2 October 2019 FLUTTER ENTERTAINMENT PLC THE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monthly Performance Review Enhanced Income Fund W Income Shares 31 August 2021

MPR.en.xx.20210831.GB00B87HPZ94.pdf For Investment Professionals Only FIDELITY INVESTMENT FUNDS MONTHLY PERFORMANCE REVIEW ENHANCED INCOME FUND W INCOME SHARES 31 AUGUST 2021 Portfolio manager: Michael Clark, David Jehan, Rupert Gifford Performance over month in GBP (%) Performance for 12 month periods in GBP (%) Fund 2.0 Market index 2.7 FTSE All Share Index Market index is for comparative purposes only. Source of fund performance is Fidelity. Basis: bid-bid with income reinvested, in GBP, net of fees. Other share classes may be available. Please refer to the prospectus for more details. Fund Index Market Environment UK equities continued to advance, recording a seventh straight monthly gain in August. Sentiment remained buoyant, propelled by a spate of merger and acquisition (M&A) activity, alongside expectations for continued earnings strength. The Bank of England kept its monetary policy unchanged, but warned of a more pronounced period of above-target inflation in the near term. Meanwhile, the pace of economic activity remains solid in the UK despite a modest deceleration over the month. While the flash PMI reading remained above the 50 mark that suggest growth, staffing shortages and supply bottlenecks kept a lid on activity levels. Authorities finally lifted the last of the domestic COVID-19 restrictions during the month. Almost all sectors posted positive returns, with technology, real estate, industrials and consumer discretionary the largest gainers. Conversely, materials and consumer staples lagged the market. Fund Performance The fund delivered 2.0%, while the index was up by 2.7% in August. UK equities continued to advance, and the fund lagged due to its defensive bias. -

1 2 March 2021 Flutter Entertainment

2 March 2021 Flutter Entertainment plc - 2020 Preliminary Results Transformational year for Group; Earnings ahead of expectations Flutter Entertainment plc (the “Group”) announces preliminary results for year ended 31 December 2020. Reported1 Pro forma2 2020 2019 2020 2019 CC3 £m £m YoY % £m £m YoY % YoY % Group revenue4 4,398 2,140 +106% 5,264 4,144 +27% +28% Adjusted5 Group EBITDA6 excluding US 1,037 462 +125% 1,401 1,170 +20% +23% Adjusted Group EBITDA 889 425 +109% 1,231 1,089 +13% +16% Profit before tax 1 136 -99% Earnings per share7 29.3p 180.2p -84% Adjusted earnings per share 402.7p 298.4p +35% 496.6p 415.7p +19% Net debt at year end8 2,814 265 Operational highlights • Transformational year for Group - Unparalleled scale and diversification achieved following merger with The Stars Group, Inc (“TSG”) - Accelerated buy-out of minority shareholders in FanDuel at compelling valuation - Reinforced balance sheet to support investment and growth • Excellent momentum with 19% growth in recreational players9 across Group - Acceleration of channel shift from retail to online and increased share of entertainment spend • Further investment in safer gambling initiatives to ensure sustainable growth - Enhanced predictive technology; increase in safer gambling tool usage by customers - Advocating a customer driven approach to affordability • Merger integration progressing well - Australian integration complete, PokerStars strategy in place and core momentum maintained - Annualised cost synergies now expected to be £170m, up from £140m previously -

The Stars Group Welcomes Landmark U.S. Supreme Court Ruling Permitting Sports Betting

The Stars Group Welcomes Landmark U.S. Supreme Court Ruling Permitting Sports Betting Decision opens the door for The Stars Group to expand business broadly in the United States TORONTO, May 15, 2018 /CNW/ - The Stars Group Inc. (NASDAQ: TSG; TSX: TSGI) reacted today to the decision by the United States Supreme Court to strike down, as an unconstitutional exercise of federal power, the nearly 30-year ban on sports betting under the Professional and Amateur Sports Protection Act, or PASPA. Congress enacted PASPA in 1992, which resulted in all states, other than Nevada and three others, being prohibited from authorizing sports betting. The litigation that reached the Supreme Court arose from New Jersey's repeated attempts to resist the federal ban and to legalize sports betting within the state. "The decision by the Supreme Court is an important step forward in the regulation of sports betting in the United States," said Marlon Goldstein, Executive Vice President and Chief Legal Officer of The Stars Group. "We believe we are well-positioned to take advantage of any new business and market opportunities, and to work with state legislatures in setting up sports betting frameworks that satisfy local consumers' interest in sports betting while protecting them through safe and regulated betting environments." The decision follows The Stars Group's recent announcement of its agreement to acquire Sky Betting & Gaming, the fastest growing established sports betting operator in the United Kingdom, the world's largest online gaming market, and its recent acquisition of 80% of the combined CrownBet and William Hill Australia businesses, which combined form the third largest online sports betting operator in Australia, the world's second largest online gaming market. -

COMMON STOCKS - 97.05% Argentina - 1.72% (A)

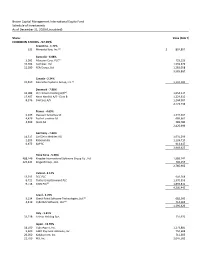

Yeah Brown Capital Management International Equity Fund Schedule of Investments As of December 31, 2020 (Unaudited) Shares Value (Note 1) COMMON STOCKS - 97.05% Argentina - 1.72% (a) 533 MercadoLibre, Inc. $ 892,892 Australia - 6.88% (a) 3,092 Atlassian Corp. PLC 723,126 10,704 Cochlear, Ltd. 1,559,676 11,180 REA Group, Ltd. 1,283,058 3,565,860 Canada - 2.24% (a) 19,819 Descartes Systems Group, Inc. 1,159,183 Denmark - 7.96% (a) 16,089 Chr Hansen Holding A/S 1,654,217 17,487 Novo Nordisk A/S - Class B 1,224,612 8,376 SimCorp A/S 1,244,907 4,123,736 France - 4.69% 6,639 Dassault Systemes SE 1,347,557 4,426 EssilorLuxottica SA 689,662 4,699 Ipsen SA 389,780 2,426,999 Germany - 7.66% 14,517 Carl Zeiss Meditec AG 1,931,296 1,209 Rational AG 1,124,710 6,975 SAP SE 913,617 3,969,623 Hong Kong - 5.38% 488,146 Kingdee International Software Group Co., Ltd. 1,989,747 123,443 Kingsoft Corp., Ltd. 796,155 2,785,902 Ireland - 8.12% 13,293 DCC PLC 941,268 6,721 Flutter Entertainment PLC 1,370,359 (a) 9,718 ICON PLC 1,894,816 4,206,443 Israel - 2.70% (a) 5,134 Check Point Software Technologies, Ltd. 682,360 (a) 4,419 CyberArk Software, Ltd. 714,066 1,396,426 Italy - 1.41% 33,718 Azimut Holding SpA 731,970 Japan - 13.70% 18,500 CyberAgent, Inc. 1,273,885 5,600 GMO Payment Gateway, Inc. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Ftse4good UK 50

2 FTSE Russell Publications 19 August 2021 FTSE4Good UK 50 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.81 UNITED GlaxoSmithKline 5.08 UNITED Rentokil Initial 0.67 UNITED KINGDOM KINGDOM KINGDOM Anglo American 2.56 UNITED Halma 0.74 UNITED Rio Tinto 4.68 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.36 UNITED HSBC Hldgs 6.17 UNITED Royal Dutch Shell A 4.3 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.56 UNITED InterContinental Hotels Group 0.64 UNITED Royal Dutch Shell B 3.75 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 8.25 UNITED International Consolidated Airlines 0.47 UNITED Schroders 0.28 UNITED KINGDOM Group KINGDOM KINGDOM Aviva 1.15 UNITED Intertek Group 0.65 UNITED Segro 0.95 UNITED KINGDOM KINGDOM KINGDOM Barclays 2.1 UNITED Legal & General Group 1.1 UNITED Smith & Nephew 0.99 UNITED KINGDOM KINGDOM KINGDOM BHP Group Plc 3.2 UNITED Lloyds Banking Group 2.39 UNITED Smurfit Kappa Group 0.74 UNITED KINGDOM KINGDOM KINGDOM BT Group 1.23 UNITED London Stock Exchange Group 2.09 UNITED Spirax-Sarco Engineering 0.72 UNITED KINGDOM KINGDOM KINGDOM Burberry Group 0.6 UNITED Mondi 0.67 UNITED SSE 1.13 UNITED KINGDOM KINGDOM KINGDOM Coca-Cola HBC AG 0.37 UNITED National Grid 2.37 UNITED Standard Chartered 0.85 UNITED KINGDOM KINGDOM KINGDOM Compass Group 1.96 UNITED Natwest Group 0.77 UNITED Tesco 1.23 UNITED KINGDOM KINGDOM KINGDOM CRH 2.08 UNITED Next 0.72 UNITED Unilever 7.99 UNITED KINGDOM KINGDOM -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

The Stars Group and FOX Sports Announce Historic U.S. Media and Sports Wagering Partnership

The Stars Group and FOX Sports Announce Historic U.S. Media and Sports Wagering Partnership May 8, 2019 Toronto and Los Angeles, May 8, 2019 – The Stars Group Inc. (Nasdaq: TSG)(TSX: TSGI) and FOX Sports, a unit of Fox Corporation (Nasdaq: FOXA, FOX), today announced plans to launch FOX Bet, the first-of-its kind national media and sports wagering partnership in the United States. The Stars Group and FOX Sports have entered a long-term commercial agreement through which FOX Sports will provide The Stars Group with an exclusive license to use certain FOX Sports trademarks. The Stars Group and FOX Sports expect to launch two products in the Fall of 2019 under the FOX Bet umbrella. One will be a nationwide free-to-play game, awarding cash prizes to players who correctly predict the outcome of sports games. The second product, which will be named FOX Bet, will give customers in states with regulated betting the opportunity to place real money wagers on the outcome of a wide range of sporting events in accordance with the applicable laws and regulations. In addition to the commercial agreement of up to 25 years and associated product launches, Fox Corporation will acquire 14,352,331 newly issued common shares in The Stars Group, representing 4.99% of The Stars Group’s issued and outstanding common shares, at a price of $16.4408 per share, the prevailing market price leading up to the commencement of exclusive negotiations. The Stars Group currently intends to use the aggregate net proceeds of approximately $236 million for general corporate purposes and to prepay outstanding indebtedness on its first lien term loans. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

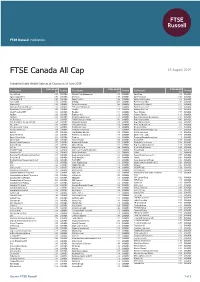

FTSE Publications

2 FTSE Russell Publications 19 August 2019 FTSE Canada All Cap Indicative Index Weight Data as at Closing on 28 June 2019 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Aecon Group 0.05 CANADA Element Fleet Management 0.19 CANADA Onex Corp 0.3 CANADA Agnico Eagle Mines 0.73 CANADA Emera Inc 0.58 CANADA Open Text Corp 0.65 CANADA Air Canada Cl B 0.25 CANADA Empire Co Cl A 0.26 CANADA Osisko Gold Royalties 0.1 CANADA Alacer Gold 0.06 CANADA Enbridge 4.35 CANADA Pan American Silver 0.16 CANADA Alamos Gold 0.14 CANADA Encana Corporation 0.46 CANADA Paramount Res Class A 0.02 CANADA Algonquin Power & Utilities Co 0.36 CANADA Endeavour Mining Corp. 0.07 CANADA Parex Resources Inc 0.14 CANADA Alimentation Couche-Tard B 1.63 CANADA Enerflex 0.07 CANADA Parkland Fuel Corp. 0.28 CANADA Allied Properties REIT 0.24 CANADA Enerplus 0.11 CANADA Pason Systems 0.07 CANADA AltaGas. 0.25 CANADA Enghouse Sys 0.06 CANADA Pembina Pipeline 1.14 CANADA Aphria Inc 0.09 CANADA Ensign Energy Services 0.03 CANADA Peyto Exploration & Development 0.03 CANADA Arc Resources 0.1 CANADA Fairfax Financial Holdings 0.81 CANADA Power Corp Canada 0.46 CANADA Artis Real Estate Investment Trust 0.07 CANADA Finning International 0.18 CANADA Power Financial Corp 0.32 CANADA Atco Class I 0.15 CANADA First Capital Realty 0.16 CANADA PrairieSky Royalty Ltd 0.2 CANADA ATS Automation Tooling 0.07 CANADA First Majestic Silver 0.08 CANADA Precision Drilling 0.03 CANADA Aurora Cannabis Inc 0.38 CANADA First National Financial 0.02 CANADA Premium Brands Holdings Corp 0.12 CANADA B2Gold 0.18 CANADA First Quantum Minerals 0.39 CANADA Pretium Resources 0.1 CANADA Bank of Montreal 2.93 CANADA FirstService Corporation 0.18 CANADA Quebecor Inc. -

Quarterly Commentary 18 AM Canadian Equity Portfolio March 31, 2020

Quarterly Commentary 18 AM Canadian Equity Portfolio March 31, 2020 18 AM Canadian Equity Highlights The 18 AM Canadian Equity portfolio is uniquely positioned, with 50/50 exposure to two focused style portfolios, Offence (growth and momentum) and Defence (income, quality and low risk). We manage the Offence and Defence styles independently, using 15-stock portfolios of companies that exhibit attractive balance sheet and income statement fundamentals (factors) of the respective style. As of the close of 2019, the 18 AM Canadian Equity portfolio reached a 6-year track record. Over that period, the portfolio realized objectives by: ✓ Outperforming the benchmark S&P/TSX Composite (TSX) in 5 of 6 calendar years, and overall since inception before fees. ✓ Experiencing a lower risk profile versus the TSX, evidenced by having both a lower volatility, and by losing less during calendar years when the index declined. ✓ Maintaining a fundamental profile that is superior to the benchmark across a variety of impactful factors as intended within each style, such as: i) a lower Price/Earnings ratio, ii) higher Return on Equity, iii) better Earnings Growth and iv) enhanced Yield. Details of the portfolio and style performance are shown in the following table. Since Inception Performance Q1 2020 1 Year 3 Year 5 Year Return Volatility Offence* -25.6% -20.0% -3.6% -2.1% 0.2% 14.1% Defence* -15.9% -7.7% 0.9% 4.1% 6.3% 10.0% Portfolio** -20.8% -13.9% -1.1% 1.1% 3.3% 11.1% Benchmark -20.9% -14.2% -1.9% 0.9% 2.8% 11.4% *The chart depicts performance data for the style portfolios managed by 18 AM and is for information purposes only. -

Interactive Gambling and Broadcasting Amendment (Online Transactions and Other Measures) Bill 2011

iBus Media Limited Joint Select Committee on Gambling Reform Inquiry into the Interactive Gambling and Broadcasting Amendment (Online Transactions and Other Measures) Bill 2011 July 2011 597773v4 1 TABLE OF CONTENTS 1. EXECUTIVE SUMMARY __________________________________________ 3 2. BACKGROUND ___________________________________________________ 4 3. INTRODUCTION__________________________________________________ 4 4. THE IGA _________________________________________________________ 7 5. THE PRODUCTIVITY COMMISSION REPORT ______________________ 9 6. INTERACTIVE GAMBLING AND BROADCASTING AMENDMENT (ONLINE TRANSACTIONS AND OTHER MEASURES) BILL 2011 _____ 12 7. OVERSEAS MEASURES __________________________________________ 13 8. AUSTRALIAN REGULATORY FRAMEWORK ______________________ 20 9. AUSTRALIAN HARM MINIMISATION MEASURES _________________ 21 10. CONCLUSION ___________________________________________________ 23 597773v4 2 1. Executive Summary 1.1 Over the last decade, there has been an enormous increase in the popularity of poker, both terrestrial and online. It is clear that poker is a popular form of entertainment and that there is great consumer demand for poker services. There can be no doubt that increasing numbers of Australians are playing poker online despite the prohibition on online poker services contained in the Interactive Gambling Act 2001 (the IGA ). 1.2 Online poker can be clearly distinguished from other forms of interactive gambling and wagering activities. Online poker is a game of skill, which is conducted peer-to- peer in a social setting. 1.3 The Productivity Commission's Inquiry Report: Gambling ( PC Report ) released on 23 June 2010 recognised that online poker may be distinguished readily from online casino-type games. The Productivity Commission considered that online poker presented the least risk to consumers of all online games and recommended that the provision of online poker services by Australian-based operators to Australian-based consumers in a regulated environment be permitted.