Mad City Money Financial Reality Simulation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TC Code Institution City State 001370 UNIV of ALASKA ANCHORAGE ANCHORAGE AK 223160 KENNY LAKE SCHOOL COPPER CENTER AK 161760

TC Code Institution City State 001370 UNIV OF ALASKA ANCHORAGE ANCHORAGE AK 223160 KENNY LAKE SCHOOL COPPER CENTER AK 161760 GLENNALLEN HIGH SCHOOL GLENNALLEN AK 217150 HAINES HIGH SCHOOL HAINES AK 170350 KETCHIKAN HIGH SCHOOL KETCHIKAN AK 000690 KENAI PENINSULA COLLEGE SOLDOTNA AK 000010 CENTRAL ALABAMA COMMUNITY COLLEGE ALEXANDER CITY AL 000810 LURLEEN B WALLACE COMM COLLEGE ANDALUSIA AL 232220 ANNISTON HIGH SCHOOL ANNISTON AL 195380 ATHENS HIGH SCHOOL ATHENS AL 200490 AUBURN HIGH SCHOOL AUBURN AL 000350 COASTAL ALABAMA COMMUNITY COLLEGE BAY MINETTE AL 000470 JEFFERSON STATE C C - CARSON RD BIRMINGHAM AL 000560 UNIV OF ALABAMA AT BIRMINGHAM BIRMINGHAM AL 158980 CARVER HIGH SCHOOL BIRMINGHAM AL 159110 WOODLAWN HIGH SCHOOL BIRMINGHAM AL 162830 HUFFMAN HIGH SCHOOL BIRMINGHAM AL 224680 SHADES VALLEY HIGH SCHOOL BIRMINGHAM AL 241320 RAMSAY HIGH SCHOOL BIRMINGHAM AL 000390 COASTAL ALABAMA COMMUNITY COLLEGE BREWTON AL 170150 WILCOX CENTRAL HIGH SCHOOL CAMDEN AL 227610 MACON EAST MONTGOMERY ACADEMY CECIL AL 207960 BARBOUR COUNTY HIGH SCHOOL CLAYTON AL 230850 CLEVELAND HIGH SCHOOL CLEVELAND AL 165770 DADEVILLE HIGH SCHOOL DADEVILLE AL 163730 DAPHNE HIGH SCHOOL DAPHNE AL 170020 DECATUR HIGH SCHOOL DECATUR AL 163590 NORTHVIEW HIGH SCHOOL DOTHAN AL 170030 DOTHAN PREPARATORY ACADEMY DOTHAN AL 203600 ELMORE COUNTY HIGH SCHOOL ECLECTIC AL 213060 ELBA HIGH SCHOOL ELBA AL 000450 ENTERPRISE STATE COMM COLLEGE ENTERPRISE AL 170100 EUFAULA HIGH SCHOOL EUFAULA AL 166720 FAIRHOPE HIGH SCHOOL FAIRHOPE AL 000800 BEVILL STATE C C - BREWER CAMPUS FAYETTE AL 000140 -

Official Publication of MSHSAA Vol. 78, No. 1 Sept. 2013 Missouri State

Missouri State High School JournalActivities Association Official Publication of MSHSAA Vol. 78, No. 1 Sept. 2013 Departments Missouri State High School Executive Director’s Message .............................1 Questions & Answers ..........................................2 News...............................................................3-13 Activities Association Board of Directors.........................................14-21 Fall Athletics .................................................22-25 Winter Athletics .............................................26-27 2013-14 Board of Directors Activities .......................................................28-30 Awards ........................................................31-IBC Executive Staff DR. KERWIN URHAHN, Executive Director Eligibility rulings, transfers, interpretation of Constitu- tion and By-Laws, budget and finance, insurance, litiga- tion, legislative liaison, school classification, enrollments. STACY SCHROEDER, Assoc. Executive Director Swimming and diving, Scholar Bowl, Transfers (hard- ships & waivers), personnel, MSHSAA Leadership School program, eligibility. Don Maurer, Pres. Paul Sulser, V.P. Dr. Mark Beem Travis Brown Ken Eaton HARVEY RICHARDS, Assoc. Executive Director St. Louis District Northeast District Central District At-Large Region 1 Northwest District Football, cross country, track and field, camps and Athletic Director Superintendent Superintendent Athletic Administrator Superintendent clinics, all-star events, sports medicine, team hosts, MICDS North -

Best Practices in History Education Conference

Best Practices in Non-Profit INTERNATIONAL EDUCATION CONSORTIUM U.S. Postage PAID 1460 Craig Road St. Louis, MO History Education St. Louis, MO 63146 Conference Permit No. 175 Helping History Teachers Teach The Common Core Featured Speakers Dr. Daisy Martin Stanford Center for Assessment, Learning and Equity, Stanford University Dr. David Wheelock, Vice President St. Louis Federal Reserve Conference includes breakout sessions, continental break - fast, lunch, door prizes and partial parking reimbursement. September 26, & 2 7, 2 01 3 Gateway Conference Center of the St. Louis Federal Reserve Bank A Missouri Council for History Education Conference Edward Jones Best Practices in History Dome Education Conference America’s Center Convention Plaza Gateway Conference Center – Lucas Convention Center Saint Louis Federal Reserve Bank M Metro Link Locust Street Between 4th & Broadway P Washington a r k St. Charles St. Charles i n g Federal Reserve Locust Bank Conference Hotel Olive Crowne Plaza: St. Louis Downtown Crowne 200 N. 4th St. Plaza t . t t . Pine . S y t t t S S www.crowneplaza.com/stlouisdt a h S S S t h h y t w t 0 h h h a t 9 t t d 1 1 1-800-925-1395 8 1 6 4 a W o k r East c B $99 per night Chestnut u B free parking k c a J reserve by 9-10-13 Thursday, September 26, 2013 8:00 – 9:00 Registration – Photo ID Required Continental Breakfast 9:00 – 10:00 Breakout Sessions 10:00 – 10:30 Break – Exhibit Area 10:30 – 11:30 General Session – Gateway Auditorium David Wheelock Vice President & Economist, Federal Reserve Bank of St. -

Virtual Brown Bag Lunch for High School Counselors and Access Advisers May 22, 2020 Today’S Agenda

Virtual Brown Bag Lunch for high school counselors and access advisers May 22, 2020 Today’s Agenda • Welcome and Housekeeping • You made it! • Thank you! • Check In • Take a Deep Breath • Admissions/Financial Aid Updates • NCAA student athlete updates – Trudy Steins, ret. counselor, Pattonville • “Summer melt” strategies – TaRael Kee, Collinsville HS • Upward Bound Summer Academy – Marvin Bullard, Lakeisha Graves, HEC • Resources to Share • Check-out and Adjourn Housekeeping Reminders • Please remain on mute. But join us by video if you can. • Please use the Chat function to react to a presenter or to ask a question. • “Private” chat is not private – it shows up in our chat log we send out. FYI! • Thanks to: • Ashley June Moore for managing our Chat • Kaitlyn Sanders for taking today’s notes • All of our amazing presenters today for sharing their insights • YOU for all you are doing to support students every day • We are recording today’s session. Video, chat, notes and PPT will be posted to our website: https://stlouisgraduates.org/2020/04/01/brown-bag-virtual- lunches/ Thank You to the St. Louis Graduates Professional Development Committee! Beth Bender, Chair, Associate Superintendent Michelle Luraschi, Pattonville High School for College and Career Readiness, St. Louis Public Schools Ashley June Moore, Washington University College Advising Corps Michael Boulanger, Pattonville High School Amber Mitchell, Ritenour High School Marvin Bullard, Higher Education Consortium Gabrielle Ray, Missouri College Advising Corps Michelene Carbol, EducationPlus Desiree Speed, Gateway STEM High School/St. Melissa Findley, Missouri Scholarship & Loan Louis Public Schools Foundation Teresa Steinkamp, The Scholarship Foundation Monica Fleisher, UMSL Office of Precollegiate of St. -

Official Report Regular Meeting March 14, 2019 St

CXCVI TRANSITIONAL SCHOOL DISTRICT OF THE CITY OF ST. LOUIS SPECIAL ADMINISTRATIVE BOARD OFFICIAL REPORT REGULAR MEETING MARCH 14, 2019 ST. LOUIS, MO M I N U T E S The meeting convened on the above date in Room 108 of the Administrative Building, 801 North 11th Street, St. Louis, MO 63101. Those in attendance were Mr. Rick Sullivan, Mrs. Darnetta Clinkscale, Mr. Richard K. Gaines, Superintendent Dr. Kelvin R. Adams, Mr. Jeffrey St. Omer, and Ms. Ruth Lewis. CALL TO ORDER AND ROLL CALL Mr. Sullivan called the meeting to order at 6:05PM on the following roll call. AYE: Mrs. Darnetta Clinkscale, Mr. Richard K. Gaines, Mr. Rick Sullivan A quorum was present. The Board and audience recited the Pledge of Allegiance. STUDENT/STAFF RECOGNITIONS The Compton-Drew Boys Basketball Team was recognized for winning the 2018- 2019 middle school boys’ basketball championship. Likewise, the Gateway Middle Girls Basketball Team was recognized for winning the 2018-2019 middle school girls basketball championship. The final recognition went to the Vashon High School Boys Basketball Team for winning the Class 3 state championship. PUBLIC COMMENTS Mr. Bob Miller thanked the SAB for a job well done during their tenure as the governance body over the St. Louis Public School. He also expressed his appreciation to the Superintendent for his leadership abilities in guiding the District and staff. It is expected the State Board of Education will take a vote at their April 2019 meeting to reinstate governance of the St. Louis Public Schools back to the Elected Board of Education, after 12 years of being under state control. -

Slps School Walk-Through

SLPS SCHOOL WALK-THROUGH Team 1 Team 2 Derrick Johnson (314) 399-2359 Mon 3/21 Marcus Townsend (314) 202-3237 Mon 3/21 Carnahan High School 8am Blewett (Innovative concept) 8am Froebel Elementary 9am Carr Lane Middle 9am Hodgen Elementary 10am Cole (Pamoja) Elementary 10am Humboldt Elementary 11am Columbia Elementary 11am Long Middle 1pm Compton Drew Middle 1pm L'Ouverture 2pm Cote Brilliante Elementary 2pm Lyon @ Blow Middle 3pm Dunbar Elementary 3pm Madison College Prep 4pm Farragut Elementary 4pm Eric Hamel (314) 609-6141 Tues 3/22 Ron King (314) 574- 6760 Tues 3/22 Mann Elementary 8am Hickey Elementary 8am McKinley Middle 9am Langston Middle 9am Meramec Elementary 10am Lexington Elementary 10am Monroe Elementary 11am Lexington Food Service 11am Oak Hill Elementary 1pm Stevens Middle 1pm Peabody Elementary 2pm Sumner High School 2pm Roosevelt High School 3pm Vashon High School 3pm Shenandoah Elementary 4pm Washington Montessori 4pm Lisa Williams (314) 215-7324 Wed 3/23 Maurnice Tipton (314) 202-3282 Wed 3/23 Sigel Elementary 8am Administrative - 801 8am Woerner Elementary 9am Ames Elementary 9am Woodward Elementary 10am Beaumont High School 10am Adams Elementary 11am Bryan Hill Elementary 11am Buder Elementary 1pm Carver Elementary 1pm Busch Middle 2pm Clay Elementary 2pm Central VPA High School/Cleveland 3pm Clyde C. Miller High School 3pm Dewey Elementary 4pm Des Peres 4pm Lisa Williams (314) 215-7324 Thurs 3/24 Robert Stallion (314) 306-5475 Thurs 3/24 Fanning Middle 8am Gateway Complex 8am Gallaudet 9am Hamilton Elementary 9am Gateway STEM High School 10am Henry Elementary 10am Kennard Elementary 11am Herzog Elementary 11am Kottmeyer (NAPA) 1pm Jefferson Elementary 1pm Mallinckrodt Elementary 2pm Laclede Elementary 2pm Mason Elementary 3pm Nance Elementary 3pm Meda P. -

Washington University College Prep Program Cohort 6 Scholars

Washington University College Prep Program Cohort 6 Scholars Praise Iyinoluwa Aruwajoye Paige Guillermo Hazelwood West High School Affton High School Yunus Bekirov Camille Gunter Collegiate School of Medicine & Bayless High School Bioscience Ayah Hamed C’Kyra Burnette John Burroughs High School Ritenour High School Kamden Hill NaKaila Campbell Timberland High School Nerinx Hall High School Christopher Holland Samaria Coleman Northwest High School McCluer North High School Abeer Hreedeen Damius Collins Maplewood Richmond Heights High Saint Louis University High School School Carlito Davis Yemil Lopez Leal Lovejoy Technology Academy Ritenour High School DeVin Davis Dino Mahmutovic KIPP St. Louis High School Mehlville High School Makiyah Day Edvin Mahmutovic Lift for Life Academy Affton High School Dezaray Dorsey Anel Malagic Clyde C. Miller Career Academy Bayless High School Kaila Ford Raygan McDile Metro Academic & Classical High School Mary Institute & Country Day School (MICDS) Coumba Frango Alina Mendoza Hawthorn Leadership School for Girls Central Visual Performing Arts Darnesha Franks Collegiate School of Medicine & Bioscience Jehaleleel Gandy Sumner High School Washington University College Prep Program Cohort 6 Scholars Jose Montoya Marquon Wright Collegiate School of Medicine & Central Visual Performing Arts Bioscience Keriale Zimmerman Anaya Moody Riverview Gardens High School KIPP St. Louis High School Nathan Morrison Gateway Stem High School Reina Nadal University City High School Dim (Mary) Nem Rosati-Kain High School Dayrin Oviedo McCluer High School SweetP Owens McCluer High School Deja Poe Hazelwood Central High School Jarrett Pope Lutheran High School North Mason Shaver Bayless High School Taeyon Shields KIPP St. Louis High School DeMarionia Smith KIPP St. Louis High School Dominique Taylor Gateway Stem High School Journee White Mary Institute Country Day School (MICDS) . -

“Working to Be Who God Made Me.” Our Students Dianne Decker Came up with That Jingle on the First Day of School

2014-2015 ANNUAL REPORT “Working to be who God made me. ” 2014 2015 OUR MISSION Marian Middle School, a Catholic school serving adolescent girls of all religious, racial, and ethnic backgrounds, is committed to breaking the cycle of poverty by fostering their spiritual, academic, social, moral, emotional, and physical development in preparation for and successful completion of college preparatory high schools. Theme for 2014-2015 School Year Transformation: Transformed Into Our True Selves Terms Used Each Quarter 2 Self Aware • Self Determining • Self Advocating • Self Giving Message from the Board Chair 2014-2015 Board of Directors Dear Friends, Officers Fifteen years ago, seven communities of Catholic Craig Hunt, Chairperson sisters and several lay women had a vision. They Donna Farmer, Vice-Chairperson sought to establish a school that would alter the Peter Frane, Treasurer lives of girls from low-income backgrounds and Mary Jo Gorman, MD, Secretary their families by providing a quality, faith-based education in a private school setting. Their goal was to provide the knowledge and resources necessary to break the cycle of poverty for families in the St. Louis community. Board Members Thanks to their vision and supporters like you who believe in their vision, Diane Bernard Marian Middle School became a reality. Joe Garea Trish Geldbach, RN During the 2014-2015 school year, Marian Middle School’s 15th school Victoria Gonzalez year, 76 urban adolescent girls received a life-altering education. These girls received a quality education through the Academic Program and Rosemary Hufker, SSND enriching extra-curricular activities through the Enrichment Program. Donna Jahnke, PhD An additional 65 young women received academic, social, and financial Tracie Johnson support through the Graduate Support Program. -

Letting Students Speak: Making the Classroom Student-Centered Through Multimodal Projects

Nova Southeastern University NSUWorks CAHSS Faculty Presentations, Proceedings, Lectures, and Symposia Faculty Scholarship 11-18-2017 Letting Students Speak: Making the Classroom Student-Centered through Multimodal Projects Claire Lutkewitte Nova Southeastern University, [email protected] Follow this and additional works at: https://nsuworks.nova.edu/cahss_facpres Part of the Arts and Humanities Commons, and the Social and Behavioral Sciences Commons NSUWorks Citation Lutkewitte, Claire, "Letting Students Speak: Making the Classroom Student-Centered through Multimodal Projects" (2017). CAHSS Faculty Presentations, Proceedings, Lectures, and Symposia. 2481. https://nsuworks.nova.edu/cahss_facpres/2481 This Panel Discussion is brought to you for free and open access by the Faculty Scholarship at NSUWorks. It has been accepted for inclusion in CAHSS Faculty Presentations, Proceedings, Lectures, and Symposia by an authorized administrator of NSUWorks. For more information, please contact [email protected]. program 2017 NCTE ANNUAL CONVENTION PROGRAM 41 2017 BACK.indd 41 10/25/17 9:51 PM SATURDAY, NOVEMBER 18 SATURDAY, NOVEMBER 18 NOVEMBER SATURDAY, 6:30– 8:45 A.M. 222, 223, 226, & 227 ALAN Breakfast Assembly on Literature for Adolescents of NCTE Rick Riordan Former middle school English and history teacher Rick Riordan’s books and series for both young readers and adults have won numerous awards. He is author of the Percy Jackson series, the Kane Chronicles, the Magnus Chase series, and more. ALAN President: Laura Renzi, West Chester University, PA ALAN Award Winner: Neal Shusterman, Simon & Schuster Hipple Award Winner: Lois Stover, Marymount University, VA 122 2017 NCTE ANNUAL CONVENTION PROGRAM 2017 BACK.indd 122 10/25/17 9:51 PM 7:30–8:45 A.M. -

Youth Leadership St. Louis

Youth Leadership St. Louis Since 1989, the Youth Leadership St. Louis (YLSL) program has been informing, connecting, preparing and empowering high WHAT TO EXPECT school students to become civic and community leaders. Youth Leadership St. Louis takes students out of the An internationally recognized program of FOCUS St. Louis, classroom and into the community to explore what YLSL brings together high school juniors from around 30 public, leadership means in our region – and help them develop private and parochial schools across the region, as well as Girl their own leadership potential. Scouts of Eastern Missouri. Curriculum Each program day immerses students into a different issue What Makes It Unique in the region, giving them the opportunity to connect and Youth Leadership St. Louis is the area’s only established inter- learn from community leaders, collaborate with their peers district high school program that is non-competitive in nature. and put their leadership skills into action. Topics include: No other program brings together such a large and diverse group • Experiencing St. Louis of students – 150 students representing 55 ZIP codes. • Exploring Health Care • Perspectives on Criminal and Juvenile Justice Upon completing the program, students report and demonstrate: • Valuing Diversity • An increase in leadership skill level and positive decision • Understanding the Effects of Discrimination making • Realizing Poverty • Greater understanding of issues affecting the St. Louis • Leadership and Social Responsibility region • Power of Education • An increase in knowledge relating to diversity and willing- ness to interact more frequently with persons different from Commitment themselves The YLSL program kicks off with opening retreat in • A desire to become more involved in their community October and runs through April, meeting one to two days per month (except in December). -

High School Theatre Teachers

High School Theatre Teachers FIRST NAME LAST NAME SCHOOL ADDRESS CITY STATE ZIP Pamela Vallon-Jackson AGAWAM HIGH SCHOOL 760 Cooper St Agawam MA 01001 John Bechtold AMHERST PELHAM REGIONAL HIGH SCHOOL 21 Matoon St Amherst MA 01002 Susan Comstock BELCHERTOWN HIGH SCHOOL 142 Springfield Rd Belchertown MA 01007 Denise Freisberg CHICOPEE COMPREHENSIVE HIGH SCHOOL 617 Montgomery St Chicopee MA 01020 Rebecca Fennessey CHICOPEE COMPREHENSIVE HIGH SCHOOL 617 Montgomery St Chicopee MA 01020 Deborah Sali CHICOPEE HIGH SCHOOL 820 Front St Chicopee MA 01020 Amy Davis EASTHAMPTON HIGH SCHOOL 70 Williston Ave Easthampton MA 01027 Margaret Huba EAST LONGMEADOW HIGH SCHOOL 180 Maple St East Longmeadow MA 01028 Keith Boylan GATEWAY REGIONAL HIGH SCHOOL 12 Littleville Rd Huntington MA 01050 Eric Johnson LUDLOW HIGH SCHOOL 500 Chapin St Ludlow MA 01056 Stephen Eldredge NORTHAMPTON HIGH SCHOOL 380 Elm St Northampton MA 01060 Ann Blake PATHFINDER REGIONAL VO-TECH SCHOOL 240 Sykes St Palmer MA 01069 Blaisdell SOUTH HADLEY HIGH SCHOOL 153 Newton St South Hadley MA 01075 Sean Gillane WEST SPRINGFIELD HIGH SCHOOL 425 Piper Rd West Springfield MA 01089 Rachel Buhner WEST SPRINGFIELD HIGH SCHOOL 425 Piper Rd West Springfield MA 01089 Jessica Passetto TACONIC HIGH SCHOOL 96 Valentine Rd Pittsfield MA 01201 Jolyn Unruh MONUMENT MOUNTAIN REGIONAL HIGH SCHOOL 600 Stockbridge Rd Great Barrington MA 01230 Kathy Caton DRURY HIGH SCHOOL 1130 S Church St North Adams MA 01247 Jesse Howard BERKSHIRE SCHOOL 245 N Undermountain Rd Sheffield MA 01257 Robinson ATHOL HIGH SCHOOL -

FB Game Notes.Indd

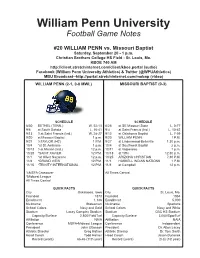

William Penn University Football Game Notes #20 WILLIAM PENN vs. Missouri Baptist Saturday, September 20 - 1 p.m. Christian Brothers College HS Field - St. Louis, Mo. KBOE 740 AM http://client.stretchinternet.com/client/kboe.portal (audio) Facebook (William Penn University Athletics) & Twitter (@WPUAthletics) MBU Broadcast--http://portal.stretchinternet.com/mobap (video) WILLIAM PENN (2-1, 0-0 MWL) MISSOURI BAPTIST (0-3) SCHEDULE SCHEDULE 8/30 BETHEL (TENN.) W, 52-13 8/28 at SE Missouri State L, 0-77 9/6 at South Dakota L, 16-41 9/4 at Saint Francis (Ind.) L, 10-42 9/13 %at Saint Francis (Ind.) W, 28-27 9/13 at Oklahoma Baptist L, 7-59 9/20 at Missouri Baptist 1 p.m. 9/20 WILLIAM PENN 1 P.M. 9/27 %TAYLOR (HC) 1 P.M. 9/27 at Lindenwood-Belleville 1:30 p.m. 10/4 *at St. Ambrose 1 p.m. 10/4 at Southwest Baptist 2 p.m. 10/18 %at Marian (Ind.) 12 p.m. 10/11 at Valparaiso 1 p.m. 10/25 *SAINT XAVIER 12 P.M. 10/18 at Tiffi n 12:30 p.m. 11/1 *at Olivet Nazarene 12 p.m. 10/25 ARIZONA CHRISTIAN 7:30 P.M. 11/8 *GRAND VIEW 12 P.M. 11/1 HASKELL INDIAN NATIONS 1 P.M. 11/15 *TRINITY INTERNATIONAL 12 P.M. 11/8 at Campbell 12 p.m. %MSFA Crossover All Times Central *Midwest League All Times Central QUICK FACTS QUICK FACTS City Oskaloosa, Iowa City St. Louis, Mo. Founded 1873 Founded 1964 Enrollment 1,146 Enrollment 5,000 Nickname Statesmen Nickname Spartans School Colors Navy and Gold School Colors Navy and White Stadium Lacey Complex Stadium Stadium CBC HS Stadium Capacity/Surface 2,800/FieldTurf Capacity/Surface 3,000/SporTurf Affi liation NAIA Affi liation NAIA Conference MSFA-Midwest League Conference Independent President John Ottosson President Dr.