The Bv/Srl: a Modern and Flexible Company

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Besloten Vennootschap Met Beperkte Aansprakelijkheid) Incorporated Under the Laws Ofthe Netherlands with Its Statutory Seat in Amsterdam)

FINAL TERMS 21 September 2016 VCL MASTER NETHERLANDS B.V. a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws ofthe Netherlands with its statutory seat in Amsterdam) as Issuer for the issuance of the EUR 6,600,000 Class A Series 2016-6 Notes to be consolidated andform a single Series with the EUR 37,100,000 Class A Series 2016-6 Notes already outstanding) issued pursuant to the EUR 1, 000,000,000 Programme for the Issuance of Notes These Final Terns are issued to give details of an issue of Class A Notes by VCL Master Netherlands B. V. under the EUR 1, 000,000,000 programme for the issuance of Notes ( the " Programme"). The Final Terms attached to the Base Prospectus dated 26 May 2016 are presented in the form of a separate document containing only the final terms according to Article 26 para. 5 subpara. 2 of the Commission' s Regulation ( EC) No 809/ 2004 of 29 April 2004. The Base Prospectus and the Final Terms have been published on the website of the Luxembourg Stock Exchange ( www.bourse.lu). The Final Terms of the Series 2016- 6 Class A Notes must be read in conjunction with the Base Prospectus. Full information on the Issuer and the offer of the Series 2016-6 Class A Notes is only available on the basis of the combination of these Final Terms and the Base Prospectus. Capitalised terms not otherwise defined herein shall have the meaning specified in the Conditions of the Class A Notes. -

Setting up and Maintaining a Joint Venture Company in the Netherlands 21 April 2017 About Noviotax Table of Contents

Setting up and maintaining a joint venture company in the Netherlands 21 april 2017 About NovioTax Table of contents NovioTax is a Dutch research-based tax advisory firm, which members have 1. Introduction pag. 3 many years (20+) of experience in AAA advisory firms and have strong connections in the UK, US and Luxembourg. In our DNA we are a research based 2. The Dutch besloten vennootschap pag. 4 advisory firm that is programmed to excel in quality and service. 3. Exit scenarios pag. 5 Through research, we develop our intellectual capital. For instance, every 4. Structure example pag. 6 member of NovioTax is required to participate in research activities. We believe that through the use of research we will discover new ideas and opportunities that support our clients. We also strongly believe in a superior service. We are dedicated to invest in getting to know our clients, listening to them and enabling that our advices add value to clients. Our aim is to actively leverage our experience and knowledge for our clients as transparently and accessibly as possible. 2 Joint venture companies in the Netherlands There are several legal entities in the Netherlands that can be used to partake in a joint venture. Most commonly used is the Besloten Vennootschap (B.V.) since there is no minimum capital, limited liability, many subsidies and many more advantages. In light of this, the following presentation take note of basic information about setting up and maintaining a Dutch B.V. Joint venture companies in the Netherlands 3 The Dutch besloten vennootschap In this context it should be noted, though, that a lock-up, during which the transfer of shares is prohibited for a certain period of time, is possible. -

Comparative Company Law

Comparative company law 26th of September 2017 – 3rd of October 2017 Prof. Jochen BAUERREIS Attorney in France and Germany Certified specialist in international and EU law Certified specialist in arbitration law ABCI ALISTER Strasbourg (France) • Kehl (Germany) Plan • General view of comparative company law (A.) • Practical aspects of setting up a subsidiary in France and Germany (B.) © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 2 A. General view of comparative company law • Classification of companies (I.) • Setting up a company with share capital (II.) • Management bodies (III.) • Transfer of shares (IV.) • Taxation (V.) • General tendencies in company law (VI.) © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 3 I. Classification of companies • General classification – Partnerships • Typically unlimited liability of the partners • Importance of the partners – The companies with share capital • Shares can be traded more or less freely • Typically restriction of the associate’s liability – Hybrid forms © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 4 I. Classification of companies • Partnerships – « Civil partnership » • France: Société civile • Netherlands: Maatschap • Germany: Gesellschaft bürgerlichen Rechts • Austria: Gesellschaft nach bürgerlichem Recht (GesnbR) • Italy: Società simplice © Prof. Jochen BAUERREIS - Avocat & Rechtsanwalt 5 I. Classification of companies • Partnerships – « General partnership » • France: Société en nom collectif • UK: General partnership (but without legal personality!) • USA: General partnership -

The Emergence of the Corporate Form

JLEO, V33 N2 193 The Emergence of the Corporate Form Giuseppe Dari-Mattiacci Downloaded from https://academic.oup.com/jleo/article-abstract/33/2/193/3089484 by Universiteit van Amsterdam user on 07 October 2018 University of Amsterdam Oscar Gelderblom Utrecht University Joost Jonker Utrecht University and University of Amsterdam Enrico C. Perotti University of Amsterdam and CEPR We describe how, during the 17th century, the business corporation gradually emerged in response to the need to lock in long-term capital to profit from trade opportunities with Asia. Since contractual commitments to lock in capital were not fully enforceable in partnerships, this evolution required a legal innovation, essentially granting the corporation a property right over capital. Locked-in cap- ital exposed investors to a significant loss of control, and could only emerge where and when political institutions limited the risk of expropriation. The Dutch East India Company (VOC, chartered in 1602) benefited from the restrained executive power of the Dutch Republic and was the first business corporation with permanent capital. The English East India Company (EIC, chartered in 1600) kept the traditional cycle of liquidation and refinancing until, in 1657, Giuseppe Dari-Mattiacci gratefully acknowledges the financial support by the Netherland Organization for Scientific Research (NWO VIDI grant 016.075.332) and the Becker-Friedman Institute at the University of Chicago (BFI Fellowship winter 2012). The authors would like to thank Kenneth Ayotte, Douglas Baird, Patrick -

Corporate Governance 2020

Corporate Governance 2020 A practical cross-border insight into corporate governance law 13th Edition Featuring contributions from: Advokatfirmaet BAHR AS Hannes Snellman Attorneys Ltd Olivera Abogados / IEEM Business School Al Hashmi Law Herbert Smith Freehills Pinsent Masons LLP Arthur Cox Houthoff Schoenherr Rechtsanwälte GmbH Baker McKenzie Lacourte Raquin Tatar SZA Schilling, Zutt & Anschütz Rechtsanwaltsgesellschaft mbH Bowmans Law Firm Neffat Tian Yuan Law Firm Cravath, Swaine & Moore LLP Lenz & Staehelin Uría Menéndez Creel Abogados, S.C. Macfarlanes LLP Wachtell, Lipton, Rosen & Katz Cyril Amarchand Mangaldas Mannheimer Swartling Advokatbyrå Walalangi & Partners (in association with Davis Polk & Wardwell LLP Marsh & McLennan Companies Nishimura & Asahi) Ferraiuoli LLC Nielsen Nørager Law Firm LLP Wolf Theiss GSK Stockmann Nishimura & Asahi Zunarelli – Studio Legale Associato Table of Contents Expert Chapters Dual-Class Share Structures in the United States 1 George F. Schoen & Keith Hallam, Cravath, Swaine & Moore LLP Legal Liability for ESG Disclosures – Investor Pressure, State of Play and Practical Recommendations 11 Katherine J. Brennan & Connor Kuratek, Marsh & McLennan Companies Joseph A. Hall & Betty Moy Huber, Davis Polk & Wardwell LLP Corporate Governance for Subsidiaries and Within Groups 17 Martin Webster & Tom Proverbs-Garbett, Pinsent Masons LLP Global Transparency Trends and Beneficial Ownership Disclosure 22 Nancy Hamzo, Bonnie Tsui, Olivia Lysenko & Paula Sarti, Baker McKenzie Q&A Chapters Australia Mexico 28 Herbert -

ANNEXES 1 to 2

EUROPEAN COMMISSION Brussels, 25.10.2016 COM(2016) 683 final ANNEXES 1 to 2 ANNEXES to the Proposal for a Council Directive on a Common Consolidated Corporate Tax Base (CCCTB) {SWD(2016) 341 final} {SWD(2016) 342 final} EN EN ANNEX I (a) The European company or Societas Europaea (SE), as established in Council Regulation (EC) No 2157/2001 1 and Council Directive 2001/86/EC 2; (b) The European Cooperative Society (SCE), as established in Council Regulation (EC) No 1435/2003 3 and Council Directive 2003/72/EC 4; (c) companies under Belgian law known as “naamloze vennootschap"/“société anonyme”, “commanditaire vennootschap op aandelen”/“société en commandite par actions”, “besloten vennootschap met beperkte aansprakelijkheid”/“société privée à responsabilité limitée”, “coöperatieve vennootschap met beperkte aansprakelijkheid”/“société coopérative à responsabilité limitée”, “coöperatieve vennootschap met onbeperkte aansprakelijkheid”/“société coopérative à responsabilité illimitée”, “vennootschap onder firma”/“société en nom collectif”, “gewone commanditaire vennootschap”/“société en commandite simple”, public undertakings which have adopted one of the abovementioned legal forms, and other companies constituted under Belgian law subject to the Belgian Corporate Tax; (d) companies under Bulgarian law known as: “събирателното дружество”, “командитното дружество”, “дружеството с ограничена отговорност”, “акционерното дружество”, “командитното дружество с акции”, “кооперации”,“кооперативни съюзи”, “държавни предприятия” constituted under Bulgarian -

8 the Duty of Directors to Be Guided by the Best Interests of the Company

8 The Duty of Directors to be Guided by the Best Interests of the Company Cees de Groot 1INTRODUCTORY REMARKS The corporate form (referred to as the company or the corporation) is a core concept in corporate law that is recognized worldwide. In its basic appearance the corporate form is a legal person (as opposed to e.g. partnerships) with a capital that is divided into transferable shares, that is led by a corporate board, and in which neither the shareholders nor the corporate directors are personal- ly liable for the obligations of the company. This contribution considers the nature of the company as a statutory core legal concept in the Netherlands. After some observations of a more general nature, the discussion of the com- pany as a core legal concept will take place against the backdrop of another statutory core legal concept that is firmly rooted in corporate law in the Netherlands: the duty of corporate directors in the performance of their duties to be guided by the best interests of the company and the undertaking that is connected with it. Paragraph 2 is introductory and describes some elements of corporate law in the Netherlands. Paragraph 3 investigates the origins of the company in the Netherlands. Then attention shifts to the core legal concept that corporate directors must be guided by the best interests of the company and its undertaking. Paragraphs 4 and 5 discuss landmark cases of the Dutch Supreme Court on corporate law: historic case law (the Doetinchemse IJzergie- terij and Forum-Bank cases in paragraph 4) and a more recent case (the ASMI- case in paragraph 5) that show how the core legal concept of acting in the best interests of the company and its undertaking has in Netherlands case law gradually shaped thinking about the company as such. -

GUIDE to GOING GLOBAL CORPORATE Belgium

GUIDE TO GOING GLOBAL CORPORATE Belgium Downloaded: 25 Sep 2021 INTRODUCTION GUIDE TO GOING GLOBAL | CORPORATE INTRODUCTION Welcome to the 2021 edition of DLA Piper’s Guide to Going Global – Corporate. GUIDE TO GOING GLOBAL SERIES To compete and be successful today, companies need to develop and scale their businesses globally. Each country presents its own set of unique laws, rules and regulations and business practices that companies must understand to be successful. In order to help clients meet the opportunities and challenges of expanding internationally, we have created a handy set of global guides that cover the basics companies need to know when going into and doing business in new countries. The Guide to Going Global series reviews business-relevant corporate, employment, intellectual property and technology, executive compensation, and tax laws in key jurisdictions around the world. CORPORATE The Guide to Going Global – Corporate has been created based on our research, our experience and feedback we have received from clients in both established and emerging businesses that have expanded internationally. We hope it will be a helpful resource for you. The Guide to Going Global – Corporate covers corporate basics in 54 key jurisdictions across the Americas, Asia Pacific, Europe and the Middle East. We touch on a wide range of corporate issues for companies expanding internationally, including establishing a corporate presence and choice of entity, liability considerations, tax presence and tax filings, capital requirements, the formation process, director, officer and shareholder requirements, registration processes, office lease processes and possible exit strategies. With more than 600 lawyers, DLA Piper’s global Corporate group is one of the largest in the world, with one of the widest geographical footprints of any global law firm and experience across the legal areas companies need as they expand internationally. -

Members' Agreement

MEMBERS’ AGREEMENT in relation to the International Licensing Platform MEMBERS’ AGREEMENT This Agreement is between: 1. AGRISEMEN B.V., a private company with limited liability incorporated under the laws of the Netherlands (besloten vennootschap met beperkte aansprakelijkheid), having its official seat (statutaire zetel) in Ellewoutsdijk, the Netherlands, and its office at Zeedijk 4, 4454 PM Borssele, the Netherlands, registered with the Dutch Trade Register of the Chamber of Commerce under number 22047292; 2. Nunhems B.V., a private company with limited liability incorporated under the laws of the Netherlands (besloten vennootschap met beperkte aansprakelijkheid), having its official seat (statutaire zetel) in Haelen, the Netherlands, and its office at Napoleonsweg 152, 6083 AB Nunhem, the Netherlands, registered with the Dutch Trade Register of the Chamber of Commerce under number 13002516; 3. Bejo Finance B.V., a private company with limited liability incorporated under the laws of the Netherlands (besloten vennootschap met beperkte aansprakelijkheid), having its official seat (statutaire zetel) in Warmenhuizen, the Netherlands, and its office at Trambaan 1, 1749 CZ Warmenhuizen, the Netherlands, registered with the Dutch Trade Register of the Chamber of Commerce under number 37083070; 4. Enza Zaden Beheer B.V., a private company with limited liability incorporated under the laws of the Netherlands (besloten vennootschap met beperkte aansprakelijkheid), having its official seat (statutaire zetel) in Enkhuizen, the Netherlands, and -

No 2157/2001 of 8 October 2001 on the Statute for a European Company (SE)

2001R2157 — EN — 01.07.2013 — 003.001 — 1 This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents ►B COUNCIL REGULATION (EC) No 2157/2001 of 8 October 2001 on the Statute for a European company (SE) (OJ L 294, 10.11.2001, p. 1) Amended by: Official Journal No page date ►M1 Council Regulation (EC) No 885/2004 of 26 April 2004 L 168 1 1.5.2004 ►M2 Council Regulation (EC) No 1791/2006 of 20 November 2006 L 363 1 20.12.2006 ►M3 Council Regulation (EU) No 517/2013 of 13 May 2013 L 158 1 10.6.2013 2001R2157 — EN — 01.07.2013 — 003.001 — 2 ▼B COUNCIL REGULATION (EC) No 2157/2001 of 8 October 2001 on the Statute for a European company (SE) THE COUNCIL OF THE EUROPEAN UNION, Having regard to the Treaty establishing the European Community, and in particular Article 308 thereof, Having regard to the proposal from the Commission (1 ), Having regard to the opinion of the European Parliament (2 ), Having regard to the opinion of the Economic and Social Committee (3 ), Whereas: (1) The completion of the internal market and the improvement it brings about in the economic and social situation throughout the Community mean not only that barriers to trade must be removed, but also that the structures of production must be adapted to the Community dimension. For that purpose it is essential that companies the business of which is not limited to satisfying purely local needs should be able to plan and carry out the reorganisation of their business on a Community scale. -

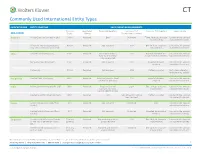

Commonly Used International Entity Types

Commonly Used International Entity Types COUNTRY/REGION ENTITY STRUCTURE BASIC FORMATION REQUIREMENTS Minimum Registered Corporate Secretary Minimum # of Minimum # of Directors Legal Liability ASIA-PACIFIC Capital Address Shareholders/Partners Australia Public Company (Limited or Ltd.) AUD 0 Required One Unlimited Three. At least 2 must be Limited to the amount local residents subscribed for shares Private or Proprietary Company AUD 0 Required Not required 1-50 One. At least 1 must be Limited to the amount (Pty. Ltd. or Proprietary Limited) local resident subscribed for shares China Limited Liability Company CNY 0 Required Not required. But a 1-50 Board of directors or a Limited to the amount local representative single executive director subscribed for shares may be required. Company Limited by Shares CNY 0 Required Not required 2-200 Board of directors Limited to the amount required subscribed for shares Partnership CNY 0 Required Not required 2-50 Partner managed Not a separate legal entity from its parent Hong Kong Limited Private Company HKD 0 Required Required, must be local 1-50 Board of directors Limited to the amount resident or company required subscribed for shares India Private Limited Company (Pvt Ltd) INR 0 Required Required if initial 2-200 Two. At least 1 must be Limited to the amount capital investment local resident subscribed for shares exceeds INR100 million Limited Liability Partnership (LLP) INR 0 Required N/A Two. At least 1 must be Partner managed Limited to the amount local resident subscribed for shares Japan General Corporation (Kabushiki JPY 1 Required Not required Unlimited One Limited to the amount Kaisha) subscribed for shares Limited Liability Company (Godo- JPY 1 Required Not required Unlimited Managed by managing Limited to the amount Kaisha) members subscribed for shares Singapore Private Limited Company (Private $1 in any Required Required and must be 1-50 One. -

Netherlands Besloten Vennootschap – Flex-BV

Netherlands Besloten Vennootschap – Flex-BV General Type of entity BV Type of law Civil Shelf company availability No Our time to establish a new company 4 - 6 weeks Minimum government fees (excluding taxation) Nil 20% for taxable income up to €200,000 Corporate Taxation 25% above €200,000 Double taxation treaty access Yes Share Capital or Equivalent Standard currency Euro Permitted currencies Any Minimum paid up Euro 0.1 Usual authorised Optional Directors Minimum number One Local required No Publicly accessible records Yes Location of meetings Anywhere Shareholders Minimum number One Publicly accessible records Yes for single member, otherwise No. Location of meetings Netherlands Company Secretary Required No Local or qualified No Accounts Requirement to prepare Yes Audit requirements Yes Requirement to file accounts Yes Excerpts for small companies, full details for large Publicly accessible accounts companies Other Requirement to file annual return Yes Change in domicile permitted No [130123] 2 GENERAL INFORMATION Introduction The Netherlands, generally known as Holland, is situated at the estuaries of the Rhine and the Mass and is bordered by Germany in the East and Belgium in the South. The country is small and just 37,000 square Kilometres with almost all of the coastal areas below sea-level, the highest point only being 320 meters above sea level. The capital of the Netherlands is Amsterdam. The Hague is the seat of the Dutch Government. Rotterdam is the largest port in the world. Population The population of the Netherlands is approximately 16 million, with the majority of these living in the west of the country.