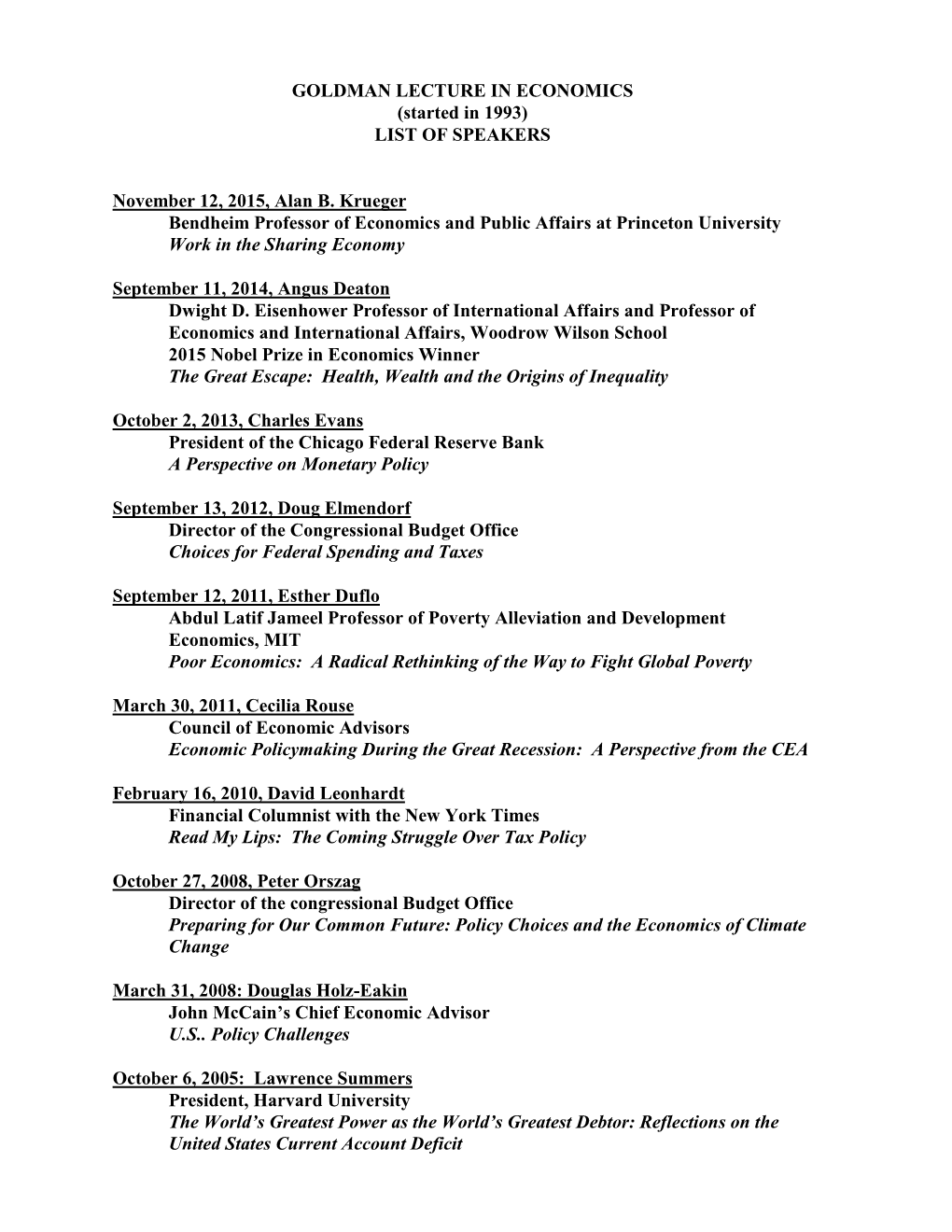

GOLDMAN LECTURE in ECONOMICS (Started in 1993) LIST of SPEAKERS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Artificial Intelligence, Automation, and Work

Artificial Intelligence, Automation, and Work The Economics of Artifi cial Intelligence National Bureau of Economic Research Conference Report The Economics of Artifi cial Intelligence: An Agenda Edited by Ajay Agrawal, Joshua Gans, and Avi Goldfarb The University of Chicago Press Chicago and London The University of Chicago Press, Chicago 60637 The University of Chicago Press, Ltd., London © 2019 by the National Bureau of Economic Research, Inc. All rights reserved. No part of this book may be used or reproduced in any manner whatsoever without written permission, except in the case of brief quotations in critical articles and reviews. For more information, contact the University of Chicago Press, 1427 E. 60th St., Chicago, IL 60637. Published 2019 Printed in the United States of America 28 27 26 25 24 23 22 21 20 19 1 2 3 4 5 ISBN-13: 978-0-226-61333-8 (cloth) ISBN-13: 978-0-226-61347-5 (e-book) DOI: https:// doi .org / 10 .7208 / chicago / 9780226613475 .001 .0001 Library of Congress Cataloging-in-Publication Data Names: Agrawal, Ajay, editor. | Gans, Joshua, 1968– editor. | Goldfarb, Avi, editor. Title: The economics of artifi cial intelligence : an agenda / Ajay Agrawal, Joshua Gans, and Avi Goldfarb, editors. Other titles: National Bureau of Economic Research conference report. Description: Chicago ; London : The University of Chicago Press, 2019. | Series: National Bureau of Economic Research conference report | Includes bibliographical references and index. Identifi ers: LCCN 2018037552 | ISBN 9780226613338 (cloth : alk. paper) | ISBN 9780226613475 (ebook) Subjects: LCSH: Artifi cial intelligence—Economic aspects. Classifi cation: LCC TA347.A78 E365 2019 | DDC 338.4/ 70063—dc23 LC record available at https:// lccn .loc .gov / 2018037552 ♾ This paper meets the requirements of ANSI/ NISO Z39.48-1992 (Permanence of Paper). -

The Influence of Randomized Controlled Trials on Development Economics Research and on Development Policy

The Influence of Randomized Controlled Trials on Development Economics Research and on Development Policy Paper prepared for “The State of Economics, The State of the World” Conference proceedings volume Abhijit Vinayak Banerjee Esther Duflo Michael Kremer12 September 11, 2016 Many (though by no means all) of the questions that development economists and policymakers ask themselves are causal in nature: What would be the impact of adding computers in classrooms? What is the price elasticity of demand for preventive health products? Would increasing interest rates lead to an increase in default rates? Decades ago, the statistician Fisher proposed a method to answer such causal questions: Randomized Controlled Trials (RCT) (Fisher, 1925). In an RCT, the assignment of different units to different treatment groups is chosen randomly. This insures that no unobservable characteristics of the units is reflected in the assignment, and hence that any difference between treatment and control units reflects the impact of the treatment. While the idea is simple, the implementation in the field can be more involved, and it took some time before randomization was considered to be a practical tool for answering questions in social science research in general, and in development economics more specifically. 1 Abhijit Banerjee and Esther Duflo are in the department of economics at MIT and co-director of J-PAL Michael Kremer is in the department of economics at Harvard and serves as part-time Scientific Director of Development Innovation Ventures at USAID, which has also funded research by both Banerjee and Duflo. The views expressed in this document reflect the personal opinions of the author and are entirely the author’s own. -

Econ 244: Market Failures and Public Policy

Econ 244: Market Failures and Public Policy Liran Einav and Heidi Williams Winter 2021 Mondays and Wednesdays, 11:30 AM{1:20 PM Course overview. This course will cover selected topics in applied microeconomics, namely insurance and credit markets (aka \selection markets"), markets for innovation, and healthcare markets. The common theme (as the course name suggests) is that in all three contexts there are good a priori reasons to be concerned about potential market failures, suggesting that some type of government intervention or regulation may be critical for achieving efficient market outcomes. These three markets are also particularly useful in illustrating the connection and interplay between economic research and public policy. The focus of the course will be on topics, not methods, and will therefore cater to a broad set of students { especially those with interests in applied microeconomics, broadly defined. While, formally, this class is not attached to any of the second-year sequences, it should be particularly complementary to the second-year sequences in IO and public economics. In addition to discussing existing work and bringing students closer to the research frontier, the course will emphasize areas of inquiry where additional research is feasible and warranted, thus hopefully generating possible leads for second-year research papers. Course logistics. The class meets regularly on Mondays and Wednesdays, 11:30am{1:20pm. There is no class on January 18 (MLK Jr. Day) nor February 15 (Presidents' Day). We will be using Canvas to post material and send announcements. A tentative list of lectures is below. Starred papers on the reading list are those we expect to discuss in detail in class. -

Understanding Development and Poverty Alleviation

14 OCTOBER 2019 Scientific Background on the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2019 UNDERSTANDING DEVELOPMENT AND POVERTY ALLEVIATION The Committee for the Prize in Economic Sciences in Memory of Alfred Nobel THE ROYAL SWEDISH ACADEMY OF SCIENCES, founded in 1739, is an independent organisation whose overall objective is to promote the sciences and strengthen their influence in society. The Academy takes special responsibility for the natural sciences and mathematics, but endeavours to promote the exchange of ideas between various disciplines. BOX 50005 (LILLA FRESCATIVÄGEN 4 A), SE-104 05 STOCKHOLM, SWEDEN TEL +46 8 673 95 00, [email protected] WWW.KVA.SE Scientific Background on the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2019 Understanding Development and Poverty Alleviation The Committee for the Prize in Economic Sciences in Memory of Alfred Nobel October 14, 2019 Despite massive progress in the past few decades, global poverty — in all its different dimensions — remains a broad and entrenched problem. For example, today, more than 700 million people subsist on extremely low incomes. Every year, five million children under five die of diseases that often could have been prevented or treated by a handful of proven interventions. Today, a large majority of children in low- and middle-income countries attend primary school, but many of them leave school lacking proficiency in reading, writing and mathematics. How to effectively reduce global poverty remains one of humankind’s most pressing questions. It is also one of the biggest questions facing the discipline of economics since its very inception. -

Understanding Inflation!Indexed Bond Markets

Understanding In‡ation-Indexed Bond Markets John Y. Campbell, Robert J. Shiller, and Luis M. Viceira1 First draft: February 2009 This version: May 2009 1 Campbell: Department of Economics, Littauer Center, Harvard University, Cambridge MA 02138, and NBER. Email [email protected]. Shiller: Cowles Foundation, Box 208281, New Haven CT 06511, and NBER. Email [email protected]. Viceira: Harvard Business School, Boston MA 02163 and NBER. Email [email protected]. Campbell and Viceira’s research was sup- ported by the U.S. Social Security Administration through grant #10-M-98363-1-01 to the National Bureau of Economic Research as part of the SSA Retirement Research Consortium. The …ndings and conclusions expressed are solely those of the authors and do not represent the views of SSA, any agency of the Federal Government, or the NBER. We are grateful to Carolin P‡ueger for ex- ceptionally able research assistance, to Mihir Worah and Gang Hu of PIMCO, Derek Kaufman of Citadel, and Albert Brondolo, Michael Pond, and Ralph Segreti of Barclays Capital for their help in understanding TIPS and in‡ation derivatives markets and the unusual market conditions in the fall of 2008, and to Barclays Capital for providing data. An earlier version of the paper was presented at the Brookings Panel on Economic Activity, April 2-3, 2009. We acknowledge the helpful comments of panel members and our discussants, Rick Mishkin and Jonathan Wright. Abstract This paper explores the history of in‡ation-indexed bond markets in the US and the UK. It documents a massive decline in long-term real interest rates from the 1990’suntil 2008, followed by a sudden spike in these rates during the …nancial crisis of 2008. -

Notes and Sources for Evil Geniuses: the Unmaking of America: a Recent History

Notes and Sources for Evil Geniuses: The Unmaking of America: A Recent History Introduction xiv “If infectious greed is the virus” Kurt Andersen, “City of Schemes,” The New York Times, Oct. 6, 2002. xvi “run of pedal-to-the-medal hypercapitalism” Kurt Andersen, “American Roulette,” New York, December 22, 2006. xx “People of the same trade” Adam Smith, The Wealth of Nations, ed. Andrew Skinner, 1776 (London: Penguin, 1999) Book I, Chapter X. Chapter 1 4 “The discovery of America offered” Alexis de Tocqueville, Democracy In America, trans. Arthur Goldhammer (New York: Library of America, 2012), Book One, Introductory Chapter. 4 “A new science of politics” Tocqueville, Democracy In America, Book One, Introductory Chapter. 4 “The inhabitants of the United States” Tocqueville, Democracy In America, Book One, Chapter XVIII. 5 “there was virtually no economic growth” Robert J Gordon. “Is US economic growth over? Faltering innovation confronts the six headwinds.” Policy Insight No. 63. Centre for Economic Policy Research, September, 2012. --Thomas Piketty, “World Growth from the Antiquity (growth rate per period),” Quandl. 6 each citizen’s share of the economy Richard H. Steckel, “A History of the Standard of Living in the United States,” in EH.net (Economic History Association, 2020). --Andrew McAfee and Erik Brynjolfsson, The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies (New York: W.W. Norton, 2016), p. 98. 6 “Constant revolutionizing of production” Friedrich Engels and Karl Marx, Manifesto of the Communist Party (Moscow: Progress Publishers, 1969), Chapter I. 7 from the early 1840s to 1860 Tomas Nonnenmacher, “History of the U.S. -

Ec 1530 Reading List Becker Chapters 1 and 2 J. Angrist and A

Ec 1530 Reading List Becker Chapters 1 and 2 J. Angrist and A. Krueger "Instrumental variables and the search for identification: From supply and demand to natural experiments" J of Economic Perspectives 15(4):69‐85 2001 Banerjee and Duflo, 2011, Chapters 1 and 2 Pitt, Mark, "Food Preferences and Nutrition in Rural Bangladesh," Review of Economics and Statistics, February 1983, 105‐114. [JSTOR] Jensen, Robert and Nolan Miller (2008). “Giffen Behavior and Subsistence Consumption,” American Economic Review, 98(4), p. 1553 − 1577. [jstor] M. Ravallion, "The performance of rice markets in Bangladesh during the 1974 famine", Oxford Economic Journal 95 (377): 15‐29 A.D. Foster, "Prices, Credit Constraints, and Child Growth in Rural Bangladesh", Economic. Journal, 105(430): 551‐570, May 1995 JM Cunha, G DeGiorgi, S Jayachandran, NBER 17456The Price Effects of Cash Versus In‐Kind Transfers Banerjee and Duflo, Chapter 3 'Bliss, Christopher and N.H. Stern, "Productivity, Wages and Nutrition, Part I Journal of Development Economics, 1978, 331‐398. [E‐journal] J. Strauss, "Does better nutrion raise farm productivity", JPE, 94(2) 297‐320. Foster, Andrew D. and Mark R. Rosenzweig, "A Test for Moral Hazard in the Labor Market: Contractual Arrangements, Effort and Health," Review of Economic and Statistics, May 1994, 213‐227. [JSTOR] Banerjee and Duflo Chapter 4 Andrew Foster and Mark Rosenzweig, "Technical change and human capital returns and investments: Evidence from the Green Revoloution", American Economic Review 86(4): 931‐53 [jstor] Esther Duflo "Schooling and labor market consequences of school construction in Indonesia: Evidence from an unusual policy experement", American Economic Review 91(4):795‐813 [jstor] Jensen, Robert (2010). -

Rohini Pande

ROHINI PANDE 27 Hillhouse Avenue 203.432.3637(w) PO Box 208269 [email protected] New Haven, CT 06520-8269 https://campuspress.yale.edu/rpande EDUCATION 1999 Ph.D., Economics, London School of Economics 1995 M.Sc. in Economics, London School of Economics (Distinction) 1994 MA in Philosophy, Politics and Economics, Oxford University 1992 BA (Hons.) in Economics, St. Stephens College, Delhi University PROFESSIONAL EXPERIENCE ACADEMIC POSITIONS 2019 – Henry J. Heinz II Professor of Economics, Yale University 2018 – 2019 Rafik Hariri Professor of International Political Economy, Harvard Kennedy School, Harvard University 2006 – 2017 Mohammed Kamal Professor of Public Policy, Harvard Kennedy School, Harvard University 2005 – 2006 Associate Professor of Economics, Yale University 2003 – 2005 Assistant Professor of Economics, Yale University 1999 – 2003 Assistant Professor of Economics, Columbia University VISITING POSITIONS April 2018 Ta-Chung Liu Distinguished Visitor at Becker Friedman Institute, UChicago Spring 2017 Visiting Professor of Economics, University of Pompeu Fabra and Stanford Fall 2010 Visiting Professor of Economics, London School of Economics Spring 2006 Visiting Associate Professor of Economics, University of California, Berkeley Fall 2005 Visiting Associate Professor of Economics, Columbia University 2002 – 2003 Visiting Assistant Professor of Economics, MIT CURRENT PROFESSIONAL ACTIVITIES AND SERVICES 2019 – Director, Economic Growth Center Yale University 2019 – Co-editor, American Economic Review: Insights 2014 – IZA -

2021 Leg Agenda February 12

LEGISLATIVE COMMITTEE MEETING Committee Members Mayor Pro Tem Michael A. Cacciotti, Chair Council Member Joe Buscaino, Vice Chair Dr. William A. Burke Senator Vanessa Delgado (Ret.) Supervisor V. Manuel Perez Supervisor Janice Rutherford February 12, 2021 9:00 a.m. Pursuant to Governor Newsom’s Executive Orders N-25-20 (March 12, 2020) and N-29-20 (March 17, 2020), the South Coast AQMD Legislative Committee meeting will only be conducted via video conferencing and by telephone. Please follow the instructions below to join the meeting remotely. INSTRUCTIONS FOR ELECTRONIC PARTICIPATION AT BOTTOM OF AGENDA Join Zoom Webinar Meeting - from PC or Laptop https://scaqmd.zoom.us/j/99574050701 Zoom Webinar ID: 995 7405 0701 (applies to all) Teleconference Dial In +1 669 900 6833 One tap mobile +16699006833,, 99574050701# Audience will be able to provide public comment through telephone or Zoom connection during public comment periods. PUBLIC COMMENT WILL STILL BE TAKEN AGENDA Members of the public may address this body concerning any agenda item before or during consideration of that item (Gov't. Code Section 54954.3(a)). If you wish to speak, raise your hand on Zoom or press Star 9 if participating by telephone. All agendas for regular meetings are posted at South Coast AQMD Headquarters, 21865 Copley Drive, Diamond Bar, California, at least 72 hours in advance of the regular meeting. Speakers may be limited to three (3) minutes each. South Coast AQMD -2- February 12, 2021 Legislative Committee CALL TO ORDER - Roll Call DISCUSSION ITEMS (Items 1 through 2): 1. Update and Discussion on Federal Legislative Issues Gary Hoitsma (No Motion Required) Carmen Group Consultants will provide a brief oral report of Federal legislative pgs 5-12 activities in Washington DC. -

Equilibrium Analysis in the Behavioral Neoclassical Growth Model

Equilibrium Analysis in Behavioral One-Sector Growth Models* Daron Acemoglu† and Martin Kaae Jensen‡ December 12, 2020 Abstract Rich behavioral biases, mistakes and limits on rational decision-making are often thought to make equilibrium analysis much more intractable. We establish that this is not the case in the context of one-sector growth models such as Ramsey-Cass-Koopmans or Aiyagari models. We break down the response of the economy to a change in the environment or policy into two parts: the direct response at the given (pre-tax) prices, and the equilibrium response which plays out as prices change. Our main result demonstrates that under weak regularity conditions, re- gardless of the details of behavioral preferences, mistakes and constraints on decision-making, the long-run equilibrium will involve a greater capital-labor ratio if and only if the direct re- sponse (from the corresponding consumption-saving model) involves an increase in aggregate savings. One implication of this result is that, from a qualitative point of view, behavioral biases matter for long-run equilibrium if and only if they change the direction of the direct response. We show how to apply this result with the popular quasi-hyperbolic discounting preferences, self-control and temptation utilities and systematic misperceptions, clarifying the conditions under which usual comparative statics hold and those under which they are reversed. Keywords: behavioral economics, comparative statics, general equilibrium, neoclassical growth. JEL Classification: D90, D50, O41. *We thank Xavier Gabaix for very useful discussion and comments. Thanks also to Drew Fudenberg, Marcus Hagedorn, David Laibson, Paul Milgrom and Kevin Reffett, as well as participants at the TUS-IV-2017 conference in Paris, and seminar participants at Lund University and the University of Oslo for helpful comments and suggestions. -

For Immediate Release: April 8, 2020 Contact: Emma Wells, [email protected], 215–622–8623

For Immediate Release: April 8, 2020 Contact: Emma Wells, [email protected], 215–622–8623 PENNINGTON, N.J., Apr.---Cecilia Rouse sworn in as Chair of the Council of Economic Advisers to President Biden On March 12, Cecilia Rouse was sworn in as Chair of the Council of Economic Advisers (CEA) by Vice President Kamala Harris. Rouse was a member of the Pennington School Board of Trustees from 2017 until March 2021, Pennington’s 2020 Commencement speaker, and is a current Pennington School parent. Rouse was nominated by President Joe Biden in December to lead the CEA, an agency within the Executive Office of the President of the United States that is charged with offering the President objective economic advice on the formulation of both domestic and international economic policy. The Council bases its recommendations and analysis on economic research and empirical evidence, using the best data available to support the President in setting the nation’s economic policy. Rouse previously served on the CEA under President Obama, and will be only the fourth woman, and first Black, to lead this agency. Rouse is the former dean of Princeton University’s School of Public and International Affairs. She writes, “This is a moment of urgency and opportunity unlike anything we’ve faced in modern times. The urgency of ending a devastating crisis. And the opportunity to build a better economy in its wake—an economy that works for everyone, and leaves no one to fall through the cracks.” The Pennington School is an independent coeducational school for students in grades 6 through 12, in both day and boarding programs. -

Estimating Welfare in Insurance Markets Using Variation in Prices∗

THE QUARTERLY JOURNAL OF ECONOMICS Vol. CXXV August 2010 Issue 3 ESTIMATING WELFARE IN INSURANCE MARKETS USING VARIATION IN PRICES∗ LIRAN EINAV AMY FINKELSTEIN MARK R. CULLEN We provide a graphical illustration of how standard consumer and producer theory can be used to quantify the welfare loss associated with inefficient pricing in insurance markets with selection. We then show how this welfare loss can be estimated empirically using identifying variation in the price of insurance. Such variation, together with quantity data, allows us to estimate the demand for insurance. The same variation, together with cost data, allows us to estimate how insurers’ costs vary as market participants endogenously respond to price. The slope of this estimated cost curve provides a direct test for both the existence and the nature of selection, and the combination of demand and cost curves can be used to estimate welfare. We illustrate our approach by applying it to data on employer- provided health insurance from one specific company. We detect adverse selection but estimate that the quantitative welfare implications associated with inefficient pricing in our particular application are small, in both absolute and relative terms. ∗We are grateful to Felicia Bayer, Brenda Barlek, Chance Cassidy, Fran Filpovits, Frank Patrick, and Mike Williams for innumerable conversations ex- plaining the institutional environment of Alcoa, to Colleen Barry, Susan Busch, Linda Cantley, Deron Galusha, James Hill, Sally Vegso, and especially Marty Slade for providing and explaining the data, to Tatyana Deryugina, Sean Klein, Dan Sacks, and James Wang for outstanding research assistance, and to Larry Katz (the Editor), three anonymous referees, Kate Bundorf, Raj Chetty, Peter Dia- mond, Hanming Fang, David Laibson, Jonathan Levin, Erzo Luttmer, Jim Poterba, Dan Silverman, Jonathan Skinner, and numerous seminar participants for help- ful comments.