 044 2235 3068 E.Mail: [email protected] Website: www.tnpcb.gov.in OCMMS Team Thiru.M.Muralidharan AEE - 7338897138 Thiru.R.Sridhar AE - 8056042168 JCEE (MONITORING) OFFICES Sl. Zonal Office Postal Address Jurisdiction(O/o DEE) No. 1 Chennai Tamil Nadu Pollution Control Board, Chennai, Ambattur First Floor, 950/1, Poonamallee High Maraimalai Nagar, Road, Arumbakkam, Sriperumbudur, Chennai - 600 106. Tiruvallur, Phone: 044-26220219 Gummidipoondi Email: [email protected] 2 Coimbatore Tamil Nadu Pollution Control Board, Coimbatore (North), Plot No.E-55A, SIDCO Industrial Coimbatore (South), Estate, Pollachi Main Road, Kurchi Tiruppur North, Coimbatore – 641021 Tiruppur South, Phone: 0422-2677007 Udhagamandalam Email.: [email protected] 3 Madurai Tamil Nadu Pollution Control Board, Madurai, SIDCO Industrial Estate, Sivagangai, Kappalur, Thirumangalam Taluk, Theni, Madurai - 625 008. Ramanathapuram, Phone: 0452-2489739 Dindigul Email: [email protected] 4 Tirunelveli Tamil Nadu Pollution Control Board Tirunelveli, No.30/2, SIDCO Industrial Estate, Thoothukudi, Pettai, Tirunelveli - 627010. Virudhunagar, Phone:0462-2342931 Nagercoil Email: [email protected] 5 Trichy Tamil Nadu Pollution Control Board, Trichy, Ariyalur, No.25, Developed Plots, Pudukottai, Thuvakudy, Trichy - 620 015 Thanjavur, Phone: 0431-2502020 Nagapattinam, Email : [email protected] Cuddalore 6 Vellore Tamil Nadu Pollution Control Board Vellore, Auxillium College Road, Villupuram, (Opposite to Auxillium College) Hosur, Gandhi Nagar, Vellore -632 006 Tiruvannamalai, Phone: 0416-2242120 Vaniyambadi, Email : [email protected] Dharmapuri 7 Salem Tamil Nadu Pollution Control Board Erode, No.9, 4th Cross Street Namakkal, Brindhavan road, Perundurai, Fair lands,Salem-636 016 Salem, Karur Phone : 0427 – 2445526 Kumarapalayam Email :[email protected] DISTRICT OFFICES Office Headed by District Environmental Engineer Sl. -

Exploring Groundwater Level of Namakkal District in Tamil

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395 -0056 Volume: 04 Issue: 02 | Feb -2017 www.irjet.net p-ISSN: 2395-0072 EXPLORING GROUNDWATER LEVEL OF NAMAKKAL DISTRICT IN TAMIL NADU BY EMPLOYING GEOGRAPHIC INFORMATION SYSTEM S.Vinothkanna1, Dr.V.Emayavaramban2 and K.Senthilraja3 1Department of Geography, SEAS, Madurai Kamaraj University, Madurai – 625 021 2Department of Agronomy, Agricultural College and Research Institute, Tamil Nadu Agricultural University, Madurai, Tamil Nadu–625104, India ---------------------------------------------------------------------***--------------------------------------------------------------------- Abstract - Groundwater is one of the important resources temporal variogram to find the suitable sampling interval. for living organism’s life. It will act as a life bearing layer when Monitoring groundwater level fluctuation data on seasonal rainfall fails. India is an agriculture country and mostly basis can identify early indicators of changes in the depends on monsoon rainfall, the study on ground water is groundwater resource and help to understand how to very important. This study focuses groundwater level of protect it (Holmes et.al., 2001). Namakkal district in Tamil Nadu. Nearly 34 years (1980 to 2013) of secondary data has been analyzed with simple 2. STUDY AREA statistical method and the result was brought out using The Namakkal District lies in the interior part of Geographical Information System technology. The data were Tamil Nadu and extends between 11000’ to 11036’ north analysed based on seasonal and mean annual level. The Latitudes and 77040’to 78030’ east longitudes. The total overall study identified that at seasonal level the average geographical area of the district is 3429.3 sq.km. Namakkal maximum fall in groundwater level is identified in south west district is divided into five Taluks namely, Namakkal, monsoon at Thimmanaickenpatti (22.20 m) and minimum is Tiruchengode, Paramathi, Rasipuram and Kollimalai. -

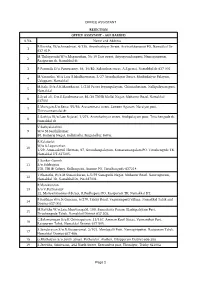

OFFICE ASSISTANT Page 1 REJECTION OFFICE Assistantанаage BARRED S.No. Name and Address 1 2 3 P.Parimala D/O.Ponnusamy

OFFICE ASSISTANT REJECTION OFFICE ASSISTANT - AGE BARRED S.No. Name and Address P.Kavitha, W/o.Annadruai, 4/136, Arunthathiyar Street, Avalnaikkenpatti PO, Namakkal Dt- 1 637 019. M.Thilagavathi W/o.Maganathan, No.39 East street, Ariyagoundanpatti, Namagiripettai, 2 Rasipuram tk, Namakkal dt 3 P.Parimala D/o.Ponnusamy, 68, 10/B2, Kolanthan street, A.S.pettai, Namakkal dt 637 001 M.Vasantha, W/o.Late S.Madheswaran, 3/27 Arunthathiyar Street, Muthudaiyar Palayam, 4 Uduppam, Namakkal M.Kala, D/o.A.K.Manokaran, 1/218 Periya Iyyampalayam, Chinnathottam, Nallipalayam post, 5 Namakkal S.Syed ali, S/o.S.Syedmunavar, B1/36 TNHB Mullai Nagar, Mohanur Road, Namakkal 6 637001 S.Murugan S/o.Settu, 55/56, Arasammara street, Jameen Agaram, Naraiyur post, 7 Thiruvannamalai dt S.Sathiya W/o.Late.Rajavel, 1/273, Arunthathiyar street, Andipalayam post, Tiruchengode tk, 8 Namakkal dt V.Sathyalakshmi 9 W/o M.Senthilkumar 80, Kamaraj Nagar, Kallimadai, Singanallur, Kovai. R.Kalaiselvi W/o G.Loganathan 10 1/29, Ammankovil Thottam, 87, Goundampalayam, Kumaramangalam PO, Tiruchengode TK, Namakkal DT-637205. S.Sankar Ganesh 11 S/o Subbaiyan 358, TNHB Colony, Kollampatti, Animur PO, Tiruchengode-637214. T.Bharathi, W/o.M.Gunasekaran, L-5/59 Ganapathi Nagar, Mohanur Road, Ganesapuram, 12 Namakkal Tk, Namakkal Dt, Pin 637001. P.Manikandan 13 S/o V.Periyasamy 12, Mariyammankovil Street, R.Pudhupatti PO, Rasipuram TK, Namakkal DT. P.Karthiga W/o.N.Ganesan, 6/279, Trichy Road, Vagurampatti Village, Namakkal Taluk and 14 District-637 001. M.Kavitha W/o.Late.ManivasagaM, 100, Samathuva Puram, Elachipalayam Post, 15 Tiruchengode Taluk, Namakkal District-637 202. -

Tamil Nadu Government Gazette

© [Regd. No. TN/CCN/467/2012-14. GOVERNMENT OF TAMIL NADU [R. Dis. No. 197/2009. 2016 [Price: Rs. 32.80 Paise. TAMIL NADU GOVERNMENT GAZETTE PUBLISHED BY AUTHORITY No. 30] CHENNAI, WEDNESDAY, JULY 27, 2016 Aadi 12, Thunmugi, Thiruvalluvar Aandu – 2047 Part VI—Section 4 Advertisements by private individuals and private institutions CONTENTS PRIVATE ADVERTISEMENTS Pages. Change of Names .. 1825-1905 Notice .. 1905 Notice .. NOTICE NO LEGAL RESPONSIBILITY IS ACCEPTED FOR THE PUBLICATION OF ADVERTISEMENTS REGARDING CHANGE OF NAME IN THE TAMIL NADU GOVERNMENT GAZETTE. PERSONS NOTIFYING THE CHANGES WILL REMAIN SOLELY RESPONSIBLE FOR THE LEGAL CONSEQUENCES AND ALSO FOR ANY OTHER MISREPRESENTATION, ETC. (By Order) Director of Stationery and Printing. CHANGE OF NAMES 26561. I, Ruby, G., wife of Thiru K. Ganapathy, 26564. My daughter, N.B. Dhuviksha Janasri, born on born on 2nd May 1977 (native district: Madurai), 13th October 2008 (native district: Perambalur), residing at residing at No. 3/308, Anna Street, Thenur Post, No. 2-99, Mela Street, Sivarakottai, Thirumangalam Taluk, North Taluk, Madurai-625 402, shall henceforth be Madurai-625 706, shall henceforth be known as B. VARSHAA. known as BACKIYALAKSHMI, G. T.N. BALAMURUGAN. RUBY, G. Madurai, 18th July 2016. (Father.) Madurai, 18th July 2016. 26565. I, P. Arumugam alias Rohini, wife of Thiru 26562. My son, N.B. Sugan, born on 25th January 2004 R. Karthikeshav, born on 3rd June 1989 (native district: (native district: Madurai), residing at No. 2-99, Mela Street, Tiruchirappalli), residing at No. 5-2-17, Raj Nagar 2nd Street, Sivarakottai, Thirumangalam Taluk, Madurai-625 706, Shanthi Nagar, Vilangudi, Madurai-625 018, shall henceforth shall henceforth be known as B. -

D D Agrawal Co. Chartered Accountants

D D Agrawal Co. M-9582101001 Chartered Accountants M- [email protected] Commission State Zone Division Name Range Name Range Jurisdiction erate Name Andaman And Kolkata Haldia Andaman And RANGE-I Ward I to VI of Port Blair Municipal Council Nicobar Island Nicobar Division Andaman And Kolkata Haldia Andaman And RANGE-II Ward VII to XI of Port Blair Municipal Council Nicobar Island Nicobar Division Andaman And Kolkata Haldia Andaman And RANGE-III Ward XII to XVIII of Port Blair Municipal Council Nicobar Island Nicobar Division Andaman And Kolkata Haldia Andaman And RANGE-IV Ward-XIX to Ward-XXIV of Port Blair, Municipal Council, Area of South Andaman District outside Port Nicobar Island Nicobar Division Blair Municipal Council along with entire area of Havelok & Neil Islands. Andaman And Kolkata Haldia Andaman And RANGE-V Entire Area of North & Middle Andaman District and Nicobar District & Little Andaman & Nicobar Nicobar Island Nicobar Division Andhra Pradesh Visakhapatnam - Guntur Amaravathi AMARAVATHI Amaravathi, Pedakurapadu, Thulluru, Tadikonda, Mangalagiri, Tadepalli and Pedakakani Mandals Amaravathi Division CAPITAL CITY RANGE Andhra Pradesh Visakhapatnam - Guntur Amaravathi BHAVANIPURAM East: “Indrakeeladri Range” starting from west side of Nagarjuna Street, starting from BhavanipuramGhat via Amaravathi Division Crambay road uptoGollapudi Bye pass road. Northside of Tunnel Road commencing from Tunnel via Sitara Road, Kabela Road, up to Y.S.R. Fly over. Further, villages of KothuruTadepalli, Ambapuram, P.Nainavaram, Patapadu, Nunna and Jakkampudi.North: Starting from P.Nainavaram Village to Jakkampudi Village.South: South-west side of Nagarjuna Street of Krishna River Bank via Darga Street, M.K.R. Buildings upto eastern side of Pantakaluva (MustabadKanal).West: Starting from Eastern side of Pantakaluva via Mail Rai Centre, Gollapudi Bye pass road leads to all villages upto Jakkampudi Village. -

Namakkal District Statistical Handbook 2016-17

NAMAKKAL DISTRICT STATISTICAL HANDBOOK 2016-17 1. AREA POPULATION 1.1 AREA, POPULATION, SC’S, ST’S, and LITERATES – SEX WISE BY BLOCK MUNICIPALITIES YEAR: 2016-17 Population Scheduled Caste Scheduled Tribes Literates Name of the Blocks / Area S.No Minicipalities (Sq.Km) Persons Male Female Persons Male Female Persons Male Female Persons Male Female 1 Namakkal 211.9 100770 50918 49852 24959 12521 12438 381 211 170 74044 40589 33455 2 Erumaipatty 194 138204 69680 68524 38001 18966 19035 501 273 228 95935 53188 42747 3 Sendamangalam 185.3 80374 40126 40248 21540 10788 10752 2596 1342 1254 53181 29334 23847 4 Mohanur 278.6 95990 47550 48440 18499 9201 9298 61 35 26 63796 35708 28088 5 Puduchatram 262.4 83640 42714 40926 21575 10905 10670 316 173 143 53821 31239 22582 6 Kollihills 371.3 40479 20862 19617 668 337 331 38678 19963 18715 21073 12240 8833 7 Rasipuram 105.6 83379 43307 40072 25921 13325 12596 350 120 230 54577 31720 22857 8 Namagiripettai 291 104094 52939 51155 27383 13955 13428 11810 6041 5769 66888 37570 29318 9 Vennathur 212.4 87631 45098 42533 20116 10244 9872 1195 625 570 56273 32516 23757 10 Tiruchengode 220.2 101686 51532 50154 20484 10333 10151 84 42 42 69427 39006 30421 11 Mallasamudram 214.3 78082 39999 38083 19888 10177 9711 47 24 23 50207 29041 21166 12 Elachipalayam 262 73163 35918 37245 20535 10297 10238 52 30 22 48485 26564 21921 13 Pallipalayam 153.9 171507 85239 86268 25713 12816 12897 150 73 77 110009 58796 51213 14 Paramathi 244 81580 41290 40290 17245 8565 8680 98 52 46 56549 32121 24428 15 Kabilarmalai 105.908