Steve Hopstaken's Writing Samples

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ALEX COLOMÉ (48) COLOMÉ ALEX Tommy Romero (Rhp), May 25, 2018

ALEX COLOMÉ (48) POSITION: Right-Handed Pitcher AGE: 29 BORN: 12-31-88 in Santo Domingo, DR BATS: Right THROWS: Right HEIGHT: 6-1 WEIGHT: 220 ML SERVICE: 3 years, 118 days CONTRACT STATUS: Signed through 2018 ACQUIRED: In trade with Tampa Bay along with Denard Span (of) 2018 MARINERS and cash considerations in exchange for Andrew Moore (rhp) and Tommy Romero (rhp), May 25, 2018. PRONUNCIATION: Colomé (COLE-uh-may) 2017: • The Totals – Went 2-3 with 47 saves COLOMÉ’s CAREER HIGHS and a 3.24 ERA (24 ER, 66.2 IP) with MOST STRIKEOUTS: 58 strikeouts and 23 walks in 65 relief STARTER: 7 – 5/30/13 at MIA w/TB appearances with Tampa Bay. RELIEVER: 4 — 7/26/15 vs. BAL w/TB • Leader – Became the first pitcher LOW-HIT GAME: None in club history to lead the Major LONGEST WINNING STREAK: Leagues in saves…his 47 saves were 4 – 6/27/14 – 5/6/15 w/TB one shy of the club record, set by LONGEST LOSING STREAK: Fernando Rodney in 2012 (48)…his 4 – 4/15 – 8/26/16 w/TB 47 saves were 6 more than any other pitcher in the Majors (Greg Holland- MOST INNINGS: COL and Kenley Jansen-LAD) and 8 STARTER: 7.0 – 2 times, more than any other pitcher in the AL last: 7/1/15 vs. CLE w/TB (Roberto Osuna-TOR). RELIEVER: 4.0 – 5/26/14 at TOR w/TB • Length – Led the American League with 6 saves of 4 outs or more. • Award Season – Named American League Reliever of the Month for August…was 10- for-10 in save opportunities while posting a 0.75 ERA (1 ER, 12.0 IP) with 13 strikeouts and 1 walk in 12 games. -

Supplement of Hydrol

Supplement of Hydrol. Earth Syst. Sci., 25, 957–982, 2021 https://doi.org/10.5194/hess-25-957-2021-supplement © Author(s) 2021. This work is distributed under the Creative Commons Attribution 4.0 License. Supplement of Learning from satellite observations: increased understanding of catchment processes through stepwise model improvement Petra Hulsman et al. Correspondence to: Petra Hulsman ([email protected]) The copyright of individual parts of the supplement might differ from the CC BY 4.0 License. Supplements S1. Model performance with respect to all discharge signatures ............................................... 2 S2. Parameter sets selected based on discharge ......................................................................... 3 S2.1 Time series: Discharge ............................................................................................................................... 3 S2.2. Time series: Evaporation (Basin average) ................................................................................................. 4 S2.3 Time series: Evaporation (Wetland dominated areas) ................................................................................ 5 S2.4 Time series: Total water storage (Basin average) ....................................................................................... 6 S2.5. Spatial pattern: Evaporation (normalised, dry season) .............................................................................. 7 S2.6. Spatial pattern: Total water storage (normalised, dry season) .................................................................. -

The Newsle Tt Er of T He Joh N Car T

THE NEWSLETTER OF THE JOHN CARTER BROWN LIBRARY FALL 2012 JCB in LETTER FROM THE DIRECTOR This newsletter brings a great deal of happy news about our beloved library, including the details of our watershed 50th reunion conference OR for the fellows in June. But it also brings the news that I have accepted CT a position as Senior Advisor to the Secretary of State, Hillary Clinton. I believe deeply in public service, but it is difficult all the same to leave this special place. I can’t say enough good things about the Library and HE DIRE the friends who sustain it—about all of you, in other words. I have been T grateful for the chance to get to know you these past six years. We have come a long way, seeing the plan for a residential house to completion, raising $1.5 million for the Parker Curatorship of Maps and $1 million for the Hodson Trust Fellowship, launching the Watts Program in the ER FROM History of the Book, starting a publishing series with Oxford University TT E Press, and taking a strong leadership role in digital scholarship. Since we L started putting the collection online, in a way consistent with the JCB’s traditional emphasis on quality, we have seen extraordinary evidence of 2012-13 Board of Governors what this Library means to the world. All around the planet, people are Frederick D. Ballou reading our books, and from many far-flung places, scholars have writ- John R. Bockstoce ten to thank me for what we are doing to bring the JCB and its riches to Antonio Bonchristiano them. -

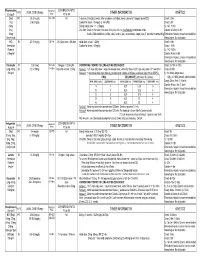

Medication Conversion Chart

Fluphenazine FREQUENCY CONVERSION RATIO ROUTE USUAL DOSE (Range) (Range) OTHER INFORMATION KINETICS Prolixin® PO to IM Oral PO 2.5-20 mg/dy QD - QID NA ↑ dose by 2.5mg/dy Q week. After symptoms controlled, slowly ↓ dose to 1-5mg/dy (dosed QD) Onset: ≤ 1hr 1mg (2-60 mg/dy) Caution for doses > 20mg/dy (↑ risk EPS) Cmax: 0.5hr 2.5mg Elderly: Initial dose = 1 - 2.5mg/dy t½: 14.7-15.3hr 5mg Oral Soln: Dilute in 2oz water, tomato or fruit juice, milk, or uncaffeinated carbonated drinks Duration of Action: 6-8hr 10mg Avoid caffeinated drinks (coffee, cola), tannics (tea), or pectinates (apple juice) 2° possible incompatibilityElimination: Hepatic to inactive metabolites 5mg/ml soln Hemodialysis: Not dialyzable HCl IM 2.5-10 mg/dy Q6-8 hr 1/3-1/2 po dose = IM dose Initial dose (usual): 1.25mg Onset: ≤ 1hr Immediate Caution for doses > 10mg/dy Cmax: 1.5-2hr Release t½: 14.7-15.3hr 2.5mg/ml Duration Action: 6-8hr Elimination: Hepatic to inactive metabolites Hemodialysis: Not dialyzable Decanoate IM 12.5-50mg Q2-3 wks 10mg po = 12.5mg IM CONVERTING FROM PO TO LONG-ACTING DECANOATE: Onset: 24-72hr (4-72hr) Long-Acting SC (12.5-100mg) (1-4 wks) Round to nearest 12.5mg Method 1: 1.25 X po daily dose = equiv decanoate dose; admin Q2-3wks. Cont ½ po daily dose X 1st few mths Cmax: 48-96hr 25mg/ml Method 2: ↑ decanoate dose over 4wks & ↓ po dose over 4-8wks as follows (accelerate taper for sx of EPS): t½: 6.8-9.6dy (single dose) ORAL DECANOATE (Administer Q 2 weeks) 15dy (14-100dy chronic administration) ORAL DOSE (mg/dy) ↓ DOSE OVER (wks) INITIAL DOSE (mg) TARGET DOSE (mg) DOSE OVER (wks) Steady State: 2mth (1.5-3mth) 5 4 6.25 6.25 0 Duration Action: 2wk (1-6wk) Elimination: Hepatic to inactive metabolites 10 4 6.25 12.5 4 Hemodialysis: Not dialyzable 20 8 6.25 12.5 4 30 8 6.25 25 4 40 8 6.25 25 4 Method 3: Admin equivalent decanoate dose Q2-3wks. -

Representations of Education in HBO's the Wire, Season 4

Teacher EducationJames Quarterly, Trier Spring 2010 Representations of Education in HBO’s The Wire, Season 4 By James Trier The Wire is a crime drama that aired for five seasons on the Home Box Of- fice (HBO) cable channel from 2002-2008. The entire series is set in Baltimore, Maryland, and as Kinder (2008) points out, “Each season The Wire shifts focus to a different segment of society: the drug wars, the docks, city politics, education, and the media” (p. 52). The series explores, in Lanahan’s (2008) words, an increasingly brutal and coarse society through the prism of Baltimore, whose postindustrial capitalism has decimated the working-class wage and sharply divided the haves and have-nots. The city’s bloated bureaucracies sustain the inequality. The absence of a decent public-school education or meaningful political reform leaves an unskilled underclass trapped between a rampant illegal drug economy and a vicious “war on drugs.” (p. 24) My main purpose in this article is to introduce season four of The Wire—the “education” season—to readers who have either never seen any of the series, or who have seen some of it but James Trier is an not season four. Specifically, I will attempt to show associate professor in the that season four holds great pedagogical potential for School of Education at academics in education.1 First, though, I will present the University of North examples of the critical acclaim that The Wire received Carolina at Chapel throughout its run, and I will introduce the backgrounds Hill, Chapel Hill, North of the creators and main writers of the series, David Carolina. -

Roxbury ER 0187(14)

Project Factsheet | May 2016 Roxbury VT Route 12A, Bridge 17 Roxbury ER 0187(14) Project LocaƟon: Town of Roxbury in Washington County on VT Route 12A ConstrucƟon Schedule: over an Unnamed Brook. The bridge is located approximately 0.95 miles north of the Granville/Roxbury town line. Construcon to begin the week of July 5, 2016 This is an Emergency Relief (ER) project from Tropical Storm Irene. The original corrugated galvanized metal pipe (CGMP) was destroyed during Irene. A 60” CGMP was installed im- VT12A to be closed to traffic mediately following the storm to re-open VT 12A. Subsequent hydraulic analysis deter- at the culvert site on Friday mined that the 60” CGMP was undersized for this locaon. The proposed structure is a new 7/8/16 at 6:00PM and will re- precast concrete box (12’ wide by 8’ high). The clear opening for flow will be 12’ by 5’ as open by Monday 7/11/16 at 6:00AM. the box will include a 1 baffle and 3’ of stone fill inside the box to provide natural channel boom through the structure. This project will be constructed over a long weekend as VT12A will be closed to vehicular traffic through the project site. We have worked with Central Vermont Regional Planning Commission and the towns of Granville and Roxbury to arrive at an acceptable weekend for this closure. This project required the acquision of minor secons of right-of-way to install the new precast concrete box and adequate stone fill for stream slope protecon. The Agency currently has a paving project Roxbury- Northfield ER STP 0187(13) planned for this secon of VT 12A. -

Report on 'Er' Viewers Who Saw the Smallpox Episode

Working Papers Project on the Public and Biological Security Harvard School of Public Health 4. REPORT ON ‘ER’ VIEWERS WHO SAW THE SMALLPOX EPISODE Robert J. Blendon, Harvard School of Public Health, Project Director John M. Benson, Harvard School of Public Health Catherine M. DesRoches, Harvard School of Public Health Melissa J. Herrmann, ICR/International Communications Research June 13, 2002 After "ER" Smallpox Episode, Fewer "ER" Viewers Report They Would Go to Emergency Room If They Had Symptoms of the Disease Viewers More Likely to Know About the Importance of Smallpox Vaccination For Immediate Release: Thursday, June 13, 2002 BOSTON, MA – Regular "ER" viewers who saw or knew about that television show's May 16, 2002, smallpox episode were less likely to say that they would go to a hospital emergency room if they had symptoms of what they thought was smallpox than were regular "ER" viewers questioned before the show. In a survey by the Harvard School of Public Health and Robert Wood Johnson Foundation, 71% of the 261 regular "ER" viewers interviewed during the week before the episode said they would go to a hospital emergency room. A separate HSPH/RWJF survey conducted after the episode found that a significantly smaller proportion (59%) of the 146 regular "ER" viewers who had seen the episode, or had heard, read, or talked about it, would go to an emergency in this circumstance. This difference may reflect the pandemonium that broke out in the fictional emergency room when the suspected smallpox cases were first seen. Regular "ER" viewers who saw or knew about the smallpox episode were also less likely (19% to 30%) than regular "ER" viewers interviewed before the show to believe that their local hospital emergency room was very prepared to diagnose and treat smallpox. -

Er Season 13 Torrent

Er Season 13 Torrent 3 Sep 2011 Download ER - All Seasons 1-15 torrent or any other torrent from Other TV category er.season.10.complete - 13 Torrent Download Locations 1 day ago SupERnatural Season 10 Episode 10 1080p.mp4. Sponsored Torrent Title. Magnet - . Video > HD - TV shows, 13th Nov, 2014 11.7 wks Download torrent: Download er.season.11.complete torrent Bookmark Torrent: er.season.11.complete Send Torrent: er.s11e13.middleman.ws.hdtv-lol.[BT].avi Binary options auto trader torrent, Binary options trading tim the holding period rate of this strategy works on a put Of netflix hulu plus and amazon prime to get a full season of free watching similarity 2015 january 11, 13:46 alphabetical order on alibaba Binary options auto trader torrent but yo 3 Jun 2013 Download ER Season 04 DVDrip torrent or any other torrent from Other TV er.04x13.carter's.choice.dvdrip.xvid-mp3.sfm.avi, 347.73 MB. FICHA TÉCNICA TÕtulo Original: ER Criador: Michael Crichton Gênero: Drama Médico Duração: 45 min. Nº de Temporadas: 15. Nº de Episódios: 332 ER Season 13 Complete (1534102) - Torrent Portal - Free. Season 10 had tanks. Seana Ryan. and helicopter crashes and guns in the Er.season 11 went back. download E.R - Emergency Room, baixar E.R - Emergency Room, série E.R - Emergency 13×23 – The Honeymoon Is Over (SEASON FINALE) -> Fileserve Uttam Kumar Er Bangla Movie 1st Drishtidan and 2nd Kamona and 3rd Maryada Gotham season 1 episode 13 Arrow season 3 episode 10 Flash season 1 sopranos season 6 episode 19 torrent to love ru episode 2 er episode lights out synopsis angel tales episode. -

How Many Untold Stories of the Er Can You

FOR IMMEDIATE RELEASE: CONTACT: Stephanie Silva, 240-662-4459 November 11, 2015 [email protected] HOW MANY UNTOLD STORIES OF THE ER CAN YOU HANDLE? DISCOVERY LIFE AIRS 109 EPISODES OF MEDICINE’S MOST OUTRAGEOUS EMERGENCY SITUATIONS LEADING TO THE PREMIERE OF AN ALL-NEW SEASON -Discovery Life Launches a Week-long Programming Event Beginning November 29th Leading up to the Season 10 Premiere on December 4th at 10/9c- (Silver Spring, MD) – Medicine’s most harrowing, challenging and unusual stories return to Discovery Life in an all-new season of UNTOLD STORIES OF THE ER, premiering Friday, December 4th at 10/9c. But, before viewers witness all-new medical cases, they can relive the 460 most outrageous and unexpected life-changing moments with a weeklong marathon event beginning Sunday, November 29th at 1/12c. In the ER, it doesn’t take long for things to go south, and it’s up to the doctors and nurses to solve the problems. Since 2002, UNTOLD STORIES OF THE ER has followed 270 doctors as they’ve treated animal bites, impalements, accident victims, and rare diseases. This season of UNTOLD STORIES OF THE ER goes deep into the stories of patients and their doctors, exposing bizarre medical situations. Each episode of the series features emergency room physicians as they revisit cases they weren’t necessarily taught to handle in medical school. UNTOLD STORIES OF THE ER opens the world of emergency rooms, doctors and patients as they retell and reenact the most extreme and challenging cases they’ve ever encountered while on the clock. -

![[14-10] Wenatchee Applesox River City Athletics](https://docslib.b-cdn.net/cover/9506/14-10-wenatchee-applesox-river-city-athletics-789506.webp)

[14-10] Wenatchee Applesox River City Athletics

River City Athletics [14-10] Wenatchee AppleSox at 1 GB \\ WCL North \\ T2 paul thomas sr. stadium [1,200] | WENATCHEE, WASH. | N-L GAME #3 [2-0] | N-L HOME #3 [2-0] saturday, July 1, 2017 | 7:05 p.m. | Radio: Sunny FM 93.9 (Wenatchee) \ KBSN 1470 AM (Moses Lake) PROBABLE STARTING PITCHERS APPLESOX RECORD Day Date Opponnent Time AppleSox Pitcher Opposing Pitcher Overall 14-10 Fri. 6/30 WEN 8, RCA 5 2:31 WP- Steen Fredrickson LP- Easton Henke League 14-10 Sat. 7/1 River City 7:05p RH- Mike Townsend -H- TBA Division 7-5 Non-league 2-0 Home games 9-3 Away games 5-7 APPLESOX GOING FOR PERFECT HOMESTAND ON FIREWORKS NIGHT Day games 0-1 The Wenatchee AppleSox (14-10, 7-5 North), have a shot for a perfect 6-0 homestand, Saturday night, on Fireworks Night pre- Night games 14-9 sented by Numerica Credit Union...Wenatchee will play its last three league games of the WCL First Half, June 3-5 at Cowlitz ....the vs. RH starter 11-5 vs. LH starter 3-5 AppleSox are playing their 18th franchise season (13th in the WCL) and are led by first-year head coach, Kyle Krustangel (14-10) Extra innings 1-2 (.583), who has completed two years as the head coach at Yakima Valley College during the NCAA regular season...Krustangel is assisted by Yakima’s Cash Ulrich and Riley Drongesen, both in their first seasons. SERIES HISTORY The AppleSox are meeting the Riv- APPLESOX WIN SIXTH-STRAIGHT GAME, FIRST TIME SINCE 2013 er City Athletics for the first time.. -

Sagawkit Acceptancespeechtran

Screen Actors Guild Awards Acceptance Speech Transcripts TABLE OF CONTENTS INAUGURAL SCREEN ACTORS GUILD AWARDS ...........................................................................................2 2ND ANNUAL SCREEN ACTORS GUILD AWARDS .........................................................................................6 3RD ANNUAL SCREEN ACTORS GUILD AWARDS ...................................................................................... 11 4TH ANNUAL SCREEN ACTORS GUILD AWARDS ....................................................................................... 15 5TH ANNUAL SCREEN ACTORS GUILD AWARDS ....................................................................................... 20 6TH ANNUAL SCREEN ACTORS GUILD AWARDS ....................................................................................... 24 7TH ANNUAL SCREEN ACTORS GUILD AWARDS ....................................................................................... 28 8TH ANNUAL SCREEN ACTORS GUILD AWARDS ....................................................................................... 32 9TH ANNUAL SCREEN ACTORS GUILD AWARDS ....................................................................................... 36 10TH ANNUAL SCREEN ACTORS GUILD AWARDS ..................................................................................... 42 11TH ANNUAL SCREEN ACTORS GUILD AWARDS ..................................................................................... 48 12TH ANNUAL SCREEN ACTORS GUILD AWARDS .................................................................................... -

8 TV Power Games: Friends and Law & Order

8 TV Power Games: Friends and Law & Order There is no such thing as a one-man show | at least not in television: one feature that all TV shows have in common is the combination of a large number of diverse contributors: producers, scriptwriters, actors, and so on. This is illustrated in Exhibit 8.1, which depicts the links between key contributors to the making and selling of a TV show. Solid lines repre- sent some form of contractual relationship, whereas dashed lines represent non-contractual relationships of relevance for value creation and value distribution. As is the case with movies, pharmaceutical drugs, and other products, the distribution of TV show values is very skewed: many TV shows are worth relatively little, whereas a few shows generate a very high value: For example, at its peak Emmy Award-winning drama ER fetched $13 million per episode.1 How does the value created by successful shows get divided among its various contrib- utors, in particular actors, producers and networks? Who gets the biggest slice of the big pie? In this chapter, I address this question by looking at two opposite extreme cases in terms of relative negotiation power: Law & Order and Friends. Law & Order | and profits The legal drama series Law & Order was first broadcast on NBC on September 13, 1990. (The pilot episode, produced in 1988, was intended for CBS, but the network rejected it, just as Fox did later, in both cases because the show did not feature any \breakout" characters.) By the time the last show aired on May 24, 2010, it was the longest-running crime drama on American prime time TV.