Spirent TTCN-3 Introduction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fund Fact Sheet

Franklin Templeton Funds GB00B3ZGH246 FTF Franklin UK Mid Cap Fund - A 31 July 2021 (inc) Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund GBP Performance over 5 Years in Share Class Currency (%) Total Net Assets (GBP) 1.16 billion FTF Franklin UK Mid Cap Fund A (inc) FTSE 250 ex-Investment Trusts Index Fund Inception Date 17.10.2011 180 Number of Issuers 36 Benchmark FTSE 250 ex-Investment 160 Trusts Index IA Sector UK All Companies 140 ISA Status Yes 120 Summary of Investment Objective The Fund aims to grow in value by more than the FTSE 250 100 (ex-Investment Trusts) Index, from a combination of income and investment growth over a three to five-year period after all fees and costs are deducted. 80 07/16 01/17 07/17 01/18 07/18 01/19 07/19 01/20 07/20 01/21 07/21 Fund Management Discrete Annual Performance in Share Class Currency (%) Richard Bullas: United Kingdom 07/20 07/19 07/18 07/17 07/16 Mark Hall: United Kingdom 07/21 07/20 07/19 07/18 07/17 Dan Green, CFA: United Kingdom A (inc) 36.52 -12.79 -1.25 9.89 23.81 Marcus Tregoning: United Kingdom Benchmark in GBP 42.85 -15.10 -4.98 8.39 17.21 Ratings - A (inc) Performance in Share Class Currency (%) Cumulative Annualised Overall Morningstar Rating™: Since Since Asset Allocation 1 Mth 3 Mths 6 Mths YTD 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (inc) 4.45 5.93 20.14 16.83 36.52 17.58 59.90 821.63 5.55 9.84 10.60 Benchmark in GBP 3.24 3.01 16.86 15.60 42.85 15.25 46.41 622.69 4.84 7.92 9.38 Prior to 7 August 2021, the Fund was named Franklin UK Mid Cap Fund. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The Importance of Human Motion for Simulation Testing of GNSS

The Importance of Human Motion for Simulation Testing of GNSS Kimon Voutsis, Paul D Groves, University College London, United Kingdom Mark Holbrow, Colin Ford, Spirent Communications plc, United Kingdom BIOGRAPHY ABSTRACT Kimon Voutsis is a PhD student of the Space Geodesy and Human motion is generally considered benign to the Navigation Laboratory (SGNL) at University College performance of global navigation satellite system (GNSS) London (UCL). He is interested in positioning sensors and and other positioning sensors. This study proves that this is navigation systems, human biomechanics and routing not the case, even for typical human behaviour involving models. The aim of his current research is the development GNSS user equipment, e.g. in smartphones. Using of a pedestrian motion model intended for testing the recorded human motion, it is shown that phase-lock loops performance of positioning sensors in a simulation (PLLs) in GNSS receivers are sensitive to jerk dynamics environment. He holds a first-class Bachelor (Hons) in induced by user motion, resulting in carrier cycle slips. Geography from Harokopio University of Athens, Greece and an MSc in Geographic Information Science from UCL. To test the effects of human dynamics on GNSS carrier He has worked for three years in technical analysis and tracking, real human motion profiles were captured. These developing GIS software solutions for the transport profiles comprised typical types of movements using a industry. ([email protected]) mobile phone, e.g. holding, answering and texting, different types of activities, e.g. walking or jogging, as well Dr Paul Groves is a Lecturer (academic faculty member) at as different phone locations on the human body, e.g. -

Company Date of Meeting Event Resolution

Date of Resolution Company meeting Event number Resolution Vote Henderson Group plc 01/05/2013 AGM 2 To adopt the remuneration report for the year ended 31 December 2012 Against Spirent Communications plc 01/05/2013 AGM 2 To adopt the remuneration report for the year ended 31 December 2012 Abstain Spirent Communications plc 01/05/2013 AGM 11 To re-appoint as auditors, Ernst & Young LLP Against Spirent Communications plc 01/05/2013 AGM 12 To authorise the directors to determine the auditor's remuneration Against 4imprint Group plc 01/05/2013 AGM 3 To adopt the remuneration report for the year ended 31 December 2012 Abstain Aga Rangemaster Group plc 01/05/2013 AGM 9 To re-appoint as auditors, Ernst & Young LLP Abstain Aga Rangemaster Group plc 01/05/2013 AGM 10 To authorise the directors to determine the auditor's remuneration Abstain 4imprint Group plc 01/05/2013 AGM 10 To re-appoint PricewaterhouseCoopers LLP as auditors Against 4imprint Group plc 01/05/2013 AGM 11 To authorise the directors to determine the auditor's remuneration Against Ladbrokes plc 01/05/2013 AGM 12 To re-appoint as auditors, Ernst & Young LLP Against Ladbrokes plc 01/05/2013 AGM 13 To authorise the directors to determine the auditor's remuneration Against Ladbrokes plc 01/05/2013 AGM 14 To adopt the remuneration report for the year ended 31 December 2012 Against Novae Group plc 01/05/2013 AGM 2 To adopt the remuneration report for the year ended 31 December 2012 Abstain Novae Group plc 01/05/2013 AGM 13 To re-appoint as auditors, KPMG Audit plc Abstain Novae Group -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

Networks – Software Defined Solutions and Services Eine Untersuchung Der Information Services Germany 2021 Group Germany Gmbh

Networks – Software Defined Solutions and Services Eine Untersuchung der Information Services Germany 2021 Group Germany GmbH Quadrant Report Customized report courtesy of: Juni 2021 ISG Provider Lens™ Quadrant Report | Juni 2021 Section Name Über diesen Bericht Information Services Group übernimmt die alleinige Verantwortung für diesen Das ISG Provider Lens™ Programm bietet marktführende, handlungsorientierte Bericht. Soweit nicht anders angegeben, wurden sämtliche Inhalte, u.a. Abbildungen, Studien, Berichte und Consulting Services, bei denen es insbesondere um die Stärken Marktforschungsdaten, Schlussfolgerungen, Aussagen und Stellungnahmen im und Schwächen von Technologieanbietern und Dienstleistern sowie deren Position- Rahmen dieses Berichtes von Information Services Group, Inc. entwickelt und sind ierung im Wettbewerbsumfeld geht. Diese Berichte bieten maßgebliche Einsichten, die Alleineigentum von Information Services Group Inc. von unseren Advisors im Rahmen ihrer Beratungstätigkeit bei Outsourcing-Verträgen Die in diesem Bericht vorgestellten Marktforschungs- und Analysedaten umfassen genutzt werden, aber auch von vielen ISG-Unternehmenskunden, die potentiell als Research-Informationen aus dem ISG Provider Lens™ Programm sowie aus Outsourcer auftreten (z.B. FutureSource). kontinuierlich laufenden ISG Research-Programmen, Gesprächen mit ISG- Advisors, Briefings mit Dienstleistern und Analysen von öffentlich verfügbaren Weitere Informationen zu unseren Studien sind über [email protected], Marktinformationen aus unterschiedlichen -

FTSE UK 100 ESG Select

2 FTSE Russell Publications 19 August 2021 FTSE UK 100 ESG Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.83 UNITED KINGDOM Halfords Group 0.06 UNITED KINGDOM Prudential 2.67 UNITED KINGDOM 888 Holdings 0.08 UNITED KINGDOM Harbour Energy PLC 0.01 UNITED KINGDOM Rathbone Brothers 0.08 UNITED KINGDOM Anglo American 2.62 UNITED KINGDOM Helical 0.03 UNITED KINGDOM Reckitt Benckiser Group 3.01 UNITED KINGDOM Ashmore Group 0.13 UNITED KINGDOM Helios Towers 0.07 UNITED KINGDOM Rio Tinto 4.8 UNITED KINGDOM Associated British Foods 0.65 UNITED KINGDOM Hiscox 0.21 UNITED KINGDOM River and Mercantile Group 0.01 UNITED KINGDOM Aviva 1.18 UNITED KINGDOM HSBC Hldgs 6.33 UNITED KINGDOM Royal Dutch Shell A 4.41 UNITED KINGDOM Barclays 2.15 UNITED KINGDOM Imperial Brands 1.09 UNITED KINGDOM Royal Dutch Shell B 3.85 UNITED KINGDOM Barratt Developments 0.52 UNITED KINGDOM Informa 0.56 UNITED KINGDOM Royal Mail 0.39 UNITED KINGDOM BHP Group Plc 3.29 UNITED KINGDOM Intermediate Capital Group 0.44 UNITED KINGDOM Schroders 0.29 UNITED KINGDOM BP 4.66 UNITED KINGDOM International Personal Finance 0.02 UNITED KINGDOM Severn Trent 0.44 UNITED KINGDOM British American Tobacco 4.75 UNITED KINGDOM Intertek Group 0.66 UNITED KINGDOM Shaftesbury 0.12 UNITED KINGDOM Britvic 0.19 UNITED KINGDOM IP Group 0.09 UNITED KINGDOM Smith (DS) 0.4 UNITED KINGDOM BT Group 1.26 UNITED KINGDOM Johnson Matthey 0.43 UNITED KINGDOM Smurfit Kappa Group 0.76 UNITED KINGDOM Burberry Group 0.62 UNITED KINGDOM Jupiter Fund Management 0.09 UNITED KINGDOM Spirent Communications 0.11 UNITED KINGDOM Cairn Energy 0.05 UNITED KINGDOM Kingfisher 0.57 UNITED KINGDOM St. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, March 31, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 96.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.4% Legrand SA 131,321 8,375,908 AGL Energy Ltd. 880,686 9,216,678 L’Oreal SA 104,607 27,073,419 Aristocrat Leisure Ltd. 728,775 9,443,206 Orange SA 949,535 11,496,452 ASX Ltd. 162,820 7,642,885 Peugeot SA 1,014,598 13,209,331 BHP Group Ltd. 471,264 8,549,345 Schneider Electric SE 553,434 46,777,833 CIMIC Group Ltd. 332,784 4,713,315 STMicroelectronics NV 400,446 8,608,225 CSL Ltd. 166,037 30,097,798 Total SA 1,095,152 41,264,011 Fortescue Metals Group Ltd. 4,669,354 28,614,857 Total 209,274,345 (a),(b) IDP Education Ltd. 447,152 3,487,548 Germany 4.2% Inghams Group Ltd. 1,200,179 2,405,115 Adidas AG 22,586 5,014,708 Magellan Financial Group Ltd. 729,823 19,356,167 Allianz SE, Registered Shares 319,746 54,451,936 Regis Resources Ltd. 1,318,187 2,929,557 Continental AG 32,324 2,304,645 Santos Ltd. 4,606,425 9,460,470 Dialog Semiconductor PLC(c) 82,878 2,154,248 (c) Saracen Mineral Holdings Ltd. 3,513,246 7,900,242 Hugo Boss AG 273,602 6,848,821 Technology One Ltd. 897,813 4,336,750 MTU Aero Engines AG 74,698 10,801,095 Total 148,153,933 SAP SE 91,344 10,198,367 Austria 0.2% Siemens Healthineers AG 179,517 6,939,504 OMV AG 81,189 2,221,890 Total 98,713,324 Raiffeisen Bank International AG 111,223 1,599,856 Hong Kong 3.9% Total 3,821,746 CK Hutchison Holdings Ltd. -

Direct Equity Investments 310315

Security Name ISIN ABERDEEN ASSET MANAGEMENT PLC COMMON STOCK GBP 10 GB0000031285 AMEC FOSTER WHEELER PLC COMMON STOCK GBP 50 GB0000282623 ANTOFAGASTA PLC COMMON STOCK GBP 5 GB0000456144 ASHTEAD GROUP PLC COMMON STOCK GBP 10 GB0000536739 BHP BILLITON PLC COMMON STOCK GBP 0.5 GB0000566504 ARM HOLDINGS PLC COMMON STOCK GBP 0.05 GB0000595859 WS ATKINS PLC COMMON STOCK GBP 0.5 GB0000608009 BARRATT DEVELOPMENTS PLC COMMON STOCK GBP 10 GB0000811801 BELLWAY GBP0.125 GB0000904986 BALFOUR BEATTY PLC COMMON STOCK GBP 50 GB0000961622 BTG ORD GBP0.10 GB0001001592 BIOSCIENCE INVESTMENT TRUST ORD GBP0.25 GB0001121879 BRITISH LAND CO PLC/THE REIT GBP 25 GB0001367019 SKY PLC COMMON STOCK GBP 50 GB0001411924 TULLOW OIL PLC COMMON STOCK GBP 10 GB0001500809 J D WETHERSPOON PLC COMMON STOCK GBP 2 GB0001638955 DIPLOMA ORD GBP0.05 GB0001826634 BOVIS HOMES GROUP GBP0.50 GB0001859296 AVIVA PLC COMMON STOCK GBP 25 GB0002162385 CRODA INTERNATIONAL PLC COMMON STOCK GBP 10 GB0002335270 DIAGEO PLC COMMON STOCK GBP 28.93518 GB0002374006 SCHRODERS VTG SHS GBP1 GB0002405495 ELEMENTIS PLC COMMON STOCK GBP 5 GB0002418548 DCC PLC COMMON STOCK GBP 0.25 IE0002424939 DAIRY CREST GROUP PLC COMMON STOCK GBP 25 GB0002502812 BAE SYSTEMS PLC COMMON STOCK GBP 2.5 GB0002634946 DERWENT LONDON PLC ORD GBP 0.05 GB0002652740 BRITISH AMERICAN TOBACCO PLC COMMON STOCK GBP 25 GB0002875804 ELECTROCOMPONENTS ORD GBP0.10 GB0003096442 SPECTRIS PLC COMMON STOCK GBP 5 GB0003308607 PREMIER FARNELL ORD GBP0.05 GB0003318416 FENNER PLC COMMON STOCK GBP 25 GB0003345054 FIRSTGROUP ORD GBP0.05 GB0003452173 -

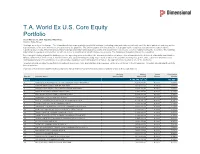

T.A. World Ex U.S. Core Equity Portfolio As of March 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

T.A. World Ex U.S. Core Equity Portfolio As of March 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021 FTF - FTF Franklin UK Mid Cap August 31, 2021 Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date B132NW2 ASHMORE GROUP PLC 5,750,000 £22,954,000 1.89% N/A N/A 0066701 AVON PROTECTION PLC 701,792 £13,186,671 1.08% N/A N/A 0090498 BELLWAY PLC 925,000 £32,550,750 2.68% N/A N/A B3FLWH9 BODYCOTE PLC 4,450,000 £42,920,250 3.53% N/A N/A BMH18Q1 BYTES TECHNOLOGY GROUP PLC 4,500,000 £23,130,000 1.90% N/A N/A 0231888 CRANSWICK PLC 935,000 £37,082,100 3.05% N/A N/A 0265274 DERWENT LONDON PLC 825,000 £31,292,250