FTSE Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exploring the Secrets of Success

people technolog siness Issue 35 In this issue Exploring the secrets of success 2 Business Insight GS-insight discusses some of the latest trends and Graham Charlton, CFO, Softcat opportunities in the international technology industry, the importance of company culture in business 5 Consulting Insight success and much more … Martin Smith, Executive Director, Sheffield Haworth Welcome to the 35th edition of GS-insight, fit and thereby de-risk the hiring process. Consulting Solutions the magazine of international technology Understandably, investors and Boards are sector Executive Search specialists Gillamor very keen to have a robust assessment of Stephens, part of Sheffield Haworth, the global the strengths and risks associated with 6 International Insight talent consulting and leadership advisory management teams and of their capability to Kelly Kinnard, VP Talent, firm. As a recruitment team, we are fortunate grow, change and adapt to achieve business Battery Ventures to work with companies at all stages of organ- objectives. isational and business development; from This issue of GS-insight explores a wide 8 Investment Insight university “spin-outs” requiring CEOs to help range of themes with leaders across our commercialise “bleeding edge” technology, Mark Boggett, CEO, industry sector. We discuss the importance Seraphim Space Capital through to privately owned and VC/PE of company culture and business growth with funded small-mid size businesses seeking Graham Charlton of Softcat and Russell Sloan the leaders to drive organic and acquisitive of Kainos, two of the most successful and 10 Non-Executive growth/internationalisation strategies to the fastest growing publicly listed technology Insight larger corporate entities hiring executives to businesses. -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Bytes Technology Group

This document comprises a prospectus (the "Prospectus") for the purposes of Regulation (EU) 2017/1129, as amended (the "Prospectus Regulation") relating to Bytes Technology Group plc (the "Company") prepared in accordance with the Prospectus Regulation Rules of the Financial Conduct Authority (the "FCA") made under section 73A of the Financial Services and Markets Act 2000 (the "FSMA") and a pre-listing statement prepared in accordance with the applicable JSE Listings Requirements. A copy of this Prospectus has been filed with, and approved by, the FCA and the JSE and has been made available to the public in accordance with the Prospectus Regulation Rules. The FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is, or the quality of the securities that are, the subject of this Prospectus. Investors should make their own assessment as to the suitability of investing in the ordinary shares in the capital of the Company (the "Shares"). Application will be made to the FCA for all of the Shares, issued and to be issued in connection with the Offer to be admitted to the premium listing segment of the Official List of the FCA and to London Stock Exchange plc (the "London Stock Exchange") for all of the Shares to be admitted to trading on the London Stock Exchange's main market for listed securities (the "Main Market") (together, "Admission"). Conditional dealings in the Shares are expected to commence on the Main Market at 8.00 a.m. -

Enabling Success

ENABLING SUCCESS Computacenter plc Annual Report and Accounts 2020 2020 Highlights 1. Adjusted operating profit or loss, Revenue £m +7.7% Dividend per share Pence +402.0% adjusted net finance income or expense, adjusted profit or loss before tax, adjusted tax, adjusted profit or 5,441.3 50.7 loss, adjusted earnings per share and adjusted diluted earnings per share are, as appropriate, each stated 2020 5,441.3 2020 50.7 before: exceptional and other 2019 5,052.8 2019 10.1 adjusting items including gains or losses on business acquisitions and 2018 4,352.6 2018 30.3 disposals, amortisation of acquired intangibles, utilisation of deferred tax 2017 3,793.4 2017 26.1 assets (where initial recognition was 2016 3,245.4 2016 22.2 as an exceptional item or a fair value adjustment on acquisition), and the related tax effect of these exceptional Profit before tax £m +46.5% Adjusted1 profit before tax £m +37.0% and other adjusting items, as Management do not consider these items when reviewing the underlying performance of the Segment or the 206.6 200.5 Group as a whole. A reconciliation to adjusted measures is provided on page 2020 206.6 2020 200.5 61 of the Group Finance Director’s Review which details the impact of 2019 141.0 2019 146.3 exceptional and other adjusted items when compared to the non-Generally 2018 108.1 2018 118.2 Accepted Accounting Practice financial 2017 111.7 2017 106.2 measures in addition to those reported in accordance with IFRS. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Supporting Our Customers on Their Journey Annual Report and Accounts 2011 Our Business Model

Supporting our customers on their journey Annual Report and Accounts 2011 Our business model What we do Manage & Transform To improve quality and fl exibility of service while signifi cantly reducing costs Services provided Service Desk, Managed Workplace, Managed Network, Managed Datacenter, Managed Applications and Support & Maintenance Enhancing our customers’ The work we undertake is typically • Technologically or logistically complex journey by: • Multiple parallel projects • Innovating • Contract-based • Managing cost • Uses our core assets • Mitigating risk • Improving their service This creates Consult & Change advantages for Optimise technology, enabling their businesses: effective change • Smarter technology • On time and on budget Services provided • Better services Flexible Workplace, Borderless • Greater effi ciencies Network, Dynamic Datacenter, • Lower cost Unifi ed Communications & Collaboration and Secure Information The work we undertake is typically We do this by: • Medium to high complexity • Outcome-based projects • Using processes and tools • Referrals or existing customers that help ensure the outcomes • Uses our people’s technical skills • Collaborating with customers’ IT departments • Securing the best product for the solution through our vendor independence • Being fl exible in our approach • Hiring and retaining talent Source & Deploy Address customer technology requirements Services provided Smart Supply, Supply Chain Services, Lifecycle Management, Software Licensing and Compliant Disposals The work we undertake -

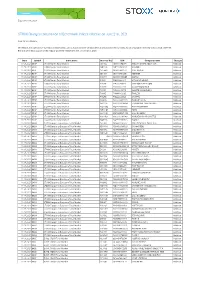

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. -

INVITATION BERENBERG Is Delighted to Invite You to Its

INVITATION BERENBERG is delighted to invite you to its UK CORPORATE CONFERENCE 2019 on Wednesday 27th – Thursday 28th March 2019 at The Grove Chandler’s Cross • Watford • Hertfordshire • WD3 4TG • United Kingdom LIST OF ATTENDING COMPANIES BY SECTOR (SUBJECT TO CHANGE) Business Services Consumer Financials Alpha Financial Markets Consulting plc Applegreen plc Ashmore Group plc BBA Aviation plc Compass Group plc Burford Capital Ltd Big Yellow Group plc Cranswick plc Legal & General Group plc Clipper Logistics plc Dalata Hotel Group plc Lloyds Banking Group plc CLS Holdings plc DFS Furniture plc London Stock Exchange plc Green REIT plc Greggs plc Provident Financial plc Hibernia REIT plc Hollywood Bowl Group plc Schroders plc HomeServe plc IG Design Group plc St. James’s Place plc International Consolidated Airlines Group SA Inchcape plc Intertek Group plc On The Beach Group plc John Menzies plc PPHE Hotel Group Ltd Marlowe plc TUI Group RWS Holdings plc Whitbread plc Safestore Holdings plc WM Morrison plc Sirius Real Estate Ltd Staffline Group plc Healthcare Materials TMT Abcam plc Anglo Pacific Group plc Ascential plc Clinigen Group plc BAE Systems plc BT Group plc Dechra Pharmaceuticals PLC Bodycote plc Computacenter plc GlaxoSmithKline plc BP plc Craneware plc Huntsworth plc Cairn Energy plc Daily Mail & General Trust plc IP Group Plc Central Asia Metals plc GB Group plc NMC Health plc Centrica plc GVC Holdings plc Smith & Nephew plc Ceres Power Holdings plc JPJ Group plc (formerly Jackpotjoy) Spire Healthcare Group plc Coats Group plc -

Jpmorgan Funds Europe Dynamic Small Cap Fund a (Perf) EUR This Fund Is Managed by Jpmorgan Asset Management (Europe) S.À.R.L

22 February, 2021 JPMorgan Funds Europe Dynamic Small Cap Fund A (perf) EUR This fund is managed by JPMorgan Asset Management (Europe) S.à.r.l. EFC Classification Equity Advanced Europe SmallCap Price +/- Date 52wk range 57.08 EUR 0.15 19/02/2021 29.39 58.30 Issuer Profile Administrator JPMorgan Asset Management (Europe) S.à.r.l. Investment Objective: The Sub-Fund aims to maximise long-term capital growth by Address Route de Trèves 6 2633 investing primarily in an aggressively managed portfolio of small capitalisation European companies. Investment Policy: At least 67% of the Sub-Fund's assets (excluding cash and City Senningerberg cash equivalents) will be invested in equity securities of small capitalisation companies Tel/Fax +352 (0)3 410 30 20 that are domiciled in, or carrying out the main part of their economic activity in, a Website www.jpmorganassetmanagement.lu European country. Market capitalisation is the total value of a company's shares and may fluctuate materially over time. Small capitalisation companies are those whose market capitalisation is within the range of the market capitalisation of companies in the General Information Benchmark for the Sub-Fund at the time of purchase. The Sub-Fund uses an investment ISIN LU0210072939 process that is based on systematic investments in equity securities with specific style Fund Type Capitalization characteristics, such as value, quality and momentum in price and earnings trends. Quote Frequency daily Historical research has demonstrated that such... Quote Currency EUR Currency -

Top Vars 2020 Intros.Indd

Top In association with ARs V 2020 Welcome to Top VARs 2020 Although uncertain times lie ahead, the UK’s top 100 resellers, MSPs and front-line channel partners turned over £17bn in their latest financial years on record, Doug Woodburn discovers This year’s report has a feel of the calm Together, they now turn over before the storm about it. £16.96bn – that’s more than the GDP As a group, the UK’s largest 100 of Botswana and equal to what the resellers and MSPs had a fairly serene government has spent on PPE and and uneventful time of it in their most other COVID-related goods and recent financial years, posting collective services since April. Combined revenues of nearly £17bn – an 8.5 per headcount of over 42,000 means cent annual jump. Profits were also they employ more staff than the roughly flat, depending on how you population of ancient Egyptian city look at it (see p13). Thebes in its pomp. Top VARs charts not current financial When it comes to the rankings, this performance, but the fortunes of these year’s supplement contains more sub- 100 firms in their latest financial years plots than a presidential election. on record – most of which ended The race for top spot has heated before the pandemic hit the industry up, with Softcat just £60m shy of like a force 10 gale. Computacenter’s UK top line (we opted This centuplicate of front-line this year to rank both on their gross channel partners has, however, held up invoiced income, rather than revenue, remarkably well this year.