LESSON PLAN Compound Interest

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Discovery of E Name: Compound Interest – Interest Paid on The

Discovery of E Name: Compound Interest – interest paid on the principal of an investment and any previously earned interest. A -> P-> r-> n-> t-> 1) An investment account pays 4.2% annual interest compounded monthly. If $2500 is invested in this account, what will be the balance after 15 years? Set up the equation: A = 2) Find the balance of an account after 7 years if $700 is deposited into an account paying 4.3% interest compounded monthly. John Bernoulli discovered something by studying a question about compound interest. (Who is John Bernoulli? Johann Bernoulli (27 July 1667 – 1 January 1748) was a Swiss mathematician and was one of the many prominent mathematicians in the Bernoulli family. He is known for his contributions to infinitesimal calculus and educated Leonhard Euler in his youth. (Source: Wikipedia) Ready to be John Bernoulli? An account starts with $1.00 and pays 100 percent interest per year. If the interest is credited once, at the end of the year, the value of the account at year-end will be $2.00. What happens if the interest is computed and credited more frequently during the year? Write your prediction here: ______________________________________________________ ___________________________________________________________________________ Let’s do solve this mathematically using compound interest rate formula. Frequency (number of compounding Equation Total periods each year.) Once a year $2.00 Twice a year $2.25 Yay! We made $0.25 more! Compound bimonthly Compound monthly Compound weekly Compound daily Compound hourly Compound secondly What did you observe from the above table? Can we ever reach $3? _________________________ ________________________________________________________________________________ Bernoulli noticed that this sequence approaches a limit with larger n and, thus, smaller compounding intervals. -

HW 3.1.2 Compound Interest

HW 3.1.2: Compound Interest n Compounds per year Compound Continuously A= Amount nt P = Principal (initial investment) ⎛⎞r rt AP=+1 A = Pe r = APR (annual percent rate, decimal) ⎜⎟n ⎝⎠ t = number of years n = number of compounds per year Do each of the bullets for Exercises 1-6. • Find the amount, A(t) , in the account as a function of the term of the investment t in years. • Determine how much is in the account after 5 years, 10 years, and 30 years. Round your answers to the nearest cent. • Determine how long will it take for the initial investment to double. Round your answer to the nearest year. 1. $500 is invested in an account, which offers 0.75%, compounded monthly. 2. $500 is invested in an account, which offers 0.75%, compounded continuously. 3. $1000 is invested in an account, which offers 1.25%, compounded quarterly. 4. $1000 is invested in an account, which offers 1.25%, compounded continuously. 5. $5000 is invested in an account, which offers 2.125%, compounded daily. 6. $5000 is invested in an account, which offers 2.125%, compounded continuously. 7. Look back at your answers to Exercises 1-6. What can be said about the differences between monthly, daily, or quarterly compounding and continuously compounding the interest in those situations? 8. How much money needs to be invested now to obtain $2000 in 3 years if the interest rate in a savings account is 0.25%, compounded continuously? Round your answer to the nearest cent. 9. How much money needs to be invested now to obtain $5000 in 10 years if the interest rate in a CD is 2.25%, compounded monthly? Round your answer to the nearest cent. -

Compounding-Interest-Notes.Pdf

AP US Government/Econ Compounding Interest NAME_________ The two most common methods of calculating interest use the simple interest and the compound interest formulas. Simple interest: Simple interest is the dollar cost of borrowing money. This cost is based on three elements: the amount borrowed, which is called the principal; the rate of interest; and the time for which the principal is borrowed. The formula used to find simple interest is: interest = principal x rate of interest x amount of time the loan is outstanding or I = P x R x T Example Suppose you borrow $1,000 at 10 percent simple annual interest and repay it in one lump sum at the end of 3 years. To find the amount that must be repaid, calculate the interest: Interest = $1,000 x .10 x 3 = $300 This computes to $100 of interest each year. The amount that must be repaid is the $1,000 principal plus the $300 interest or a total of $1,300. Compound interest: Unlike simple interest, compound interest calculates interest not only on the principal, but also on the prior period's interest. The formula for calculating compound interest is: Future repayment value = principal x (1 + rate of interest)amount of time or F = P x (1 + R)T The factor (1+ R)T can be obtained easily using pencil and paper, a calculator, or a compound interest table. Most consumer loans use monthly or, possibly, daily compounding. Thus, if you are dealing with monthly compounding, the "R" term in the above formula relates to the monthly interest rate, and "T" equals the number of months in the loan term. -

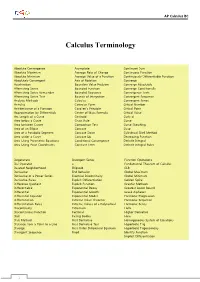

Calculus Terminology

AP Calculus BC Calculus Terminology Absolute Convergence Asymptote Continued Sum Absolute Maximum Average Rate of Change Continuous Function Absolute Minimum Average Value of a Function Continuously Differentiable Function Absolutely Convergent Axis of Rotation Converge Acceleration Boundary Value Problem Converge Absolutely Alternating Series Bounded Function Converge Conditionally Alternating Series Remainder Bounded Sequence Convergence Tests Alternating Series Test Bounds of Integration Convergent Sequence Analytic Methods Calculus Convergent Series Annulus Cartesian Form Critical Number Antiderivative of a Function Cavalieri’s Principle Critical Point Approximation by Differentials Center of Mass Formula Critical Value Arc Length of a Curve Centroid Curly d Area below a Curve Chain Rule Curve Area between Curves Comparison Test Curve Sketching Area of an Ellipse Concave Cusp Area of a Parabolic Segment Concave Down Cylindrical Shell Method Area under a Curve Concave Up Decreasing Function Area Using Parametric Equations Conditional Convergence Definite Integral Area Using Polar Coordinates Constant Term Definite Integral Rules Degenerate Divergent Series Function Operations Del Operator e Fundamental Theorem of Calculus Deleted Neighborhood Ellipsoid GLB Derivative End Behavior Global Maximum Derivative of a Power Series Essential Discontinuity Global Minimum Derivative Rules Explicit Differentiation Golden Spiral Difference Quotient Explicit Function Graphic Methods Differentiable Exponential Decay Greatest Lower Bound Differential -

11.8 Compound Interest and Half Life.Notebook November 08, 2017

11.8 Compound interest and half life.notebook November 08, 2017 Compound Interest AND Half Lives Nov 21:43 PM What is compound interest?? This is when a bank pays interest on both the principal amount AND on accrued interest. **This is different from simple interest....how is that? • Simple interest is interest earned solely on the principal amount. • Remember I=prt?? Nov 21:43 PM 1 11.8 Compound interest and half life.notebook November 08, 2017 Let's take a look at a chart when interest is compound at an annual rate of 8% Interest Rate Time Periods in a Earned Per Compounded Year Period annually 1 8% per year 8% / 2 periods so..... semiannually 2 4% every 6 months 8% / 4 periods so...... quarterly 4 2% every 3 months 8% / 12 periods so..... monthly 12 0.6% every month Nov 21:47 PM How do we find compound interest? Nov 21:53 PM 2 11.8 Compound interest and half life.notebook November 08, 2017 $1,500 at 7% compounded annually for 3 years Nov 22:08 PM Suppose your parents deposited $1500 in an account paying 6.5% interest compounded quarterly when you were born. Find the account balance after 18 years. Nov 38:29 AM 3 11.8 Compound interest and half life.notebook November 08, 2017 You deposit $200 into a savings account earning 5% compounded semiannually. How much will it be worth after 1 year? After 2 years? After 5 years? Nov 38:29 AM What is a halflife? A halflife is the length of time it takes for one half of the substance to decay into another substance. -

Rates of Return: Part 3

REFJ The Real Estate Finance Journal A WEST GROUP PUBLICATION Copyright ©20 11 West Group REAL ESTATE JV PROMOTE CALCULATIONS: RATES OF RETUR PART 3- COMPOUND INTEREST TO THE RESCUE? By Stevens A. C arey* Based on an article published in the Fall 2011 issue of The Real Estate Finance Journal *STEVENS A. CAREY is a transactional partner with Pircher, Nichols & Meeks, a real estate law firm with offices in Los Angeles and Chicago. The author thanks Dick A skey for corresponding with him, Jeff Rosenthal and Carl Tash for providing comments on a prior draft of this article, and Bill Schriver for cite checking. Any errors are those of the author. TABLE OF CONTENTS Compound Interest - The Basics . 1 Definition....................................................................................................................... 1 CompoundingPeriod......................................................................................................2 FundamentalFormula.....................................................................................................2 Futureand Fractional Periods.........................................................................................2 ContinuousCompounding.......................................................................................................2 Future Value Interest Factor...........................................................................................3 Generalized Fundamental Formula.................................................................................3 NominalRate.................................................................................................................3 -

Compound Interest

Compound Interest Invest €500 that earns 10% interest each year for 3 years, where each interest payment is reinvested at the same rate: End of interest earned amount at end of period Year 1 50 550 = 500(1.1) Year 2 55 605 = 500(1.1)(1.1) Year 3 60.5 665.5 = 500(1.1)3 The interest earned grows, because the amount of money it is applied to grows with each payment of interest. We earn not only interest, but interest on the interest already paid. This is called compound interest. More generally, we invest the principal, P, at an interest rate r for a number of periods, n, and receive a final sum, S, at the end of the investment horizon. n S= P(1 + r) Example: A principal of €25000 is invested at 12% interest compounded annually. After how many years will it have exceeded €250000? n 10P= P( 1 + r) Compounding can take place several times in a year, e.g. quarterly, monthly, weekly, continuously. This does not mean that the quoted interest rate is paid out that number of times a year! Assume the €500 is invested for 3 years, at 10%, but now we compound quarterly: Quarter interest earned amount at end of quarter 1 12.5 512.5 2 12.8125 525.3125 3 13.1328 538.445 4 13.4611 551.91 Generally: nm ⎛ r ⎞ SP=⎜1 + ⎟ ⎝ m ⎠ where m is the amount of compounding per period n. Example: €10 invested at 12% interest for one year. Future value if compounded: a) annually b) semi-annuallyc) quarterly d) monthly e) weekly As the interval of compounding shrinks, i.e. -

Compound Interest

Compound Interest (18.01 Exercises, 1I-5) If you invest P dollars at the annual interest rate r, then after one year the interest is I = rP dollars, and the total amount is A = P + I = P (1 + r). This is simple interest. For compound interest, the year is divided into k equal time periods and the interest is calculated and added to the account at the end of each period. So 1 at the end of the first period, A = P (1 + r( k )); this is the new amount for the 1 1 second period, at the end of which A = P (1 + r( k ))(1 + r( k )), and continuing this way, at the end of the year the amount is r k A = P 1 + : k The compound interest rate r thus earns the same in a year as the simple interest rate of r k 1 + − 1; k this equivalent simple interest rate is in bank jargon the \annual percentage rate" or APR.1 a) Compute the APR of 5% compounded monthly and daily.2 b) As in part (a), compute the APR of 10% compounded monthly, biweekly (k = 26), and daily. (We have thrown in the biweekly rate because loans can be paid off biweekly.) Solution a) Compute the APR of 5% compounded monthly and daily. You've been given the formula: r k APR = 1 + − 1: k All that remains is to determine values for r and k, then evaluate the ex- pression. In part (a) the interest rate r is 5%. Hence, r = 0:05. -

Effective Rates of Interest: Beware of Inconsistencies

I I I I "kI bN 4:)* 61 Rewards ISSUE 58 AUGUST 2011 EFFECTIVE RATES OF INTEREST: BEWARE OF INCONSISTENCIES By Stevens A. Carey* Synopsis: Current introductory textbooks on the mathematics offinance inconsistently define an "effective rate of interest ". Many, if not most, of these definitions are general and cover not only compound interest but also simple interest. These general definitions yield the same results onlyfor interest accumulation functions, such as continuous compound interest at a constant rate, which satisfy any one of three equivalent regularity conditions known as Markov accumulation, the consistency principle and the transitivity of the corresponding time value relation. Simple interest, as it is generally known, does not satisfy these conditions. Outside the context of compound interest, care must be taken to ensure that there is a common understanding of an effective rate of interest. * STEVENS A. CAREYis a transa ctional partner with Pircher, Nichols & Meeks, a real estate law firm with offices in Los Angeles and Chicago. This article is a condensed version of an article previously published by the author: Carey, "Effective Rates ofInterest", The Real Estate Finance Journal (JVinter 2011) © 2010 Thompson/West. Please refer to the prior article for more detail (including acknowledgments, citations, quotes of effective rate definitionsfrom various textbooks, and proofs). 1 INTRODUCTION - MUCH ADO ABOUT NOTHING? What is an effective rate of interest? Isn't the definition relatively standard? As the word "effective" suggests, the effective rate for a particular time period seems to be nothing more than the rate that reflects the actual economic "effect" of the interest during that period, namely: the actual percentage increase by which a unit investment would grow during the applicable period. -

Compound Interest and Exponential Equations

Compound Interest and Exponential Equations Math 98 Among the many applications of exponential functions is compound interest, where, as opposed to simple interest, the interest rate is applied after a pred- ermined time has passed, to the initial investment plus the acquired interest to that point. In practice, this means that the following formula applies. Let P be the initial investment (the principal), and r the effective annual interest rate – that means that $1 will grow, to 1+ r after one year. Then, after t years (not 4 necessarily an integer: for example, t = 3 corresponds to 16 months) the invest- t ment will have grown to P (1 + r) (see below for the reason). We often write exponential functions in the form “abx”. In this case, a = P,b =1+ r, x = t. Example An initial investment of $2500 at 3.5% rate (r = 0.035) will grow, after 27 9 27 9 · 4 months (two years and three months or t = 12 = 4 ) to 2500 (1 + 0.035) = 9 2500 · 1.035 4 ≈ 2701.10 This exponential growth is markedly faster than the linear growth coming from simple interest, and is what applies to most any debt or investment you might incur into. A typical question we might ask is how long it will take for an investment to grow to a given value. This leads to an exponential equation, an equation where the unknown is in the exponent. Such an equation can be solved by taking logarithms of both sides, and using the properties of logarithms (see the book and the corresponding additional file). -

Basis Between Compound and Simple SOFR 20 Monthly Compound - Simple Basis 15 Quarterly Compound - Simple Basis 10

Appendix 1. Simple versus Compound Interest The ARRC conventions recognize that either simple or compound interest can be charged when using SOFR in arrears. As discussed in the User’s Guide to SOFR, although compound interest will more accurately reflect the time value of money and will match the payment structure in derivatives and debt market, simple interest is in some ways operationally easier to implement, because daily interest accruals only depend on the principal outstanding at the time of accrual, while daily accruals under compound interest will additionally depend on the amount of unpaid interest (or, as discussed in Appendix 3, the cumulative compound rate of interest rates from the start of an interest period) The ARRC expects that market participants will choose between simple or compounded interest, depending on the circumstances of each loan; however, many members of the ARRC’s business loans working group expressed a preference for simple interest in arrears over compound interest in arrears for syndicated U.S. dollar business loans. Those who held this preference noted that the basis between simple and compound interest has historically been very small, and even in higher interest rate periods was a few basis points, as shown in the figure below: 1 Basis Between Compound and Simple SOFR 20 Monthly Compound - Simple Basis 15 Quarterly Compound - Simple Basis 10 5 0 -5 -10 -15 -20 1998 2001 2004 2007 2010 2013 2016 2019 As shown in the next figure, compared to the basis between 1-month and 3-month LIBOR, which is relevant for loans that allow the borrower to move between different LIBOR tenors, the basis between simple and compound interest is essentially de minimis. -

The Emergence of Compound Interest

British Actuarial Journal (2019), Vol. 24, e34, pp. 1–27 doi:10.1017/S1357321719000254 DISCUSSION PAPER The emergence of compound interest C. G. Lewin Correspondence to: C. G. Lewin. E-mail: [email protected] Abstract Compound interest was known to ancient civilisations, but as far as we know it was not until medieval times that mathematicians started to analyse it in order to show how invested sums could mount up and how much should be paid for annuities. Starting with Fibonacci in 1202 A.D., techniques were developed which could produce accurate solutions to practical problems but involved a great deal of laborious arithmetic. Compound interest tables could simplify the work but few have come down to us from that period. Soon after 1500, the availability of printed books enabled knowledge of the mathematical techniques to spread, and legal restrictions on charging interest were relaxed. Later that century, two mathematicians, Trenchant and Stevin, published compound interest tables for the first time. In 1613, Witt published more tables and demonstrated how they could be used to solve many practical problems quite easily. Towards the end of the 17th century, interest calculations were combined with age-dependent survival rates to evaluate life annuities, and actuarial science was created. Keywords: Interest; History; Loans; Annuities; Tables 1. Introduction This paper describes the emergence and study of compound rather than simple interest. For a loan lasting less than a year, simple interest was usually added when the loan fell due for repayment. If a loan contract lasting more than a year required simple interest, this was usually paid in cash periodically, often yearly, and the size of the sum lent remained unchanged when it was eventually repaid.