The Best Opportunity in a Generation for UK Equities?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NOTICE of ANNUAL GENERAL MEETING to BE HELD on 16Th MAY 2014 at 11:00 AM (JERSEY TIME) at the ROYAL YACHT HOTEL, ST. HELIER, JERSEY, CHANNEL ISLANDS

NOTICE OF ANNUAL GENERAL MEETING TO BE HELD ON 16th MAY 2014 AT 11:00 AM (JERSEY TIME) AT THE ROYAL YACHT HOTEL, ST. HELIER, JERSEY, CHANNEL ISLANDS THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of the proposals referred to in this document or what action you should take, you are recommended to seek your own personal financial advice from a stockbroker, bank manager, solicitor, accountant, fund manager, or other appropriate independent financial adviser duly authorised under the Financial Services and Markets Act 2000, as amended, if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. If you have sold or transferred all of your shares in Centamin plc, please forward this document, together with the accompanying documents, as soon as possible either to the purchaser or transferee or to the person who arranged the sale or transfer so they can pass these documents to the person who now holds the shares. 1 NOTICE OF ANNUAL GENERAL MEETING (“NOTICE”) NOTICE is hereby given that the Annual General Meeting (the “Meeting”) of shareholders of Centamin plc (the “Company”) will be held at The Royal Yacht Hotel, St Helier, Jersey, Channel Islands on Friday, 16 May 2014 commencing at 11:00 am (Jersey time) to consider and, if thought fit, pass, with or without amendments, the following resolutions numbered 1, 2, 3.1 to 3.7, 4.1 to 4.2 and 5 as ordinary resolutions and 6 and 7 as special resolutions. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

CDP NON-DISCLOSURE CAMPAIGN: 2020 RESULTS Measuring the Impact of Investor Engagement on Corporate Environmental Disclosure

DISCLOSURE INSIGHT ACTION CDP NON-DISCLOSURE CAMPAIGN: 2020 RESULTS Measuring the impact of investor engagement on corporate environmental disclosure WWW.CDP.NET CONTENTS CDP NON-DISCLOSURE CAMPAIGN 2 Introduction In the fight against climate change, 2020 ended with perhaps more 3 Non-Disclosure Campaign overview optimism than it started with. Analysts predict that recent net-zero Good disclosure enables pledges made by several countries, including China and the incoming US 5 2020 campaign disclosure results investors to assess how well administration, could, if achieved, limit global temperature rise to around companies manage their 2.1 degrees by the end of the century - around a degree lower than the 19 Regional focus ESG risks. CDP now reflects trajectory of current policies1. This could bring the world within striking 11 Climate change TCFD requirements and is a distance of the well below 1.5 degree target set out in the Paris Agreement. However, figures recently released from Brazil’s National 13 Forests model disclosure framework Institute for Space Research (INPE) show that deforestation in one of the 5 1 Water security on climate change, one of world’s largest carbon sinks has increased by 9.5% over the past year, the broadest risks facing with 11,088 km2 of Amazonian forest being destroyed. 17 Sectoral focus companies. We encourage all 19 Climate change companies to respond fully to Greater action is needed if the world is to avoid the worst effects of 21 Forests the CDP questionnaire. catastrophic climate change. The capital markets and corporate sector have a vital role to play. -

Investec W&I – Morning Minutes 16.06.2020

Morning Meeting 16 June 2020 Index +/- % change Currencies +/- 12 month range FTSE 100 6064.7 -40.5 -0.7 £:$ 1.257 0.00 1.15 1.33 FTSE All-Share 3362.1 -17.7 -0.5 Y:$ 107.405 0.07 102.55 112.09 DJ Industrial Average 25763.2 157.6 0.6 E:£ 1.115 0.00 1.07 1.20 S&P 500 3066.6 25.3 0.8 E:$ 1.127 0.00 1.07 1.14 NASDAQ Composite Index 9726.0 137.2 1.4 10 Yr Bond Yld % +/- -3 months -12 months Nikkei Japan 1000 Index 1829.3 -48.5 -2.6 UK 0.19 -0.01 0.38 0.93 Hang Seng Index 23777.0 -524.4 -2.2 US 0.70 0.01 0.95 2.09 EURO STOXX 50 (EUR) 3136.4 -17.3 -0.5 Germany -0.45 -0.02 -0.58 -0.25 Switzerland SMI (PR) 9842.6 46.2 0.5 Price (p) +/- 12 month range France CAC 40 4815.7 -23.5 -0.5 Germany DAX (TR) 11911.4 -37.9 -0.3 Investec plc 165.55 -2.15001 128.8 518.6 Matrix Winners Price +/- % change Sector Winners % change Mkt Wt Bunzl plc 2069.0 185.0 9.8 FTSE All-Share / Support Services - SEC 0.9 5.6 LondonMetric Property Plc 213.2 6.4 3.1 FTSE All-Share / Leisure Goods - SEC 0.85 5.6 Ted Baker PLC 128.3 3.8 3.1 FTSE All-Share / Health Care Equipment & Services - SEC 0.62 1.1 Ashtead Group plc 2417.0 56.0 2.4 FTSE All-Share / Technology Hardware & Equipment - SEC 0.6 0.1 Hikma Pharmaceuticals Plc 2359.0 54.0 2.3 FTSE All-Share / Software & Computer Services - SEC 0.6 1.0 Matrix Losers Price +/- % change Sector Losers % change Mkt Wt Fresnillo PLC 747.6 -46.6 -5.9 FTSE All-Share / Industrial Metals & Mining - SEC -2.1 0.1 Barratt Developments PLC 499.2 -26.6 -5.1 FTSE All-Share / Beverages - SEC -1.8 3.7 Hurricane Energy Plc 6.6 -0.34 -4.9 FTSE All-Share -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Customer Engagement Summit 2016

OFFICIAL CUSTOMER EVENT ENGAGEMENT GUIDE SUMMIT 2016 TUESDAY, 8 NOVEMBER 2016 WESTMINSTER PARK PLAZA, LONDON TECHNOLOGY THE GREAT ENABLER PLATINUM GOLD ORGANISED BY: CustomerEngagementSummit.com @EngageCustomer #EngageSummits Find out more: www.verint.com/customer-engagement THE TEAM WELCOME Steve Hurst Editorial Director E: [email protected] T: 01932 506 304 Nick Rust WELCOME Sales Director E: [email protected] T: 01932 506 301 James Cottee Sponsorship Sales E: [email protected] T: 01932 506 309 Claire O’Brien Sponsorship Sales E: [email protected] T: 01932 506 308 Robert Cox A warm welcome to our fifth Customer Engagement Sponsorship Sales E: [email protected] Summit, now firmly established as Europe’s premier T: 01932 302 110 and most highly regarded customer and employee Katie Donaldson Marketing Executive engagement conference. E: [email protected] T: 01932 506 302 Our flagship Summit has gained a reputation for delivering leading-edge world class case-study led content in a business-like yet informal atmosphere which is conducive to delegate, speaker Claire Poole and sponsor networking. It’s a place both to learn and to do business. The overarching theme of Conference Producer this year’s Summit is ‘Technology the Great Enabler’ as we continue to recognise the critical E: [email protected] role that new technologies and innovations are playing in the fields of customer and employee T: 01932 506 300 engagement. Dan Keen We have several new elements to further improve this year’s Summit – not least our move to Delegate Sales E: [email protected] this new bigger venue, the iconic London Westminster Bridge Park Plaza Hotel following on T: 01932 506 306 from four hugely successful Summits at the London Victoria Park Plaza. -

26490 Christmas Trading Index 2015.Indd

DAMP SPIRITS?The OC&C Christmas Trading Index 2015 THE OC&C CHRISTMAS TRADING INDEX 2015 A merry online Christmas Mild weather but lukewarm sales Overall retail like-for-likes were broadly flat in Christmas 2015, The mildest December for more than 100 years, coming after continuing the trend of the previous 3 years. Over the entire an unseasonably warm November, had a more chilling effect period from 2011 to present, UK retail has benefited in aggregate on retailer sales – particularly in fashion where outerwear and from less than 0.5% of like-for-like growth – indicating how hard winter clothing sales were depressed and significant discounting retailers are having to fight for consumer spend. activity was needed to move product. With early autumn also being unseasonably warm, this has been a challenging quarter What spend growth there is continues to be captured by the online or two for the clothing sector – and the full picture may only channel, experiencing an acceleration of growth rates, much of emerge when annual profit announcements reveal what level this growth being driven by mobile. Making mobile at the centre of markdown needed to be invested. Retailers will need to of online strategy rather than an afterthought is likely to be continue to build flexibility into supply chains, reduce lead times critical to future success – particular in attracting the millennial and increase open-to-buy levels to give flexibility to counter generation of shoppers. increasingly erratic weather. The corollary of this was poor footfall on the streets – down by 2% in aggregate across all location types (and Retail Parks the only Christmas winners locations seeing any footfall growth this year). -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

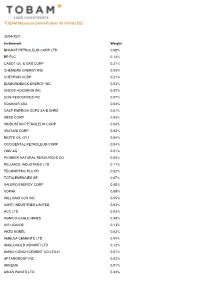

TOBAM Maximum Diversification All World USD

TOBAM Maximum Diversification All World USD 30/04/2021 Instrument Weight BHARAT PETROLEUM CORP LTD 0.08% BP PLC 0.12% CABOT OIL & GAS CORP 0.21% CHENIERE ENERGY INC 0.03% CHEVRON CORP 0.21% DIAMONDBACK ENERGY INC 0.03% ENEOS HOLDINGS INC 0.02% EOG RESOURCES INC 0.07% EQUINOR ASA 0.03% GALP ENERGIA SGPS SA-B SHRS 0.01% HESS CORP 0.03% HINDUSTAN PETROLEUM CORP 0.03% IWATANI CORP 0.02% NESTE OIL OYJ 0.04% OCCIDENTAL PETROLEUM CORP 0.04% OMV AG 0.01% PIONEER NATURAL RESOURCES CO 0.05% RELIANCE INDUSTRIES LTD 0.11% TECHNIPFMC PLC FP 0.02% TOTALENERGIES SE 0.07% VALERO ENERGY CORP 0.05% VOPAK 0.09% WILLIAMS COS INC 0.05% AARTI INDUSTRIES LIMITED 0.03% ACC LTD 0.03% AGNICO-EAGLE MINES 0.48% AIR LIQUIDE 0.13% AKZO NOBEL 0.03% AMBUJA CEMENTS LTD 0.04% ANGLOGOLD ASHANTI LTD 0.12% ANHUI CONCH CEMENT CO LTD-H 0.01% APTARGROUP INC 0.02% ARKEMA 0.01% ASIAN PAINTS LTD 0.33% TOBAM Maximum Diversification All World USD 30/04/2021 Instrument Weight AVON RESOURCES LTD 0.17% BALL CORP 0.05% BARITO PACIFIC TBK PT 0.03% BERGER PAINTS INDIA LTD 0.03% CCL INDUSTRIES INC - CL B 0.01% CEMEX SAB-CPO 0.02% CHINA STEEL CORP 0.03% CHR HANSEN HOLDING A/S 0.07% COROMANDEL INTERNATIONAL LTD 0.02% CORTEVA INC 0.06% COVESTRO AG 0.02% CRODA INTERNATIONAL PLC 0.02% DEEPAK NITRITE LTD 0.04% DS SMITH PLC 0.01% EREGLI DEMIR VE CELIK FABRIK 0.05% ETERNAL CHEMICAL CO LTD 0.02% FORMOSA PLASTICS CORP 0.03% FORTESCUE METALS GROUP LTD 0.05% FRANCO-NEVADA CORP 0.83% GIVAUDAN-REG 0.06% GOLD FIELDS LTD 0.10% GRASIM INDUSTRIES LTD 0.01% ICL GROUP LTD 0.14% INDUSTRIAS PENOLES SAB DE CV -

DATABANK INSIDE the CITY SAM CHAMBERS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

10 The Sunday Times December 20, 2020 BUSINESS Liam Kelly first. BDO said the RICS’s finished with milder tickings- by Paul Marcuse. This is success of TV drama Strike Bosses of the rickety treasury, reserves and off over interbank transfer where the four NEDs sat. and the West End play Harry investment policies were processes and the Many of the RICS’s 134,000 Potter and the Cursed Child. “not properly version- implementation of actions. members are already The reason for the RICS are on the ropes controlled, appear to be out The report was not shared irritated at having to pay fees dividend damage pre-dated of date and have never been beyond the RICS’s audit to an organisation that seems the pandemic: higher costs The Royal Institution of annual fees of about £540 are communicated to the committee until four NEDs to do little more than chase squeezed pre-tax profits at Chartered Surveyors (RICS) now due — more details of treasury team”, who “just got hold of it, tried to speak them endlessly about “CPD” Brontë — which Rowling runs responded to last weekend’s the report their institution follow instructions ... and to then president Chris — continuing professional with her long-time agent Neil revelation that four non- has strangely failed to share. rely on their own experience Brooke about it — and had development. Those who Blair, 54 — from £7.2m to executive directors had been The 152-year-old body, from previous ... roles”. their contracts terminated pressed £500,000-a-year £4.8m. However, newly filed dismissed for trying to raise which sets professional The second was banking. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore