Jan 27 Reddit Article

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Robinhood, Reddit, Gamestop, and You | 2X Wealth Group to the Sophisticated Goliaths Who Were Short These Stocks

February 3, 2020 | 2X Wealth Group With a combined 50+ years of experience, Robinhood, Reddit, GameStop, 2X Wealth Group is committed to educating and You and empowering investors. We firmly believe financial The Making of a Financial Flash Mob literacy helps people make better decisions. Who doesn’t love the story of David’s triumph over Goliath? This past week a group of “small” investors made tremendous amounts of money (on paper at least) by buying stocks that were heavily shorted by large, sophisticated hedge funds. We explore what happened, factors that spurred the market disruption, the subsequent fallout still unfolding, and finally, what it all means going forward. What Happened? First, it’s important to understand three concepts - short selling, call options, and a short squeeze. If an investor wants to profit from a stock declining in value, they can short the stock. Most understand the concept of buying stock, but shorting is more complicated. Shorting involves selling a stock that you don’t own. So, how do you sell something that you don’t own? The answer is - you borrow the stock through your brokerage firm, and you must put up money to do so. The broker requires that you maintain a balance large enough to repurchase the borrowed stock at any time. Therein lies the risk. If you buy a stock, the most you can lose is the amount you paid. In other words, the value of your investment can only go to zero. If you short a stock, however, there is no limit to the amount you can lose. -

Individual Investors Rout Hedge Funds

P2JW028000-5-A00100-17FFFF5178F ***** THURSDAY,JANUARY28, 2021 ~VOL. CCLXXVII NO.22 WSJ.com HHHH $4.00 DJIA 30303.17 g 633.87 2.0% NASDAQ 13270.60 g 2.6% STOXX 600 402.98 g 1.2% 10-YR. TREAS. À 7/32 , yield 1.014% OIL $52.85 À $0.24 GOLD $1,844.90 g $5.80 EURO $1.2114 YEN 104.09 What’s Individual InvestorsRout HedgeFunds Shares of GameStop and 1,641.9% GameStop Thepowerdynamics are than that of DeltaAir Lines News shifting on Wall Street. Indi- Inc. AMC have soared this week Wednesday’stotal dollar vidual investorsare winning While the individuals are trading volume,$28.7B, as investors piled into big—at least fornow—and rel- rejoicing at newfound riches, Business&Finance exceeded the topfive ishing it. the pros arereeling from their momentum trades with companies by market losses.Long-held strategies capitalization. volume rivaling that of giant By Gunjan Banerji, such as evaluatingcompany neye-popping rally in Juliet Chung fundamentals have gone out Ashares of companies tech companies. In many $25billion and Caitlin McCabe thewindowinfavor of mo- that were onceleftfor dead, cases, the froth has been a mentum. War has broken out including GameStop, AMC An eye-popping rally in between professionals losing and BlackBerry, has upended result of individual investors Tesla’s 10-day shares of companies that were billions and the individual in- the natural order between defying hedge funds that have trading average onceleftfor dead including vestorsjeering at them on so- hedge-fund investorsand $24.3 billion GameStopCorp., AMC Enter- cial media. -

YOLO Trading: Riding with the Herd During the Gamestop Episode

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Lyócsa, Štefan; Baumöhl, Eduard; Vŷrost, Tomáš Working Paper YOLO trading: Riding with the herd during the GameStop episode Suggested Citation: Lyócsa, Štefan; Baumöhl, Eduard; Vŷrost, Tomáš (2021) : YOLO trading: Riding with the herd during the GameStop episode, ZBW - Leibniz Information Centre for Economics, Kiel, Hamburg This Version is available at: http://hdl.handle.net/10419/230679 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights -

View December 2013 Report

MOBILE SMART FUNDAMENTALS MMA MEMBERS EDITION DECEMBER 2013 messaging . advertising . apps . mcommerce www.mmaglobal.com NEW YORK • LONDON • SINGAPORE • SÃO PAULO MOBILE MARKETING ASSOCIATION DECEMBER 2013 REPORT A Year of Transformation The new-year invariably kicks off with a slew of predictions, many of which are being usefully defined and shared by our global and regional board members, and many of which are likely to come to fruition or certainly build in momentum. The one area that we feel is certain to gain momentum and have a huge impact on how the mobile industry develops in 2014 is the number of brands that we will see moving from the sidelines and fully into the game. The impact of this will be seen both in the gains in mobile spend as brands move away from the 1% average that we’ve been seeing and start moving towards 10-15% mobile spend with increased ROIs as a result. We will also start to see how mobile is driving both innovation in marketing and transformation of business. As always, the MMA will be providing support and guidance for the entire industry, shining a light on inspiration, capability development, measurement and advocacy allowing all constituents to continue building their businesses, with mobile at its core. We look forward to supporting you and the industry. I wish you much success in 2014. Onwards, Greg Stuart INTRODUCTION 2 MOBILE MARKETING ASSOCIATION DECEMBER 2013 REPORT Table of Contents EXECUTIVE MOVES 4 PUBLIC COMPANY ANALYSIS 7 M&A TRANSACTIONS 9 FINANCING TRANSACTIONS 13 MMA OVERVIEW 25 HIDDEN RIVER OVERVIEW 26 Greg Stuart Todd Parker CEO, Mobile Marketing Association Managing Director, Hidden River [email protected] [email protected] MOBILE MARKETING ASSOCIATION DECEMBER 2013 REPORT Executives on the Move Name New Company Old Company New Company Summary Date T-Mobile is a mobile telephone operator headquartered in Gary King Chief Information Officer, T-Mobile Chief Information Officer, Chico's FAS 12/20/13 Bonn, Germany. -

The Big Picture Three Years On, Can Collaboration Stop Another Financial Crisis?

banking technology www.bankingtech.com SEPTEMBER 2011 SEPTEMBER 2011 Risk: the big picture Three years on, can collaboration stop another financial crisis? Beyond the Fringe The Standards Forum and Innotribe events are stepping out of the shadow of Sibos. Interview: State Street in the cloud CIO Chris Perretta outlines how State Street plans to transform itself with cloud computing. Let's work together Post-trade interoperability efforts in clearing and settlement are coming to a head. Join the social club Why social media is all the rage in financial services at the moment. Contents September 2011 In this issue 22 34 27 18 4 news 27 Beyond the Fringe the Standards Forum and Innotribe strands of 8 news Analysis Swift’s annual Sibos gathering are starting to ■ Heather mcKenzie: cheque row highlights emerge from the shadow of the main conference banks’ rift with public and become year-round events in their own right. ■ banks could improve roe says Ibm 30 Roundtable: Moving beyond messages 12 By the numbers the ISO 20022 standard and XmL provide ■ Financial markets to spend $90 billion on It business benefits and opportunities beyond The best view ■ FSA pay rules will weaken UK banking sector mere standardisation according to a panel of With Wallstreet Cash Management you can sit back and see ■ iphone users most keen on mobile banking experienced practitioners brought together by ■ Hiring slowdown hits financial services in London Swift and Banking Technology. a real-time global view of all your cash positions. ■ Firms fail to focus on projects 34 Interview: Chris Perretta, state street 14 Cover Focus: Risk – the Big Picture State Street’s chief information officer explains three years after the collapse of Lehman brothers, why a wholesale adoption of cloud computing will what lessons have been learned and how has the lead to a transformation in the way the bank does relationship between risk and technology changed? business. -

Cecilia Diaz Critical/Cultural Methods Dr. Bob Bednar 4/8//21

Cecilia Diaz Critical/Cultural Methods Dr. Bob Bednar 4/8//21 Research Project Draft Protests in the name of social reform have recently undergone drastic transformations in how they are founded and manifested. The ascension of social media use in the early 2000s gave rise to streamlined instant communication between people that otherwise may have never communicated organically. History has proven that we gather together in times of hardship and join forces when those hardships necessitate change and reform. The internet eliminates the practical issue of distance and facilitates the possibility of an infinite number of formed communities. In the case of protest, it facilitates the ability to organize and gather to demand social and political change. Sebastián Valenzuela suggests that one explanation for use of social networks and political protest may be online expression as a foundation for action. It is stated, “In addition to cognitive preparation, the expression of opinions can be facilitators of political protest” (Valenzuela, 2014). Research has shown that when individuals talk about political subjects publicly, they are more likely to mobilize and engage in political activities. The expression “allows people to face their ideas, make arguments, and reflect on the information obtained” (Schmitt-Beck, 2008). Platforms like Twitter and Facebook have acted as multiplexes for the expression of political views and serve as the foundation for many modern protests such as the Black Lives Matter movement, #MeToo, Arab Spring, and the Sunflower Student Movement. The protest this study will focus on is unique in that it was not founded as a politically driven protest but became one, or perhaps more accurately, was received as one as it gained popularity in mainstream media publics. -

Reddit Users Unite to Buy Gamestop Shares and Turn Stock Market World Upside Down

Reddit Users Unite To Buy GameStop Shares and Turn Stock Market World Upside Down Pdf Published On January 30, 2021 06:19 AM Kyle Murphy | January 30, 2021 06:19:02 AM 0 What happens when an online chatroom convinces everyone in it to buy one stock simultaneously? Individual investors win and hedge funds lose big and people who have been trading stocks in suits rage at those trading stocks from their phones. The stock market saw just that with GameStop over the past few weeks. On Jan. 15, GameStop was valued at $35 but on Jan 28 it was valued at $469.42. This astronomical increase has been tied to a Reddit Forum, Wall Street Bets, whose users learned that Melvin Capital “shorted” GameStop, betting that the stock price would fall, and people in the forum decided that they would buy the stock so that Melvin Capital would lose their money. This initial reaction set off a chain of events that will most likely be remembered for a long time. The stock price of GameStop has since gone on a wild ride that has all media outlets glued to this constantly developing story. On Tuesday, the stock opened at $88.28 but closed the day at $145.96; by the closing bell on Wednesday it rose all the way to $345. The stock's peak on Thursday was $469.42 before trading companies like Robinhood took away the option to buy GameStop stock, causing the stock to temporarily plummet all the way down to $132 by 11:30 a.m on Thursday. -

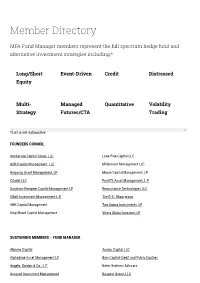

Member Directory

Member Directory MFA Fund Manager members represent the full spectrum hedge fund and alternative investment strategies including:* Long/Short Event-Driven Credit Distressed Equity Multi- Managed Quantitative Volatility Strategy Futures/CTA Trading *List is not exhaustive FOUNDERS COUNCIL Anchorage Capital Group, LLC Lone Pine Capital LLC AQR Capital Management, LLC Millennium Management LLC Balyasny Asset Management, LP Moore Capital Management, LP Citadel LLC Point72 Asset Management, L.P. Davidson Kempner Capital Management LP Renaissance Technologies LLC Elliott Investment Management L.P. The D. E. Shaw group HBK Capital Management Two Sigma Investments, LP King Street Capital Management Viking Global Investors LP SUSTAINING MEMBERS – FUND MANAGER Abrams Capital Axonic Capital LLC Alphadyne Asset Management LP Bain Capital Credit and Public Equities Angelo, Gordon & Co., L.P. Baker Brothers Advisors Assured Investment Management Baupost Group, LLC BlackRock Alternative Investors IONIC Capital Management LLC Bracebridge Capital, LLC Junto Capital Management LP Bridgewater Associates, LP. Kensico Capital Management Brigade Capital Management, LP Kepos Capital LP Cadian Capital Management Kingdon Capital Management, LLC Campbell & Company, LP Laurion Capital Management LP Capula Investment Management LLP Magnetar Capital LLC CarVal Investors Man Group Casdin Capital Marathon Asset Management, L.P. Castle Hook Partners LP Marshall Wace North America LP Centerbridge Partners, L.P. Melvin Capital CIFC Asset Management Meritage Group LP Coatue Management LLC Millburn Ridgeeld Corporation D1 Capital Partners MKP Capital Management Diameter Capital Partners LP Monarch Alternative Capital LP EJF Capital, LLC Napier Park Global Capital Element Capital Management LLC One William Street Capital Management LP Eminence Capital, LP P. Schoenfeld Asset Management LP Empyrean Capital Partners, LP Palestra Capital Management LLC Emso Asset Management Limited Paloma Partners Management Company ExodusPoint Capital Management, LP PAR Capital Management, Inc. -

The Reddit Army That's Crushing Wall Street And

Dave Hutchison, CERTIFIED FINANCIAL PLANNERTM 1720 E Calle Santa Cruz HUTCHISON INVESTMENT ADVISORS E-mail:[email protected] Phoenix Arizona 85022 Registered Investment Advisor website: www.hutchisonria.com Founded on a CPA Firm Background Fax (602) 955-1458 (602) 955-7500 The Reddit Army That’s Crushing Wall Street and Hedge Funds - February 2021 Reuters reports short-sellers had about $70.87 billion of estimated losses to cover, which rattled markets. CNN reported on 1/29/2021: WallStreetBets exploded into the mainstream, moving from the front page of Reddit to the front page of the New York Times and nearly every other major news site. The subreddit's short-squeeze shot up prices, captivating the minds and wallets of investors — both casual and institutional — and financial regulators. Remember day traders? Well, in the last couple of weeks, they have become famous in the US, But while millions are now discovering thanks to the Internet's Reddit forums. Using a WallStreetBets for the first time, it has been cartoonish approach to investing, young folks building momentum throughout the pandemic. have decided to approach the stock market like One can trace its epic rise to a perfect storm of it's a video death game, with a goal to take down favorable conditions: the exponential growth of the hedge fund billionaires. And guess what, they the app Robinhood and its no-fee options trading, have been somewhat succeeding! Of all the the extreme volatility Covid-19 brought to the goofy things to arise during a pandemic. markets, the stimulus checks mailed to millions of Americans, the lack of televised sports for much Mostly younger generation players, they picked of the year, and the unwanted free time stuck at stocks that had little fundamental value and drove home the pandemic has forced on many people. -

Received by NSD/FARA Registration Unit 02/01/2021 11:58:35 AM

Received by NSD/FARA Registration Unit 02/01/2021 11:58:35 AM 01/29/21 Friday This material is distributed by Ghebi LLC on behalf of Federal State Unitary Enterprise Rossiya Segodnya International Information Agency, and additional information is on file with the Department of Justice, Washington, District of Columbia. Is Dogecoin Next? Robinhood Blocks Skyrocketing Cryptocurrency Championed by Online Traders by Morgan Artvukhina While there are many superficial similarities between the GameStop and Dogecoin online investment frenzies, Wall Street stocks and cryptocurrencies are valued using very different systems. The cryptocurrency Dogecoin is experiencing an unparalleled rise in value amid a push by online investors trying to rally purchases. In response, the trading app Robinhood halted instant deposits for crypto purchases; however, the comparisons with the GameStop affair end there. Dogecoin was begun as a joke in 2013, based on then-popular internet memes about Shiba Inu dogs dubbed “doge.” However, the cryptocurrency amassed a sort of cult following over the years. On Wednesday, Dogecoin’s value began to rise quickly, climbing more than tenfold by Thursday night from $0,007 per coin to $0.78 per coin before declining again. As CNBC reported, the explosion in value was driven by a subreddit called SatoshiStreetBets, named after Satoshi, the mythical founder of bitcoin. Bitcoin has also seen its value spike in recent days amid a flurry of buying. The spike began amid another buying storm cooked up by amateur investors on a Reddit message board site; small-time investors on the WallStreetBets subreddit bought large numbers of GameStop and other stocks that Wall Street investors had taken out substantial short positions on, betting the stocks would soon decline in value. -

January 2021 - a Recap of Recent Financial and Economic Market Activity

January 2021 - A recap of recent financial and economic market activity. Markets ended 2020 higher, and well off the lows of March. The Dow Jones Industrials ended the year better by 7%, and 64% higher than the lows of March. The S&P 500 was up 16%, and 67% higher than the March 23rd close. The Nasdaq was the clear winner of the year, gaining 43%, while bouncing 88% higher from the March lows. AmerisourceBergen will buy Walgreens Boots Alliance’s ‘Alliance Healthcare’ business for about $6.5 billion, the companies reported in a press release. UnitedHealth Group's Optum unit has agreed to buy Change Healthcare for $7.84 billion in cash plus about $5 billion in debt, the companies said on Wednesday. The acquisition will strengthen the insurer's portfolio of healthcare technology services and capabilities. Investors digested Democratic wins in the Georgia Senate runoff and congressional representatives gathered to certify the 2020 presidential election. During all this, protesters stormed the U.S. Capitol and breached congressional chambers. Images of mobs storming the building, police drawing guns while barricading the door to the House chamber, and protesters sauntering across the Senate floor. Oil prices stayed above $50 per barrel and the yield on the 10-year U.S. Treasury held its ground above 1%. Gold prices continued their recent rebound and copper hit a seven-year high as commodity investors bet on more demand. The latest spike in Covid-19 cases in the U.S. and resulting restrictions on gatherings and certain businesses are likely to have caused a meaningful deceleration from prior months' pace of recovery. -

The Gamestop Short Squeeze © 2021 Top Targets Market Disruptors Financial Establishment Government the GAMESTOP SHORT SQUEEZE U.S

The GameStop Short Squeeze © 2021 www.onepagethinking.net Top Targets Market Disruptors Financial Establishment Government THE GAMESTOP SHORT SQUEEZE U.S. Asset Managers, Hedge In 2020, hedge funds “shorted” GameStop stock Retail Traders & Online Online Forums and Traditional Broker- Meme Stocks Funds and Private Equity Firms Legislators and Regulators by borrowing shares from owners and brokers of Trading Platforms Influencers Dealer Firms the stock, and selling the borrowed shares to Purpose: Purpose: Concern: “Losing Their Shirts” over Short Concern: Customer Solvency to Cover Purpose: Profit Motive Concern: Possible Market Manipulation and Integrity of buyers (e.g., for $20), with the expectation that the Improve Operating and Online Investment Community Positions That Went Contrary to Expectations Margin Calls on Short Sale Positions Stock Markets Financial Performance GameStop stock price would decline sharply (e.g., Novice Day Traders Reddit Maplelane Capita U.S. Securities and Exchange Commission to $2), at which point shares could be purchased GameStop r/WallStreetBets Social Media Platform that Hedge Fund That Lost 45% of its Value Hosts Stock Trading Discussions JP Morgan Chase Enforces Prohibition on Manipulation of U.S. Stock Markets Video Game Retailer Experienced Retail Due to Short-Stock Positions Large U.S. Financial Services Institution in the market, returned to the lender, turning a Investors and Prime Broker to Hedge Funds Mark Cuban Financial Industry profit on the short. But in late January 2021, AMC Entertainment