1 This Announcement Is for Information Purposes Only and Does

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Hyperlinks of Merchant Websites Will Bring to You to Another Website on the Internet, Which Is Published and Operated by a Third Party

The hyperlinks of merchant websites will bring to you to another website on the Internet, which is published and operated by a third party. Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such websites, then the terms of use and other terms and guidelines for such website shall prevail. Offers are applicable for Standard Chartered Visa Credit Card Offers are applicable for Standard Chartered Mastercard Offers are applicable for Standard Chartered UnionPay Dual Currency Platinum Credit Card Offers are applicable for Standard Chartered WorldMiles Card Merchants Offers Details and Merchant's Additional Terms and Conditions Contact Details (852) 2833 0128 BEE CHENG HIANG SHOP NO.1 GROUND FLOOR, YING KONG MANSION, NO. 2-6 10% off on regular-priced meat products upon spending of HK$300 or above YEE WO STREET, CAUSEWAY BAY Promotion period is from 1 Jan to 31 Dec 2017. (852) 2730 8390 SHOP C, G/F, DAILY HOUSE, Merchant website: http://www.bch.hk NO.35-37 HAIPHONG ROAD, TSIM SHA TSUI (852) 2411 0808 SHOP NO.2 GROUND FLOOR,NO. 60 SAI YEUNG CHOI STREET SOUTH, MONGKOK (852) 3514 4018 SHOP NO.B02-36, LANGHAM PLACE,NO.8 ARGYLE STREET, MONGKOK (852) 2362 0823 SHOP NO.E5,HUNG HOM STATION,HUNG HOM (852) 2357 077 SHOP NO.KWT 20 ,KWUN TONG STATION, KWUN TONG (852) 2365 2228 Shop B12, Basement 1, Site 5,(Aeon Dept Store)Whampoa Garden, Hung Hom, Kowloon (852) 2698 8310 SHOP NO. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

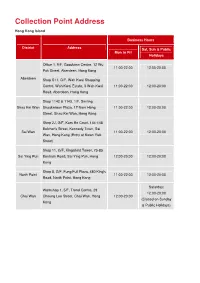

Collection Point Address

Collection Point Address Hong Kong Island Business Hours District Address Sat, Sun & Public Mon to Fri Holidays Office 1, 9/F, Goodview Centre, 12 Wu 11:00-22:00 12:00-20:00 Pak Street, Aberdeen, Hong Kong Aberdeen Shop S11, G/F, Wah Kwai Shopping Centre, Wah Kwai Estate, 3 Wah Kwai 11:00-22:00 12:00-20:00 Road, Aberdeen, Hong Kong Shop 1142 & 1143, 1/F, Smiling Shau Kei Wan Shaukeiwan Plaza, 17 Nam Hong 11:00-22:00 12:00-20:00 Street, Shau Kei Wan, Hong Kong Shop 2J, G/F, Kam Ho Court, 144-148 Belcher's Street, Kennedy Town, Sai Sai Wan 11:00-22:00 12:00-20:00 Wan, Hong Kong (Entry at Kwan Yick Street) Shop 11, G/F, Kingsfield Tower, 73-83 Sai Ying Pun Bonham Road, Sai Ying Pun, Hong 12:00-20:00 12:00-20:00 Kong Shop 8, G/F, Fung Full Plaza, 480 King's North Point 11:00-22:00 12:00-20:00 Road, North Point, Hong Kong Saturday: Workshop 1, 5/F, Trend Centre, 29 12:00-20:00 Chai Wan Cheung Lee Street, Chai Wan, Hong 12:00-20:00 (Closed on Sunday Kong & Public Holidays) Kowloon Business Hour District Address Sat, Sun & Public Mon – Fri Holidays Shop 38, G/F, Charming Garden Phase Mongkok 11:00-22:00 12:00-20:00 2, 8 Hoi Ting Road, Mong Kok, Kowloon Shop C, G/F, 1 Whampoa Street, Hung Hung Hom 11:00-22:00 12:00-20:00 Hom, Kowloon Shop 29A, G/F, Tropicana Gardens, 110 Wong Tai Sin Lung Cheung Road, Wong Tai Sin, 11:00-22:00 12:00-20:00 Kowloon Shop 6, Level 3, Sceneway Plaza, 8 Lam Tin 11:00-22:00 12:00-20:00 Sceneway Road, Lam Tin, Kowloon Shop 23, G/F., Yue Man Centre, 300 & 302 Ngau Tau Kok Road, Kwun Tong, 11:00-22:00 12:00-20:00 Kowloon -

Saint Honore Cake Shop

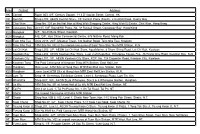

Saint Honore Cake Shop Address Telephone G/F, 11 Tung Sing Road, Aberdeen 2873 5881 Shop 402A, Chi Fu Landmark, Pok Fu Lam. 2538 0870 Shop E, G/F, Top View Mansion, 10 Canal Road West, Hong Kong 2575 5161 Ground Floor and Mezzanine Floor, No. 21 Sing Woo Road, Hong Kong 2572 3255 No. 15 Lan Fong Road, Ground Floor, Hong Kong 2752 7706 Shop No. 113b on Level 1 of New Jade Shopping Arcade, Chai Wan Inland Lot No. 120 2625 4831 Shop No. 22 on Ground Floor, Coronet Court, Nos. 321-333 King’s Road & Nos. 1, 3, 5, 7, 7A, 9 & 9A North 2505 7318 Point Road, Hong Kong Shop 113, 1/F, Oi Tung Shopping Ctr., Oi Tung Estate, Shaukeiwan 3156 1438 Shop D, G/F, Pier 3, 11 Man Kwong Street, Central, H.K. 2234 9744 Shop Unit 129, Paradise Mall, Hong Kong 2976 5261 Shop No.4 on Ground Floor and Air-Conditioning Plant Room on 1st Floor of Perfect Mount Gardens, No.1 2543 0138 Po Man Street, Hong Kong Shop No. 1, Ground Floor, V Heun Building, 138 Queen's Road Central, H.K. 2544 0544 Shop No. 2, G/F., East Commercial Block of South Horizons, No. 18A South Horizon Drive, Apleichau, Hong 2871 9155 Kong Shop No. 10, G/F., Fairview Height, 1 Seymour Road, Mid-Levels, Hong Kong 2546 8031 Shop No. 8, Shek Pai Wan Shopping Centre, Shek Pai Wan Estate, Southern, Hong Kong 2425 8979 Shop G3B, G/F, Amoy Plaza, Phase I, 77 Ngau Tau Kok Road, Ngau Tau Kok. -

D10441 2018 年第 47 期憲報第 4 號特別副刊 S. S. No. 4 to Gazette

2018 年第 47 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 47/2018 D10441 G.N. (S.) 62 of 2018 Employment Ordinance (Chapter 57) Employment Agency Regulations ISSUE OF EMPLOYMENT AGENCY LICENCES/CERTIFICATES OF EXEMPTION Pursuant to regulation 16 of the Employment Agency Regulations, the Commissioner for Labour hereby publishes the names of the persons and agencies to whom licences were issued during the period 1 January 2017 to 31 December 2017 and certificates of exemption that have been issued and remained valid during the same period. The data published in this gazette shall ONLY be used for the purpose of ascertaining whether a person or an employment agency has been granted a licence/certificate of exemption. (a) Employment Agency Licences Issued Licensee Employment Agency Remarks LEE Miu-ha Cindy Good Jobs Personnel & Secretarial Services Room 701, 7th floor, Dannies House, 20 Luard Road, Wan Chai, Hong Kong. CHUI Siu-yee Smartech Consultants Center Room 1202, 12th floor, 655 Nathan Road, Mong Kok, Kowloon. Sonmass Limited Sonmass Limited Room 609, 6th floor, David House, 8-20 Nanking Street, Yau Ma Tei, Kowloon. KWEE Kei Alexander Gracia Trading & Services Co. 16th floor, Kam Fung Commercial Building, 2-4 Tin Lok Lane, Wan Chai, Hong Kong. WONG Wing-yi C & Y PERSONNEL CONSULTANTS Room A105, 1st floor, New East Sun Industrial Building, 18 Shing Yip Street, Kwun Tong, Kowloon. Executive Access Limited Executive Access Limited Room 1302-1308, 13th floor, Prince’s Building, 10 Chater Road, Central, Hong Kong. Nation Employment Nation Employment Agency Limited Agency Limited Shop 73, 1st floor, Fu Fai Shopping Centre, 28 On Shing Street, Ma On Shan, New Territories. -

English Version

Indoor Air Quality Certificate Award Ceremony COS Centre 38/F and 39/F Offices (CIC Headquarters) Millennium City 6 Common Areas Wai Ming Block, Caritas Medical Centre Offices and Public Areas of Whole Building Premises Awarded with “Excellent Class” Certificate (Whole Building) COSCO Tower, Grand Millennium Plaza Public Areas of Whole Building Mira Place Tower A Public Areas of Whole Office Building Wharf T&T Centre 11/F Office (BOC Group Life Assurance Millennium City 5 BEA Tower D • PARK Baby Care Room and Feeding Room on Level 1 Mount One 3/F Function Room and 5/F Clubhouse Company Limited) Modern Terminals Limited - Administration Devon House Public Areas of Whole Building MTR Hung Hom Building Public Areas on G/F and 1/F Wharf T&T Centre Public Areas from 5/F to 17/F Building Dorset House Public Areas of Whole Building Nan Fung Tower Room 1201-1207 (Mandatory Provident Fund Wheelock House Office Floors from 3/F to 24/F Noble Hill Club House EcoPark Administration Building Offices, Reception, Visitor Centre and Seminar Schemes Authority) Wireless Centre Public Areas of Whole Building One Citygate Room Nina Tower Office Areas from 15/F to 38/F World Commerce Centre in Harbour City Public Areas from 5/F to 10/F One Exchange Square Edinburgh Tower Whole Office Building Ocean Centre in Harbour City Public Areas from 5/F to 17/F World Commerce Centre in Harbour City Public Areas from 11/F to 17/F One International Finance Centre Electric Centre 9/F Office Ocean Walk Baby Care Room World Finance Centre - North Tower in Harbour City Public Areas from 5/F to 17/F Sai Kung Outdoor Recreation Centre - Electric Tower Areas Equipped with MVAC System of The Office Tower, Convention Plaza 11/F & 36/F to 39/F (HKTDC) World Finance Centre - South Tower in Harbour City Public Areas from 5/F to 17/F Games Hall Whole Building Olympic House Public Areas of 1/F and 2/F World Tech Centre 16/F (Hong Yip Service Co. -

Shop 123, 1St Floor, Peninsula Centre, 67 Mody Road, Tsim Sha Tsui East, Kowloon

NO NAME ADDRESS TELP FAX 1 A Maids Employment Services Centre Shop 123, 1st Floor, Peninsula Centre, 67 Mody Road, Tsim Sha Tsui East, Kowloon. 2111 3319 3102 9909 2 A.V.M.S Limited Shop L115, 1st floor, Metro Harbour Plaza, Tai Kok Tsui, Kowloon 3144 3367 3144 3962 3 Abadi Employment Consultant Centre Room 1108, 1st floor, Inciti Kar Shing Building, 15-19 Kau Yuk Road, Yuen Long, New Territories 3106 5716 3106 5717 4 ABNC Employment Agencies Co. Flat 79, Ground floor, Maximall, Blocks 1-3, City Garden, 233 Electric Road, North Point, Hong Kong. 25762911 25763600 5 Active Global Specialised Caregivers (HK) Pte Ltd. Unit 1703-04, 17th floor, Lucky Centre, 165-171 Wan Chai Road, Wan Chai, Hong Kong 3426 2909 3013 9815 6 Advance Court Overseas Employment Co. Shop 34B, Level 2, Waldorf Shopping Centre, Castle Peak Road, TMTL 194, Tuen Mun, New Territories 2458 1573 2452 6735 7 Advantage Consultant Co. Flat C, 12th FIoor, Kam Wah Building, 516 Nathan Road, Yau Ma Tei, Kowlon 26012708 27711420 8 AIE Employment Centre Room 1605, 16th floor, Hollywood Plaza, 610 Nathan Road, Mong Kok, Kowloon 2770 1198 2388 9057 9 Alim Prima Employment Agency Room K & L, 4th floor, Hennessy Apartments, 488 Hennessy Road, Causeway Bay, Hong Kong 25040629 27709803 10 All The Best Employment Limited. 1st floor, 92 Kam Tin Road, Yuen Long, New Territories 2807 0870 2807 0869 11 Allwin Employment Centre Limited Mezzanine floor, 408 Ma Tau Wau Road, Hung Hom, Kowloon 28668585 28669595 12 An Apple Travel & Employment Services Limited Room 907, 9th floor, Tower 2, Silvercord, -

Aeon Atm Rmb Service.Pdf

Area District Address HK Central Room 803, 8/F, Century Square, 1-13 D' Aguilar Street, Central, HK HK Kornhill Shop L108, AEON Kornhill Store, 1/F Kornhill Plaza (South), 2 Kornhill Road, Quarry Bay HK Chai Wan Shop No. 128 on the first floor of Hing Wah Shopping Centre, Hing Wah (I) Estate, Chai Wan, Hong Kong HK Causeway Bay Unit 05 10/F SoundWill Plaza, No. 38 Russell Street, Causeway Bay, Hong Kong KLN Mongkok G/F., No.43 Bute Street, Kowloon KLN Mongkok A-B, G/F, Hua Chiao Commercial Centre, 678 Nathan Road, Mong Kok KLN Tsim Sha Tsui Units 2018, 20/F, Miramar Tower, 132 Nathan Road, Tsim Sha Tsui, Kowloon KLN Tsim Sha Tsui ATM Site No. M2 at the unpaid concourse of East Tsim Sha Tsui MTR Station, KLN KLN Lai Chi Kok Shop L203, 2/F, AEON Lai Chi Kok Store, AquaMarine, 8 Sham Shing Road, Lai Chi Kok, Kowloon KLN Kowloon Bay Shop L204, AEON Kowloon Bay Store, Level 2 of Mega Box, Enterprise Square Five, 38 Wang Chiu Road, Kowloon Bay, KLN KLN Kowloon City Shop L301, 3/F, AEON Kowloon City Store, KCP, No. 128 Carpenter Road, Kowloon City, Kowloon KLN Kowloon Tong The Paid Concourse of Kowloon Tong MTR Station, East Rail Line KLN Hunghom Main Level, ATM Site at Hung Hom MTR East Rail Line Station, KLN. KLN Hunghom Lower Level,ATM Site at Hung Hom MTR East Rail Line Station, KLN. KLN Lam Tin Shop 19, Sceneway Exhibition Centre, Level 3, Sceneway Plaza, Lam Tin, Kln. -

渣打香港分行地址資料address of Standard Chartered Hong Kong

渣打香港分行地址資料 Address of Standard Chartered Hong Kong Branch 分行 Branch 地址 Address 香港島 Hong Kong Island 德輔道中88號 中環德輔道中88號1樓及地下4號鋪 88 Des Voeux Road Central Shop 4, G/F & 1/F, 88 Des Voeux Road Central, Hong Kong 德輔道中88號優先理財服務中心 中環德輔道中88號1樓及地下5號鋪 88 Des Voeux Road PB Centre Shop 5, G/F & 1/F, 88 Des Voeux Road Central, Hong Kong 香港仔 香港仔南寧街6-12號香港仔中心第五期地下4A鋪及1樓1號鋪 Aberdeen Shop 4A, G/F & Shop 1, 1/F, Aberdeen Centre Site 5, 6-12 Nam Ning Street, Aberdeen, Hong Kong 金鐘 金鐘夏慤道16號遠東金融中心地下高層C號鋪 Admiralty Shop No. C, UG/F, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong 銅鑼灣 銅鑼灣怡和街38-40A號怡華大廈地下至2樓 Causeway Bay G/F- 2/F, Yee Wah Mansion, 38-40A Yee Wo Street, Causeway Bay, Hong Kong 中環 中環皇后大道中16-18號新世界大廈16號鋪地下及地庫 Central Shop No. 16, G/F & Lower G/F, New World Tower, 16-18 Queen's Road Central, Hong Kong 太古城 太古城中心第二期地下42-43號鋪 Cityplaza Shop 42-43, G/F, Cityplaza II, Quarry Bay, Hong Kong 太古城優先理財服務中心 太古城中心第二期地下44號鋪 Cityplaza PB Centre Shop 44, G/F, Cityplaza II, Quarry Bay, Hong Kong 德輔道中 中環德輔道中4-4A號渣打銀行大廈地下12室 Des Voeux Road Shop 12, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Hong Kong 跑馬地 跑馬地景光街16號地下 Happy Valley G/F , 16 King Kwong Street, Happy Valley, Hong Kong 軒尼詩道 灣仔軒尼詩道393-407號地下 Hennessy Road G/F, 393-407 Hennessy Road, Wanchai, Hong Kong 新翠花園 柴灣新翠花園地鋪145號鋪 New Jade Garden Shop 145, Level 1, New Jade Shopping Arcade, Chai Wan, Hong Kong 北角中心大廈 北角英皇道278-288號北角中心大廈地下G鋪 North Point Centre Shop G, G/F., North Point Centre, 278-288 King's Road, North Point, Hong Kong 港運城 北角英皇道500號港運城地下003號鋪 North Point Island Place -

Annex Branches of the Retail Exchange Fund Notes Distributors

Annex Branches of the Retail Exchange Fund Notes Distributors Bank of China (Hong Kong) Limited Enquiry hotline 3669 3668 Branch Name Address Hong Kong Island Central District Branch 2A Des Voeux Road Central, Hong Kong Bonham Road Branch 63 Bonham Road, Hong Kong Des Voeux Road West 111-119 Des Voeux Road West, Hong Kong Branch Shek Tong Tsui Branch 534 Queen's Road West, Shek Tong Tsui, Hong Kong Wan Chai Road Branch 127-135 Wan Chai Road, Wan Chai, Hong Kong Kennedy Town Branch Harbour View Garden, 2-2F Catchick Street, Kennedy Town, Hong Kong Happy Valley Branch 11 King Kwong Street, Happy Valley, Hong Kong Connaught Road Central 13-14 Connaught Road Central, Hong Kong Branch Caine Road Branch 57 Caine Road, Hong Kong 409 Hennessy Road Branch 409-415 Hennessy Road, Wan Chai, Hong Kong Hennessy Road (Wan Chai) 310-312 Hennessy Road, Wan Chai, Hong Kong Branch Sheung Wan Branch 252 Des Voeux Road Central, Hong Kong Wan Chai (China Overseas 139 Hennessy Road, Wan Chai, Hong Kong Building) Branch Johnston Road Branch 152-158 Johnston Road, Wan Chai, Hong Kong Gilman Street Branch 136 Des Voeux Road Central, Hong Kong Wyndham Street Branch 1-3 Wyndham Street, Central, Hong Kong Queen’s Road Central 81-83 Queen’s Road Central, Hong Kong Branch Western District Branch 386-388 Des Voeux Road West, Hong Kong First Street Branch 55A First Street, Sai Ying Pun, Hong Kong United Centre Branch Shop 1021, United Centre, 95 Queensway, Hong Kong Gloucester Road Wealth Unit 3, G/F Immigration Tower, 7 Gloucester Road, Wan Chai, Hong Management Centre -

Smartone Authorised Resellers Lists 20130108

SmarTone Authorised Resellers Kowloon News stand Side door G/F, Kim Shin Lane, 475 Castle Peak Rd News stand Shop 2, Tak Tin Estate Market, Lam Tin News stand Front of 520-530 Fuk Wing Street, Sham Shui Po, Kln News stand Shop K29, G/F (ALLMART), 47 Kai Tin Rd, Lam Tin News stand 789 Cheung Sha Wan Road, Cheung Sha Wan (near Tai Nan West Street) Computer / CD Shop Shop B2, Sceneway Garden Level 3, Lam Tin, Kln News stand Beside of Block 8,Un Chau Estate (In front of Un Chau Shopping Center), Cheung Sha Wan, KLN Stationary store Shop 314, 3/F Kin Tin Shopping Centre, 47 Kai Tin Rd, Lam Tin News stand No. 56, Lai Lo House, Lai Kok Estate, Cheung Sha Wan, Kln Color 3 Photo Shop 3 Tak Tin Shopping Centre, Tak Tin Est, Lam Tin, Kln News stand Hing Wah Street Cheung Sha Wan (near 369-371 Po On Road) News stand Shop 32A Kwong Tin Market, Kwong Tin Estate, Lam Tin , Kln News stand G/F 794, Cheung Sha Wan Road, Cheung Sha Wan, Kln Pharmacy Shop 211 1/F, Hing Ting Shopping Centre, Lam Tin, Kln News stand 8A, 23 Cheung Wah Street, Florence Plaza, Cheung Sha Wan, KlnLam Tin News stand Shop 15 L5, Sceneway Garden, Lam Tin, Kln News stand Shop 30 Banyan Mall, 863 Lai Chi Kok Road, Cheung Sha Wan, Kln Computer / CD Shop Shop 222, Tak Tin Shopping Centre, Tak Tin Estate, Lam Tin Convenience store Shop A, G/F, Prince Theatre, 181 Castle Peak Rd, Sham Shui Po Telecom Shop 49.Level 3, Sceneway Plaza, LamTin, Kln Convenience store Shop A3, 174-188 Un Chau St, Sham Shui Po, KLN Telecom Shop 305 of Unit 1, Level 4, Sceneway Plaza, 8 Sceneway Rd Cheung Sha -

List of Authorized Agents of Public Light Bus (PLB) Driver Identity Plate

(Last updated: 22 July 2020) List of authorized agents of Public Light Bus (PLB) driver identity plate Any PLB driver should bring along his or her valid PLB driver licence and Hong Kong Identity Card original to apply for PLB driver identity plate at specified locations below at his or her own cost. Hong Kong Island Office/ Shop/ Outlet Address Service Charge* Service hours Telephone No. Shop 24, Pod/F, Wah Fu (I) Shopping $100 / 1 piece (pc) The day Mon – Sun: 1. Create Art Photo Shop Centre, Wah Fu (I) Estate, Aberdeen, 2551 6348 $140 / 2 pcs after 09:00 - 20:00 Hong Kong $100 / 1 pc Within a Mon – Sun: Lee Kin Driving School Room 2036, 2/F, United Centre, 95 $150 / 2 pcs day 11:00 - 20:00 2. 2577 9921 Limited Queensway, Hong Kong $50 / 1 pc The day (Subject to the time of $100 / 2 pcs after each branch) $100 / 1 pc Within a Mon – Sun: Lee Kin Driving School Room 1, 17/F, 22 Yee Woo Street, $150 / 2 pcs day 11:00 - 20:00 3. 2577 9007 Limited Causeway Bay, Hong Kong $50 / 1 pc The day (Subject to the time of $100 / 2 pcs after each branch) $100 / each pc Mon – Sat: Motor Transport Workers 2/F, 213-219 Hennessy Road, Wan The day 10:00 - 18:00 4. 2519 0110 General Union Chai, Hong Kong Member: after Closed: Sun & Public Holiday $20 / each pc Shop 24, G/F, New Century Plaza, $100 / 1 pc Mon – Sat: Colour Express Photo 2866 9222 5.