Impact of Macroeconomic Variables on Karachi Stock Market Returns

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stock Market in Pakistan: an Overview

Munich Personal RePEc Archive Stock Market in Pakistan: An Overview Iqbal, Javed Monash University July 2008 Online at https://mpra.ub.uni-muenchen.de/11868/ MPRA Paper No. 11868, posted 04 Dec 2008 06:14 UTC Stock Market in Pakistan: An Overview Stock Market in Pakistan: An Overview By Javed Iqbal Department of Econometrics and Business Statistics, Monash University Australia and Department of Statistics, University of Karachi, Pakistan Postal Address: Department of Statistics, Karachi University, Karachi 75270, Pakistan Email: [email protected] 1 Stock Market in Pakistan: An Overview Stock Market in Pakistan: An Overview ABSTRACT This paper reviews the main features of the Stock market in Pakistan focussing on post- liberalization period. The aspects of the market investigated include liberalization of the market, integration the market with the world markets, trading and settlement mechanism, and corporate governance issues. Finally salient features of the market are compared to a selected set of emerging and developed markets. Pakistan’s stock market is smaller in size but is significantly more active than the markets of this size. In recent years the market has provided very high returns to investors. In 2002 the market was declared as the best performing stock market globally. 2 Stock Market in Pakistan: An Overview Stock Market in Pakistan: An Overview 1. NTRODUCTION The Karachi Stock Excahnge (KSE) is Pakistan’s first and one of the oldest stock exchanges in emerging markets. KSE was established in 18 September 1947 just two months after Pakistan became an independent state. The other exchanges in Pakistan, the Lahore Stock Exchange (LSE) and the Islamabad Stock Exchange (ISE), were estbalished in 1974 and 1997 respectively. -

Analyzing the Stock Markets Role As a Source of Capital Formation in Pakistan

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Kanasro, Hakim Ali; Junejo, Mumtaz Ali; Junejo, Mansoor Ahmed Article Analyzing the stock markets role as a source of capital formation in Pakistan Pakistan Journal of Commerce and Social Sciences (PJCSS) Provided in Cooperation with: Johar Education Society, Pakistan (JESPK) Suggested Citation: Kanasro, Hakim Ali; Junejo, Mumtaz Ali; Junejo, Mansoor Ahmed (2011) : Analyzing the stock markets role as a source of capital formation in Pakistan, Pakistan Journal of Commerce and Social Sciences (PJCSS), ISSN 2309-8619, Johar Education Society, Pakistan (JESPK), Lahore, Vol. 5, Iss. 2, pp. 273-282 This Version is available at: http://hdl.handle.net/10419/188030 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

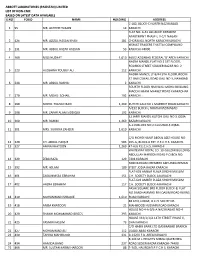

Abbott Laboratories (Pakistan) Limited List of Non-Cnic Based on Latest Data Available S.No Folio Name Holding Address 1 95

ABBOTT LABORATORIES (PAKISTAN) LIMITED LIST OF NON-CNIC BASED ON LATEST DATA AVAILABLE S.NO FOLIO NAME HOLDING ADDRESS C-182, BLOCK-C NORTH NAZIMABAD 1 95 MR. AKHTER HUSAIN 14 KARACHI FLAT NO. A-31 ALLIANCE PARADISE APARTMENT PHASE-I, II-C/1 NAGAN 2 126 MR. AZIZUL HASAN KHAN 181 CHORANGI, NORTH KARACHI KARACHI. KISMAT TRADERS THATTAI COMPOUND 3 131 MR. ABDUL RAZAK HASSAN 53 KARACHI-74000. 4 169 MISS NUZHAT 1,610 469/2 AZIZABAD FEDERAL 'B' AREA KARACHI NAZRA MANZIL FLAT NO 2 1ST FLOOR, RODRICK STREET SOLDIER BAZAR NO. 2 5 223 HUSSAINA YOUSUF ALI 112 KARACHI NADIM MANZIL LY 8/44 5TH FLOOR, ROOM 37 HAJI ESMAIL ROAD GALI NO 3, NAYABAD 6 244 MR. ABDUL RASHID 2 KARACHI FOURTH FLOOR HAJI WALI MOHD BUILDING MACCHI MIANI MARKET ROAD KHARADHAR 7 270 MR. MOHD. SOHAIL 192 KARACHI 8 290 MOHD. YOUSUF BARI 1,269 KUTCHI GALI NO 1 MARRIOT ROAD KARACHI A/192 BLOCK-L NORTH NAZIMABAD 9 298 MR. ZAFAR ALAM SIDDIQUI 192 KARACHI 32 JAFRI MANZIL KUTCHI GALI NO 3 JODIA 10 300 MR. RAHIM 1,269 BAZAR KARACHI A-113 BLOCK NO 2 GULSHAD-E-IQBAL 11 301 MRS. SURRIYA ZAHEER 1,610 KARACHI C/O MOHD HANIF ABDUL AZIZ HOUSE NO. 12 320 CH. ABDUL HAQUE 583 265-G, BLOCK-6 EXT. P.E.C.H.S. KARACHI. 13 327 AMNA KHATOON 1,269 47-A/6 P.E.C.H.S. KARACHI WHITEWAY ROYAL CO. 10-GULZAR BUILDING ABDULLAH HAROON ROAD P.O.BOX NO. 14 329 ZEBA RAZA 129 7494 KARACHI NO8 MARIAM CHEMBER AKHUNDA REMAN 15 392 MR. -

The Effect of Uncertainty on Stock Returns and Risk-Returns (Volatility) Relationship Across Military and Democratic Regimes in Pakistan

Marketing and Branding Research 7(2020) 24-46 Marketing and Branding Research WWW.CIKD.CA The Effect of Uncertainty on Stock Returns and Risk-returns (Volatility) Relationship Across Military and Democratic Regimes in Pakistan Zareen Zafar1*, Danish Ahmed Siddiqui2 1, 2Karachi University Business School, University of Karachi, Pakistan ABSTRACT Keywords: This research includes empirical results in making a consistent understanding of investor Pakistan Stock Market, Stock sagacity, investment returns, and behavioral stock market performance in the behavioral Returns, Risk Returns, finance trend theoretical context. The data were collected using a long range of Returns data Military Regieme, Pakistan's stock market Since June 1994 to December 2018 on the two economic segments Democratic Regieme, known as the Military Period (1999-2008 and 2009-2018). Quantile Regression (QR) and Ordinary Least Square, Ordinary Least Square (OLS) carried out on future returns and risk-returns (volatility) where Quantile Regression, the independent variables Consumer Price Index (CPI), Gross Domestic Product (GDP), Uncertainty index Money Market Rate (MMR), Discount Rate (DR) and Pakistan's Uncertainty Index were taken at annual data base. The findings indicated that DR and past returns significantly impact future Received returns. Other factors such as GDP, inflations, MMR and conditions of instability, however, 14 October 2020 had no major impact on returns. With regard to the military process, all variables such as past Received in revised form returns, GDP, discount and cash market levels, as well as volatility, had a major return impact. 26 October 2020 Whereas in the process of democracy, no macroeconomic factor affected those returns. With regard to volatility, CPI appeared to be the only factor that positively impacted the volatility Accepted of share prices, as well as each of the two phases while all other factors had no significant 26 October 2020 effect overall. -

Shareholders Without CNIC.PDF

Gharibwal Cement Limited DETAIL OF WITHOUT CNIC SHAREHOLDERS S.No. Folio Name Address Current Net Dividend shareholding (Net of Zakat and Balance tax) 1 1 HAJI AMIR UMAR C/O.HAJI KHUDA BUX AMIR UMAR COTTON MERCHANT,3RD FLOOR COTTON EXCHANGE BLDG, MCLEOD ROAD, P.O.BOX.NO.4124 586 KARACHI 578 2 3 MR.MAHBOOB AHMAD MOTI MANSION, MCLEOD ROAD, LAHORE. 11 11 3 11 MRS.FAUZIA MUGHIS 25-TIPU SULTAN ROAD MULTAN CANTT 1,287 1,271 4 19 MALIK MOHAMMAD TARIQ C/O.MALIK KHUDA BUX SECRETARY AGRICULTURE (WEST PAKISTAN), LAHORE. 110 108 5 20 MR. NABI AHMED CHAUDHRI, C/O, MODERN MOTORS LTD, VOLKSWAGEN HOUSE, P.O.BOX NO.8505, BEAUMONT ROAD, KARACHI.4. 2,193 2,166 6 24 BEGUM INAYAT NASIR AHMED 134 C MODEL TOWN LAHORE 67 66 7 26 MRS. AMTUR RAUF AHMED, 14/11 STREET 20, KHAYABAN-E-TAUHEED, PHASE V,DEFENCE, KARACHI. 474 468 8 27 MRS.AMTUL QAYYUM AHMED 134-C MODEL TOWN LAHORE 26 25 9 31 MR.ANEES AHMED C/O.DR.GHULAM RASUL CHEEMA BHAWANA BAZAR, FAISALABAD 649 642 10 36 MST.RAFIA KHANUM C/O.MIAN MAQSOOD A.SHEIKH M/S.MAQBOOL CO.LTD ILAMA IQBAL ROAD, LAHORE. 1,789 1,767 11 37 MST.ABIDA BEGUM C/O HAJI KHUDA BUX AMIR UMAR 3RD FLOOR. COTTON EXCHANGE BUILDING, 1.1.CHUNDRIGAR ROAD, KARACHI. 2,572 2,540 12 39 MST.SAKINA BEGUM F-105 BLOCK-F ALLAMA RASHID TURABI ROAD NORTH NAZIMABAD KARACHI 2,657 2,625 13 42 MST.RAZIA BEGUM C/O M/S SADIQ SIDDIQUE CO., 32-COTTON EXCHANGE BLDG., I.I.CHUNDRIGAR ROAD KARACHI. -

Formerly: Karachi Stock Exchange Limited) Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: 111-001-122

PAKISTAN STOCK EXCHANGE LIMITED (Formerly: Karachi Stock Exchange Limited) Stock Exchange Building, Stock Exchange Road, Karachi-74000, Phones: 111-001-122 CRITERIA FOR SELECTION OF TOP 25 COMPANIES FOR THE YEAR 2016 1) Prerequisites for Selection of Top Companies: a) A minimum distribution of 30% (including at least 15% cash dividend) for the year; b) The Shares of the company are traded 50% of the total trading days during the year c) The company should not be in the Defaulters’ Segment of the Exchange or trading in its shares has not been suspended on account of violation of Listing of Companies & Securities Regulations of the Exchange during the year. 2) The Companies that Qualify above Prerequisites will be selected on the Basis of Highest Marks Obtained as per the following Criteria: a) Capital Efficiency: (i) Shareholders Return on Equity (on the basis of before tax profit) 15% (ii) Ratio of Capital Expenditure to Total Assets 3% (iii) Change in Market Value Added (MVA of a year in the difference 2.5% between Market Value minus Book Value for that year.) b) Dividend Distribution (including Bonus) (i) Total Distribution out of Current Year’s Profit only. (In case 10% dividend/bonus is paid out of prior year’s earnings/reserves, than the dividend/bonus shall be adjusted proportionately) (ii) Payout Ratio (DPS / EPS) 10% c) Growth in Operating Revenue 6% Change in EBITDA Margin (Operating margin) in absolute terms 6% d) Free-Float of Shares 10% Free-Float of shares as a percentage of total shares outstanding e) Turnover of Shares -

Abbott Laboratories (Pakistan) Limited List of Non-Cnic As at May 13, 2019 S.No Folio Name Address Holding 1 95 Mr

ABBOTT LABORATORIES (PAKISTAN) LIMITED LIST OF NON-CNIC AS AT MAY 13, 2019 S.NO FOLIO NAME ADDRESS HOLDING 1 95 MR. AKHTER HUSAIN C-182, BLOCK-C 14 NORTH NAZIMABAD KARACHI 2 126 MR. AZIZUL HASAN KHAN FLAT NO. A-31 181 ALLIANCE PARADISE APARTMENT PHASE-I, II-C/1 NAGAN CHORANGI, NORTH KARACHI KARACHI. 3 131 MR. ABDUL RAZAK HASSAN KISMAT TRADERS 53 THATTAI COMPOUND KARACHI-74000. 4 169 MISS NUZHAT 469/2 AZIZABAD 1,610 FEDERAL 'B' AREA KARACHI 5 223 HUSSAINA YOUSUF ALI NAZRA MANZIL FLAT NO 2 112 1ST FLOOR, RODRICK STREET SOLDIER BAZAR NO. 2 KARACHI 6 244 MR. ABDUL RASHID NADIM MANZIL LY 8/44 2 5TH FLOOR, ROOM 37 HAJI ESMAIL ROAD GALI NO 3, NAYABAD KARACHI 7 270 MR. MOHD. SOHAIL FOURTH FLOOR 192 HAJI WALI MOHD BUILDING MACCHI MIANI MARKET ROAD KHARADHAR KARACHI 8 290 MOHD. YOUSUF BARI KUTCHI GALI NO 1 1,269 MARRIOT ROAD KARACHI 9 298 MR. ZAFAR ALAM SIDDIQUI A/192 BLOCK-L 192 NORTH NAZIMABAD KARACHI 10 300 MR. RAHIM 32 JAFRI MANZIL 1,269 KUTCHI GALI NO 3 JODIA BAZAR KARACHI 11 301 MRS. SURRIYA ZAHEER A-113 BLOCK NO 2 1,610 GULSHAD-E-IQBAL KARACHI 12 320 CH. ABDUL HAQUE C/O MOHD HANIF ABDUL AZIZ 583 HOUSE NO. 265-G, BLOCK-6 EXT. P.E.C.H.S. KARACHI. 13 327 AMNA KHATOON 47-A/6 1,269 P.E.C.H.S. KARACHI 14 329 ZEBA RAZA WHITEWAY ROYAL CO. 129 10-GULZAR BUILDING ABDULLAH HAROON ROAD P.O.BOX NO. -

Risk Disclosure

TRE Certicate Holder – 149 Pakistan Stock Exchange Limited (Formerly Karachi Stock Exchange Ltd.) Broker Registration No. BRK-169 JS Global Capital Limited REGISTERED OFFICE: The Center, 17th & 18th Floor, Plot No. 28, S.B.5, Abdullah Haroon Road, Karachi. UAN: (92-21) 111-574-111 Fax: (92-21) 32800167 equity JS Global has also been awarded BMR-1 (Broker Management Rating) ranking by PACR. 1 2 JS Global 3 4 5 Date: Account Holder JS Global Capital Limited Islamabad Branch: Room No. 413, 4th Floor, ISE Towers, The Center, 17th & 18th Floor, Plot No. 28, S.B.5, 55-B,Jinnah Avenue, Islamabad, Pakistan. Abdullah Haroon Road, Karachi. UAN: +92 51 111 574 111, Fax: +92 51 289 4417 UAN: +92 21 111 574 111 Stock Exchange Branch: Room No. 634, 6th Floor, www.jsglobalonline.com Stock Exchange Building, Stock Exchange Road, Karachi, Pakistan. www.jsgcl.com Tel: +92 21 3242 7461, Fax: 92 21 3246 2640, 3241 5136 Pakistan Stock Exchange Karachi Gulshan Branch: Suite No.607/A, 6th Floor, Al Ameen Towers, www.psx.com.pk Plot # E-2, Block-10, Gulshan-e-Iqbal, Main NIPA, Karachi. Securities Exchange Commission of Pakistan Tel: +92 21 3483 5701-9 www.secp.gov.pk Hyderabad Branch: Shop # 20, Ground Floor, Auto Bhan Towers, National Clearing Company of Pakistan Auto Bhan Road, Unit # 3, Latifabad, Hyderabad. www.nccpl.com.pk Tel: +92 22-2114651-55, Central Depositary Company of Pakistan Multan Branch: Oce No. 608 – A, 6th Floor, The United Mall, www.cdc.com Plot # 74, Abdali Road, Multan, Pakistan. Pakistan Mercantile Exchange Tel: +92 61 457 0260 - 66,68,69, Fax: +92 61 457 0267 www.pmex.com.pk Faisalabad Branch: G4, Mezan Executive Tower, Liaquat Road, Faisalabad, Pakistan. -

Analyzing the Stock Markets Role As a Source of Capital Formation in Pakistan

Pak. J. Commer. Soc. Sci. 2011 Vol. 5 (2), 273-282 Analyzing the Stock Markets Role as a Source of Capital Formation in Pakistan Hakim Ali Kanasro (Corresponding Author) Associate Professor, Institute of Commerce, University of Sindh, Jamshoro, Pakistan E-mail: [email protected] Mumtaz Ali Junejo Professor, Department of Commerce, Shah AbdulLatif University, Khairpur, Pakistan E-mail: [email protected] Mansoor Ahmed Junejo Lecturer, Sukkur Institute of Business Administration, Sukkur, Pakistan E-mail: [email protected] Abstract This paper is to examine the stock markets role in the capital formation in Pakistan from the period 1st January 2001 to 31st December 2008. This analytical study is based on the data collected from the secondary sources such as State Bank of Pakistan and three stock exchanges; Karachi, Lahore and Islamabad Stock exchanges. The stock market size of capital, number of listed companies and liquidity positions has been examined in the study. The study reveals that Karachi Stock exchange is the oldest and biggest Stock exchange of Pakistan and it is the first mover to adapt institutional developments, new policies and procedures in the business of securities exchange and shares a big role in the capital formation in Pakistan. In recent years all stock exchanges have implemented the advanced technology and fully automated trading systems. This has changed the stock markets role in the capital formation as great boom has been observed during the study period. Keywords: Stock Exchange, Investment, Capitalization, Economic growth, Financial Institutions. 1. Introduction Stock markets are crucial in mobilizing domestic and foreign capital resources and channeling that capital efficiently to the most productive usage for a country. -

Evidence from Karachi Stock Exchange

CORE Metadata, citation and similar papers at core.ac.uk Provided by International Institute for Science, Technology and Education (IISTE): E-Journals Developing Country Studies www.iiste.org ISSN 2224-607X (Paper) ISSN 2225-0565 (Online) Vol.5, No.9, 2015 Investment Behavior and Stock Preference of an Individual Investor: Evidence from Karachi Stock Exchange Muhammad Waseem Ur Rehman 1 Kashif Arif 2* 1.MS-Finance Scholar, Mohammad Ali Jinnah University, Karachi 2.Faculty of Business Administration, Mohammad Ali Jinnah University, Karachi *Corresponding Author: Email: [email protected] Abstract The purpose of the research is to study the individual investor’s behavior in Karachi Stock Exchange. In this study data was collected from individual clients at Karachi Stock Exchange. Type of the study is descriptive and deductive approach was used. The data was collected from 389 respondents at Karachi Stock Exchange with the help of designed questionnaire. The individual behavior is tested with the help of regression analysis. There are three regression models developed to study the relationship and impact of Independent variables (Accounting information & financial literacy, overconfidence, irrationality and biasness in decision making) on three different dependent variables (Preference of capital gain, preference of dividend and gambling). Results explain no relationship toward preference of capital gain but the significant relationships found toward preference of dividend and gambling. So it can be easily concluded that the investors at Karachi Stock Exchange do not prefer capital gain but they want better payout and speculation in the market. There were also studied that the accounting information & financial literacy increase the behavior toward preference of dividend and decrease toward gambling. -

The Impact of Macroeconomic Variables on Stock Prices: a Case Study of Karachi Stock Exchange

Journal of Economics and Sustainable Development www.iiste.org ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.9, No.13, 2018 The Impact of Macroeconomic Variables on Stock Prices: A Case Study of Karachi Stock Exchange Jawad Khan MS student, COMSATS Institute of Information Technology, Abbottabad Dr. Imran Khan Assistant Professor, COMSATS Institute of Information Technology, Abbottabad Abstract Investment decisions are highly influenced by macroeconomic variables as changes in macroeconomic variables effect stock markets differently according to the country economic conditions and government policies. The study contributes by determining the effect of various macroeconomic variables on stock prices of Pakistan by analyzing the monthly data from May 2000 - August 2016. As all the variables are stationary at first difference thus ideal ARDL approach of bound testing is applied to check the short term and long term cointegration of the macroeconomic variables on stock prices. The findings suggest that stock prices of Karachi Stock Exchange in long term are significantly affected by money supply, exchange rate, and interest rate. In short term all the variables are insignificant except exchange rate which is negatively cointegrated with stock prices. The central bank shall be vigilant while changing the money supply in market because too much increase in money supply could effect investment as well as stock market. The regulator should keep interest rate relatively low to encourage economic activities, improve external economic environment through rule based exchange rate policy and avoid discretionary measures. Keywords : Karachi Stock Exchange, Macroeconomic variables, Time series analysis, KSE-100 index, Cointegration, ARDL, Bound testing approach. Introduction Emerging markets keep on attracting an expanding level of investments by specialized and institutional investors. -

To Open Bankislami Pakistan Limited Details

S.No Branch Name Address City Province Supply Bazar 1 Plot # 195-207, Khasra # 2302-2305, Abbottabad Business Complex, Moza Shaikul Bandi, Amir Shaheed Road, Supply Bazar, Manshera Road, Abbottabad. Abbottabad KPK 2 Arifwala Plot No.115, H-Block, Thana Bazar, Arifwala Arifwala Punjab 3 Attock Omair Arcade, Opposite Peoples Colony, Main Attock Road, Attock. Attock Punjab 4 Ghourghusti Miskeenabad, Ghourghusti, Tehsil Hazro, District Attock Attock Punjab 5 Badin Mani Quaid-e-azam Road, Near Qazia Wah, Badin Badin Sindh 6 Golarchi Plot No. A-4, Golarchi Town, Taluka Shaheed Fazil Rao, District Badin Badin Sindh 7 Satellite Town Plot # 53-C, Commercial Area, Satellite Town, Bahawalpur Bahawalpur Punjab 8 Circular Road Block No. 915, Circular Road Bahawalpur. Bahawalpur Punjab 9 Balakot Plot, Khasra No.3626/1046, Moza Balakot,Tehsil Balakot, District Mansehra Balakot KPK 10 Batagram Khasra No.792, Moza Ajmairah, Tehsil & District Batgram. Batagram KPK 11 Batkhela Main Bazar Batkhela, Tehsil Sawat Ranizai, District Malakand Batkhela KPK 12 Beesham Plot Khasra No.583, Moza Butyal, Main Road Besham, Tehsil Besham, District Shangla Beesham KPK 13 Booni Booni Bazar, Village & P.O Booni, Tehsil Mastaj, District Chitral Booni KPK 14 Chaksawari, AJK Main Mirpur Road, Near Attock Petrol Pump, Chaksawari, District Mirpur, Azad Kashmir Chaksawari AJK 15 Chakwal Khasra # 4516 Jhelum Road Chakwal. Chakwal Punjab 16 Chaman Khasra # 208 & 209, Mall Road, Chaman Chaman Balochistan 17 Chichawatni Plot No.146, Khatooni # 239, G.T. Road, Chichawatni Chichawatni Punjab 18 Chilas Main Bazar, DC Chowk, Rani Road Chillas, District Diamer. Chilas KPK 19 Chiniot 1- A Shahra-e- Quaid Azam , Chiniot.