New Zealand Craft Beer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Annual Report

AB InBev annual report 2018 AB InBev - 2018 Annual Report 2018 Annual Report Shaping the future. 3 Bringing People Together for a Better World. We are building a company to last, brewing beer and building brands that will continue to bring people together for the next 100 years and beyond. Who is AB InBev? We have a passion for beer. We are constantly Dreaming big is in our DNA innovating for our Brewing the world’s most loved consumers beers, building iconic brands and Our consumer is the boss. As a creating meaningful experiences consumer-centric company, we are what energize and are relentlessly committed to inspire us. We empower innovation and exploring new our people to push the products and opportunities to boundaries of what is excite our consumers around possible. Through hard the world. work and the strength of our teams, we can achieve anything for our consumers, our people and our communities. Beer is the original social network With centuries of brewing history, we have seen countless new friendships, connections and experiences built on a shared love of beer. We connect with consumers through culturally relevant movements and the passion points of music, sports and entertainment. 8/10 Our portfolio now offers more 8 out of the 10 most than 500 brands and eight of the top 10 most valuable beer brands valuable beer brands worldwide, according to BrandZ™. worldwide according to BrandZTM. We want every experience with beer to be a positive one We work with communities, experts and industry peers to contribute to reducing the harmful use of alcohol and help ensure that consumers are empowered to make smart choices. -

Indies Entry Process 2019

INDIES ENTRY PROCESS 2019 Independent Brewers Association PO Box 138, Fitzroy VIC 3065 iba.org.au ABN: 96 866 105 506 +61 3 9417 3105 brewcon.org.au [email protected] Table of Contents The Independent Beer Awards Aus. (the Indies) ........................................................................................ 2 Indies 2019 Key Dates ....................................................................................................................... 2 Eligibility .................................................................................................................................................. 3 Brewery Eligibility ................................................................................................................................. 3 Australian independent breweries .................................................................................................... 3 Eligibility compliance........................................................................................................................ 3 Beer Entry Eligibility ............................................................................................................................. 3 Judging Process ...................................................................................................................................... 4 Judge Selection ................................................................................................................................... 4 Judging Process ................................................................................................................................. -

N&B 3.10.Pub

News and brews Spring Free Magazine of 2010 The South Devon Branch of FREE THE CAMPAIGN FOR REAL ALE South Devon CAMRA Supporting Real Ale in the South West Welcome to News and brews 29th edition spring 2010 From the content of this magazine it is clear that South Devon CAMRA members enjoy being mobile, hunting for good beer. At the March Meeting, providing we have visited every pub, we get the opportunity to vote for our South Devon CAMRA Pub of the Year (or POTY for short). The pubs are compared for several criteria, which include beer quality; atmosphere; style and décor; service and welcome; value for money; clientele mix; and sympathy with CAMRA aims. The highest scoring becomes our POTY and receives our sought after certificate. They are then put forward for Regional Pub of the Year against all South West branch-winning pubs from Gloucester down, and if successful there, National Pub of the Year. Several of our short-listed pubs have appeared in previous POTY votes, which indicate consistency in the quality of the service provided. The pubs in the running this year are: The Queen's Arms, Slapton The Rugglestone Inn, Widecombe The Teign House Inn, Christow The Wild Goose, Combeinteignhead The next issue will give the results but all of them would be worthy winners, and all of them deserve a visit Cheers, Tina Hemmings, Editor Cover picture— The Pigs Nose, East Prawle Colin and Heather welcome you to the Ship Inn. Our traditional Village Pub & Restaurant offers a selection of real ales, good food, together with a wide choice of popular drinks and first-class wines. -

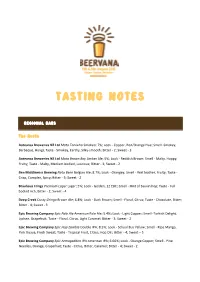

Tasting Notes

TASTING NOTES REGIONAL BARS The North Aotearoa Breweries NZ Ltd Mata Taniwha Smoked; 7%; Look - Copper, Red/Orange Hue; Smell -Smokey, Barbeque, Hangi; Taste - Smokey, Earthy, Silky-smooth; Bitter - 2; Sweet - 3 Aotearoa Breweries NZ Ltd Mata Brown Boy Amber Ale; 5%; Look - Reddish Brown; Smell - Malty, Hoppy, Fruity; Taste - Malty, Medium-bodied, Luscious; Bitter - 3; Sweet - 2 Ben Middlemiss Brewing Nota Bene Belgian Ale; 8.7%; Look - Orangey; Smell - Wet leather, Fruity; Taste - Crisp, Complex, Spicy; Bitter - 3; Sweet - 2 Brauhaus Frings Premium Lager Lager; 5%; Look - Golden, 12 EBC; Smell - Hint of Sauvin hop; Taste - Full bodied rich; Bitter - 2; Sweet - 4 Deep Creek Dusty Gringo Brown Ale; 6.8%; Look - Dark Brown; Smell - Floral, Citrus; Taste - Chocolate, Bitter; Bitter - 4; Sweet - 3 Epic Brewing Company Epic Pale Ale American Pale Ale; 5.4%; Look - Light Copper; Smell -Turkish Delight, Lychee, Grapefruit; Taste - Floral, Citrus, Light Caramel; Bitter - 3; Sweet - 2 Epic Brewing Company Epic Hop Zombie Double IPA; 8.5%; Look - School Bus Yellow; Smell - Ripe Mango, Pink Guava, Fresh Sweat; Taste - Tropical Fruit, Citrus, Hop Oil ; Bitter - 4; Sweet – 5 Epic Brewing Company Epic Armageddon IPA American IPA; 6.66%; Look - Orange Copper; Smell - Pine Needles, Orange, Grapefruit; Taste - Citrus, Bitter, Caramel; Bitter - 4; Sweet - 2 Galbraiths Munich Lager Pilsner; 5.5%; Look - Clear Gold; Smell - Malt, Floral; Taste - Crisp, Clean, Hoppy; Bitter - 4; Sweet – 3 Hallertau Porter Noir Barrel Aged Beer; 6.6%; Look - Dark, Ruby, Tan -

Bar Tending Draft

The Hospitality Handbook Series Volume 3 Know Your Beers A Guide to Alcoholic Drinks, Drinking Culture and the Hospitality Industry in Australia INTRODUCTION ............................................................................................................................................... 1 KNOW YOUR BEERS ....................................................................................................................................... 2 WHAT IS BEER? ................................................................................................................................................................. 2 WHAT ARE THE IMPORTANT THINGS TO KNOW ABOUT BEER? ................................................................................. 4 KNOW WHAT YOU’RE TALKING ABOUT... ....................................................................................................................... 5 TYPES OF BEER ................................................................................................................................................................. 7 FAMOUS AUSTRALIAN BRANDS AND REGIONS ......................................................................................................... 10 FOOD MATCHING TIPS .................................................................................................................................................. 12 BEER CULTURE ............................................................................................................................................................. -

Financial Services Guide and Independent Expert's Report In

Financial Services Guide and Independent Expert’s Report in relation to the Proposed Demerger of Treasury Wine Estates Limited by Foster’s Group Limited Grant Samuel & Associates Pty Limited (ABN 28 050 036 372) 17 March 2011 GRANT SAMUEL & ASSOCIATES LEVEL 6 1 COLLINS STREET MELBOURNE VIC 3000 T: +61 3 9949 8800 / F: +61 3 99949 8838 www.grantsamuel.com.au Financial Services Guide Grant Samuel & Associates Pty Limited (“Grant Samuel”) holds Australian Financial Services Licence No. 240985 authorising it to provide financial product advice on securities and interests in managed investments schemes to wholesale and retail clients. The Corporations Act, 2001 requires Grant Samuel to provide this Financial Services Guide (“FSG”) in connection with its provision of an independent expert’s report (“Report”) which is included in a document (“Disclosure Document”) provided to members by the company or other entity (“Entity”) for which Grant Samuel prepares the Report. Grant Samuel does not accept instructions from retail clients. Grant Samuel provides no financial services directly to retail clients and receives no remuneration from retail clients for financial services. Grant Samuel does not provide any personal retail financial product advice to retail investors nor does it provide market-related advice to retail investors. When providing Reports, Grant Samuel’s client is the Entity to which it provides the Report. Grant Samuel receives its remuneration from the Entity. In respect of the Report in relation to the proposed demerger of Treasury Wine Estates Limited by Foster’s Group Limited (“Foster’s”) (“the Foster’s Report”), Grant Samuel will receive a fixed fee of $700,000 plus reimbursement of out-of-pocket expenses for the preparation of the Report (as stated in Section 8.3 of the Foster’s Report). -

Beer Knowledge – for the Love of Beer Section 1

Beer Knowledge – For the Love of Beer Beer Knowledge – For the Love of Beer Contents Section 1 - History of beer ................................................................................................................................................ 1 Section 2 – The Brewing Process ...................................................................................................................................... 4 Section 3 – Beer Styles .................................................................................................................................................... 14 Section 4 - Beer Tasting & Food Matching ...................................................................................................................... 19 Section 5 – Serving & Selling Beer .................................................................................................................................. 22 Section 6 - Cider .............................................................................................................................................................. 25 Section 1 - History of beer What is beer? - Simply put, beer is fermented; hop flavoured malt sugared, liquid. It is the staple product of nearly every pub, club, restaurant, hotel and many hospitality and tourism outlets. Beer is very versatile and comes in a variety of packs; cans, bottles and kegs. It is loved by people all over the world and this world wide affection has created some interesting styles that resonate within all countries -

Carnival's Private Label Beers Arrive in Australia

CHEERS! CARNIVAL’S PRIVATE LABEL BEERS ARRIVE IN AUSTRALIA Responding to Australia’s growing passion for craft beers, Carnival Cruise Line now offers ParchedPig Toasted Amber Ale, West Coast IPA and ThirstyFrog Caribbean Wheat on its Australia- based ships. SYDNEY (11 June, 2019) – Building on the growing demand for craft beer in Australia, Carnival Cruise Line has become the first cruise line to can and keg its own private label beers crafted by Brewmaster Colin Presby and the in-house brewery team aboard Carnival Horizon and Carnival Vista. “With the success of our breweries on Carnival Vista and Carnival Horizon, the obvious next step was to let all of our guests fleetwide including Australia, enjoy our refreshing craft beers,” said Edward Allen, Carnival’s Vice President of Beverage Operations. “We are pleased to be the first cruise line to scale up its beverage operations by canning and kegging our own beer. My hope is that our Australian guests will enjoy a refreshing beer on the top decks and then take a four-pack home with them to share with family and friends as a tasty reminder of their cruise.” The three beers, which are based on recipes developed by Brewmaster Colin Presby and the Carnival brewery team, are now available in cans on Carnival’s Australia-based ship, Carnival Spirit. They will also be available on Carnival Splendor, the newest and largest ship to be homeported in Australia, when she arrives through the Sydney Heads in December. The beers include: • ThirstyFrog Caribbean Wheat - an unfiltered wheat beer with flavors of orange and spices. -

Brewcon 2018! 9:15 AM: KEYNOTE – Kim Jordan, Founder and Executive Chair, New Belgium Brewing

PROGRAM DETAIL PLENARY SESSIONS WEDNESDAY 27 JUNE 2018 9:00 AM: WELCOME to BrewCon 2018! 9:15 AM: KEYNOTE – Kim Jordan, Founder and Executive Chair, New Belgium Brewing KIM JORDAN – BIOG Kim Jordan, Co-founder, Executive Chair of the Board and former CEO of New Belgium Brewing, has developed expertise at the intersection of business, the environment and community to create one of the most respected craft breweries and innovative businesses in America. Her lifelong commitment to developing healthy communities has informed New Belgium's culture through progressive policies like employee ownership, open- book management, and philanthropic giving. In more than a quarter century as an entrepreneur, Kim has spoken to thousands of people in the business, nonprofit, and academic worlds about how to create a vibrant and rewarding work culture that enhances the bottom line. Kim has been a director on many diverse Boards over the years including The Brewers Association, 1% for The Planet and The Governor’s Renewable Energy Authority Board. She currently participates on the Board of Governors for Colorado State University, and the Advanced Energy Economy. She serves on Boards where she believes her progressive business philosophy can make a difference on important issues. Now as the Executive Chair, Kim serves as a link between New Belgium’s highly competent and engaged management group and its Board of Directors. She continues to champion foundational aspects of New Belgium that make it a business role model with fresh thinking about progressive business practices and the marketplace of the future. Kim works to represent New Belgium, speaking with brewers, business people and legislators about the power of progressive business to make positive change in the world. -

Brewery Name Beer Name ABV 3 Words to Describe the Look 3

Brewery Name Beer Name ABV 3 Words To Describe The Look 3 Words To Describe The Aroma 3 Words To Describe The Taste Unfined Altarnun Brewing Ltd BreakOut IPA 6.5 Red Tropical Fruit Malty Tropical Fruit No Altarnun Brewing Ltd Graffiti IPA 5.0 Deep Golden Fruity Citrus Tropical Fruity Citrus Tropical No Arkells Brewery Bees Organic 4.5 Fine Golden Beer Sweet, Fresh Honey Honey Sweet, Fresh No Arkells Brewery Hoperation I.P.A. 4.2 Golden Floral, Lemon Citrus, Hoppy, Dry No Arkells Brewery Moonlight 4.5 Golden Auburn Fruity, Sharpe, Dry Finish Pineapple, Tropical Fruits No Arkells Brewery Wiltshire Gold 3.7 Golden Amber Gentle, Floral Hop Sweet, Malty, Hoppy No Art Brew CCCP 4.9 Pale And Interesting Wowzer Citra Boom American Hopped Bigly Yes Art Brew Love or Nothing 6.0 Rich Deep Gold Citrusy Floral Light Citrusy Zingy Zesty Yes Art Brew Pale 3.2 Hazy Sun Shine Citrusy Tomato Leaves Lemon Grove Adventure Yes Barum Brewery Breakfast 5.0 Brown Fruity Bitter Sweet No Barum Brewery Mild 4.2 Dark Brown Dark Burnt Malty No Barum Brewery Original 4.4 Brown Fruity Bitter Sweet No Bath Ales Gem 4.1 Auburn chestnut brown Spicy, malt, toffee Sweet bitter balance No Bays Brewery Devon Dumpling 5.1 Golden, Amber Pineapple, Fruity, Spicy Full, Herbal, Complex Fruit No Bays Brewery Gold 4.3 Golden, Amber Orange, Grapefruit, Floral Soft, Fruity, Zesty No Bays Brewery Springtime 4.5 Ruby, Rich Toffee, Sweet Malty, Full, Moreish No Bays Brewery Topsail 4.0 Rich, Amber Soft Fruits, Toffee, Vanilla Malty, Refreshing, Crisp No Beat Ales Metal Head ‐ Stout 4.8 -

Happy New Year from All at Dayla! See Our Pricebuster Cask Ales to Beat the January Blues!

JANUARY 2015 Happy New Year from all at Dayla! See our Pricebuster Cask Ales to beat the January Blues! 3.8% 3.6% 6£59.50 6£59.50 I See pages 8 - 12 for our I James Pettit wine sale CLEARANCE SALE INSIDE DRINKS DISTRIBUTORS · AN INDEPENDENT FAMILY BUSINESS AWARDED CASK MARQUE EVERY YEAR SINCE 2006 SALES HOTLINE: 01296 630013 CRAFT BEER NOW AVAILABLE · WWW.DAYLADRINKS.CO.UK COOPER'S CHOICE JANUARY 2015 COOPER'S CHOICE JANUARY 2015 SHARP'S OF CORNWALL NORTH COTSWOLD BREWERY TRING OF HERTFORDSHIRE NORTH COTSWOLD BREWERY CORNISH COASTER 3.6% WINDRUSH 3.6% KOTUKU 4.0% COTSWOLD BEST 4.0% The fresh aroma of hops blends seamlessly An easy drinking straw colour best bitter with light fruity sweet notes. In the mouth A thirst quenching amber coloured session A light straw coloured ale with dry, made with finest English Challenger, Goldings the beer feels succulent and delivers a good bitter, brewed with English Challenger and crisp floral characteristics defined by and Fuggles hops. A popular ale appealing measure of hoppy bitterness.The finish First Gold hops for a traditional taste. A malty the inclusion of Rye Crystal malt and to drinkers that like a traditional best bitter. A is dry and hoppy with a light moreish slightly sweeter palate. NZ Waimea hops. bold claim “Cotswold’s Best” but we believe bitterness. it is! £73.95 9 Gallons £67.95 9 Gallons £74.80 9 Gallons £70.50 9 Gallons BAYS BREWERY OF DEVON HOOK NORTON OF COTSWOLDS WADWORTH OF WILTSHIRE B&T OF BEDFORDSHIRE TOPSAIL 4.0% LION 4.0% HENRY IPA 3.6% SHEFFORD BITTER 3.6% “A perfect balanced beer, full of fruit This golden brown beer, named A pleasant and well hopped session beer. -

Cicerone® Certification Program Australia & New Zealand Certified Beer Server Syllabus

Cicerone® Certification Program Australia & New Zealand Certified Beer Server Syllabus Updated 1 June 2019 This syllabus outlines the knowledge required of those preparing for the Certified Beer Server exam in Australia and New Zealand (for syllabi pertaining to other regions, visit cicerone.org). While this list is comprehensive in its scope of content, further study beyond the syllabus is necessary to fully understand each topic. The content tested on the Certified Beer Server exam is a subset of the information presented within the Master Cicerone® syllabus, and individual syllabi for all four levels of the program may be found on the cicerone.org website. Outline (Full syllabus begins on next page.) I. Keeping and Serving Beer A. Beer distribution B. Serving alcohol C. Beer storage D. Draught systems E. Beer glassware F. Serving bottled beer G. Serving draught beer II. Beer Styles A. Understanding beer styles B. Style parameters C. Beer style knowledge III. Beer Flavour and Evaluation A. Taste and flavour B. Identify normal flavours of beer and their source C. Off-flavour knowledge IV. Beer Ingredients and Brewing Processes A. Ingredients V. Pairing Beer with Food Appendix A – Australian Beer Styles © Copyright 2019, Cicerone® Certification Program For more information, visit cicerone.org or email [email protected] Cicerone® Certification Program Version 4.0 – 1 June 2019 Certified Beer Server Syllabus – Page 2 Full Syllabus I. Keeping and Serving Beer A. Beer distribution 1. Various parties participate in the production and delivery of beer in Australia and New Zealand a. Brewery – brews and packages beer into kegs, bottles, cans, etc.