MOTORCYCLE INDUSTRY (The Indian Scenario)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HRP LIST.Xlsx

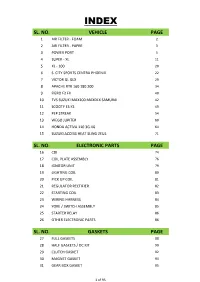

INDEX SL. NO. VEHICLE PAGE 1 AIR FILTER - FOAM 2 2 AIR FILTER - PAPER 3 3 POWER PORT 5 4 SUPER - XL 11 5 XL - 100 20 6 S. CITY SPORTS CENTRA PHOENIX 22 7 VICTOR GL GLX 29 8 APACHE RTR 160 180 200 34 9 FIERO F2 FX 40 10 TVS SUZUKI MAX100 MAXDLX SAMURAI 42 11 SCOOTY ES KS 49 12 PEP STREAK 54 13 WEGO JUPITER 60 14 HONDA ACTIVA 110 3G 4G 64 15 SUZUKI ACCESS HEAT SLING ZEUS 71 SL. NO. ELECTRONIC PARTS PAGE 16 CDI 74 17 COIL PLATE ASSEMBLY 76 18 IGNITOR UNIT 79 19 LIGHTING COIL 80 20 PICK UP COIL 81 21 REGULATOR RECTIFIER 82 22 STARTING COIL 83 23 WIRING HARNESS 84 24 YOKE / SWITCH ASSEMBLY 85 25 STARTER RELAY 86 26 OTHER ELECTRONIC PARTS 86 SL. NO. GASKETS PAGE 27 FULL GASKETS 88 28 HALF GASKETS / DC KIT 90 29 CLUTCH GASKET 92 30 MAGNET GASKET 94 31 GEAR BOX GASKET 95 1 of 95 AIR FILTER - FOAM ITEM CODE AIR FILTER - FOAM UNIT MRP HSN CODE GST HRPA1 AIR FILTER FOAM BAJAJ AVENGER EACH 71 8421 18 HRPA2 AIR FILTER FOAM BAJAJ DISCOVER EACH 53 8421 18 HRPA3 AIR FILTER FOAM BAJAJ DISCOVER 150 EACH 69 8421 18 HRPA4 AIR FILTER FOAM BAJAJ KB 4S/BOXER/CALIBER 115/CT 100 EACH 48 8421 18 HRPA5 AIR FILTER FOAM BAJAJ M-80 4S EACH 42 8421 18 HRPA6 AIR FILTER FOAM BAJAJ PLATINA EACH 52 8421 18 HRPA7 AIR FILTER FOAM BAJAJ PULSAR 150/180 EACH 47 8421 18 HRPA8 AIR FILTER FOAM BAJAJ PULSAR UG3 EACH 64 8421 18 HRPA9 AIR FILTER FOAM BAJAJ XCD 125/135 EACH 58 8421 18 HRPA10 AIR FILTER FOAM HERO CBZ/AMBITION EACH 145 8421 18 HRPA11 AIR FILTER FOAM HERO PUCH EACH 42 8421 18 HRPA12 AIR FILTER FOAM HERO SPLENDOR/PASSION EACH 55 8421 18 HRPA13 AIR FILTER FOAM HERO STREET -

TWO WHEELERS : MOTOR CYCLES M/S Royal Enfield Motors Ltd M/S Bajaj Auto Ltd M/S Honda Motorcycle & Scooter India Pvt. Ltd M

TWO WHEELERS : MOTOR CYCLES M/s Royal Enfield Motors Ltd Sl No. Index No. Nomenclature 1 63022-E Motor Cycle 350cc STD (12 Volt) Bullet Electra 2 63107-X Bullet Classic 500 3 64003-P Classic 500 Desert Strom 499cc 4 64004-H Thunderbird UCE 350cc 5 64005-I Classic 350cc 346 6 64006-S Bullet Electra UCE 346cc M/s Bajaj Auto Ltd Sl No. Index No. Nomenclature 1 63024-P Motor Cycle Bajaj Pulsar DTSi (150cc Electric Start) 2 63029-K Motor Cycle Bajaj Discover DTS-Si (Electric Start) 3 63030-X Motor Cycle Bajaj Discover 150 cc (Electric Start) 4 63032-D Bajaj Platina Motor Cycle DZ-02 (100cc) Alloy Wheel 5 63174-A Bajaj Platina 125 (With Electric Start) 6 63175-D Bajaj Discover 125 Drum Brake (Electric Start) 7 63176-E Bajaj Pulsar 135 LS (With Electric Start) 8 63177-L Bajaj Pulsar 180 (With Electric Start) 9 63178-P Bajaj Pulsar 220 (Without Full Fairing) (With Electric Start) 10 63179-H Bajaj Pulsar 220 F (With Full Fairing) (With Electric Start) 11 63180-I Bajaj Avenger 220 (With Electric Start) 12 64000-D Bajaj Discover 125 ST DTS-I Electric Start Disc Brake 13 64001-E Bajaj Discover 125 DTS-I Electric Start Disc Brake 14 64002-L Bajaj Discover 100 DTS-I Electric Start 4 Gears Drum Brake M/s Honda Motorcycle & Scooter India Pvt. Ltd Sl No. Index No. Nomenclature 1 63009-A Motor Cycle Honda CB Shine Self Drum Alloy (125 cc) 2 63010-D ‘Honda’ Unicorn (Self) Motor Cycle 4 Stroke Single Cylinder Air Cooled 150 cc 3 63122-L Honda CB Twister (Self Disc Alloy) 110cc 4 63124-H Honda CBR 150R STD 149.4cc 5 63125-I Honda ‘CBF Stunner’ (Self Disk Alloy) 125 cc 6 63128-K Honda CBR 150R DLX 149.4cc 7 63188-L Honda CB Trigger (STD) 149.1cc 8 63189-P Honda Dream Yuga (Self Drum Alloy) 109cc 9 63190-H Honda CB Twister 110cc (Self Drum Alloy) 10 63193-T Honda Dream Yuga (Kick Drum Alloy) 109cc 11 63194-K Honda Dream NEO (Kick Drum Spoke) 109cc 12 63195-X Honda Dream NEO (Kick Drum Alloy) 109cc 13 63196-A Honda Dream NEO (Self Drum Spoke) 109cc 14 63197-D Honda CBR 250R STD 249.6cc 15 63198-E Honda CBR 250R ABS 249.6cc M/s TVS Motor Company Ltd Sl No. -

TRADING LIST.Xlsx

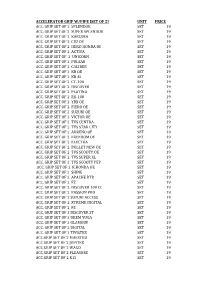

ACCELERATOR GRIP W/PIPE [SET OF 2] UNIT PRICE ACC. GRIP SET OF 2 SPLENDOR SET 19 ACC. GRIP SET OF 2 SUPER SPLENDOR SET 19 ACC. GRIP SET OF 2 KARIZMA SET 19 ACC. GRIP SET OF 2 CBZ OE SET 19 ACC. GRIP SET OF 2 HERO HONDA OE SET 19 ACC. GRIP SET OF 2 ACTIVA SET 19 ACC. GRIP SET OF 2 UNICORN SET 19 ACC. GRIP SET OF 2 PULSAR SET 19 ACC. GRIP SET OF 2 CALIBER SET 19 ACC. GRIP SET OF 2 KB OE SET 19 ACC. GRIP SET OF 2 KB 4S SET 19 ACC. GRIP SET OF 2 CT-100 SET 19 ACC. GRIP SET OF 2 DISCOVER SET 19 ACC. GRIP SET OF 2 PLATINA SET 19 ACC. GRIP SET OF 2 RX-100 SET 19 ACC. GRIP SET OF 2 YBX OE SET 19 ACC. GRIP SET OF 2 FIERO OE SET 19 ACC. GRIP SET OF 2 SUZUKI OE SET 19 ACC. GRIP SET OF 2 VICTOR OE SET 19 ACC. GRIP SET OF 2 TVS CENTRA SET 19 ACC. GRIP SET OF 2 TVS STAR CITY SET 19 ACC. GRIP SET OF 2 ADRENO OE SET 19 ACC. GRIP SET OF 2 FREEDOM OE SET 19 ACC. GRIP SET OF 2 ELECTRA SET 19 ACC. GRIP SET OF 2 BULLET NEW OE SET 19 ACC. GRIP SET OF 2 TVS SCOOTY OE SET 19 ACC. GRIP SET OF 2 TVS SUPER XL SET 19 ACC. GRIP SET OF 2 TVS SCOOTY PEP SET 19 ACC. GRIP SET OF 2 K.HONDA OE SET 19 ACC. -

UCAL Spare Product Catalogue Full Assembly

Product Catalogue - 2/3 Wheeler/ Gensets Carburettor Assembly Customer UCAL Part Number Applications Vehicle MOQ Bajaj BS29-14 Bajaj Avenger (Aura) 2W 5 BS29-17 Bajaj Avenger UG 2W 5 VM18-231 Bajaj Auto 3W 10 VM18-265 Bajaj Auto CNG 3W 10 VM18-266 Bajaj Auto LPG 3W 10 VM18-251 Bajaj Auto Petrol 3W 10 VM18-268 Bajaj Auto Petrol 3W 10 VM18-232/ VM18-238 Caliber/ Boxer 2W 10 VM16-579 Bajaj BYK (4S) 2W 10 VM18-257 Bajaj Chetak Scooter 2W 10 VM16-613 Bajaj Krystal 2W 10 VM16-556 Bajaj M80 (4S) 2W 10 VM16-539 Bajaj Saffire 100CC(4S) 2W 10 VM12-114 Bajaj Spirit (2S) 2W 10 BS26-176 Bajaj Wind 125cc 2W 5 VM16-614 Bajaj XCD 125cc 2W 10 BS26-165 Pulsar 150cc K1 2W 5 BS26-188 Pulsar 150cc K1UG 2W 5 BS26-221 Pulsar 150cc K1UG2 2W 5 BS26-239 Pulsar 150cc K1UG3 2W 5 BS29-6 Pulsar 180cc 2W 5 BS29-9 Pulsar 180cc K2UG1 2W 5 BS29-13 Pulsar 180cc K2UG2 2W 5 BS29-16 Pulsar 180cc K2UG3 2W 5 BS29-18 Pulsar 200cc 2W 5 TVS VM18-143 & 237 TVS Samurai Max 100R 2W 10 VM12-116,106 & 95 TVS Scooty (CAT/NON-CAT) (2S) 2W 10 VM14-393 TVS Scooty PEP 2W 10 VM14-398 Scooty PEP Plus 90cc N52 2W 10 VM18-241 TVS Victor 110cc 2W 10 VM19-121 TVS Victor 125cc N17 2W 10 VM19-259 Victor 125cc GX (U54) 2W 10 VM19-125 Victor GLX-R 125cc 2W 10 VM18-254 Victor GX 110cc 2W 10 VM18-X31 Victor GX 110cc 2W 10 BS26-230 TVS Apache 150cc U68 2W 5 BS26-253 Apache RTR 160cc U86 2W 5 VM18-273 TVS Auto LPG U76 3W 10 VM18-269 TVS Auto Petrol N46 3W 10 VM17-150 TVS Centra 2W 10 BS26-118 TVS Fiero 2W 5 BS26-184 TVS Fiero F2 2W 5 VM20-419 TVS Flame N90 2W 10 Yamaha VM22-394 Yamaha RX135 4 Speed 2W -

Bajaj Pulsar 150 Dtsi • Bajaj Saffire • Recorded Its Higher Ever Net Sales & Operating Income

•Bajaj Auto Limited is an Indian motorised vehicle- producing company. •Bajaj Auto is a part of Bajaj Group. •Bajaj Auto is the world's third-largest manufacturer of motorcycles and the second-largest in India. • The Forbes Global 2000 list for the year 2005 ranked Bajaj Auto at 1,946. It features at 1639 in Forbes 2011 list. •Bajaj Auto came into existence on 29 November 1945 as M/s Bachraj Trading Corporation Private Limited. • It started off by selling imported two- and three-wheelers in India. •In 1959, it obtained a licence from the government of India to manufacture two- and three-wheelers and it went public in 1960. •In 1970, it rolled out its 100,000th vehicle. •In 1977, it sold 100,000 vehicles in a financial year. •In 1985, it started producing at Waluj near Aurangabad . •In 1986, it sold 500,000 vehicles in a financial year . •In 1995, it rolled out its ten millionth vehicle and produced and sold one million vehicles in a year. • 1961–1971 – Vespa 150 • 1971 – three-wheeler goods carrier • 1972 – Bajaj Chetak • 1976 – Bajaj Super • 1975 – Bajaj Priya • 1981 – Bajaj M-50 • 1986 – Bajaj M-80, Kawasaki Bajaj KB100 • 1990 – Bajaj Sunny • 1994 – Bajaj Classic • 1998 – Kawasaki Bajaj Caliber, Bajaj Super 99 • 2001 – Eliminator, Bajaj Pulsar, Caliber Croma • 2004 – Bajaj KT 100, New Bajaj Chetak 4-stroke, Bajaj Discover DTS-I • 2005 – Bajaj Wave, Bajaj Avenger, Bajaj Discover 112 • 2006 – Bajaj Platina • 2009 – Bajaj Pulsar 220 DTS-i, Bajaj Discover 100 DTS-Si, Kawasaki Ninja 250R • 2011 – Bajaj Discover 125 • 2012 – KTM Duke 200 • -

Poland Regional Cities-Comfort-Vehicle-List

Make Model Year Oldsmobile 19 Oldsmobile Alero Oldsmobile Aurora Oldsmobile Bravada Oldsmobile Cutlass Supreme Oldsmobile Intrigue Oldsmobile Silhouette Dodge Attitude Dodge Avenger 2013 Dodge Caliber Dodge Caravan 2015 Dodge Challenger Dodge Charger 2013 Dodge Dakota Dodge Dart 2015 Dodge Durango 2013 Dodge Grand Caravan 2015 Dodge Intrepid Dodge JCUV Dodge Journey 2013 Dodge Magnum 2013 Dodge Neon 2015 Dodge Nitro 2013 Dodge Ram 1500 Dodge Ram 2500 Dodge Ram 3500 Dodge Ram 4500 Dodge Ram 700 Dodge Ram Van 2015 Dodge Sprinter Dodge Stratus 2015 Dodge Stretch Limo Dodge Viper Dodge Vision Dodge i10 Land Rover Defender 2013 Land Rover Discovery 2013 Land Rover Freelander 2013 Land Rover Freelander 2 Land Rover LR2 Land Rover LR3 Land Rover LR4 Land Rover Range Rover 2013 Land Rover Range Rover Evoque 2013 Land Rover Range Rover Sport 2013 Land Rover Range Rover Velar 2013 Land Rover Range Rover Vogue 2013 Chevrolet Agile Chevrolet Astra 2015 Chevrolet Astro Chevrolet Avalanche 2013 Chevrolet Aveo Chevrolet Aveo5 Chevrolet Beat Chevrolet Blazer Chevrolet Bolt Chevrolet CMV Chevrolet Camaro Chevrolet Caprice Chevrolet Captiva 2013 Chevrolet Cavalier Chevrolet Celta Chevrolet Chevy Chevrolet City Express Chevrolet Classic Chevrolet Cobalt 2015 Chevrolet Colorado Chevrolet Corsa Chevrolet Corsa Sedan Chevrolet Corsa Wagon Chevrolet Corvette Chevrolet Corvette ZR1 Chevrolet Cruze 2015 Chevrolet Cruze Sport6 Chevrolet Dmax Chevrolet Enjoy Chevrolet Epica 2013 Chevrolet Equinox 2013 Chevrolet Esteem Chevrolet Evanda 2013 Chevrolet Exclusive Chevrolet -

ASK 2W 3W BRAKE SHOE Catalogue

2W BRAKE SHOE O.D. of Shoe S.No. Application ASK Part No. Brake Brake Shoe Pictures Width shoe BRAKE SHOE - MOTOR CYCLES BRAKE SHOE- 1 ASK/NA/BS/0020 Ø 110 mm 25 mm HERO HONDA-CD-100 (F&R) BRAKE SHOE- 2 ASK/NA/BS/0019 Ø 110 mm 30 mm BAJAJ KAWASAKI-4S (F&R) 3 BRAKE SHOE-BAJAJ CALIBER ASK/NA/BS/0019 Ø 110 mm 30 mm BRAKE SHOE- 4 ASK/NA/BS/0015 Ø 110 mm 30 mm TVS SUZUKI AX-100 (F&R) 5 BRAKE SHOE-TVS VICTOR ASK/NA/BS/0015 Ø 110 mm 30 mm 6 BRAKE SHOES-SPLENDOR-(F) ASK/NA/BS/0126 Ø 130 mm 25 mm 7 BRAKE SHOE-BAJAJ KB-100 ASK/NA/BS/0018 Ø 130 mm 28 mm ASK Automotive Pvt. Ltd. Corporate Office: Plot No. 28 Sector-4, IMT Manesar (Gurgaon) - 122050, Haryan, India E-Mail: [email protected], [email protected] Tel: - +91 - 124 - 4659300, Fax: +91 - 124 - 4659388 Registered Office: 929/1 Flat No. 104, Naiwala, Faiz Road, Karol Bagh, New Delhi - 110005 INDIA Website: www.askbrake.com 2W BRAKE SHOE O.D. of Shoe S.No. Application ASK Part No. Brake Brake Shoe Pictures Width shoe BRAKE SHOE- 8 ASK/NA/BS/0018 Ø 130 mm 28 mm BAJAJ-PULSAR (F&R) BRAKE SHOE- 9 ASK/NA/BS/0016 Ø 130 mm 28 mm TVS SAMURAI (F&R) BRAKE SHOE- 10 ASK/NA/BS/0017 Ø 130 mm 28 mm YAMAHA RX-100 (F&R) BRAKE SHOE- 11 ASK/NA/BS/0011 Ø 130 mm 30 mm LML FREEDOM (F&R) BRAKE SHOE- 12 ASK/NA/BS/0014 Ø 110 mm 25 mm HERO HONDA CD DAWN 13 BRAKE SHOE-BULLET ( F&R) ASK/NA/BS/0978 Ø 152 mm 25 mm 14 PONY 50, ADLY 50 ASK/NA/BS/0731 Ø 110 mm 25 mm ASK Automotive Pvt. -

Auto Yearbook FY20

AutoAuto Yearbook FY20 April 30, 2020 Section I: Update – What went down? FY20 was a tough year for the entire Indian automotive industry. Myriad demand and supply side issues continued to trouble the space, continuing the system-wide weakness that set in around the 2018 festive period. Broad- based decline in OEM volumes (Exhibit 1) throughout the year encapsulated the pain at that level as well as the knock-on impact on supporting Report ecosystems of ancillaries, on the one hand, and dealerships, on the other. Higher cost incidence and general reluctance in consumer spending affected the PV and 2-W segments most, while slowing economic activity and system pecial overcapacity took a toll on CV segment. OEM focus on inventory destocking S in the run up to BS-VI switchover from April 2020 and Covid-19 outbreak were other issues that adversely impacted Q4FY20, in particular. Total industry volumes fell 14.8% YoY to 2.63 crore – one of the worst performances in decades, with all major segments registering hefty declines- PV - Down 14.8% YoY to 34.53 lakh units, was dragged by 19.9% dip in passenger cars and 39% decline in vans. UV sub segment, however, posted 2.7% growth courtesy several successful new Research Analysts product launches CV – Was hardest hit, down 29.7% YoY to 7.78 lakh units. M&HCV Shashank Kanodia, CFA [email protected] sub segment dropped 43.3% amid persistent weakness in trucks (down 49.1%) while buses bucked the trend (up 3.5%). LCV sub Jaimin Desai [email protected] segment came off by 20.7% with both – passenger and goods categories in the red 3-W – Was down 10.2% YoY to 11.39 lakh units amid double digit declines in passenger as well as goods categories 2-W – Was down 14.4% YoY to 2.1 crore units. -

A Study on Customer Satisfaction on Hero Moto Crop

A PROJECT REPORTON “A STUDY ON CUSTOMER SATISFACTION ON HERO MOTOCORP” Submitted in partial fulfillment of the requirement of the award of the degree of “bachelor of Business management’’ of Bangalore University Submitted by MR. P.HARISH KUMAR (Reg.no.13VFC24067) Under the Guidance of MRS.MANJULA NEW HORIZON COLLEGE MARATHALLI BANGALORE -560103 2015-2016 `STUDENT DECLARATION I, P.HARISH KUMAR student of bachelor of business management, NEW HORIZON COLLEGE BANGALORE, bearing registration number 13VFC24067 declare this project entitled “A STUDY ONCUSTOMER SATISFACTION ON HERO MOTOCORP” was prepared by me during by me during the year 2015-2016 and was submitted in partial fulfillment for the award of bachelor of business management to Bangalore University, I also declare that this project is original and genuine and has not been submitted to any other university/ institution for the award of any degree, diploma or other similar titles or purposes Place: Bangalore Name:P.HARISH KUMARDate: Reg.no.13VFC24067 GUIDE CERTIFICATE Certified that the project report entitled“A STUDY ON CUSTOMER SATISFACTION ON HERO MOTOCORP’ submitted by MR.P.HARISHKUMAR bearing registration no. 13VFC24084 to bangalore university in partial fulfillment for the award of “Bachelor of Business Management” of Bangalore University, Bangalore is a record of independent project work under taken by him, under my supervision and guidance and the project has not be submitted either in part or whole for the award of any other degree or diploma of any university. Place: Bangalore MRS. SREEJA NAIR Date: (Assistant Professor HOD CERTIFICATE This is to certify that P.HARISH KUMAR(13VFC24084) isbonafide student of bachelor of business management. -

Continues Improvement

Desh ki Dhadkan Dhak Dhak Go By: o “Hero” is the brand name used by the Munjal brothers for their flagship company Hero Cycles Ltd. o A joint venture between the Hero Group and Honda Motor Company was established in 1984 as the Hero Honda Motors Limited at Dharuhera India. o During the 1980s, the company introduced motorcycles that were popular in India for their fuel economy and low cost. o A popular advertising campaign based on the slogan 'Fill it - Shut it - Forget it' that emphasised the motorcycle's fuel efficiency helped the company grow at a double-digit pace since inception. o Hero Honda has three manufacturing facilities based at Dharuhera, Gurgaon in Haryana and at Hardwar in Uttarakhand. These plants together are capable of churning out 3 million bikes per year. o Hero Honda has a large sales and service network with over 4,500 dealerships and service points across India. o During the fiscal year 2008-09, the company sold 3.7 million bikes, a growth of 12% over last year. In the same year, the company had a market share of 57% in the Indian market. o Hero Honda sells more two wheelers than the second, third and fourth placed two-wheeler companies put together. Hero Honda's bike Hero Honda Splendor, the world's largest- selling motorcycle for the years 2001-2003, selling more than one million units per year. o Total unit sales of 54,02,444 two-wheelers, growth of 17.44 per cent o Total net operating income of Rs. 19401.15 Crores, growth of 22.32 per cent o Net profit after tax at Rs. -

Hero Motocorp

17 September 2020 Company Update | Sector: Automobile Hero Motocorp BSE SENSEX S&P CNX CMP: INR3,062 TP: INR3,900 (+27%) Upgrade to BUY 38,980 11,516 Increased volume visibility, with levers to drive upside GST cut; focus on bolstering weak areas could drive growth, re-rating HMCL is in a sweet spot as strong rural-led recovery plays to its strength in the Economy–Executive category in the Motorcycles segment. With an apt product Bloomberg HMCL IN portfolio for the rural market, the highest brand recall, and a strong distribution Equity Shares (m) 200 M.Cap.(INRb)/(USDb) 611.6 / 8.3 network, it is best placed to benefit from low penetration and ongoing 52-Week Range (INR) 3180 / 1475 momentum in the rural economy. 1, 6, 12 Rel. Per (%) 2/39/12 HMCL’s competitive positioning has improved in both the 100cc and 125cc 12M Avg Val (INR M) 3336 categories post BS6. This is attributable to the narrowing of the price differential Free float (%) 65.2 in the Economy segment (vis-à-vis BJAUTs CT100) and product upgrades in Executive 125cc. This would enable further recovery in market share in FY21 – Financials & Valuations (INR b) signs of recovery are visible YTD. Y/E March FY20 FY21E FY22E HMCL has a very weak presence in other segments such as Scooters, Premium Sales 288.4 310.6 373.9 Motorcycles and Exports, which contribute over 55% to the 2W industry. It has EBITDA 39.6 42.4 55.5 Adj. PAT 30.6 31.2 40.7 just 5% market share in these segments. -

Abondnend / Unclaimed Vehicles List of Alwal Traffic Police Station, Cybereabad

ABONDNEND / UNCLAIMED VEHICLES LIST OF ALWAL TRAFFIC POLICE STATION, CYBEREABAD. Vehicle Sl. No Vehicle Model Make Engine No Chassis No Case Details Status of Case Owner ship Details Remarks RegistrationNumber RAMJI,SINGH S/o RAM BACCAN SINGH HERO HONDA PASSION DD CS.No. D NO 5-3-68/161, VENKATESHWARA 1 AP28DA9946 HA10EB8GJ80449 MBLHA10EL8GJ39431 Pending Plus-2008 444/14 (2014) COLONY,BUDWEL RR DIST,RAJENDRANAGAR MAHMOOD ALI S/o Mahaboob ali r/o 17-8- DD CS.No. 2 HONDA DIO - 2003 AP11M2161 JF11E0030988 ME4JF115J38025915 Pending 415/1/D,BAGH E JAHAN ARA, YAKUTHPURA 81/15 (2015) HYDERABAD MOHD SIDDIQ s/o MOHD. QASIM SAHAB, TVS XL SUPER HEAVY DD CS.No. 3 AP11AA2852 0D1P61884927 MD621BD1862P54077 Pending 18-7-425/164,SIDDIQ NAGAR, BHAVANI DUTY – 2006 379/15 (2015) NAGAR HYDERABAD HERO HONDA CBZ X- DD CS.No. SRISAILAM SREE S/o NARSHIMHA r/o 3-92, 4 AP13S5203 KC12EBAGK00419 MBLKC12ECAGK00541 Pending TREME - 2010 485/15 (2015) DOMADUGU, BONTHAPALLI,JINNARAM DD CS.No. 5 BAJAJ BOXER CT – 2004 AP29D9116 DUMBLD16217 DUFBLD73427 Pending Records Not Found as per third eye 646 /15 (2015) SATYANARAYANA REDDY K s/o HERO HONDA SPLENDOR DD CS.No. 6 AP15AL2637 HA10EA89H08103 MBLHA10EE89H07756 Pending HANUMANTHA REDDY R/o 3-7-341, + 672/15 (2015) VAVILALAPALLY, KARIMNAGAR PULSAR 180 DTS-I BSIII - DD CS.No. Bhaskar Thanniru R/o H.NO. 30/88/12/16 7 AP10AV8245 DJGBT76288 MD2DHDJZZTCG33689 Pending 2010 962/15 (2015) Shiva Nagar Khanaji Guda Thirumalghirry JAI SANKAR A S/o RAGHAVULU R/o H NO 9- BAJAJ PULSUR 150 DTSI DD CS.No.