United States Securities and Exchange Commission Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Olliolli2 Welcome to Olliwood Patch

1 / 2 OlliOlli2: Welcome To Olliwood Patch ... will receive a patch to implement these elements): Additional NPCs added for an ... OlliOlli2: Welcome to Olliwood plucks the iconic skater from the street and .... Oct 31, 2016 — This is a small update to the original GOL game that greatly improves the ... Below is a list of updates. ... OlliOlli2: Welcome to Olliwood.. Apr 27, 2020 — ... into the faster, more arcade-like titles like OlliOlli2: Welcome to Olliwood, ... Related: Skate 4 Update: EA Gives Up Skate Trademark Only To .... End Space Quest 2 Update Brings 90Hz and More. ... 2 Bride of the New Moon PS4 pkg 5.05, OlliOlli2 Welcome to Olliwood Update v1.01 PS4-PRELUDE, 8-BIT .... Mar 3, 2015 — Those more subtle changes include new tricks to pull off, curved patches of ground, launch ramps, and split routes. It's not that these go unnoticed .... Aug 18, 2015 — I rari problemi di frame rate sono stati risolti con l'ultima patch, quindi non vale la pena dilungarsi a parlarne. L'unico appunto che possiamo fare .... Olliolli2: Welcome To Olliwood Free Download (v1.0.0.7). Indie ... Wallpaper Engine Free Download (Build 1.0.981 Incl. Workshop Patch) · Indie ... Apr 2, 2015 — ... scores on OlliOlli2: Welcome to Olliwood seemed strange at launch. ... In the latest patch for the PlayStation 4, we have fixed the bug and .... Feb 27, 2016 — Welcome to the latest entry in our Bonus Round series, wherein we tell you all about the new Android games ... OlliOlli2: Welcome to Olliwood.. Nov 22, 2020 — Following an update, you can now pet the dog in Hades pic. -

Xbox Cheats Guide Ght´ Page 1 10/05/2004 007 Agent Under Fire

Xbox Cheats Guide 007 Agent Under Fire Golden CH-6: Beat level 2 with 50,000 or more points Infinite missiles while in the car: Beat level 3 with 70,000 or more points Get Mp model - poseidon guard: Get 130000 points and all 007 medallions for level 11 Get regenerative armor: Get 130000 points for level 11 Get golden bullets: Get 120000 points for level 10 Get golden armor: Get 110000 points for level 9 Get MP weapon - calypso: Get 100000 points and all 007 medallions for level 8 Get rapid fire: Get 100000 points for level 8 Get MP model - carrier guard: Get 130000 points and all 007 medallions for level 12 Get unlimited ammo for golden gun: Get 130000 points on level 12 Get Mp weapon - Viper: Get 90000 points and all 007 medallions for level 6 Get Mp model - Guard: Get 90000 points and all 007 medallions for level 5 Mp modifier - full arsenal: Get 110000 points and all 007 medallions in level 9 Get golden clip: Get 90000 points for level 5 Get MP power up - Gravity boots: Get 70000 points and all 007 medallions for level 4 Get golden accuracy: Get 70000 points for level 4 Get mp model - Alpine Guard: Get 100000 points and all gold medallions for level 7 ghðtï Page 1 10/05/2004 Xbox Cheats Guide Get ( SWEET ) car Lotus Espirit: Get 100000 points for level 7 Get golden grenades: Get 90000 points for level 6 Get Mp model Stealth Bond: Get 70000 points and all gold medallions for level 3 Get Golden Gun mode for (MP): Get 50000 points and all 007 medallions for level 2 Get rocket manor ( MP ): Get 50000 points and all gold 007 medalions on first level Hidden Room: On the level Bad Diplomacy get to the second floor and go right when you get off the lift. -

Social Point Invites Gamers to Achieve Their Culinary Dreams with Tasty Town

Social Point Invites Gamers to Achieve Their Culinary Dreams with Tasty Town January 31, 2019 New free-to-play mobile title from Take-Two Interactive’s acclaimed studio now available on iOS and Android Devices NEW YORK--(BUSINESS WIRE)--Jan. 31, 2019-- Social Point, a leading mobile games developer and wholly-owned studio of Take-Two Interactive Software, Inc. (NASDAQ: TTWO), today announced that their latest free-to-play offering, Tasty Town, is now available on iOS and Android devices. From the creators of the popular mobile titles Dragon City and Monster Legends, comes an all-new game that allows players to fulfill their culinary dreams of designing and managing their own restaurant. In Tasty Town, players will embark on an incredible journey - from farm to table – to build their gastronomic empire, including experiencing the joy of growing their own ingredients, hiring the best chefs, creating delectable dishes, creating and managing their own restaurant, and racing against the clock to serve meals with their food truck. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190131005105/en/ “Tasty Town is the best all-in-one cooking game that lets you create a restaurant, decorate it to your taste, fill it with world-class chefs and have great fun doing it,” said Alexandre Besenval, Vice President of Product at Social Point. “Tasty Town builds on the game mechanics we have become so famous for in our top-grossing games Dragon City, Monster Legends and World Chef. The game also From the creators of the popular mobile titles Dragon City and Monster Legends, comes an all-new allows players to discover passionate chefs game that allows players to fulfill their culinary dreams of designing and managing their own and serve their loyal customers with a restaurant. -

Brace Yourself for Lightspeed Arcade Multiplayer Mayhem in Laser League

BRACE YOURSELF FOR LIGHTSPEED ARCADE MULTIPLAYER MAYHEM IN LASER LEAGUE 505 Games and Roll7 Team Up to Redefine the Arcade Genre with Fast-Paced, Exhilarating Online Competition for Everyone CALABASAS, Calif. – June 9, 2017 – 505 Games announced today a partnership with BAFTA- winning indie dev magicians Roll7 on Laser League , a fast, fun, multiplayer arcade-style action game. Known for the award-winning OlliOlli series and NOT A HERO , Roll7 bring their trademark addictive gameplay to an original vision of near-future competition. With up to 4 v. 4 intense online or local multiplayer mode with friends, Laser League ’s frenetic yet intuitive matches are easy to play but difficult to master, in a throwback to the heyday of gaming’s more approachable arcade action. Witness the exhilarating action in the first trailer. [INSERT ESRB or PEGI embed code ] “We have admired and enjoyed Roll7’s work from afar ever since the first OlliOlli game,” said Tim Woodley, senior vice president of brand and marketing, 505 Games. “When we saw the first prototype for Laser League , we could already feel that all-too-rare ‘just one more go’ impulse. We jumped at the chance to help Roll7 take their proven studio to the next level and realize their ambitions for Laser League. ” In Laser League , the exhilarating, high-octane contact sport of 2150, players battle against the opposition for control of nodes that bathe the arena in deadly light. Evading rival colored beams, teams attempt to fry their opponents with speed, strength and strategy. Special offensive and defensive abilities, as well as game-changing power-ups on the arena floor, provide an edge at the crucial moment. -

Social Point Invites Gamers to Relax and Challenge Their Brains with Word Life

Social Point Invites Gamers to Relax and Challenge Their Brains with Word Life May 9, 2019 New free-to-play crossword puzzle game from Take-Two Interactive’s acclaimed studio now available on iOS and Android Devices NEW YORK--(BUSINESS WIRE)--May 9, 2019-- Social Point, a leading mobile games developer and wholly-owned studio of Take-Two Interactive Software, Inc. (NASDAQ: TTWO), today announced that their latest free-to-play offering, Word Life, is now available on iOS and Android devices. From the creators of the popular mobile titles Dragon City, Monster Legends andTasty Town, comes an all-new crossword puzzle game that invites players to discover the most stunning landscapes nature has to offer, while they sit back, relax, and play word puzzles on their phones. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190509005024/en/ “Whether you are looking for a brief distraction, a fun challenge or a puzzle to sharpen your brain, Word Life has you covered,” said Horacio Martos, CEO at Social Point. “Word Life is the best real-time multiplayer game, where you can challenge your friends and compete to see who is the brightest. The game also allows you to play in 7 different languages, and it's an opportunity to learn new vocabulary while you have fun solving the crosswords.” Word Lifeplayers are encouraged to challenge themselves each day with thousands of levels and new modes to play, such as the Pyramid and Spider levels. Players can go the extra mile with daily puzzles, which allow them to collect fun stickers highlighting some of nature's most amazing animals, as well as great Social Point, a leading mobile games developer and wholly-owned studio of Take-Two Interactive in-game rewards. -

August 2016 FPF Mobile Apps Study

August 2016 FPF Mobile Apps Study 2 | P a g e I. INTRODUCTION With 68% of Americans owning smartphones1 and more than 2 million apps available in each of the major app store platforms today2, notice and transparency about how apps collect, use, protect, and share users’ personal data is critical for consumer trust . Although providing a privacy policy is only the first step in addressing the broad range of consumer privacy concerns, it is an essential tool in communicating with consumers and establishing organizational accountability. By publicly documenting its data practices, an organization can begin building consumer trust, and when a policy is linked from the app store, users can assess apps’ privacy practices before they download or purchase.3 Perhaps most importantly, a detailed privacy policy ensures that the FTC and State Attorneys General can hold apps accountable for the commitments they make to consumers. Since the first and second FPF Mobile App Studies in 2011 and 2012, apps have become even more embedded in consumers’ daily lives. Increasingly, the app ecosystem is expanding beyond traditional smartphone apps to incorporate apps that help users control a wide array of connected objects and services in their homes, offices, schools, doctors’ offices, and more. The market for apps shows no signs of stopping its prodigious growth, with worldwide mobile app downloads expected to exceed 268 billion by 2017. This study concludes that leading app developers have continued to heed consumers’ and regulators’ call for privacy policies, and increasingly have worked to make them available to users prior to purchase or download via links on the app platform listing page. -

Sony Computer Entertainment Inc

FOR IMMEDIATE RELEASE SONY COMPUTER ENTERTAINMENT INC. INTRODUCES PLAYSTATION®4 (PS4™) PS4’s Powerful System Architecture, Social Integration and Intelligent Personalization, Combined with PlayStation Network with Cloud Technology, Delivers Breakthrough Gaming Experiences and Completely New Ways to Play New York City, New York, February 20, 2013 –Sony Computer Entertainment Inc. (SCEI) today introduced PlayStation®4 (PS4™), its next generation computer entertainment system that redefines rich and immersive gameplay with powerful graphics and speed, intelligent personalization, deeply integrated social capabilities, and innovative second-screen features. Combined with PlayStation®Network with cloud technology, PS4 offers an expansive gaming ecosystem that is centered on gamers, enabling them to play when, where and how they want. PS4 will be available this holiday season. Gamer Focused, Developer Inspired PS4 was designed from the ground up to ensure that the very best games and the most immersive experiences reach PlayStation gamers. PS4 accomplishes this by enabling the greatest game developers in the world to unlock their creativity and push the boundaries of play through a system that is tuned specifically to their needs. PS4 also fluidly connects players to the larger world of experiences offered by PlayStation, across the console and mobile spaces, and PlayStation® Network (PSN). The PS4 system architecture is distinguished by its high performance and ease of development. PS4 is centered around a powerful custom chip that contains eight x86-64 cores and a state of the art graphics processor. The Graphics Processing Unit (GPU) has been enhanced in a number of ways, principally to allow for easier use of the GPU for general purpose computing (GPGPU) such as physics simulation. -

Private Division Announces Kerbal Space Program Enhanced Edition Coming to Playstation®5 and Xbox Series X|S This Fall

Private Division Announces Kerbal Space Program Enhanced Edition Coming to PlayStation®5 and Xbox Series X|S this Fall June 24, 2021 Critically acclaimed rocket-building, space-flight sim will bring multiple enhancements for players on the latest consoles NEW YORK--(BUSINESS WIRE)--Jun. 24, 2021-- Private Division, Squad, and BlitWorks today announced that Kerbal Space Program Enhanced Edition is coming to PlayStation®5 and Xbox Series X|S this fall. Kerbal Space Program Enhanced Edition on these consoles will benefit from multiple hardware advancements and developments which allow for an upgraded resolution, improved framerate, advanced shaders, better textures, and additional performance improvements. Originally released for PlayStation®4 and Xbox One in January 2018, Kerbal Space Program Enhanced Edition on the latest consoles will also provide full support for a mouse and keyboard. In addition, existing owners of Kerbal Space Program Enhanced Edition on PlayStation 4 will receive a free upgrade to the PlayStation 5 version. Xbox One owners of Kerbal Space Program Enhanced Edition can upgrade to Xbox Series X|S version upon launch free of charge. Kerbal Space Program Enhanced Edition will be available digitally for purchase for $39.99. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210624005060/en/ “Today marks the celebration of the 10th anniversary of the original release of Kerbal Space Program, and over the last decade the team has continued to iterate and grow this incredible space sim into what it is today,” said Grant Gertz, Franchise Producer at Private Division. “Kerbal Space Program Enhanced Edition on the latest generation of consoles marks yet another great milestone for the game, introducing new players to the franchise, as well as providing existing console players with an upgraded experience for free.” In Kerbal Space Program, players take control of the development of the Kerbals’ space exploration program. -

Cgm V2n2.Pdf

Volume 2, Issue 2 July 2004 Table of Contents 8 24 Reset 4 Communist Letters From Space 5 News Roundup 7 Below the Radar 8 The Road to 300 9 Homebrew Reviews 11 13 MAMEusements: Penguin Kun Wars 12 26 Just for QIX: Double Dragon 13 Professor NES 15 Classic Sports Report 16 Classic Advertisement: Agent USA 18 Classic Advertisement: Metal Gear 19 Welcome to the Next Level 20 Donkey Kong Game Boy: Ten Years Later 21 Bitsmack 21 Classic Import: Pulseman 22 21 34 Music Reviews: Sonic Boom & Smashing Live 23 On the Road to Pinball Pete’s 24 Feature: Games. Bond Games. 26 Spy Games 32 Classic Advertisement: Mafat Conspiracy 35 Ninja Gaiden for Xbox Review 36 Two Screens Are Better Than One? 38 Wario Ware, Inc. for GameCube Review 39 23 43 Karaoke Revolution for PS2 Review 41 Age of Mythology for PC Review 43 “An Inside Joke” 44 Deep Thaw: “Moortified” 46 46 Volume 2, Issue 2 July 2004 Editor-in-Chief Chris Cavanaugh [email protected] Managing Editors Scott Marriott [email protected] here were two times a year a kid could always tures a firsthand account of a meeting held at look forward to: Christmas and the last day of an arcade in Ann Arbor, Michigan and the Skyler Miller school. If you played video games, these days writer's initial apprehension of attending. [email protected] T held special significance since you could usu- Also in this issue you may notice our arti- ally count on getting new games for Christmas, cles take a slight shift to the right in the gaming Writers and Contributors while the last day of school meant three uninter- timeline. -

Annual Review

annual review 2017 our board Ukie Annual Review 2016/17 contents 02 foreword 04 Noirin Carmody - Chair Harvey Eagle chair’s report Owner and COO Xbox UK Marketing Director Our initiatives Revolution Software Microsoft 06 ceo’s report Ian Livingstone CBE - Vice Chair Miles Jacobson OBE Chairman Studio Director Playmob Sports Interactive 08 a year in westminster and brussels askaboutgames Dave Gould - Treasurer Veronique Lallier askaboutgames.com Snr Director of Sales UK & Export European Managing Director 12 Take 2 Interactive Hi-Rez Studios research and analysis Without house background Simon Barratt Warwick Light 16 Director UK Managing Director and Vice President ukie’s year in numbers Sony Interactive Entertainment Barog Game Labs INSPIRATIONAL COMPUTING 18 Katherine Bidwell Phil Mansell Digital Schoolhouse acting locally thinking globally Co-Founder CEO digitalschoolhouse.org.ukWith house background State of Play Games Jagex 20 ukie’s global trade programme Neil Boyd Andy Payne OBE INSPIRATIONAL COMPUTING European Anti-Piracy Counsel CEO Nintendo Europe AppyNation 22 the digital schoolhouse Shaun Campbell Kirsty Rigden Games London UK Country Manager Operations Director games.london 24 Electronic Arts FuturLab inspiring talent John Clark Ella Romanos 26 Senior Vice President, Commercial Director promoting a positive image Publishing Rocket Lolly Games SEGA Europe Students 27 Rob Cooper Roy Stackhouse making the most of your IP Managing Director Northern Europe and Vice President - UK, Ireland & Benelux Ukie Students Export Territories -

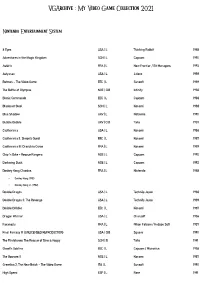

Vgarchive : My Video Game Collection 2021

VGArchive : My Video Game Collection 2021 Nintendo Entertainment System 8 Eyes USA | L Thinking Rabbit 1988 Adventures in the Magic Kingdom SCN | L Capcom 1990 Astérix FRA | L New Frontier / Bit Managers 1993 Astyanax USA | L Jaleco 1989 Batman – The Video Game EEC | L Sunsoft 1989 The Battle of Olympus NOE | CiB Infinity 1988 Bionic Commando EEC | L Capcom 1988 Blades of Steel SCN | L Konami 1988 Blue Shadow UKV | L Natsume 1990 Bubble Bobble UKV | CiB Taito 1987 Castlevania USA | L Konami 1986 Castlevania II: Simon's Quest EEC | L Konami 1987 Castlevania III: Dracula's Curse FRA | L Konami 1989 Chip 'n Dale – Rescue Rangers NOE | L Capcom 1990 Darkwing Duck NOE | L Capcom 1992 Donkey Kong Classics FRA | L Nintendo 1988 • Donkey Kong (1981) • Donkey Kong Jr. (1982) Double Dragon USA | L Technōs Japan 1988 Double Dragon II: The Revenge USA | L Technōs Japan 1989 Double Dribble EEC | L Konami 1987 Dragon Warrior USA | L Chunsoft 1986 Faxanadu FRA | L Nihon Falcom / Hudson Soft 1987 Final Fantasy III (UNLICENSED REPRODUCTION) USA | CiB Square 1990 The Flintstones: The Rescue of Dino & Hoppy SCN | B Taito 1991 Ghost'n Goblins EEC | L Capcom / Micronics 1986 The Goonies II NOE | L Konami 1987 Gremlins 2: The New Batch – The Video Game ITA | L Sunsoft 1990 High Speed ESP | L Rare 1991 IronSword – Wizards & Warriors II USA | L Zippo Games 1989 Ivan ”Ironman” Stewart's Super Off Road EEC | L Leland / Rare 1990 Journey to Silius EEC | L Sunsoft / Tokai Engineering 1990 Kings of the Beach USA | L EA / Konami 1990 Kirby's Adventure USA | L HAL Laboratory 1993 The Legend of Zelda FRA | L Nintendo 1986 Little Nemo – The Dream Master SCN | L Capcom 1990 Mike Tyson's Punch-Out!! EEC | L Nintendo 1987 Mission: Impossible USA | L Konami 1990 Monster in My Pocket NOE | L Team Murata Keikaku 1992 Ninja Gaiden II: The Dark Sword of Chaos USA | L Tecmo 1990 Rescue: The Embassy Mission EEC | L Infogrames Europe / Kemco 1989 Rygar EEC | L Tecmo 1987 Shadow Warriors FRA | L Tecmo 1988 The Simpsons: Bart vs. -

ᕯ7adhwl`≠ DRAGON CITY HACK GEMS GENERATOR 2021 ¶No Password>Daily Codes

ᕯ7adHWl`≠ DRAGON CITY HACK GEMS GENERATOR 2021 ¶No password>daily codes¶ [( Updated : June 23,2021)]→ ( 3HWcKr ) How to get free gems in dragon city 2020 - Dragon City Hack Dragon City Gems Hack 2020. Gems, Gold and Food Generator . About The Game. Collect the cutest dragons on the island in this fun dragon breeding game! . Ready to take on the hottest dragon game and collect tons of adorable fire- breathing dragons? Train them to your will, grow your collection, and prove your might to claim the title of top Dragon Master in the world? Build a Dragon City on … How to get Gems in Dragon City FAST and EASY 2020!!! - Dragon … This Dragon City Gems guide for beginners was filmed on and this is the most recent and working tutorial. Make sure to Like, Comment, and Subscribe if you need me to do it for you! Just make sure to follow my step by step guide and everything will 100% work for you and most importantly its fast and easy to do so. The reason why I made this video was because there are so … Dragon City Hack - Best Dragon City Cheats For Free Gems The last step of the dragon city hack is very easy. Lots of people generating free dragon city gems from our latest dragon city tool 2020. Sometime it will verify automatically but players around the world playing dragon city and they all want dragon city cheats and free gems. So the tool will ask you to verify. Dragon City Hack Gems Online Tool Free - [100% Verified] Dragon City Gems Hack 2020 – Unlimited Gems Generator https://theapkpoint.com/dragon-city-gems-hack-2020- unlimited-free-gems-generator/ Dragon City Gems Hack is a free online tool to generate gems and gold.