COMPETITION MONTHLY (June-July 2021) DUA ASSOCIATES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India Capital Markets Experience

Dorsey’s Indian Capital Markets Capabilities March 2020 OVERVIEW Dorsey’s capital markets team has the practical wisdom and depth of experience necessary to help you succeed, even in the most challenging markets. Founded in 1912, Dorsey is an international firm with over 600 lawyers in 19 offices worldwide. Our involvement in Asia began in 1995. We now cover Asia from our offices in Hong Kong, Shanghai and Beijing. We collaborate across practice areas and across our international and U.S. offices to assemble the best team for our clients. Dorsey offers a full service capital markets practice in key domestic and international financial centers. Companies turn to Dorsey for all types of equity offerings, including IPOs, secondary offerings (including QIPs and OFSs) and debt offerings, including investment grade, high-yield and MTN programs. Our capital markets clients globally range from emerging companies, Fortune 500 seasoned issuers, and venture capital and private equity sponsors to the underwriting and advisory teams of investment banks. India has emerged as one of Dorsey’s most important international practice areas and we view India as a significant market for our clients, both in and outside of India. Dorsey has become a key player in the Indian market, working with major global and local investment banks and Indian companies on a range of international securities offerings. Dorsey is recognized for having a market-leading India capital markets practice, as well as ample international M&A and capital markets experience in the United States, Asia and Europe. Dorsey’s experience in Indian capital markets is deep and spans more than 15 years. -

SAIL and NTPC Summary Report India Pilot Survey for Disseminating

SAIL and NTPC Summary Report India Pilot Survey for Disseminating SME’s Technologies for reflecting the image of the industrial furnace inside of national steel plant and national coal thermal power plant to improve the combustion efficiency by the Heat Resistant Camera System in India. September, 2015 Japan International Cooperation Agency Joint Venture of SECURITY JAPAN CO., LTD. and OGAWA SEIKI CO., LTD. 1. BACKGROUND India has experienced rapid economic growth over the past decade. However, the rapid economic growth has also brought about increasing and demanding issues such as unstable power supply and environmental pollution/climate change. Japan and India government established the Japan-India energy dialogue to start consideration of a comprehensive cooperation concerning the electricity supply, energy conservation, coal supply and other relevant matters. The Japan Iron and Steel Federation are also promoting the support of energy conservation technology to India Iron and Steel industry. Thus, the cooperation between Japan and India has been increasing immensely over the past years both in public and private sectors. On the other hands, the Heat Resistant Camera System (hereinafter referred to as Camera System) can bring the internal image of industrial furnace such as coke oven or coal boiler for thermal power under the combustion. The image can be used for analysis like improvement of energy efficiency of furnace. In line with this, Camera System proposed in this survey is expected to also contribute to the Japan-India cooperation in the field of energy saving. 2. OUTLINE OF THE PILOT SURVEY FOR DISSEMINATING SME’S TECHNOLOGIES (1) Purpose The purpose of the survey is to verify the visualizing of internal situation of furnace under combustion and improving the efficiency of combustion through reflecting the internal image by Camera System. -

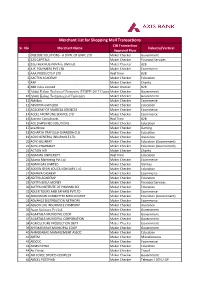

Merchant List for Shopping Mall Transactions CIB Transaction Sr

Merchant List for Shopping Mall Transactions CIB Transaction Sr. No Merchant Name Industry/Vertical Approval Flow 1 (N)CODE SOLUTIONS - A DIVN. OF GNFC LTD. Maker Checker Government 2 123 CAPITALS Maker Checker Financial Services 3 2GETHER HUB PRIVATE LIMITED Maker Checker B2B 4 A.R. POLYMERS PVT LTD Maker Checker Ecommerce 5 AAA PRODUCTS P LTD Real Time B2B 6 AACTEN ACADEMY Maker Checker Education 7 AAP Maker Checker Charity 8 ABB India Limited Maker checker B2B 9 Abdul Kalam Technical University (UPSEE-2017 Counselling)Maker Checker Government 10 Abdul Kalam Technological University Maker Checker Government 11 Abhibus Maker Checker Ecommerce 12 ABVIIITM-GWALIOR Maker Checker Education 13 ACADEMY OF MAGICAL SCIENCES Maker Checker Ecommerce 14 ACCEL FRONTLINE SERVICE LTD Maker Checker Ecommerce 15 Accrete Consultants Real Time B2B 16 ACE SIMPLIFIED SOLUTIONS Maker Checker Education 17 ace2three Maker Checker Gaming 18 ACHARYA PRAFULLA CHANDRA CLG Maker Checker Education 19 ACKO GENERAL INSURANCE LTD Maker Checker Insurance 20 ACPC-GUJARAT Maker Checker Education (Government) 21 ACPC-PHARMACY Maker Checker Education (Government) 22 ACTION AID Maker Checker Charity 23 ADAMAS UNIVERSITY Real Time Education 24 Adams Marketing Pvt Ltd Maker Checker Ecommerce 25 ADANI GAS LIMITED Maker Checker Utilities 26 ADDON GYAN EDUCATION SERV LTD Maker Checker Education 27 ADHAVA CASHEW Maker Checker Ecommerce 28 ADITYA ACADEMY Maker Checker Education 29 ADITYA BIRLA MONEY Maker Checker Financial Services 30 ADITYA INSTITUTE OF PHARMA SCI Maker Checker -

Jaiprakash Power Ventures Limited

JAIPRAKASH POWER VENTURES LIMITED Ref: JPVL:SEC:2021 6th August, 2021 The General Manager The General Manager Listing Department Listing Department National Stoc k Exchange of India Ltd., BSE Limited, "Exchange Plaza", C-l, Block G, 25th Floor, New Trading Ring, Bandra-Kurla Complex, Rotunda Building, Bandra (E), P J Towers, Dalal Street, Mumbai -400 051 Fort, Mumbai - 400 001 Scrip Code: JPPOWER Scrip Code: 532627 Dear Sirs, 1. Pursuant to Regulation 30(2) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, this is to inform you that on the recommendation of Nomination and Remuneration Committee, the Board of Directors of the Company, in its meeting held on 6th August, 2021, has appointed Dr. Dinesh Kumar Likhi (DIN 03552634), aged 61 years as Additional Director (Independent Director) on the Board of the Company subject to approval of shareholders. 2. In terms of Circular No.CIRj CFDj CMDj 4 j 2015 dated 9th September, 2015, the detail's of change of directors are given below:- 81. Particulars Date of Change No. 1 Appointment of Dr. Dinesh Kumar Likhi 6th August, 2021 as an Additional Director (Independent Director) 2 Brief profile (in case of appointment) Attached as Annexure-I 3 Disclosure of relationship with Directors NIL You are requested to take the above information on records. Thanking you, Yours faithfully, For Jaiprakash Power Ventures Limited (Mahesh Chaturvedi) Addl. G.M. & Company Secretary FCS:3188 Encl: As above Corp. Office: 'JA House' 63, Basant Lok, Vasant Vlhar, New Oelhl-110057 (india) Ph. : +91 (11) 26141358 Fax: +91(11) 26145389, 26143591 Regd. -

Revision in Market Lot of Derivative Contracts on Individual Stocks

Department : FUTURES & OPTIONS Download Ref No: NSE/FAOP/45895 Date : September 30, 2020 Circular Ref. No: 87/2020 All Members, Revision in Market Lot of Derivative Contracts on Individual Stocks In pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts specified in the SEBI circular CIR/MRD/DP/14/2015 dated July 13, 2015, the market lots of derivatives contracts shall be revised as follows: Sr. Underlying whose Derivative Count of Annexure No Effective date contract size shall be Underlying Number October 30, 2020 (for Nov 1 Revised Downwards 15 1 2020 & later expiries) 2 Revised Upwards 12 October 30, 2020 (for Jan 2 2021 & later expiries) 3 Unchanged 108 - 3 Revised Downwards but new October 30, 2020 (for Jan 4 lot size is not a multiple of old 1 4 2021 & later expiries) lot size To avoid operational complexities, in case of Annexure 2 and 4 above, following will be applicable: 1. Only the far month contract i.e. January 2021 expiry contracts will be revised for market lots. Contracts with maturity of November 2020 and December 2020 would continue to have the existing market lots. All subsequent contracts (i.e. January 2021 expiry and beyond) will have revised market lots. 2. The day spread order book will not be available for the combination contract of Dec 2020 – Jan 2021 expiry. For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of September 1st – September 30th 2020. This circular shall come into effect from October 30, 2020. -

The Mineral Industry of Iindia in 2001

THE MINERAL INDUSTRY OF INDIA By Chin S. Kuo India’s economy in 2001 was characterized by a gross Government Policies and Programs domestic product (GDP) growth of 5.4%. Fiscal deficit was projected to be 4.7% of GDP (Far Eastern Economic Review, India’s import duty on gold had been reduced from $8.57 per 2001a). Interest rates were low with the Reserve Bank of India 10 grams (g) of metal to $5.35 per 10 g in an attempt to reduce lending rate at 7%. Agriculture encompassed 25% of GDP and smuggling. The tariff on imports of second-choice and was forecast at 3.5% growth rate. Industrial production growth defective quality steel was raised from 25% to 35%. The rate declined compared to that for 2000. The Government reduced duty rate of 5% on scrap for melting, currently scrapped various surcharges on corporate income tax, simplified available only to electric arc furnace operators, had been excise duties, and cut interest rates. It also sold its stakes in extended to all steel producers irrespective of process route. state-owned enterprises through privatization. The rate of Meanwhile, dumping action had restricted Indian flat producers’ growth of exports led by jewelry, leather goods, machinery, exports to Canada, the European Union, and the United States. software, and textiles declined in 2001 and total exports The Government asked the U.S. Government to suspend represented 10% of GDP. dumping duties on its steel exports in exchange for tonnage India is endowed with vast mineral resources, and their quotas and price limits (Metal Bulletin, 2001j). -

International Journal of Computing and Corporate Research IJCCR India

International Journal of Computing and Corporate Research IJCCR India BALANCE SHEET OF THE NEXT MILLENNIUM – PERSPECTIVE, POSSIBILITIES AND PROBLEMS Shirish Raibagkar, Professor, Institute of Business Management & Rural Developments MBA Centre, Ahmednagar, Maharashtra, India. Abstract ‘What gets measured gets managed.’ Guided by this powerful performance improvement thought, this article tries to set up a framework for understanding the problems faced by organizations in measuring intangible assets. Very few organizations like Infosys have been valuing their intangible assets and have been publishing what may be called as the “balance sheet of the next millennium.” Taking clue from this balance sheet this is an attempt to appreciate the importance of valuing intangible assets and also in understanding practical problems and possibilities associated with it. Keywords: Balance Sheet, Intangible Assets, Measurement Introduction ‘What gets measured, gets managed.’ This idea has been hailed as one of the brilliant ideas in the field of performance improvement, be it personal, professional or organizational. Despite great utility, unfortunately it has been observed, that measurement of intangible assets doesn’t happen at all in most of the business organizations. It is indeed a paradox that while it has been accepted that human resources, for instance, are the most important asset for any business, there is hardly any attempt in practice to measure them. Why? What are the key issues that are acting as hindrances in translating this amazing theoretical concept of measurement into a practical application? This article intends to develop a framework for understanding these hindrances by way of a comprehensive study of the problems faced by organizations of different types– corporate, non-profit, small and medium 1 International Journal of Computing and Corporate Research IJCCR India enterprises, government organization etc, in measuring and reporting its intangible assets. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

STEEL AUTHORITY of INDIA LIMITED (SAIL) 1. Main Area of Activity 1.1 the Steel Authority of India (SAIL) Was Set up in 1973

STEEL AUTHORITY OF INDIA LIMITED (SAIL) 1. Main Area of Activity 1.1 The Steel Authority of India (SAIL) was set up in 1973 and is a company registered un- der the Indian Companies Act, 1956. The Company is primarily engaged in the produc- tion of steel. SAIL is a Maharatna, Schedule ‘A’ Company. It is the largest steel produc- er in the country with five integrated steel plants and three special steel plants. The main products of each of these plants are given below: Integrated Steel Plants : Bhilai Steel Plant (BSP), Bhilai (Chattisgarh): Integrated Steel Plant. Products – Rails [upto 260 m long rail panels], Light & Heavy Structurals, Bars &Rods, Plates, Semis, Pig Iron. Durgapur Steel Plant (DSP), Durgapur (West Bengal): Integrated Steel Plant. Products – Wheel & Axles, Light & Medium Structurals, Bars, Semis, Pig Iron. Rourkela Steel Plant (RSP), Rourkela (Orissa): Integrated Steel Plant. Products – Plates, Hot Rolled Coils, Cold Rolled Coils/Sheets, Galvanised Sheets, Pipes, Sili- con Steel Sheets. Bokaro Steel Plant (BSL), Bokaro (Jharkhand): Integrated Steel Plant, Products – Hot Rolled & Cold Rolled Coils/Sheets, Galvanised Products, Pig Iron. IISCO Steel Plant (ISP), Burnpur (West Bengal): Integrated Steel Plant, Products – Structurals, Bars & Rods, Pig Iron, Semis. Special Steel Plants: Alloy Steels Plant (ASP), Durgapur (West Bengal) : Production of alloy and special steels including production of Austenitic and Ferritic stainless steel and a variety of non-stainless steel. Salem Steel Plant (SSP), Salem (Tamil Nadu): Cold Rolled Stainless steel coils and sheets, Coin blanks, 18 grades of stainless steel, Hot Rolled carbon steel coils. Visvesvaraya Iron & Steel Plant (VISL), Bhadravati (Karnataka): Amalgamated and became a unit of SAIL w.e.f. -

Morning News Call

MORNING NEWS CALL FACTORS TO WATCH No major events are scheduled. LIVECHAT - LIVE FROM DAVOS As leaders gather at the World Economic Forum, industry experts and peers brainstorm strategies and share valuable takeaways as we untangle critical issues arising from Globalisation 4.0 and the Fourth Industrial Revolution. Jean- Philippe Courtois, Executive Vice President & President, Global, Sales, Marketing and Operations, Microsoft joins the Global Markets Forum at 5:45 pm IST; Kenneth Rogoff, Professor of Economics and Public Policy, Harvard University at 8:30 pm IST; Anthony Scaramucci, Founder, SkyBridge Capital at 10:00 pm IST and Sir Suma Chakrabarti, President, European Bank for Reconstruction, and Development (EBRD) at 12:30 am on Friday. To join the conversation, click here INDIA TOP NEWS India to spend 6.5 percent more on food subsidies in FY 2019-20 - sources India is poised to raise the subsidies for the world's biggest food welfare programme by 6.5 percent for the fiscal year beginning April 1, the smallest increase in three years, in the nation's interim budget next month, two sources directly involved in the decision told Reuters. IndiGo to push international growth for higher profit IndiGo, India's biggest airline by market share, will take more deliveries of the longer-range Airbus A321neo aircraft next year as it plans to launch more international flights, its interim CEO said on Wednesday after the company's profit fell sharply. ITC December-quarter profit beats estimate ITC Ltd, India's biggest cigarette maker, posted on Wednesday a 3.85 percent rise in December-quarter profit, boosted by higher cigarette sales. -

Press Release Steel Authority of India Limited October 7, 2020 Ratings

Press Release Steel Authority of India Limited October 7, 2020 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) CARE AA-; Negative Long-term Bond 1,134.00 (Double A minus; Outlook: Reaffirmed Programme-I* (reduced from 1,198.00) Negative) CARE AA-; Negative Reaffirmed Long-term Bond 144.00 (Double A minus; Outlook: Programme-II* (reduced from 1,147.00) Negative) CARE AA-; Negative Reaffirmed Long-term Bond 1,855.00 (Double A minus; Outlook: Programme-III* (reduced from 3,276.00) Negative) CARE AA-; Negative Reaffirmed Long-term Bond 1,185.00 (Double A minus; Outlook: Programme-IV* (reduced from 1,950.00) Negative) CARE AA-; Negative Reaffirmed Long-term Bond 2,000.00 (Double A minus; Outlook: Programme-V* Negative) CARE AA-; Negative Reaffirmed Long-term Public Deposit 1,000.00 (Double A minus; Outlook: Programme Negative) Short term CP/ICD CARE A1+ Reaffirmed 8,000.00 Programme (Single A one plus) 15,318.00 (Rupees fifteen thousand Total Instruments three hundred and eighteen crore only) 30,000.00 CARE AA-; Negative Long term Bank Facilities (Rupees thirty thousand (Double A minus; Outlook: Reaffirmed crore only) Negative) Details of instruments/facilities in Annexure-1 * Bonds outstanding as on September 3, 2020 stood at Rs.6,318 crore. Detailed Rationale & Key Rating Drivers The ratings assigned to the debt instruments/bank facilities of Steel Authority of India Limited (SAIL) continue to derive strength from its ‘Maharatna’ status with its majority ownership by the Government of India (GoI), its established position as one of the largest integrated steel producers in India with captive iron ore mines. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd.