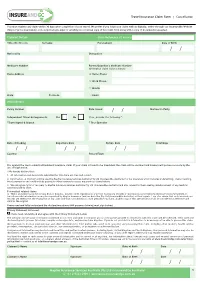

Insureandgo USA – Trip Interruption Claims Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Auto –Accidents - What Is “No-Fault” Insurance?

AUTO –ACCIDENTS - WHAT IS “NO-FAULT” INSURANCE? If you are injured in a car accident who pays your medical bills? Believe it or not, your medical insurance carrier does not have the primary responsibility to pay your medical bills for injuries sustained in an automobile accident - The applicable automobile insurance carrier does. But remember, if your injuries or above a certain threshold you can still sue the person who cause your injuries for money damages above what the applicable automobile insurance carrier provides. In New York State each automobile insurance policy must provide coverage known as Personal Injury Protection (“PIP”) and typically referred to a “No-Fault” insurance. Medical bills, some or all of the injured party’s lost wages and other expenses are paid from this portion of the policy, whether or not the injured party caused the accident. So if were in a car accident driving your own vehicle and you are injured as a result of another person's negligence, the no-fault portion of your automobile insurance policy will cover your medical bills to the extent that you have coverage. If your coverage runs out other insurance will kick in. The New York State Insurance Law, requires that all automobile insurance policies issued in this state contain a Personal Injury Protection (“PIP”) or “No-Fault” endorsement with a minimum of $50,000.00 in coverage. Generally speaking, this coverage extends to the driver and passengers in a covered vehicle, as well as to a pedestrian struck by the covered vehicle. The coverage “kicks in” regardless of fault in connection with an accident; under most circumstances, a covered individual will be afforded certain enumerated benefits regardless of that individual’s fault in connection with the happening of the accident. -

Directors Guild of America, Inc. National Commercial Agreement of 2017

DIRECTORS GUILD OF AMERICA, INC. NATIONAL COMMERCIAL AGREEMENT OF 2017 TABLE OF CONTENTS Page WITNESSETH: 1 ARTICLE 1 RECOGNITION AND GUILD SHOP 1-100 RECOGNITION AND GUILD SHOP 1-101 RECOGNITION 2 1-102 GUILD SHOP 2 1-200 DEFINITIONS 1-201 COMMERCIAL OR TELEVISION COMMERCIAL 4 1-202 GEOGRAPHIC SCOPE OF AGREEMENT 5 1-300 DEFINITIONS OF EMPLOYEES RECOGNIZED 1-301 DIRECTOR 5 1-302 UNIT PRODUCTION MANAGERS 8 1-303 FIRST ASSISTANT DIRECTORS 9 1-304 SECOND ASSISTANT DIRECTORS 10 1-305 EXCLUSIVE JURISDICTION 10 ARTICLE 2 DISPUTES 2-101 DISPUTES 10 2-102 LIQUIDATED DAMAGES 11 2-103 NON-PAYMENT 11 2-104 ACCESS AND EXAMINATION OF BOOKS 11 AND RECORDS ARTICLE 3 PENSION AND HEALTH PLANS 3-101 EMPLOYER PENSION CONTRIBUTIONS 12 3-102 EMPLOYER HEALTH CONTRIBUTIONS 12 i 3-103 LOAN-OUTS 12 3-104 DEFINITION OF SALARY FOR PENSION 13 AND HEALTH CONTRIBUTIONS 3-105 REPORTING CONTRIBUTIONS 14 3-106 TRUST AGREEMENTS 15 3-107 NON-PAYMENT OF PENSION AND HEALTH 15 CONTRIBUTIONS 3-108 ACCESS AND EXAMINATION OF BOOKS 16 RECORDS 3-109 COMMERCIAL INDUSTRY ADMINISTRATIVE FUND 17 ARTICLE 4 MINIMUM SALARIES AND WORKING CONDITIONS OF DIRECTORS 4-101 MINIMUM SALARIES 18 4-102 PREPARATION TIME - DIRECTOR 18 4-103 SIXTH AND SEVENTH DAY, HOLIDAY AND 19 LAYOVER TIME 4-104 HOLIDAYS 19 4-105 SEVERANCE PAY FOR DIRECTORS 20 4-106 DIRECTOR’S PREPARATION, COMPLETION 20 AND TRAVEL TIME 4-107 STARTING DATE 21 4-108 DIRECTOR-CAMERAPERSON 21 4-109 COPY OF SPOT 21 4-110 WORK IN EXCESS OF 18 HOURS 22 4-111 PRODUCTION CENTERS 22 ARTICLE 5 STAFFING, MINIMUM SALARIES AND WORKING CONDITIONS -

AUTOMOBILE INSURANCE TOOLKIT Automobile Insurance Toolkit

Florida Department of Financial Services AUTOMOBILE INSURANCE TOOLKIT Automobile Insurance Toolkit Insurance coverage is an integral part of a solid financial foundation. Insurance can help us recover financially after illness, accidents, natural disasters or even the death of a loved one. There are a wide variety of insurance products available and choosing the correct type and amount of coverage can be a challenge. This toolkit provides information to assist you with insuring your automobile and tips for settling an automobile insurance claim. TABLE OF CONTENTS Click a title or page number to navigate to a section. 01 Coverages & Minimum Requirements - 4 Coverage Descriptions - 5 Insurance Requirements for Special Cases - 8 02 Underwriting Guidelines - 11 Underwriting Factors That Cannot Affect Your Ability to Purchase Insurance - 11 Underwriting Factors That Affect Your Insurance Policy Premium - 12 Other Factors Affecting Your Premiums - 13 Shopping for Auto Insurance - 13 03 Automobile Claims - 14 Actions to Take Before and After an Auto Accident - 14 Disputing Claim Settlements - 16 04 Shopping for Coverage Checklist - 17 01 Coverages & Minimum Requirements In Florida, vehicle owners may be required to The second type of auto insurance is outlined in the purchase two types of auto insurance. Florida Financial Responsibility Law. It requires drivers The first type of auto insurance is outlined in the who have caused accidents involving bodily injury/death Florida Motor Vehicle No-Fault Law (s. 627.736, Florida or received certain citations, to purchase bodily injury Statutes). It requires every person who registers a liability (BI) coverage with minimum limits of $10,000 vehicle in Florida to provide proof they have personal per person and $20,000 per accident, referred to as injury protection (PIP) and property damage liability split limits. -

Investigations Unveil Extent of Fraud

ESSENTIAL READING FOR TRAVEL INSURANCE INDUSTRY PROFESSIONALS WWW.ITIJ.CO.UK NOVEMBER 2011 • ISSUE 130 Investigations unveil extent of fraud Kenyan conundrum The summer holiday season has come to an end in the northern hemisphere, and with it has come more dire warnings from travel insurance Travel insurers basing their coverage decisions on companies that fraud is on the up – both from travel advice from government agencies have hit clinics treating travellers, and from travellers the headlines in the UK recently. Mandy Aitchison themselves. Sarah Watson reports on the problem looks into the issue In a recent editorial piece in Insurance Insight, The UK’s Foreign and Commonwealth Offi ce (FCO) Mike Keating of AXA Insurance explained that has advised against ‘all but essential travel to coastal the company noticed ‘a worrying trend over the areas within 150 km of the Kenya-Somalia border’. It summer’, stating that AXA’s claims department further explained: “We advise against all but essential received some excessively high medical bills as part travel to coastal areas within 150 km of the Somali of claims for treatment in Spain, Turkey, Bulgaria, border, following two attacks by armed gangs in small Egypt and sub-Saharan Africa. He added: “There boats against beach resorts in the Lamu area on 11 is evidence of overcharging, overdiagnosis and September and 1 October 2011. This advice will be over-treatment of minor problems and collusion kept under review. Both attacks were on beach-front between clinics and holidaymakers. Travellers need properties, with two Westerners kidnapped and one to be warned of the risks involved in using overseas murdered. -

What You Need to Know

What AutoAuto you InsuranceInsurance need to know A consumer information publication The Minnesota Department of Commerce has prepared this guide to help you better understand auto insurance. It gives you information on shopping for insurance, the different types of coverage, and a basic understanding of “no fault” coverage. The Minnesota Department of Commerce regulates insurance agents, agencies, adjusters, and companies operating in Minnesota. If they are licensed to do business in the State, they are responsible for adhering to the laws and rules that govern the industry. This guide does not list all of these regulations. If you have a question about your insurance, please contact the Department’s Consumer Response Team at 651-296-2488, or toll free 800-657-3602. Duplication of this guide is encouraged. Please feel free to copy this information and share it with others. Department of Commerce Auto Insurance can protect you from the financial costs of an accident or injury, provided you have the proper coverage. Yet many people are unclear about what their insurance policy cov- ers until it is too late. They may have difficulties settling a claim or face rate increases or termination of coverage. Auto Insurance I s ... Protection. Insurance is a way of transferring risk for a loss among a certain group of people. You, and others, pay premiums to an insurance company to be reimbursed if you have an acci- dent. The amount you can collect and under what circumstances are outlined in your policy. Required. Under most circumstances, a licensed vehicle in the state of Minnesota must have liability, personal injury protection, uninsured motorist, and underinsured motorist coverage. -

Img Signature Travel Insurancesm

IMG SIGNATURE TRAVEL INSURANCESM BENEFITS SIGNATURE TRAVEL INSURANCE BENEFITS SIGNATURE TRAVEL INSURANCE Available – if purchased within 20 days of initial trip Trip Cancellation Trip cost insured (up to $100,000) Pre-existing Condition Waiver payment Trip Interruption 150% of trip cost insured Common Carrier AD&D Up to $100,000 Travel Delay Up to $1,000 ($250 per day max after delay of 6 hrs) Search & Rescue Up to $10,000 Missed Connection Up to $500 (after a delay of 3 hours) Sports Equipment Rental Up to $2,000 ($500 Day Max) Change Fee Up to $300 Waives excluded sports/ Included Reimbursement of Miles or recreation activities Up to $75 Reward Points Rental Car Damage Up to $40,000 Lost/Baggage Up to $2,500 Coverage Type Primary Baggage Delay Up to $500 Cancel for Any Reason Up to 75% of the trip cost insured if purchased Emergency Medical Up to $100,000 (UPGRADE) within 20 days of initial trip payment Interrupt for Any Reason Up to 75% of the trip cost insured Emergency Dental Up to $1,000 (UPGRADE) TRAVEL COVERAGE BAGGAGE & EQUIPMENT COVERAGE TRIP CANCELLATION/INTERRUPTION BAGGAGE AND PERSONAL EFFECTS You can be reimbursed for unused travel arrangements, as well as up to $75 for fees If your baggage or personal effects are lost, stolen or damaged, we will cover the to rebank frequent flyer miles, for reasons such as death or covered sickness or injury loss or cost of repair. If your baggage is delayed for more than 24 hours after you of you, family member, traveling companion, business partner or child caregiver; being reach your -

The RAM Health Insurance Cooperative Is NOW Thriving

Health Insurance Cooperative The RAM Health Insurance Cooperative is NOW thriving – and growing – in 2020! The program offers RAM members: A 3% DISCOUNT OFF PREMIUM RATES FOR SMALL BUSINESSES IN THE SMALL GROUP MARKET (Groups of 1-50 employees) ACCESS TO EVERY SMALL GROUP PLAN OFFERED BY BCBSMA & ALMOST ALL SMALL GROUP PLANS OFFERED BY FALLON HEALTH DEFINED CONTRIBUTION OPTIONS TO ADDRESS THE NEEDS OF BOTH YOUR BUSINESS AND YOUR EMPLOYEES And for those members who choose a BCBSMA plan, the program also offers additional value-added benefits including: A WELLNESS PROGRAM WITH POTENTIAL EMPLOYEE INCENTIVES OF UP TO $300 AND AN OPPORTUNITY TO EARN 7.5% IN BACK END EMPLOYER INCENTIVES A FREE SUPPLEMENTAL HOSPITALIZATION POLICY FOR ALL SUBSCRIBERS, WHICH COVERS $750 FOR A HOSPITAL ADMISSION AND $150 EACH ADDITIONAL DAY UP TO 10 DAYS A FREE $10,000 LIFE INSURANCE POLICY FOR ALL SUBSCRIBERS Visit www.retailersma.org or call us at (617) 523-1900 to learn more! Health Insurance Cooperative Dear RAM Member, RAMHIC is a service of the Retailers Association of Massachusetts—the leading voice for more choice and fairer premiums for small businesses and their employees in the Massachusetts insurance market. RAMHIC is an important example of our efforts to deliver economic equality for Main Street. Since the adoption of universal healthcare in Massachusetts, small businesses have received disproportionate increases in their health insurance premiums compared to their large competitors and government programs. In response, RAM fought for the creation of small business group purchasing cooperatives designed to allow like-minded businesses to join together and negotiate with carriers for reduced premium rates based on the projected experience of the group. -

Lloyd's Policy Signing Office, Quoting the Lloyd's Policy Signing Office Number and Date Or Reference Shown in the Table

Lloyd’s Policy of the Syndicates whose definitive numbers We, Underwriting Members and proportions are shown in the Table attached hereto (hereinafter referred to as 'the Underwriters'), hereby agree, in consideration of the payment to Us by or on behalf of the Assured of the Premium specified in the Schedule, to insure against loss, including but not limited to associated expenses specified herein, if any, to the extent and in the manner provided in this Policy. The Underwriters hereby bind themselves severally and not jointly, each for his own part and not one for another, and therefore each of the Underwriters (and his Executors and Administrators) shall be liable only for his own share of his Syndicate's proportion of any such Loss and of any such Expenses. The identity of each of the Underwriters and the amount of his share may be ascertained by the Assured or the Assured's representative on application to Lloyd's Policy Signing Office, quoting the Lloyd's Policy Signing Office number and date or reference shown in the Table. If the Assured shall make any claim knowing the same to be false or fraudulent, as regards amount or otherwise, this Policy shall become void and all claim hereunder shall be forfeited. In Witness whereof the General Manager of Lloyd's Policy Signing Office has signed this Policy on behalf of each of Us. LLOYD'S POLICY SIGNING OFFICE General Manager If this policy (or any subsequent endorsement) has been produced to you in electronic form, the original document is stored on the Insurer's Market Repository to which your broker has access. -

Understanding How Insurance Works: a Case Study About Lucy (Guide) Cfpb Building Block Activities Understanding-How-Insurance-Works-Lucy Guide.Pdf

BUILDING BLOCKS TEACHER GUIDE Understanding how insurance works: A case study about Lucy Students read about how insurance works, then review a case study to see how insurance choices can affect personal finances for a rural young adult. Learning goals KEY INFORMATION Big idea Building block: When you purchase insurance, you are Executive Function transferring financial risk from yourself to an Financial knowledge and insurance company. decision-making skills Essential questions Grade level: High school (9–12) § What is the main benefit of choosing to Age range: 13–19 purchase insurance? Topic: Protect (Managing risk) § How do the insurance company and the policyholder share risks and costs? School subject: CTE (Career and technical education), Math, Physical education or Objectives health, Social studies or history Teaching strategy: Cooperative learning, § Understand how insurance works Simulation § Apply insurance policy specifics to a case study to evaluate costs and benefits Bloom’s Taxonomy level: Understand, Apply, Evaluate What students will do Activity duration: 45–60 minutes § Read about how the insurance process works and discover what roles the insurance STANDARDS company and the policyholders play. § Review information about specific types of Council for Economic Education Standard VI. Protecting and insuring insurance policy coverage and costs. Jump$tart Coalition Risk management and insurance – Standard 1 To find this and other activities go to: Consumer Financial Protection Bureau consumerfinance.gov/teach-activities 1 of 7 Winter 2020 § Evaluate a case study to see how one policyholder’s insurance choices affected her financially. § Write an advice email about the value of insurance in that policyholder’s life. -

Travel Insurance Important Policy Information

Insurance Travel Insurance Important policy information 24-hour medical assistance & to access cashless medical expenses +44 (0)203 362 2451 Non-medical emergency claims www.travel.co-opinsurance.co.uk/login or call +44 (0)203 362 2450 Other policy queries +44 (0)203 362 2452 coop.co.uk/travelinsurance Co-op covers BKP 0320.indd 1 28/04/2020 10:12:27 COOP/MF/PW/BKP/0321 This policy document will outline everything you need to know about your cover. Have a read and make sure you’re completely happy. If you have any questions or concerns, please don’t hesitate to call us on 0330 400 1626. Useful contact details Optional upgrades For medical screening To further enable you to tailor your policy to Either complete the online medical your specific travel requirements, we have screening step as part of the online designed the following great range of purchase of your policy; or optional upgrades. Call 0330 400 1626 • Winter sports cover See pages 3 and 4 for more information • Gadget and valuables upgrade • Natural disaster cover For emergency medical assistance • Car hire excess waiver Call +44 (0)207 748 0060 • Hazardous activities cover See pages 4 and 11 – 12 for more For full details of these cover options, information please see pages 29 – 34. To make a claim To submit your claim online, go to: www.travel.co-opinsurance.co.uk/login To start, just log in through ‘Manage your quote or policy’ or ‘Make a claim’. If your query relates to an existing claim, please call us on +44 (0)203 362 2450. -

My Insurance Doesn't Cover What?

MYMY INSURANCE INSURANCE DOESN’T DOESN’T COVER COVER WHAT? WHAT? AvoidAvoid surprises surprises by understanding by understanding your homeowners your insurance insurance policy policy DepartmentDepartment of Commerceof Commerce & Consumer & Consumer Affairs Affairs InsuranceInsurance Division Division CCA.HAWAII.GOV/INS @INSURANCEHI TABLE OF CONTENTS 1 My Insurance Doesn’t Cover What? . .2 2 Home Inventory . 4 3 Theft . 5 4 Fire . 6 5 Flooding . 7 6 Natural Disasters . 8 7 Preventative Measures and Actions . 10 8 What Isn’t Typically Covered . 12 9 The Claims Process . 13 The State of Hawaii Department of Commerce and Consumer Affairs (DCCA) is a regulatory agency that promotes a strong and healthy business environment by upholding fairness and public confidence in the marketplace. The department also strives to increase knowledge and opportunity for businesses and individuals, and to protect consumers against unfair and deceptive business practices. The DCCA Insurance Division oversees the insurance industry in the State of Hawaii. Its regulatory functions include: issuing licenses, examining the fiscal condition of Hawaii-based companies, reviewing rate and policy filings, and investigating insurance-related complaints. The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. The NAIC’s website is a great source of consumer information at www.naic.org. This guide was created to equip you with information to better prepare for an emergency and understand what may or may not be covered by their insurance policy or policies. -

Cancellation Claim Form

Travel Insurance Claim Form | Cancellation You must register any claim within 30 days after completion of your travel. We prefer if you lodge your claim with us digitally, either through our InsureandGo Website (https://quote.insureandgo.com.au/policylogin.aspx) or emailing us a scanned copy of this claim form along with a copy of documents requested. Claimant Details Claim Reference (if known) Title (Mr/Mrs etc) Surname Forename(s) Date of Birth / / Nationality Occupation Medicare Number Parent/Guardian’s Medicare Number (If medical claim is for a minor) Home Address ' Home Phone ' Work Phone ' Mobile State Postcode Email Policy Details Policy Number Date Issued / / Number in Party Independent Travel Arrangements: Yes No If no, provide the following *: *Travel Agent & Branch * Tour Operator Date of Booking Departure Date Return Date Total Days / / / / / / Country Resort/Town It is against the law to submit a fraudulent insurance claim. If your claim is found to be fraudulent the claim will be declined and Insurers will pursue recovery by the use of legal action. I/We hereby declare that: 1. All information and documents submitted for this claim are true and correct. 2. Information on this form will be used by Mapfre Insurance Services Australia Pty Ltd (InsureandGo Australia) for my insurance which includes underwriting, claims handling, fraud prevention and could include passing to other insurers to access my previous claims history. 3. We subrogate rights of recovery to Mapfre Insurance Services Australia Pty Ltd (InsureandGo Australia) and also consent to them seeking reimbursement of any medical expenses paid by them. For medical related claims: 4.