Second Quarter 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AC/DC You Shook Me All Night Long Adele Rolling in the Deep Al Green

AC/DC You Shook Me All Night Long Adele Rolling in the Deep Al Green Let's Stay Together Alabama Dixieland Delight Alan Jackson It's Five O'Clock Somewhere Alex Claire Too Close Alice in Chains No Excuses America Lonely People Sister Golden Hair American Authors The Best Day of My Life Avicii Hey Brother Bad Company Feel Like Making Love Can't Get Enough of Your Love Bastille Pompeii Ben Harper Steal My Kisses Bill Withers Ain't No Sunshine Lean on Me Billy Joel You May Be Right Don't Ask Me Why Just the Way You Are Only the Good Die Young Still Rock and Roll to Me Captain Jack Blake Shelton Boys 'Round Here God Gave Me You Bob Dylan Tangled Up in Blue The Man in Me To Make You Feel My Love You Belong to Me Knocking on Heaven's Door Don't Think Twice Bob Marley and the Wailers One Love Three Little Birds Bob Seger Old Time Rock & Roll Night Moves Turn the Page Bobby Darin Beyond the Sea Bon Jovi Dead or Alive Living on a Prayer You Give Love a Bad Name Brad Paisley She's Everything Bruce Springsteen Glory Days Bruno Mars Locked Out of Heaven Marry You Treasure Bryan Adams Summer of '69 Cat Stevens Wild World If You Want to Sing Out CCR Bad Moon Rising Down on the Corner Have You Ever Seen the Rain Looking Out My Backdoor Midnight Special Cee Lo Green Forget You Charlie Pride Kiss an Angel Good Morning Cheap Trick I Want You to Want Me Christina Perri A Thousand Years Counting Crows Mr. -

Summerwine-Musik Werner Stand 08.03.2018 Kursiv Titel in Vorbereitung Micha Karin 18

Songliste "Silver Spurs 2018" Summerwine-Musik Werner Stand 08.03.2018 kursiv Titel in Vorbereitung Micha Karin 18 Wheels and a dozend roses Wheels N´Roses Kathy Mattea Achy breaky heart Barn Dance / Electric Slide / Chill Factor Billy Ray Cyrus All my X´s live in Texas Tag on, Barn Dance, Shadow George Strait All shook up All shook up Elvis Presley All summer long Cowboy Charlston# AllSummerLong/Sprentlinger Kid Rock All you ever do is bring me down Cucaracha / Ridin' /Rio / Springswing The Mavericks Always on my mind Willi Nelson And then he kissed me Derailed The Crystals Any Man of Mine Canadian Stump# Power Shania Twain Angle in blue jeans Angle in blue jeans Apache Riding´/Wild Stallion Shadows Bad Case of loving you Doctor Doctor Be my baby tonight Thush Push, BBC Bible Belt, Hallelujah John Michael Montgomery Beer for my horses Beer for my horses Toby Keith + Nelson Black coffe Black coffe Lacy J.Dalton Black Velvet Black Velvet Alannah Myles Blame it on the Bosa Nova Bosa Nova Jane McDonald Blanket on the Ground Blanket on the Ground Billie Jo Spears Blue Bayou Blue Bayou Linda Ronstadt Bonfire Heart Bonfire Heart James Blunt Boot Scootin Boogie Ghost train Brooks & Dunn C´est la vie Line chacha Emmylou Harris Cabo san Lucas Cabo san Lucas Toby Keith Cajun Hoedown Firestorm Karen Mc Dawn Calm After the Storm Calm After the Storm The common Linnets Chattahoochie Chatterhoochee / South sideshuffle/Country Rock Alan Jackson City of new Orleans 2 Steps Willi Nelson Closer Closer Susan Ashton Come Dance with me Come Dance with me Nancy -

Tomorrow Never Comes" by Garth Brooks (78 BPM) "If Tomorrow Never Comes" by Ronan Keating (79 BPM) Choreographer: Karl "The Spirit" Gregeen

TomorrowTomorrow Never Never Comes Comes Type: 32 Counts, 4 Wall Line Dance, Smooth (Night Club) Level: Improver Music: "If Tomorrow Never Comes" by Garth Brooks (78 BPM) "If Tomorrow Never Comes" by Ronan Keating (79 BPM) Choreographer: Karl "The Spirit" Gregeen 1-8 Step fwrd. R, 1/2 Turn R & Step back L, Step back R, Touch L across, Step fwrd. L, Lock Step fwrd. R, Step Turn 1/2 R, 1/4 Turn R & Side L 1, 2 RF Schritt nach vorn, 1/2 Drehung rechts herum (face 6:00) und LF Schritt zurück &3,4 RF Schritt zurück, LFSp vor RF gekreuzt auftippen, LF Schritt nach vorn 5&6 RF Schritt nach vorn, LF hinter RF einkreuzen, RF Schritt nach vorn 7& LF Schritt nach vorn, 1/2 Drehung rechts herum (face 12:00) 8 1/4 Drehung rechts herum (face 3:00) und LF Schritt nach links 9-16 Rock back R, Recover, 1/4 L & Side R, Rock back L, Recover, Step fwrd. L, Lock Step fwrd. R, Step Turn 1/2 R 1, 2 RF Schritt zurück, Gewicht nach vorn auf LF & 1/4 Drehung links herum (face 12:00) und RF Schritt nach rechts 3, 4 LF Schritt zurück, Gewicht nach vorn auf RF 5 LF Schritt nach vorn 6&7 RF Schritt nach vorn, LF hinter RF einkreuzen, RF Schritt nach vorn 8& LF Schritt nach vorn, 1/2 Drehung rechts herum (face 6:00) 17-24 1/4 Turn R into Basic L, Basic R, 1/4 Turn R into Basic L, Basic R 1 1/4 Drehung rechts herum (face 9:00) und LF Schritt nach links 2& RF an LF heran setzen, LF vor RF kreuzen 3 RF Schritt nach rechts 4& LF an RF heran setzen, RF vor LF kreuzen 5 1/4 Drehung rechts herum (face 12:00) und LF Schritt nach links 6& RF an LF heran setzen, LF vor RF kreuzen 7 RF Schritt nach rechts 8& LF an RF heran setzen, RF vor LF kreuzen 25-32 Rock fwrd. -

Garth Brooksdouble Live CD 1 Full Album Zip

Garth Brooks-Double Live (CD 1) Full Album Zip 1 / 4 Garth Brooks-Double Live (CD 1) Full Album Zip 2 / 4 3 / 4 ON: GOLD ALBUM ... strong growth to more than 60 million paid subscriptions drove the U.S. music industry to its fourth consecutive year of double digit growth.. Buy Garth Brooks - Gunslinger (CD) at Walmart.com. ... Enter Zip Code or city, state. ... Double Live (CD) (Includes DVD) (Exclusive). 11 ... From a Room: Volume 1 (CD). 5 ... 2016 release, the 10th studio album from the country music superstar and 2016 CMA ... Whisky to wine is the best track but the whole CD is great!. GARTH BROOKS Double Live 2-disc Cd Like New, CD Case Cracked ... Limited Commemorative Package [Disc 1] by Garth Brooks (CD, 2001) ... Release Year: 1998, Record Label: Capitol/EMI Records ... Additionally, you will be entitled to a replacement item (if available) or a full refund -. ... Please enter a valid ZIP Code.. A RIAA certification for sales of 1 million units, with multimillion sellers ... For boxed sets, and double albums with a running time that exceeds two hours, the ... Most tape prices, and CD prices for BMG and WEA labels, are suggested lists. ... 11 5 BAD BOY 73000VARISTA (9.98/16.98) 64 GARTH BROOKS A9 THE HITS 12 .... Garth Brooks Lyrics - Download Albums from Zortam Music. ... Download "Garth Brooks" for FREE!!! ... Garth Brooks - Double Live (Disc 1) - Zortam Music .... and picking his best hits package and live disc. ... platinum eight times over – but you can tell from listening to Sevens that Brooks wanted to win ... -

Univision Leads Boom What's New in TV Syndication

$4.95 i The Newsrreekly of Televisioñ VDI 127 No. 41 66th Year 199i A Cahner SPECIAL REPOR- Hispanic 1V/Radio: Univision Leads Boom 105 Days to NATPE: What's New in TV Syndication TV Takes Heat *******************3 -Dion* 591 1111hI1I1tu1ln 11111111111111111111111111111 FCC 11111 at Hearings 8C075184 ALG98 REGE 1887 JOHN C ZOFESON -T9 265 KATERTON NAY BILLINGS, ItT 59102 -7755 www.americanradiohistory.com ALRE DY IN 64% OF T AVALUBLE «W 1 ,.>s..-i v Next To Last Productions and BabyWay Productions in association with Warner Bros. Television Warren-Rinsler Productions The Townsend Entertainment Corporation in association with Warner Bros Television www.americanradiohistory.com BOUGHT HE COUNTRY! FALL 1999! VARNER BROS. DOMESTIC TELEVISION DISTRIBLI ION www.americanradiohistory.com http://www.broadcastingcable.com Must Reading from Fast October 6. 1997 TOP OF THE WEEK / 10 105 days to NATPE With less than four months until the NATPE convention, syndicators are already looking to next season after a less than spectacular fall. The majority of new talk shows for fall 1998 have been announced, and more remakes and spin-offs are in the offing. / 10 Report from MIPCOM The biggest deal of the MIPCOM programming marketplace emerged when UK media conglomerate Pearson Plc. tendered an offer to buy All American Communications for $513 million in cash and debt -possibly creating the world's largest international television producer. / 12 Even NBC feels the pinch NBC's 11.6 rating and 19 share during premiere week last month earned the network first place, but even the top network was pinched by the ratings decline that plagued nearly all of the broadcast networks for the week. -

The Dance Pdf, Epub, Ebook

THE DANCE PDF, EPUB, EBOOK Oriah Mountain Dreamer | 208 pages | 27 Jul 2002 | HarperCollins Publishers | 9780007112999 | English | London, United Kingdom The Dance PDF Book Let us know if you have suggestions to improve this article requires login. Lenny Castro. Nobody Gets Off in This Town. Gibson the Rockstar Cat. Josephus specified that the execution took place at Machaerus, a fort near the Dead Sea in modern-day Jordan. Close cart. Available on Amazon. Unsourced material may be challenged and removed. Explore Our Dance Classes. Lindsey Buckingham : I think all of us have an inner demon that we struggle with Some scholars were not convinced, expressing doubts about whether the newly identified niche represents the remains of the throne of Herod Antipas. Unlike the movements performed in everyday living, dance movements are not directly related to work, travel, or survival. Hair Accessories. As the pics flashed across the screen of friends of kindergarten that were still friends there senior year, it's like you never will really know what that group went through the past 13 years but i was probably rough, and not to think that even if it was the worst of times that would not have changed anything. The three of us had been hanging out at a benefit for M. Garth Brooks. A Dance Shop Exclusive. Save Cancel. By Artist. Victim of the Game. Against The Grain. No you would want to dance with the "love of you life" what if you just sat back and watched everyone else dance with that one person you could have maybe possibly had that chance with Shop Best Sellers View all. -

Issue 157 Gold Dependent on PD Background? a Funny Thing Happened on the Way to Checking out the Top 100 Most-Played Country Radio Power Gold

September 8, 2009 Issue 157 Gold Dependent On PD Background? A funny thing happened on the way to checking out the Top 100 most-played Country radio Power Gold. I ran the PG list as normal, using Mediabase 24/7 for all CA/Mediabase reporting stations for the two-week period Aug. 23-Sept. 5, 2009. I figure with the start of the fall book just a couple weeks away, it’s a great time to make sure your Power Gold list is polished to a high gloss. After running that list, which appears on Page 6 of this CA Weekly, I decided to run the PG list using the Mediabase 24/7 Custom Report tool for both the “Country PD” and the “Pop- Parr None: KKGO/Los Angeles morning host Shawn Parr served as the background Country PD” filter I’ve run in the past. voice of the Jerry Lewis MDA telethon this past weekend (9/6-7), rubbing Background: In the April 13 CA Weekly (see elbows with everyone from Charro (l) to Wynonna (r). CountryAircheck.com, archives), we ran a comparison of the current music lists from the two sets of programmers. Taylor Turns 10 The “Country PD” list consists of 20 veteran Country radio According to Big Machine, Taylor Swift’s programmers. The “Pop PD” group is 18 current Country radio worldwide album sales have surpassed 10 million programmers who have come to the format for the first time in units, and she’s sold an additional 20 million paid the last year or so. song downloads. -

Jazzing the Music Mix NASHVILLE- Two Number One Songs by Garth

Jazzing the Music Mix NASHVILLE- Two number one songs by Garth Brooks-and she’s not even country!In the world of jazz, Benita Hill’s one-two punch is hitting its mark. The former background singer for the Allman Brothers Band released her first critically acclaimed CD, Fan The Flame, and established herself as a silky-voiced stylist and hit songwriter.In addition to Brooks, Hill’s songs have been recorded by Isaac Hayes and Kirk Whalum, among others. Her live performances regularly receive accolades and Hill has shared the stage with such jazz/pop luminaries as Boney James, Chuck Mangione, Kirk Whalum Michael Franks and Yolanda Adams, to mention a few. Fan the Flame elicited these raves: “One of the top ten albums of the year”(Entertainment At Home),”An immensely involving vocalist”(Billboard),”Sexy enough to put a eunuch in the mood”(Charles Earle, In Review),”Music with a languid, timeless quality that draws on pop standards and cocktail jazz...a stylist on the order of Julie London or Peggy Lee”(Michael McCall, Nashville Scene),”An exquisitely crafted recording from an amazing talent”(Brent Clanton,KODA,Houston). Her second CD, Tangerine Moon, features the title cut and fourteen songs ranging from the sultry Southern style “Dream About You” to a swinging “More Money”. Jazz from Nashville? Jazz at its purest freely interprets myriad influences.Benita’s standard-sounding original songs crossed so many boundaries that even Garth Brooks is a fan and was moved to record three of her compositions.”Take The Keys To My Heart” and “Two Pina Coladas” (also a #1 single) were on his Sevens album and “It’s Your Song” (renamed as a dedication to his mother) was the first single from his Double Live CD. -

112 It's Over Now 112 Only You 311 All Mixed up 311 Down

112 It's Over Now 112 Only You 311 All Mixed Up 311 Down 702 Where My Girls At 911 How Do You Want Me To Love You 911 Little Bit More, A 911 More Than A Woman 911 Party People (Friday Night) 911 Private Number 10,000 Maniacs More Than This 10,000 Maniacs These Are The Days 10CC Donna 10CC Dreadlock Holiday 10CC I'm Mandy 10CC I'm Not In Love 10CC Rubber Bullets 10CC Things We Do For Love, The 10CC Wall Street Shuffle 112 & Ludacris Hot & Wet 1910 Fruitgum Co. Simon Says 2 Evisa Oh La La La 2 Pac California Love 2 Pac Thugz Mansion 2 Unlimited No Limits 20 Fingers Short Dick Man 21st Century Girls 21st Century Girls 3 Doors Down Duck & Run 3 Doors Down Here Without You 3 Doors Down Its not my time 3 Doors Down Kryptonite 3 Doors Down Loser 3 Doors Down Road I'm On, The 3 Doors Down When I'm Gone 38 Special If I'd Been The One 38 Special Second Chance 3LW I Do (Wanna Get Close To You) 3LW No More 3LW No More (Baby I'm A Do Right) 3LW Playas Gon' Play 3rd Strike Redemption 3SL Take It Easy 3T Anything 3T Tease Me 3T & Michael Jackson Why 4 Non Blondes What's Up 5 Stairsteps Ooh Child 50 Cent Disco Inferno 50 Cent If I Can't 50 Cent In Da Club 50 Cent In Da Club 50 Cent P.I.M.P. (Radio Version) 50 Cent Wanksta 50 Cent & Eminem Patiently Waiting 50 Cent & Nate Dogg 21 Questions 5th Dimension Aquarius_Let the sunshine inB 5th Dimension One less Bell to answer 5th Dimension Stoned Soul Picnic 5th Dimension Up Up & Away 5th Dimension Wedding Blue Bells 5th Dimension, The Last Night I Didn't Get To Sleep At All 69 Boys Tootsie Roll 8 Stops 7 Question -

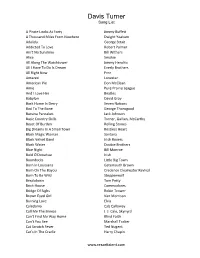

Davis Turner Song List

Davis Turner Song List A Pirate Looks At Forty Jimmy Buffett A Thousand Miles From Nowhere Dwight Yoakum Adalida George Strait Addicted To Love Robert Palmer Ain't No Sunshine Bill Withers Alice Smokie All Along The Watchtower Jimmy Hendrix All I Have To Do Is Dream Everly Brothers All Right Now Free Amazed Lonestar American Pie Don McClean Amie Pure Prairie League And I Love Her Beatles Babylon David Gray Back Home In Derry Seven Nations Bad To The Bone George Thorogood Banana Pancakes Jack Johnson Basic Country Skills Turner, Gallian, McCarthy Beast Of Burden Rolling Stones Big Dreams In A Small Town Restless Heart Black Magic Woman Santana Black Velvet Band Irish Rovers Black Water Doobie Brothers Blue Night Bill Monroe Bold O'Donahue Irish Boondocks Little Big Town Born In Louisiana Gatemouth Brown Born On The Bayou Credence Clearwater Revival Born To Be Wild Steppenwolf Breakdown Tom Petty Brick House Commodores Bridge Of Sighs Robin Trower Brown Eyed Girl Van Morrison Burning Love Elvis Caledonia Cab Calloway Call Me The Breeze J. J. Cale, Skynyrd Can't Find My Way Home Blind Faith Can't You See Marshall Tucker Cat Scratch Fever Ted Nugent Cat's In The Cradle Harry Chapin www.resorttalent.com Charlie On The MTA Kingston Trio Chicken Fried Zack Brown China Grove Doobie Brothers City Of New Orleans Arlo Guthrie Cocaine J. J. Cale, Eric Clapton Cold Shot Stevie Ray Vaughn Come Monday Jimmy Buffett Come Out Ye Black And Tans Irish Cool Change Little River Band Copper Head Road Steve Earl Couldn't Stand The Weather Stevie Ray Vaughn -

EB Confused About Prayer

I’m Confused About Prayer? by John W. Cowart Cowart Communications Jacksonville, Florida I’m Confused About Prayer? by John W. Cowart Previously published as: Why Don’t I get What I Pray For? InterVarsity Press, 1993 © 2005 by John W. Cowart www.cowart.info ISBN 1-4116-2434-3 Library of Congress Control Number: 2005922523 Cover Art & Book Design by Donald Z. Cowart http://www.rdex.net Cowart Communications Jacksonville, Florida A Lulu Press Book For Gin When I prayed 35 years ago to get over loving you, I'm so glad that God did not answer my prayer. --- John There is one way of overcoming our ghostly enemies: spiritual mirth and a perpetual bearing of God in our minds. --- St. Anthony This is what the Lord says, He who made the earth, The Lord who formed it and established it -- The Lord is His name: Call to me And I will answer you And tell you Great and unsearchable things You do not know. --- Jeremiah 33: 2-3 Table Of Contents INTRODUCTION WHY DON'T I GET WHAT I PRAY FOR?...............1 CHAPTER TWO MULES, OXEN AND SKUNKS...........................19 CHAPTER THREE Does God Have The Clout To Do What We Ask? 33 CHAPTER FIVE PRAYER: WHAT IT AIN'T PRAYER: WHAT IT IS......................................56 CHAPTER SIX SWEET PRAYERS TO AN ANGRY GOD...............71 CHAPTER SEVEN MAYBE GOD JUST DOESN'T CARE....................81 CHAPTER EIGHT WHAT HAVE I DONE THAT'S SO AWFUL?.........99 CHAPTER NINE WHAT AM I DOING NOW THAT'S SO AWFUL?.114 CHAPTER TEN MOUNTAIN GET OUT OF MY WAY! I GOT FAITH -- SORT OF...............................129 CHAPTER -

Request List 600 Songs 01012020

PAT OWENS 3 Doors Down Big and Rich Bruce Springsteen Counting Crows (cont.) Dion Eric Church (cont.) Gary Allan (cont.) Hootie and the Blowfish Be Like That Save A Horse Glory Days Mr. Jones Runaround Sue Springsteen Watching Airplanes Hold My Hand Here Without You Rain King Talladega Let Her Cry Kryptonite Bill Withers Bryan Adams Round Here Dishwalla George Jones Only Wanna Be With You Ain't No Sunshine Heaven Counting Blue Cars Eric Clapton The Race Is On Time 4 Non Blondes Summer of '69 Craig Campbell Hello Old Friend What's Up (What’s Going On) Billy Currington Outta My Head The Divinyls Wonderful Tonight George Michael Howie Day Good Directions Buckcherry I Touch Myself Faith Collide 7 Mary 3 Must Be Doin' Somethin' Right Crazy Bitch Craig Morgan Eurythmics Cumbersome People Are Crazy Redneck Yacht Club Dixie Chicks Sweet Dreams George Strait Huey Lewis Pretty Good At Drinking Beer Buffalo Springfield That's What I Love About Sundays Goodbye Earl All My Ex's Live In Texas I Want A New Drug Aaron Lewis For What It's Worth This Ole Boy Eve 6 Amarillo By Morning Country Boy Billy Idol Dobie Gray Inside Out Carried Away The Impressions Rebel Yell Bush Creed Drift Away Carrying Your Love With Me It’s All Right AC/DC Comedown My Sacrifice Everclear Check Yes Or No Shook Me All Night Billy Joel Don Henley Santa Monica Give It Away Incubus Only The Good Die Young The Calling Creedence Clearwater Revival Boys Of Summer Love Without End, Amen Drive Adam Sandler Piano Man Wherever You Will Go Have You Ever Seen The Rain Extreme Ocean Front Property At A Medium Pace Still Rock And Roll Don McLean More Than Words One Night At A Time J.