Innovation Drives Growth 2011 ANNUAL REPORT Generating Another Record Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(SB #097802) [email protected]

Electronically FILED by Superior Court of California, County of Los Angeles on 12/04/2020 09:16 AM Sherri R. Carter, Executive Officer/Clerk of Court, by M. Mariscal,Deputy Clerk 20SMCV01866 Assigned for all purposes to: Santa Monica Courthouse, Judicial Officer: H. Ford III 1 DANIEL M. PETROCELLI (S.B. #097802) [email protected] 2 MOLLY M. LENS (S.B. #283867) [email protected] 3 O’MELVENY & MYERS LLP 1999 Avenue of the Stars, 8th Floor 4 Los Angeles, CA 90067-6035 Telephone: (310) 553-6700 5 Facsimile: (310) 246-6779 6 ERIC AMDURSKY (S.B. #180288) [email protected] 7 O'MELVENY & MYERS LLP 2765 Sand Hill Road 8 Menlo Park, California 94025 Telephone: (650) 473-2600 9 Facsimile: (650) 473-2601 10 Attorneys for Plaintiff ACTIVISION BLIZZARD, INC. 11 12 SUPERIOR COURT OF THE STATE OF CALIFORNIA 13 COUNTY OF LOS ANGELES, WEST DISTRICT 14 ACTIVISION BLIZZARD, INC., a Delaware Case No. Corporation, 15 Plaintiff, COMPLAINT FOR: 16 vs. (1) Intentional Interference with 17 Contract; NETFLIX, INC., a Delaware Corporation, and 18 DOES 1 through 25, inclusive, (2) Unfair Competition – Cal. Bus. & Prof. Code §§ Code 17200 et seq.; and 19 Defendants. (3) Aiding and Abetting Breach of 20 Fiduciary Duty 21 DEMAND FOR JURY TRIAL 22 23 24 25 26 27 28 COMPLAINT 1 Plaintiff Activision Blizzard, Inc. (“Plaintiff” or “Activision”), for its complaint against 2 Netflix, Inc. (“Netflix” or “Defendant”), alleges on knowledge as to itself and its own acts, and on 3 information and belief as to all other matters, as follows: 4 NATURE OF ACTION 5 1. -

Activision Blizzard, Inc

Investment Club Presentation Activision Blizzard, Inc. (ATVI) Analyst: Niko Martinovic 5-Yr Stock Performance $90 $80 $70 $60 $50 $40 $30 Decline in stock primarily driven by analyst sentiment changes, missing expectations, CFO firings, $20 and most recently, Bungie games leaving ATVI $10 $0 1/15/20144/15/20147/15/201410/15/20141/15/20154/15/20157/15/201510/15/20151/15/20164/15/20167/15/201610/15/20161/15/20174/15/20177/15/201710/15/20171/15/20184/15/20187/15/201810/15/2018 Source: AIM/Martinovic 2018, Company Filings, S&P Capital IQ, and IBIS World 2 They’re Wrong Activision Blizzard has three meaningful and diverse revenue streams that can all grow in unique ways. E-Sports and Virtual Reality are the most exciting growth opportunities in this industry and ATVI is the best positioned to take advantage of it with the power of their brands, aggressive R&D spend, and patience. Source: 3 Note: Three Year Stock Performance ATVI has outperformed the S&P consistently since early 2017 while the Peer Set1 has reverted back. 160.00% 140.00% Stock Price $46.85 Shares Outstanding $762.41mm 120.00% Market Cap $36.08bn 52 Week Range $43.71-$84.68 100.00% Avg. Volume 7,550,000 EPS (TTM) $2.13 80.00% Past Month Performance -1.60% Past 1 Year -33.63% 60.00% Past 5 Year 170.36% 40.00% 20.00% 0.00% -20.00% -40.00% 1/15/2016 4/15/2016 7/15/2016 10/15/2016 1/15/2017 4/15/2017 7/15/2017 10/15/2017 1/15/2018 4/15/2018 7/15/2018 10/15/2018 S&P ATVI Peer Set Source: AIM/Martinovic 2018, Company Filings, S&P Capital IQ, and IBIS World 4 1Electronic Arts, Ubisoft, Take Two Interactive, Square Enix, and Zynga Company Overview & Monetization Activision Blizzard, Inc. -

Activision and ABC Entertainment Group Announce Exclusive Wipeout in the Zone, Coming This Summer on Kinect for Xbox 360

Activision and ABC Entertainment Group Announce Exclusive Wipeout In The Zone, Coming This Summer on Kinect for Xbox 360 The Hit Game is Back With More Thrills, Spills and Chills Than Ever! SANTA MONICA, Calif., March 16, 2011 /PRNewswire/ -- Activision Publishing, Inc. (Nasdaq: ATVI) and ABC Entertainment Group today announced that Wipeout In the Zone is coming this summer to Kinect™, controller-free games and entertainment, for Xbox 360®. Based on the ABC hit show Wipeout, Wipeout In the Zone will be the latest release in this hit video game franchise and will have players running, ducking, dodging and wiping out using Kinect for Xbox 360's full-motion capabilities right in their own living room. "The ABC hit show Wipeout continues to thrill a growing fan base of viewers with hilarious new obstacles. Everyone who watches the show wishes they could try the obstacle course — and now this is their chance!" said David Oxford, Activision Publishing. "The show is all about absurd movement and well-timed balance, so it's a perfect fit for a Kinect game." Wipeout In the Zone features over thirty outrageous obstacles that will test players' limits in more ridiculous ways than ever. Players can try to run the entire course in one shot, conquering one challenge after another, such as leaping over a pool of water using the infamous "Big Balls" and maneuvering their players to avoid being pummeled by the "Smack Wall Sweeper." Once again featuring the talents and hilarious commentary of the show's hosts, John Anderson, John Henson and co-host Jill Wagner, Wipeout In the Zone will bring hours upon hours of fun and laughter for the entire family. -

UPC Platform Publisher Title Price Available 730865001347

UPC Platform Publisher Title Price Available 730865001347 PlayStation 3 Atlus 3D Dot Game Heroes PS3 $16.00 52 722674110402 PlayStation 3 Namco Bandai Ace Combat: Assault Horizon PS3 $21.00 2 Other 853490002678 PlayStation 3 Air Conflicts: Secret Wars PS3 $14.00 37 Publishers 014633098587 PlayStation 3 Electronic Arts Alice: Madness Returns PS3 $16.50 60 Aliens Colonial Marines 010086690682 PlayStation 3 Sega $47.50 100+ (Portuguese) PS3 Aliens Colonial Marines (Spanish) 010086690675 PlayStation 3 Sega $47.50 100+ PS3 Aliens Colonial Marines Collector's 010086690637 PlayStation 3 Sega $76.00 9 Edition PS3 010086690170 PlayStation 3 Sega Aliens Colonial Marines PS3 $50.00 92 010086690194 PlayStation 3 Sega Alpha Protocol PS3 $14.00 14 047875843479 PlayStation 3 Activision Amazing Spider-Man PS3 $39.00 100+ 010086690545 PlayStation 3 Sega Anarchy Reigns PS3 $24.00 100+ 722674110525 PlayStation 3 Namco Bandai Armored Core V PS3 $23.00 100+ 014633157147 PlayStation 3 Electronic Arts Army of Two: The 40th Day PS3 $16.00 61 008888345343 PlayStation 3 Ubisoft Assassin's Creed II PS3 $15.00 100+ Assassin's Creed III Limited Edition 008888397717 PlayStation 3 Ubisoft $116.00 4 PS3 008888347231 PlayStation 3 Ubisoft Assassin's Creed III PS3 $47.50 100+ 008888343394 PlayStation 3 Ubisoft Assassin's Creed PS3 $14.00 100+ 008888346258 PlayStation 3 Ubisoft Assassin's Creed: Brotherhood PS3 $16.00 100+ 008888356844 PlayStation 3 Ubisoft Assassin's Creed: Revelations PS3 $22.50 100+ 013388340446 PlayStation 3 Capcom Asura's Wrath PS3 $16.00 55 008888345435 -

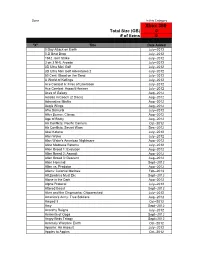

Xbox 360 Total Size (GB) 0 # of Items 0

Done In this Category Xbox 360 Total Size (GB) 0 # of items 0 "X" Title Date Added 0 Day Attack on Earth July--2012 0-D Beat Drop July--2012 1942 Joint Strike July--2012 3 on 3 NHL Arcade July--2012 3D Ultra Mini Golf July--2012 3D Ultra Mini Golf Adventures 2 July--2012 50 Cent: Blood on the Sand July--2012 A World of Keflings July--2012 Ace Combat 6: Fires of Liberation July--2012 Ace Combat: Assault Horizon July--2012 Aces of Galaxy Aug--2012 Adidas miCoach (2 Discs) Aug--2012 Adrenaline Misfits Aug--2012 Aegis Wings Aug--2012 Afro Samurai July--2012 After Burner: Climax Aug--2012 Age of Booty Aug--2012 Air Conflicts: Pacific Carriers Oct--2012 Air Conflicts: Secret Wars Dec--2012 Akai Katana July--2012 Alan Wake July--2012 Alan Wake's American Nightmare Aug--2012 Alice Madness Returns July--2012 Alien Breed 1: Evolution Aug--2012 Alien Breed 2: Assault Aug--2012 Alien Breed 3: Descent Aug--2012 Alien Hominid Sept--2012 Alien vs. Predator Aug--2012 Aliens: Colonial Marines Feb--2013 All Zombies Must Die Sept--2012 Alone in the Dark Aug--2012 Alpha Protocol July--2012 Altered Beast Sept--2012 Alvin and the Chipmunks: Chipwrecked July--2012 America's Army: True Soldiers Aug--2012 Amped 3 Oct--2012 Amy Sept--2012 Anarchy Reigns July--2012 Ancients of Ooga Sept--2012 Angry Birds Trilogy Sept--2012 Anomaly Warzone Earth Oct--2012 Apache: Air Assault July--2012 Apples to Apples Oct--2012 Aqua Oct--2012 Arcana Heart 3 July--2012 Arcania Gothica July--2012 Are You Smarter that a 5th Grader July--2012 Arkadian Warriors Oct--2012 Arkanoid Live -

AM General V. Activision Blizzard

Case 1:17-cv-08644-GBD-JLC Document 218 Filed 03/31/20 Page 1 of 29 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORI( -- -- ----- -- -- ------------------------- --x AM GENERAL LLC, Plaintiff, MEMORANDUM DECISION -against- AND ORDER ACTIVISION BLIZZARD, INC., ACTIVISION 17 Civ. 8644 (GBD) PUBLISHING, INC., and MAJOR LEAGUE GAMING CORP., Defendants. --------- -- --- -- --------- -- -- -- ---- -- - --x GEORGE B. DANIELS, United States District Judge: Plaintiff AM General LLC ("AMG") brings this action against Defendants Activision Blizzard, Inc. and Activision Publishing, Inc. (collectively, "Activision") and Major League Gaming Corp. ("MLG") for trademark infringement, trade dress infringement, unfair competition, false designation of origin, false advertising, and dilution under the Lanham Act, 15 U.S.C. §§ 1114, 1125, and 1125(c), respectively. (Compl., ECF No. 1, ~~ 82-147.) AMG also raises pendant New York state law claims for trademark infringement, unfair competition, false designation of origin, trade dress infringement, false advertising, and dilution. (Jd. ~~ 148-81.) On May 31, 2019, Defendants moved for summaty judgment on all of AMG's claims pursuant to Federal Rule of Civil Procedure 56. (Defs. Activision and MLG's Notice of Mot. for Summ. J., ECF No. 131.) On the same day, Plaintiff moved for partial summaty judgment on Defendants' laches claim pursuant to Federal Rule of Civil Procedure 56(a). (PI. AMG's Notice of Mot. for Partial Summ. J., ECF No. 138.) Subsequently, Defendants filed a motion to strike (1) certain portions of Plaintiffs Rule 56.1 statement of material facts and (2) the "experiment" contained in the rebuttal report of Plaintiff s expeli, Dr. Y oran Wind ("MTS I"). -

Starbucks to Grow in Yunnan Percent of the IPO Proceeds Chemchina Currently to Expand and Upgrade Its Has Four Overseas Subsidiar- European Plants and Another Ies

10 businesscompanies SATURDAY, NOVEMBER 13, 2010 CHINA DAILY Bluestar Adisseo seeks $1.56 billion in HK IPO BEIJING — Bluestar Adisseo Nutrition Group, the French animal-nutrition company backed by China National Chemical Corp (ChemChina), is seeking In all of our compa- HK$12.08 billion ($1.56 bil- nies we show respect lion) in a Hong for diff erent cultures, RETAIL Kong initial public ‘‘ offering, accord- which I believe is the ing to a term sheet sent to key to success.” investors. REN JIANXIN Bluestar Adisseo is off er- PRESIDENT, CHEMCHINA ing 2.3 billion shares, or 25 percent of the company, at HK$3.50 to HK$5.25. pany would take advantage Pricing the stock at the of its rich resources in the ARIANA LINDQUIST / BLOOMBERG top end of the range would country to help Bluestar Howard Schultz (center), chairman, president and chief executive offi cer of Starbucks Corp, speaks at a news conference after a signing ceremony for a Memorandum give the company a market Adisseo to achieve further of Understanding (MOU) between Starbucks Corp, the Yunnan Academy of Agricultural Science and the People’s Government of Pu’er city, in Kunming, Yunnan capitalization of about development. province, on Friday. Starbucks Corp, the world’s biggest coff ee chain, will set up a farm and processing facilities in China’s southern Yunnan province. $6.23 billion. Deutsche “In all of our companies Bank AG and Morgan we show respect for diff er- Stanley are managing the ent cultures, which I believe sale. is the key to success,” said The company will use 40 Ren. -

Esports – Who Are the Big Players and the Likely

Esports – Who are the big players and the likely winners Millennial driven esports continues to grow rapidly. The number of esports enthusiasts worldwide was estimated to be ~165 million in 2018, and for total global viewers, the forecast is ~453 million in 2019. Esports global revenue is forecast to pass US$1b in 2019 and by 2022 the global eSports market revenue is forecast to reach US$1.79 billion growing at a CAGR of 22.3%. The big players in esports Activision Blizzard Inc. (NASDAQ: ATVI) Activision Blizzard owns the popular Overwatch League as well as World of Warcraft, StarCraft, Diablo, and Hearthstone. In 2018 Activision Blizzard signed a multiyear deal with Walt Disney to broadcast the Overwatch League. As of March 2018, it was the largest game company in the Americas and Europe in terms of revenue and market capitalization. Activision Blizzard has several business units: Activision Publishing, Blizzard Entertainment, King, Major League Gaming,and Activision Blizzard Studios. Alphabet Inc. (NASDAQ: GOOGL) Alphabet (Google) has a new cloud gaming platform called Stadia. It operates games hosted on remote servers and then streams video content to connected devices, including smartphones, tablets, computers and TVs. Other competitors in the streaming space include Amazon (Twitch), Facebook, Twitter, Microsoft, Tencent, and Alibaba. Amazon (NASDAQ: AMZN) Amazon’s Twitch leads the online USA streaming market. Amazon acquired Twitch for nearly $1 billion in 2014. Twitch is only a very small percentage of Amazon’s massive revenue. Electronic Arts Inc. (NASDAQ: EA) Electronic Arts is an American video game company headquartered in California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization. -

Net Neutrality and Game Development Back in 2007 … FCC Goal

Net Neutrality and Game Development Back in 2007 … FCC Goal “[W]e seek to preserve the open, safe, and secure Internet and to promote and protect the legitimate business needs of broadband Internet access service providers and broader public interests such as innovation, investment, research and development, competition, consumer protection, speech, and democratic engagement.” Open Internet NPRM (October 2009) The Core Distinction Telecommunications services The offering of telecommunications for a fee directly to the public. “Telecommunications” is the transmission of information of the user’s choosing, without change in the form or content of the information as sent and received. Information services The offering of a capability for generating, acquiring, storing, transforming, processing, retrieving, utilizing, or making available information via telecommunications. FCC Classification Decisions Conclusion: Broadband Internet Access Service is an information service. The transmission element is not a separate component that must be offered to others. “Telecommunications service” obligations do not apply. 2005 FCC Policy Statement Consumers are entitled to access the lawful Internet content of their choice; Consumers are entitled to run applications and use services of their choice, subject to the needs of law enforcement; Consumers are entitled to connect their choice of legal devices that do not harm the network; and Consumers are entitled to competition among network providers, application and service providers, and content -

The Loyola News

LOYOLA HIGH SCHOOL’S STUDENT NEWSPAPER October 24, 2017 Volume XV, Issue I The Loyola News Loyola Welcomes New Principal Tom Malone By ADAM one another and strive to be INSIDE THIS ISSUE their best every day.” PELLEGRINO Current News, Page 1-3 “When asked what he brings Arts and Culture, Page 4-7 to the Loyola community, Mr. Malone replied that he “brings Sports and Clubs, Page 8-10 a deep belief in Jesuit educa- Important News and Upcoming tion, my experience as a school “I feel that this school offers principal and father of three Events, Page 12 me the best professional fit of sons, and a love of working any school I’ve ever worked with teachers on classroom at,” claimed our new principal, instruction. Mr. Tom Malone, who was gracious enough to answer a Mr. Malone is a Harvard University graduate and he few questions about his experi- about the future and strong claims there are a few similari- ence thus far in his new job. school spirit.” ties between Loyola and Har- Mr. Malone has felt very vard. “Like Harvard students, Mr. Malone finished our welcomed and the school com- Loyola students ask good ques- interview with an important munity has already had quite a tions, and think deeply about message for the school commu- positive impact on him. “It the world around them. I've nity: “Remember that God's feels like a strong and compas- also experienced at both spirit is in and around you all sionate school communi- schools a sense of hopefulness the time and prayer works!” ty. -

Summer Catalog 2020

5)&5*/:#00,4503& Summer Catalog 2020 Summer books for readers of all ages Arts and Crafts……………………………………………………………. p.1 Biography and Autobiography………………………………...……. p. 1-2 Business and Economics……………………………………...……….. p. 2-4 Comics and Graphic Novels……………………………..…………… p. 4-6 Computers and Gaming………………………………...…….……….. p. 6 Cooking……………………………………………………………………… p. 6 Education…………………………………………………………………… p. 6 Family and Relationships………………………………...……………. p. 6 Adult Fiction………………………………………………….……………. p. 7-10 Health and Fitness…………………………………………..…………… p. 10 History……………………………………………………………………….. p. 10 Humor…………………………………………………………….………….. p. 11 Kids Fiction for Kids…………………………………………………… p. 11-18 Nonfiction for Kids……………………………………………… p. 18-20 Social Studies Language Arts………………………………………...........…….. p. 21 Law………………………………………………………….….....….. p. 21 Literary Collections……………………………………..…........ p. 21 Math…………………………………………………………..…....... p. 21 Philosophy…………………………………………………..…...... p. 21 Table of Contents of Table Politics…………………………………………………………........ p. 21-22 Psychology…………………………………………………......…. p. 23 Religion……………………………………....…………………..… p. 23 Science………………………………………....…………………... p. 23 Self-Help……………………………………………….………………....... p. 23-25 Social Science…………………………………………………………….. p. 25 Sports………………………………………………………………………… p. 25 True Crime…………………………………………………………………. p. 25 Young Adult Fiction……………………………………………………................ p. 25-27 Nonfiction……………………………………………................… p. 27-28 Buy Online and Pick-up at Store or Shop and Ship to Home tinybookspgh.com/online -

August 5, 2021 Robert J. Morgado Lead Independent Director

August 5, 2021 Robert J. Morgado Lead Independent Director Activision Blizzard, Inc. 3100 Ocean Park Boulevard Santa Monica, CA 90405 Dear Mr. Morgado: While we appreciate the improved tone and increased detail in CEO Kotick’s recent letter to Activision Blizzard employees, customers, and shareholders,1 the changes Mr. Kotick has announced do not go nearly far enough to address the deep and widespread issues with equity, inclusion, and human capital management at the company. To wit: • No changes have been announced or proposed that would in any way alter the current process for filling vacancies either to the board of directors or to senior management. • No changes have been announced with respect to executive pay, either with respect to clawing back compensation from executives who are found to have engaged in or enabled abusive practices, or to align executives with the equity goals Mr. Kotick articulated. • The announced review by Wilmer Hale is deficient in a number of ways: this firm has a sterling reputation as a defender of the wealthy and connected, but it has no track record of uncovering wrongdoing, the lead investigator does not have in-depth experience investigating workplace harassment and abuse, and the scope of the investigation fails to address the full range of equity issues Mr. Kotick acknowledges. We believe that to ensure smooth operations and a strong reputation going forward, Activision Blizzard should commit to the following changes: • Increase board diversity and equity by adding a woman director – preferably one with a history of advocacy for marginalized people and communities - by the end of 2021, committing to gender-balance on the board by 2025, and reserving at least one board seat for a nominee selected by current employees as their representative.