4053 Final COMMISSION DECISION of 4.7.2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Resume Kim Zwitserloot

Résumé Kim Zwitserloot Personal data: Surname: Zwitserloot First names: Kim Reinier Lucia Working experience: Sept 2014 – present University College Utrecht Member College Council Sept 2014 – present University College Utrecht Responsible for student recruitment in the UK Aug 2007 – present University College Utrecht Lecturer in economics and Tutor (Student Counsellor/Academic Advisor) Aug 2009 – Aug 2014 University College Utrecht Recruitment officer, responsible for international marketing Aug 2007 – 2009 Utrecht School of Economics Lecturer and course coordinator Aug 2005-Aug 2007 University of Maastricht and Faculty of Economics and Business Administration (FEBA) 2004, Oct-Dec Function: Lecturer and course coordinator 2005, Jan-June Inlingua Venezuela/AIESEC Caracas, Venezuela Teacher of English, clients were employees of MNCs Commissioner Internal Affairs, responsible for organisation of social activities Education: 1999-2004 Maastricht University Faculty of Economics and Business Administration (FEBA) International Economic Studies, MSc Master thesis: Getting what you want in Brussels, NGOs and Public Affairs Management in the EU Supervisor: Prof. Dr. J.G.A. van Mierlo 2003, Jan-June Tecnológico de Monterrey, Mexico City, Mexico Exchange student 1993-1999 St-Janscollege, Hoensbroek Gymnasium Dutch, English, German, Latin, General economics, Accounting, Standard level and higher level mathematics (Wiskunde A and B) Voluntary work 2002-2007 AEGEE-Academy1 Trainer and participant in several training courses concerning project management, -

Fan Onderzoek in Samenwerking Met: FAN ONDERZOEK JUPILER LEAGUE 2014/’15

KNVB Expertise is een gezamenlijk initiatief van: Fan onderzoek in samenwerking met: FAN ONDERZOEK JUPILER LEAGUE 2014/’15 ERE C M IT L Y A F O B O LU TBALL C ME AL RE C I T Y F O O T B A L L CLUB 3 INLEIDING Sinds het seizoen 2009/’10 organiseert de Jupiler League in samenwerking met KNVB Expertise het Fan Onderzoek. Duizenden fans van de clubs uit de Jupiler League worden in de gelegenheid gesteld om hun ervaringen en mening over de club te delen. De editie van dit jaar kende ruim 8500 respondenten. Met als eindresultaat een schat aan waardevolle informatie waar de clubs concreet mee aan de slag kunnen om hun fans nog beter van dienst te zijn. Het Jupiler League Fan Onderzoek is uitgevoerd onder geregistreerde seizoenkaart- en clubcardhouders. In december 2014 is hun mening gevraagd over uiteen- lopende onderwerpen zoals waardering stadion bezoek, merchandising, sfeer, catering, communicatie en maatschappelijke betrokkenheid. Enkele resultaten in het seizoen 2014/’15 zijn: 85% van de seizoenkaarthouders is van plan zijn kaart komend seizoen te verlengen. 86 % van de Jupiler League fans beoordeelt het stadionbezoek als (zeer) goed 76 % van alle fans beoordeelt de sfeer in het stadion als (zeer) goed 85% beoordeelt de sportiviteit van hun club als goed of uitstekend 78 % van alle fans beoordeelt de informatie- voorziening van hun club als (zeer) goed 96 % van alle fans voelt zich meestal of altijd veilig in het stadion 4 INHOUD Fan kenmerken 5 Fan profielen 6 Wedstrijdbezoek 8 Stadionbezoek 8 Fankaart 9 Toeschouwersaantallen 10 Bezettingsgraad 11 Stadionbezoek 12 Stadionspeaker 13 Sfeer 14 Catering 16 Klantvriendelijkheid 17 Communicatie 18 Internet 19 Social media 19 Veiligheid - Sportiviteit & Respect - MVO 20 Kidsclub 21 Colofon 22 5 FAN KENMERKEN jaar is de gemiddelde leeftijd van seizoen- en clubcardhouders in de 49 Jupiler League De fans in het onderzoek zijn verdeeld over seizoenkaart- houders en clubcardhouders. -

1 Abstract: the Ratification of the Maastricht Treaty Caused Significant

Abstract: The ratification of the Maastricht Treaty caused significant ratification problems for a series of national governments. The product of a new intergovernmental conference, namely the Amsterdam Treaty, has caused fewer problems, as the successful national ratifications have demonstrated. Employing the two-level concept of international bargains, we provide a thorough analysis of these successful ratifications. Drawing on datasets covering the positions of the negotiating national governments and the national political parties we highlight the differences in the Amsterdam ratification procedures in all fifteen European Union members states. This analysis allows us to characterize the varying ratification difficulties in each state from a comparative perspective. Moreover, the empirical analysis shows that member states excluded half of the Amsterdam bargaining issues to secure a smooth ratification. Issue subtraction can be explained by the extent to which the negotiators were constrained by domestics interests, since member states with higher domestic ratification constraints performed better in eliminating uncomfortable issues at Intergovernmental Conferences. 1 Simon Hug, Department of Government ; University of Texas at Austin ; Burdine 564 ; Austin TX 78712-1087; USA; Fax: ++ 1 512 471 1067; Phone: ++ 1 512 232 7273; email: [email protected] Thomas König, Department of Politics and Management; University of Konstanz; Universitätsstrasse 10; D-78457 Konstanz; Fax: ++ 49 (0) 7531 88-4103; Phone: ++ (0) 7531 88-2611; email: [email protected]. 2 (First version: August 2, 1999, this version: December 4, 2000) Number of words: 13086 3 An earlier version of this paper was prepared for presentation at the Annual meeting of the American Political Science Association, Atlanta, September 2-5, 1999. -

Culture at a First Glance Is Published by the Dutch Ministry of Education, Culture and Science

... Contents Section 1 Introduction 7 Section 2 General Outline 9 2.1 Geography and language 9 2.2 Population and demographics 9 2.3 The role of the city 11 2.4 Organisation of government 13 2.5 Politics and society 14 2.6 Economic and social trends 15 Section 3 Cultural Policy 19 3.1 Historical perspective 19 3.2 Division of roles in tiers of government in funding of culture 20 3.3 Government spending on culture 21 3.3.1 Central government’s culture budget for 2013-2016 21 3.3.2 Municipal spending on culture 22 3.3.3 Impact of cuts on funded institutions 25 3.4 Cultural amenities: spread 26 3.5 Priority areas for the Dutch government 29 3.5.1 Cultural education and participation in cultural life 29 3.5.2 Talent development 30 3.5.3 The creative industries 30 3.5.4 Digitisation 31 3.5.5 Entrepreneurship 31 3.5.6 Internationalisation, regionalisation and urbanisation 32 3.6 Funding system 33 3.7 The national cultural funds 34 3.8 Cultural heritage 35 3.9 Media policy 38 Section 4 Trends in the culture sector 41 4.1 Financial trends 41 4.2 Trends in offering and visits 2009-2014 44 4.2.1 Size of the culture sector 44 4.2.2 Matthew effects? 45 4.3 Cultural reach 45 4.3.1 More frequent visits to popular performances 47 4.3.2 Reach of the visual arts 47 4.3.3 Interest in Dutch arts abroad 51 4.3.4 Cultural tourism 53 4.3.5 Culture via the media and internet 54 4.4 Arts and heritage practice 57 4.5 Cultural education 59 5 1 Introduction Culture at a first Glance is published by the Dutch Ministry of Education, Culture and Science. -

The Hague District Court

THE HAGUE DISTRICT COURT Chamber for Commercial Affairs case number / cause list number: C/09/456689 / HA ZA 13-1396 Judgment of 24 June 2015 in the case of the foundation URGENDA FOUNDATION, acting on its own behalf as well as in its capacity as representative ad litem and representative of the individuals included in the list attached to the summons, with its registered office and principal place of business in Amsterdam, claimant, lawyers mr.1R.H.J. Cox of Maastricht and mr. J.M. van den Berg of Amsterdam, versus the legal person under public law THE STATE OF THE NETHERLANDS (MINISTRY OF INFRASTRUCTURE AND THE ENVIRONMENT), seated in The Hague, defendant, lawyers mr. G.J.H. Houtzagers of The Hague and mr. E.H.P. Brans of The Hague. Parties are hereinafter referred to as Urgenda and the State. (Translation) Only the Dutch text of the ruling is authoratative. TABLE OF CONTENTS 1THE PROCEEDINGS 1 2 THE FACTS 2 A. The Parties 2.1 B. Reasons for these proceedings 2.6 C. Scientific organisations and publications 2.8 IPCC 2.8 AR4/2007 2.12 AR5/2013 2.18 PBL and KNMI 2.22 EDGAR 2.25 UNEP 2.29 D. Climate change and the development of legal and policy frameworks 2.34 In a UN context 2.35 UN Framework Convention on Climate Change 1992 2.35 Kyoto Protocol 1997 and Doha Amendment 2012 2.42 Climate change conferences (Conference of the Parties - COP) 2.47 a) Bali Action Plan 2007 2.48 b) The Cancun Agreements 2010 2.49 c) Durban 2011 2.51 In a European context 2.53 In a national context 2.69 3THE DISPUTE 3 4 THE ASSESSMENT 4 A. -

Hotel Accommodations

Dear Participant, For the upcoming conference, Migration: A World in Motion A Multinational Conference on Migration and Migration Policy 18-20 February 2010 Maastricht, the Netherlands We have made a short list of preferable hotels in the inner-city of Maastricht. In order to help you find accommodation during your stay in Maastricht, we have arranged a number of options at various preferable hotels in the city. Please not that it is your own responsibility to make reservations and get in contact with the applicable hotel. The hotels will ask you to indicate your dietary and special needs, in order to make your stay as comfortable as possible. Moreover, the hotels will also need your credit card details, in order to guarantee the booking. For further information, please contact the hotel directly. They also want you to mention the following code while making reservations so they know that your booking is within regards to the APPAM conference. Without mentioning this code you won’t be able to book a room for a special arranged price! Please use the following code in your reservation: APPAM_2010 You can choose from the following hotels. Please note that the available rooms will be booked on a “first-come-first-serve”basis. Derlon Hotel Maastricht 1. Special price for APPAM participants; €135,- per room, per night, including breakfast; 2. Reservations made before November 1st 2009 will get a €2,50 discount per person, per stay; 3. Deluxe Hotel; 4. Directly located in the city centre of Maastricht, at 5 minutes walk from the Maastricht Graduate School of Governance, situated at one of the most beautiful squares in the Netherlands: the Onze Lieve Vrouwe Plein; 5. -

Clubs Without Resilience Summary of the NBA Open Letter for Professional Football Organisations

Clubs without resilience Summary of the NBA open letter for professional football organisations May 2019 Royal Netherlands Institute of Chartered Accountants The NBA’s membership comprises a broad, diverse occupational group of over 21,000 professionals working in public accountancy practice, at government agencies, as internal accountants or in organisational manage- ment. Integrity, objectivity, professional competence and due care, confidentiality and professional behaviour are fundamental principles for every accountant. The NBA assists accountants to fulfil their crucial role in society, now and in the future. Royal Netherlands Institute of Chartered Accountants 2 Introduction Football and professional football organisations (hereinafter: clubs) are always in the public eye. Even though the Professional Football sector’s share of gross domestic product only amounts to half a percent, it remains at the forefront of society from a social perspective. The Netherlands has a relatively large league for men’s professio- nal football. 34 clubs - and a total of 38 teams - take part in the Eredivisie and the Eerste Divisie (division one and division two). From a business economics point of view, the sector is diverse and features clubs ranging from listed companies to typical SME’s. Clubs are financially vulnerable organisations, partly because they are under pressure to achieve sporting success. For several years, many clubs have been showing negative operating results before transfer revenues are taken into account, with such revenues fluctuating each year. This means net results can vary greatly, leading to very little or even negative equity capital. In many cases, clubs have zero financial resilience. At the end of the 2017-18 season, this was the case for a quarter of all Eredivisie clubs and two thirds of all clubs in the Eerste Divisie. -

Arrival by Plane

ARRIVAL BY CAR Maastricht is located on the E25 junction on the A2 motorway (Amsterdam-Brussels) and the A79 motorway (Liege-Aachen/Cologne) with good links to other European motorways. When travelling to Maastricht by car, you should travel into the city centre, direction "Vrijthof". The Faculty of Law is located at the Bouillonstraat 1-3, which is a side street of the famous (city centre) square "Vrijthof". The parking lot closest to the Faculty of Law is Q-Park Vrijthof. Click here for an overview of parking possibilities (website in Dutch only). ARRIVAL BY TRAIN Maastricht has 3 railway stations: North, Randwyck and Central. Please arrive at Maastricht CENTRAL Railway Station. It is a 15 minute walk to the venue (walk towards the city centre to square “Vrijthof”). Please check the travel possibilities through the various public transport websites: within the Netherlands coming from Belgium coming from Germany ARRIVAL BY PLANE Coming from Maastricht/Aachen Airport: 30 minutes by bus to Maastricht City Centre (bus line 59 to Maastricht Central railway station) or 15 minutes by taxi. Very few airlines fly this route. Visit their website to learn about the possibilities. Coming from Brussels Airport (Zaventem, Belgium) In order to travel from Brussels Airport (Zaventem) to Maastricht Central Railway Station you can use the train (+/- 1.5 hours). The airport railway station is located below the terminal (basement level -1). 1 Coming from Eindhoven Airport (NL) When you arrive at Eindhoven Airport, you can travel to Maastricht Central Railway Station by public transport (+/- 1 hour). You can travel by bus to Eindhoven railway station and further by train to Maastricht Central Railway Station. -

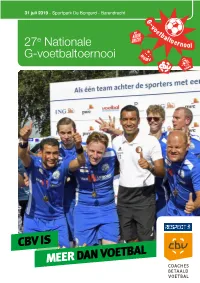

G-Toernooi Programmaboekje 2019

31 juli 2019 - Sportpark De Bongerd - Barendrecht 27e Nationale G-voetbaltoernooi ‘Een dag om Inhoud Michael van Praag apetrots op te zijn’ Voor wat betreft de partner voor pagina 2 zijn dat de volgende: Inhoud 2 Het ligt misschien niet direct in onze volksaard om heel trots op iets of iemand te Voorwoord KNVB 3 zijn. Het ingetogen calvinisme zit nog altijd een beetje in elke Nederlander. In mijn - Bilderberg hoedanigheid als bondsvoorzitter en UEFA-bestuurder heb ik echter een kijkje achter - Q-Promotions Welkomstwoord CBV en BSBV 4 de schermen van heel veel andere voetballanden kunnen nemen. Dat deed mij keer KNVB Art Langeler 5 op keer beseffen hoe uniek en divers wij als voetballand zijn. En daar mogen we best - Eisma / De Voetbaltrainer trots op zijn. Heel erg trots zelfs. - Seacon Programma 6 ‘Goed om te weten’ 7 Dat geldt natuurlijk voor de toplaag, met onze goed presterende Oranjeteams en - Landstede Ajax dat op een haar een finaleplaats in de Champions League miste, maar vooral G-toernooi, informatie 8 ook voor de breedtesport. Kijk maar eens naar die 3.000 amateurclubs, verspreid - Basic-Fit over het hele land. Wekelijks zijn ruim 1,2 miljoen leden actief op onze velden. Mede - Teamsportbedarf Kleedkamerindeling 9 dankzij al die vrijwilligers die zich geheel belangeloos inzetten voor onze geliefde voetbalsport. - Perspectief Fonds Gehandicaptensport 10 - Fonds Gehandicaptensport Poule indeling senioren 11 Er is één dag waarop beide werelden naadloos in elkaar opgaan en dat is op de Schema B-Categorie 12 G-voetbaldag in Barendrecht. Vandaag alweer voor de 27e keer en inmiddels vaste - & logo respect KNVB (hebben jullie dit logo?) 2 prik op de kalender. -

Cambuur Speaker Okt 2020

MET ONDER ANDERE MARK DIEMERS, SONNY STEVENS EN GERALD VAN DEN BELT DE SPEAKER Officieel Club Magazine Oktober 2020 Johannes 'Hampie' Bakker "Het doet mij enorm goed dat de club het rood-wit heeft omarmd" Wedstrijden in het Cambuur Stadion zonder de aanwezigheid en onaflatende steun van de Twaalfde Man. Het is een surrealistisch beeld en het zal nooit gaan wennen. Toch is het even de realiteit waar we nu met z'n allen in zitten en het beste van zullen moeten maken. Dat valt zeker niet mee en al helemaal niet bij een club als de onze. Laat ik dan ook beginnen met het uitspreken van de hoop dat we dit snel achter ons kunnen laten en een ieder zo snel mogelijk weer mogen begroeten in het stadion bij de trainingen en wedstrijden van onze gezamenlijke trots en passie. Voorwoord Als club proberen we ons zo goed mogelijk door de coronacrisis te slaan. Allereerst sportief, waarbij we -zeker bij thuiswedstrijden- de unieke Cambuur sfeer moeten missen en het enorme thuisvoordeel wat we altijd hebben gehad even niet hebben. Gelukkig hebben we de selectie en staf zoveel mogelijk in tact weten te houden en staat er ook dit seizoen een selectie met kwaliteit en daarbovenop de ambitie om te gaan voor sportieve revanche. Dat de competitiestart niet helemaal vlekkeloos verliep is daarbij ook goed te verklaren. De slordige zes maanden zonder wedstrijden in competitieverband en de nieuwe status als 'de te kloppen ploeg' in de Keuken Kampioen Divisie maakt dat het zoeken is naar scherpte en dat tegenstanders zich soms volledig aanpassen. -

MVV Maastricht Audit 1-Meting April 2014

MVV Maastricht Audit 1-meting april 2014 Auditteam Voetbal en Veiligheid In opdracht van Het Auditteam Voetbal en Veiligheid Met dank aan MVV Maastricht Gemeente Maastricht Parket Maastricht Politie Eenheid Limburg Centraal Informatiepunt Voetbalvandalisme Opmaak Marcel Grotens (Bureau Beke) Onderzoeksteam en rapportage Henk Ferwerda (projectleider) Bo Bremmers Tom van Ham Henk de Man Siert Vos © Arnhem, april, 2014 Inhoudsopgave 1. Inleiding 5 1.1 Over het Auditteam Voetbal en Veiligheid 5 1.2 De 1-meting 5 1.3. Visie op voetbalveiligheid 6 1.4. Leeswijzer 6 2. Aanbevelingen uit de 0-meting 7 2.1. Conclusies en aanbevelingen 7 2.2. Stappen van de vierhoek 8 2.3. Reflectie op de stappen door de vierhoek 10 3. Actuele situatie 11 3.1. Club en supporters 11 3.2. Infrastructuur 12 3.3. Organisatie en samenwerking 14 4. Conclusies en aanbevelingen 16 4.1. Ontwikkelingen: verbetering of niet? 16 4.2 Aanbevelingen 16 4.3. Veelbelovende praktijken voor andere vierhoeken 17 Bijlage: verantwoording 18 Geraadpleegde documenten 19 1. Inleiding 1.1. Over het Auditteam Voetbal en Veiligheid Het Auditteam Voetbal en Veiligheid bestaat sinds 2003. De hoofddoelstelling van het Auditteam is om concreet advies en aanbevelingen te geven over de aanpak van voetbalvandalisme en voetbalgeweld. Het Auditteam richt zich op de lokale ‘voetbalvierhoek’, bestaande uit gemeente, politie, Openbaar Ministerie (OM) en de Betaald voetbalorganisatie (BVO). In de afgelopen jaren heeft het Auditteam in 0-metingen, samen met de betrokken partijen, de (tussen)balans opgemaakt. Hierbij bracht het Auditteam in kaart hoe de veiligheidsorganisatie en de fysieke infrastructuur zijn afgestemd op het profiel van de supporters en op het risiconiveau van de wedstrijden. -

Competitieprogramma Keuken Kampioen Divisie 2021/2022

COMPETITIEPROGRAMMA KEUKEN KAMPIOEN DIVISIE 2021/2022 NR. DATUM WEDSTRIJD AANVANG 1 Maandag 9 augustus 2021 Jong Utrecht – MVV Maastricht 20:00 uur 2 Vrijdag 13 augustus 2021 MVV Maastricht – De Graafschap 20.00 uur 3 Vrijdag 20 augustus 2021 MVV Maastricht – Helmond Sport 20.00 uur 4 Vrijdag 27 augustus 2021 FC Volendam – MVV Maastricht 20:00 uur 5 Zondag 5 september 2021 MVV Maastricht – Telstar 14:30 uur 6 Vrijdag 10 september 2021 FC Emmen - MVV Maastricht 20.00 uur 7 Vrijdag 17 september 2021 MVV Maastricht – FC Eindhoven 20.00 uur 8 Maandag 27 september 2021 Jong Ajax - MVV Maastricht 20.00 uur 9 Vrijdag 1 oktober 2021 MVV Maastricht – ADO Den Haag 20:00 uur 10 Zondag 10 oktober 2021 VVV-Venlo - MVV Maastricht 12.15 uur 11 Vrijdag 15 oktober 2021 MVV Maastricht – FC Dordrecht 20.00 uur 12 Vrijdag 22 oktober 2021 NAC Breda – MVV Maastricht 20.00 uur 13 Vrijdag 29 oktober 2021 MVV Maastricht – Roda JC 20.00 uur 14 Vrijdag 5 november 2021 Jong AZ – MVV Maastricht 20:00 uur 15 Maandag 15 november 2021 MVV Maastricht – FC Den Bosch 21.00 uur 16 Vrijdag 19 november 2021 Almere City - MVV Maastricht 20.00 uur 17 Vrijdag 26 november 2021 MVV Maastricht – Jong PSV 20.00 uur 18 Vrijdag 3 december 2021 MVV Maastricht – TOP Oss 20.00 uur 19 Vrijdag 10 december 2021 Excelsior - MVV Maastricht 20.00 uur 20 Vrijdag 17 december 2021 MVV Maastricht – FC Emmen 20.00 uur 21 Vrijdag 7 januari 2022 Roda JC - MVV Maastricht 21.00 uur 22 Vrijdag 14 januari 2022 Telstar - MVV Maastricht 20:00 uur 23 Vrijdag 21 januari 2022 MVV Maastricht – FC Volendam