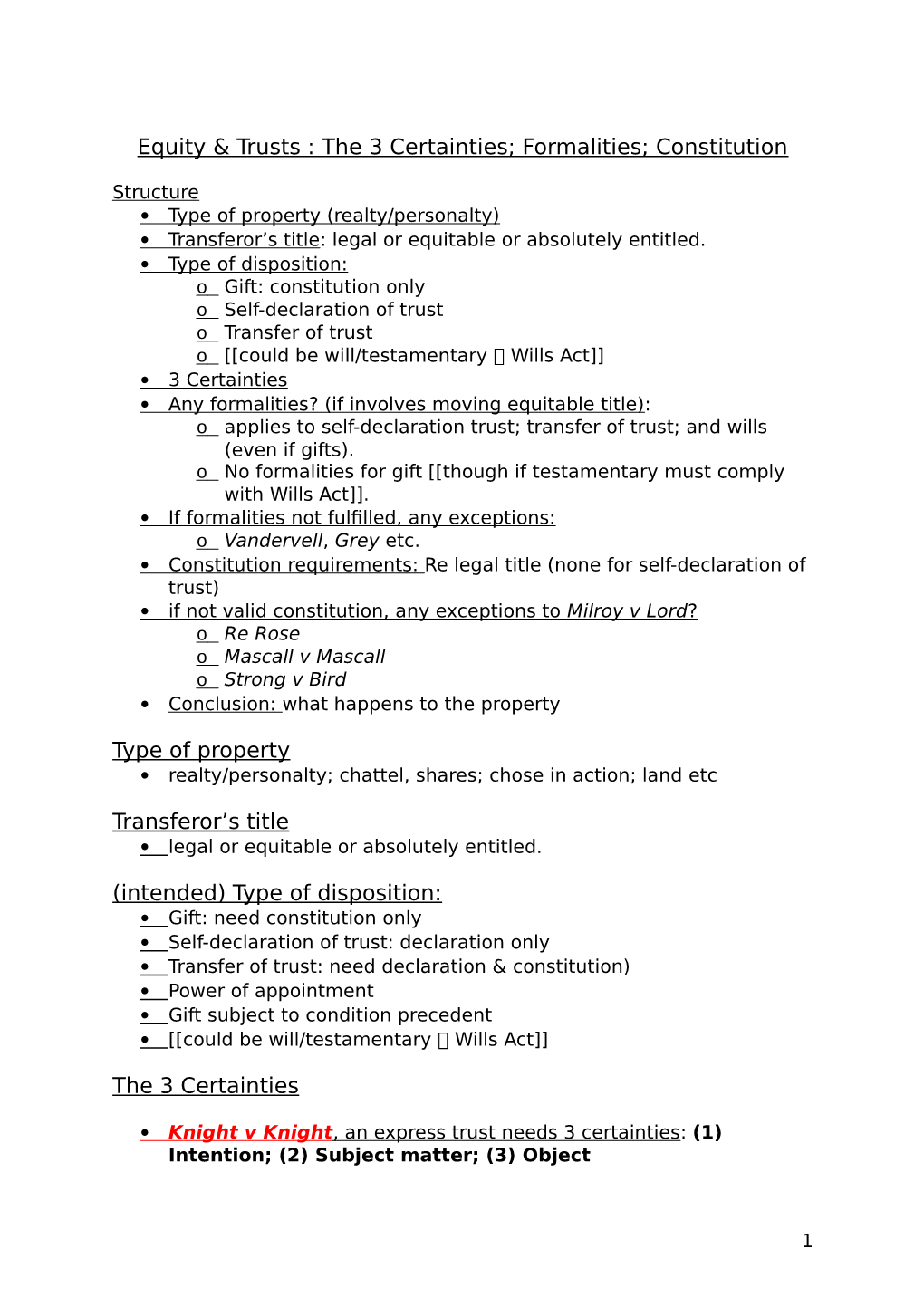

Equity & Trusts : the 3 Certainties; Formalities; Constitution

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

“The Execution of a Trust Shall Be Under the Control of the Court” : a Maxim in Modern Times

This is a repository copy of “The execution of a trust shall be under the control of the court” : A Maxim in Modern Times. White Rose Research Online URL for this paper: https://eprints.whiterose.ac.uk/88217/ Version: Published Version Article: Nolan, Richard orcid.org/0000-0002-7134-5124 (2016) “The execution of a trust shall be under the control of the court” : A Maxim in Modern Times. Canadian Journal of Comparative and Contemporary Law. pp. 469-496. ISSN 2368-4046 Reuse Items deposited in White Rose Research Online are protected by copyright, with all rights reserved unless indicated otherwise. They may be downloaded and/or printed for private study, or other acts as permitted by national copyright laws. The publisher or other rights holders may allow further reproduction and re-use of the full text version. This is indicated by the licence information on the White Rose Research Online record for the item. Takedown If you consider content in White Rose Research Online to be in breach of UK law, please notify us by emailing [email protected] including the URL of the record and the reason for the withdrawal request. [email protected] https://eprints.whiterose.ac.uk/ (2016) 2(2) CJCCL 469 “e execution of a trust shall be under the control of the court”: A Maxim in Modern Times Richard C Nolan* This article examines the ancient, well attested, but largely unexamined, inherent jurisdiction of the court to supervise, and if necessary administer and execute, any trust. It considers the modern and inventive use of this jurisdiction, and its vital role in the juridication of innovative trust practice. -

Key Facts and Key Cases

KEY FACTS KEY CASES Equity & Trusts 25726.indb i 18/11/2013 10:40 KEY FACTS KEY CASES The Key Facts Key Cases revision series is designed to give you a clear understanding and concise overview of the fundamental principles of your law course. The books’ chapters refl ect the most commonly taught topics, breaking the law down into bite- size sections with descriptive headings. Diagrams, tables and bullet points are used throughout to make the law easy to understand and memorise, and comprehensive case checklists are provided that show the principles and application of case law for your subject. Titles in the series: Contract Law Criminal Law English Legal System Equity & Trusts EU Law Family Law Human Rights Land Law Tort Law For a full listing of the Routledge Revision range of titles, visit www.routledge.com/law 25726.indb ii 18/11/2013 10:40 KEY FACTS KEY CASES Equity & Trusts Chris Turner and Judith Bray Routledge Taylor & Francis Group LONDON AND NEW YORK 25726.indb iii 18/11/2013 10:40 First edition published 2014 by Routledge 2 Park Square, Milton Park, Abingdon, Oxon OX14 4RN and by Routledge 711 Third Avenue, New York, NY 10017 Routledge is an imprint of the Taylor & Francis Group, an informa business © 2014 Chris Turner and Judith Bray The right of Chris Turner and Judith Bray to be identifi ed as authors of this work has been asserted by them in accordance with sections 77 and 78 of the Copyright, Designs and Patents Act 1988. All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. -

Equity Notes

THREE CERTAINITIES • An express trust must be certain in three (3) distinct respects (Knight v Knight (1840)): 1) Certainty of intention: settlor must have intended to create a trust of the property as opposed to making a gift or lending it to another; 2) Certainty of subject-matter: property must be specified with reasonable certainty; 3) Certainty of objects: the beneficiaries of trust must be sufficiently identifiable. • Charitable trusts are not required to satisfy the requirement of certainty of objects. • Resulting and constructive trusts will not satisfy the requirement of certainty of intention. CERTAINTY OF INTENTION • The settlor must’ve intended to create a trust of their property as opposed to making a gift or a loan. • An intention to create a trust is an intention to impose on a property owner an obligation to apply the property for the benefit of identified beneficiaries or for recognised charitable purposes. • The settlor must’ve intended to create a legally binding relationship. • The settlor need not need to use the word “trust” or any particular words: Re Armstrong [1960]. • The intention is determined by reference to the settlor’s objective intention: Byrnes v Kendle [2011], question is whether a reasonable person would consider that in all the circumstances the settlor intended to create the trust? Must consider the settlor’s words and actions to assess whether they manifested a sufficient objective intention to create a trust: Paul v Constance [1977]. • A settlor must intend to create a trust which takes effect immediately (unless consideration had been provided to create trust at later time): Harpur v Levy [2007]. -

Text, Cases and Materials on Equity and Trusts

TEXT, CASES AND MATERIALS ON EQUITY AND TRUSTS Fourth Edition Text, Cases and Materials on Equity and Trusts has been considerably revised to broaden the focus of the text in line with most LLB core courses to encompass equity, remedies and injunctions and to take account of recent major statutory and case law developments. The new edition features increased pedagogical support to outline key points and principles and improve navigation; ‘notes’ to encourage students to reflect on areas of complexity or controversy; and self-test questions to consolidate learning at the end of each chapter. New to this edition: • Detailed examination of The Civil Partnership Act 2004 and the Charities Act 2006. • Important case law developments such as Stack v Dowden (constructive trusts and family assets), Oxley v Hiscock (quantification of family assets), Barlow Clowes v Eurotrust (review of the test for dishonesty), Abou-Ramah v Abacha (dishonest assistance and change of position defence), AG for Zambia v Meer Care & Desai (review of the test for dishonesty), Re Horley Town Football Club (gifts to unincorporated association), Re Loftus (defences of limitation, estoppel and laches), Templeton Insurance v Penningtons Solicitors (Quistclose trust and damages), Sempra Metals Ltd v HM Comm of Inland Revenue (compound interest on restitution claims) and many more. • New chapters on the equitable remedies of specific performance, injunctions, rectification, rescission and account. • Now incorporates extracts from the Law Commission’s Reports and consultation papers on ‘Sharing Homes’ and ‘Trustee Exemption Clauses’ as well as key academic literature and debates. The structure and style of previous editions have been retained, with an emphasis on introduc- tory text and case extracts of sufficient length to allow students to develop analytical and critical skills in reading legal judgments. -

Creation of Express Trusts Capacity

Creation of Express Trusts Capacity - ‘Legal competency or qualification’ - Two common exclusions = poor mental health, infancy - S1(6) LPA 1925: a minor cannot hold a legal estate in land (so cannot create a trust of land). THE THREE CERTAINTIES - Knight v Knight: Lord Langdale: for an express trust to be created the settlor must express 3 things with certainty. o Certainty of intention o Certainty of subject matter o Certainty of objects Certainty of Intention - Did settlor intend to subject the property to a trust obligation? - Two ways in which a trust can be created: o The settlor declares himself trustee of property that he already owns; o Settlor transfers property to another person directing that they hold it on trust for the beneficiary. - Has the settlor done enough to make clear his intention? - Re Kayford Ltd – Megarry LJ: ‘a trust can be created without using the words “trust” or “confidence” or the like; the question is whether in substance a sufficient intention to create a trust has been manifested’. - Company opened separate account, ‘Customer’s Trust deposit Account’ to pay in money received for goods not yet delivered, withdrawing the money only if goods were later delivered – so they could refund customers if goods not supplied (if company went into liquidation). - Held: trust had been created. - Paul v Constance: C separate from his wife + lived with P. A number of times C told P that the money was as much hers as his. o C died intestate + as he had not divorced his wife, wife was entitled to all of his estate. -

Equity and Trusts

LAWS2385: EQUITY AND TRUSTS LAWS2385: EQUITY AND TRUSTS ..................................................................................... 1 Express Trusts .................................................................................................................. 3 General principles ..................................................................................................................... 3 Methods of Creation: RUN THROUGH ASSIGNMENT REQUIREMENTS AND THEN THE CERTAINTIES ............................................................................................................................. 3 The Three Certainties: Knight v Knight ...................................................................................... 4 Duties and Powers of Trustees .................................................................................................. 4 Rights and Liabilities of Trustees ............................................................................................... 7 Rights of Beneficiaries .............................................................................................................. 7 Breach of Trusts ............................................................................................................... 9 Exculpation in the trust instrument ........................................................................................... 9 Statutory exculpation ............................................................................................................. 10 Quisclose -

Testamentary Trusts in English Law: an Introductory Approach* Aproximación a Los Trusts Sucesorios En El Derecho Inglés

TESTAMENTARY TRUSTS IN ENGLISH LAW: AN INTRODUCTORY APPROACH* APROXIMACIÓN A LOS TRUSTS SUCESORIOS EN EL DERECHO INGLÉS Raúl lafuente Sánchez Senior Lecturer in Private International Law University of Alicante Recibido: 15.01.2015 / Aceptado: 26.01.2015 Abstract: The trust is a legal institution developed in courts of equity in common law jurisdictions. Among the different types of trusts, the testamentary are created under a will and, traditionally, have been considered as an effective structure when considering estate planning. Nevertheless, this figure has not passed to civil jurisdictions. This article is aimed to offer a general and preliminary analysis of this insti- tution in English law, identifying the parties involved and the formalities required to create a testamentary trust, analysing the purpose for which they are used, and highlighting the main advantages and incentives offered by this instrument. It must be read in the context of the debate about the recognition of trusts in Civil law jurisdictions in order to conclude whether the testamentary trusts may be an appropriate and useful instrument to be used as an estate-planning tool. Key words: Trusts, testamentary trusts, international succession law, English law, settlor, trustee, beneficiaries. Resumen: El trust anglosajón es una creación de los tribunales de equidad en los países del Com- mon Law. Entre los diferentes tipos existentes, los trusts sucesorios son creados por el causante en su tes- tamento y, tradicionalmente, se han considerado muy útiles en la planificación sucesoria. Sin embargo, esta figura no se encuentra regulada en la mayoría de los países de tradición jurídica de Civil Law. -

Moffat's Trusts Law Text and Materials Seventh Edition

Cambridge University Press 978-1-108-79644-6 — Moffat's Trusts Law 7th Edition Frontmatter More Information Moffat’s Trusts Law Text and Materials Seventh Edition Always the serious student’s choice for a Trusts Law textbook, the new seventh edition of Moffat’s Trusts Law once again provides a clear examination of the rules of Trusts, retaining its hallmark combination of a contextualised approach and a commercial focus. The impact of statutory developments and a wealth of new cases – including the Supreme Court and Privy Council decisions in Patel v. Mirza [2016] UKSC 42, PJS v. News Group Newspapers Ltd [2016] UKSC, Burnden Holdings v. Fielding [2018] UKSC 14, and Federal Republic of Brazil v. Durant [2015] UKPC 35 – is explored. A streamlining of the chapters on charitable Trusts, better to align the book with the typical Trusts Law course, helps students understand the new directions being taken in the areas of Trust Law and equitable remedies. Jonathan Garton is a professor of Law at the University of Warwick. His main research interests are in the law of Trusts, with a particular focus on charities. Rebecca Probert is a professor of Law at the University of Exeter. She has published widely on both modern family law and its history. Gerry Bean is a partner at DLA Piper, one of the largest global law firms, where he practices in corporate law and M&A. © in this web service Cambridge University Press www.cambridge.org Cambridge University Press 978-1-108-79644-6 — Moffat's Trusts Law 7th Edition Frontmatter More Information The Law in Context Series Editors: William Twining (University College London), Maksymilian Del Mar (Queen Mary, University of London) and Bronwen Morgan (University of New South Wales). -

The Three Certainties Required to Declare a Trust – Or Is It Four? “Distributional Certainty”

Cambridge Law Journal, 79(2), July 2020, pp. 349–359 This is an Open Access article, distributed under the terms of the Creative Commons Attribution licence (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted reuse, distribution, and reproduction in any medium, provided the original work is properly cited. doi:10.1017/S0008197320000264 THE THREE CERTAINTIES REQUIRED TO DECLARE A TRUST – OR IS IT FOUR? “DISTRIBUTIONAL CERTAINTY” DAVID WILDE* ABSTRACT. This article argues certainty in trusts is better understood by recognising a fourth certainty: “distributional certainty”. Distributional certainty is required in private trusts that involve dividing the property between beneficiaries: their shares must be clear. Distributional uncer- tainty is not, as usually understood, merely an instance of uncertainty of property: it has differing consequences, special resolution techniques, and may explain “administrative unworkability” in discretionary trusts. Distributional certainty is not required in charitable trusts. But this is not, as usually understood, merely an instance of the rule that charitable trusts do not need certainty of objects: it is an independent proposition. KEYWORDS: Trusts, certainty, equity, administrative unworkability, charity. I. THE CERTAINTIES NEEDED TO CREATE A TRUST The “three certainties” required to declare an express private trust were fam- ously stated by Lord Langdale M.R. in Knight v Knight.1 The settlor must indicate with certainty: (1) intention – that a trust was intended; (2) subject matter – the property going into the trust; and (3) objects – the identity of the beneficiary or beneficiaries.2 The suggestion here is that exposition and understanding could be enhanced by recognising that many (but not all) private trusts require a fourth certainty: “distributional certainty”. -

The Three Certainties Required to Declare a Trust – Or Is It Four? "Distributional Certainty"

The three certainties required to declare a trust – or is it four? "Distributional certainty" Article Published Version Creative Commons: Attribution 4.0 (CC-BY) Open Access Wilde, D. (2020) The three certainties required to declare a trust – or is it four? "Distributional certainty". Cambridge Law Journal, 79 (2). pp. 349-359. ISSN 0008-1973 doi: https://doi.org/10.1017/S0008197320000264 Available at http://centaur.reading.ac.uk/89259/ It is advisable to refer to the publisher’s version if you intend to cite from the work. See Guidance on citing . To link to this article DOI: http://dx.doi.org/10.1017/S0008197320000264 Publisher: Cambridge University Press All outputs in CentAUR are protected by Intellectual Property Rights law, including copyright law. Copyright and IPR is retained by the creators or other copyright holders. Terms and conditions for use of this material are defined in the End User Agreement . www.reading.ac.uk/centaur CentAUR Central Archive at the University of Reading Reading’s research outputs online Cambridge Law Journal, 79(2), July 2020, pp. 349–359 This is an Open Access article, distributed under the terms of the Creative Commons Attribution licence (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted reuse, distribution, and reproduction in any medium, provided the original work is properly cited. doi:10.1017/S0008197320000264 THE THREE CERTAINTIES REQUIRED TO DECLARE A TRUST – OR IS IT FOUR? “DISTRIBUTIONAL CERTAINTY” DAVID WILDE* ABSTRACT. This article argues certainty in trusts is better understood by recognising a fourth certainty: “distributional certainty”. Distributional certainty is required in private trusts that involve dividing the property between beneficiaries: their shares must be clear. -

The Three Certainties Required to Declare a Trust – Or Is It Four? “Distributional Certainty”

Cambridge Law Journal, 79(2), July 2020, pp. 349–359 This is an Open Access article, distributed under the terms of the Creative Commons Attribution licence (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted reuse, distribution, and reproduction in any medium, provided the original work is properly cited. doi:10.1017/S0008197320000264 THE THREE CERTAINTIES REQUIRED TO DECLARE A TRUST – OR IS IT FOUR? “DISTRIBUTIONAL CERTAINTY” DAVID WILDE* ABSTRACT. This article argues certainty in trusts is better understood by recognising a fourth certainty: “distributional certainty”. Distributional certainty is required in private trusts that involve dividing the property between beneficiaries: their shares must be clear. Distributional uncer- tainty is not, as usually understood, merely an instance of uncertainty of property: it has differing consequences, special resolution techniques, and may explain “administrative unworkability” in discretionary trusts. Distributional certainty is not required in charitable trusts. But this is not, as usually understood, merely an instance of the rule that charitable trusts do not need certainty of objects: it is an independent proposition. KEYWORDS: Trusts, certainty, equity, administrative unworkability, charity. I. THE CERTAINTIES NEEDED TO CREATE A TRUST The “three certainties” required to declare an express private trust were fam- ously stated by Lord Langdale M.R. in Knight v Knight.1 The settlor must indicate with certainty: (1) intention – that a trust was intended; (2) subject matter – the property going into the trust; and (3) objects – the identity of the beneficiary or beneficiaries.2 The suggestion here is that exposition and understanding could be enhanced by recognising that many (but not all) private trusts require a fourth certainty: “distributional certainty”. -

Front Matter

Cambridge University Press 978-1-108-47308-8 — A Student's Guide to Equity and Trusts Judith Bray Frontmatter More Information A Student’s Guide to EQUITY AND TRUSTS This engaging introduction explores the key principles of equity and trusts law and offers students effective learning features. By covering the essentials of each topic, it ensures students have the foundations for successful fur- ther study. The law is made relevant to current practice through chapters that dei ne and explain key legal principles. Examples set the law in context and make the subject interesting and dynamic by showing how these rules apply in real life. Key points sections and summaries help students remember the cru- cial points of each topic, and practical exercises offer students the opportunity to apply the law. Exploring clearly and concisely the subject’s key principles, this should be every equity student’s i rst port of call. Judith Bray is Professor of Law at the University of Buckingham. She has taught property law and family law for many years, having previously quali- i ed as a barrister. She is the author of several student texts on land law and also a short casebook on equity and trusts. © in this web service Cambridge University Press www.cambridge.org Cambridge University Press 978-1-108-47308-8 — A Student's Guide to Equity and Trusts Judith Bray Frontmatter More Information © in this web service Cambridge University Press www.cambridge.org Cambridge University Press 978-1-108-47308-8 — A Student's Guide to Equity and Trusts Judith Bray Frontmatter