Bendigo and Adelaide Bank Submission: Inquiry Into Regional Development and Decentralisation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Annual Financial Report

Annual Financial Report 2018 Annual Financial Report 2018 A Contact us Bendigo and Adelaide Bank Limited ABN 11 068 049 178 Registered head office The Bendigo Centre Bendigo VIC Australia 3550 Telephone: 1300 236 344 +61 3 5445 0666 (if calling from overseas) Shareholder enquiries Share Registry 1800 646 042 Email: [email protected] B Annual Financial Report 2018 Table of contents Section 1 Message from the Chairman 2 Message from the Managing Director 3 Directors’ Report 4 Operating and Financial Report 12 Remuneration Report 28 Section 2 Financial Statements 51 Directors’ Declaration 123 Independent Auditor’s Report 124 Section 3 Key Performance Indicators 132 Additional Information 133 Annual Financial Report 2018 1 Message from the If trust in banking is to Chairman be restored, it is crucial This year we announced a solid full year result. that organisations with Total cash earnings were $445.1 million, up different objectives 6.4%, cash earnings per share were 92 cents and standards are per share, up by 4.1%, and dividends totalled able to compete on a 70 cents, up by 2 cents. In a very difficult level playing field and year for the banking industry, it was a strong customers can choose performance by your Bank. accordingly. There have been a number of significant milestones celebrated this year. On 9 July, we celebrated the 160th anniversary of the founding of the first Bendigo Building Society. In a year when the Royal Commission into misconduct in the financial Robert Johanson services industry has revealed some appalling behaviours, Chairman it has been useful to remind ourselves why the business was founded and what is its purpose. -

Select Committee on Financial Technology and Regulatory Technology

The Senate Select Committee on Financial Technology and Regulatory Technology Select Committee on Financial Technology and Regulatory Technology Interim report September 2020 © Commonwealth of Australia 2020 ISBN 978-1-76093-108-7 This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License. The details of this licence are available on the Creative Commons website: http://creativecommons.org/licenses/by-nc-nd/3.0/au/. Printed by the Senate Printing Unit, Parliament House, Canberra Committee Members Chair Senator Andrew Bragg LP, NSW Deputy Chair Senator Marielle Smith ALP, SA Members Senator Susan McDonald NATS, QLD Senator Rex Patrick IND, SA Senator Paul Scarr LP, QLD Senator Jess Walsh ALP, VIC Secretariat Lyn Beverley, Committee Secretary Christopher Sautelle, Principal Research Officer Kate Campbell, Senior Research Officer Elise Gruttner, Senior Research Officer Claire Rhodes, 2019 Graduate Program Margaret Cahill, Research Officer Shannon Ross, Administrative Officer Committee Webpage: http://www.aph.gov.au/senate_FinRegtech PO Box 6100 Phone: + 61 2 6277 3535 Parliament House Fax: + 61 2 6277 5818 Canberra ACT 2600 Email: [email protected] Australia iii Table of Contents Committee Members ........................................................................................................................ iii List of Recommendations ............................................................................................................... vii Chair's Foreword ............................................................................................................................ -

Annual Review 2017

Annual Review 2017 Annual Review 2017 1 Contents 1.6 million 100,800 3 Financial Performance Customers Shareholders 4 Our Group Strategy 5 Our Diverse Business 11.61% 12.46% Cash basis return Total capital 6 Innovation, Awards and Recognition on tangible equity 8 Message from the Chairman 71.4 billion 418.3 million 9 Message from the Managing Director Total assets Cash earnings after tax 10 Building 21st Century Communities 20 Financial Inclusion and Participation 243.4 million Top 70 Total tax paid ASX listed company 26 Investing in Future Generations 30 Board 31 Executive 68c 311 million Dividend per share Total dividends paid Front cover – The front cover image was captured at the “Be the Change” filming. Photographed at the Clifton Hill/North Fitzroy Community Bank® branch, “Be the Change” shows that our customers create change every day because they bank with us. A change for good. A change for better. This change has a real and positive impact on people and communities right across Australia. 2 Annual Review 2017 Bendigo and Adelaide Bank employees Jennae Parker, Wendy Kennedy and Josh Pell. Our full year lending growth was amongst the strongest in the industry at 6.4%. However, recent APRA lending caps Financial have somewhat restricted that growth across the Retail (7.7%), and Third Party channels. Margin expansion was strong in the Performance second half, up 8 basis points half on half, with an exit margin of 2.34 percent. A focus on efficiency has resulted in expenses remaining Bendigo and Adelaide Bank announced an after tax flat year on year, with the cost to income ratio moving down statutory profit of $429.6 million for the 12 months to 56.1 percent as productivity gains flow from a continued ending 30 June 2017. -

Australian Banks Financing Coal and Renewable Energy

Australian banks financing coal and renewable energy A research paper prepared for Greenpeace Australia Pacific Australian banks financing coal and renewable energy A research paper prepared for Greenpeace Australia Final version: 7 September 2010 Jan Willem van Gelder Anna van Ojik Julia Padberg Petra Spaargaren Profundo Radarweg 60 1043 NT Amsterdam The Netherlands Tel: +31-20-8208320 E-mail: [email protected] Website: www.profundo.nl Contents Chapter 1 Methodology ..........................................................................................2 1.1 Objective......................................................................................................2 1.2 Definitions ...................................................................................................2 1.3 Research activities......................................................................................2 Chapter 2 Bank profiles..........................................................................................5 2.1 Australia and New Zealand Banking Group (ANZ)....................................5 2.2 Bendigo Bank..............................................................................................7 2.3 Commonwealth Bank..................................................................................8 2.4 mecu ............................................................................................................9 2.5 National Australia Bank ............................................................................10 2.6 -

Bendigoand Adelaidebank Milestones

Bendigoand AdelaideBank Milestones fullannualreport08 Contents 1 Financial Calendar Bendigo and Adelaide Bank Limited 2008/2009 ABN 11 068 049 178 2 Report by Chairman Registered Head Office and Managing Director The Bendigo Centre PO Box 480 4 Results at a Glance Bendigo VIC Australia 3552 5 Bendigo and Telephone: 03 5485 6444 Adelaide Limited Facsimile: 03 5485 7668 > Our New Bank Email: [email protected] 6 Our Milestones In this report, the expression “the Bank”, “the Company” or 7 Our Community “the Group” refers to Bendigo and Adelaide Bank Limited and its controlled entities. 9 Our Retail Business Customer/Shareholder Inquiries 10 Our Wholesale Customer Help Centre Businesses (Head Office inquiries) 1300 361 911 (local call) 11 Specialised Products Mondays to Fridays 12 Our Wealth 8.30am – 6.30pm Australian Eastern Standard Time/ Businesses Australian Eastern Daylight Time (AEST/AEDT) 13 Our Future Bendigo OnCall 14 Our Technology (Bendigo Bank customer inquiries) 1300 366 666 (local call) 14 Our Partners 8.00am – 8.00pm weekdays 15 Our Staff 9.00am – 4.00pm Saturdays 10.00am – 4.00pm Sundays 16 Executive Profiles (AEST/AEDT) 18 Shareholder Adelaide Bank customers Information 13 22 20 (within SA) or 1300 65 22 20 (outside SA) 19 Financials 8.00am – 8.00pm weekdays 9.00am – 6.00pm Saturdays 10.00am – 6.00pm Sundays Australian Central Standard Time/ Australian Central Daylight Time (ACST/ACDT) 24-hour Phone Bank Bendigo Bank customers -1300 366 666 (local call) Adelaide Bank customers - 08 8300 7000 or 1300 300 893 -

Discharge Authority Instructions for Completion

Discharge Authority Instructions for Completion Please read these instructions carefully before completing the Discharge Authority Section 1: Customer Details Please include details of Customer Name/s and Customer Number/s of the loan/s to be repaid. Include any other parties to the loan/s as detailed in your Letter of Offer (i.e. security providers/guarantors). Please use an additional form if there are more than four parties to the loan. Section 2: Property/Security to be released Detail each security to be released. If the security is real property, full address and title reference details are required. If the number of securities to be released exceeds 3, please use an additional form. Section 3: Settlement Type Sale: Indicates that you have sold your property and a Contract of Sale has been completed and signed by all parties to the Contract. The Contract Settlement Date and Sale Price provided must reflect the details as disclosed in the Contract of Sale. Section 27 (Victorian properties only): The purchaser may agree to release the deposit amount to you prior to settlement. If this box is ticked, the Bank will prepare a Section 27 letter and forward to the solicitor/conveyancer named in Section 4 of the Discharge Authority. Refinance: Indicates you are moving your loan/s to another financial institution. The name of this financial institution is to be completed in this section. Paid in Full: Indicates that loan/s secured by your property have been repaid in full from your own personal funds and this security is no longer required. -

BENDIGO and ADELAIDE BANK LIMITED A$7,500,000,000 Debt

Information Memorandum BENDIGO AND ADELAIDE BANK LIMITED (ABN 11 068 049 178) A$7,500,000,000 Debt Instrument Programme Dealers Australia and New Zealand Bendigo and Adelaide Bank Banking Group Limited Limited (ABN 11 005 357 522) (ABN 11 068 049 178) Deutsche Bank AG, Sydney National Australia Bank Limited Branch (ABN 12 004 044 937) (ABN 13 064 165 162) Westpac Banking Corporation (ABN 33 007 457 141) 20 October 2020 i Contents Information Memorandum Important Notice 1 Corporate Profile 6 Programme Summary 7 A. Short Term Instrument Summary 18 B. Term Instrument Summary 19 Terms and Conditions of Notes 21 Terms and Conditions of TDs 66 Form of Pricing Supplement for Term Instruments 93 Australian Taxation 103 Selling Restrictions 109 Directory 117 1 Important Notice This Information Memorandum relates solely to the Debt Instrument Programme (the Programme) established for Bendigo and Adelaide Bank Limited (the Issuer) under which transferable deposits (TD) and subordinated or unsubordinated debt instruments (the Notes) (together, the Instruments) may be issued up to a maximum aggregate amount of A$7,500,000,000 (which amount may be increased from time to time by agreement between the Issuer and the Dealers (each as defined in the Programme Summary)). Date and currency of this Information Memorandum This Information Memorandum has been prepared by the Issuer as at the Preparation Date (as defined below). The delivery of the Information Memorandum at any time after the Preparation Date does not imply the information contained in it is accurate, timely and complete at any time subsequent to the Preparation Date. -

Chairman's Welcome

July 2014 Chairman’s welcome. Hi and welcome to our first of many informative newsletters to you and the wider community. This project has taken more than two-and-a-half years to come to fruition. There have been countless hours and effort to create an opportunity for our community to become both financially and socially sustainable in the years to come. I would like to thank all those that have helped along the way especially the members of the steering committee that helped build this into the reality of today. As you would be aware, we opened our Keith & Districts Community Bank® Branch on 24 March and had our official opening on 26 March. It was well attended, with more than 300 people from all over our district attending, plus special guests from Bendigo Bank and Tatiara council. We gave away $5,000 in donations on the evening, which will be the start of more to come into the future. This was all made possible by the existing customers of our Community Bank® branch, those that have shown faith in the project and supported us over the last two years by banking with us through Robe Community Bank® Branch, a big thank you to all who supported us, and we now look forward to providing our own staff and services from now and into the future. We are very pleased to have secured five fantastic staff members. Fiona Wilkinson is our Branch Manager, with more than 20 years of experience in banking, the past three years as Branch Manager at Tumby Bay District Community Bank® Branch. -

Deed of Settlement Great Southern Group Proceedings

DATED MAY 2014 DEED OF SETTLEMENT CONTENTS 1. DEFINITIONS AND INTERPRETATION .............................................................................. 5 2. CONDITIONS PRECEDENT ................................................................................................. 11 3. SCHEME OF ARRANGEMENT ............................................................................................ 11 4. SETTLEMENT OF CLAIMS INVOLVING BEN PARTIES AND JAVELIN ..................... 12 5. VARIATION OF JAVELIN BORROWERS' LOAN TERMS ............................................... 15 6. SETTLEMENT OF CLAIMS INVOLVING GREAT SOUTHERN COMPANIES AND DIRECTORS ........................................................................................................................... 19 7. COURT APPROVAL .............................................................................................................. 21 8. DISPOSAL OF PROCEEDINGS ............................................................................................ 22 9. FORD RECOVERY DEED AND SCOTT WYND RECOVERY DEED .............................. 22 10. LIQUIDATORS’ CLAIMS AND EMPLOYEE ENTITLEMENTS ...................................... 22 11. LIQUIDATORS' LIABILITY ................................................................................................. 23 12. NO ADMISSION OF LIABILITY .......................................................................................... 23 13. COVENANT BY M+K .......................................................................................................... -

Bendigo and Adelaide Bank Capital Notes Replacement Prospectus

CAPITAL NOTES PROSPECTUS AND CPS2 REINVESTMENT OFFER INFORMATION 5 November 2020 Prospectus for the issue of Capital Notes to raise $450 million with the ability to raise more or less Issuer: Bendigo and Adelaide Bank Limited ABN 11 068 049 178 | AFSL 237879 Arranger: Westpac Institutional Bank Joint Lead Managers: National Australia Bank Limited, Ord Minnett Limited, UBS AG, Australia Branch and Westpac Institutional Bank Co-Managers: Bell Potter Securities Limited, Crestone Wealth Management Limited, JBWere Limited and Shaw and Partners Limited II BENDIGO AND ADELAIDE BANK LIMITED Important Notices About this Prospectus Defined words and expressions and downloading, or printing, the This Prospectus relates to the Offer by Some capitalised words and expressions electronic Prospectus in Australia; Bendigo and Adelaide Bank Limited (ABN used in this Prospectus have defined • you must access and download the 11 068 049 178) (“BEN” or the “Bank”) of meanings. The Glossary in Appendix B electronic Prospectus in full; and Capital Notes (“Capital Notes”) at an Issue defines these words and expressions. • your Application will only be valid Price of $100 each to raise $450 million, where you have completed an Definitions specific to Capital Notes are with the ability to raise more or less. online Application Form available in clause 15 of the Capital Notes Terms in at www.BendigoCNoffer.com.au This Prospectus is dated 5 November Appendix A. If there is any inconsistency during the Offer Period. By lodging 2020 and was lodged with the in definitions between the Prospectus and an Application, you declare that you Australian Securities and Investments the Capital Notes Terms, the definitions were given access to the electronic Commission (“ASIC”) on that date. -

2020 ANNUAL the Helpmann Academy Is the Only Organisation of Its Kind in Australia

2020 ANNUAL The Helpmann Academy is the only organisation of its kind in Australia. We empower South Australia’s most promising emerging creatives to realise their visions and build sustainable practices. We provide professional development opportunities including grants and awards, fellowships, mentorships, masterclasses and seminars, advisory services and international artist residencies, all tailored specifically for South Australia’s higher education students, graduates and emerging artists. The Helpmann Academy is a unique collaborative partnership, unifying the skills and resources of the state’s universities. Since 1994 the Helpmann Academy has been supporting emerging creatives, promoting South Australia as a centre for excellence in creative education, and contributing to the artistic community of the state. The Helpmann Academy acknowledges that we are on Kaurna Country, its sovereignty never ceded. We acknowledge the Kaurna people as the custodians of the Adelaide Plains and as the first and enduring storytellers of this land. We recognise and celebrate their cultural heritage, beliefs and relationship with this country and pay respect to the Kaurna Elders; past, present, and emerging. Contact Us Helpmann Academy Staff (08) 7089 0720 Jane MacFarlane [email protected] Chief Executive Officer Suite 417, Level 4 Nadia Dolman 147 Pirie St Program and Events Manager Kaurna Yarta, Adelaide 5000 Olivia Power HelpmannAcademy Marketing and Engagement Manager Mahalia Tanner @HelpmannAcademy Communications and Development Coordinator www.helpmannacademy.com.au Pro-bono financial and administrative support provided by: Judith Halliday Aynih Concepcion Rebecca Wisbey 01 OUR VISION For emerging creative practitioners to prosper, be valued and celebrated. OUR PURPOSE To empower South Australia’s most promising emerging creatives to realise their visions and build sustainable practices. -

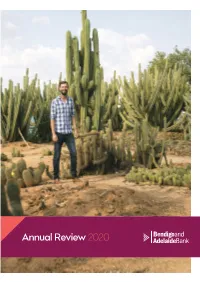

Annual Review 2020

Annual Review 2020 Front Cover 3 Highlights Small businesses come in all shapes and sizes, and 4 Our Strategy every business operates in different circumstances and faces a multitude of different situations. What 5 Our Business unifies small business owners is their innovation, commitment and resilience. One such business is 6 Message from the Chair Cactus Country, the brainchild of Jim Hall, who 7 Message from the Managing Director had a vision almost three decades ago to build Australia’s largest cactus farm. Jim and his son, John 8 Our Stakeholders Hall (pictured on cover), have brought that dream to 9 What Matters to Us fruition, growing and transforming the business from a half acre farm to a 12 acre property with a bar and 10 Customer Connection and Responsible Banking café, to meet ever changing customer preferences. With the assistance of Bendigo Bank to support 17 Enabling 21st Century Communities the expansion strategy, annual visitors to the farm 22 Supporting our people to be their best in Strathmerton, Victoria have gone from 4,000 to 25,000 people each year in just four years, bringing life 27 Growing with our Partners to the company mantra of “Go big or go home.” 29 Contributing to a Sustainable Future Bendigo Bank has more than 40,000 business customers, who form part of the Bank’s 1.9 million 34 Trust and Ethical Conduct customer network. They make important contributions 38 Good Corporate Governance to the lives of other Australians through their work and their community connections every day, backed by 40 Board the support of our Bank, who understand their unique opportunities and distinct challenges.