Retail Property Market in France

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brand Building

BRAND BUILDING inside the house of cÉline Breguet, theinnovator. Classique Hora Mundi 5717 An invitation to travel across the continents and oceans illustrated on three versions of the hand-guilloché lacquered dial, the Classique Hora Mundi is the first mechanical watch with an instant-jump time-zone display. Thanks to apatented mechanical memorybased on two heart-shaped cams, it instantlyindicates the date and the time of dayornight in agiven city selected using the dedicated pushpiece. Historyisstill being written... BREGUET BOUTIQUES –NEW YORK 646 692-6469 –BEVERLY HILLS 310860-9911 BAL HARBOUR 305 866-10 61 –LAS VEGAS 702733-7435 –TOLL FREE 877-891-1272 –WWW.BREGUET.COM Haute Joaillerie, place Vendôme since 1906 Audacious Butterflies Clip, pink gold, pink, mauve and purple sapphires, diamonds. Clip, white gold, black opals, malachite, lapis lazuli and diamonds. Visit our online boutique at vancleefarpels.com - 877-VAN-CLEEF The spirit of travel. Download the Louis Vuitton pass app to reveal exclusive content. 870 MADISON AVENUE NEW YORK H® AC CO 5 01 ©2 Coach Dreamers Chloë Grace Moretz/ Actress Coach Swagger 27 in patchwork floral Fluff Jacket in pink coach.com 800-457-TODS 800-457-TODS april 2015 16 EDITOR’S LETTER 20 CONTRIBUTORS 22 COLUMNISTS on Failure 116 STILL LIFE Mike Tyson The former heavyweight champion shares a few of his favorite things. Photography by Spencer Lowell What’s News. 25 The Whitney Museum of American Art Reopens With Largest Show Yet 28 Menswear Grooming Opts for Black Packaging The Texas Cocktail Scene Goes -

Buffet-Americain

Retrospect Buffet-Américain Peter Szende The Great Exhibition of the Works of Indus- of these was an innovative restaurant concept por- try of all Nations – also known variably as the Great trayed in the vintage advertising poster that is re- Exhibition, the Crystal Palace Exhibition, or the produced on a following page. The restaurant does World’s Fair – occurred in London during 1851. not have a single name in the modern sense, but This established the standard for industrial and cul- rather is identified by its style of service and its loca- tural exhibitions throughout Europe and the United tion. States during the next century. It also inspired Na- A buffet-Américain (American buffet) was a poleon III to organize his Exposition Universelle place where one could eat or drink while standing. des produits de l’Agriculture, de l’Industrie, et des The phrase referred to the growing popularity of im- Beaux-Arts de Paris (translated as Universal Exhibi- promptu snacking in nineteenth century America, tion of Products of Agriculture, Industry, and Fine and represented a cross-cultural dining fad that Arts of Paris) in 1855. complemented the themes of the Exposition Uni- The Paris Exhibition was a catalyst for the cre- verselle. ation of numerous related exhibits, attractions, and This particular establishment resembled an in- businesses in the neighborhoods surrounding the tegration of two concepts that are familiar today, a exhibition grounds along the Champs-Elysées. One fast-casual bakery café and an Italian enoteca (wine Spring 2013 | Boston Hospitality Review 29 bar) with standing counters. The text at the bottom ABOUT THE RESEARCH of the poster reads “VIANDES FROIDES PATIS- The original poster is archived within the collection of the Bibliothèque SERIE” (cold meats and pastries) and “Vins fins nationale de France and has been reproduced by permission. -

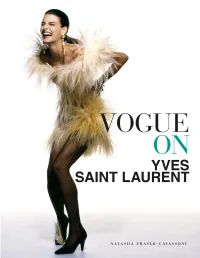

Vogue on Yves Saint Laurent

Model Carrie Nygren in Rive Gauche’s black double-breasted jacket and mid-calf skirt with long- sleeved white blouse; styled by Grace Coddington, photographed by Guy Bourdin, 1975. Linda Evangelista wears an ostrich-feathered couture slip dress inspired by Saint Laurent’s favourite dancer, Zizi Jeanmaire. Photograph by Patrick Demarchelier, 1987. At home in Marrakech, Yves Saint Laurent models his new ready-to-wear line, Rive Gauche Pour Homme. Photograph by Patrick Lichfield, 1969. DIOR’S DAUPHIN FASHION’S NEW GENIUS A STYLE REVOLUTION THE HOUSE THAT YVES AND PIERRE BUILT A GIANT OF COUTURE Index of Searchable Terms References Picture credits Acknowledgments “CHRISTIAN DIOR TAUGHT ME THE ESSENTIAL NOBILITY OF A COUTURIER’S CRAFT.” YVES SAINT LAURENT DIOR’S DAUPHIN n fashion history, Yves Saint Laurent remains the most influential I designer of the latter half of the twentieth century. Not only did he modernize women’s closets—most importantly introducing pants as essentials—but his extraordinary eye and technique allowed every shape and size to wear his clothes. “My job is to work for women,” he said. “Not only mannequins, beautiful women, or rich women. But all women.” True, he dressed the swans, as Truman Capote called the rarefied group of glamorous socialites such as Marella Agnelli and Nan Kempner, and the stars, such as Lauren Bacall and Catherine Deneuve, but he also gave tremendous happiness to his unknown clients across the world. Whatever the occasion, there was always a sense of being able to “count on Yves.” It was small wonder that British Vogue often called him “The Saint” because in his 40-year career women felt protected and almost blessed wearing his designs. -

Accompanying Person Programme Monday May 9Th 10Am to 13:00

Accompanying Person Programme Monday May 9th 10am to 13:00 10:00 Departure of the Maison de la Chimie - 28 rue Saint Dominique 75007 PARIS. Transfer by bus to the Passage Jouffroy, 10/12 boulevard Montmartre 75009 Paris 10h15/30 The Return is on the Place Colette to the metro station "Musée du Palais Royal Wolf" at 11:30 This is where the bus will take the group to transfer to Saint Germain des Pres at 11:30 (arriving at St Germain 11h45/12h00 maximum) Removing front of Eglise Saint-Germain located at 3 Place St Germain des Prés 75006 Paris to 11h45/12h00 13:00 End of tour returning the group by bus to 3 Place St Germain des Prés 75006 THE COVERED GALLERIES AND ARCADES OF PARIS Typical for 19th century architecture, the “Passages Couverts” are located in the districts of the right bank. From more than a 140 registered in the 1830, only about 30 still exist today, mostly situated between the Palais Royal and the Grands Boulevards. Offering not only protection from bad weather, but also cafés, shops and theatres, these covered galleries invite the visitor for a leisurely stroll in a fashionable place. The galeries Vivienne and Véro-Dodat, the Passage des Panoramas, Jouffroy or Verdeau have preserved the ancient splendor and charm of these “Salons du Tout Paris” of the 19th century. Their tall iron work and glass roofs, hand carved woodwork, wrought iron gas lanterns and mosaic or marble floors are simply fascinating. SAINT-GERMAIN-DES-PRES St-Germain-des-Prés was originally a little market town formed around the abbey of St. -

SENTIMENTAL EDUCATION by GUSTAVE FLAUBERT (Volume II)

SENTIMENTAL EDUCATION BY GUSTAVE FLAUBERT (Volume II) CHAPTER XI. A Dinner and a Duel. Frederick passed the whole of the next day in brooding over his anger and humiliation. He reproached himself for not having given a slap in the face to Cisy. As for the Maréchale, he swore not to see her again. Others as good-looking could be easily found; and, as money would be required in order to possess these women, he would speculate on the Bourse with the purchase-money of his farm. He would get rich; he would crush the Maréchale and everyone else with his luxury. When the evening had come, he was surprised at not having thought of Madame Arnoux. "So much the better. What's the good of it?" Two days after, at eight o'clock, Pellerin came to pay him a visit. He began by expressing his admiration of the furniture and talking in a wheedling tone. Then, abruptly: "You were at the races on Sunday?" "Yes, alas!" Thereupon the painter decried the anatomy of English horses, and praised the horses of Gericourt and the horses of the Parthenon. "Rosanette was with you?" And he artfully proceeded to speak in flattering terms about her. Frederick's freezing manner put him a little out of countenance. He did not know how to bring about the question of her portrait. His first idea had been to do a portrait in the style of Titian. But gradually the varied colouring of his model had bewitched him; he had gone on boldly with the work, heaping up paste on paste and light on light. -

PARIS Cushman & Wakefield Global Cities Retail Guide

PARIS Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | Paris | 2019 0 Regarded as the fashion capital of the world, Paris is the retail, administrative and economic capital of France, accounting for near 20% of the French population and 30% of national GDP. Paris is one of the top global cities for tourists, offering many cultural pursuits for visitors. One of Paris’s main growth factors is new luxury hotel openings or re-openings and visitors from new developing countries, which are fuelling the luxury sector. This is shown by certain significant openings and department stores moving up-market. Other recent movements have accentuated the shift upmarket of areas in the Right Bank around Rue Saint-Honoré (40% of openings in 2018), rue du Faubourg Saint-Honoré, and Place Vendôme after the reopening of Louis Vuitton’s flagship in 2017. The Golden Triangle is back on the luxury market with some recent and upcoming openings on the Champs-Elysées and Avenue Montaigne. The accessible-luxury market segment is reaching maturity, and the largest French proponents have expanded abroad to find new growth markets. Other retailers such as Claudie Pierlot and The Kooples have grown opportunistically by consolidating their positions in Paris. Sustained demand from international retailers also reflects the current size of leading mass-market retailers including Primark, Uniqlo, Zara brands or H&M. In the food and beverage sector, a few high-end specialised retailers have enlivened markets in Paris, since Lafayette Gourmet has reopened on boulevard Haussmann, La Grande Épicerie in rue de Passy replacing Franck & Fils department store, and more recently the new concept Eataly in Le Marais. -

The LVMH Group Has Recently Issued a New Code of Conduct in Order to Address the Challenges in an Ever-Changing Environment Whil

The LVMH group has recently issued a new Code of Conduct in order to address the challenges in an ever-changing environment while upholding Ethics and Governance objectives. Bulgari is part of the LVMH group, shares its values and actively participates in building the foundations for its lasting success. Bulgari is a byword for excellence. Its authenticity, combined with the ability to evolve while also remaining true to its core values, are the qualities that determine its success. In the luxury goods market, brand leadership of this level is only possible thanks to the constant search for perfection: our creations are so highly coveted because they realize a dream and bring excitement into the lives of those who own them, thanks to their extraordinary quality. Today, as never before, leadership is strongly linked to credibility. Our clients and stakeholders fully rely on the fact that this dedication to excellence is reflected in extremely high standards of behavioral integrity and business practices at Bulgari. Compliance with the standards of the Responsible Jewellery Council is a concrete example of our commitment. Bulgari has decided to fully adopt the new LVMH Code of Conduct, whose every word it shares and whose principles are in total harmony with the commitments made by the company and the values that have guided it over the years. Adherence to the LVMH Code of Conduct is an opportunity and an incentive to further strengthen all the operating guidelines and systems that we have developed over the years, guaranteeing coherence between business values and activities. Bulgari is committed to guaranteeing compliance with the principles set out in the LVMH Code of Conduct and ensuring that they are implemented and disseminated. -

Parrainage International

P A R R A I N A G E I N T E R N A T I O N A L Que faire à Paris pendant les vacances de Nöel 2020? 1. ADMIRER LES ILLUMINATIONS DE NÖEL DE PARIS 2 Place Vendôme, Paris 1er 2 Faubourg Saint Honoré, Paris 8 2 Avenue des Champs Elysées, Paris 8 3 Avenue Montaigne, Paris 8 3 2. VISITER LES MAGNIFIQUES PASSAGES CACHES DE PARIS 4 Galerie Vivienne, Paris 2 4 Passage des Panoramas, Paris 11 4 Autres passages et galeries 4 3. GRAND CLASSIQUE: DECOUVRIR LE SAPIN DE NOËL DES GALERIES LAFAYETTE 5 Boulevard Haussmann, Paris 9 5 4. ET SI ON VEUT EN PROFITER POUR UN PEU DE SHOPPING ? 6 Bercy Village, Paris 12 6 Printemps Haussmann, Paris 9 6 Bon Marché Rive Gauche, Paris 7 7 BHV Marais, Paris 4 7 Centre commercial Westfield les 4 Temps, La Défense 7 Centre commercial Westfield Forum des Halles, Paris 1 8 La Vallée Village, Val d’Europe 8 5. LES MARCHES DE NOËL 9 Le marché de Noël du Parvis de l’Hôtel de Ville, Paris 4 9 La Recyclerie, Paris 18 9 Le marché de Noël de Saint-Germain-des-Prés, Paris 6 10 6. LES EXCURSIONS EN REGION PARISIENNE 11 Parc floral de Paris, ville de Vincennes (sur RER A) 11 Château et forêt de Fontainebleau (sur Transilien R) 11 Château de Vaux-le-Vicomte (sur Transilien R + Uber) 12 Versailles (sur RER C ou Transilien L) 12 Cité médiévale de Provins (sur Transilien P) 13 Autres excursions près de Paris 13 1 / 13 1. -

Cinema, Consumer Society and Spectacle Julio Cesar Lemes De Castro

Cinema, consumer society and spectacle Julio Cesar Lemes de Castro To cite this version: Julio Cesar Lemes de Castro. Cinema, consumer society and spectacle. In: DRUMMOND, Phillip (ed.). The London film and media reader 3: the pleasures of the spectacle. London, TheLondon Symposium, pp.111-121, 2015, 978-09-5736-315-1. hal-03225773 HAL Id: hal-03225773 https://hal.archives-ouvertes.fr/hal-03225773 Submitted on 6 Jun 2021 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. The Pleasures of the Spectacle Edited by Phillip Drummond The London Film and Media Reader 3 The London Film & Media Reader 3 is published by The London Symposium on behalf of Academic Conferences London Ltd This ebook is copyright material, protected by the laws of the United Kingdom and under international law. It may not be reproduced or transmitted by any means and in any form, in whole or in part, without the permission of the publisher. The individual essays which make up this ebook are copyright material, protected by the laws of the United Kingdom and under international law. They may not be reproduced or transmitted by any means and in any form, in whole or in part, without the permission of the publisher. -

Pan-European Footfall 2017-2018

REAL ESTATE PAN-EUROPEANFOR A CHANGING WORLD FOOTFALL ANALYSIS Key global and lifestyle cities 2017-2018 PROPERTY DEVELOPMENT TRANSACTION CONSULTING VALUATION PROPERTY MANAGEMENT INVESTMENTRETAIL MANAGEMENT Real EstateReal Estate forfor a a changing changing world world CONTENT Macroeconomics ............ 04 Amsterdam .......................... 30 Helsinki ...................................... 46 Warsaw ...................................... 62 Synthesis ................................... 06 Athens ......................................... 32 Lisbon ........................................... 48 Zurich ............................................ 64 Barcelona ................................ 34 Munich ........................................ 50 London ........................................ 10 Brussels ..................................... 36 Oslo ................................................. 52 Methodology ........................ 67 Paris ................................................ 14 Budapest ................................. 38 Prague ......................................... 54 Results by country ........ 68 Madrid ........................................ 18 Copenhagen ....................... 40 Rome ............................................. 56 Contacts ..................................... 70 Milan .............................................. 22 Dublin ........................................... 42 Stockholm .............................. 58 Berlin ............................................. 26 Frankfurt .................................. -

Commercial Real Estate in the Paris Region Results & Outlook

Commercial Real Estate in the Paris Region Results & Outlook PARIS VISION 2016 1 and now, presenting... THE BIG CATCH-UP Dear friends, We saw a slow start to 2015, with transaction volumes falling sharply at the beginning of the first half of the year. The second half swept away uncertainties by making up much of the lost ground. The office rental market demonstrated its resilience and even a certain dynamism in small- and medium- sized area segments, proof that SMEs are more positive and looking to the future with confidence. The investment market meanwhile recorded its third best year of the decade after 2007. Real estate is currently a particularly popular asset class with investors and a considerable mass of liquidity is flowing into the Greater Paris region market and impacting yields – which are at a record low. Will the market be able to absorb this demand? Is the rental market at the start of a new cycle driven by more PHILIPPE PERELLO robust growth as Daniel Cohen predicts? CEO Paris Office Partner Knight Frank LLP These are some of the questions we have attempted to answer with the insights of our main contributors – Jean-Philippe Olgiati (Blackrock), François Darsonval (Publicis), Laurent Fléchet (Primonial) and Pierre Dubail (Dubail Rolex) – each of them key market players who offer us their analysis. For that, I would like to offer them my heartfelt thanks. PARIS VISION 2016 CONTENTS opinion Daniel Cohen 6 vision the jean-philippe olgiati 8 Magicians THE OFFICE LETTING MARKET TRENDS 11 OUTLOOK 24 QUESTIONS TO: François Darsonval 30 flashback 50 PARIS VISION 2016 the animal trapeze tamers artists THE INVESTMENT MARKET THE RETAIL MARKET TRENDS 33 TRENDS 55 OUTLOOK 44 OUTLOOK 70 QUESTIONS TO: Laurent Fléchet 48 QUESTIONS TO: Pierre Dubail 74 2015 key figure 52 knight frank 76 6 opinion Daniel cohen Professor and Director of the Economics Department of Higher Normal School (École Normale Supérieure de Paris) Founding member of the École d'Économie de Paris Director of CEPREMAP (Centre pour la recherche Économique et des Applications). -

Press Release 2021 LVMH PRIZE for YOUNG FASHION DESIGNERS: 8TH EDITION

Press release 2021 LVMH PRIZE FOR YOUNG FASHION DESIGNERS: 8TH EDITION LVMH ANNOUNCES THE LIST OF THE 9 FINALISTS Paris, 28th April 2021 The semi-final of the LVMH Prize took place from 6th to 11th April 2021. Twenty young designers selected among the 1,900 candidates from all over the world presented their collections on the digital platform lvmhprize.com. The committee of Experts of the Prize and, for the first time, the public as a new Expert, selected 9 brands for the final. These 9 designers will present their creations to the Jury on the occasion of the final which will be held in September at the Louis Vuitton Foundation, on a date to be announced later. The Jury of the LVMH Prize will choose the winners of the LVMH Prize and of the Karl Lagerfeld / Special Jury Prize among the finalists. The 9 finalists are: BIANCA SAUNDERS by Bianca Saunders (British designer based in London), menswear CHARLES DE VILMORIN by Charles de Vilmorin (French designer based in Paris) genderless collections CHRISTOPHER JOHN ROGERS by Christopher John Rogers (American designer based in New York), womenswear CONNER IVES by Conner Ives (American designer based in London), womenswear KIDSUPER by Colm Dillane (American designer based in New York), menswear KIKA VARGAS by Kika Vargas (Colombian designer based in Bogota), womenswear LUKHANYO MDINGI by Lukhanyo Mdingi (South African designer based in Cape Town), womenswear and menswear NENSI DOJAKA by Nensi Dojaka (Albanian designer based in London), womenswear RUI by Rui Zhou (Chinese designer based in Shanghai), genderless collections Delphine Arnault declares: "The all-digital semi-final this year, in the context of the health crisis, was a new opportunity to showcase the work of the designers.