GRAY TELEVISION, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HHS in the News

May 2021 Topics • Texas Receives $2.5B for Pandemic EBT • Emergency SNAP Benefits Extended for May • WIC Food Benefits Temporarily Expanded • HHSC Mental Health Programs and Services • Nursing Facilities Decrease Use of Antipsychotic Drugs • COVID-19 Cases Decrease at Senior Living Facilities • HHSC Connects with Older Texans • Nursing Home Hurricane Preparedness • HHSC Encourages Women’s Health Screenings • New Certification Rules for Certified Nurse Aides Texas Receives $2.5B for Pandemic EBT Federal pandemic food benefit enters 2nd round in Texas: What families of kids with free, reduced school meals need to know Amanda Cochran KPRC-TV Houston May 20, 2021 Gov. Abbott, HHSC announce approval of $2.5B in pandemic food benefits KIDY-TV San Angelo May 20, 2021 Texans Receive $2.5B in 2nd Round of Federal Pandemic Food Benefits: Gov. Abbott KXAS-TV - Dallas/Fort Worth May 20, 2021 1 Texas families with students receiving free or reduced-price lunches could be eligible for up to $1,200 in food aid Neelam Bohra Texas Tribune May 21, 2021 Texas families without access to school meals to get 2nd round of food assistance KTRK-TV Houston May 21, 2021 Gov. Abbott Announces Additional Food Benefits for Children Yantis Green San Angelo Live May 21, 2021 Texas families to get $2.5B in federal food benefits Corsicana Daily Sun May 24, 2021 Governor Abbott, HHSC Announce $2.5 Billion In Pandemic Food Benefits For Texas Families Irving Weekly May 25, 2021 Editorial: Helping Children: Low-income Texas parents to see something extra on their Lone Star -

Volume XII, No

March 31—April 6, 2011 Volume XII, No. 13 Willie Nelson added to line-up for “Kokua For Japan” on April 10 World-renowned entertainer Willie Nelson will perform at “Kokua For Japan,” a Hawai‘i-based radio, television and Internet fund raising event for the victims of the earthquake and tsunami in Japan. The event, staged by Clear Channel Radio Hawaii and Oceanic Time Warner Cable, will take place at the Great Lawn at the Hilton Hawaiian Village Beach Resort & Spa on April 10, 2011 from noon to 5 p.m. All proceeds to benefit the American Red Cross for the Japan earthquake and Pacific tsunami relief efforts. Nelson will join previously announced entertainers including: Henry Kapono with special guests Michael McDonald and Mick Fleetwood; Loretta Ables Sayre; The Brothers Cazimero; Cecilio & Kapono; Kalapana; Cecilio & Kompany; Amy Hanaialii; Na Leo; John Cruz; Natural Vibrations; ManoaDNA; Robi Kahakalau; Mailani; Taimane; Go Jimmy Go; Jerry Santos; Gregg Hammer Band; and Kenny Endo Taiko. On-air personalities from Clear Channel Radio and local broadcast and cable TV stations will host the program. “Kokua For Japan,” a Hawai‘i-based radio, television and Internet fund raising event for the victims of the earthquake and tsunami in Japan, will be held on Sunday, April 10, 2011 from noon to 5 p.m. The event, staged by Clear Channel Radio Hawaii and Oceanic Time Warner Cable, will take place at the Great Lawn at the Hilton Hawaiian Village Beach Resort & Spa. Tickets are available for $15 via Honolulu Box Office. Visit HonoluluBoxOffice.com for on-line purchasing or call 808-550-8457 for charge-by-phone. -

PUBLIC NOTICE Federal Communications Commission 445 12Th St., S.W

PUBLIC NOTICE Federal Communications Commission 445 12th St., S.W. News Media Information 202 / 418-0500 Internet: https://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 DA 18-782 Released: July 27, 2018 MEDIA BUREAU ESTABLISHES PLEADING CYCLE FOR APPLICATIONS FILED FOR THE TRANSFER OF CONTROL AND ASSIGNMENT OF BROADCAST TELEVISION LICENSES FROM RAYCOM MEDIA, INC. TO GRAY TELEVISION, INC., INCLUDING TOP-FOUR SHOWINGS IN TWO MARKETS, AND DESIGNATES PROCEEDING AS PERMIT-BUT-DISCLOSE FOR EX PARTE PURPOSES MB Docket No. 18-230 Petition to Deny Date: August 27, 2018 Opposition Date: September 11, 2018 Reply Date: September 21, 2018 On July 27, 2018, the Federal Communications Commission (Commission) accepted for filing applications seeking consent to the assignment of certain broadcast licenses held by subsidiaries of Raycom Media, Inc. (Raycom) to a subsidiary of Gray Television, Inc. (Gray) (jointly, the Applicants), and to the transfer of control of subsidiaries of Raycom holding broadcast licenses to Gray.1 In the proposed transaction, pursuant to an Agreement and Plan of Merger dated June 23, 2018, Gray would acquire Raycom through a merger of East Future Group, Inc., a wholly-owned subsidiary of Gray, into Raycom, with Raycom surviving as a wholly-owned subsidiary of Gray. Immediately following consummation of the merger, some of the Raycom licensee subsidiaries would be merged into Gray Television Licensee, LLC (GTL), with GTL as the surviving entity. The jointly filed applications are listed in the Attachment to this Public -

Tx-11 Tx-13 Tx-19

TV Station KAMC • Analog Channel 28, DTV Channel 27 • Lubbock, TX Expected Operation on June 13: Granted Construction Permit Digital CP (solid): 1000 kW ERP at 219 m HAAT, Network: ABC vs. Analog (dashed): 2000 kW ERP at 256 m HAAT, Network: ABC Market: Lubbock, TX NORTH Parmer Castro Swisher Briscoe Hall Muleshoe Olton Plainview Motley Bailey Lamb Hale Floyd Floydada Littlefield Ralls Dickens Hockley Crosby TX-13 Levelland Lubbock Cochran Lubbock TX-19 D27 A28 Kent Lynn Post Yoakum Brownfield Tahoka Terry Garza Denver City Dawson Gaines Borden Scurry Seminole Lamesa Snyder TX-11 2009 Hammett & Edison, Inc. 10MI 0 10 20 30 40 50 60 40 20 0 KM 20 Coverage gained after DTV transition Analog service 317,167 persons Digital service 359,365 No symbol = no change in coverage Analog loss 0 Digital gain 42,198 Net gain 42,198 BMPCDT-20070125ABW Map set 1 KAMC Digital CP TV Station KAMC • Analog Channel 28, DTV Channel 27 • Lubbock, TX Approved Post-Transition Operation: Granted Construction Permit Digital CP (solid): 1000 kW ERP at 219 m HAAT, Network: ABC vs. Analog (dashed): 2000 kW ERP at 256 m HAAT, Network: ABC Market: Lubbock, TX NORTH Parmer Castro Swisher Briscoe Hall Muleshoe Olton Plainview Motley Bailey Lamb Hale Floyd Floydada Littlefield Ralls Dickens Hockley Crosby TX-13 Levelland Lubbock Cochran Lubbock TX-19 D27 A28 Kent Lynn Post Yoakum Brownfield Tahoka Terry Garza Denver City Dawson Gaines Borden Scurry Seminole Lamesa Snyder TX-11 2009 Hammett & Edison, Inc. 10MI 0 10 20 30 40 50 60 40 20 0 KM 20 Coverage gained after DTV transition Analog service 317,167 persons Digital service 359,365 No symbol = no change in coverage Analog loss 0 Digital gain 42,198 Net gain 42,198 BMPCDT-20070125ABW Map set 2 KAMC Digital CP TV Station KCBD • Analog Channel 11, DTV Channel 11 • Lubbock, TX Expected Operation on June 13: Granted Construction Permit Digital CP (solid): 15.0 kW ERP at 232 m HAAT, Network: NBC vs. -

Supremacy WAKR -TV Akron, Ohio WAND Decatur, Ill

ABC -TV's affiliates: 185 going along for a much richer ride KAAL -TV Austin, Minn. KGO -TV San Francisco KOMO -TV Seattle KABC -TV Los Angeles KGTV San Diego KOVR Sacramento, Calif. KAIT -TV Jonesboro, Ark. KGUN -TV Tucson, Ariz. KPAX -TV Missoula, Mont. KAKE -TV Wichita, Kan. KHGI -TV Kearney, Neb. KPLM -TV Palm Springs, Calif. KAPP -TV Yakima, Wash. KHVO Hilo, Hawaii KPOB-TV Popular Bluffs, Mo. KATC Lafayette, La. KIII -TV Corpus Christi, Tex. KPVI Pocatello /Idaho Falls, Idaho KATU Portland, Ore. KIMO Anchorage KQTV St. Joseph, Mo. KATV Little Rock, Ark. KITV Honolulu KRCR -TV Redding, Calif. KBAK -TV Bakersfield, Calif. KIVI -TV Boise, Idaho KRDO Colorado Springs KBMT Beaumont, Tex. KIVV -TV Lead /Deadwood, S.D. KRGV -TV Weslaco, Tex. KBTX -TV Bryan, Tex. KJEO Fresno, Calif. KSAT-TV San Antonio, Tex. KBTV Denver KLTV-TV Tyler, Tex. KSHO -TV Las Vegas KCAU -TV Sioux City, Iowa KMBC -TV Kansas City, Mo. KSNB -TV Superior, Neb. KCBJ -TV Columbia, Mo. KMCC -TV Lubbock, Tex. KSWO -TV Lawton, Okla. KCNA -TV Albion, Neb. KMOM -TV Monahans, Tex. KTBS-TV Shreveport, La. KCRG -TV Cedar Rapids /Waterloo KMSP -TV Minneapolis KTEN Ada, Okla. KDUB Dubuque, Iowa KMTC Springfield, Mo. KTHI -TV Fargo /Grand Forks, N.D. KETV Omaha KNTV San Jose, Calif. KTRE -TV Lufkin, Tex. KEVN -TV Rapid City, S.D. KOAT-TV Albuquerque, N.M. KTRK -TV Houston KEYT Santa Barbara, Calif. KODE -TV Joplin, Mo. KTUL -TV Tulsa, Okla. KEZI -TV Eugene, Ore. KOCO -TV Oklahoma City KTVE -TV El Dorado, Ark. KFBB -TV Great Falls, Mont. -

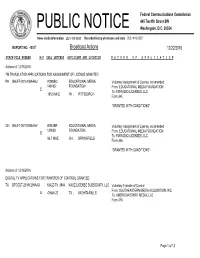

Broadcast Actions 12/22/2016

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48887 Broadcast Actions 12/22/2016 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 12/15/2016 FM TRANSLATOR APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED PA BALFT-20161004AAU W288BO EDUCATIONAL MEDIA Voluntary Assignment of License, as amended 148465 FOUNDATION From: EDUCATIONAL MEDIA FOUNDATION E To: FM RADIO LICENSES, LLC 105.5 MHZ PA , PITTSBURGH Form 345 *GRANTED WITH CONDITIONS* OH BALFT-20161004AAV W244BR EDUCATIONAL MEDIA Voluntary Assignment of License, as amended 139038 FOUNDATION From: EDUCATIONAL MEDIA FOUNDATION E To: FM RADIO LICENSES, LLC 96.7 MHZ OH , SPRINGFIELD Form 345 *GRANTED WITH CONDITIONS* Actions of: 12/16/2016 DIGITAL TV APPLICATIONS FOR TRANSFER OF CONTROL GRANTED TX BTCCDT-20161209AAO KAUZ-TV 6864 KAUZ LICENSE SUBSIDIARY, LLC Voluntary Transfer of Control From: SOUTHEASTERN MEDIA ACQUISITION, INC. E CHAN-22 TX , WICHITA FALLS To: AMERICAN SPIRIT MEDIA, LLC Form 316 Page 1 of 13 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48887 Broadcast Actions 12/22/2016 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 12/16/2016 DIGITAL TV APPLICATIONS FOR TRANSFER OF CONTROL GRANTED IA BTCCDT-20161209AAP KYOU-TV KYOU LICENSE SUBSIDIARY, LLC Voluntary Transfer of Control 53820 From: SOUTHEASTERN MEDIA ACQUISITION, INC. -

GRAY TELEVISION, INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934 Date of Report (Date of earliest event reported): October 16, 2013 (October 15, 2013) GRAY TELEVISION, INC. (Exact name of registrant as specified in its charter) Georgia 1-13796 58-0285030 (State of incorporation (Commission (IRS Employer or organization) File Number) Identification No.) 4370 Peachtree Road, NE, Atlanta, GA 30319 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (404) 504-9828 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 7.01. Regulation FD Disclosure. In connection with various meetings that management of Gray Television, Inc. (the “Company”) expects to hold with investors, the Company has prepared a slide presentation. A copy of the slides to be used in connection with such investor meetings is furnished as Exhibit 99.1 hereto and incorporated herein by this reference. -

He KMBC-ÍM Radio TEAM

l\NUARY 3, 1955 35c PER COPY stu. esen 3o.loe -qv TTaMxg4i431 BItOADi S SSaeb: iiSZ£ (009'I0) 01 Ff : t?t /?I 9b£S IIJUY.a¡:, SUUl.; l: Ii-i od 301 :1 uoTloas steTaa Rae.zgtZ IS-SN AlTs.aantur: aTe AVSí1 T E IdEC. 211111 111111ip. he KMBC-ÍM Radio TEAM IN THIS ISSUE: St `7i ,ytLICOTNE OSE YN in the 'Mont Network Plans AICNISON ` MAISHAIS N CITY ive -Film Innovation .TOrEKA KANSAS Heart of Americ ENE. SEDALIA. Page 27 S CLINEON WARSAW EMROEIA RUTILE KMBC of Kansas City serves 83 coun- 'eer -Wine Air Time ties in western Missouri and eastern. Kansas. Four counties (Jackson and surveyed by NARTB Clay In Missouri, Johnson and Wyan- dotte in Kansas) comprise the greater Kansas City metropolitan trading Page 28 Half- millivolt area, ranked 15th nationally in retail sales. A bonus to KMBC, KFRM, serv- daytime ing the state of Kansas, puts your selling message into the high -income contours homes of Kansas, sixth richest agri- Jdio's Impact Cited cultural state. New Presentation Whether you judge radio effectiveness by coverage pattern, Page 30 audience rating or actual cash register results, you'll find that FREE & the Team leads the parade in every category. PETERS, ñtvC. Two Major Probes \Exclusive National It pays to go first -class when you go into the great Heart of Face New Senate Representatives America market. Get with the KMBC -KFRM Radio Team Page 44 and get real pulling power! See your Free & Peters Colonel for choice availabilities. st SATURE SECTION The KMBC - KFRM Radio TEAM -1 in the ;Begins on Page 35 of KANSAS fir the STATE CITY of KANSAS Heart of America Basic CBS Radio DON DAVIS Vice President JOHN SCHILLING Vice President and General Manager GEORGE HIGGINS Year Vice President and Sally Manager EWSWEEKLY Ir and for tels s )F RADIO AND TV KMBC -TV, the BIG TOP TV JIj,i, Station in the Heart of America sú,\.rw. -

Brief for Respondents

No. 10-1293 In the Morris Tyler Moot Court of Appeals at Yale FEDERAL COMMUNICATIONS COMMISSION, ET AL., PETITIONERS v. FOX TELEVISION STATIONS, INC., ET AL., RESPONDENTS FEDERAL COMMUNICATIONS COMMISSION AND UNITED STATES OF AMERICA, PETITIONERS v. ABC, INC., ET AL., RESPONDENTS ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE SECOND CIRCUIT BRIEF FOR THE RESPONDENTS LEWIS BOLLARD JONATHAN SIEGEL Counsel for Respondents The Yale Law School 127 Wall Street New Haven, CT 06511 (203) 432–4992 QUESTIONS PRESENTED The FCC forbids the broadcasting of indecent speech, defined “as material that, in context, depicts or describes sexual or excretory activities or organs in terms patently offensive as measured by contemporary community standards for the broadcast medium.” J.A. 49. The questions presented are: 1. Whether the FCC’s definition of indecency violates the Fifth Amendment because it is impermissibly vague. 2. Whether the FCC’s ban on indecency violates the First Amendment because it is not narrowly tailored and because it does not require scienter for liability. i PARTIES TO THE PROCEEDINGS Petitioners are the Federal Communications Commission and the United States of America. Respondents who were petitioners in the court of appeals in Fox Television Stations, Inc. v. FCC are: Fox Television Stations, Inc., CBS Broadcasting Inc., WLS Television, Inc., KTRK Television, Inc., KMBC Hearst-Argyle Television, Inc., and ABC Inc. Respondents who were intervenors in the court of appeals in Fox Television Stations, Inc. v. FCC are: NBC Universal, Inc., NBC Telemundo License Co., NBC Television Affiliates, FBC Television Affiliates Association, CBS Television Network Affiliates, Center for the Creative Community, Inc., doing business as Center for Creative Voices in Media, Inc., and ABC Television Affiliates Association. -

Journal, Summer 2009 | National Association of Black Journalists

Journal, Summer 2009 | www.nabj.org | National Association of Black Journalists | 1 2 | National Association of Black Journalists | www.nabj.org | Journal, Summer 2009 Table of Contents Features 6 – Prime Movers. Program started by former NABJ President grooms future journalists 8 – The Contenders. Angelo Henderson and Kathy Times are both able, willing and passionate about being the next NABJ President. See how the candidates, as well as the candidates for the 2009-2011 Board of Directors, stack up. Cover Story – NABJ Special Honors 12 – Journalist of the Year – National Public Radio’s Michele Norris 16 – Lifetime Achievement – Michael Wilbon 18 – Legacy Award – Sandra Rosenbush and Leon Carter 20 – Student Journalist of the Year – Jamisha Purdy 22 – Educator of the Year – Lawrence Kaggwa 24 – Hall of Famers – Caldwell, Norment, Peterman and Whiteside inducted 26 – Emerging Journalist of the Year – Cynthia Gordy, Essence Magazine 27 – Community Service Award – The Chauncey Bailey Project 27 – Percy Qoboza Foreign Journalist Award – Andrison Shadreck Manyere NABJ Convention 30 – Welcome to Tampa. Departments President’s Column .............................................................4 8 – Election 2009: Kathy Times, the current NABJ Executive Director .............................................................5 VP of Broadcast, and Angelo Henderson, a former Comings and Goings .......................................................34 parliamentarian, are both now seeking the organization’s Passages .........................................................................35 presidency. Read more on page 8. Photos by Ad Seymour. Cover Photo by Mark Gail / Washington Post The NABJ Journal (USPS number pending) is published quarterly by the National Association of Black Journalists (NABJ) at 8701-A Adelphi Road, Adelphi, MD 20783-1716. Pending periodicals postage is paid at Adelphi, MD. NABJ is the largest organization of journalists of color in the nation. -

Kmsb, Kttu Eeo Public File Report I. Vacancy List

Page: 1/11 KMSB, KTTU EEO PUBLIC FILE REPORT May 20, 2020 - May 21, 2021 I. VACANCY LIST See Section II, the "Master Recruitment Source List" ("MRSL") for recruitment source data Recruitment Sources ("RS") RS Referring Job Title Used to Fill Vacancy Hiree Account Executive 1-22 12 National Account Manager 1-11, 13-18, 20-22 17 Account Executive - 9990 6, 17 17 Page: 2/11 KMSB, KTTU EEO PUBLIC FILE REPORT May 20, 2020 - May 21, 2021 II. MASTER RECRUITMENT SOURCE LIST ("MRSL") Source Entitled No. of Interviewees RS to Vacancy Referred by RS RS Information Number Notification? Over (Yes/No) Reporting Period Arizona Broadcasters Association 426 N 44th St Ste 310 Phoenix, Arizona 85008 1 Phone : 602-252-4833 N 0 Url : http://www.azbroadcasters.org Jennifer Latko Manual Posting Arizona Hispanic Chamber of Commerce 255 E Osborn Rd #201 Phoenix, Arizona 85012 2 Phone : 602-294-6086 N 0 Email : [email protected] Fax : 1-602-279-8900 Joseph Ortiz Arizona State University POB 871312, Student Svc Bldg #329 Tempe, Arizona 85287 3 Phone : 480-965-5112 N 0 Email : [email protected] Career Services Arizona State University of Cronkite Alumni-Walter Cronkite School of Jour. & Mass Comm. Stauffer Hall A 231 PO Box 871305 Tempe, Arizona 85287 4 Phone : 480-965-5011 N 0 Email : [email protected] Fax : 1-480-965-7041 Mike Wong Arizona@Work 2797 E Ajo Way Tucson, Arizona 85713 5 Phone : 520-243-6700 N 0 Rosemary Cora-Cruz Manual Posting Career Builder 200 N. LaSalle St Suite 1100 Chicago, Illinois 60601 6 Phone : 773-527-3600 N 0 Url : http://www.careerbuilder.com Career Service Manual Posting Page: 3/11 KMSB, KTTU EEO PUBLIC FILE REPORT May 20, 2020 - May 21, 2021 II. -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees.