The Valuation of Equity Derivatives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dividend Swap Indices

cover for credit indices.qxp 14/04/2008 13:07 Page 1 Dividend Swap Indices Access to equity income streams made easy April 2008 BARCAP_RESEARCH_TAG_FONDMI2NBUR7SWED The Barclays Capital Dividend Swap Index Family Equity indices have been the most essential of measurement tools for all types of investors. From the intrepid retail investor, to the dedicated institutional devotees of modern portfolio theory, the benchmarks of the major stock markets have served as the gauge of collective company price performance for decades, and have been incorporated as underlying tradable reference instruments in countless financial products delivering stock market returns. In most cases, equity indices are available as price return or total return, the latter being, broadly speaking, a blend of the return derived from stock price changes, as well as the receipt of dividends paid out to holders of the stock. The last few years have seen the rapid growth of a market in stripping out the dividend return and trading it over the counter through dividend swaps – a market that has so far been open to only the most sophisticated investors, allowing them to express views on the future levels of dividend payments, hedge positions involving uncertainty of dividend receipts and implement trades that profit from the relative value between one stream of dividend payments and another. The Barclays Capital Dividend Swap Index Family opens this market up to investors of all kinds. The indices in the family track the most liquid areas of the dividend swap market, thereby delivering unprecedented levels of transparency and access to a market that has grown to encompass the FTSE™, S&P 500, DJ Euro STOXX 50® and Nikkei 225 and in which the levels of liquidity that have been reached are estimated to be in the order of hundreds of millions of notional dollars per day. -

Interest Rate Options

Interest Rate Options Saurav Sen April 2001 Contents 1. Caps and Floors 2 1.1. Defintions . 2 1.2. Plain Vanilla Caps . 2 1.2.1. Caplets . 3 1.2.2. Caps . 4 1.2.3. Bootstrapping the Forward Volatility Curve . 4 1.2.4. Caplet as a Put Option on a Zero-Coupon Bond . 5 1.2.5. Hedging Caps . 6 1.3. Floors . 7 1.3.1. Pricing and Hedging . 7 1.3.2. Put-Call Parity . 7 1.3.3. At-the-money (ATM) Caps and Floors . 7 1.4. Digital Caps . 8 1.4.1. Pricing . 8 1.4.2. Hedging . 8 1.5. Other Exotic Caps and Floors . 9 1.5.1. Knock-In Caps . 9 1.5.2. LIBOR Reset Caps . 9 1.5.3. Auto Caps . 9 1.5.4. Chooser Caps . 9 1.5.5. CMS Caps and Floors . 9 2. Swap Options 10 2.1. Swaps: A Brief Review of Essentials . 10 2.2. Swaptions . 11 2.2.1. Definitions . 11 2.2.2. Payoff Structure . 11 2.2.3. Pricing . 12 2.2.4. Put-Call Parity and Moneyness for Swaptions . 13 2.2.5. Hedging . 13 2.3. Constant Maturity Swaps . 13 2.3.1. Definition . 13 2.3.2. Pricing . 14 1 2.3.3. Approximate CMS Convexity Correction . 14 2.3.4. Pricing (continued) . 15 2.3.5. CMS Summary . 15 2.4. Other Swap Options . 16 2.4.1. LIBOR in Arrears Swaps . 16 2.4.2. Bermudan Swaptions . 16 2.4.3. Hybrid Structures . 17 Appendix: The Black Model 17 A.1. -

The Synthetic Collateralised Debt Obligation: Analysing the Super-Senior Swap Element

The Synthetic Collateralised Debt Obligation: analysing the Super-Senior Swap element Nicoletta Baldini * July 2003 Basic Facts In a typical cash flow securitization a SPV (Special Purpose Vehicle) transfers interest income and principal repayments from a portfolio of risky assets, the so called asset pool, to a prioritized set of tranches. The level of credit exposure of every single tranche depends upon its level of subordination: so, the junior tranche will be the first to bear the effect of a credit deterioration of the asset pool, and senior tranches the last. The asset pool can be made up by either any type of debt instrument, mainly bonds or bank loans, or Credit Default Swaps (CDS) in which the SPV sells protection1. When the asset pool is made up solely of CDS contracts we talk of ‘synthetic’ Collateralized Debt Obligations (CDOs); in the so called ‘semi-synthetic’ CDOs, instead, the asset pool is made up by both debt instruments and CDS contracts. The tranches backed by the asset pool can be funded or not, depending upon the fact that the final investor purchases a true debt instrument (note) or a mere synthetic credit exposure. Generally, when the asset pool is constituted by debt instruments, the SPV issues notes (usually divided in more tranches) which are sold to the final investor; in synthetic CDOs, instead, tranches are represented by basket CDSs with which the final investor sells protection to the SPV. In any case all the tranches can be interpreted as percentile basket credit derivatives and their degree of subordination determines the percentiles of the asset pool loss distribution concerning them It is not unusual to find both funded and unfunded tranches within the same securitisation: this is the case for synthetic CDOs (but the same could occur with semi-synthetic CDOs) in which notes are issued and the raised cash is invested in risk free bonds that serve as collateral. -

Rational Multi-Curve Models with Counterparty-Risk Valuation Adjustments

Post-Crisis Interest Rate Markets and Models Rational Multi-Curve Models Rational Bilateral Counterparty Risk Model Conclusion Rational Multi-Curve Models with Counterparty-Risk Valuation Adjustments Stéphane Crépey Université d'Evry Val-d'Essonne, Laboratoire de Mathématiques et Modélisation d'Evry (LaMME) Joint work with A. Macrina, T. M. Nguyen and D. Skovmand 7th General AMaMeF and Swissquote Conference EPFL, 7-10 September 2015 The research presented in these slides beneted from the support of the Chair Markets in Transition under the aegis of Louis Bachelier laboratory, a joint initiative of École polytechnique, Université d'Évry Val d'Essonne and Fédération Bancaire Française 1 / 49 Post-Crisis Interest Rate Markets and Models Rational Multi-Curve Models Rational Bilateral Counterparty Risk Model Conclusion Outline 1 Post-Crisis Interest Rate Markets and Models 2 Rational Multi-Curve Models 3 Rational Bilateral Counterparty Risk Model 4 Conclusion 2 / 49 Post-Crisis Interest Rate Markets and Models Rational Multi-Curve Models Rational Bilateral Counterparty Risk Model Conclusion Libor Most interest-rate derivatives have Libor-indexed cash-ows (Libor xings) What is Libor? Libor stands for London InterBank Oered Rate. It is produced for 10 currencies with 15 maturities quoted for each, ranging from overnight to 12 Months producing 150 rates each business day. Libor is computed as a trimmed average of the interbank borrowing rates assembled from the Libor contributing banks. More precisely, every contributing bank has to submit an -

A Practitioner's Guide to Structuring Listed Equity Derivative Securities

21 A Practitioner’s Guide to Structuring Listed Equity Derivative Securities JOHN C. BRADDOCK, MBA Executive Director–Investments CIBC Oppenheimer A Division of CIBC World Markets Corp., New York BENJAMIN D. KRAUSE, LLB Senior Vice President Capital Markets Division Chicago Board Options Exchange, New York Office INTRODUCTION Since the mid-1980s, “financial engineers” have created a wide array of instru- ments for use by professional investors in their search for higher returns and lower risks. Institutional investors are typically the most voracious consumers of structured derivative financial products, however, retail investors are increasingly availing themselves of such products through public, exchange- listed offerings. Design and engineering lie at the heart of the market for equity derivative securities. Through the use of computerized pricing and val- uation technology and instantaneous worldwide communications, today’s financial engineers are able to create new and varied instruments that address day-to-day client needs. This in turn has encouraged the development of new financial products that have broad investor appeal, many of which qualify for listing and trading on the principal securities markets. Commonly referred to as listed equity derivatives because they are listed on stock exchanges and trade under equity rules, these new financial products fuse disparate invest- ment features into single instruments that enable retail investors to replicate both speculative and risk management strategies employed by investment pro- fessionals. Options on individual common stocks are the forerunners of many of today’s publicly traded equity derivative products. They have been part of the 434 GUIDE TO STRUCTURING LISTED EQUITY DERIVATIVE SECURITIES securities landscape since the early 1970s.1 The notion of equity derivatives as a distinct class of securities, however, did not begin to solidify until the late 1980s. -

Forward Contracts and Futures a Forward Is an Agreement Between Two Parties to Buy Or Sell an Asset at a Pre-Determined Future Time for a Certain Price

Forward contracts and futures A forward is an agreement between two parties to buy or sell an asset at a pre-determined future time for a certain price. Goal To hedge against the price fluctuation of commodity. • Intension of purchase decided earlier, actual transaction done later. • The forward contract needs to specify the delivery price, amount, quality, delivery date, means of delivery, etc. Potential default of either party: writer or holder. Terminal payoff from forward contract payoff payoff K − ST ST − K K ST ST K long position short position K = delivery price, ST = asset price at maturity Zero-sum game between the writer (short position) and owner (long position). Since it costs nothing to enter into a forward contract, the terminal payoff is the investor’s total gain or loss from the contract. Forward price for a forward contract is defined as the delivery price which make the value of the contract at initiation be zero. Question Does it relate to the expected value of the commodity on the delivery date? Forward price = spot price + cost of fund + storage cost cost of carry Example • Spot price of one ton of wood is $10,000 • 6-month interest income from $10,000 is $400 • storage cost of one ton of wood is $300 6-month forward price of one ton of wood = $10,000 + 400 + $300 = $10,700. Explanation Suppose the forward price deviates too much from $10,700, the construction firm would prefer to buy the wood now and store that for 6 months (though the cost of storage may be higher). -

Section 108 (Mar

NEW YORK STATE BAR ASSOCIATION TAX SECTION REPORT ON SECTION 871(m) March 8, 2011 TABLE OF CONTENTS PAGE Introduction........................................................................................................... 1 I. Summary of Section 871(m)..................................................................... 2 II. Issues with Section 871(m) ....................................................................... 5 A. PolicyBasis for Section 871(m)....................................................... 5 B. TerminologyIssues ........................................................................ 14 1. What Is a “Notional Principal Contract”?......................... 14 2. What Is “Readily Tradable on an Established Securities Market”? ........................................................................... 16 3. What Is a “Transfer”? ....................................................... 19 4. What Is an “Underlying Security”? .................................. 21 5. What Is “Contingent upon, or Determined by Reference to”?.................................................................................... 23 6. What Is a “Payment”?....................................................... 24 7. When Is a Payment “Directly or Indirectly” Contingent upon or Determined by Reference to a U.S.-Source Dividend?.......................................................................... 26 C. Ancillary/Scope Issues .................................................................. 26 1. When Are “Projected” or “Assumed” Dividend -

Dixit-Pindyck and Arrow-Fisher-Hanemann-Henry Option Concepts in a Finance Framework

Dixit-Pindyck and Arrow-Fisher-Hanemann-Henry Option Concepts in a Finance Framework January 12, 2015 Abstract We look at the debate on the equivalence of the Dixit-Pindyck (DP) and Arrow-Fisher- Hanemann-Henry (AFHH) option values. Casting the problem into a financial framework allows to disentangle the discussion without unnecessarily introducing new definitions. Instead, the option values can be easily translated to meaningful terms of financial option pricing. We find that the DP option value can easily be described as time-value of an American plain-vanilla option, while the AFHH option value is an exotic chooser option. Although the option values can be numerically equal, they differ for interesting, i.e. non-trivial investment decisions and benefit-cost analyses. We find that for applied work, compared to the Dixit-Pindyck value, the AFHH concept has only limited use. Keywords: Benefit cost analysis, irreversibility, option, quasi-option value, real option, uncertainty. Abbreviations: i.e.: id est; e.g.: exemplum gratia. 1 Introduction In the recent decades, the real options1 concept gained a large foothold in the strat- egy and investment literature, even more so with Dixit & Pindyck (1994)'s (DP) seminal volume on investment under uncertainty. In environmental economics, the importance of irreversibility has already been known since the contributions of Arrow & Fisher (1974), Henry (1974), and Hanemann (1989) (AFHH) on quasi-options. As Fisher (2000) notes, a unification of the two option concepts would have the benefit of applying the vast results of real option pricing in environmental issues. In his 1The term real option has been coined by Myers (1977). -

Pricing of Index Options Using Black's Model

Global Journal of Management and Business Research Volume 12 Issue 3 Version 1.0 March 2012 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Inc. (USA) Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Pricing of Index Options Using Black’s Model By Dr. S. K. Mitra Institute of Management Technology Nagpur Abstract - Stock index futures sometimes suffer from ‘a negative cost-of-carry’ bias, as future prices of stock index frequently trade less than their theoretical value that include carrying costs. Since commencement of Nifty future trading in India, Nifty future always traded below the theoretical prices. This distortion of future prices also spills over to option pricing and increase difference between actual price of Nifty options and the prices calculated using the famous Black-Scholes formula. Fisher Black tried to address the negative cost of carry effect by using forward prices in the option pricing model instead of spot prices. Black’s model is found useful for valuing options on physical commodities where discounted value of future price was found to be a better substitute of spot prices as an input to value options. In this study the theoretical prices of Nifty options using both Black Formula and Black-Scholes Formula were compared with actual prices in the market. It was observed that for valuing Nifty Options, Black Formula had given better result compared to Black-Scholes. Keywords : Options Pricing, Cost of carry, Black-Scholes model, Black’s model. GJMBR - B Classification : FOR Code:150507, 150504, JEL Code: G12 , G13, M31 PricingofIndexOptionsUsingBlacksModel Strictly as per the compliance and regulations of: © 2012. -

International Harmonization of Reporting for Financial Securities

International Harmonization of Reporting for Financial Securities Authors Dr. Jiri Strouhal Dr. Carmen Bonaci Editor Prof. Nikos Mastorakis Published by WSEAS Press ISBN: 9781-61804-008-4 www.wseas.org International Harmonization of Reporting for Financial Securities Published by WSEAS Press www.wseas.org Copyright © 2011, by WSEAS Press All the copyright of the present book belongs to the World Scientific and Engineering Academy and Society Press. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the Editor of World Scientific and Engineering Academy and Society Press. All papers of the present volume were peer reviewed by two independent reviewers. Acceptance was granted when both reviewers' recommendations were positive. See also: http://www.worldses.org/review/index.html ISBN: 9781-61804-008-4 World Scientific and Engineering Academy and Society Preface Dear readers, This publication is devoted to problems of financial reporting for financial instruments. This branch is among academicians and practitioners widely discussed topic. It is mainly caused due to current developments in financial engineering, while accounting standard setters still lag. Moreover measurement based on fair value approach – popular phenomenon of last decades – brings to accounting entities considerable problems. The text is clearly divided into four chapters. The introductory part is devoted to the theoretical background for the measurement and reporting of financial securities and derivative contracts. The second chapter focuses on reporting of equity and debt securities. There are outlined the theoretical bases for the measurement, and accounting treatment for selected portfolios of financial securities. -

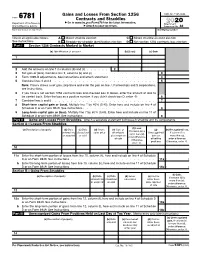

Form 6781 Contracts and Straddles ▶ Go to for the Latest Information

Gains and Losses From Section 1256 OMB No. 1545-0644 Form 6781 Contracts and Straddles ▶ Go to www.irs.gov/Form6781 for the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service ▶ Attach to your tax return. Sequence No. 82 Name(s) shown on tax return Identifying number Check all applicable boxes. A Mixed straddle election C Mixed straddle account election See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election Part I Section 1256 Contracts Marked to Market (a) Identification of account (b) (Loss) (c) Gain 1 2 Add the amounts on line 1 in columns (b) and (c) . 2 ( ) 3 Net gain or (loss). Combine line 2, columns (b) and (c) . 3 4 Form 1099-B adjustments. See instructions and attach statement . 4 5 Combine lines 3 and 4 . 5 Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions. 6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . 6 7 Combine lines 5 and 6 . 7 8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of Schedule D or on Form 8949. See instructions . 8 9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of Schedule D or on Form 8949. -

The Fama and French Three-Factor Model and Leverage: Compatibility with the Modigliani and Miller Propositions”

“The Fama and French three-factor model and leverage: compatibility with the Modigliani and Miller propositions” AUTHORS Michael Dempsey https://orcid.org/0000-0002-9059-0416 Michael Dempsey (2009). The Fama and French three-factor model and ARTICLE INFO leverage: compatibility with the Modigliani and Miller propositions. Investment Management and Financial Innovations, 6(1) RELEASED ON Monday, 16 March 2009 JOURNAL "Investment Management and Financial Innovations" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Investment Management and Financial Innovations, Volume 6, Issue 1, 2009 Michael Dempsey (Australia) The Fama and French three-factor model and leverage: compatibility with the Modigliani and Miller propositions Abstract The issue of whether the Fama and French (FF) three-factor model is consistent with the propositions of Modigliani and Miller (MM) (1958, 1963) has received surprisingly little attention. Yet, unless it is so, the model is at variance with the foundations of finance. Fama and French (FF) (1993, 1995, 1996, 1997) argue that their three-factor asset pricing model is representative of equilibrium pricing models in the spirit of Merton’s (1973) inter-temporal capital asset pricing model (ICAPM) or Ross’s (1976) arbitrage pricing theory (APT) (FF, 1993, 1994, 1995, 1996). Such claims, however, are compromised by the observations of Lally (2004) that the FF (1997) loadings on the risk factors lead to outcomes that are contradictory with rational asset pricing. In response, we outline an approach to adjustment for leverage that leads by construction to compatibility of the FF three-factor model with the Modigliani and Miller propositions of rational pricing.