Peter Castellon

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monthly Performance Review Enhanced Income Fund W Income Shares 31 August 2021

MPR.en.xx.20210831.GB00B87HPZ94.pdf For Investment Professionals Only FIDELITY INVESTMENT FUNDS MONTHLY PERFORMANCE REVIEW ENHANCED INCOME FUND W INCOME SHARES 31 AUGUST 2021 Portfolio manager: Michael Clark, David Jehan, Rupert Gifford Performance over month in GBP (%) Performance for 12 month periods in GBP (%) Fund 2.0 Market index 2.7 FTSE All Share Index Market index is for comparative purposes only. Source of fund performance is Fidelity. Basis: bid-bid with income reinvested, in GBP, net of fees. Other share classes may be available. Please refer to the prospectus for more details. Fund Index Market Environment UK equities continued to advance, recording a seventh straight monthly gain in August. Sentiment remained buoyant, propelled by a spate of merger and acquisition (M&A) activity, alongside expectations for continued earnings strength. The Bank of England kept its monetary policy unchanged, but warned of a more pronounced period of above-target inflation in the near term. Meanwhile, the pace of economic activity remains solid in the UK despite a modest deceleration over the month. While the flash PMI reading remained above the 50 mark that suggest growth, staffing shortages and supply bottlenecks kept a lid on activity levels. Authorities finally lifted the last of the domestic COVID-19 restrictions during the month. Almost all sectors posted positive returns, with technology, real estate, industrials and consumer discretionary the largest gainers. Conversely, materials and consumer staples lagged the market. Fund Performance The fund delivered 2.0%, while the index was up by 2.7% in August. UK equities continued to advance, and the fund lagged due to its defensive bias. -

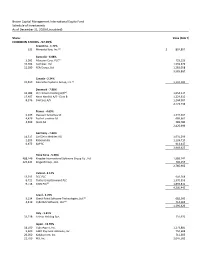

COMMON STOCKS - 97.05% Argentina - 1.72% (A)

Yeah Brown Capital Management International Equity Fund Schedule of Investments As of December 31, 2020 (Unaudited) Shares Value (Note 1) COMMON STOCKS - 97.05% Argentina - 1.72% (a) 533 MercadoLibre, Inc. $ 892,892 Australia - 6.88% (a) 3,092 Atlassian Corp. PLC 723,126 10,704 Cochlear, Ltd. 1,559,676 11,180 REA Group, Ltd. 1,283,058 3,565,860 Canada - 2.24% (a) 19,819 Descartes Systems Group, Inc. 1,159,183 Denmark - 7.96% (a) 16,089 Chr Hansen Holding A/S 1,654,217 17,487 Novo Nordisk A/S - Class B 1,224,612 8,376 SimCorp A/S 1,244,907 4,123,736 France - 4.69% 6,639 Dassault Systemes SE 1,347,557 4,426 EssilorLuxottica SA 689,662 4,699 Ipsen SA 389,780 2,426,999 Germany - 7.66% 14,517 Carl Zeiss Meditec AG 1,931,296 1,209 Rational AG 1,124,710 6,975 SAP SE 913,617 3,969,623 Hong Kong - 5.38% 488,146 Kingdee International Software Group Co., Ltd. 1,989,747 123,443 Kingsoft Corp., Ltd. 796,155 2,785,902 Ireland - 8.12% 13,293 DCC PLC 941,268 6,721 Flutter Entertainment PLC 1,370,359 (a) 9,718 ICON PLC 1,894,816 4,206,443 Israel - 2.70% (a) 5,134 Check Point Software Technologies, Ltd. 682,360 (a) 4,419 CyberArk Software, Ltd. 714,066 1,396,426 Italy - 1.41% 33,718 Azimut Holding SpA 731,970 Japan - 13.70% 18,500 CyberAgent, Inc. 1,273,885 5,600 GMO Payment Gateway, Inc. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Ftse4good UK 50

2 FTSE Russell Publications 19 August 2021 FTSE4Good UK 50 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.81 UNITED GlaxoSmithKline 5.08 UNITED Rentokil Initial 0.67 UNITED KINGDOM KINGDOM KINGDOM Anglo American 2.56 UNITED Halma 0.74 UNITED Rio Tinto 4.68 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.36 UNITED HSBC Hldgs 6.17 UNITED Royal Dutch Shell A 4.3 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.56 UNITED InterContinental Hotels Group 0.64 UNITED Royal Dutch Shell B 3.75 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 8.25 UNITED International Consolidated Airlines 0.47 UNITED Schroders 0.28 UNITED KINGDOM Group KINGDOM KINGDOM Aviva 1.15 UNITED Intertek Group 0.65 UNITED Segro 0.95 UNITED KINGDOM KINGDOM KINGDOM Barclays 2.1 UNITED Legal & General Group 1.1 UNITED Smith & Nephew 0.99 UNITED KINGDOM KINGDOM KINGDOM BHP Group Plc 3.2 UNITED Lloyds Banking Group 2.39 UNITED Smurfit Kappa Group 0.74 UNITED KINGDOM KINGDOM KINGDOM BT Group 1.23 UNITED London Stock Exchange Group 2.09 UNITED Spirax-Sarco Engineering 0.72 UNITED KINGDOM KINGDOM KINGDOM Burberry Group 0.6 UNITED Mondi 0.67 UNITED SSE 1.13 UNITED KINGDOM KINGDOM KINGDOM Coca-Cola HBC AG 0.37 UNITED National Grid 2.37 UNITED Standard Chartered 0.85 UNITED KINGDOM KINGDOM KINGDOM Compass Group 1.96 UNITED Natwest Group 0.77 UNITED Tesco 1.23 UNITED KINGDOM KINGDOM KINGDOM CRH 2.08 UNITED Next 0.72 UNITED Unilever 7.99 UNITED KINGDOM KINGDOM -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

Martin Hutchings

Martin Hutchings Partner Financing and capital markets His depth of knowledge is impressive, a good person to have in your corner. Chambers UK 2016 Primary practice Financing and capital markets 30/09/2021 Martin Hutchings | Freshfields Bruckhaus Deringer About Martin Hutchings <p><strong>Martin, whose practice encompasses all aspects of banking work, advises borrowers and lenders on complex multijurisdictional transactions, with an emphasis predominantly on corporate treasury transactions, including acquisition finance, IPO facilities, liquidity facilities and general corporate financings.</strong></p> <p>Martin's recent work has included numerous syndicated and bilateral corporate financings for clients such as Abcam, Astrazeneca, BT, Carnival, Compass Group, Croda International, Daily Mail & General Trust, Dixons CarphoneWarehouse, Intercontinental Hotels Group, John Laing, Kingfisher, London Stock Exchange Group, McCarthy & Stone, The Rank Group, RELX, Saga and Tesco.</p> Recent work <ul> <li>Advising Croda International on its term facility to support its acquisition of Avanti Polar Lipids, Inc and its syndicated working capital facility (including ESG margin adjustment).</li> <li>Advising Flutter Entertainment on its term loan A and revolving facilities, Term Loan B and Notes consent solicitation and intercreditor arrangements to support its acquisition of The Stars Group Inc.</li> <li>Advising London Stock Exchange Group on its bridge facilities to support its acquisition of Refinitiv Inc.</li> <li>Advising Berry Global -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek -

COMMON STOCKS - 95.94% Australia - 4.43% (A)

Yeah Brown Capital Management International Equity Fund Schedule of Investments As of June 30, 2020 (Unaudited) Shares Value (Note 1) COMMON STOCKS - 95.94% Australia - 4.43% (a) 483 Atlassian Corp. PLC $ 87,070 7,426 Cochlear, Ltd. 968,203 5,944 REA Group, Ltd. 442,518 1,497,791 Canada - 1.89% (a) 12,124 Descartes Systems Group, Inc. 640,046 Denmark - 7.16% 9,068 Chr Hansen Holding A/S 935,170 15,091 Novo Nordisk A/S - Class B 977,018 4,724 SimCorp A/S 509,259 2,421,447 France - 6.31% 7,521 Dassault Systemes SE 1,297,890 (a) 3,819 EssilorLuxottica SA 490,204 4,055 Ipsen SA 344,644 2,132,738 Germany - 9.22% (a) 12,528 Carl Zeiss Meditec AG 1,221,722 1,034 Rational AG 578,988 9,410 SAP SE 1,314,321 3,115,031 Hong Kong - 6.00% 611,146 Kingdee International Software Group Co., Ltd. 1,420,922 130,443 Kingsoft Corp., Ltd. 606,731 2,027,653 Ireland - 9.27% 11,472 DCC PLC 956,663 (a) 5,800 Flutter Entertainment PLC 762,404 (a) 8,387 ICON PLC 1,412,874 3,131,941 Israel - 2.34% (a) 4,998 Check Point Software Technologies, Ltd. 536,935 (a) 2,564 CyberArk Software, Ltd. 254,528 791,463 Italy - 1.47% 29,099 Azimut Holding SpA 497,254 Japan - 12.81% 16,000 CyberAgent, Inc. 783,885 4,500 GMO Payment Gateway, Inc. 468,442 17,000 Kakaku.com, Inc. 429,664 24,300 M3, Inc. -

International Fund Portfolio Holdings

PORTFOLIO HOLDINGS Harbor International Fund As of 06/30/2021 Subadviser: Marathon Asset Management LLP - Since 08/22/2018 Portfolio Managers: Neil M. Ostrer, Charles Carter, Nick Longhurst, William J. Arah, Simon Somerville, Michael Nickson, CFA, Justin Hill, Alex Duffy Shares/Par/ Current Base Base Market Value % of Total Net SEDOL Asset Description Contracts Price $ $ Assets 7110388 Roche Holding Ltd 224,553 377.08 84,673,489 1.75 0798059 BP p.l.c. 18,053,623 4.35 78,561,563 1.63 6429104 Hitachi,Ltd. 1,362,000 57.31 78,058,228 1.62 BN4MYF5 Vestas Wind Systems A/S 1,746,074 39.04 68,166,104 1.41 BHC8X90 Novo Nordisk A/S Class B 763,711 83.79 63,990,207 1.32 BYWH8S0 HelloFresh SE 613,546 97.22 59,648,997 1.23 3134865 Barclays PLC 22,968,245 2.36 54,295,493 1.12 BWXC0Z1 Flutter Entertainment Plc 276,702 181.59 50,246,759 1.04 6900643 Toyota Motor Corp. 570,800 87.49 49,936,649 1.03 3163836 Intertek Group plc 645,142 76.39 49,285,101 1.02 7309681 BNP Paribas SA Class A 775,881 62.70 48,646,603 1.01 B8FMRX8 Coloplast A/S Class B 290,847 164.10 47,728,124 0.99 BGDT3G2 Rightmove plc 5,057,785 8.97 45,374,082 0.94 0870612 Lloyds Banking Group plc 69,120,045 0.64 44,582,360 0.92 BYPC1T4 ASSA ABLOY AB Class B 1,438,489 30.14 43,362,483 0.90 B5VQMV6 Entain PLC 1,718,679 24.11 41,442,868 0.86 B1WGG93 Geberit AG 55,065 750.80 41,342,681 0.86 B11ZRK9 Legrand SA 380,942 105.85 40,324,025 0.83 BD6K457 Compass Group PLC 1,902,312 21.03 39,997,386 0.83 0718875 Rio Tinto plc 482,627 82.18 39,663,477 0.82 BDSV2V0 CNH Industrial NV 2,375,980 16.51 39,236,124 -

International Equity Fund Q1 Portfolio Holdings

Putnam International Equity Fund The fund's portfolio 9/30/20 (Unaudited) COMMON STOCKS (97.7%)(a) Shares Value Australia (1.9%) BHP Billiton, Ltd. 560,202 $14,415,565 14,415,565 Canada (1.7%) Cenovus Energy, Inc. 1,103,900 4,302,686 CI Financial Corp. 702,900 8,915,911 13,218,597 China (4.0%) 21Vianet Group, Inc. ADR(NON) 217,635 5,040,427 Alibaba Group Holding, Ltd.(NON) 171,000 6,323,352 Baidu, Inc. ADR(NON) 63,800 8,076,442 China Mobile, Ltd. 1,747,000 11,230,852 30,671,073 Denmark (1.7%) Orsted A/S 94,251 13,000,501 13,000,501 France (10.0%) AXA SA 649,811 11,995,727 Kering SA 19,990 13,281,059 Schneider Electric SA 138,157 17,147,354 Thales SA 157,930 11,825,596 Ubisoft Entertainment SA(NON) 117,836 10,648,747 Worldline SA(NON) 134,400 11,020,489 75,918,972 Germany (11.9%) adidas AG(NON) 47,060 15,231,590 Brenntag AG 128,448 8,173,190 CompuGroup Medical SE & Co. KgaA 119,506 11,060,679 Deutsche Boerse AG 82,013 14,403,049 HC Brillant Services GmbH (acquired various dates from 30 26 8/2/13 to 8/31/16, cost $20) (Private)(F)(RES)(NON) KION Group AG 120,891 10,382,255 Merck KGaA 40,308 5,885,886 Software AG 224,384 11,064,938 Zalando SE(NON) 154,585 14,469,423 90,671,036 Hong Kong (2.8%) AIA Group, Ltd. -

The Advisors' Inner Circle Fund III

The Advisors’ Inner Circle Fund III Democracy International Fund March 31, 2021 (Unaudited) SCHEDULE OF INVESTMENTS COMMON STOCK — 50.7% Shares Fair Value Belgium — 0.4% Ageas ..................................... 14 $ 849 Anheuser-Busch InBev ......................... 30 1,895 2,744 Canada — 8.0% Agnico Eagle Mines ........................... 21 1,214 Alimentation Couche-Tard, Cl B .................. 46 1,483 Bank of Montreal ............................. 25 2,228 Bank of Nova Scotia ........................... 39 2,440 Barrick Gold ................................. 101 2,003 BCE ....................................... 27 1,219 Brookfield Asset Management, Cl A ............... 44 1,957 Canadian Imperial Bank of Commerce ............. 17 1,664 Canadian National Railway ...................... 24 2,785 Canadian Natural Resources .................... 56 1,731 Canadian Pacific Railway ....................... 5 1,910 CGI, Cl A* ................................... 13 1,083 Constellation Software ......................... 1 1,396 Enbridge ................................... 60 2,185 Fortis ...................................... 26 1,128 Magna International ........................... 13 1,145 Manulife Financial ............................ 85 1,828 Nutrien .................................... 28 1,508 Rogers Communications, Cl B ................... 15 692 Royal Bank of Canada ......................... 40 3,688 Shopify, Cl A* ................................ 4 4,416 Sun Life Financial ............................. 25 1,263 Suncor Energy ..............................